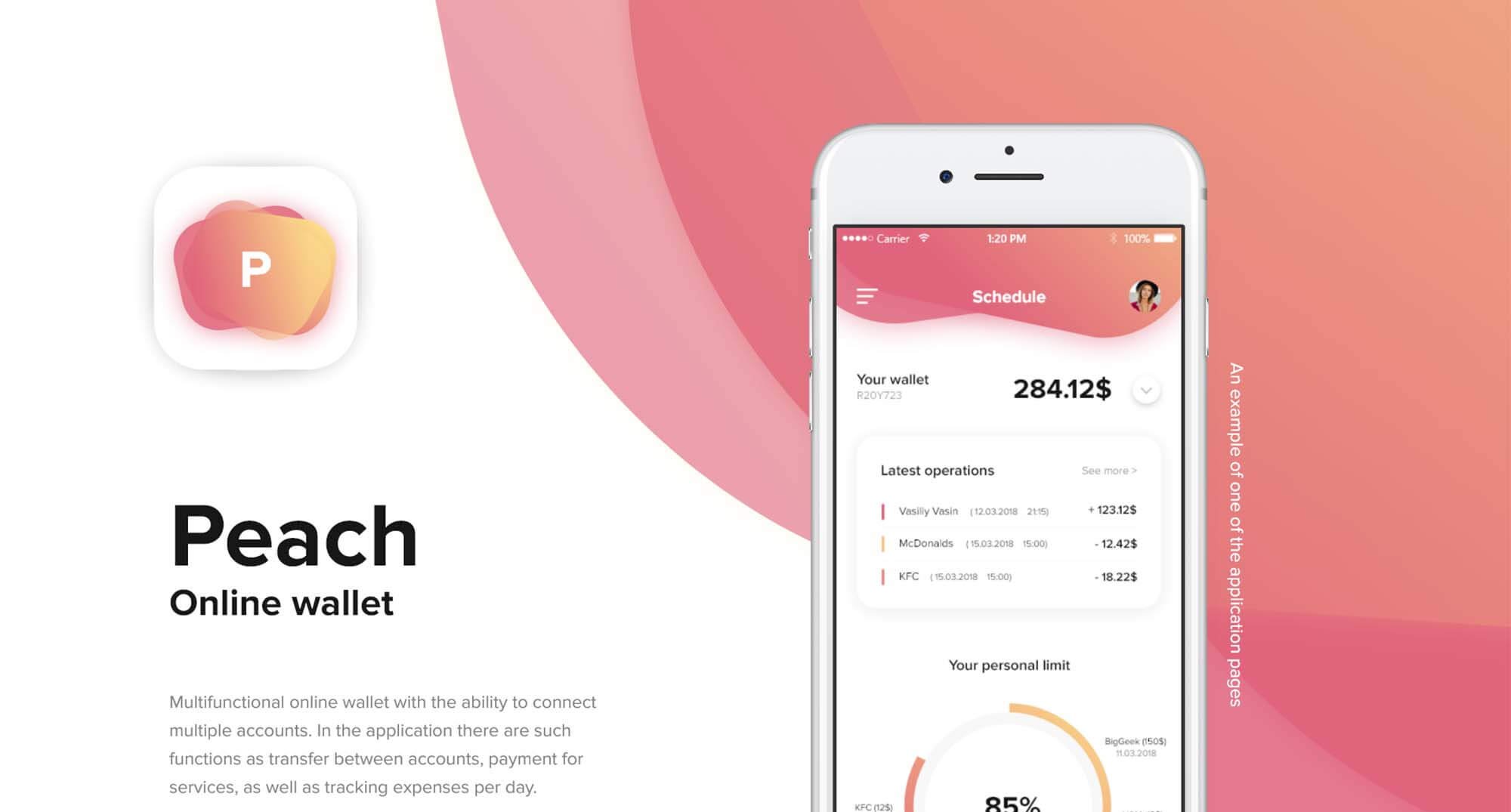

Xapo is an app-based crypto wallet that seeks to provide the most accessible and highly secure platform for Bitcoin users. It was founded by Wences Cesares – an international entrepreneur and financial technology expert – and it is registered and incorporated in Gibraltar. On their website, the Xapo crypto app is described as a ‘secure alternative platform’ that goes beyond the industry standards in helping you protect your livelihood and digital assets.

Some of the factors that set it apart from the competition include the fact that it is a Bitcoin-only wallet app. Further, it is a custodial wallet that stores your private keys in highly advanced and ultra-secure storage vaults that are never connected to the internet. In this Xapo wallet review, we vet the wallet’s security, ease of use, look at its pros and cons, and provide you with a step-by-step guide on how to use the Xapo app.

Xapo Crypto app key features:

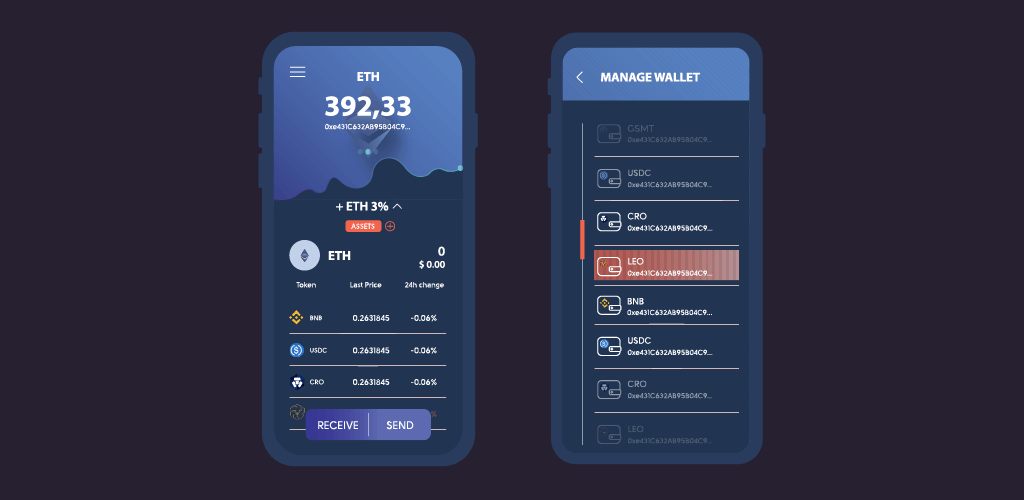

Mobile wallet: Xapo is a mobile crypto app available to Android and iOS phone users.

Purchase Crypto with Fiat: Xapo has collaborated with numerous payment processing service providers that you can use to buy Bitcoins off the platform. These include direct wire transfers as well as credit and debit card purchases.

Inbuilt exchange: Xapo has also come up with a peer-to-peer exchange platform where users can exchange Bitcoins for fiat currencies. These in-app exchanges are free.

Portfolio tracker: On the Xapo user interface is the balance tab that lets you view your wallet balances in real-time, as well as the activity tab that keeps a record of all your transaction history. The two play a key role in helping you keep tabs on your expenses and help with budgeting by monitoring your crypto inflows and outflows.

Automated notifications: Xapo makes it possible to set automated notifications for different wallet functions. For instance, you can have the wallet send you a notification every time you receive crypto when cryptos are drawn from the wallet, and Bitcoin price alerts.

Multisignature wallet: The multisignature functionality of the Xapo crypto app makes it possible for you to share the app with family and segregate everyone’s funds.

Integrates debit card: Xapo recently launched the prepaid Xapo debit card that you can integrate with your Xapo crypto wallet and use it to pay for goods and services on the different crypto-friendly point of sale or withdraw funds from Bitcoin ATMs.

Libra member: Xapo is one of the founding members of the Libra blockchain network put together by Facebook. According to the Xapo website, the app’s development team provides technical expertise to help the association launch and run the Libra global currency sustainably.

Security features:

Password: Like most other crypto wallet apps, the Xapo crypto vault is secured with a password.

Two-factor authentication: All outbound transfers from the Xapo wallet app must be subjected to two-factor authentication. You have the option of receiving the verification code via email, SMS, or google authenticator.

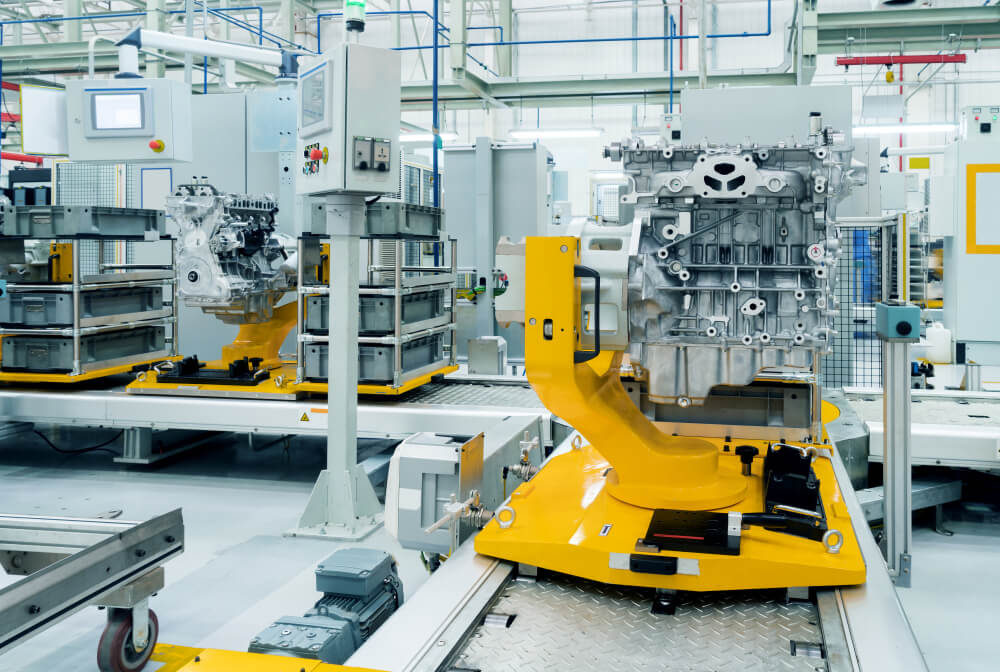

Cold storage: Unlike most other wallets that give you absolute control of your wallets by saving the private key in your phone, Xapo keeps the private keys safe on your behalf. According to the crypto security company, all your private keys are stored in ultra-secure vaults in the Swiss Alps and other parts of the world. They further add these vaults don’t connect to the internet, and they are largely made from demilitarized bunkers.

Highly encrypted: All your data, including the private keys, is shared with and stored in Xapo servers and is highly encrypted using proprietary encryption technology. And so are Xapo’s communication with third party systems like payment processors and third-party exchanges.

How to set and activate the Xapo wallet:

Step 1: Start by downloading the Xapo crypto mobile app from Google Play Store or Apple App Store.

Step 2: Install and launch the app, choose your country of residence, and enter your phone number.

Step 3: Verify the number by entering the 6-digit code received via SMS

Step 4: Enter your email address

Step 5: Complete the user profile by completing the registration form

Step 6: Choose your country of origin/citizenship from the drop-down menu

Step 7: Read and agree to Xapo wallet’s terms of use

Step 8: Create a 4-digit passcode for your Xapo wallet app

Step 9: Verify identity by uploading a photo of yourself and that of a government-issued identification document as well as a proof of address

Step 10: The app will now send a verification link to the email provided. Open the link to activate the account.

Step 11: Your Xapo wallet app account is now active and ready for use

How to add/ receive crypto into your Xapo wallet

Step 1: Log in to your Xapo app, and on the dashboard, click on ‘My Money.’

Step 2: Tap on the ‘Add Money’ on the next window

Step 3: Follow the prompts to add Bitcoins using one of the provided account funding options.

How to send crypto from your Xapo wallet

Step 1: Log in to your Xapo wallet app and click on the ‘Payments’ tab.

Step 2: If you wish to send funds to an individual on your contact list, click on the “Transfer to a contact” tab, and select “Allow access.”

Step 3: Select the recipient and click on the “$” sign to initiate a transfer.

Step 4: Choose the account you wish to send the funds from, the amount you wish to send, the currency type, and click “Send.”

Step 5: Review the transactions and check the accuracy of the details before hitting “Confirm.”

Step 6: Enter the PIN code to authorize the pay

Xapo wallet ease of use

Xapo wallet has a highly intuitive and beginner-friendly user interface. It only has a few tabs that are carefully placed on the user dashboard to ease your in-app navigation and how you interact with the wallet.

The app’s onboarding process, though lengthy, is quite straightforward. And so are the processes of adding funds, receiving and sending Bitcoins and other Fiat currencies in and out of the wallet.

Xapo wallet supported currencies and countries.

Xapo is a Bitcoin-only crypto wallet app. Interestingly, and unlike most other Bitcoin-only wallets that extend their support to Bitcoin forks, Xapo does not support any other crypto, including such Bitcoin forks as Bitcoin Gold and Bitcoin Cash.

However, the integrated peer-to-peer exchange makes it possible for users to exchange Bitcoin with over 150 Fiat currencies.

Currently, the Xapo crypto wallet app is available in about 30 countries across the world.

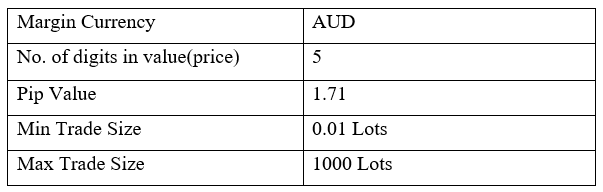

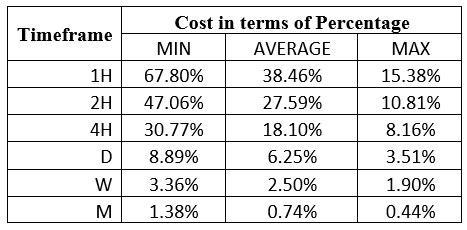

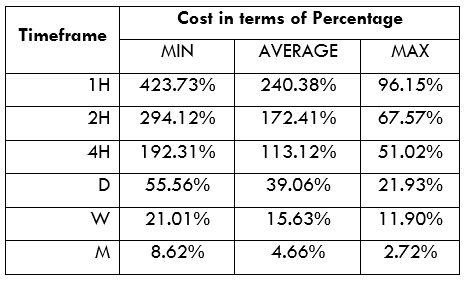

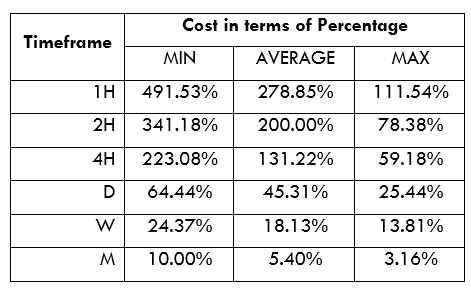

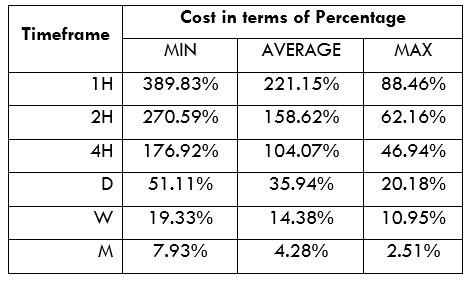

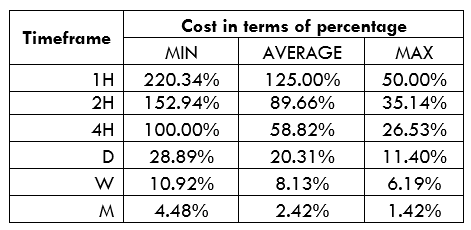

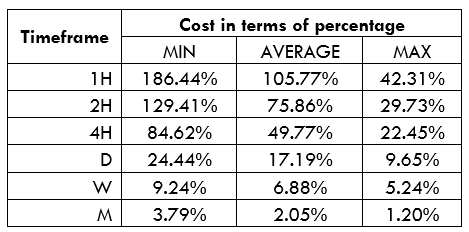

Xapo wallet cost and fees

Downloading and installing the Xapo crypto wallet app as well as storing your Bitcoins therein is free. You also won’t be charged for using their in-app peer to peer exchange or transferring funds from one Xapo wallet to another.

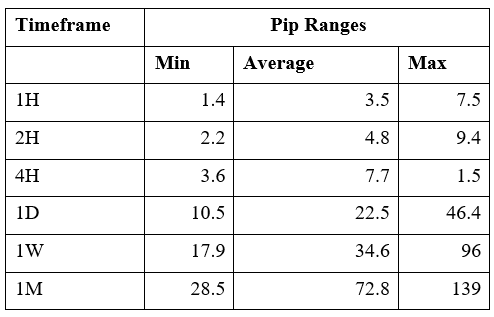

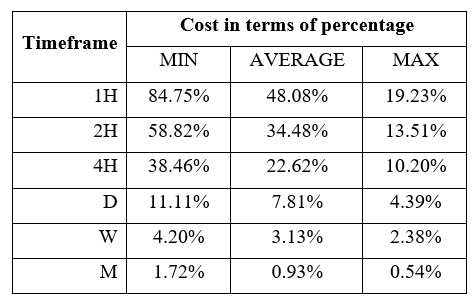

Outbound Bitcoin transfers to other wallets or exchange will, however, attract a network fee charged by Bitcoin miners and not Xapo. The fee is nevertheless dynamic, and you have the option of choosing either the standard fee for normal confirmation speeds or priority fee for trades you wish processed and confirmed urgently.

Xapo wallet customer support

Xapo’s customer support has a rather elaborate FAQ guide on the company website that addresses Xapo wallet users’ common challenges and provides troubleshooting guides. There also are tutorials that try to explain how you interact with the Xapo app.

You can also contact them via email, the live chat feature on both the website and the app, or direct message them on such social media platforms as Twitter, Facebook, and Instagram.

What are the pros and cons of using the Xapo wallet?

Pros:

- Transfers from one Xapo wallet to another are free

- It stores your private keys in cold storages and ultra-secure offline vaults

- It allows you to buy Bitcoin with Fiat currency

- It features an inbuilt peer-to-peer exchange

- It integrates the Xapo Debit that you can use to pay for goods and services or withdraw at Bitcoin ATMs

Cons:

- It will only support Bitcoins

- It doesn’t support anonymous crypto transactions as all users must be subjected to KYC and AML procedures

- It has an unnecessarily lengthy registration process

Comparing Xapo wallet with other Bitcoin-only wallets

Xapo wallet vs. BTC.com wallet

Xapo and BTC.com are both Bitcoin-only wallets. But unlike Xapo, which is a mobile crypto app, BTC.com is a web-based wallet. BTC.com is a lot easier to use and interact with as it not only features a friendly user interface but also has an easier onboarding process.

Xapo, however, carries the day when it comes to the security of client funds. Plus, while BTC.com’s online nature exposes its inherent threats associated with hot wallets, Xapo is a custodial wallet that stores client private keys in highly decentralized and ultra-secure cold storage.

Verdict: Is the Xapo wallet safe?

Xarpo is a custodial wallet that stores client funds in decentralized cold storages spread across the world. It has also put in additional client-side security features that deter unauthorized access to these keys, like securing the app with a passcode, two-factor authentication, and automated alerts on transfers and changes in digital asset balances. One might consider such security measures adequate, but we must observe that these don’t necessarily make you and your wallet immune from such social engineering threats as phishing.