Most people, when asked about ways to make money off crypto, will say trading. Trading is one of the most straightforward and probably the most popular ways to make money with crypto. But there are several other ways to make money with crypto, and most of them are surer bets than trading – by far.

And the good part? You only need to take action and sit back and watch your money grow with some of the ways. And get this: with some ways like staking, the returns are substantially higher than you could ever get with the traditional finance system. Others, like blockchain-based content creation, may require a more hands-on approach but still can be done alongside your daily job or business.

With that, let’s get straight to it!

#1. Mining

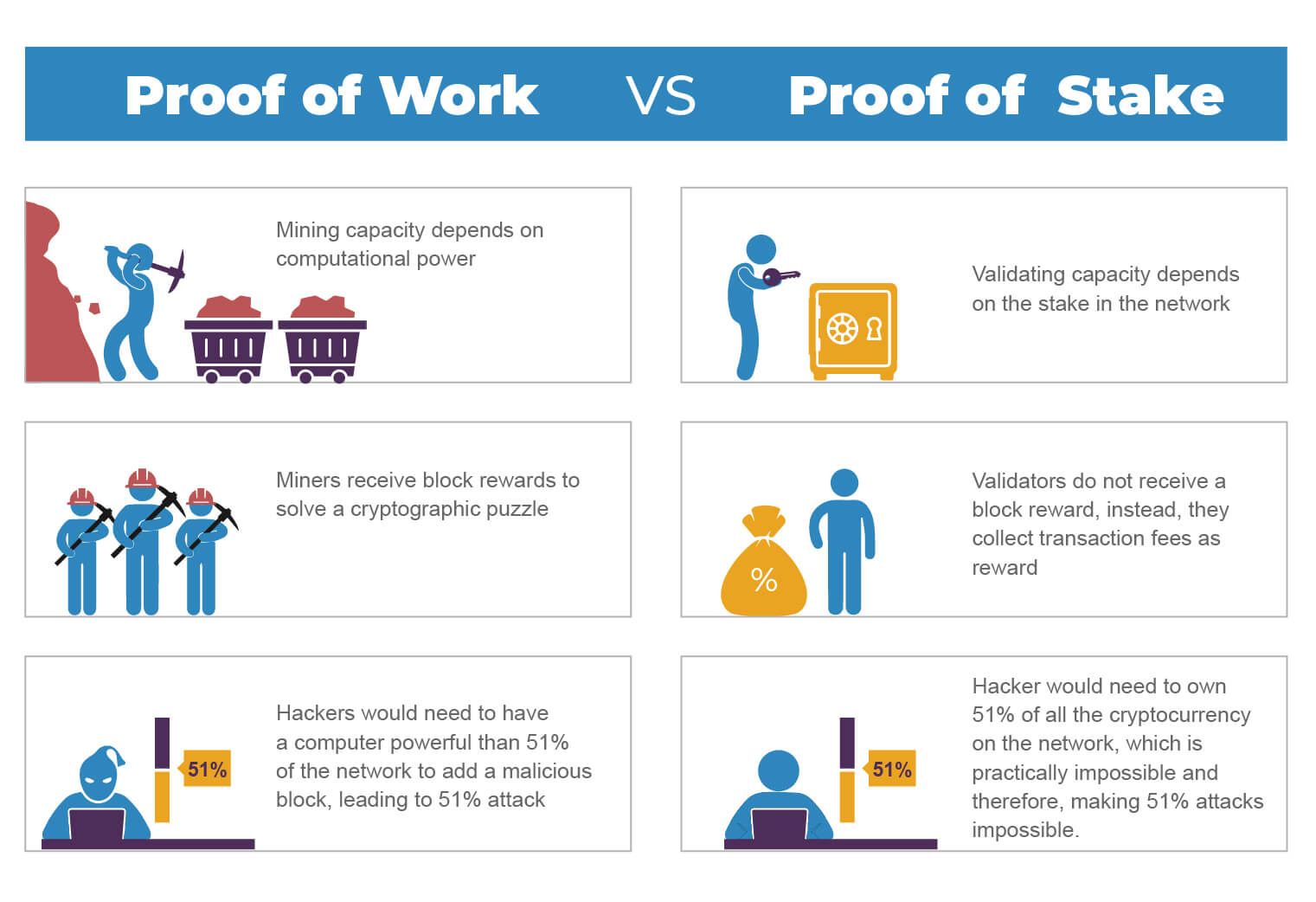

In cryptoverse, mining is the process of using computing power to make guesses until you arrive at the correct hash, which then unlocks the next block in a blockchain network. Crypto miners receive crypto rewards for finding blocks and recording them on the blockchain network. You do not have to have crypto holdings to mine crypto. Miners can choose to convert their block rewards to Fiat immediately, HODL them, or plow those earnings back to their mining system.

When Bitcoin was starting, anyone could mine from the home computer. But as the mining difficulty increased, the average daily computer could no longer hack it. We moved from CPUs to GPUs (some cryptocurrencies can still be mined with GPUs) to ASICs (Application-specific Integrated Circuits). ASICs utilize specific chips tailor-made for a particular cryptocurrency. Some of the most popular cryptocurrencies, i.e., Bitcoin and Ethereum, are mined with ASICs.

Today, you can find an ASIC miner for an average of $1,000. If you plan to mine crypto, it’s best to join a mining pool. A mining pool is a team of miners who combine their computational resources to stand a better chance of finding new blocks. The block reward is then shared among the participants, depending on their contribution. Due to the combined computational power, miners in a mining pool are more likely to discover new blocks than individual miners.

Tip: Join a mining pool for better profitability.

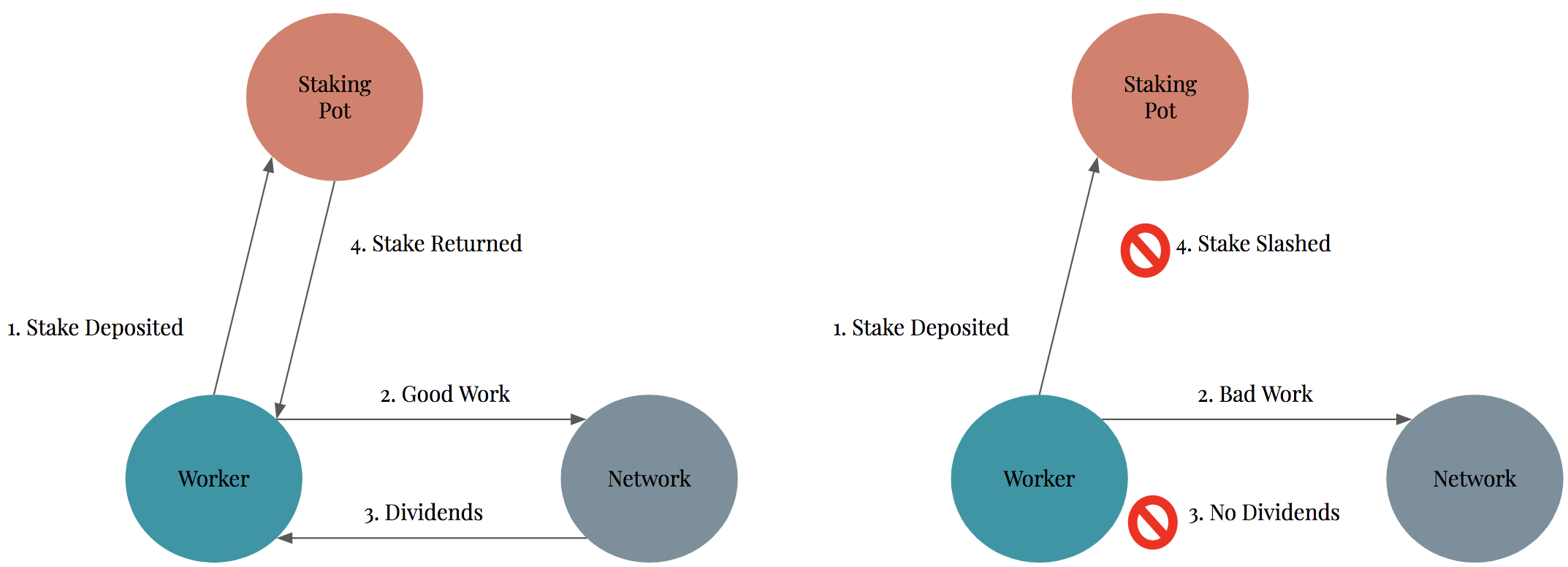

#2. Staking

One of the more easy-going ways to earn passive crypto income, staking, involves depositing crypto funds to get staking rewards. Staking networks utilize proof-of-stake or related consensus mechanisms, e.g., delegated proof of stake. With staking, mostly what’s required is just holding tokens in your wallet. In other cases, you need to add or delegate the funds to a staking pool. In DeFi pools, staking similarly involves putting up supported cryptos and earning interest.

When you stake in a network, you’re contributing to that network’s security and resilience, hence the reward. Staking is one of the simple ways to multiply your crypto holdings with minimal effort.

#3. Lending

Lending is another hands-off method to make money with crypto. There are multiple peer-to-peer lending platforms (Coin Loan, Nexo, BlockFi, Celcius, EthLend, etc.) that allow you to lock up crypto and earn interest in return. Usually, the interest rate is set by the platform or by you based on prevailing market trends. The more you lend, the more you stand to reap.

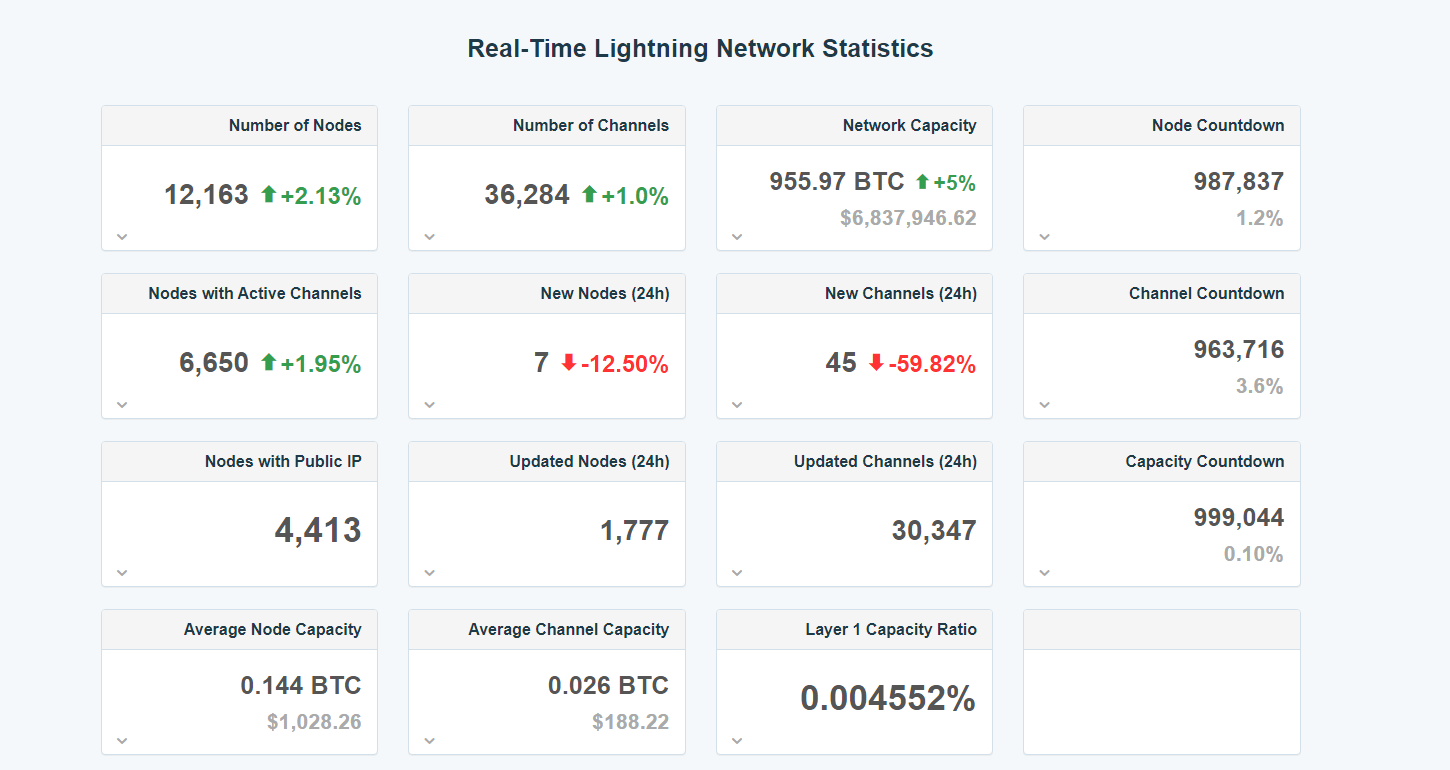

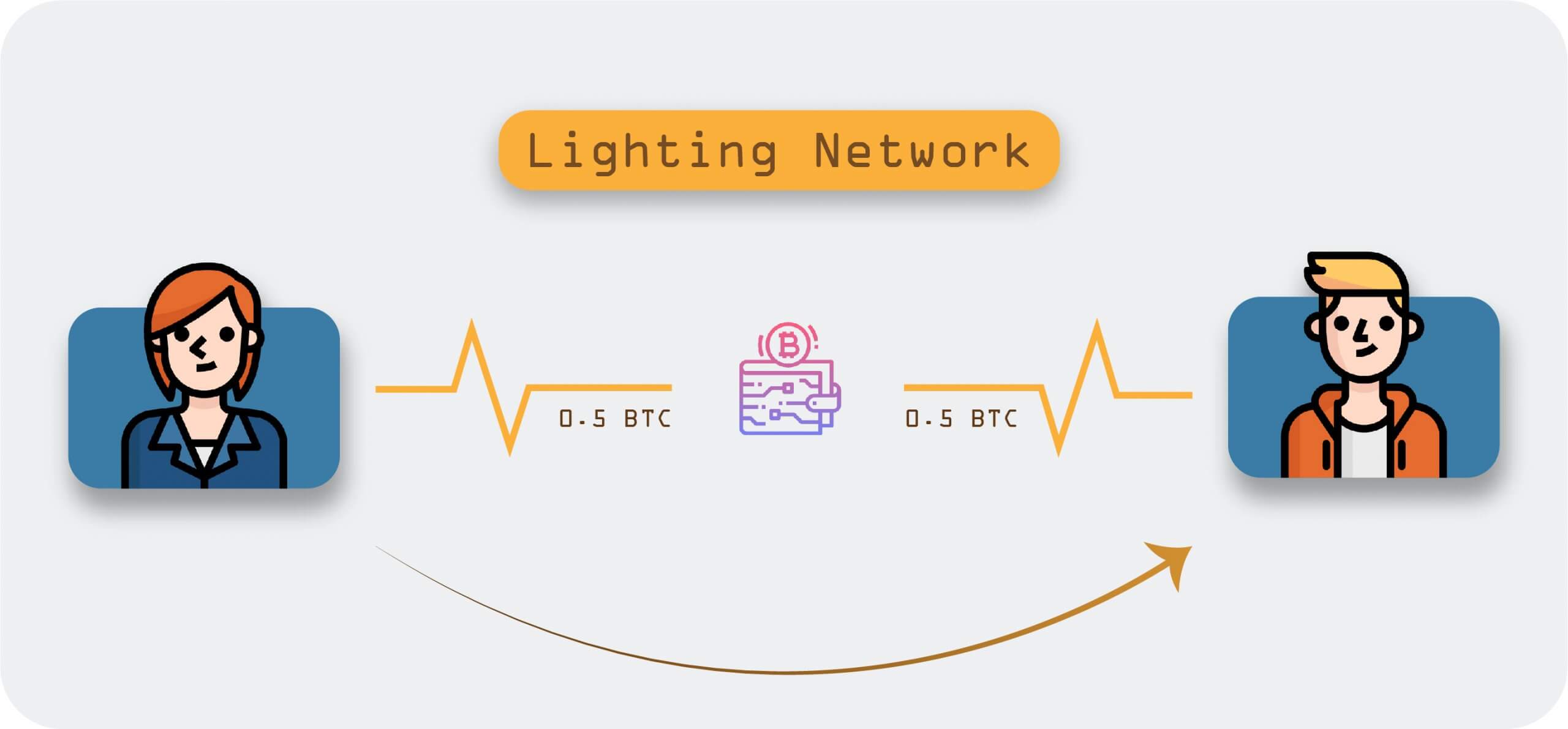

#4. Lightning nodes

The Lightning Network is a layer 2 solution for blockchains such as Bitcoin. It’s an off-chain payment channel that facilitates the processing of transactions without them being transferred to the underlying blockchain.

When you use the Lightning Network to conduct a transaction, it’s quicker than if done on the blockchain. A network like Bitcoin only allows one-directional transactions. For instance, if Alice sends Bob one bitcoin, Bob cannot use the same channel to send it back to Alice. On the other hand, the Lightning Network utilizes bi-directional channels that require the involvement of both parties. This makes transactions quicker.

When you run a Lightning node, you have the ability to process a lot of transactions quickly and get rewarded with transactions’ fees.

#5. Affiliate programs

Some crypto projects, especially new ones, will usually reward existing participants for bringing new ones to the platform. If you have, let’s say, a huge social media following, affiliate and referral programs can be a great way to earn passive income. Bear in mind that it behooves you to carry out research on any project you promote.

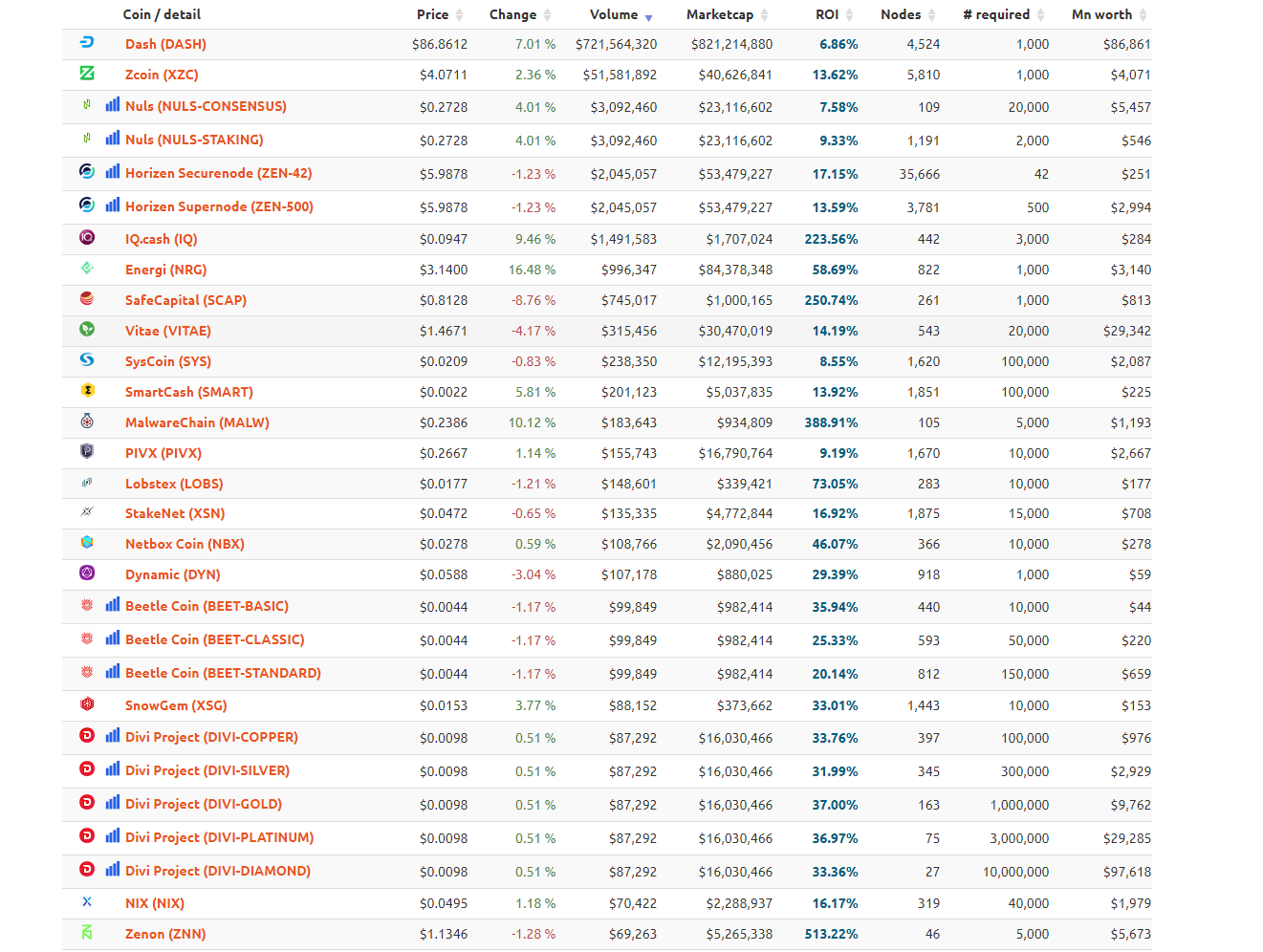

#6. Masternodes

A masternode is like a server, except it runs on a decentralized network. Typically, network participants have to put up sizable amounts of investment to become masternodes. Due to the significant investment, masternodes have a big incentive to maintain and secure the network.

Crypto projects usually give special privileges to participants who have a considerable stake in their networks, in addition to rewarding them with return rates.

#7. Airdrops

Airdrops are tokens given away for free by crypto projects in an effort to publicize or market themselves by getting people to talk about it. All you need is a wallet address of a particular crypto when the airdrop is taking place. For other projects, you’ll need to register on the project’s website and do things like retweeting posts, leaving comments on social media posts, sharing posts on platforms like WhatsApp, Telegram, and so forth. Also, some exchanges will conduct airdrops for the users occasionally.

To have a heads up on upcoming airdrops, you should register sites dedicated to spreading the word about the exact matter. Such sites include Airdropaddict, Icodrops, etc.

Note that receiving an airdrop will never require the sharing of private keys – a condition that is a telltale sign of a scam.

#8. Creating blockchain and crypto-based content

With the advent of blockchain, previously unexplored modes of content creation and sharing are now possible. Blockchain-powered content platforms like Steemit allow content owners to monetize their work in various ways – and without intrusive ads popping all over. In such platforms, content creators get to own the rights and ownership of their work. Once you create a substantial portfolio of work, you can monetize it over time.

Final Thoughts

What’s better than earning passive income is doing so in a safe and secure environment, and that’s what you get with the activities on this list. Whether it’s staking, mining, running a masternode, you can make money from crypto with minimal effort. Of course, always make sure to do your own research before putting your money anywhere. Good luck!