Earn Passive Income in Cryptocurrency – part 1

People from all around the globe started investing in cryptocurrencies due to their great long-term potential in transforming the world both in terms of technology and wealth distribution. While most focus on instant big gains, some people would like to stay on the safer side and look for passive income in the crypto space.

There are many ways to earn a passive income with cryptos, and we will cover most of them in a series of videos. This video will show you how you can earn a passive income by utilizing the Proof of Stake consensus algorithm.

What is Proof of Stake?

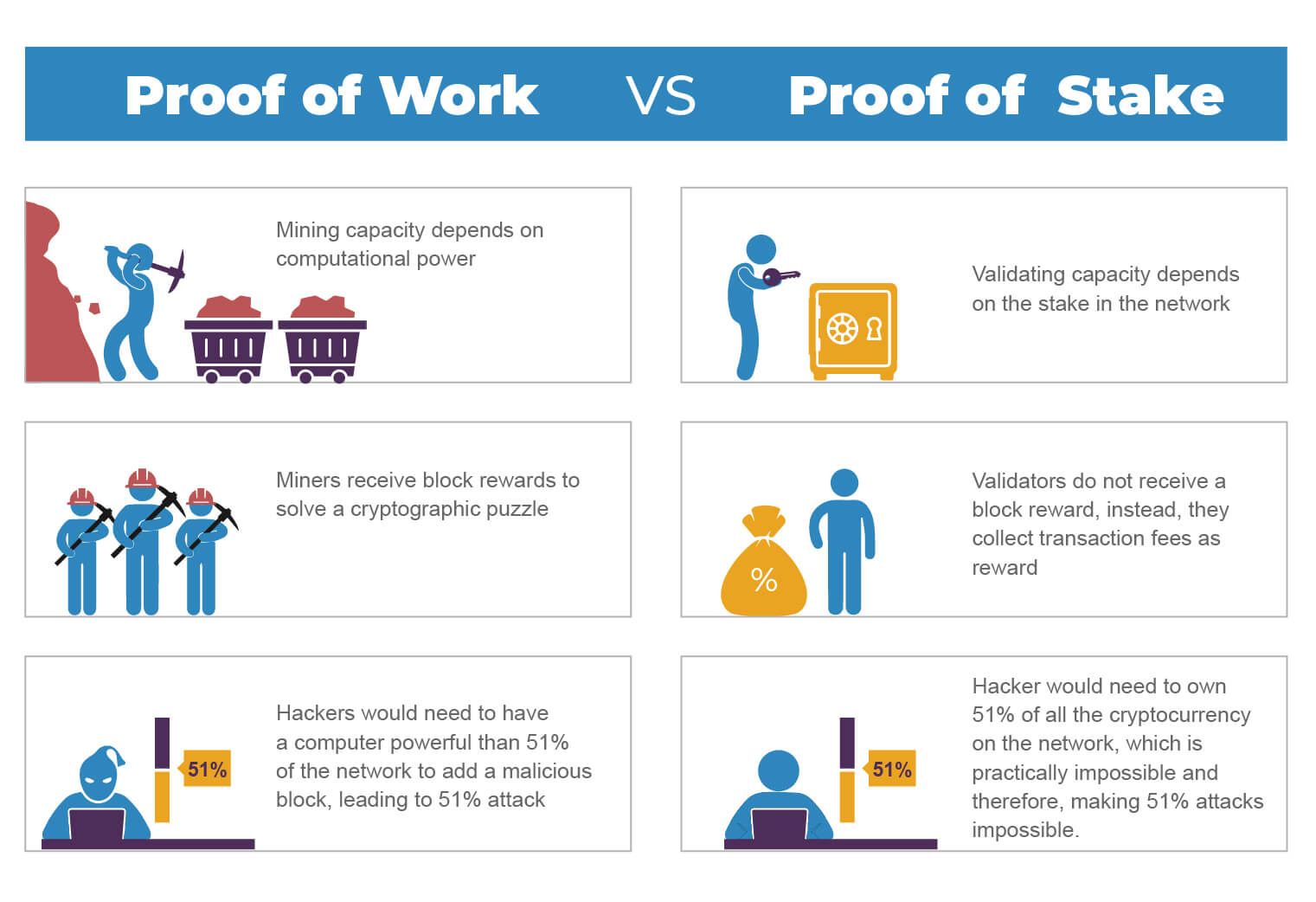

Instead of investing the users’ computing power to process transactions, PoS transactions are validated by the nodes that stake their own coins as a form of insurance. Those that stake their coins are trusted because they have put their coins on the line, so they have no incentive to scam.

Everything is quite simple — just stake the coins by keeping them in your wallet, and you will receive rewards for this.

The process is, in terms of how you get passive income, very similar to the principle of bank deposits, which have a reward over the deposit time.

Choosing the right coin to stake

First off, the currency you want to select has to support the PoS. After you are sure that the particular crypto works on PoS, just hold that crypto in your wallet and give the wallet a 24/7 access to the internet. Being connected to the internet 24/7 is the only way for staking to work, as you need it both to validate transactions and receive rewards.

Pros of the PoS system

The key difference between Proof of Work and Proof of Stake is the formation of any block. While PoS has a random selection of block validators, PoW uses computing power, which chooses only the computers which solved the validation puzzle (the better gear you have, the more you will earn). This makes staking cheaper in terms of initial costs as well as the costs of running it.

Cons of the Proof of Stake system

When using staking for passive income, you should focus on two things:

Safety

Profit

There is a reason safety comes first. It doesn’t matter if the profit is big on paper if you lose it all in the end. You need to set your account up with 2-factor authentication, use only trusted software, and never disclose any personal info to third parties.

Besides safety risks, there are other risks, mainly regarding the price volatility. Since you get paid out in the staked coin, if it drops in value – you get less money.

Always take into consideration all forms of risks before stepping into any investment.

Which cryptocurrency should you stake?

There are many cryptocurrencies you can stake, but we will name a couple you could take into consideration.

Dash — one of the first large cryptocurrencies that introduced staking

Decred (DCR) — a cryptocurrency that uses a hybrid of PoW and Pos and considers decentralized management as its main priority

NEO – often called the Ethereum of China

Zcoin (ZCX) – works on user privacy and gives great returns (17% per annum)

Ethereum (ETH) — second-largest cryptocurrency in the world, that will soon switch to PoS.

Make sure to watch the rest of the Crypto Passive Income series, where we will talk about other ways of earning a passive income through cryptocurrencies.