Scalability was always a thorny issue for Bitcoin since day one. When Satoshi Nakamoto first proposed the cryptocurrency, the very first comment by James MacDonald featured this comment “We very much need such a system, but it does not seem to scale to the required size.” A decade later, scalability is a concern that the Bitcoin and other mainstream cryptocurrencies have to grapple with.

What exactly is scalability? Well, Bitcoin has only ever been capable of processing an average of 7 transactions per second (TPS). This was okay at the beginning, but as the cryptocurrency gained more use and acceptance, congestion on the network increased. As a result, transactions took longer to be processed, and transaction fees went up.

If Bitcoin has any hopes of becoming a fully viable alternative to current payment systems – let alone the ‘world’s currency’ – as many Bitcoin believers envision, it will need to solve the current salability issues it faces.

To put this into perspective, compare Bitcoin’s current meager 7 TPS and Visa’s average of 1700. In the face of this dismal scalability potential for Bitcoin, the cryptocurrency’s enthusiasts have been hard at work reimagining the system and how it can be improved. There is one proposal that has caught the attention of the Bitcoin community and one which holds potential. This is the Lightning Network.

What is the Lightning Network?

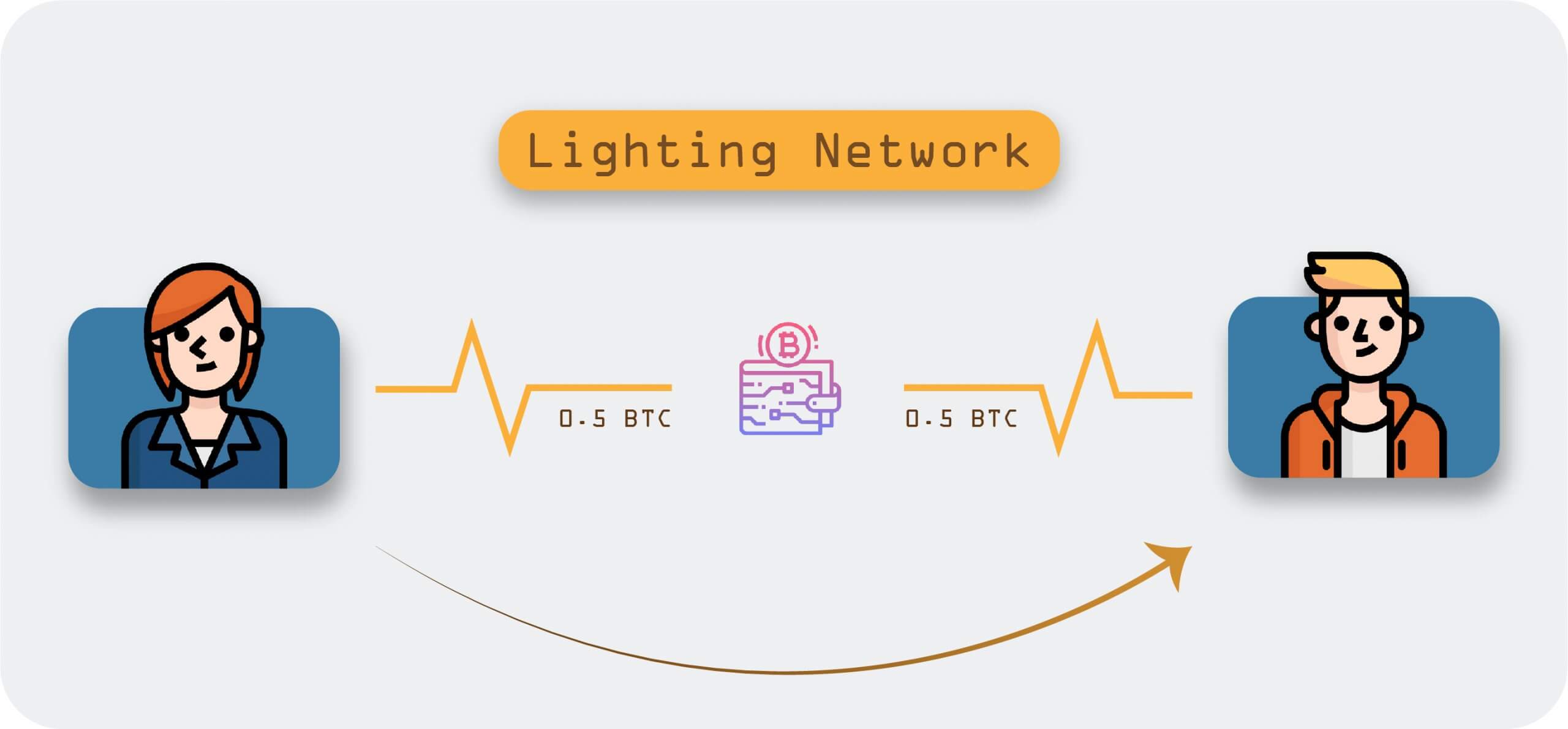

The Lightning Network (LN) is based on this premise: there’s really no need to record every single transaction on the blockchain. As such, LN is a second layer technology on Bitcoin’s blockchain that allows two users to use a micropayment channel between each other – with the hopes to scale Bitcoin’s transaction processing.

By removing transactions from the main blockchain, LN is expected to remove the backlog of transactions and reduce or get rid of transaction fees altogether. It will drastically speed up transactions, positioning Bitcoin for everyday use.

How Does the Lightning Network Work?

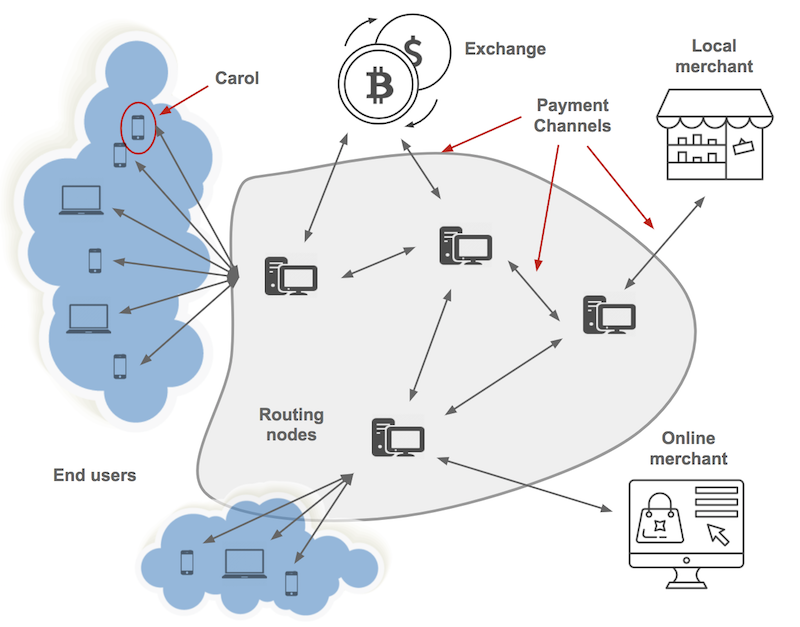

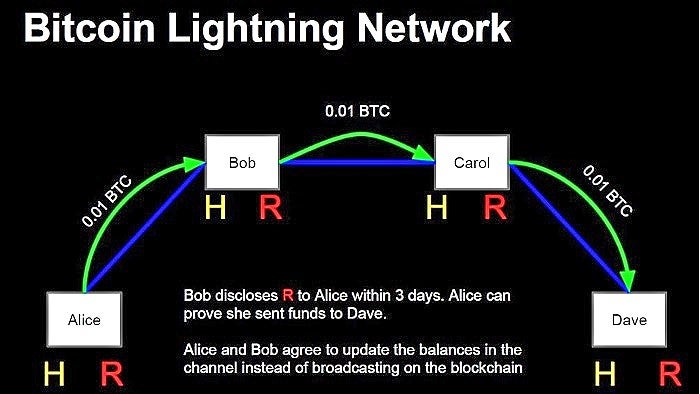

The Lightning Network comprises an off-chain layer on Bitcoin’s blockchain. It features multiple payment channels that allow two parties to open a payment channel and conduct transactions between them. Two users can open a payment channel that will allow them to shift funds back and forth between their wallets.

These transactions are processed differently from the standard transactions on the main blockchain, being only updated there once the two parties open and close a channel.

To open a payment channel, the two users need to set up a multi-signature wallet and deposit some funds into it. This is the first transaction, and it’s called the funding transaction. Funds stored in the multi-signature wallet can only be accessed upon both (or more) parties providing their private keys. This means a party can only access and/or spend the funds with the consent of the other.

The two users can conduct unlimited transactions between themselves without having to let in the main blockchain on their activities. This approach considerably scales up transactions’ speed since they don’t need to be approved by all nodes on the blockchain network.

The private channels between parties combine to form a web of lightning nodes that can channel activity among themselves. This web, or network, is the Lightning network.

The ingenuity of the Lightning Network is that once it achieves mainstream acceptance, users will not have to open a new channel to interact with others. They will be able to transact with ‘new’ users via existing channels – that is, channels with users with whom they already have a relationship. The network will execute this by automatically finding the shortest path.

Finally, the Lightning Network is being tested for another exciting feature – the ability to conduct cross-chain transactions of crypto swaps – that is, being able to exchange one crypto to another. This may render crypto exchanges – as we know them, obsolete.

Will You Pay Fees for Using the Lightning Network?

Yes, users will be required to pay fees on the Lightning Network. The fees will comprise routing charges for routing transaction details between lightning nodes, plus Bitcoin’s transaction fees to open and close payment channels.

At the moment, there are zero fees on the network owing to very few lightning nodes. However, if the project succeeds, charges are set to increase, but only slightly. In any case, if the fees became too expensive, a user has the option to move back to the main blockchain.

Implementations of the Lightning Network

The concept of LN was first proposed by Joseph Poon and Thaddeus Dryja in 2015. Currently, there are four major teams developing the concept.

Each is operating on the BOLT specification – which allows them to connect with each other as a unified network rather than separate groups competing with each other. The BOLT specification has been developed by the blockchain technology companies Block stream, ACINQ, and Lightning Labs – to allow each company’s products to interact with the others. These are the implementations and groups behind LN’s current exploration:

1. C-Lightning

C-Lightning is being developed by Blockstream. It’s coded in the C programming language and is created to only operate on Linux, with the possibility to run on Mac if you modify some coding and parameters.

This implementation supports lightweight nodes that you can run from the computer chip Raspberry Pi, allowing you to connect with other users without necessarily being online. As such, people can more conveniently adopt and contribute to the LN.

C-Lightning also features a wallet that lets you manage funds, whether online or offline.

Another exciting feature of C-Lightning is you can transact anonymously over the TOR network, so you don’t have to worry about privacy issues.

2. Éclair

Éclair is being developed by ACINQ, a French company. It’s very much like C-Lightning, with the only differences being in the coding and user interface. You can operate Éclair on Windows and also with the Raspberry Pi acting as the network node.

Éclair also has a mobile wallet for Android that you can use as a regular Bitcoin wallet and the Lightning Network for cheap and instant transactions. However, it’s advisable to not send large amounts of crypto on the wallet as its development, just like the Lightning Network, is yet to go mainstream.

Éclair is also compatible with C-lightning and Ind, another LN implementation that we’ll look at next. This means users can connect with another user(s) on either network.

3. Lightning Network Daemon (LND)

LND is under development by Lightning Labs. It’s written in the Golang programming language and can run on Linux and Windows. It’s compatible with both C-Lightning and Éclair as well as the Litecoin Lightning Network.

LND also features a desktop wallet that allows users to open a payment channel and shift funds between each other.

4.Lit

Lit is being developed by the Massachusetts University of Technology under their Digital Currency Initiative. Lit functions fairly the same as the other LN implementations, except it’s designed to support all SegWit coins as well, including those that may be developed in the future.

However, Lit does not support interoperability with the other LN implementations since it supports more coins than indicated by the BOLT specification.

MIT is currently developing a solution known as LitBox that will allow users to conduct transactions without needing to be connected to the internet.

Lit is also currently developing a multi-hop routing channel, the lack of which has made it lag behind other LN implementations. Since Lit is being developed by a small, non-commercial-driven team, its progress is slow, and at the moment, it has little real-world utility.

Benefits of the Lightning Network ;

The Lightning Network is still actively in development. The concept looks great on paper, but whether it will work as envisioned remains speculative at this point. If the network were to succeed, Bitcoin users can expect several upsides coming with it. Here are some of them:

Faster transaction speed. You can expect transactions to be much faster, thanks to the elimination of the need for validation of all nodes in the network. Also, this will be a massive step for cryptocurrencies’ ability to compete with the current financial set up in payment processing.

Faster transaction speed. You can expect transactions to be much faster, thanks to the elimination of the need for validation of all nodes in the network. Also, this will be a massive step for cryptocurrencies’ ability to compete with the current financial set up in payment processing.

Transaction fees. LN developers and enthusiasts are banking on the network to contribute to the reduction or elimination of transaction fees, as transactions will be chiefly taking place outside of the main blockchain.

Transaction fees. LN developers and enthusiasts are banking on the network to contribute to the reduction or elimination of transaction fees, as transactions will be chiefly taking place outside of the main blockchain.

LN may prove suitable for micropayments – like paying for coffee, drinks, shopping, and so on. This is because it has an ideal environ for the transfer of small currency values. Also, it will allow for transactions to take place between devices without the need for human intervention, which reduces error and saves time.

LN may prove suitable for micropayments – like paying for coffee, drinks, shopping, and so on. This is because it has an ideal environ for the transfer of small currency values. Also, it will allow for transactions to take place between devices without the need for human intervention, which reduces error and saves time.

Scalability. This is the most anticipated solution of the LN – which is touted to potentially facilitate at least 1 million transactions per second.

Scalability. This is the most anticipated solution of the LN – which is touted to potentially facilitate at least 1 million transactions per second.

Atomic swaps. Provided that two blockchains feature the same cryptographic hash function (and most do), users will be able to send funds from one blockchain to another without the need for an intermediary. This is not just cheaper, but faster.

Atomic swaps. Provided that two blockchains feature the same cryptographic hash function (and most do), users will be able to send funds from one blockchain to another without the need for an intermediary. This is not just cheaper, but faster.

Security and Anonymity. The LN technology might be the thing to finally bring true anonymity to cryptocurrency. The majority of cryptocurrencies, including Bitcoin itself, are pseudonymous – meaning you can conduct transactions without revealing your identity, but transactions can still be traced back to you. LN will enable transactions to take place off-chain, making them impossible to trace.

Security and Anonymity. The LN technology might be the thing to finally bring true anonymity to cryptocurrency. The majority of cryptocurrencies, including Bitcoin itself, are pseudonymous – meaning you can conduct transactions without revealing your identity, but transactions can still be traced back to you. LN will enable transactions to take place off-chain, making them impossible to trace.

Problems with the Lightning Network

The lightning network is a technology that’s still being explored. As such, it still experiencing ‘teething’ problems. The following are some of them.

Lightning networks are meant to be decentralized, like the blockchains, they aim to improve. However, they could instead lead to a centralized network that characterizes the traditional banking system in which banks and other financial organizations regulate transactions. Influential businesses will have more open connections than other users, resulting in their lightning nodes being centralized hubs on the network. And failure at such a hub could feasibly crash the network.

Lightning networks are meant to be decentralized, like the blockchains, they aim to improve. However, they could instead lead to a centralized network that characterizes the traditional banking system in which banks and other financial organizations regulate transactions. Influential businesses will have more open connections than other users, resulting in their lightning nodes being centralized hubs on the network. And failure at such a hub could feasibly crash the network.

LN does not really solve the transaction fee problem. Bitcoin fees will undoubtedly rise in the future, Lightning Network or not. If these fees increase, LN will be rendered obsolete as it would become cheaper to transact on the main blockchain. Thaddeus Dryja admits as much: “Bitcoin’s transaction fees could go up again and hinder the lightning network’s adoption among merchants.”

LN does not really solve the transaction fee problem. Bitcoin fees will undoubtedly rise in the future, Lightning Network or not. If these fees increase, LN will be rendered obsolete as it would become cheaper to transact on the main blockchain. Thaddeus Dryja admits as much: “Bitcoin’s transaction fees could go up again and hinder the lightning network’s adoption among merchants.”

Lightning network nodes are required to be connected to the internet at all times to facilitate transactions. This renders them vulnerable to hacks and thefts. Also, offline storage, which is the safest for cryptocurrencies, is not possible on a lightning network.

Lightning network nodes are required to be connected to the internet at all times to facilitate transactions. This renders them vulnerable to hacks and thefts. Also, offline storage, which is the safest for cryptocurrencies, is not possible on a lightning network.

Going offline would present a new set of problems for the Lightning Network, like the Fraudulent Channel Close. The fraudulent channel close means one party could easily close a payment channel and take crypto funds for themselves when the other is away. Although there’s a given window of time when the other party could contest the closing of a channel, it could expire if either party is offline too long.

Going offline would present a new set of problems for the Lightning Network, like the Fraudulent Channel Close. The fraudulent channel close means one party could easily close a payment channel and take crypto funds for themselves when the other is away. Although there’s a given window of time when the other party could contest the closing of a channel, it could expire if either party is offline too long.

The “centralized” inclination of the lightning network means funds are concentrated in specific nodes within the network. In a scenario when such a node went offline, it could lead to a downtime of the entire network, cutting off user’s access to their funds.

The “centralized” inclination of the lightning network means funds are concentrated in specific nodes within the network. In a scenario when such a node went offline, it could lead to a downtime of the entire network, cutting off user’s access to their funds.

To open and close a payment channel, you need to do so on the main Bitcoin blockchain. This requires manual work and yet more fees.

To open and close a payment channel, you need to do so on the main Bitcoin blockchain. This requires manual work and yet more fees.

When is the Lightning Network Coming?

The cryptoverse is eagerly awaiting this groundbreaking technology to fully come into form. It’s worth noting the concept targeted Bitcoin at first, but it’s currently being explored for more cryptocurrencies, including Zcash, Litecoin, Stellar, Ether, Ripple, and more.

So far, Bitcoin has been tested on Éclair and LND networks with success. It’s also a good sign that the Lightning Network’s specifications have been published. This means developers can apply the rules and implement LN in their preferred programming languages.

Still, the technology is very much in its nascent stages. As of now, the average user cannot really send and receive payments via the network. Moreover, the implementations are still being dogged by bugs – leading developers to warn users not to send real money over the network – yet.

It’s important to note that the technology’s code is very complex and requires rigorous proofing. If the Bitcoin community, and indeed the whole world, is to adopt the technology, it must prove to be safe, reliable, and a veritable upgrade from the blockchain.

Currently, there is no official launch date for the Lightning Network, with each implementation taking a different approach. With that, experts predict that the network may take from several months to two years before going live.

Conclusion

The Lightning Network sounds exciting. It has the potential to improve Bitcoin and the entire cryptocurrency market as we know it. Think instant payments, anonymity, and reduced fees – LN could herald a new beginning for the crypto ecosystem.

However, Bitcoin and crypto fans have a while to wait before the technology can really live up to its promise. It also remains to be seen whether it will live to the promise, to begin with. We can only wait to see what exciting developments and updates the implementations have in store.