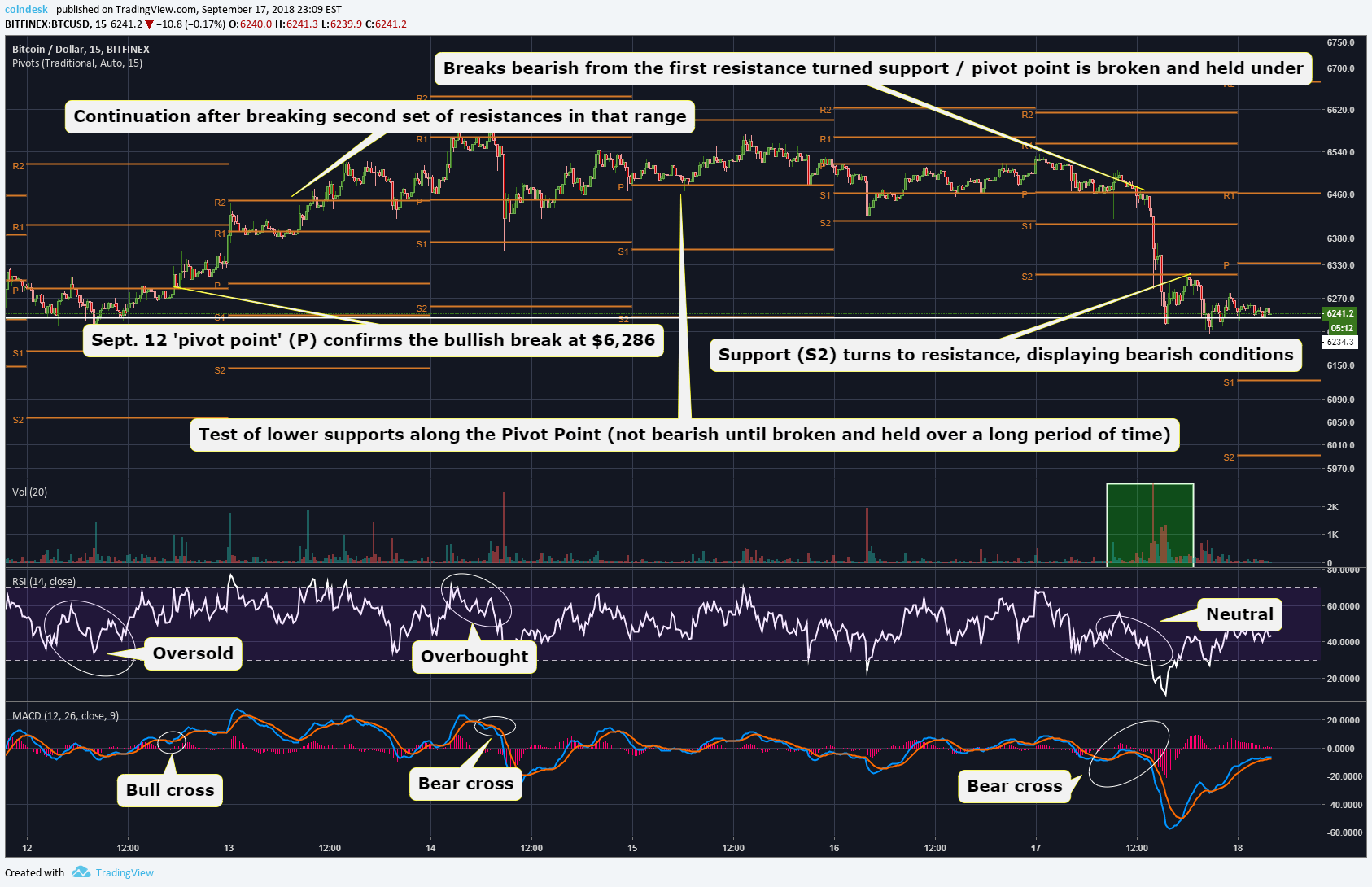

Pivot points are the significant levels used by the market technician to determine the future movement and the major support/resistance levels on the price chart. Pivot point takes the prior period high, low, and close to estimate the future support and resistance levels. Pivot points are the leading indicator, and once they are set on a price chart, it will remain the same throughout the day.

Timeframes

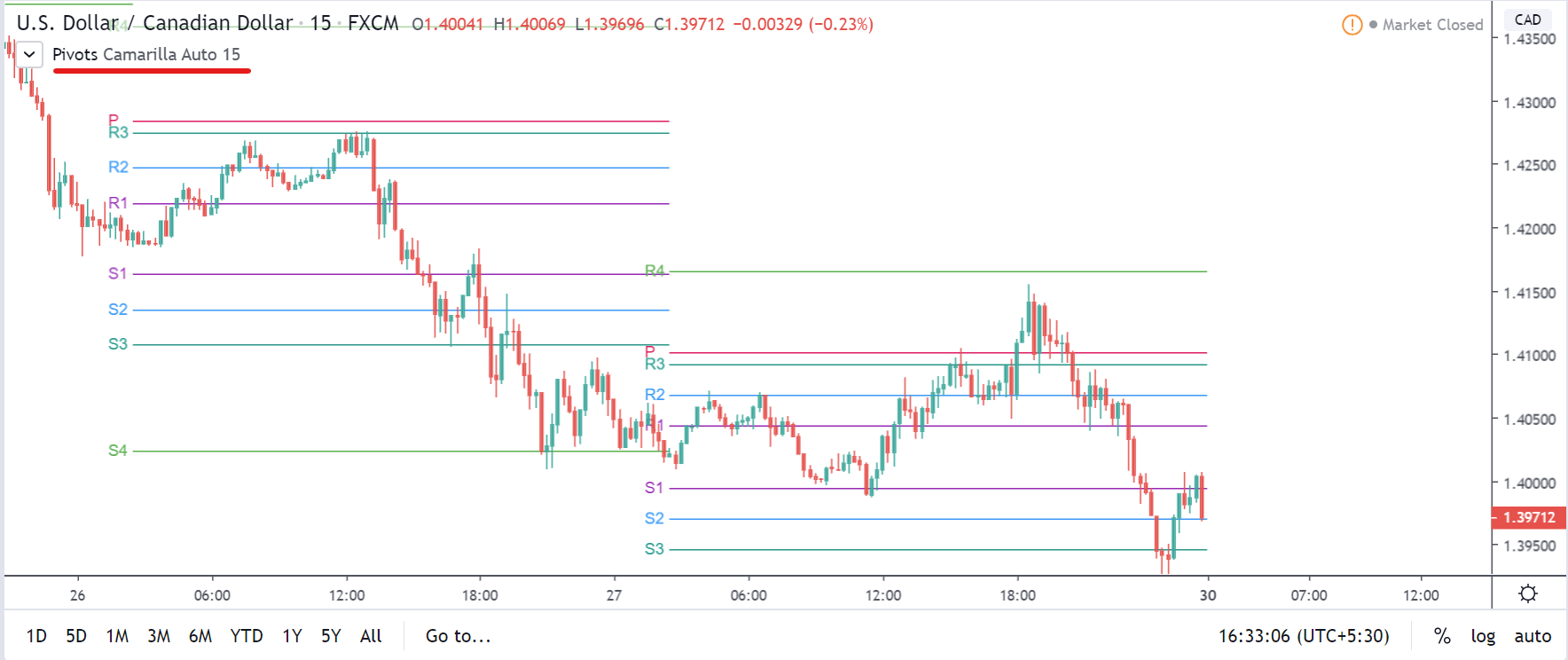

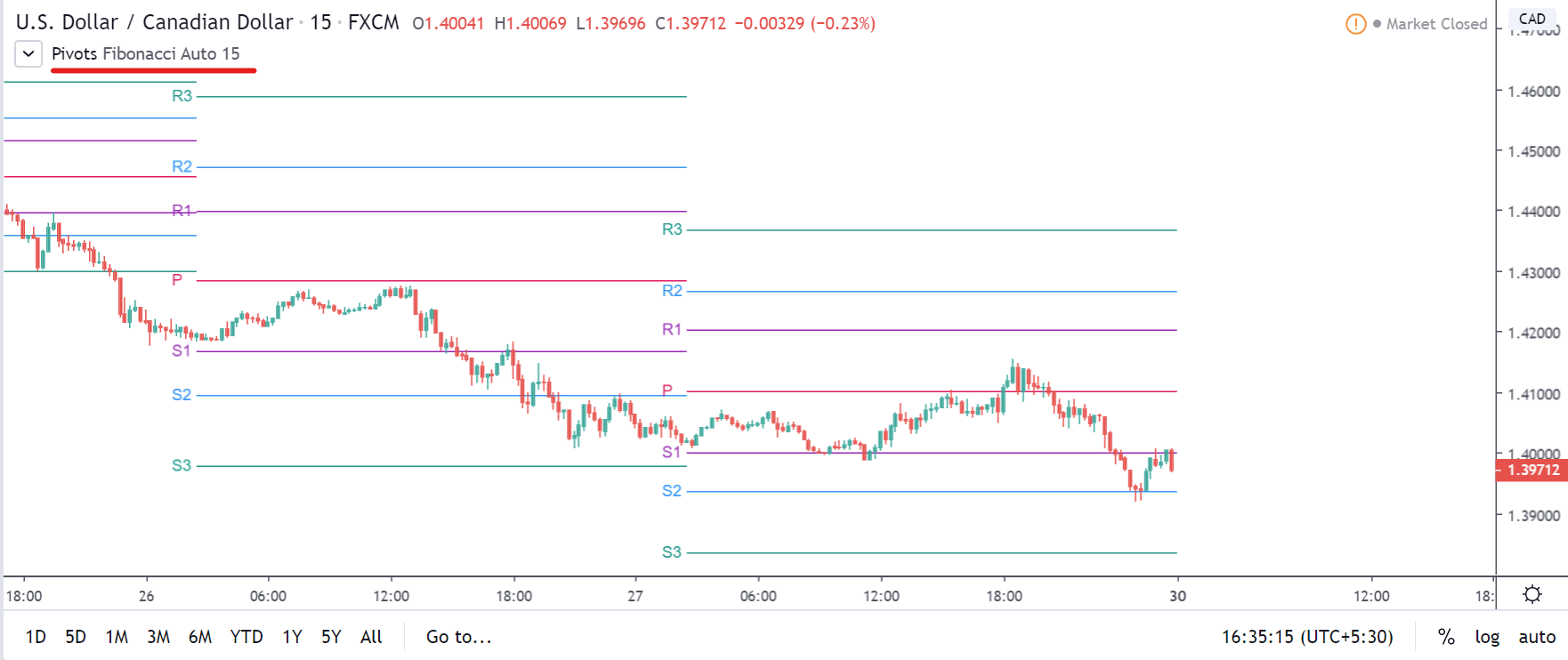

The pivot point of the 1, 5, 10, and 15-minute chart use the prior day high, low, and close. Whereas the pivot points for the 30, 60, and 240-minute chart use the last week high, low, and close to calculate the pivot points. Once the new week starts, the pivot point appears on the price chart until the end of the week.

The pivot point for the daily and chart use the prior month data, and the pivot point for the weekly and the monthly chart use the last year’s data. The new pivot point for the year ahead will be calculated on the 1st of January. These would be based on the high, low, and close of the last year’s pivot points.

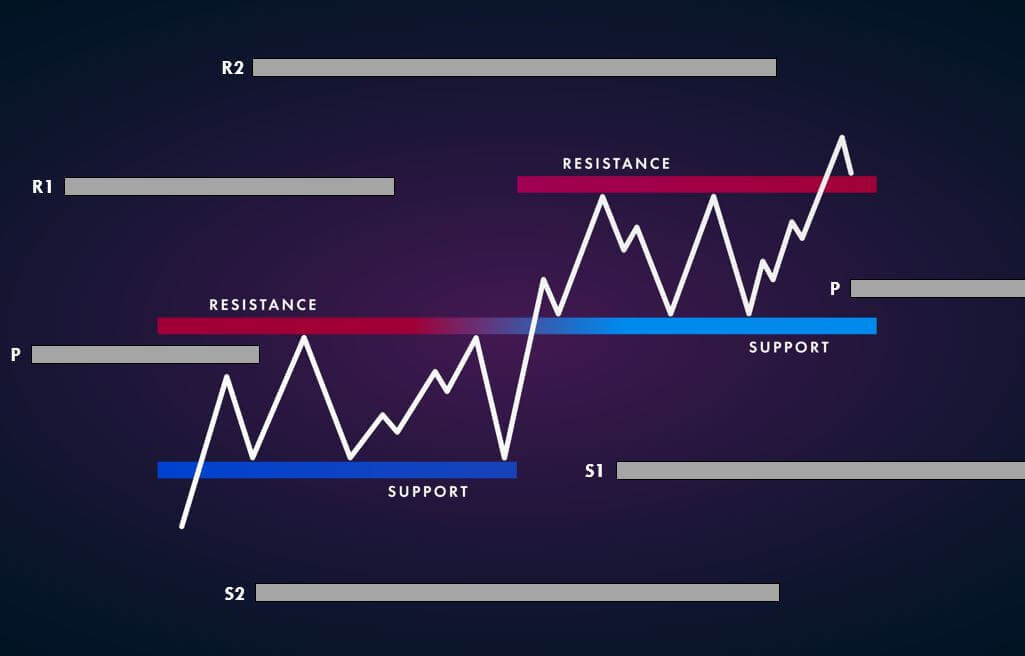

There is a total of seven basics pivot levels on the price chart.

- Basic pivot level – It is the middle of the center pivot line.

- Resistance 1 (R1) It is the first pivot point above the centerline.

- Resistance 2 (R2) It is the second pivot level above resistance 1.

- Resistance 3 (R3) It is the third pivot level above resistance 2.

- Support 1 (S1) It is the first pivot level below the middle pivot line.

- Support 2 (S2) It is the second pivot level below support 1.

- Support 3 (S3) It is the third pivot level below support 2.

Trading Strategies Using Pivot Points

There are various pivot point trading strategies in the market; this one is especially we created for our fellow traders, our strategy is backtested on demo and even on trading simulation, so you no need to put the work required to find out the probability of this strategy—all we suggest you follow this strategy very well to make consistent money from the market.

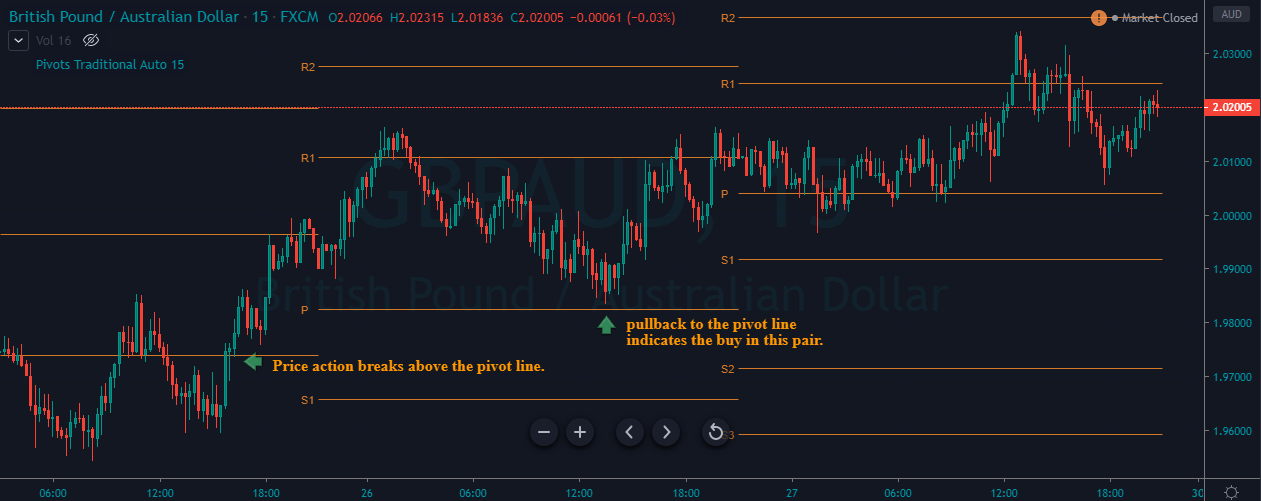

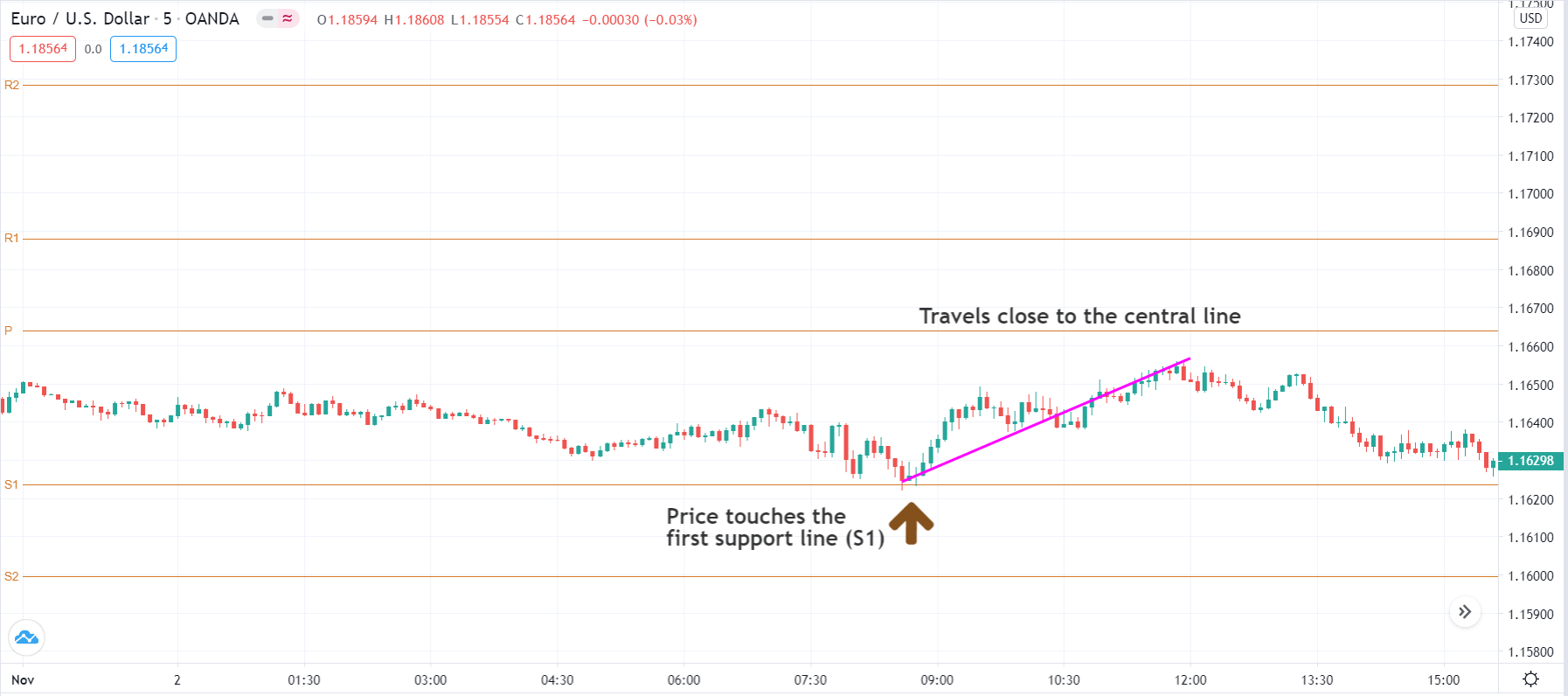

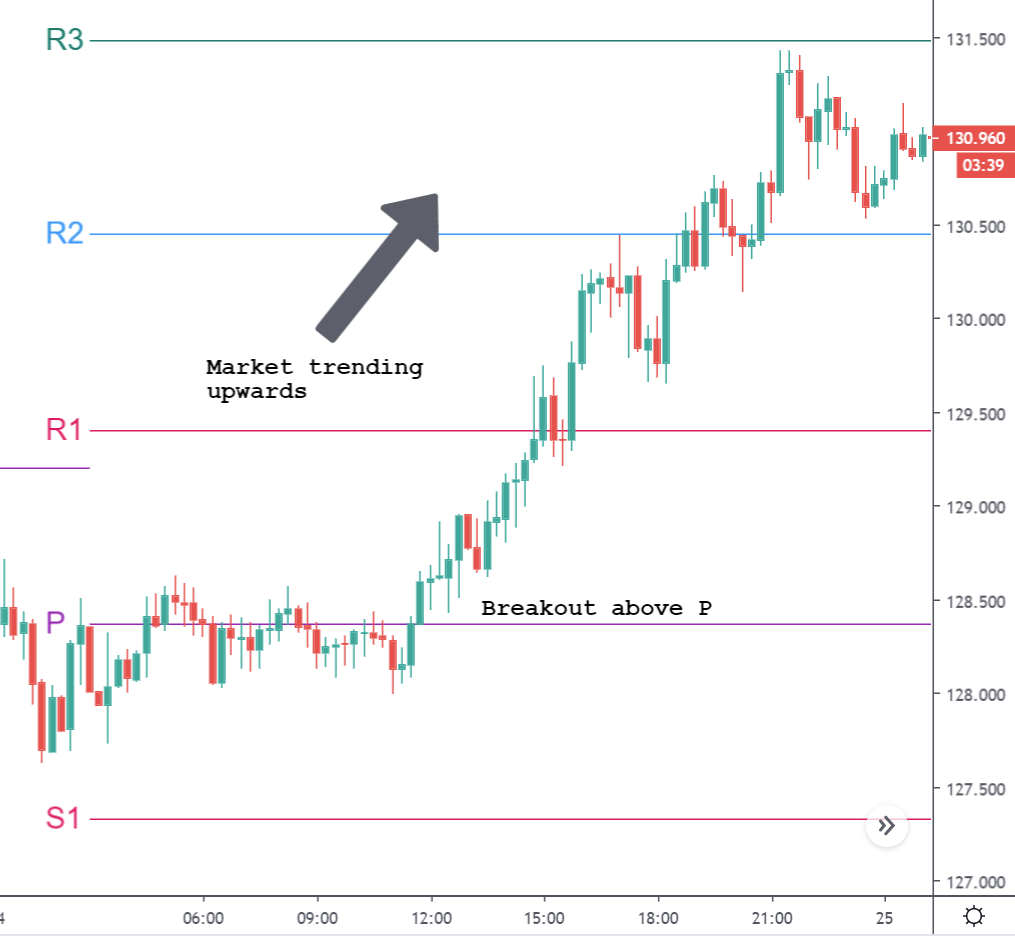

Pivot points most often work very well in trending market conditions; some traders even use pivot points on lower timeframes to scalp the markets. The strategy is to find out the uptrend in any instrument and wait for the pivot point to go above the Pivot point centerline, and then wait for the pullback back to the pivot line to take buy entry. You can close your position at resistance one if the market momentum is choppy, and even in a strong trending market, you can also book the profit at resistance two or three.

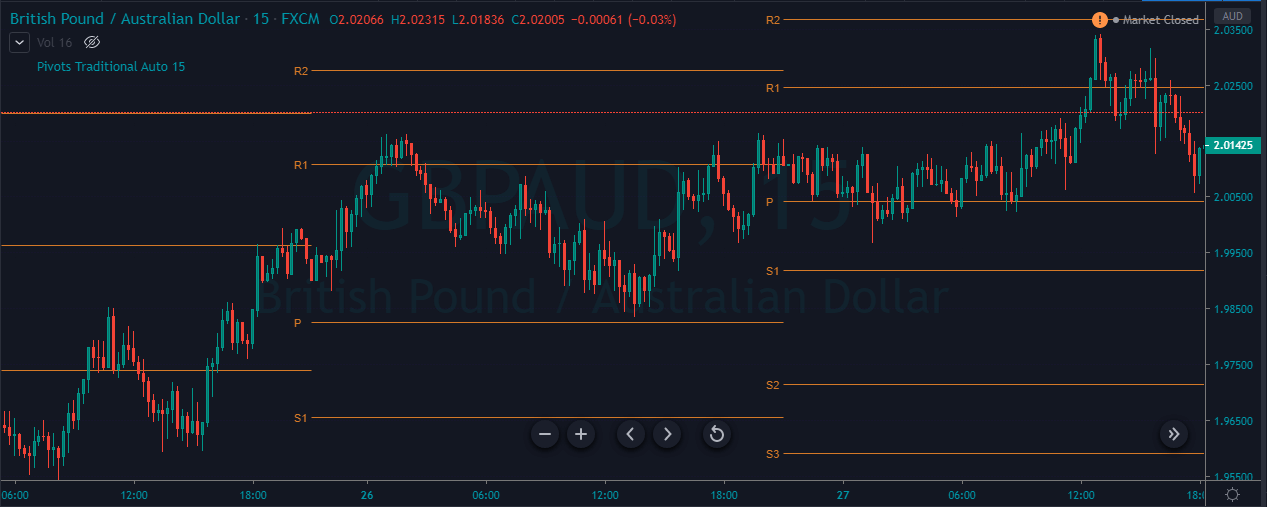

The image below represents the uptrend in the GBPAUD forex pair.

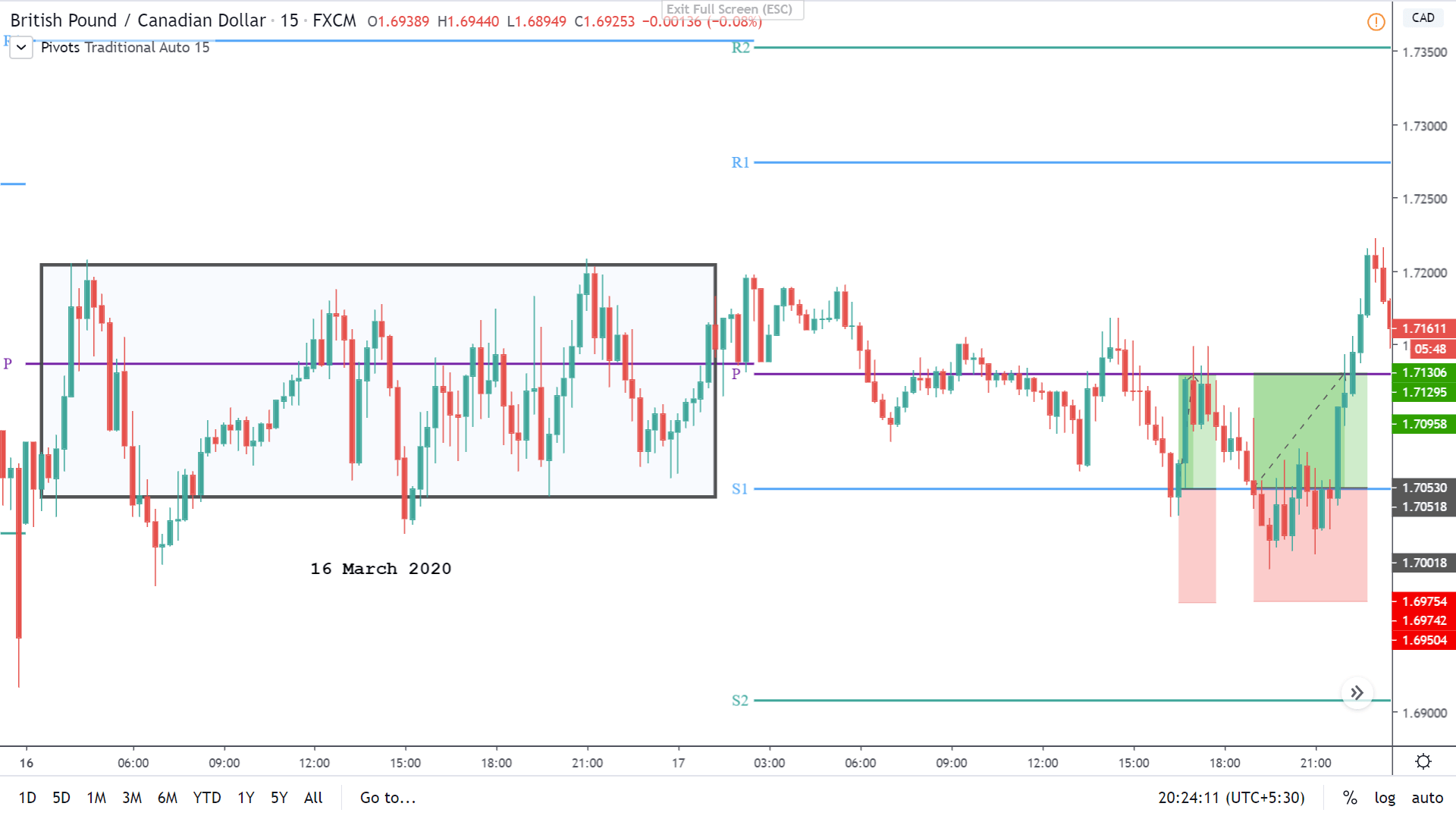

The image below represents our buying entry in this pair. Notice that the day before our entry price action breaks the pivot line and the very next price action pullback to the pivot line. Keep in mind that the pullback must hold at the pivot line then only it confirms the buy trade, never place the limit order at the pivot line. Let the price action test the support line take entry.

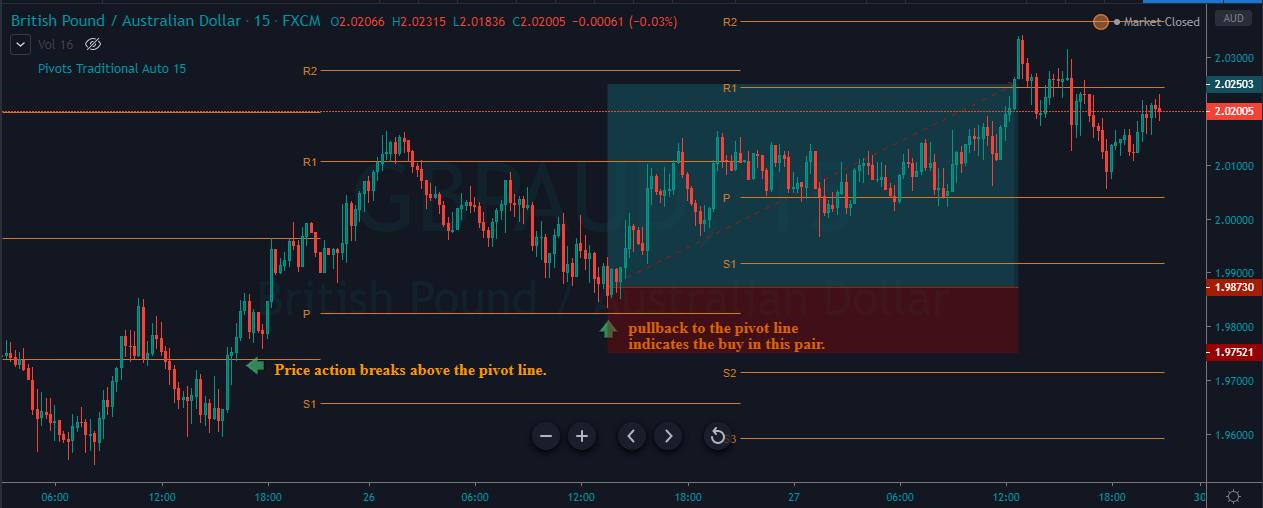

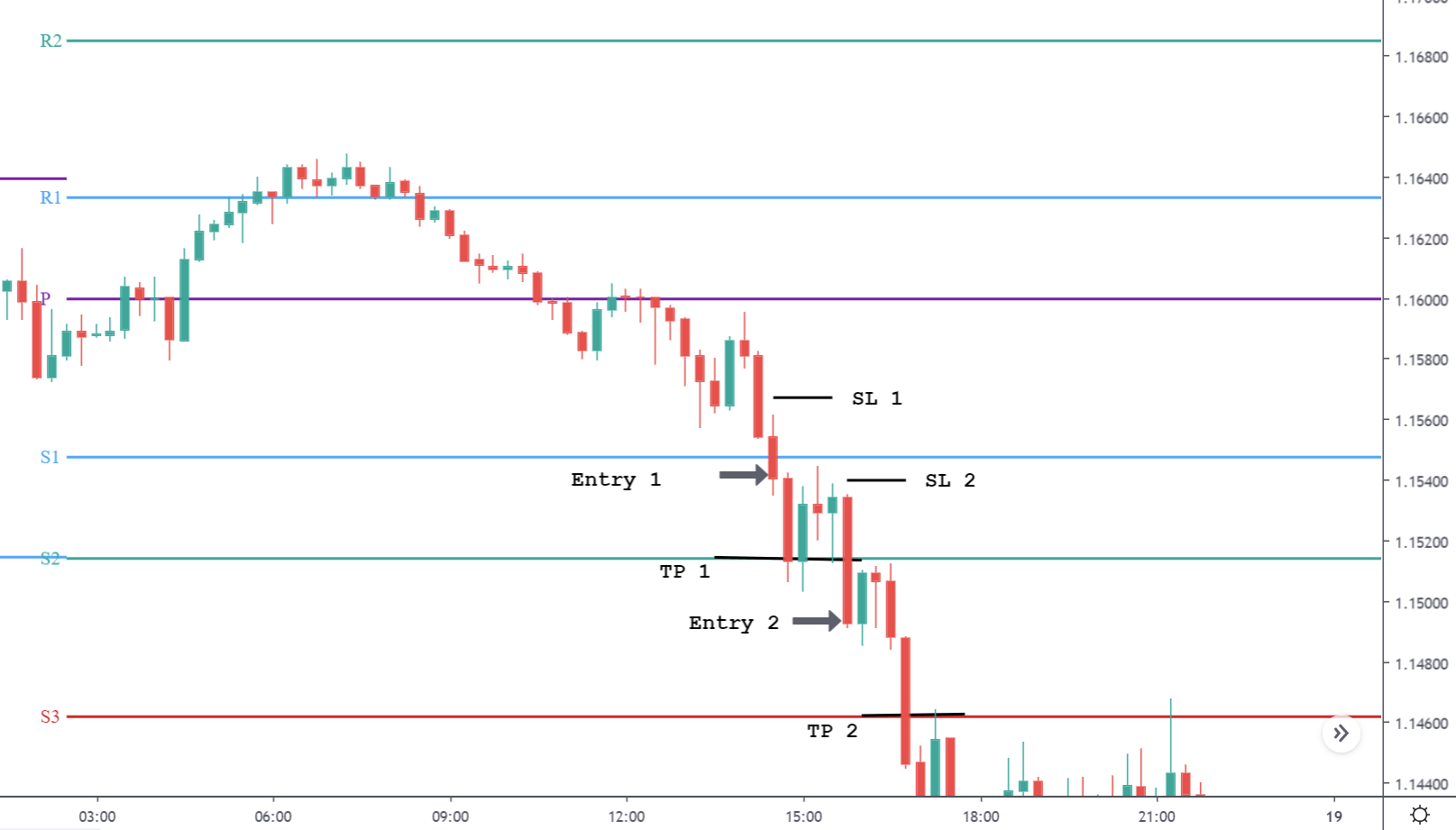

The image below represents our entry, exit, and take profit in the GBPAUD forex pair. When you follow so many steps to take an entry, it means that you are going for the precision in the market, and for the precision entries, always put the stop loss just below the entry price. In the image below, notice that our stop loss was just below the pivot line, and for the take profit, we go to the R1 of the next day, which was R2 for the previous day. Take profit is an art in the market, and when you use the pivot points, it’s even easier to book profit. If the price action immediately approaches the R1, then you can expect the price action to hit the R2 or even R3. If the price action shows you the struggle to hit the R1, then simply do not expect the deeper targets.

Pivot Points + Double Moving Average

Moving average is a widely used indicator in the market which smooths out the price action by filtering out the noise from the random short-term price fluctuations. There are an infinite amount of moving averages in the market, which helps the traders to identify the market trend, entry, and exit also the potential reversals. When the moving average goes above the price action, it means that the trend is down, and when it goes below the price action, it indicates the uptrend in the security. In this strategy, we used the 30 and 15-period average to trade the market.

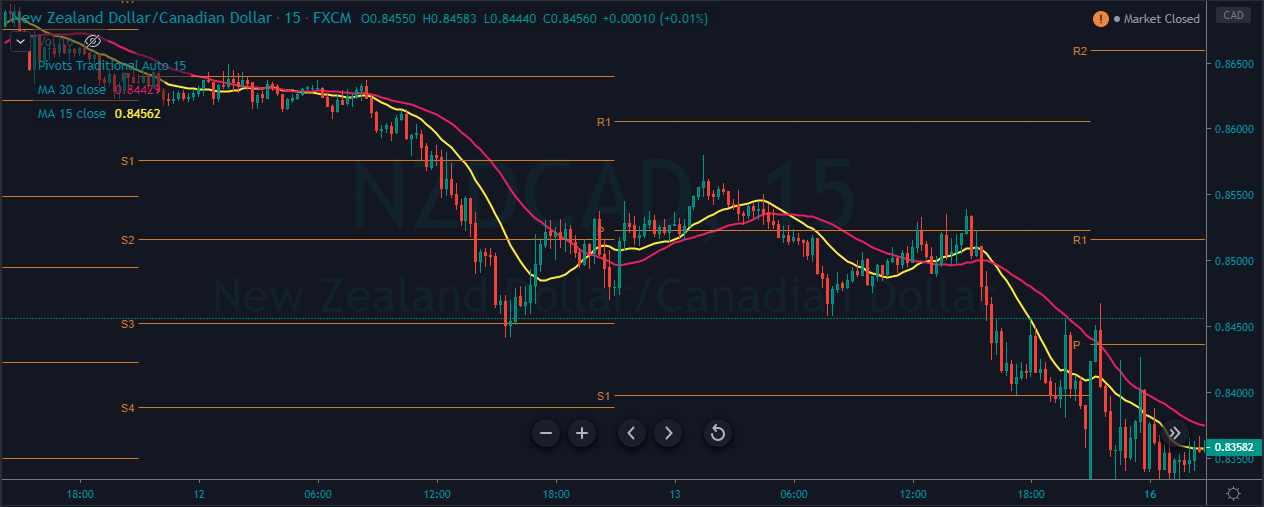

The trading strategy is, first of all, to find out the downtrend in any pair and wait for the prices to close below the pivot line also check the crossover above the price action on a double moving average to take an entry.

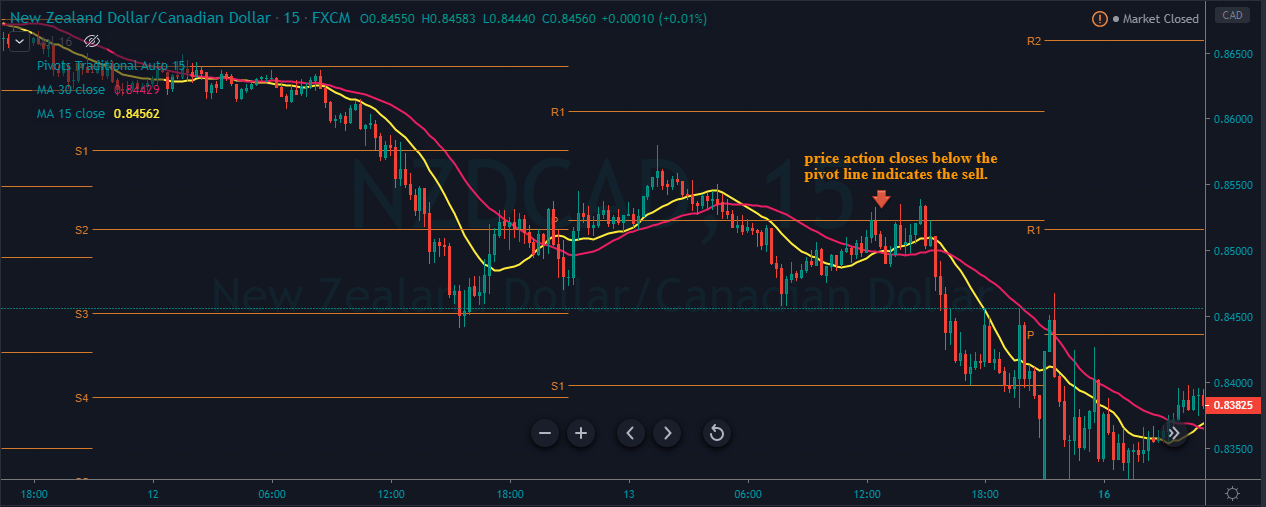

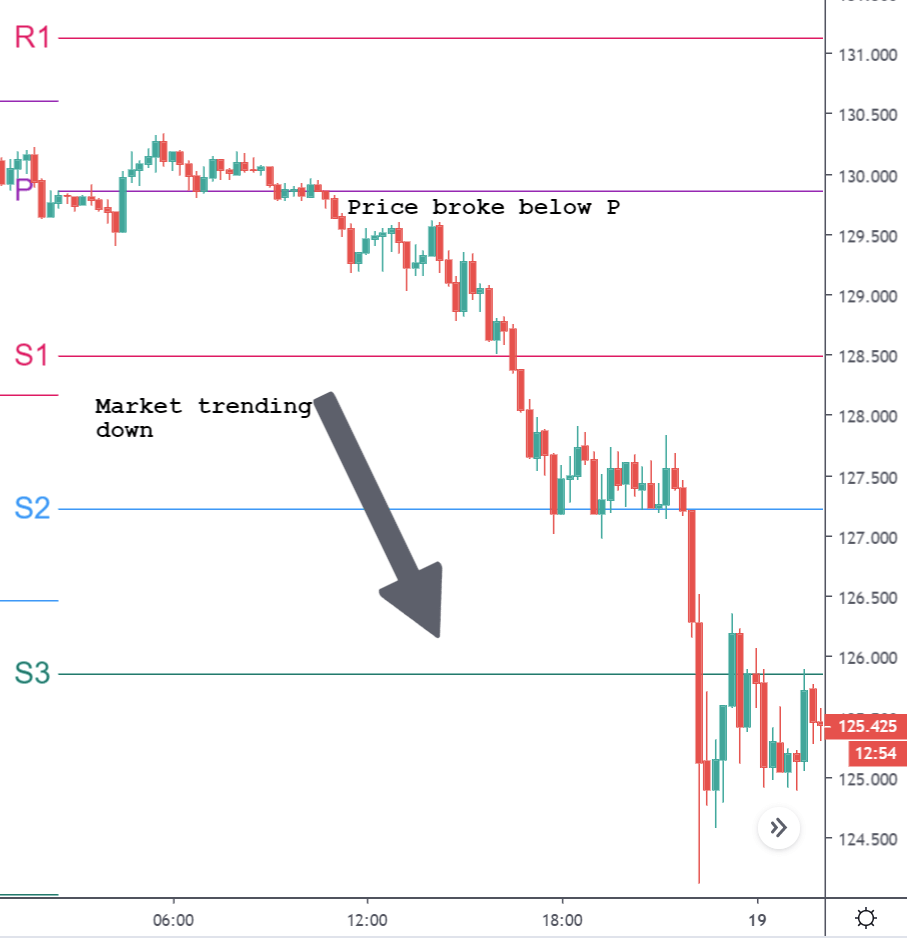

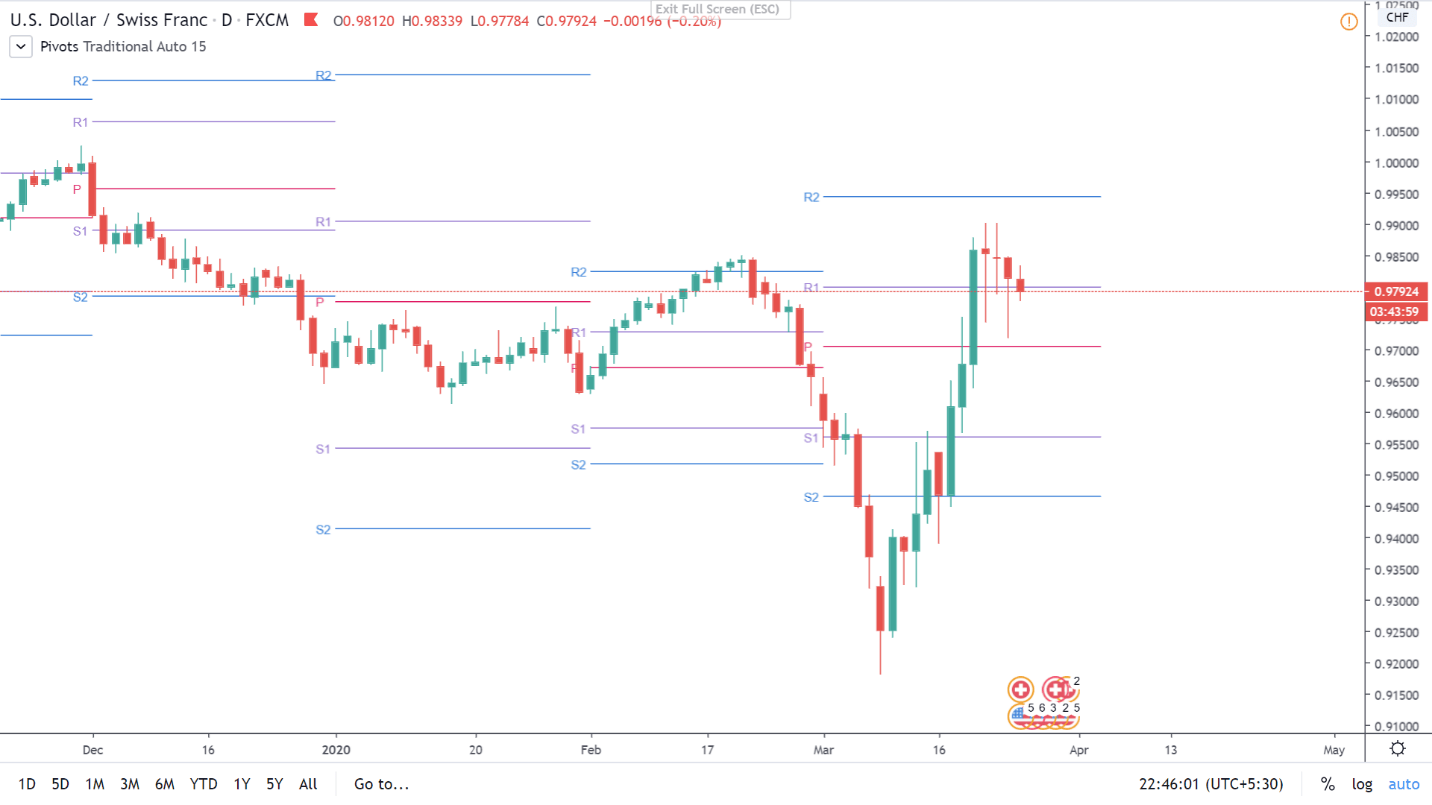

The image below represents the downtrend in an NZDCAD forex pair.

As you can see in the below image of the NZDCAD forex pair, it indicates the selling entry in this pair. In a downtrend, when the price action holds below the pivot line, it shows that the prices respect the resistance area; also, the crossover on the MA indicates the market is ready to print a brand new lower low.

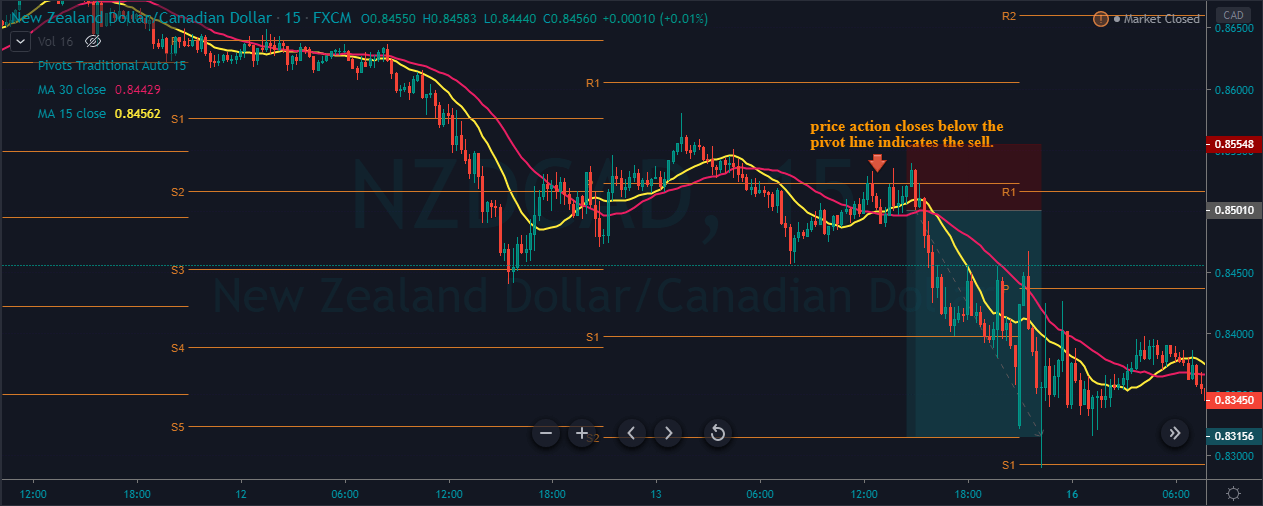

The below image represents our entry, exit, and take profit in this pair. As you can see, the entry was when prices hold below the pivot line, and the stops were just above the pivot line because the holds below show that the buyers hold no power to break above the pivot line. After our entry, price action strongly blasts to the north, which shows that we can expect our trade to travel even longer. Price action holds for some time at the S1, and then it immediately blasts to the S2 and prints the brand new lower low.

Conclusion

Pivot points are the leading indicator in the industry, which provides a glance at potential support and resistance level in the market. These levels are useful for taking an entry, or it can be useful for putting stop loss or for booking profit also. AS the leading indicator, you can use them all alone to trade the market, or you can pair them with some other indicator to trade the market. The critical benefit of pivot points is they work on all the financial markets also on all the trading timeframes. Try not to use this indicator in the ranging conditions and also avoid the use in the highly volatile markets.