Has time run out for the Brexit future trade deal? Where next for the Pound?

Thank you for joining this forex academy educational video.

The British government set itself a deadline of 15th of October with which to had a formal future, a tariff-free trade deal with the EU by the 15th October 2020.

That deadline came and went and was subsequently extended to the 13th of November, where, at the time of writing, no such agreement is in place. The United Kingdom is set to leave the European Union transition period on the last day of 2020. With both the European Union chief negotiator Michael Barnier, and the UK’s chief negotiator on this issue, David frost, both proclaiming that the other side needs to move on key issues such as fisheries, I need a so-called level playing field, it is highly unlikely that a deal can be reached in time I’m for the legal framework to be set in place whereby any such new tariff 3 agreement can be implemented on the 1st day of January 2021.

So, what are the options? The UK government cannot extend the negotiation period because the end of the transition period date is set into law. And so if they will not budge on the requirements and terms of a future trading partnership with the EU, it will appear that the British will be leaving on WTO, or world trade organization, terms, and it is perceived that this would be bad for the British economy, whereby a tariff-free arrangement with the European Union would be in the best interests of both sides because it would offer a smoother, future, trading arrangement.

Let’s have a look at how this is being played out in the forex market, where the most widely traded British pound pair is the GBPUSD.

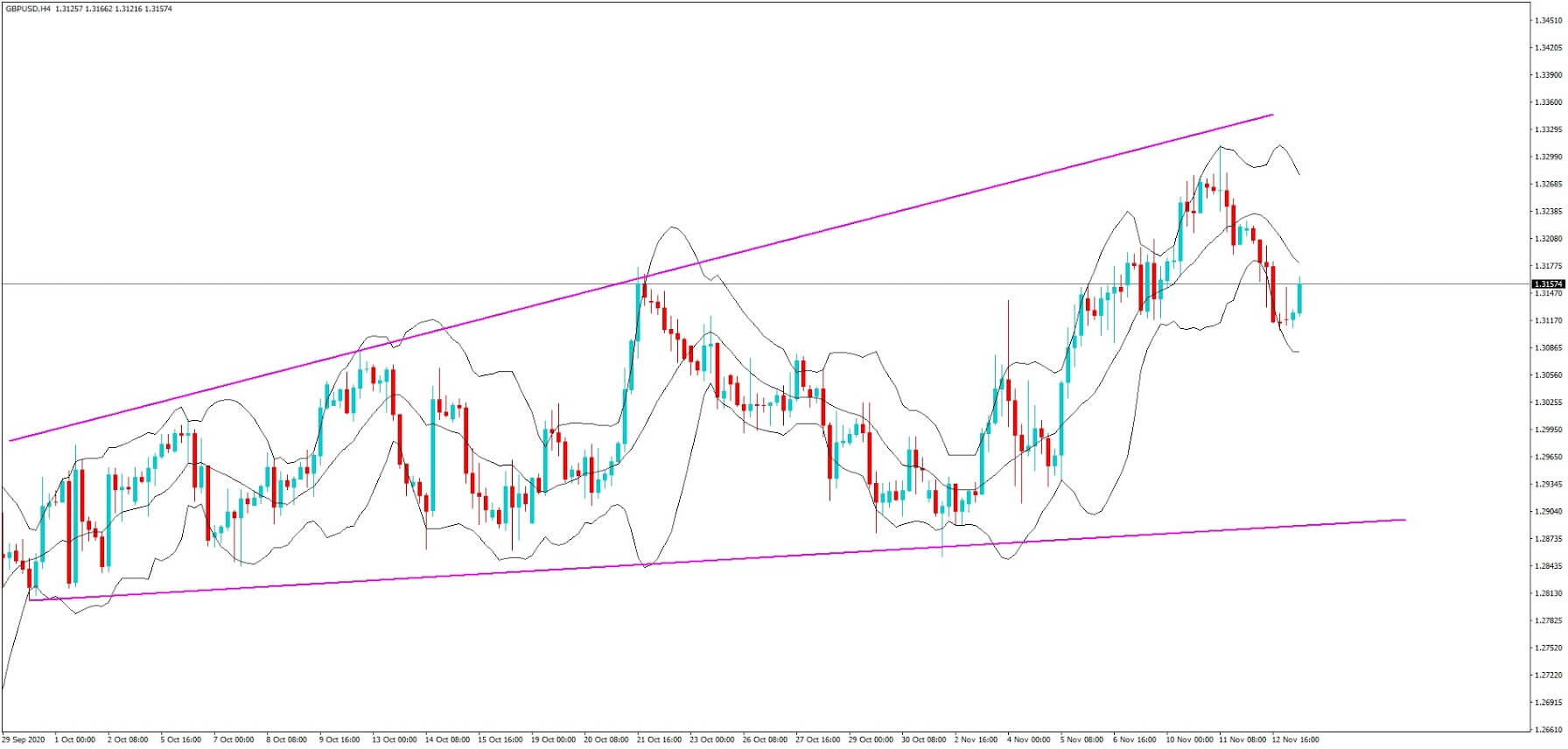

This is a daily chart for the pair. And we note and expansive bull channel, which has been conforming since the middle of May 2020. This tells us that price action has been fuelled by the potential of a future tariff-free trade deal with the EU. The overall price action has been to the upside. Although this has been waning since early September, such as position ‘A’ and the most recent high was at 1.33.

However, if we bring that daily time frame down to the 4-hour chart, we now see that although price action was waning to the upside at position A on the 1-hour chance, price action for that period has been conforming to an expanding bearish channel on the 4-hour chart.

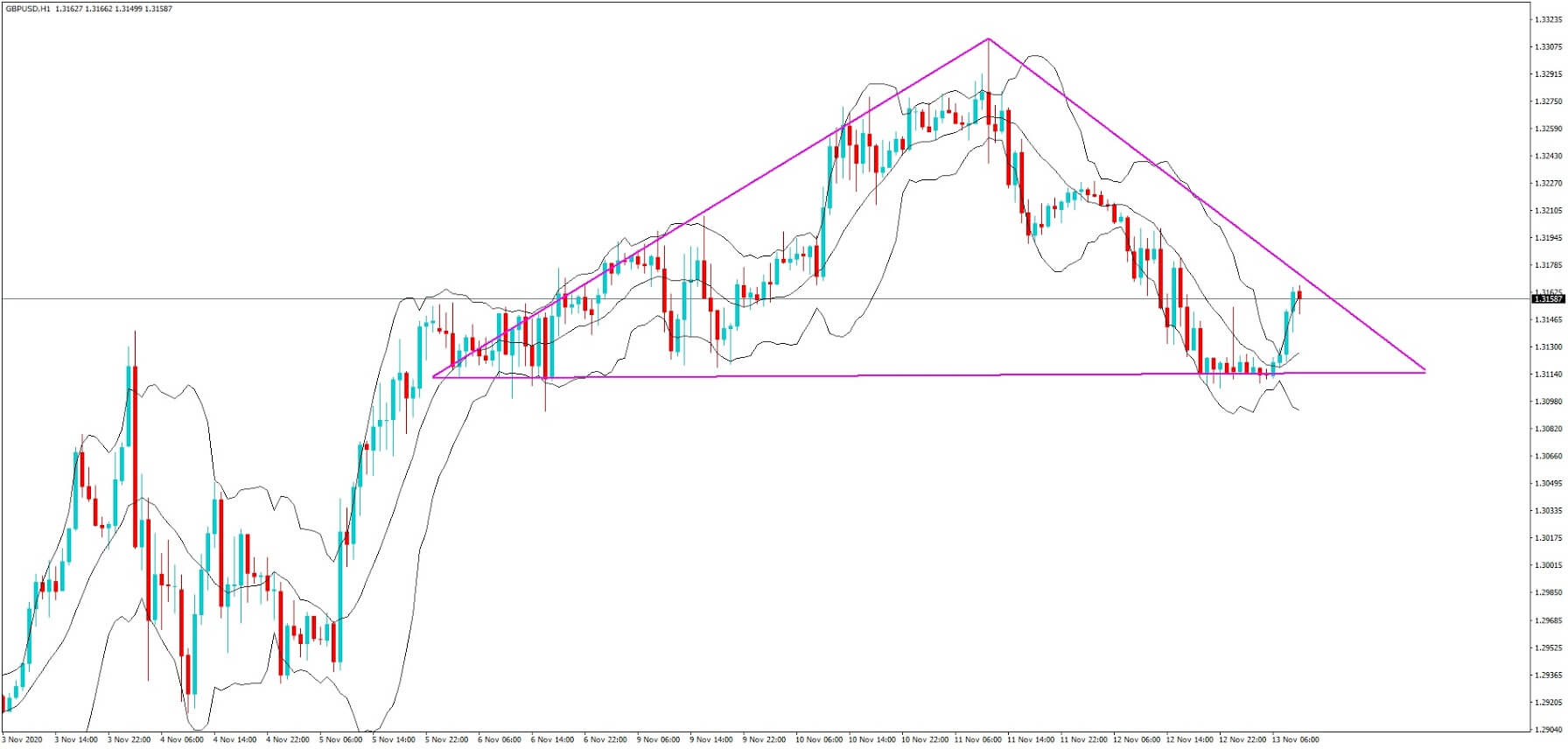

Now let’s look at what has been happening for the pair are on a 1-hour chart over the last 8 days. Here we can see that price action has been conforming to this triangle where initially we have a bull run up to a peak of just above 1.3300. Since then, price action has been falling lower, to just above 1.3100, and where price action is now conforming to the fundamentals with regard to the potential of a no tariff future trading arrangement deal Brexit.

As time runs out, with no sides giving up any grounds in order to compromise for the sake of a future tariff-free trading relationship, the pair will continue to come under pressure to the downside, in which case the pound is likely to lose value against its counterparts and especially with the United States dollar, notwithstanding the fact that the US economy is suffering because of the covid pandemic and where 150,000 cases were reported in a single day this week, heaping more pressure on the federal government to find fiscal solutions to this problem, which is not going away anytime soon.