For beginners – How to trade the EURGBP with no trade deal Brexit

Thank you for joining this forex academy educational video.

Great Britain voted in a national referendum to leave the European Union June 2016. The United Kingdom officially left the EU you in January 2020 with a one-year transition period which ends on the 31st of December 2020.

This was to allow the EU and the United Kingdom four years to come up with a future trading solution with regard to laws and arrangements which would allow the United Kingdom to take back its sovereignty, which is what the people of Great Britain wanted.

However, unravelling the years of business ties between the two areas, including laws, fishing rights, humanitarian issues, worker’s rights, competitive fairness, financial regulatory alignment, including a whole myriad of rules and regulations has been one of the most complicated issues in modern times. The affair is turning into an acrimonious divorcAfter the transition period, theThe two sides agreed thod they would work towards having a free trade agreem,ent which would lead to an almost seamless continuation of business.

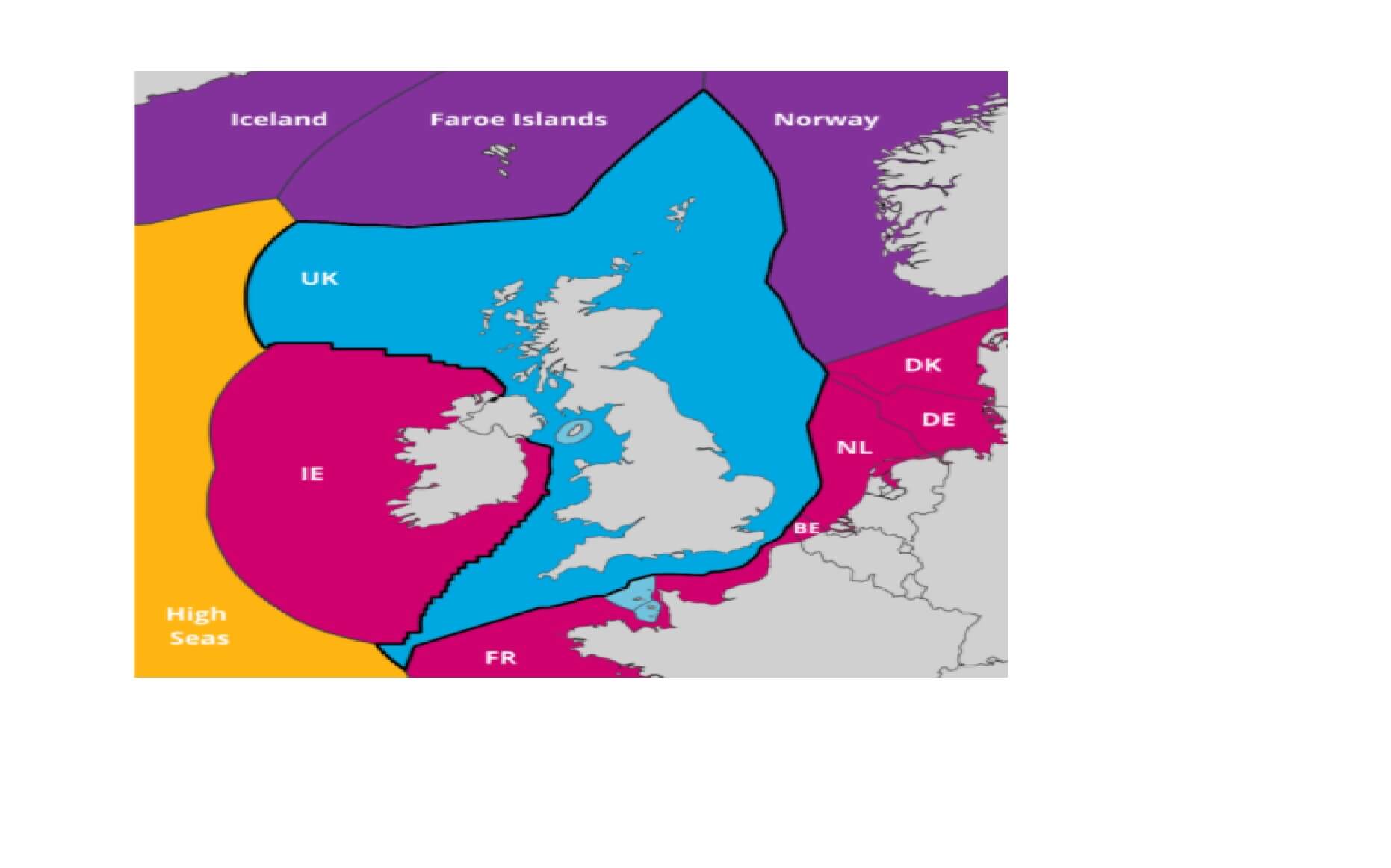

But the United Kingdom claims that many of the terms and conditions as set out by the European Union in order to grant a free trade agreement to the United Kingdom are seen as not acceptable to the British government. Some of these conditions are centred around fishing, where the EU wants to continue fishing in British sovereign waters, a so-called level playing field, where the United Kingdom cannot go out and sign up other trade agreements around the world by undercutting EU member states. And where the EU has said that any breach by the UK of such a future agreement, or where the EU changes regulations, and the UK does not fall into line, would be penalised by tariffs and which the UK has said this is totally unacceptable. Ten deadlines have come and passed between the two sides regarding reaching an agreement, and where currently, at the time of writing, there are just a few days left to instigate and agreement, and where both sides are saying this is now very unlikely to happen.

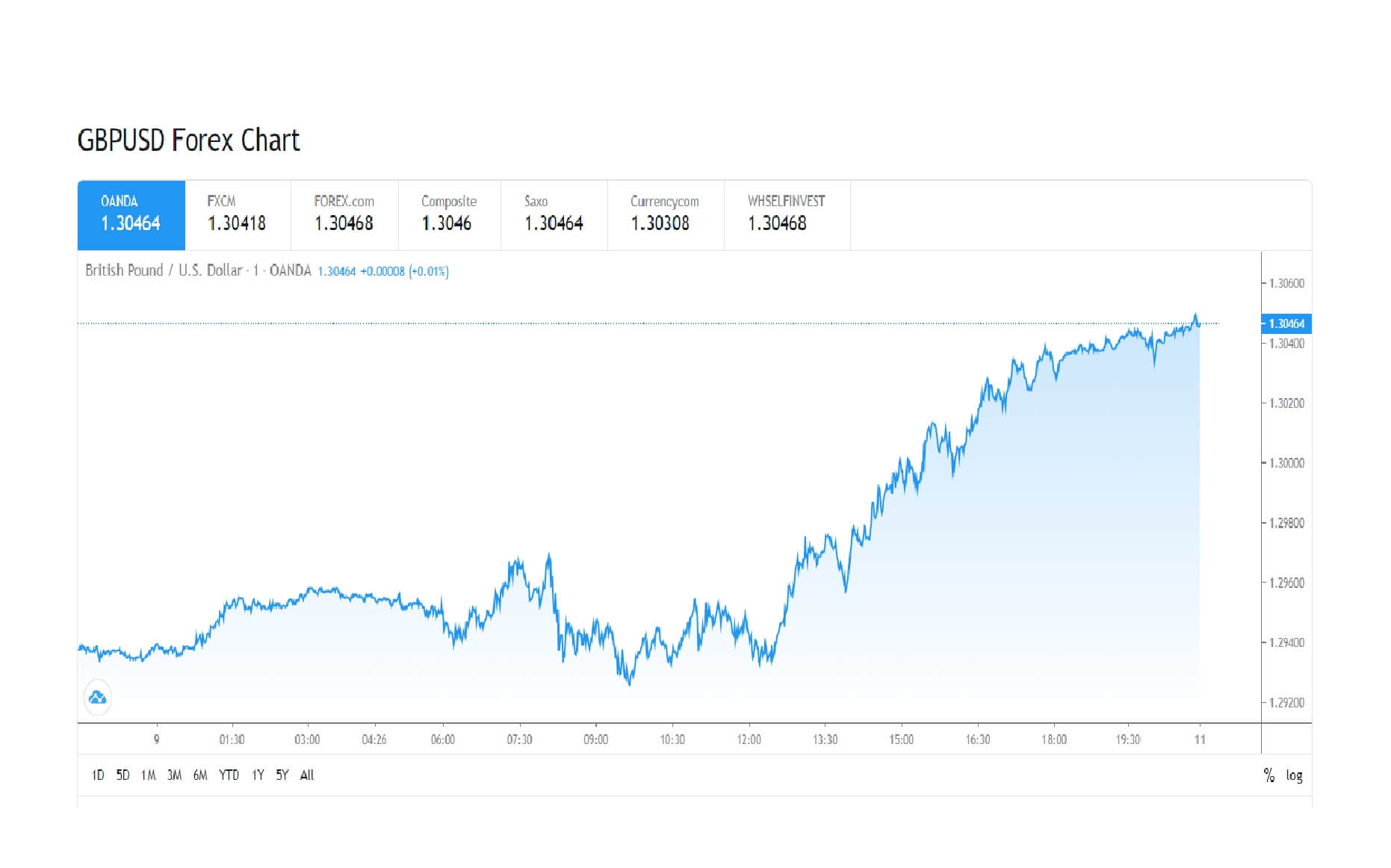

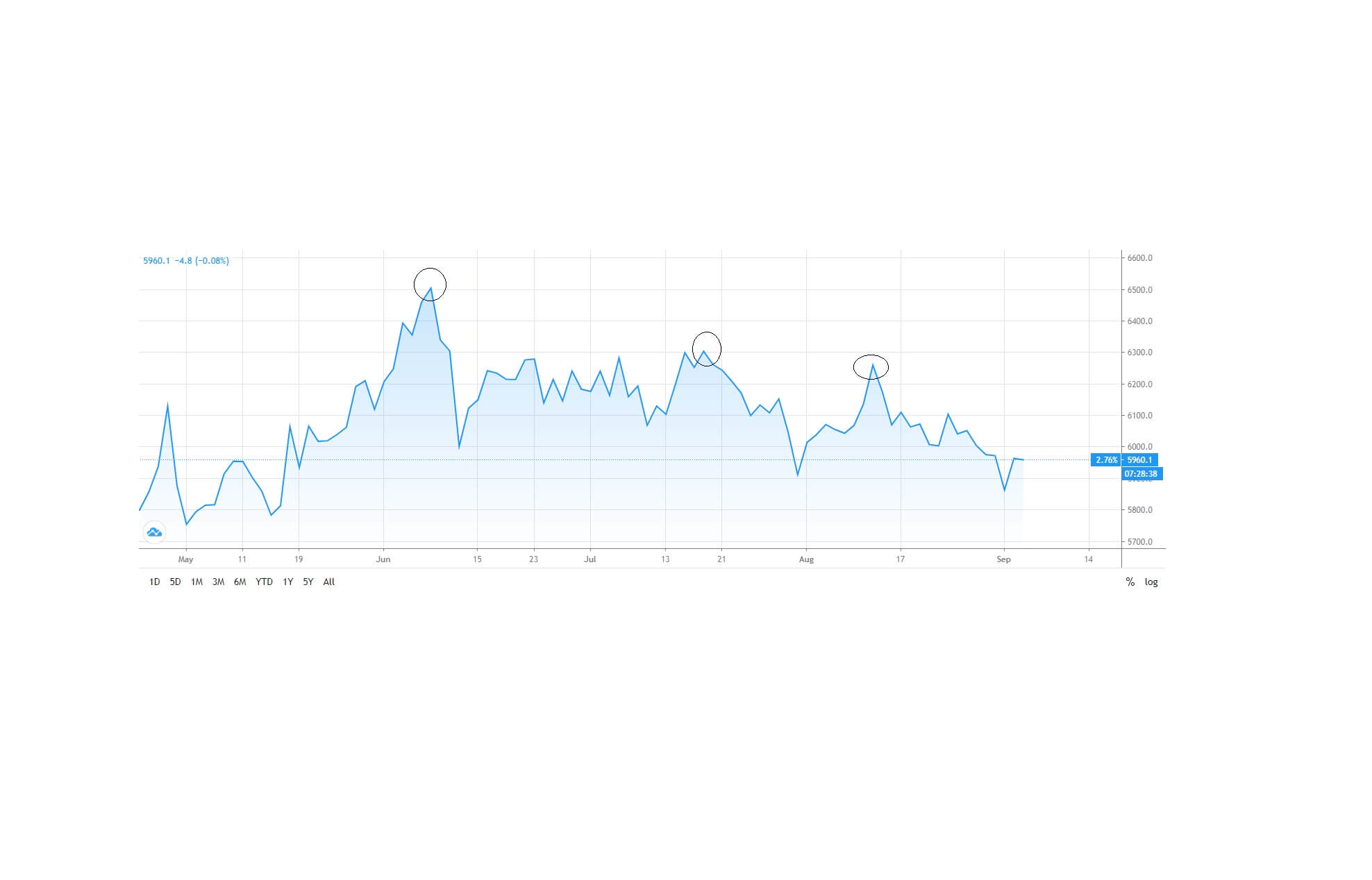

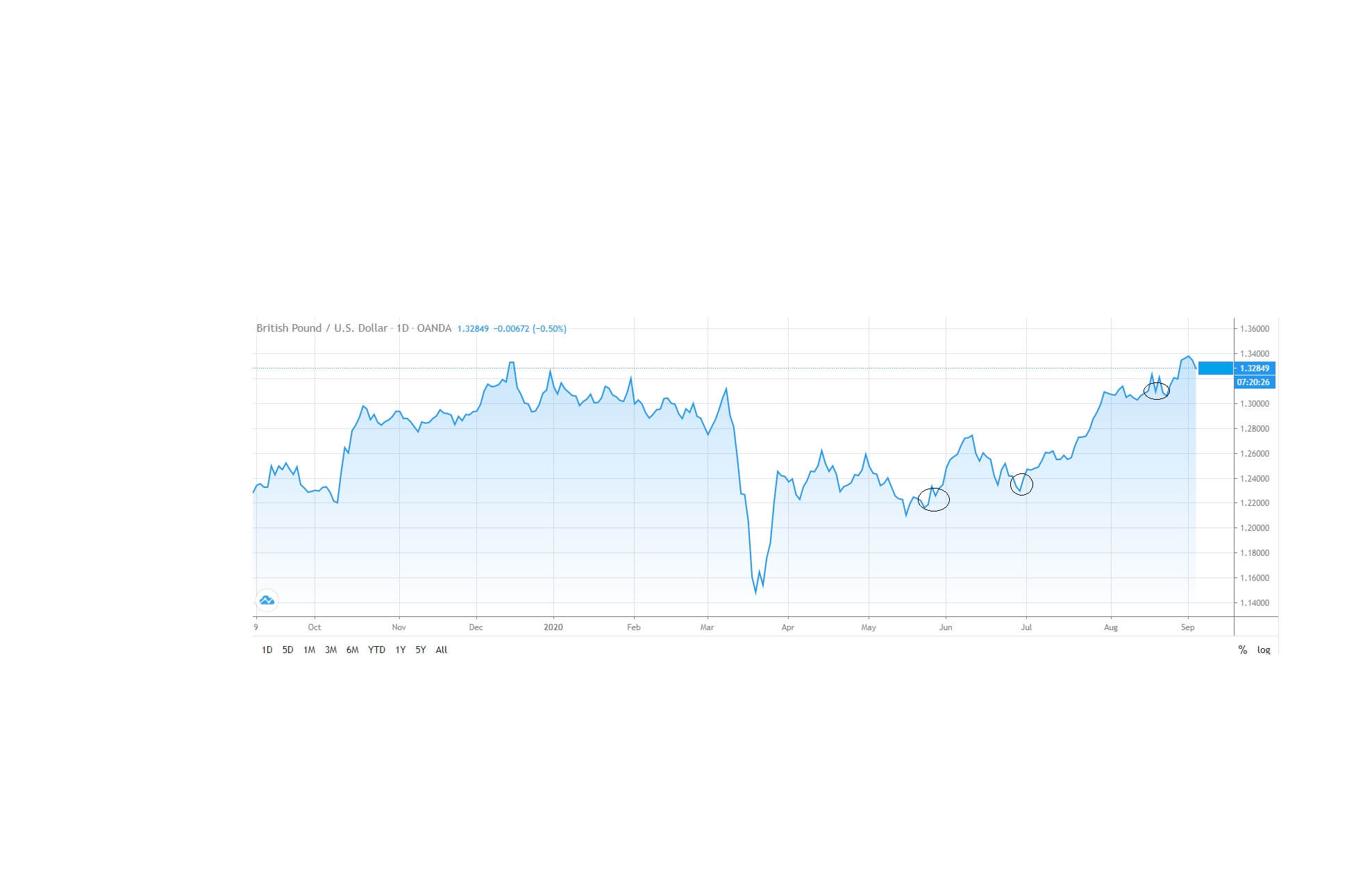

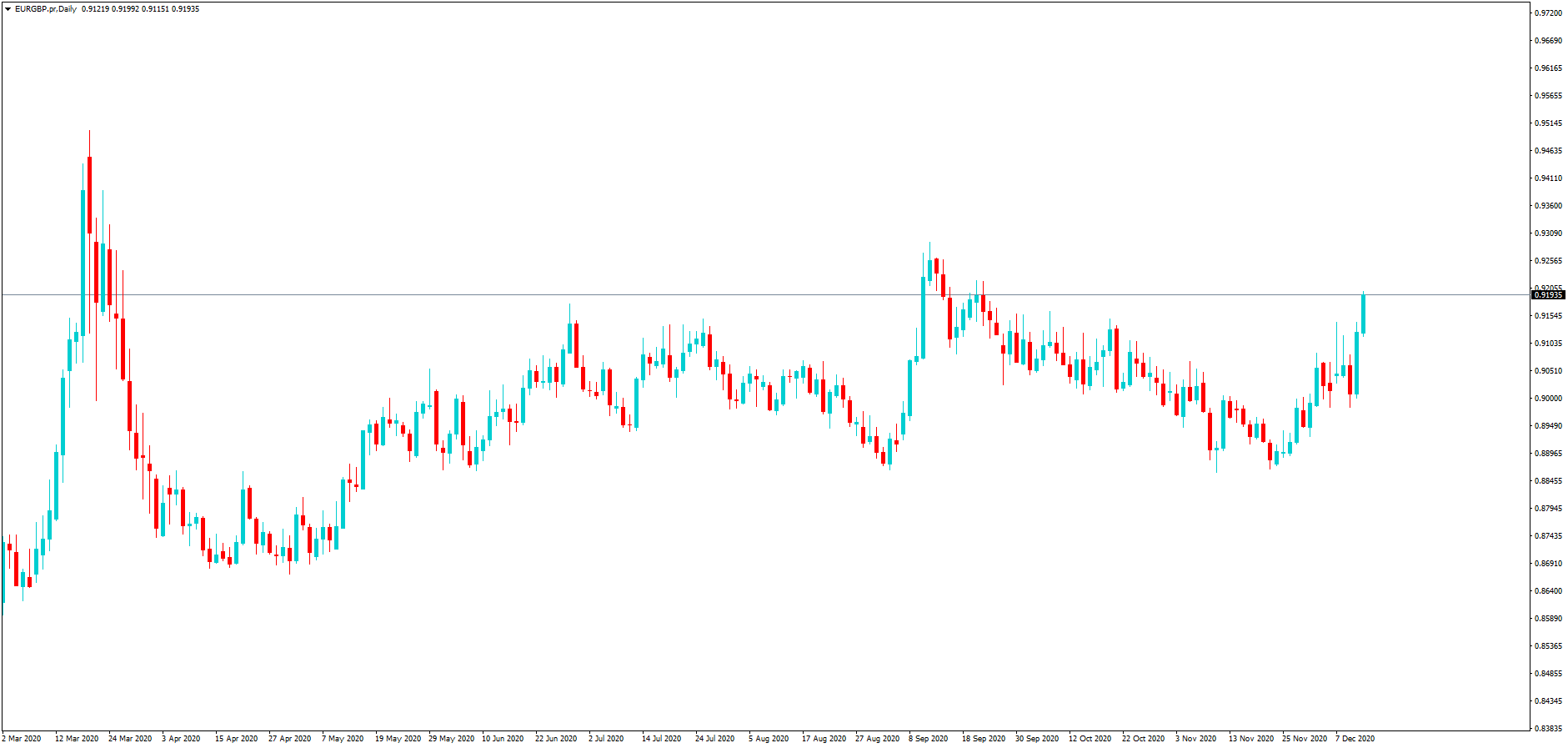

This is a daily chart of the euro to Great British pound pair ,or EURGBP, and where we can clearly by the blue candlesticks that since the latter part of November 2020, the Euro is gaining in value on the exchange rate.

Investors believe that the sentiment has changed in the latter stages of November and certainly since the 7th of December, and where they believe that in the current state there will likely be no deal and therefore because the European Union is economy is much greater than that of the United Kingdom that the Euro will fare better than the pound in the event of a no tariff-free arrangement being reached.

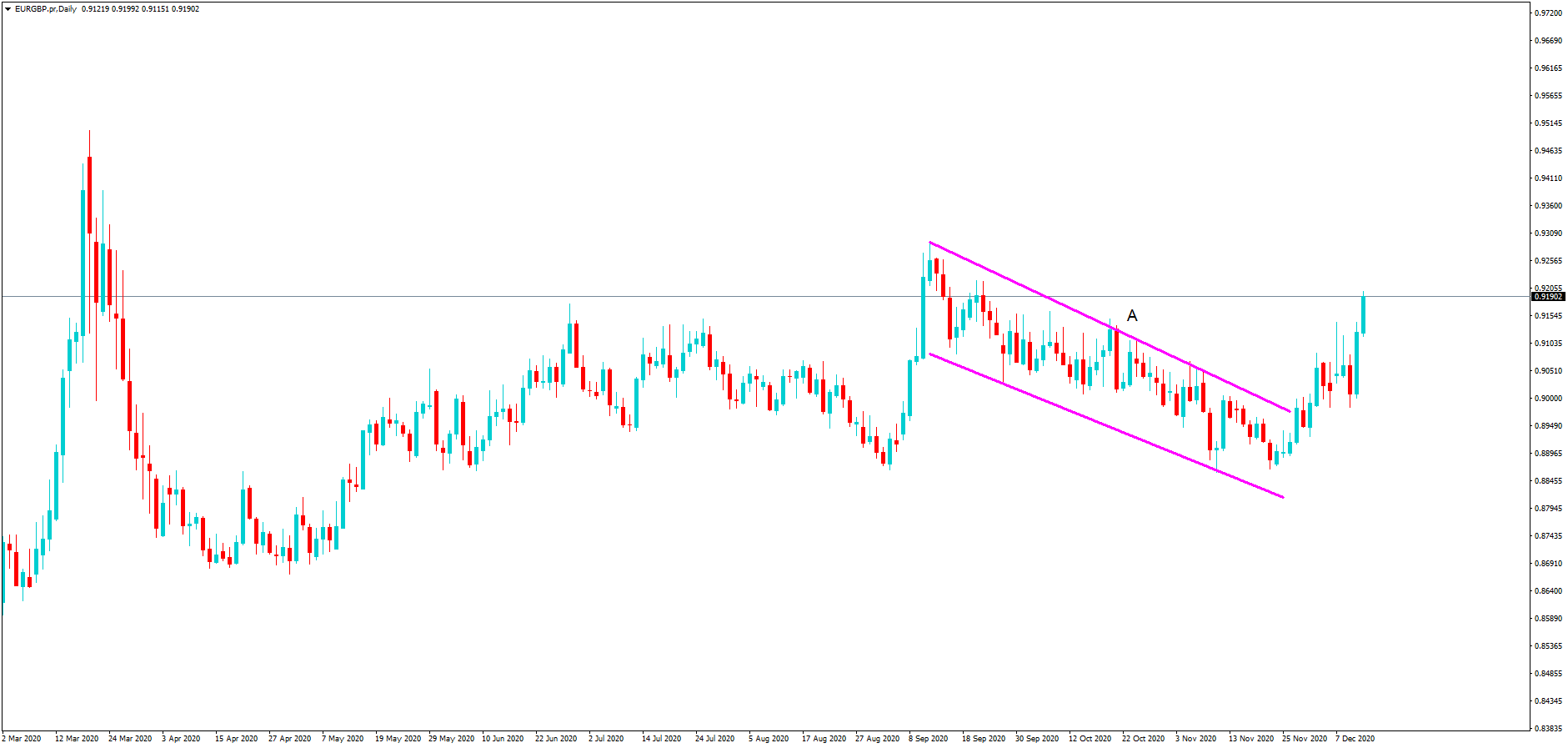

In in the same chart we have highlighted a section A, where the pound was gaining against the euro since August, because the market considered that an agreement would be reached.

So how can investors get in on the action and ride the pair hire based on current sentiment?

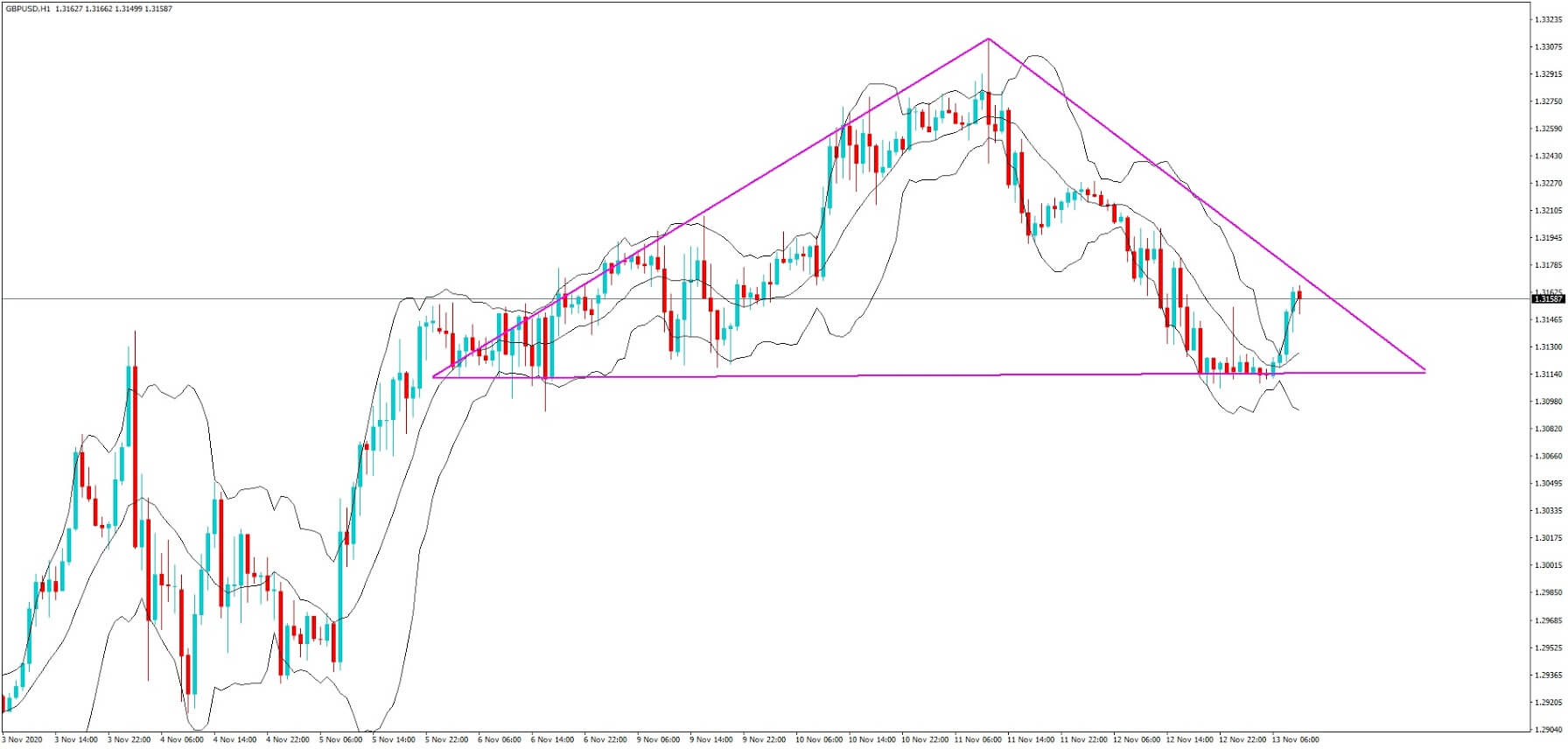

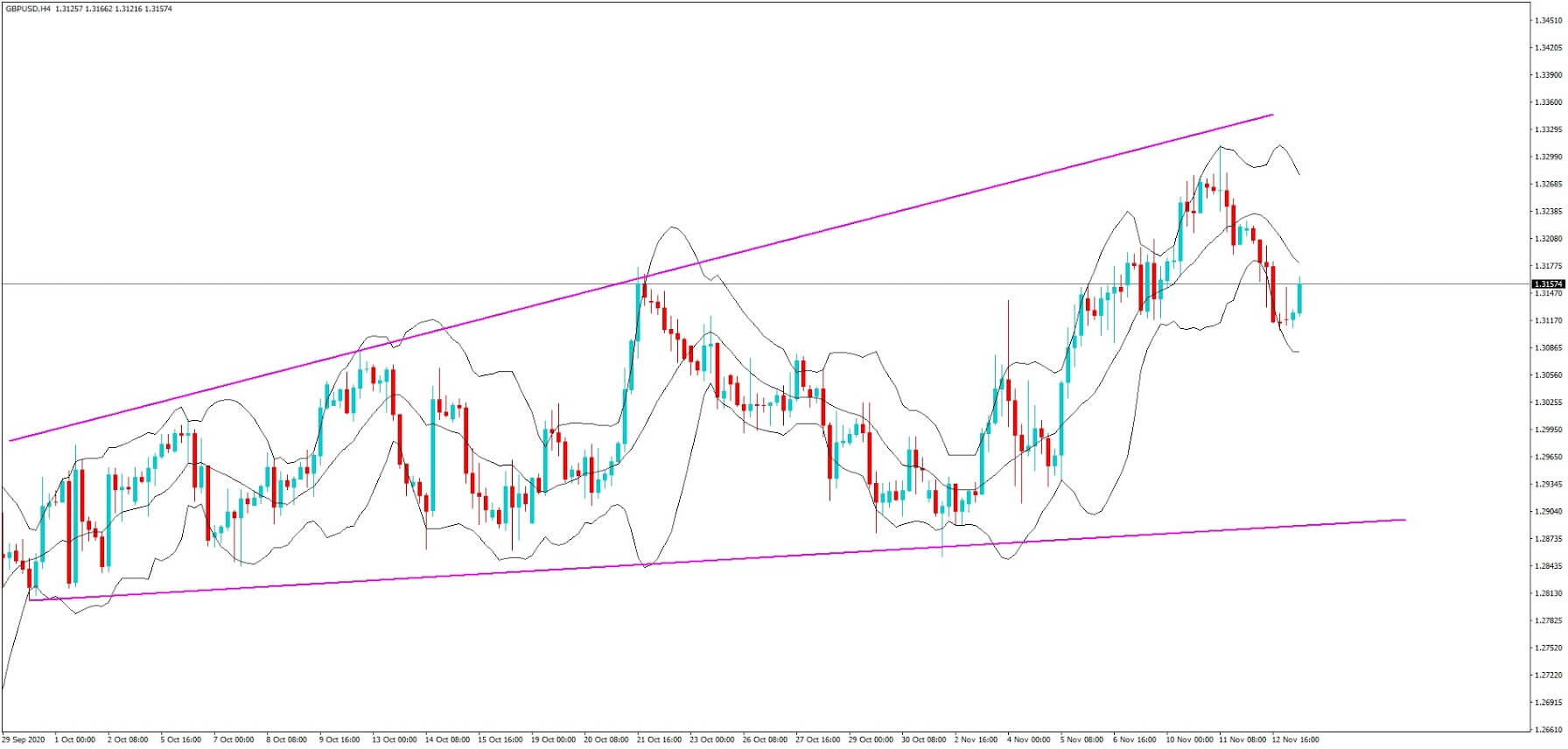

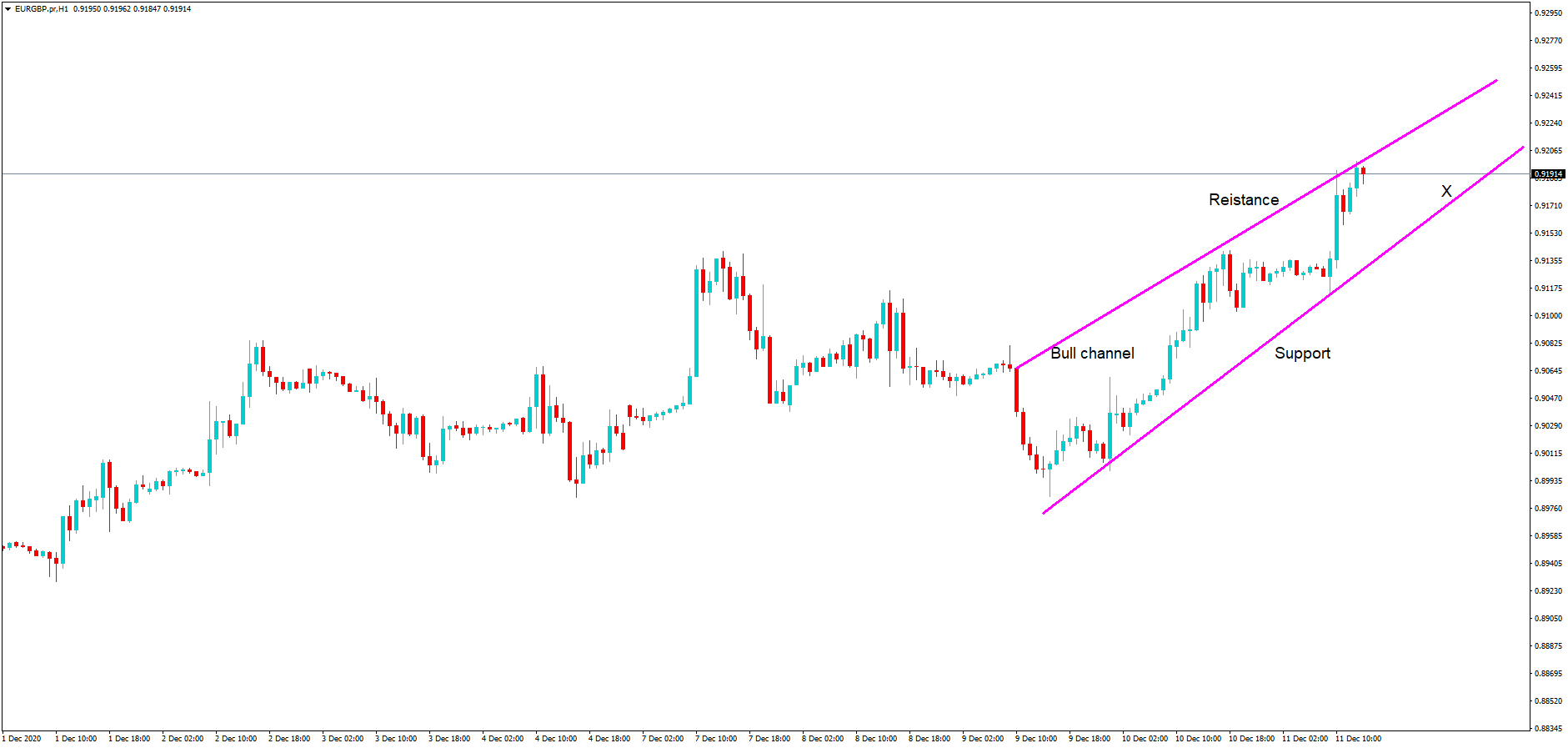

Firstly, we need to bring the chart down to a smaller time frame, such as the one hour. Here we can see a defined bull channel, with areas of support at two points and areas of resistance at two points as show by the exchange rate touching the two purple lines, and where we might consider going long at a pull-back to the support line, perhaps somewhere around the X mark.

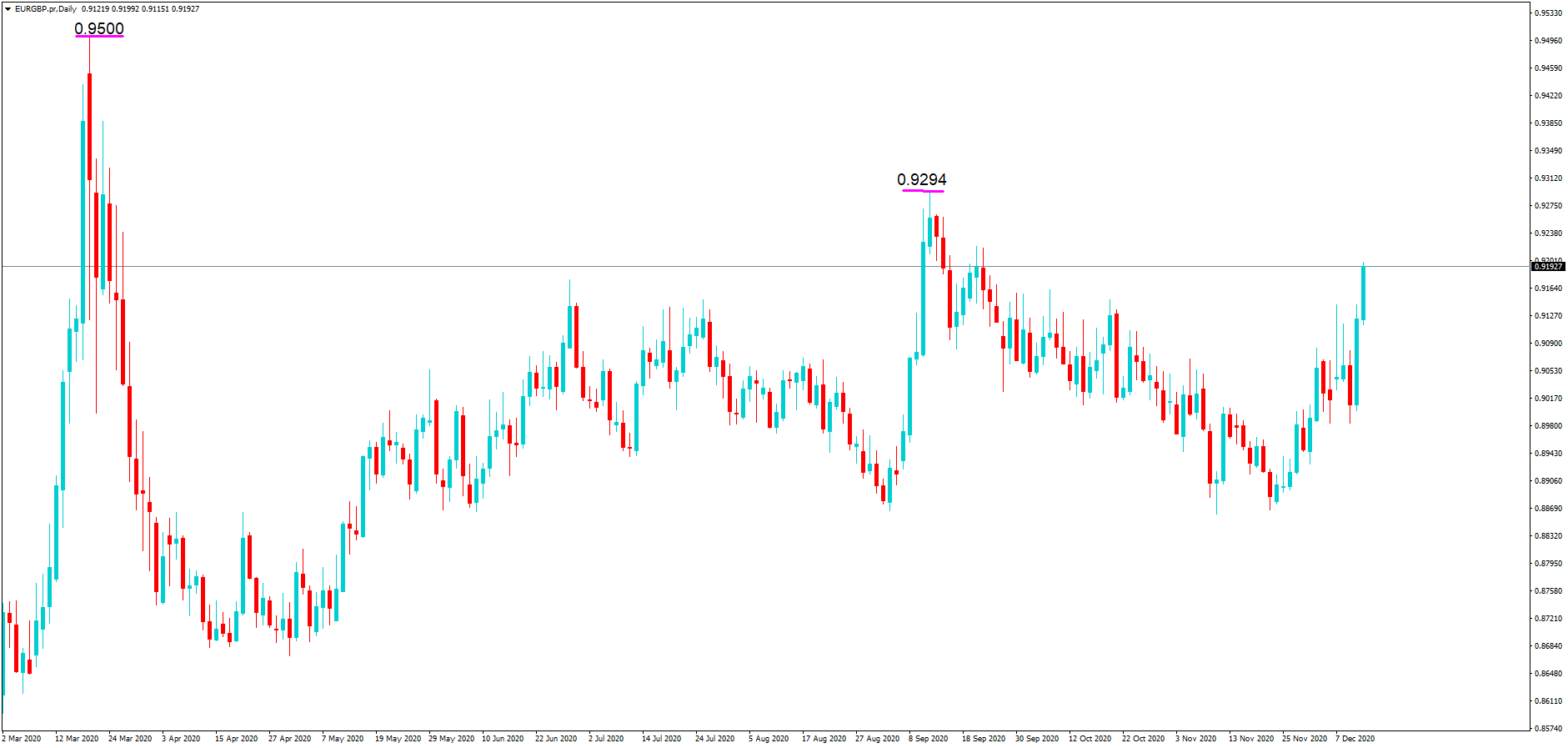

By reverting back to our daily chart we can see some potential targets, or areas of resistance, the closest is 0.9294 which was reached in September 2020 and way back in the middle of March this year, where we have a target/resistance level of 0.9500.

Of course the exchange rate might be a little different by the time you get to view this video, however, should there be a no tariff deal agreement and where the United Kingdom crashes out of the EU on world trade organisation rules, where tariffs will be imposed by either side, but most likely to be more detrimental to the UK than the EU, you should then be looking for setups such as we have shown today to buy the pair.