The Brexit Conundrum, how to trade cable?

Thank you for joining this forex academy educational video.

In this session, we will be looking at the Brexit conundrum, where Great Britain, which has left the European Union, will have completed its transition period on the 31st of December, and which this date is enshrined in law, and cannot be moved, unless by an act of legislation, which is completely unlikely, bearing in mind the government’s stance on sticking to this date.

British businesses and Europeans too, are bitterly disappointed that a formal no trade deal has not so far been agreed between the United Kingdom and European Union, where the two sides seem to be at loggerheads over fishing rights, and the so-called level playing field where the European Union is worried that the United Kingdom might undercut European businesses when the UK forms trade deals with other countries around the world, once the transition period ends.

This affects UK businesses who simply do not know whether they will be levying tariffs against the EU should a free trade deal not be set in place, and whereby they are simply not in a position to know which types of rules and regulations they will be following on the 1st of January 2021.

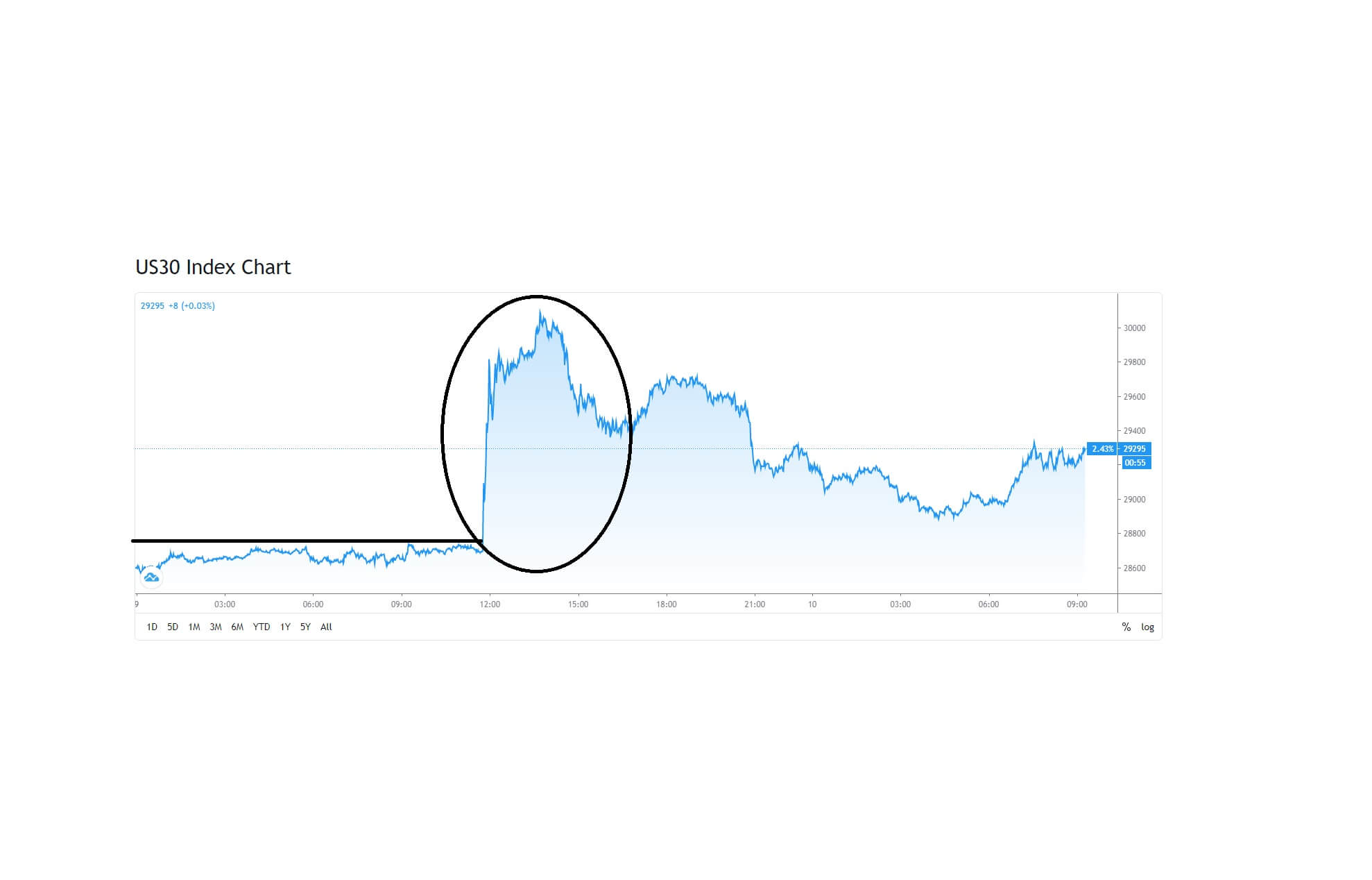

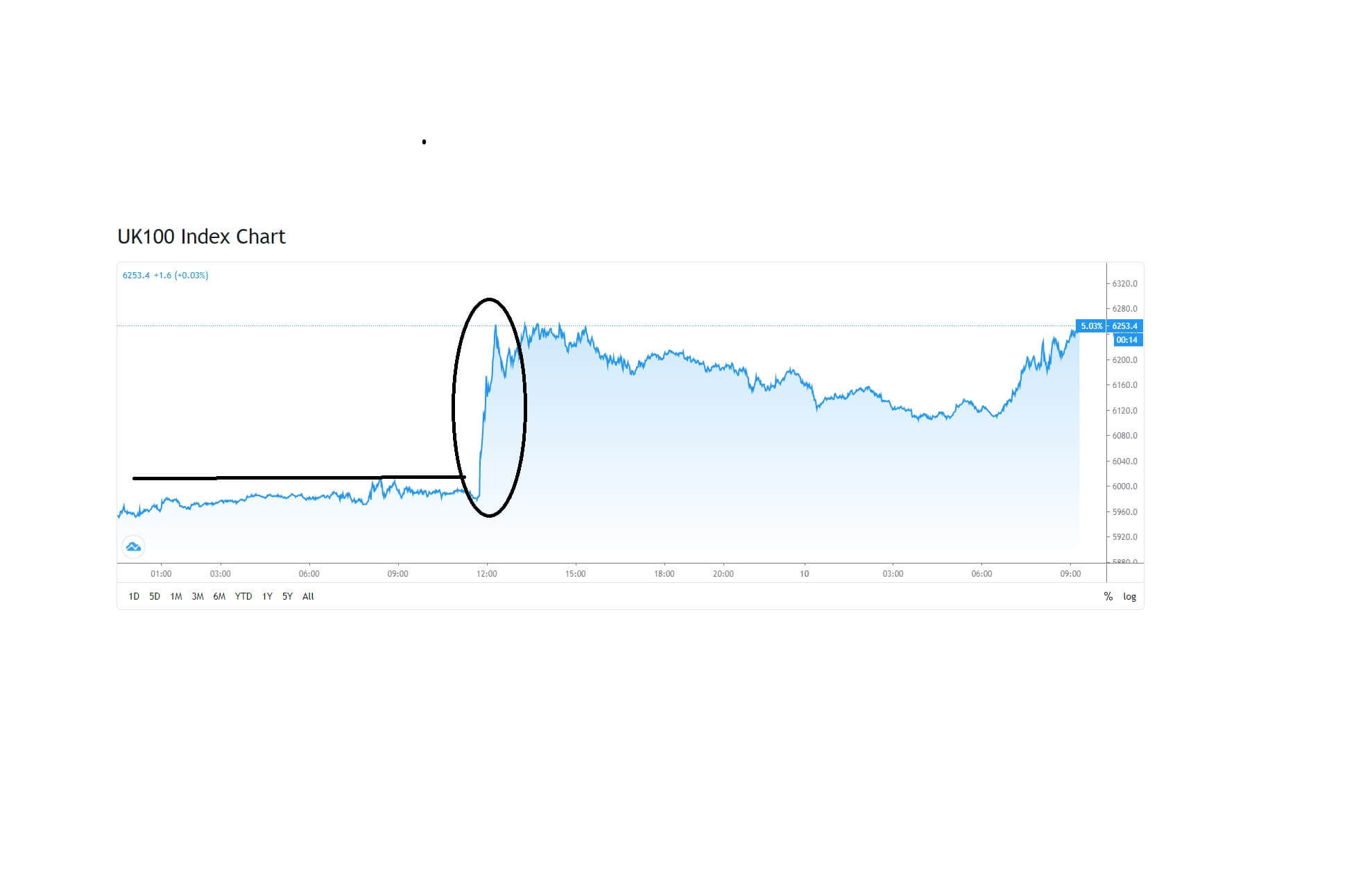

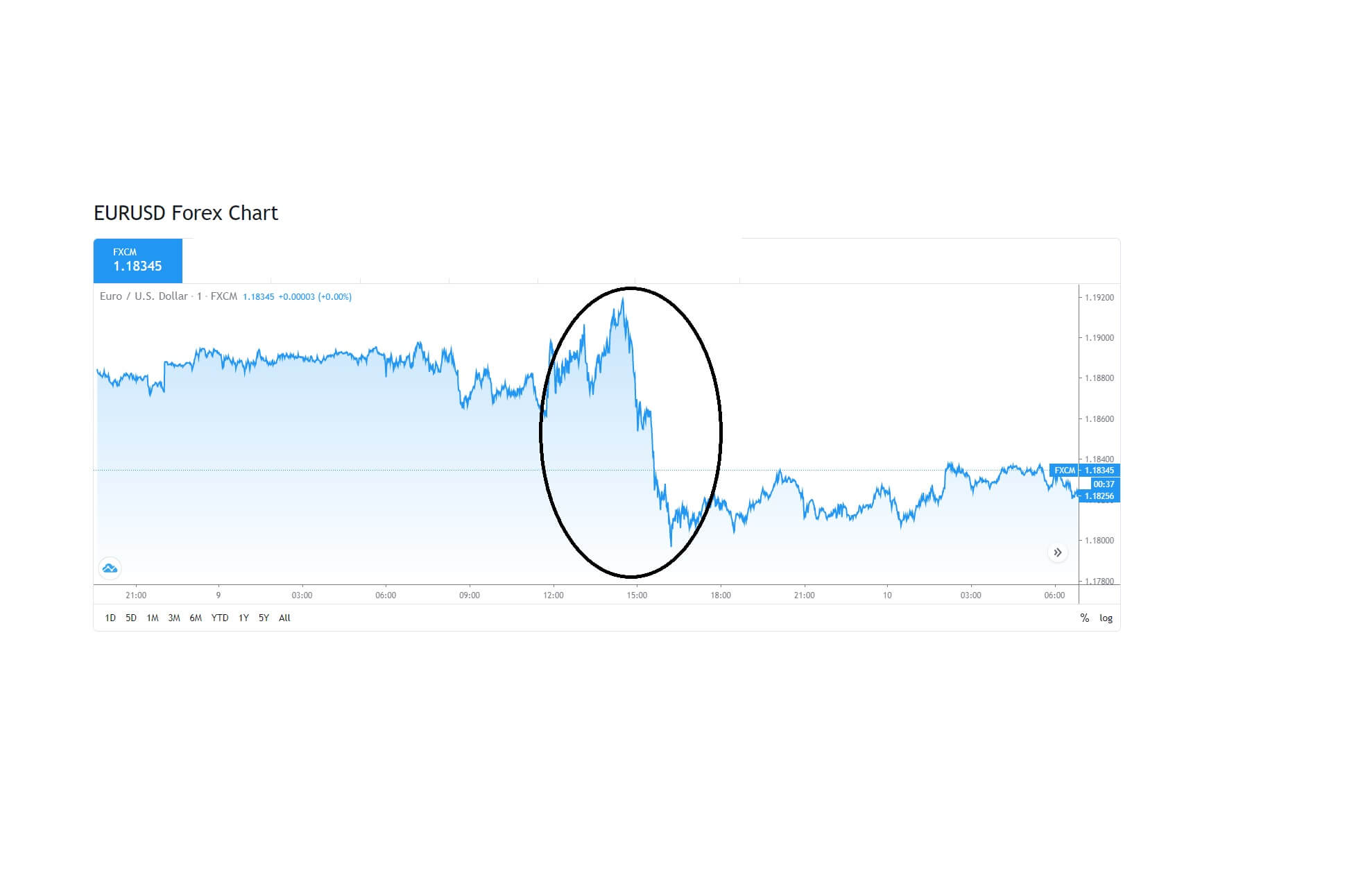

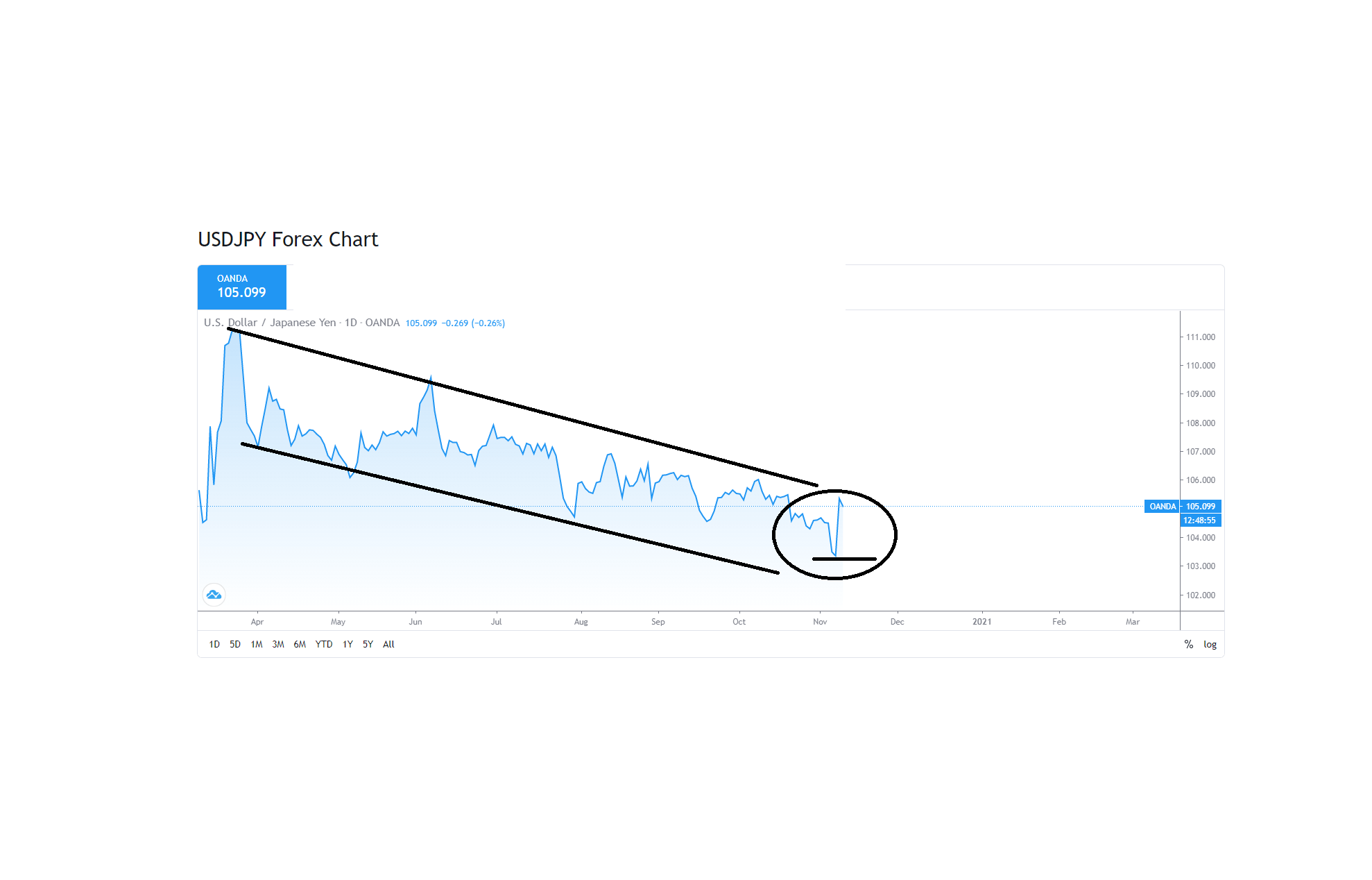

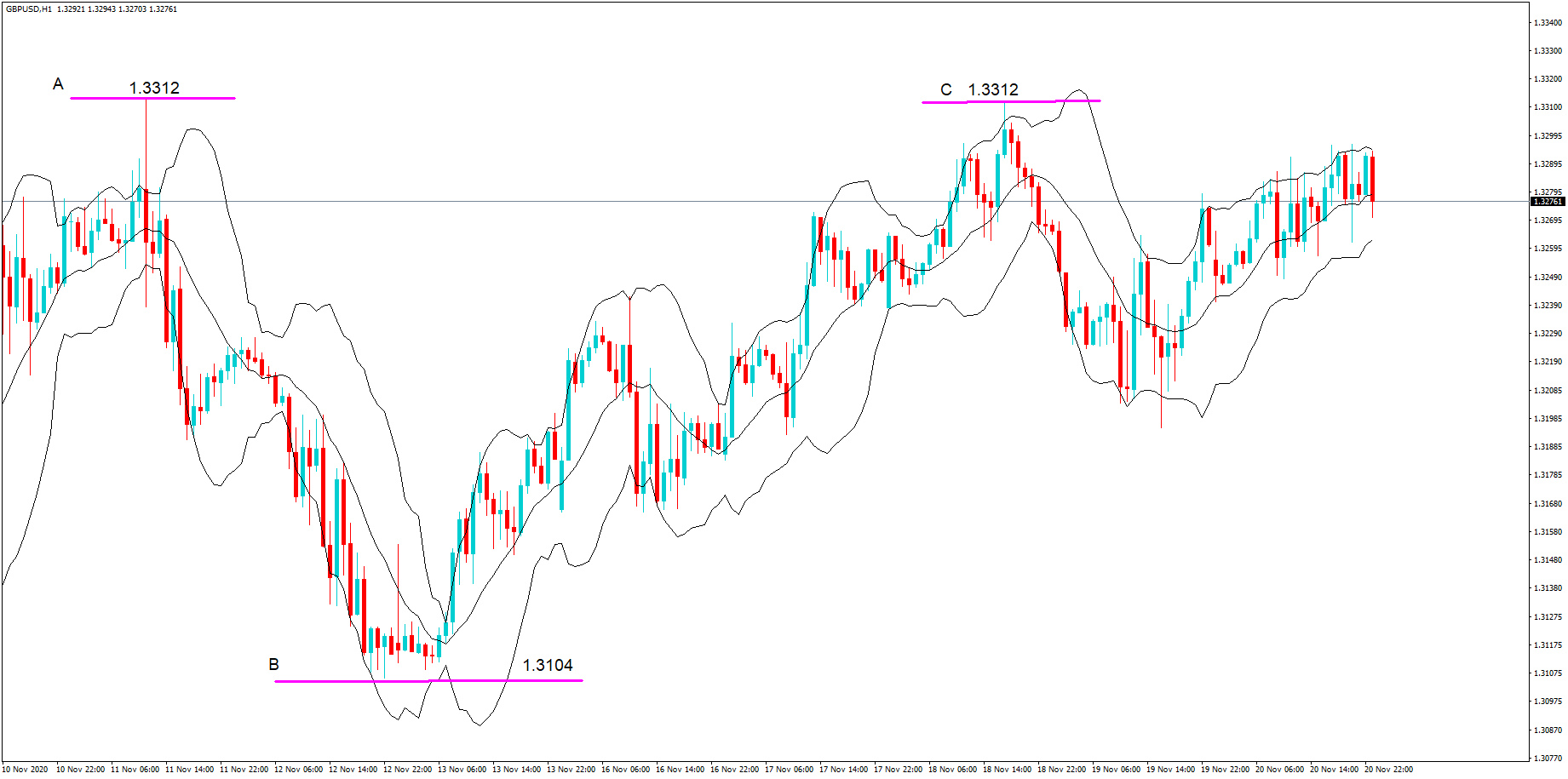

Rumors and speculation are driving the financial markets, where one moment the two sides are close to implementing a free trade deal, only to be scuppered by officials on either side saying they are still miles apart, but where while there is hope that an 11th-hour free trade deal can be completed. Traders are looking on the positive side, and this is reflected in the British pound, here seen on a one-hour chart of the GBPUSD pair where it is most widely traded.

The swing in price action between positions A B and C is over 400 pips during the 10 days of trading here. These are significant moves. But interestingly, we can see that price is largely conforming to within two key levels, 1.31 and 1.33, with a slight bias to the upside. A and C is a classic double top reversal formation.

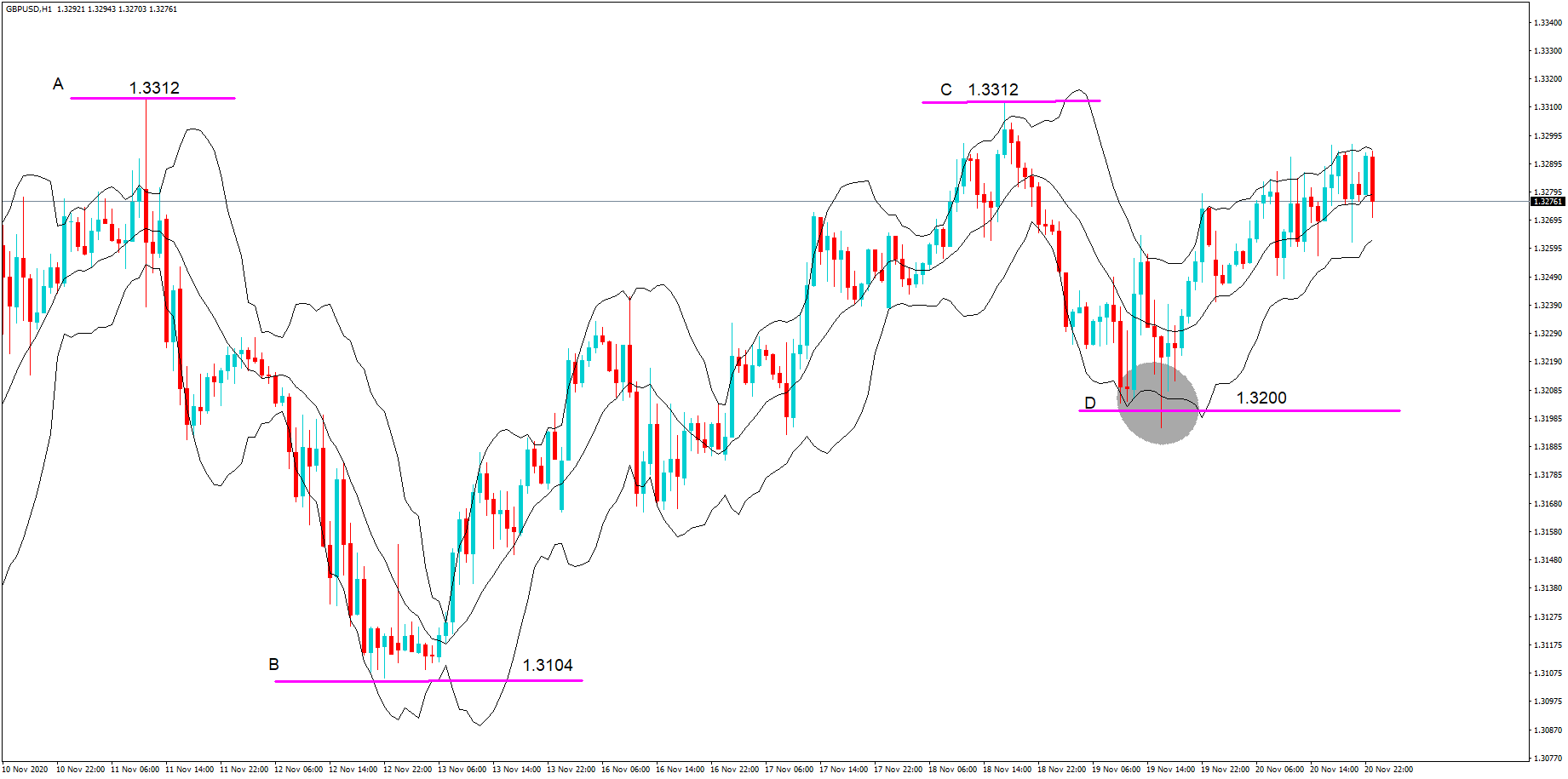

Here we have highlighted the pullback from position C to position D, which has respected the 1.3200 line after the pullback. It is a 50% retracement of the earlier move from A to B, and this is significant because traders believe there will be a last-minute attempt to close a free trade deal between the two sides, who are playing this situation like a game of poker, and where neither side wants to be the first one to blink.

So where next for the pound? Certainly, if a free trade deal is agreed on, the pound should strengthen against the dollar. Some analysts predict moves of to 1.400, should a free trade deal be agreed on. But price action could revert lower to potentially to 1.2500 should the UK leave on WTO rules.

Any trading on the pound should be done with the utmost caution and with tight stops in place. Look out for moves in price action to these key trade levels, which are round numbers, and use them in your trading setup. Expect volatile price action the longer this is drawn out, bearing in mind two deadlines have already been passed, one being the 15th of October as set down by the British government’s and more recently the middle of November, which were deemed necessary to implement new legislation pertaining to a possible free trade deal. And wherever possible, instigate break-even stop-outs on your trades.