How to trade the USDJPY pair

Thank you for joining this forex academy educational video.

How to trade the US dollar Japanese yen pair?

The US dollar Japanese yen is one of the so-called major pairs, and accounted for 13.2% of all the daily forex transactions settled during 2019. And the yen is the most frequently traded currency in Asia.

The United States is seen as the largest economy on the planet, albeit battered and bruised by the Covid pandemic, and Japan also has a strong economy, largely export-driven, and many things in common with the United States, including large stock markets. The relationship between the two countries is ever improving and has evolved significantly since the post-world war II era.

The pair can be extremely volatile at times and prone to large swings, but the basic rule of thumb is that when the United States was pre covid and its economy was strong, traders preferred dollars over yen. And since the United States has been in the grip of the pandemic, and even though the economy still massively outweighs that of Japan, traders prefer to buy the Japanese yen in times of uncertainty. It is seen as a safe-haven currency.

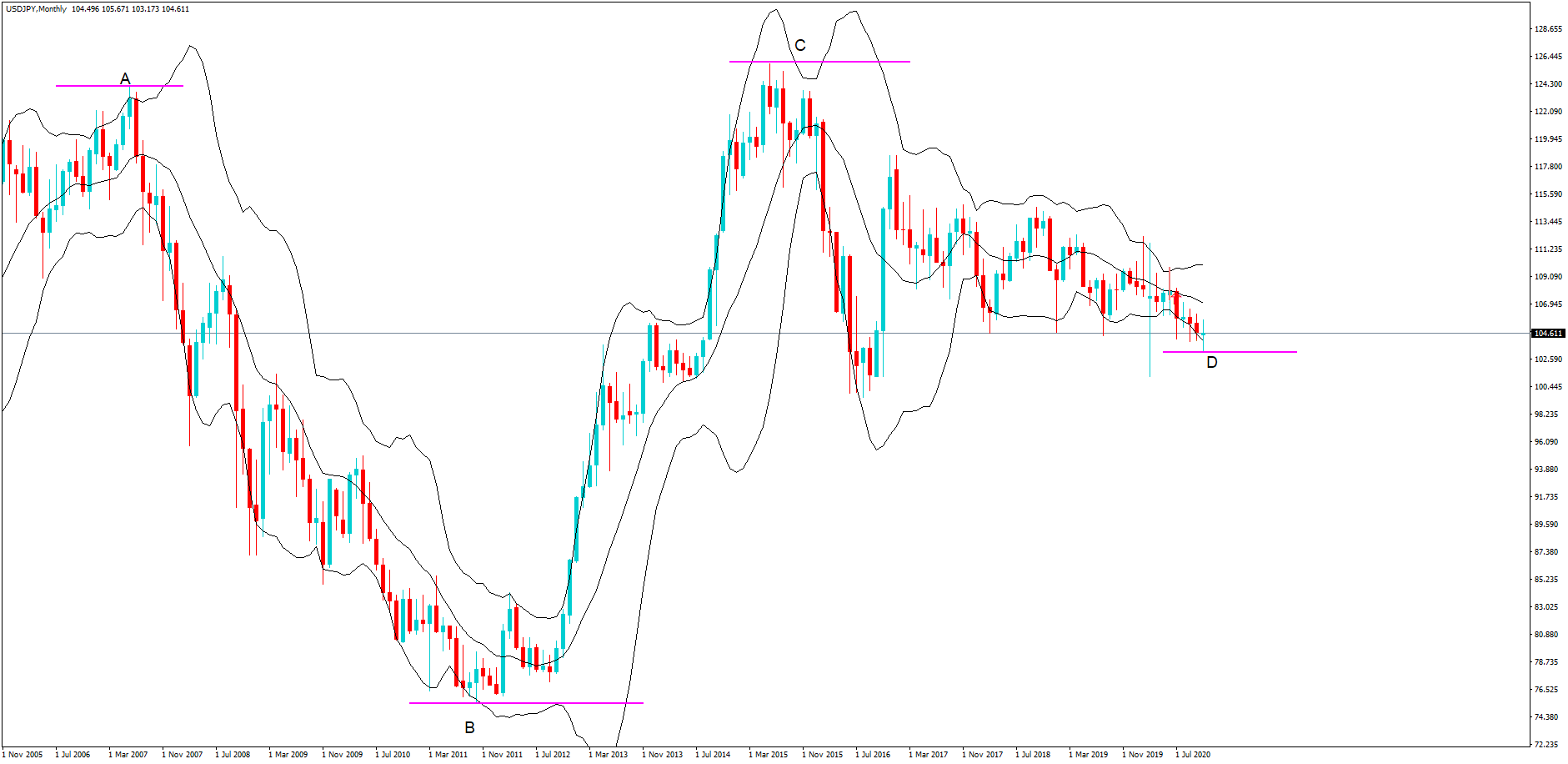

Let’s take a look at some price action on this monthly chart, where we see an A, B, C, D price swing since August 2006 of almost 13,000 pips. This is not a pair to be traded without caution and tight stop losses by retail traders.

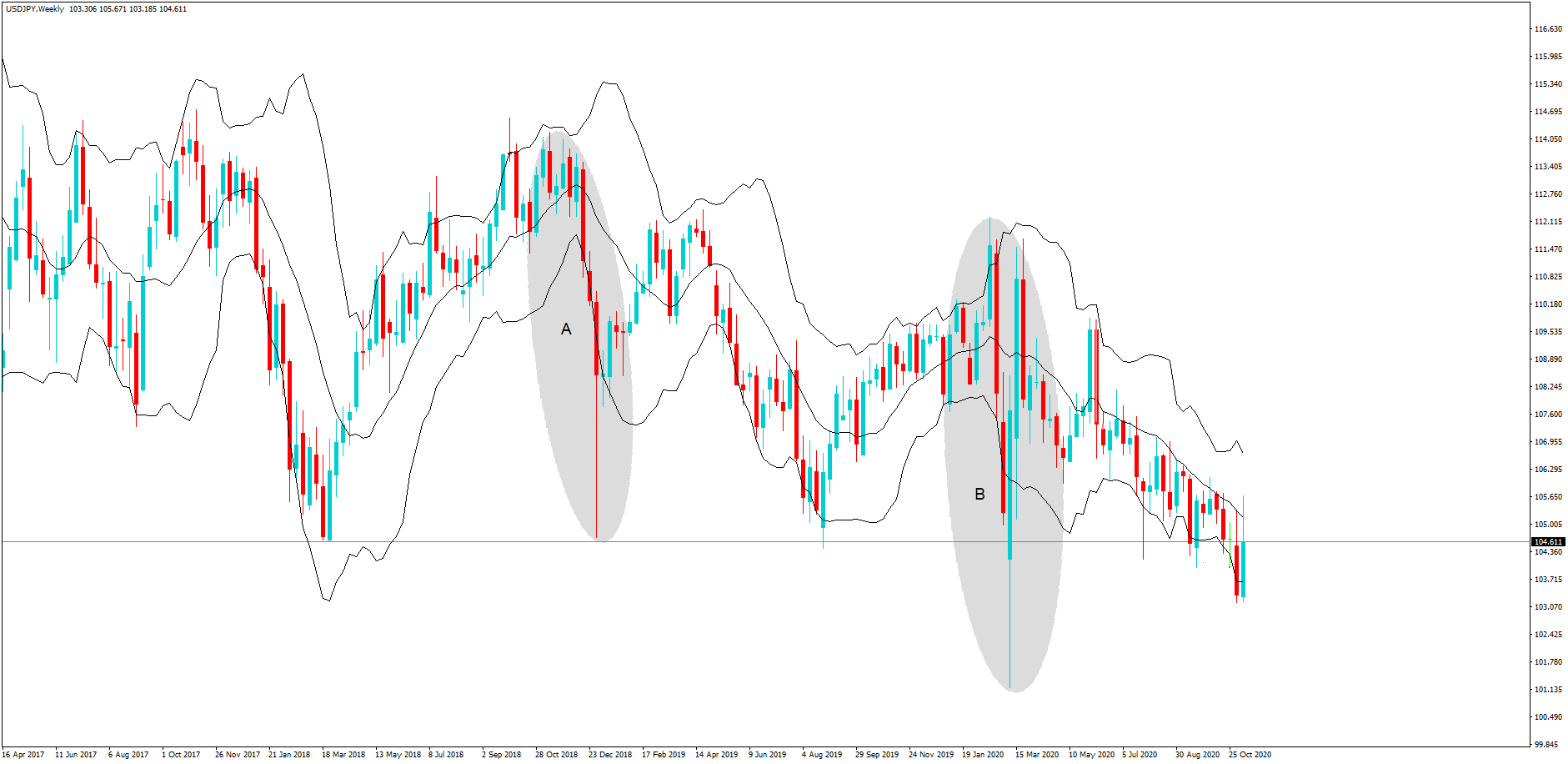

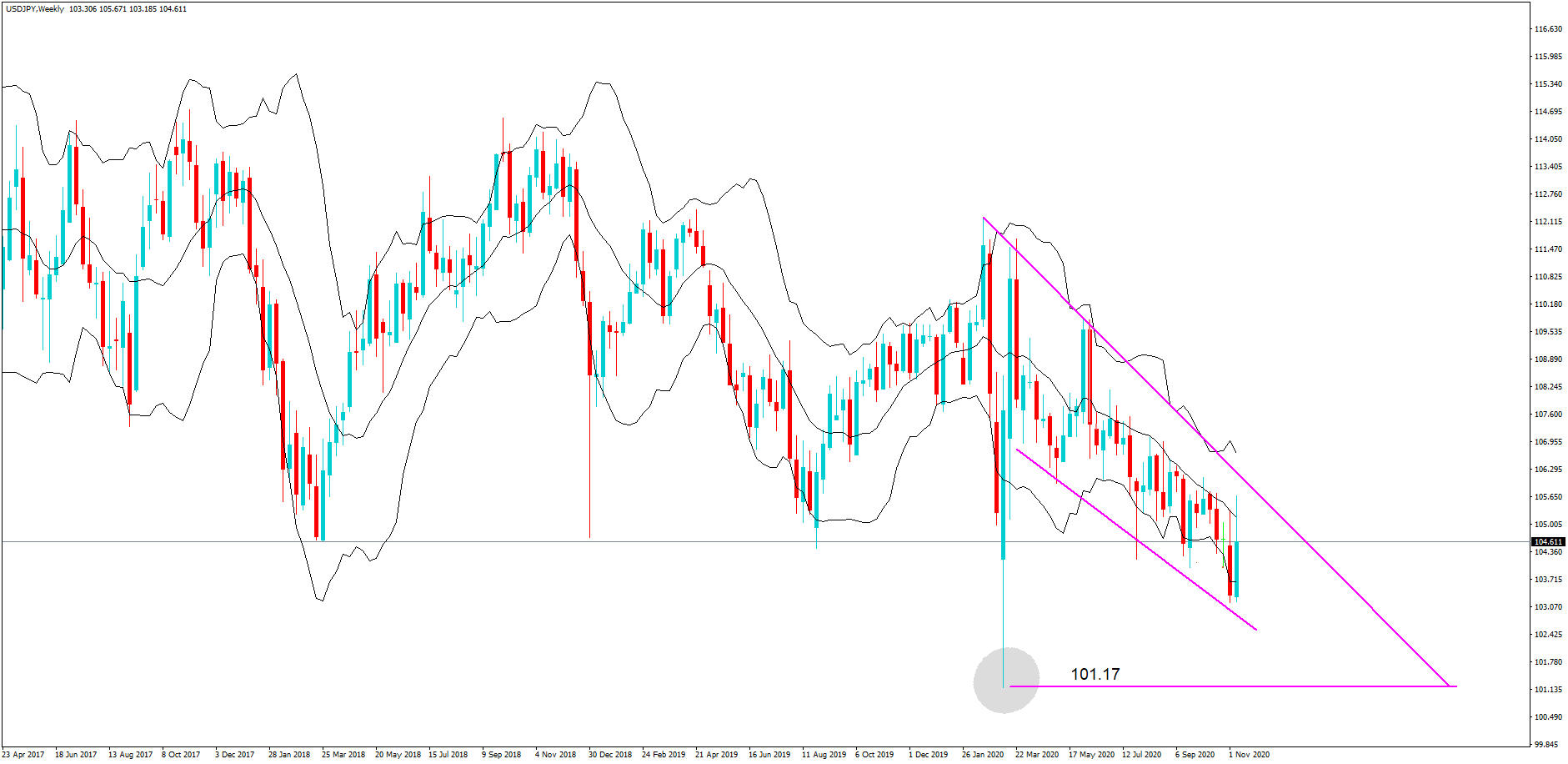

This weekly chart highlights two periods A and B between 2018 and 2020, where the difference between the top and bottom of both ranges is approximately 1000 pips. Again, these are account busting moves if you are on the wrong side of the trade and without a cautious stop loss in place.

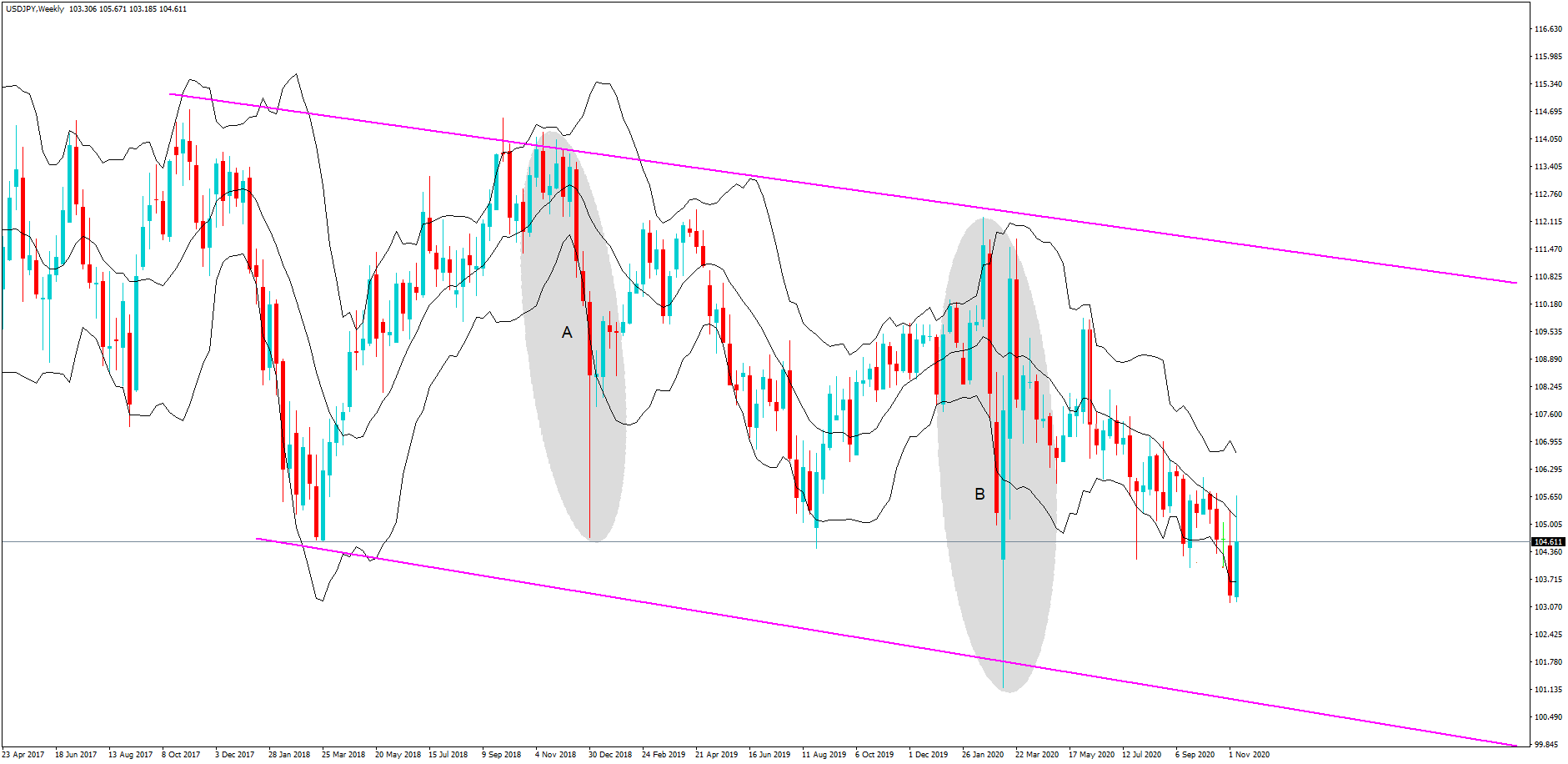

And yet, the overall trend as seen clearly here, again, on the weekly chart, which shows a snapshot of the pair since April 2017, is a downtrend. The yen is stronger overall.

Here we are still looking at the weekly chart. However, we have highlighted a couple of stages in the price action for this pair. Firstly, we must note the high at position A, with an exchange rate of 112.17, and the low at 101.17, which came just a couple of weeks later, where the yen was being bought as a safe-haven asset against the US dollar as the pandemic began to take hold. This was a significant swing in the exchange rate.

Now take a look at the bear channel shown at position C. Institutions look at the higher time frames and, as they hold all the aces in terms of their ability to move the markets with the size of their forex transaction, this is where retail traders need to focus their attention with regard to likely price action moves for the longer term.

Of course, retail traders should never trade on weekly or monthly timeframes because they would need to incorporate huge stop losses. We have already demonstrated with this pair moves of over 1000 pics is simply nothing here.

But they can and should use the information to try and establish the overall trend that institutional traders are looking at.

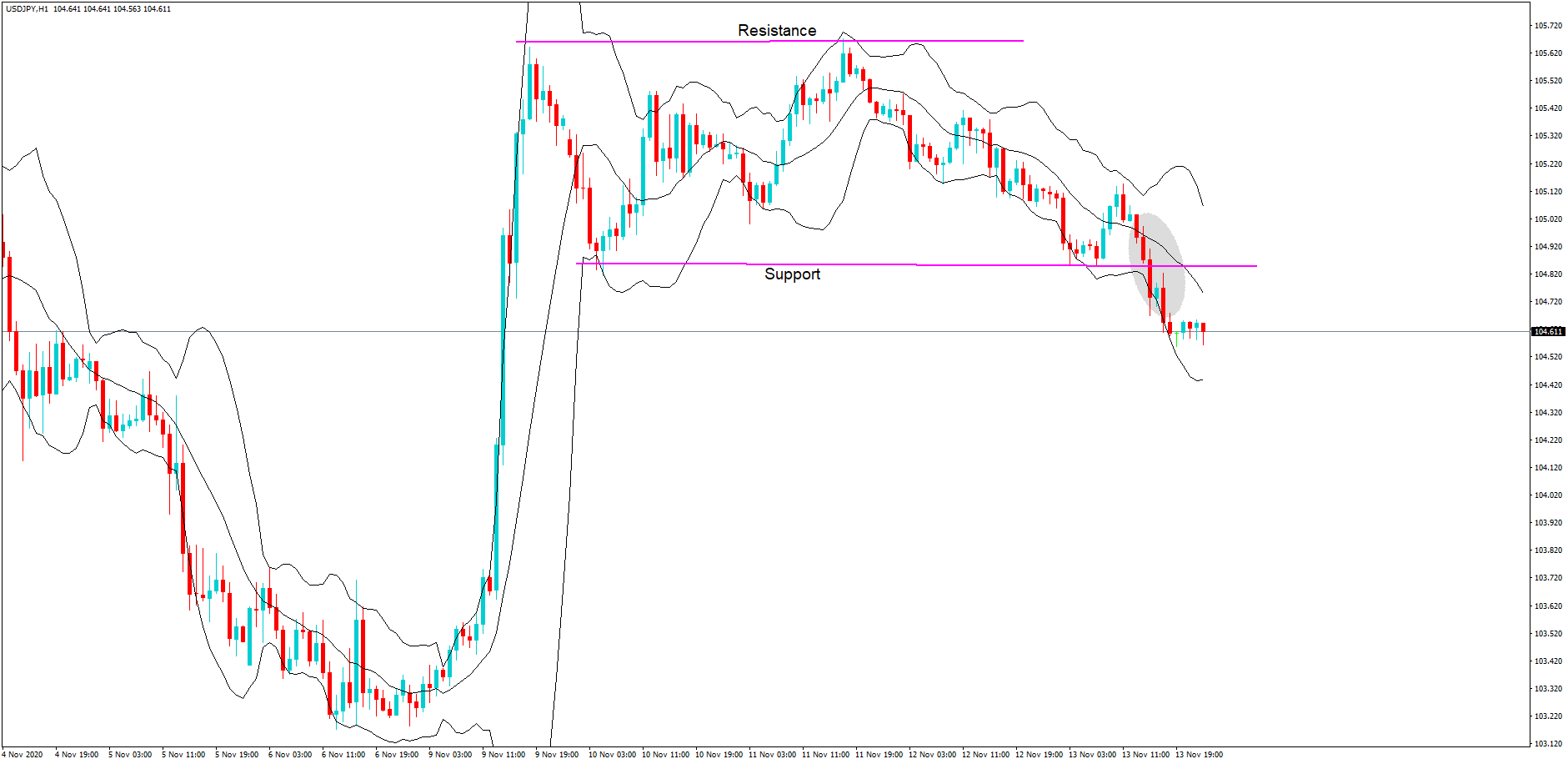

And here, we have brought the timeframe down to an hourly one, and we can see that since the 10th of November 2020, we have two peaks forming a line of resistance. Two areas forming a line of support and the grey circle, which clearly shows a breach of that support line, and with all of the uncertainty going on with regard to a new United States president, the worsening situation with regard to the pandemic in America with 150,000 new cases reported just a few days ago; we can only surmise that with all of this information that traders may continue to push the pair and to the previous low of 101.00 which we saw earlier on the monthly chart while favoring the safe-haven stats of the yen over the US dollar.

In conclusion, traders should be looking for potential signs of a weakening or pullbacks to get on board to short this pair. As we have clearly seen, the pair is subject to huge price swings, and tight stops should be incorporated.