USDCHF sinks to multi-year lows below 0.9000. Where next?

Thank you for joining this forex academy educational video.

In this session, we will be looking at the USDCHF pair, which sank to a fresh low on Friday 6th November.

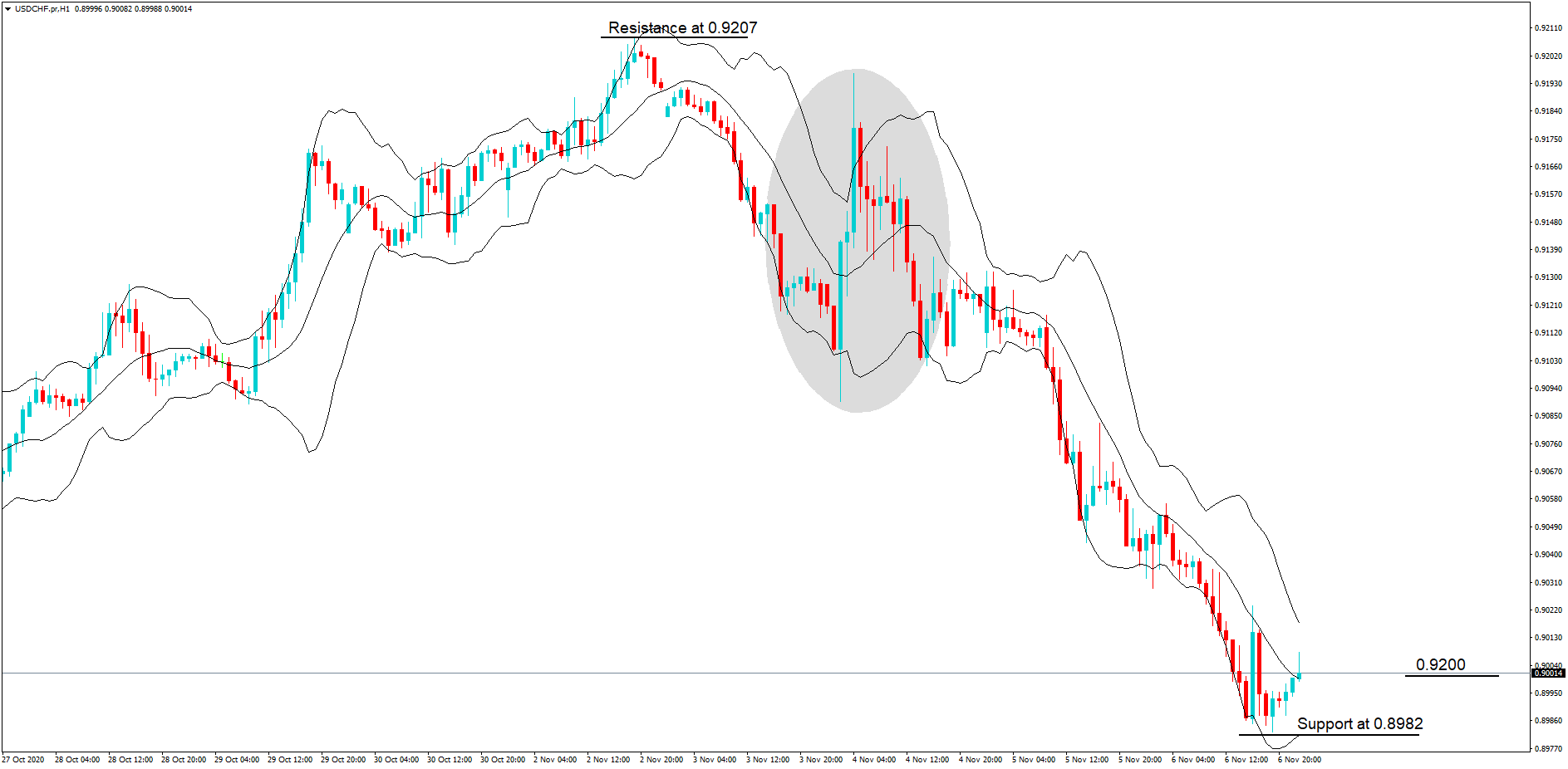

On this one-hour chart of the pair, we can see that on the 2nd of November, it had rallied to a high of 0.9207, before moving lower and where the market became extremely volatile on the 4th of November, but where the pair failed to re-establish itself at the previous high of just two days earlier. The size of the bars which have been highlighted can only mean that extra volume and volatility had crept in, and all of these moves can be associated with the lead up to and just after the US presidential election.

On Friday the 6th of November, the pair had moved over 200 pips lower to find support at 0.8982, a multi-year low, before recovering to the key 0.900 level.

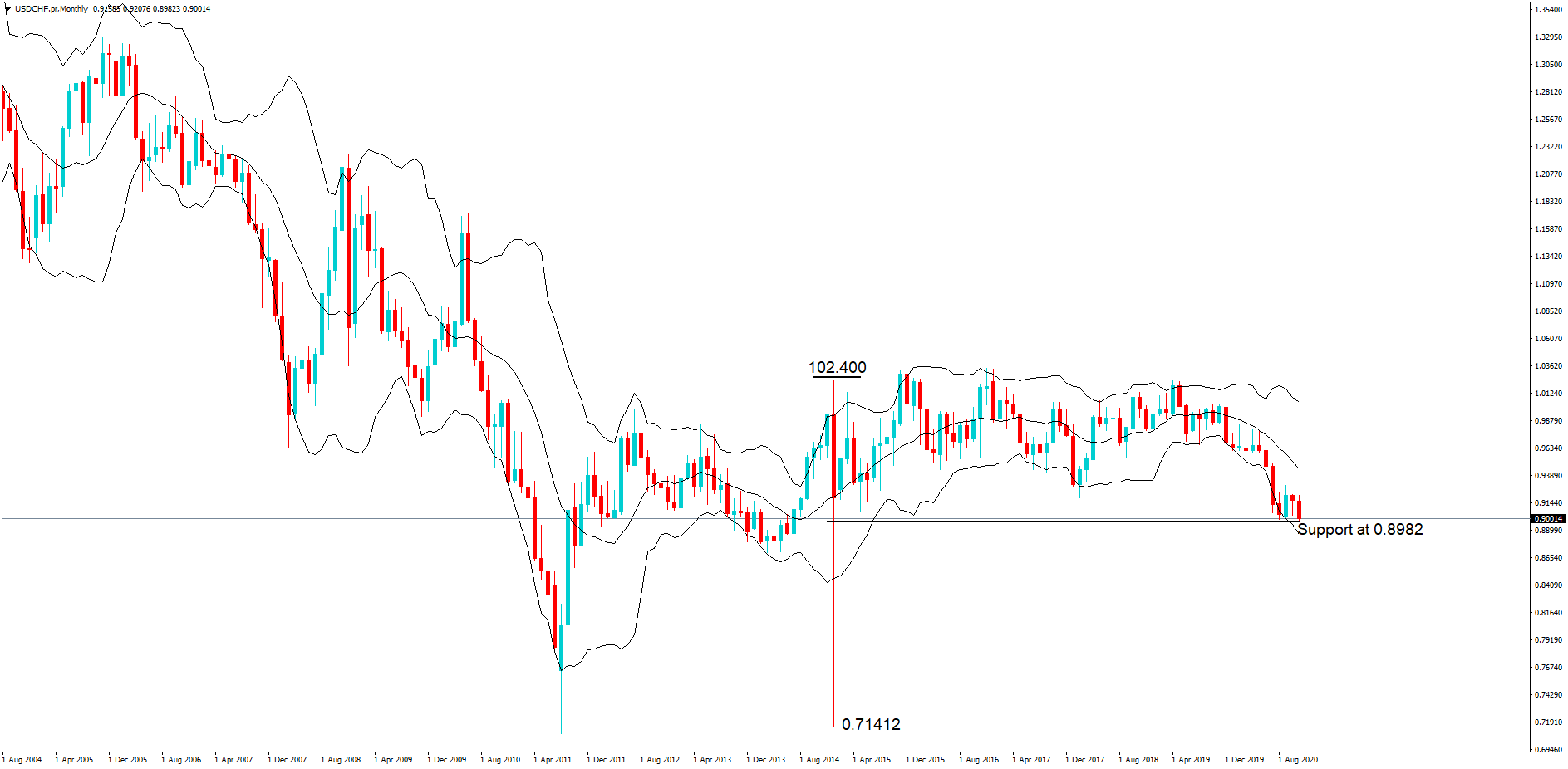

In fact, we would need to go back to April 2014, which was the last time the pair had been so low. And much of this can be attributed to the strength of the Swiss franc, which is bought as a safe-haven asset by investors around the world who see value In the Swiss economy overall.

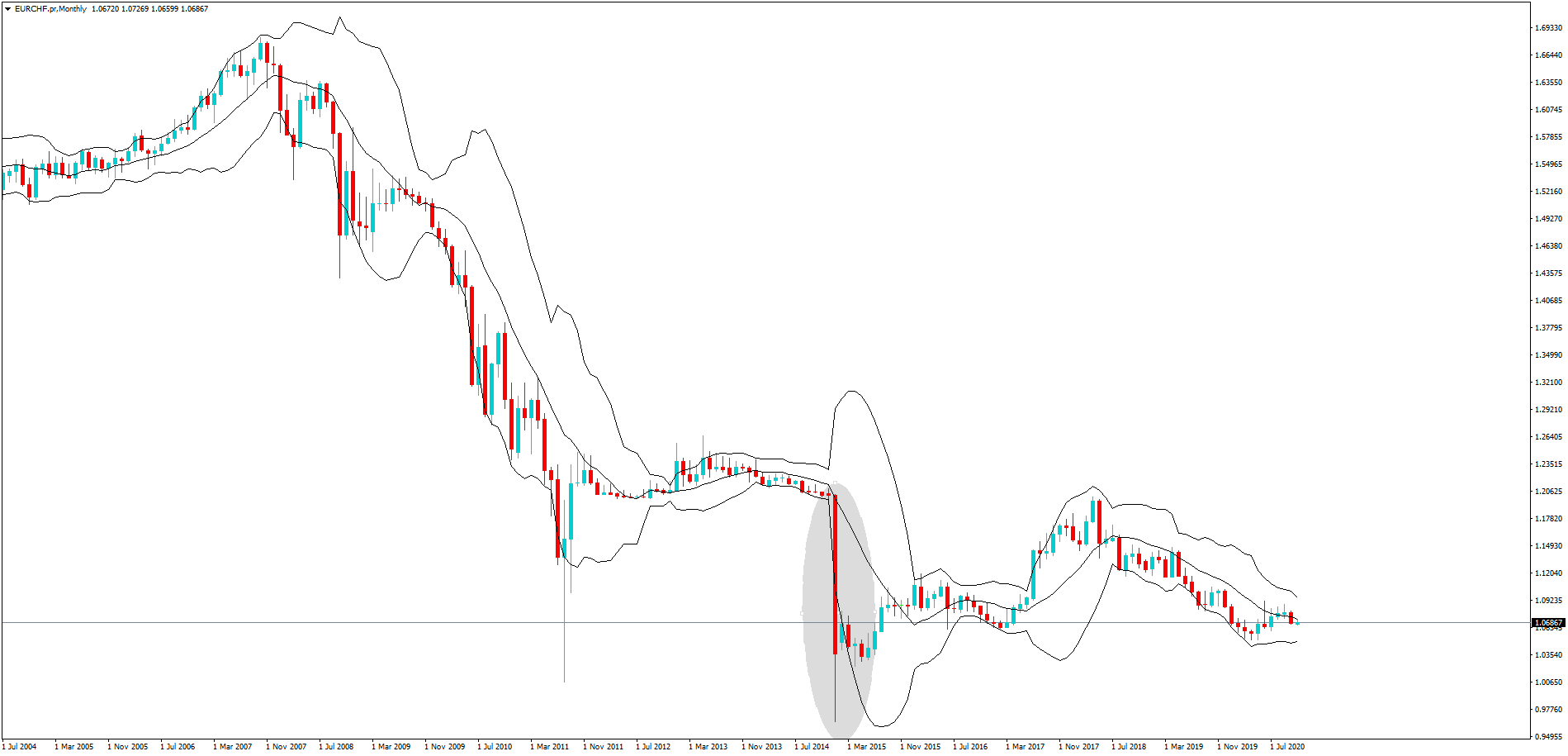

Although the chart is a monthly one, the huge swing in the price range of over 3000 pips in August 2014 worried institutional investors and traders, and that, ….

coupled with the Swiss National Bank’s abandonment of its cap on the Euro of 1.20 francs, which in January 2015 saw the EURCHF pair collapse to 0.8052 with some brokers, before recovering ground eventually to 1.04. Many traders were ruined by the unexpected move, and firms, including the Forex broker Alpari, went broke.

The Swiss National Bank has publicly stated on many occasions that it would defend the Swiss franc against strengthening with other currencies, especially the euro and the United States dollar because a strong Swiss franc means that exports become expensive and makes the country less competitive and that this is bad for the Swiss economy.

They either intervene to sell their currency or threatened to do so, and that coupled with the huge swings in price action which we have just shown you mean only one thing; traders are extremely cautious about trading the franc, which is prone to spikes, and shock moves caused by the Swiss National Bank intervening in the money markets.

That, however, has not stopped the Swiss franc being bought during this extremely volatile time, which has largely been brought about by the covid pandemic, where economies such as the United States and Europe have been badly affected, and of course, the current theme around the United States presidential election which has been the impetus for the push below 0.900 for the USDCHF pair.

This is certainly one pair to trade with tight stops and where the bias to the downside remains for the foreseeable future.