Where for the US Dollar this week?

Thank you for joining this forex academy educational video.

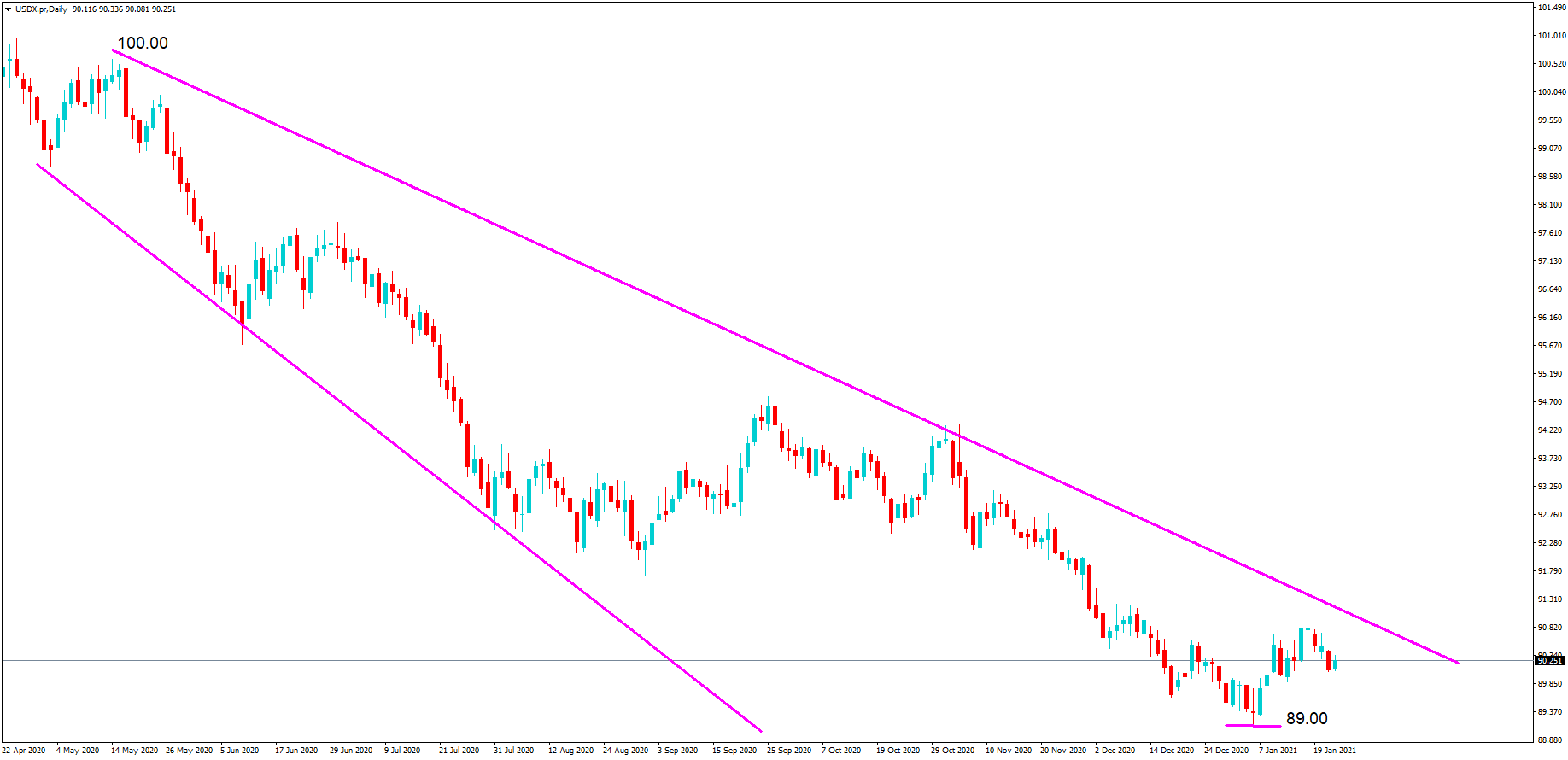

Today we will be looking at the US dollar index, also known as the DXY, which is a weighted instrument against other major currencies, including the British pound, the euro, the Swiss Franc, the Canadian dollar, and Australian and New Zealand dollars, and which has been on a major downward trajectory since march 2020, when the pandemic began to take a hold in the United States.

In this daily bear channel, which has been widening due to volatility, a recent floor was established at 89.00, however, the price action was not able to reach resistance line, which may be seen as weakness and uncertainty, and is hovering with a potential pullback to retest the 89.00 level, which, if breached, could cause a push down to 85.00.

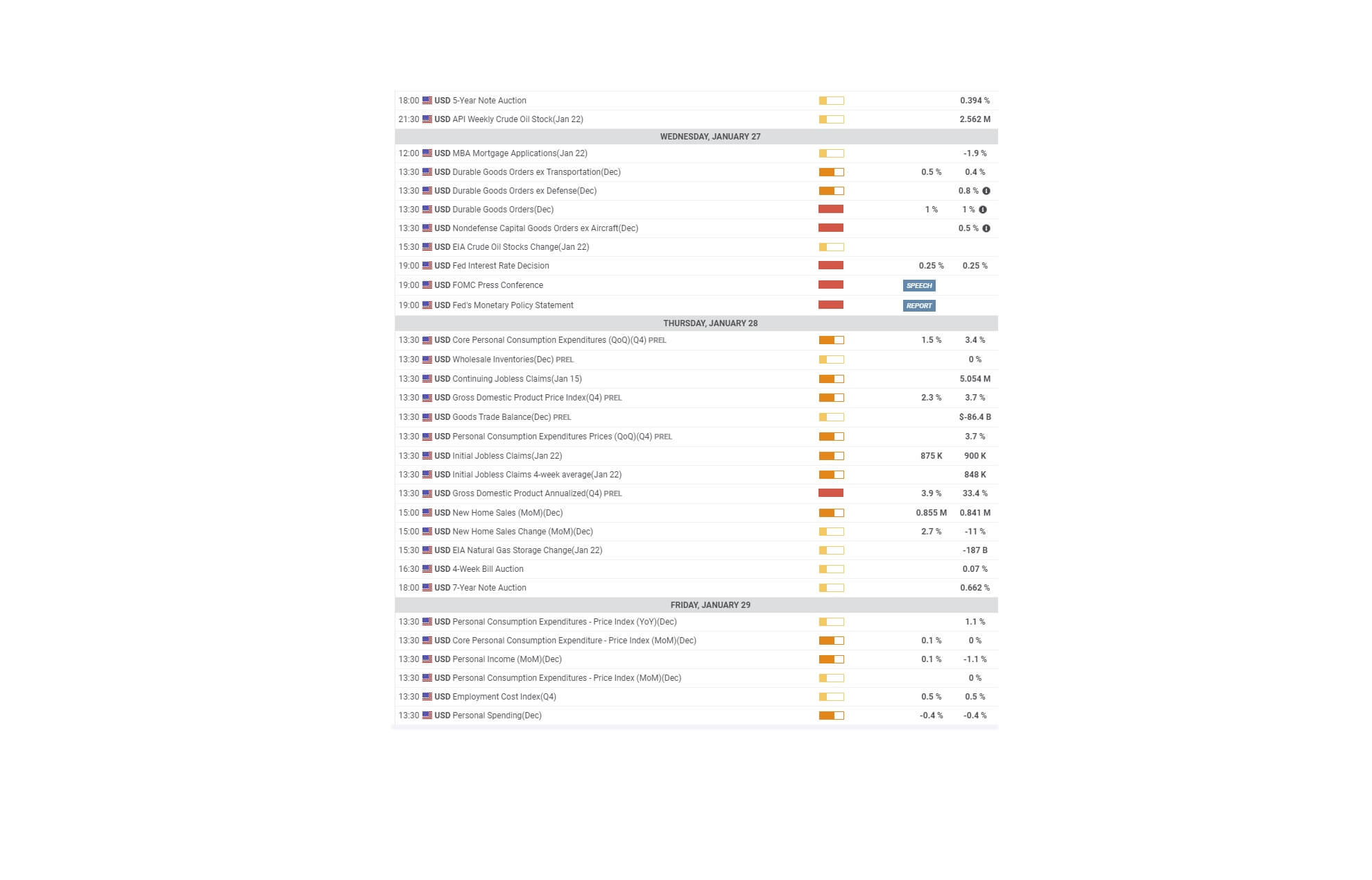

Much of this will depend on the slew of economic data coming out of the United States during the forthcoming week, from durable goods and the all-important federal reserve announcement regarding their interest rate policy decision on Wednesday, and the fourth quarter results of the USA gross domestic product, due to be released on Thursday, which will show whether or not there was a continual expansion in the recovery for the ailing American economy during the last quarter of 2020.

Not least forgetting that banks and institutions will be readjusting their investment portfolios for the end of 2020 and the beginning of 2021, and also trying to factor how the newly elected president Joe Biden and the change in government, with the democrats back in control, will influence the financial markets.

Certainly, the markets will be cautiously awaiting the US economic calendar which as shown is loaded with high-risk events and we may see some subdued price action until fed meeting on Wednesday where many analysts are predicting no change in policy decision.

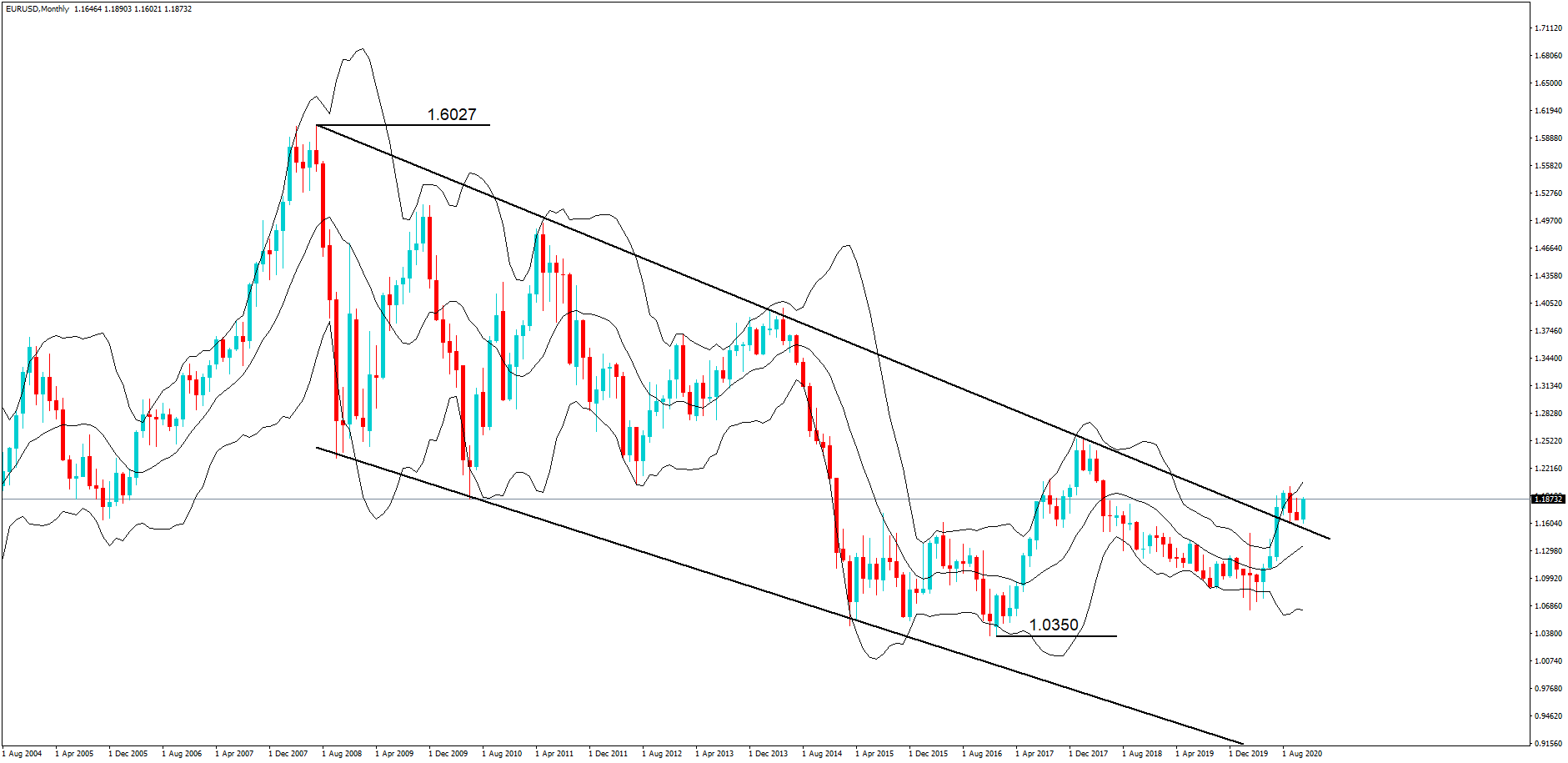

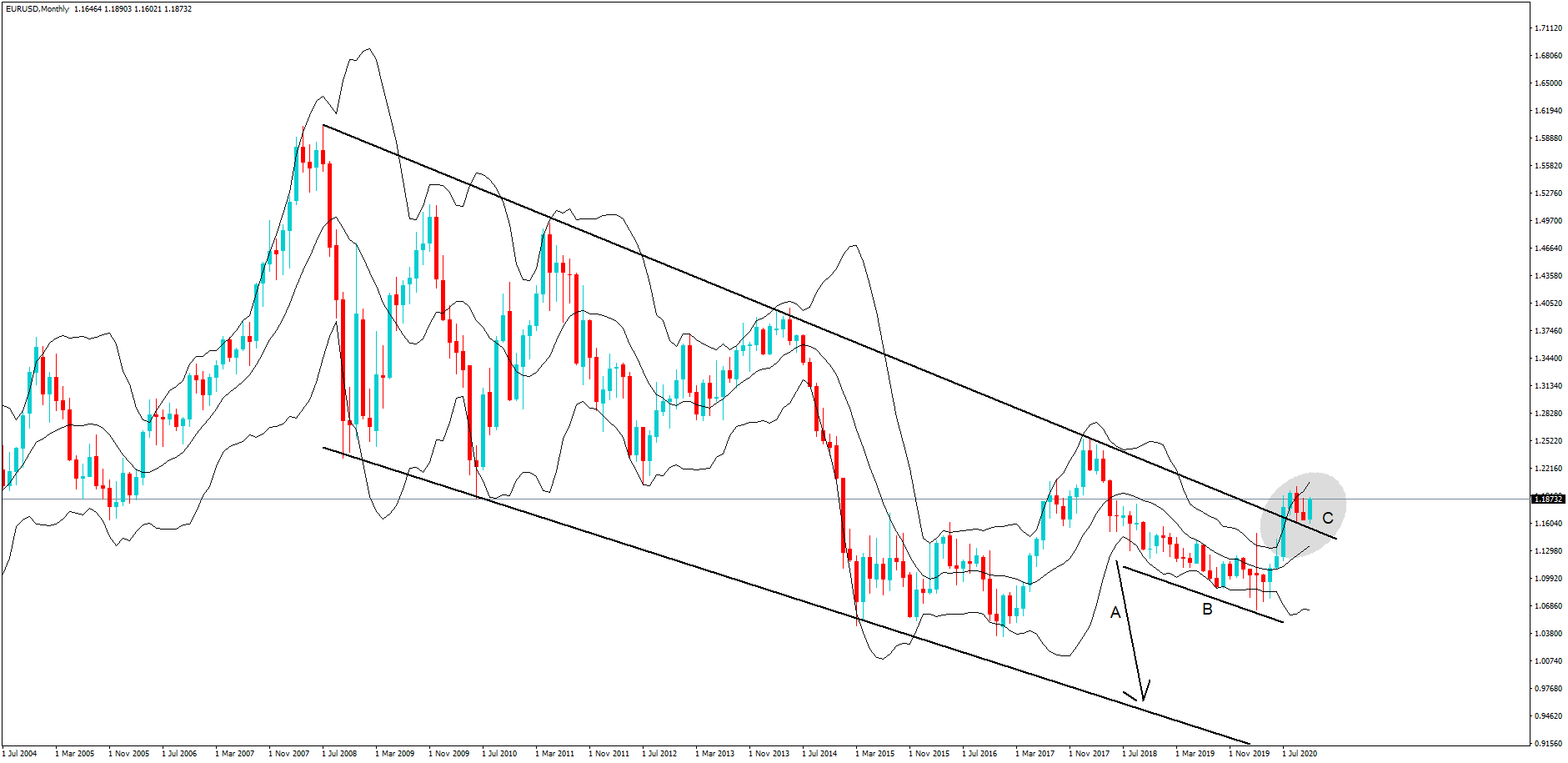

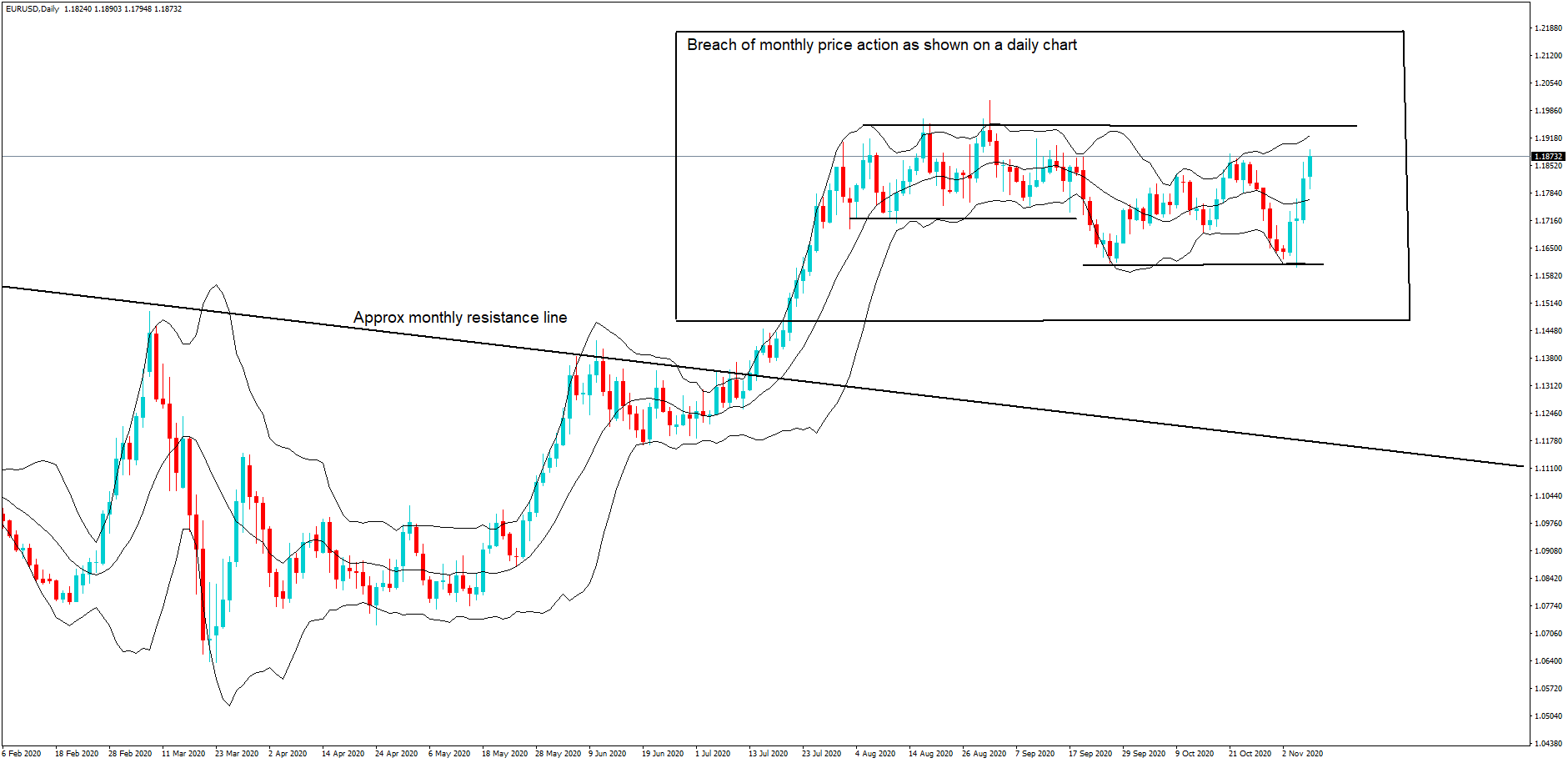

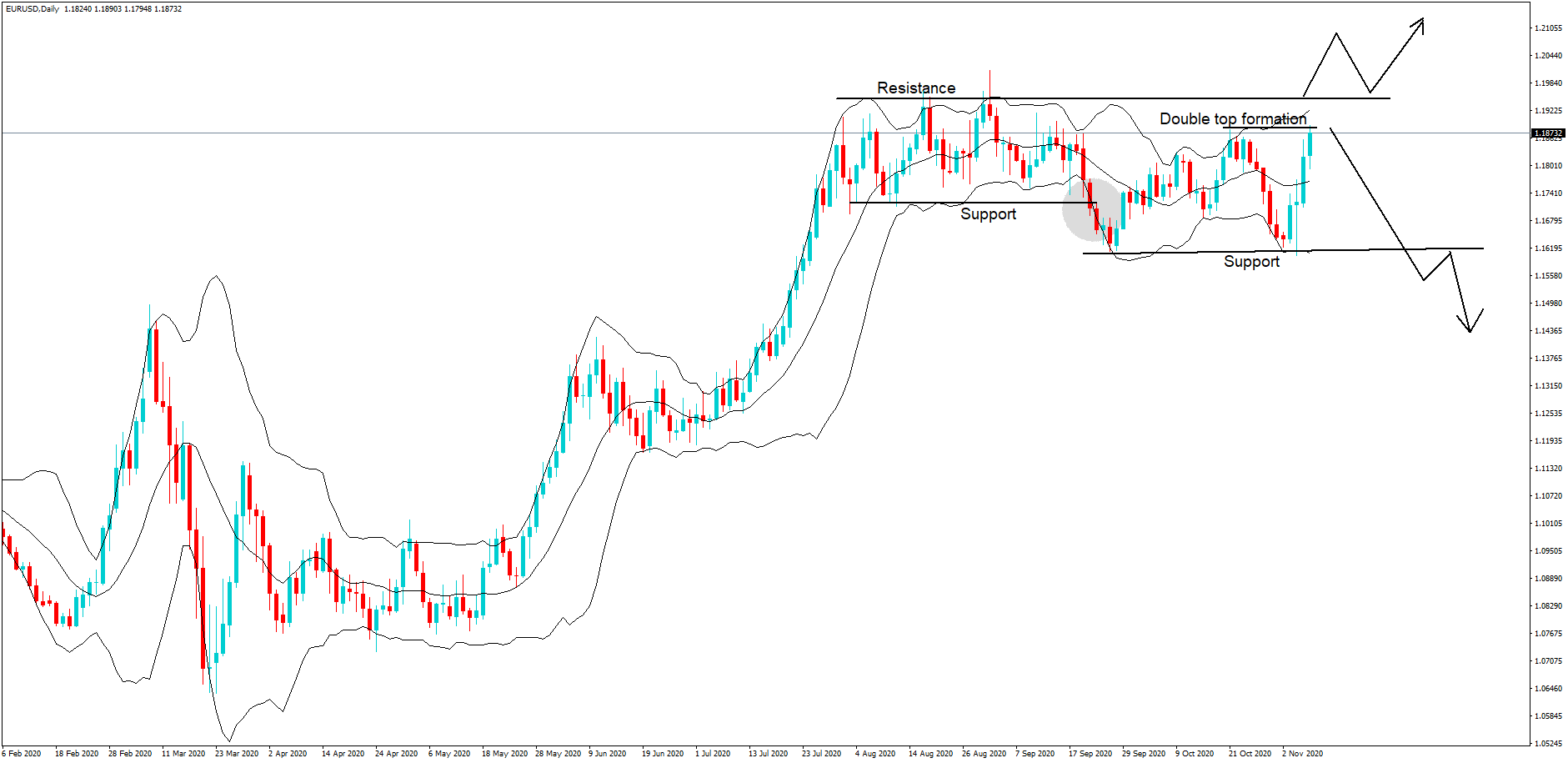

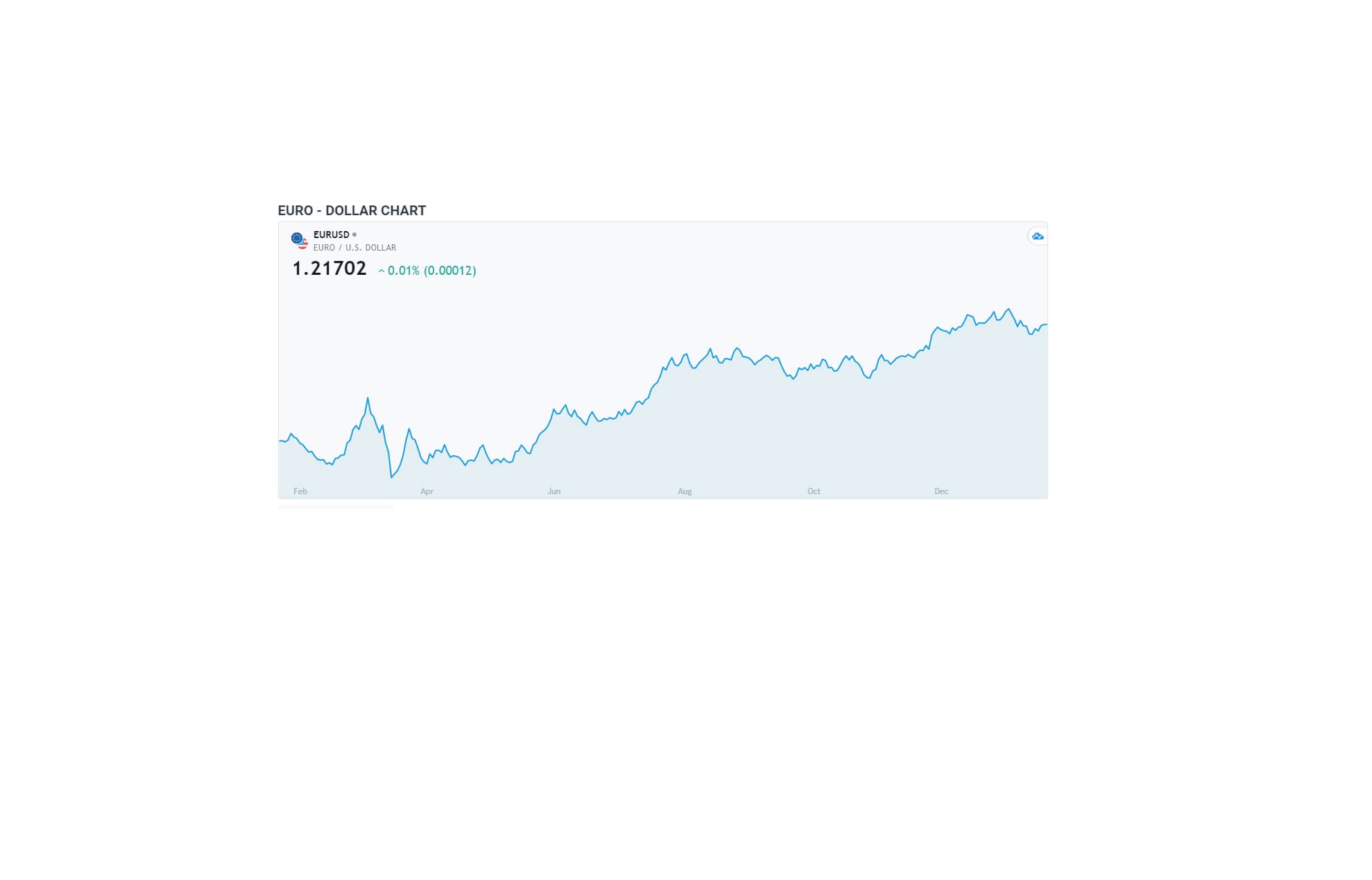

The largest components of the DXY EUR/USD finishing the week up at 1.2170 which added +0.79% last week,

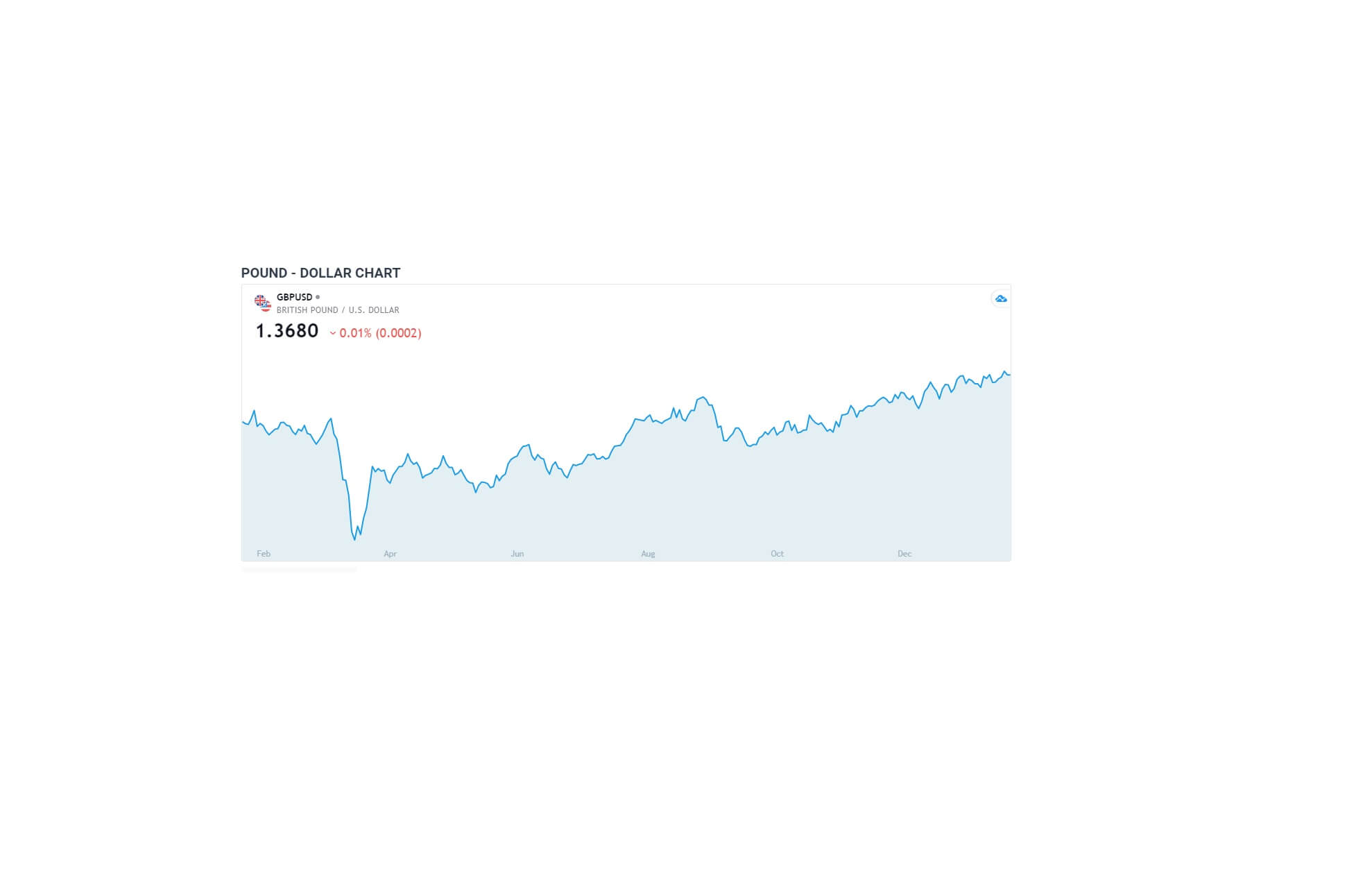

And the GBP/USD pair which climbed steadily to 1.368 or +0.71%

Therefore, a cautious approach to trading the currency markets this week is a must, as we can expect high volatility and rapid and unexpected changes in in trend direction.