Introduction

Oil is one of the most universally used commodity. Its uses span every aspect of our lives, and we can’t escape from not using it. In the US, for example, the transportation sector consumes about 68% of the total oil in the economy while industries consume 26%. Therefore, by monitoring the inventories of crude oil, we can be able to deduce the changes in economic activities.

Understanding US Crude Oil Inventories

As an economic indicator, the US crude oil inventories measure the change in the stockpile of crude oil in major oil deports in the US. The US Energy Information Administration’s (EIA) publishes the crude oil inventories report weekly. This report tracks the changes in the number of barrels of commercial crude oil that is held by US firms.

The report is called Weekly Petroleum Status Report and is published on Thursday of every week. Below is a list of items from the report.

- The US petroleum balance sheet

- US crude oil refinery inputs

- The daily average of US crude oil imports

- The daily average of US commercial crude oil inventories. These inventories exclude those held by the Strategic Petroleum Reserve

- The daily average of the total oil products supplied over the last four-week period

Using US Crude Oil Inventories

The uses of crude oil affect our daily lives. Although there has been a conscious shift towards green energy, crude oil, and its products are very much still part of our lives. To properly understand the implications of crude oil inventories on the US economy, we need to go back to supply and demand basics. Say that a supplier stocks inventory with the knowledge that there is consistent demand.

This demand is based on historical averages, of course. Now, if the supplier starts to notice that their inventory is increasing over time, it could mean that demand for their product is decreasing. Similarly, if their inventory gets depleted faster than average, it could indicate that demand for their product has increased over time. It is the same case with the US crude oil inventories.

When the crude oil invitatories increase, it is an indicator that demand for crude oil has gone down. The two significant consumers of oil in the US are the transportation sector and in industries. Suffice to say, when there is a substantial increase in the US crude oil inventories, the demand from these two sectors can be expected to have significantly declined. Let’s think about what we can infer about the economy using this logic. In nonfarm employment, the US industries are the largest employers in the labor market.

Since crude oil is used to run industries, crude oil inventories can be used as a leading indicator of economic health. A decline in demand for crude oil could mean that the industrial sector is cutting back on production and manufacturing. Being one of the largest employers in the US, scaling down industrial operations translates to massive job losses. There will be an overall increase in unemployment in the economy. The resultant unemployment also has its ripple effects on the consumer economy. Due to the decrease in disposable income, households will only spend on essential goods and services. As a result, the consumer discretionary industry will take a hit.

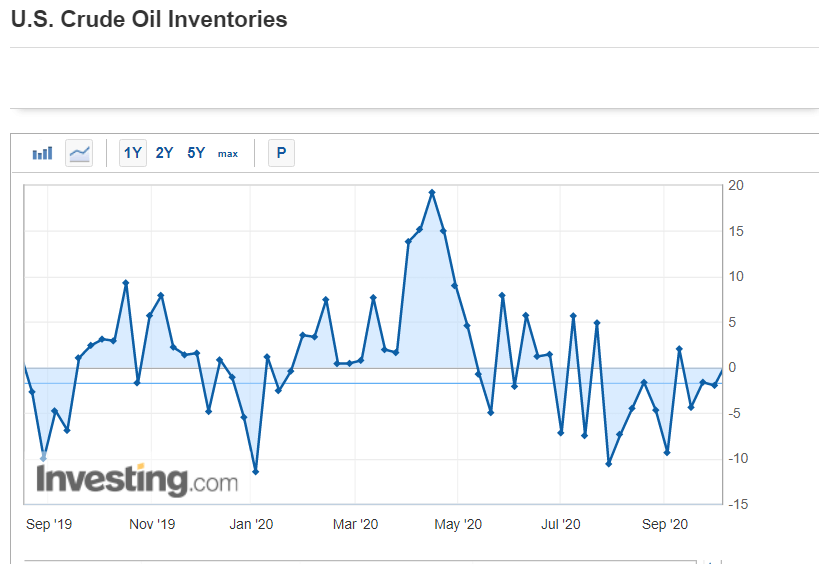

This increase in the US crude oil inventories can be witnessed towards the end of the first quarter in 2020. At the onset of the coronavirus pandemic, lockdowns and social distancing guidelines halted industrial activities and traveling. The demand for US crude oil took a hit, and inventories dramatically increased.

Source: Investing.com

Conversely, a continuous decrease in the US crude oil inventories could mean that crude oil demand is increasing. Any significant increase in the demand for crude oil can be taken as an increase in economic activities in the US’s transportation and industrial sectors. An increase in crude oil demand in the transportation sector could imply that more people are buying vehicles, which is an indicator of improved household welfare. In the industries, an increase in demand for crude oil means that industrial activities are expanding. This expansion translates to increased job opportunities and lower unemployment rates.

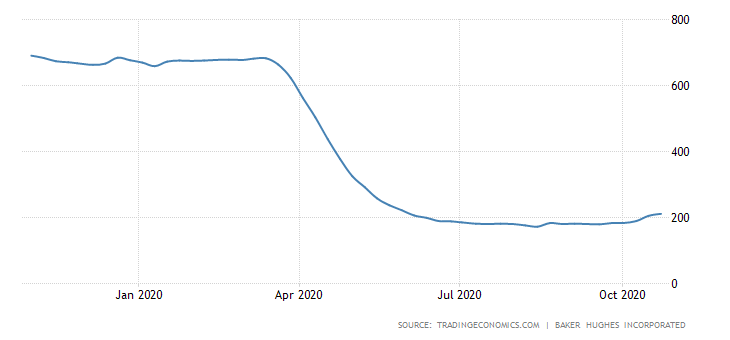

However, note that it is more plausible that a decrease in oil inventories can be a direct result of cutbacks in oil production by drilling companies. Back to the basics of the economy, the laws of supply and demand. It is inherent for any producer to strive to obtain the highest possible price in the market. According to the laws of supply and demand, oil producers might be attempting to stabilize the oil prices by cutting back on production. When prices are falling due to a decrease in demand, crude oil producers will try to cut back on drilling to stabilize the price. After all, it doesn’t make any economic sense to oversupply the market at lower prices while operation costs remain the same. This scenario was witnessed at the beginning of the second quarter of 2020. The graph below shows the decline in oil rigs that were operational in the US at the beginning of Q2 2020.

Source: Trading Economics

Due to depressed crude oil demand, crude oil prices were on a freefall, which led to cutbacks in production, hence a significant decline in inventories. Note that this decline in the US crude oil inventories does not coincide with economic expansion.

Impact of US Crude Oil Inventories on USD

We have observed that the increase in inventories can be associated with a decline in demand for crude oil. This decline in demand can imply that operations in major crude oil dependent sectors are scaling down. These are signs of economic contractions, which will make the USD depreciate in the forex market.

Conversely, when the inventories decrease, it could mean that the demand for crude oil has increased significantly. For economic sectors that are heavily dependent on crude oil, it means that they are expanding. Since this can be an indicator of economic growth, the USD can be expected to increase in value in the forex market.

Sources of Data

The US Energy Information Administration publishes the US crude oil inventories every week. Trading Economics has in-depth and historical time series data on the US crude oil inventories.

How US Crude Oil Inventories Release Affects The Forex Price Charts

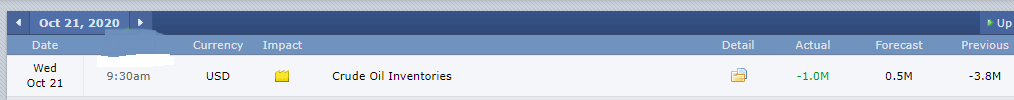

The latest publication of the US Crude Oil Inventories was on October 21, 2020, at 9.30 AM EST. This release is available at Forex Factory. When the US crude oil inventories are published, low impact is expected on the USD.

In the latest release, the US crude oil inventories decreased by 1 million barrels compared to 3.8 million barrels in the previous week. This change was more than analysts’ expectations of a 0.5 million barrels decline.

Let’s see how this release impacted the USD.

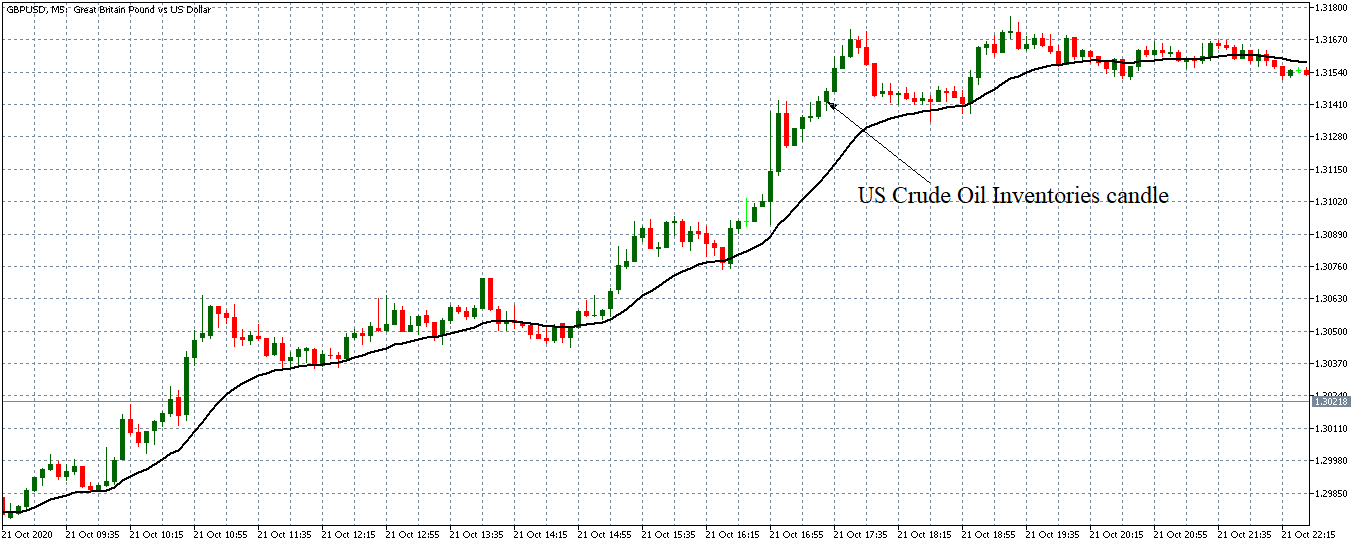

GBP/USD: Before US Crude Oil Inventories Release on October 21, 2020, just before 9.30 AM EST

The GBP/USD pair was trading in a steady uptrend before releasing the US crude oil inventories data. The 20-period MA is seen to be steadily rising with candles forming above it.

GBP/USD: After US Crude Oil Inventories Release on October 21, 2020, at 9.30 AM EST

The pair formed a 5-minute bullish candle indicating the weakness of the USD. It continued trading in the steady uptrend for a while before adopting a neutral trend.

The US crude oil inventories data is a low impact indicator in the forex market. As shown above, the release of the data had no impact on forex price action.