Introduction

Scalping is a trading strategy designed to profit from small market changes. The Scalpers took a couple of trades in any trading session, and the goal of every scalper is to seize gains when they appear on a price chart because the aim is to have a few small wins rather than one large one. Scalping is one of the most challenging style of trading to master because it requires unbelievable discipline and focus.

A scalper must follow the rules of their trading strategy like a religion because one large loss can easily wipe out dozens of successful trades. One of the most critical aspects of scalping is liquidity because we would not scalp any instrument that is not liquid enough and ensuring liquidity also ensures that we are getting the best price while entering and exiting in a trade. In this article, we will show you how to scalp the 15-minute trading timeframe by using the Donchian Channels Indicator.

Working Of A Donchian Channel

Donchian channel consists of three lines, which are generated by the moving average calculations that comprise an indicator formed by the upper and the lower band, also the median band. The celebrity trader Richard Donchian developed the indicator in the mid-twentieth century so that he can identify the trend of the market. The area between the upper and lower band represents the Donchian channel. The indicator identifies the bullish and bearish extremes areas, which are followed by the reversals or breakouts in price action.

15-Min Trading Strategy

The scalping strategies are only created to trade the lower timeframes, such as 1, 3, 5, 15-minute timeframes; do not apply any of these strategies on any higher timeframes; otherwise, you will face some trouble in your trading.

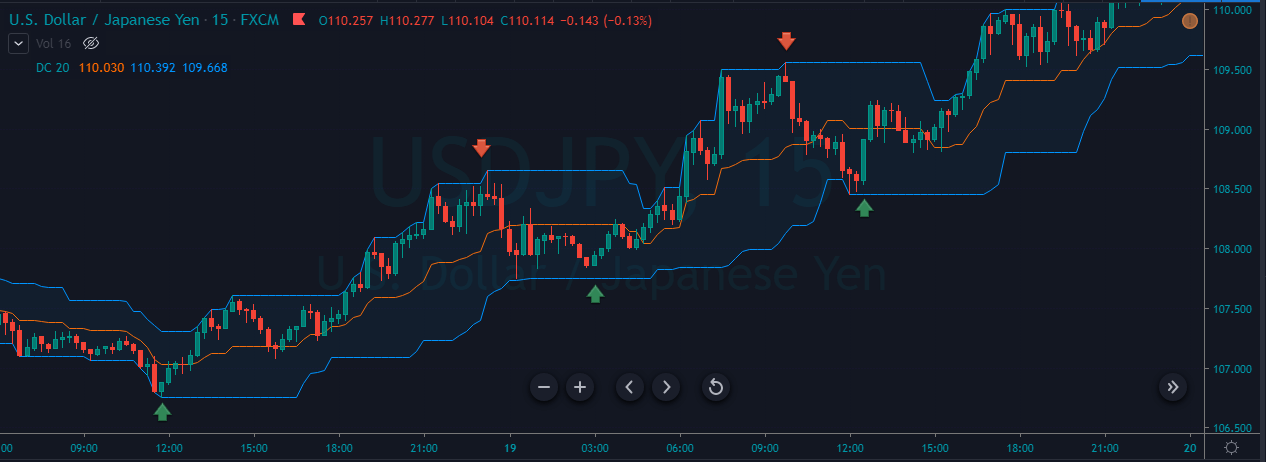

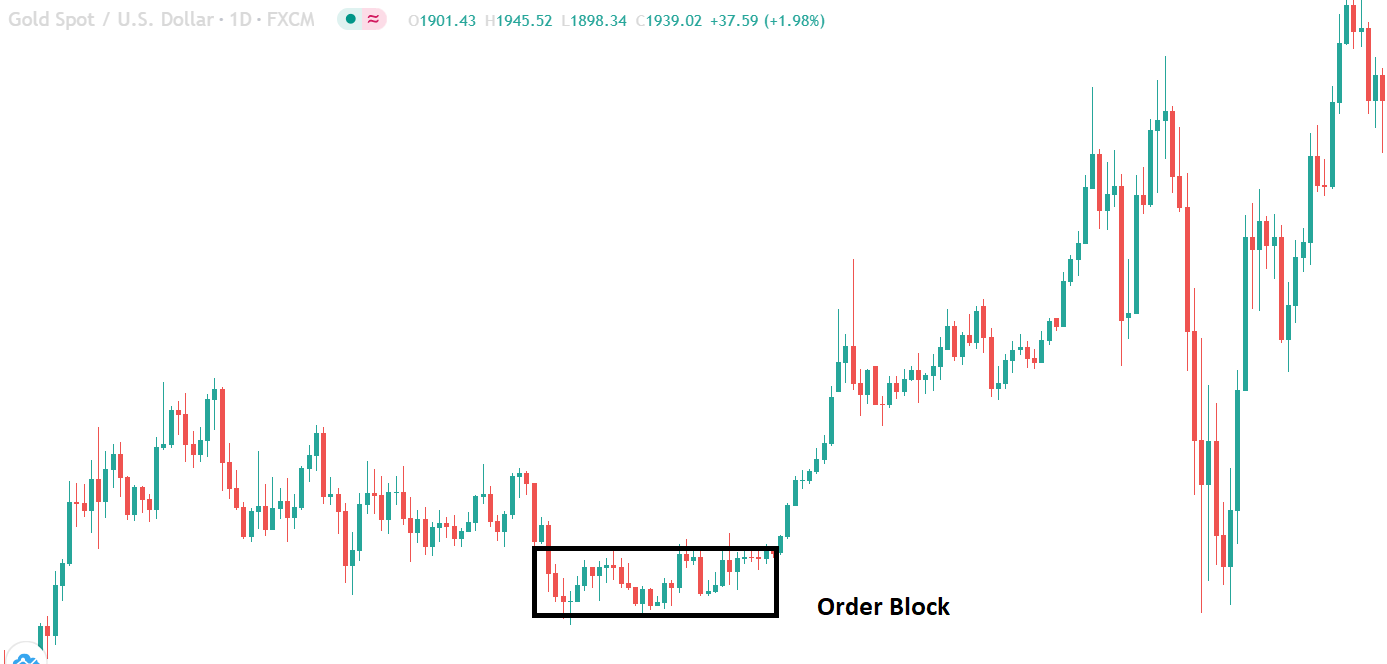

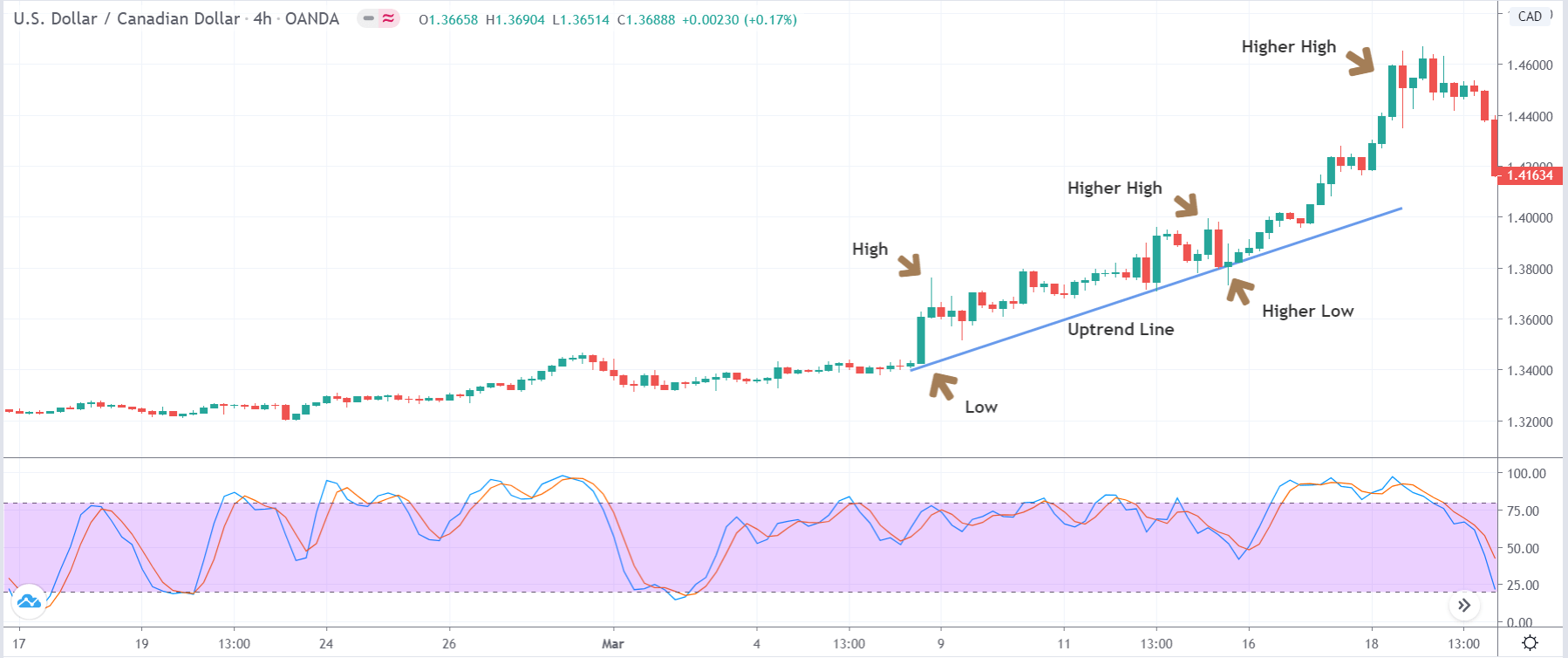

As you can see in the below image of the USDJPY forex pair, overall, the instrument is in a strong uptrend, and when the price action hits the lower band of Donchian channel it indicates the buy trade, and when it hits the upper Donchian channel, it means to go for a short trade.

In the below image the price action gives us three buying and three selling trade, most of the time the buying trades perform bit longer than the selling trades, it is because the flow of the market was up, but for the scalpers, the flow doesn’t matter, all the scalpers want is to in and out from the market. Close your position when the price action hits the opposite channel, and when you take the entry, if the price action goes a bit against you { for, e.g., 4 to 5 }, then close your position immediately and wait for the new signal.

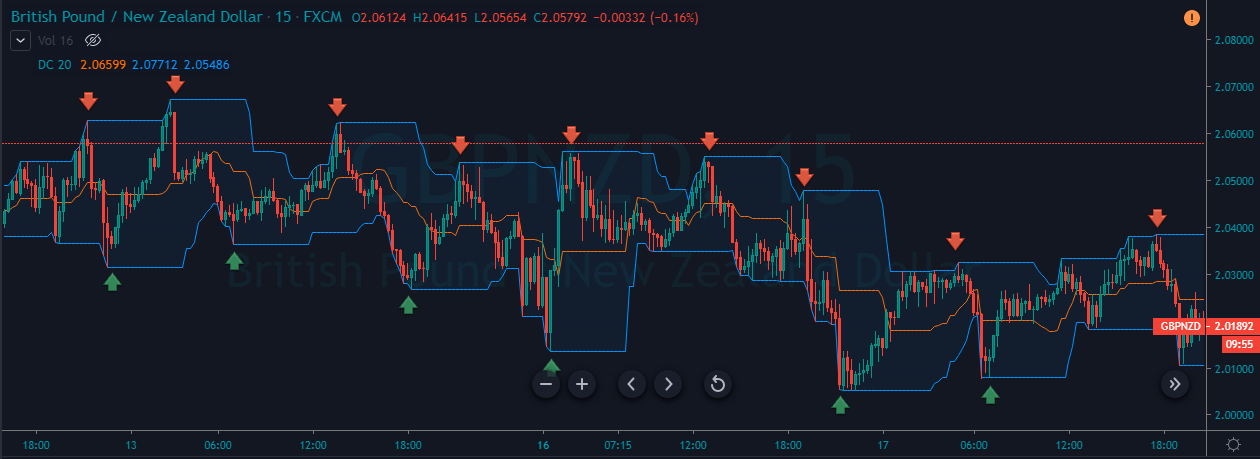

The below image represents a couple of buying and selling trades in a downtrend. The goal of every scalper is to, first of all, check the trend of the market, and expect more trades by following the trend and simply expect less counter-trend trades. You can see that the below image of the GBPNZD forex pair shows us the nine selling and six buying trades. Most of the selling and buying trades worked very well, and each trade generates a significant amount of money for us. The whole goal is to activate the position when the price action hits the Donchian channel and close your position when the price action goes a bit against us.

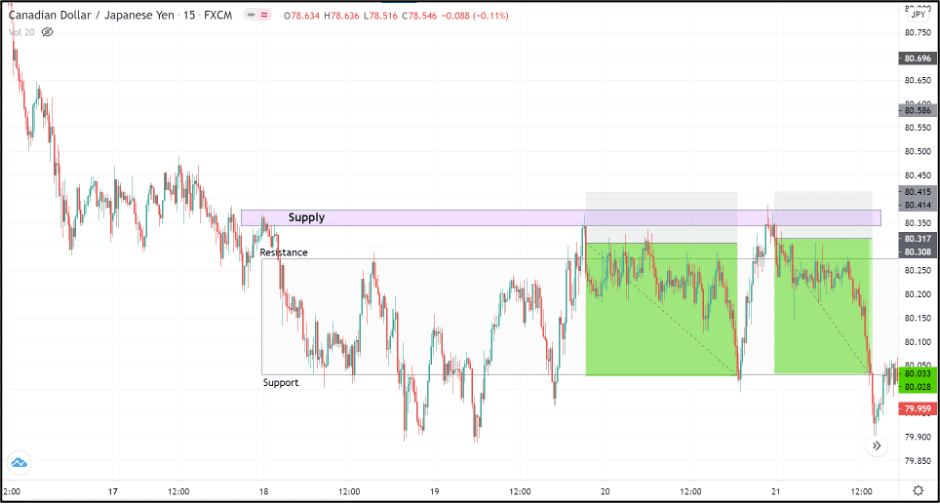

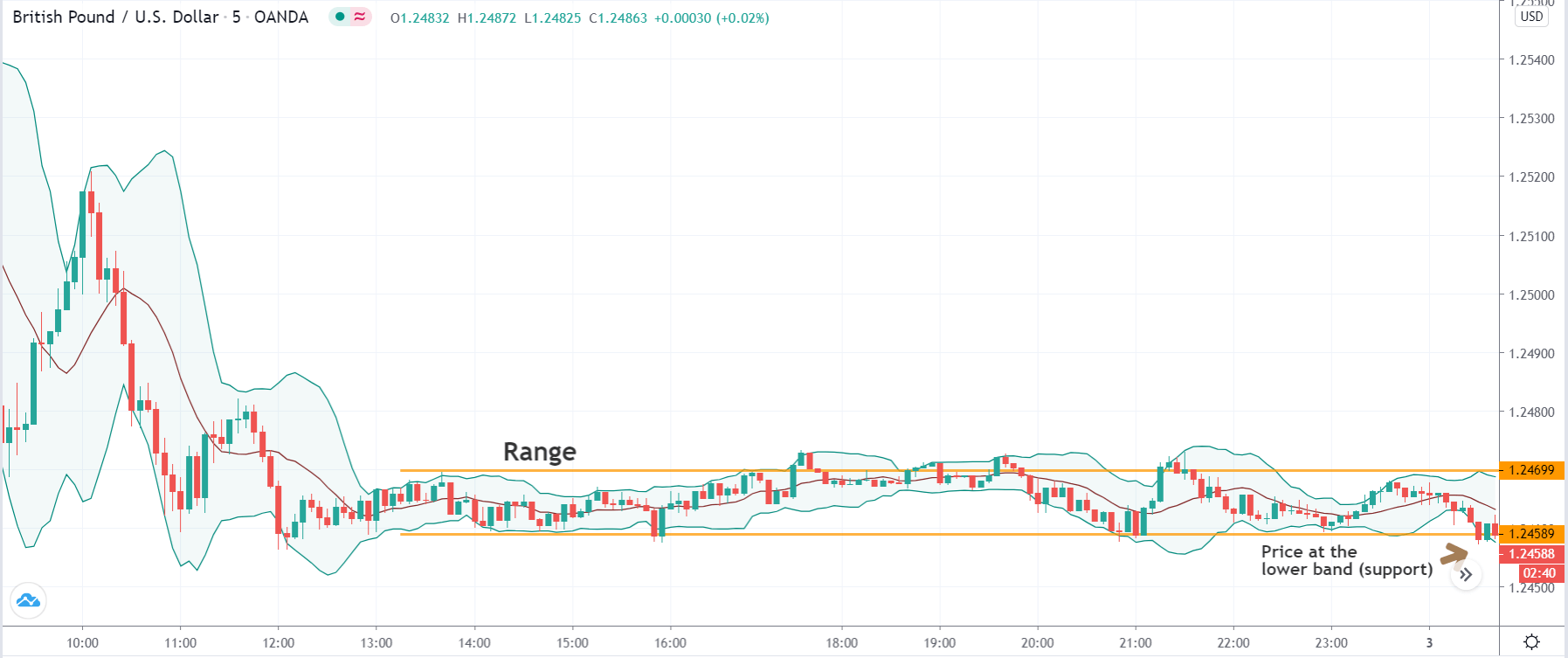

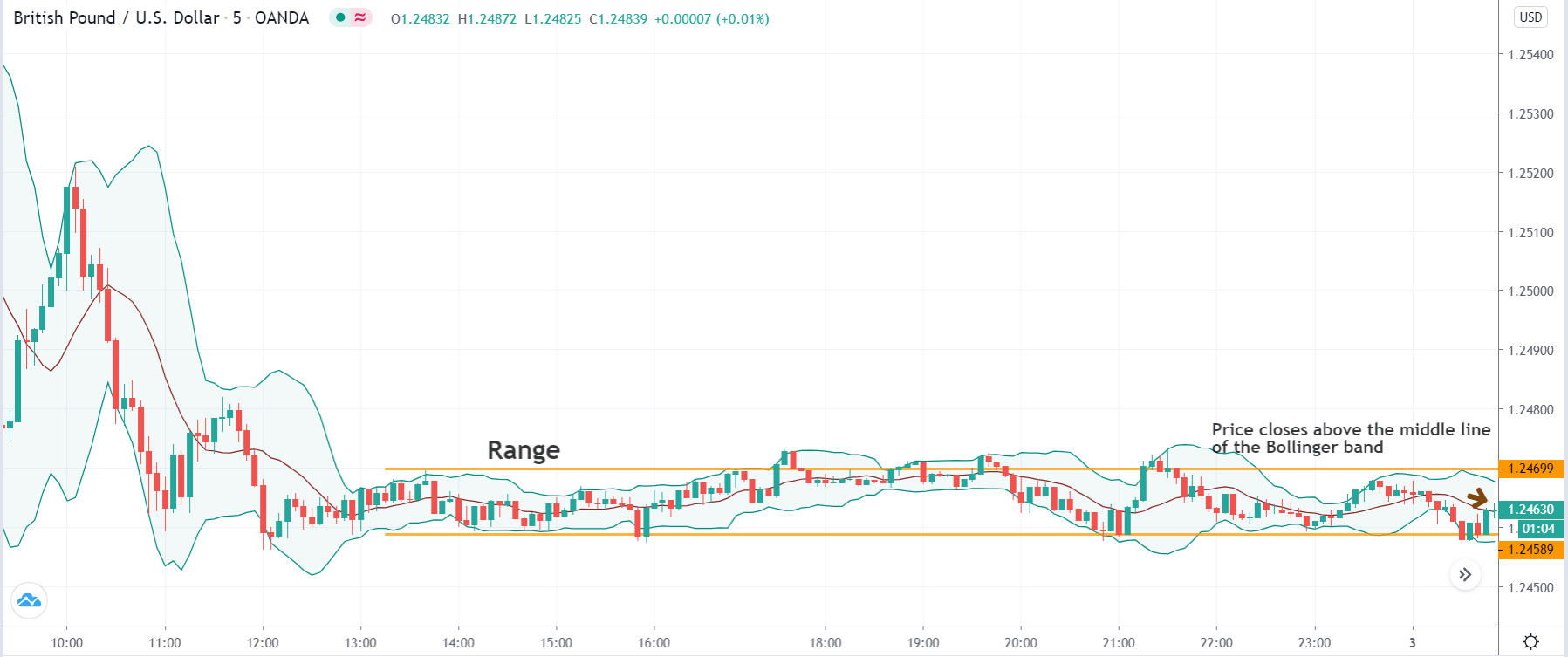

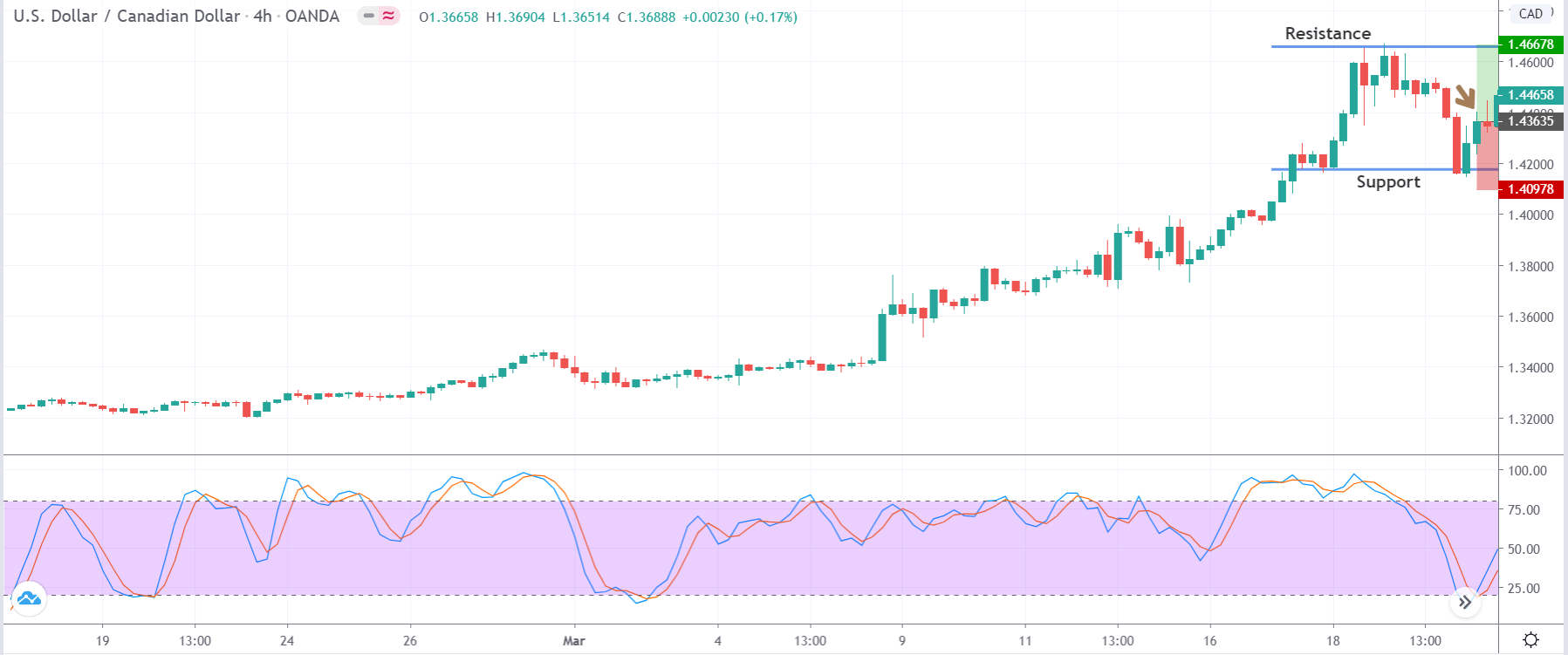

Range Trading

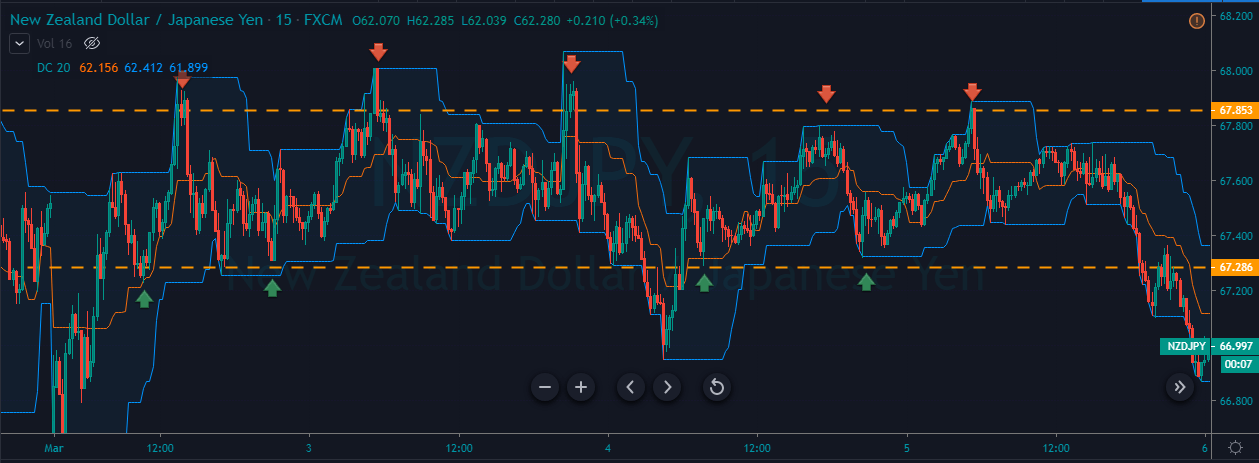

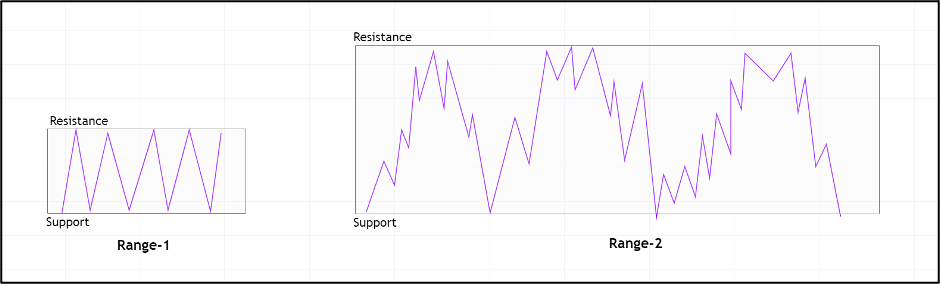

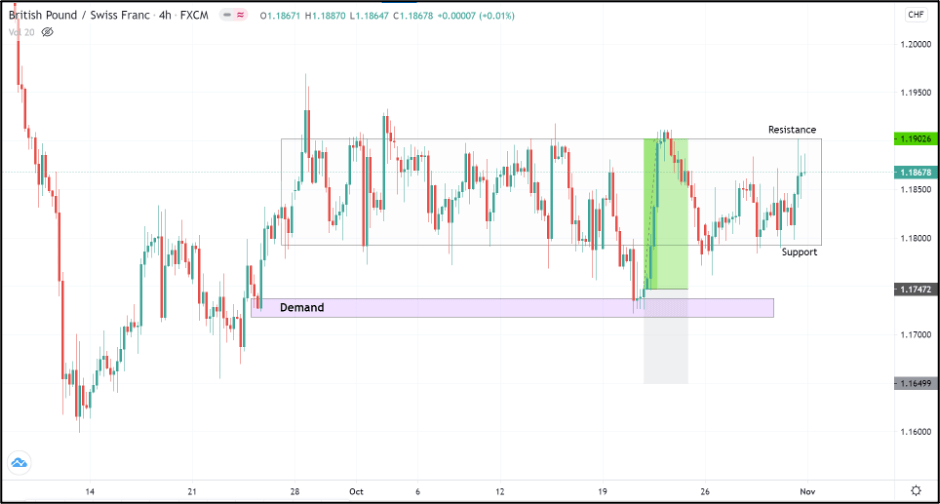

If you trade the trending market, then expect the more trend-following trades, and if you scalp the ranges and channels, then you can expect both the buying and selling trades because in ranges and channels both of the parties hold the equal powers this is the reason ranges and channels are favorite for the scalpers. The image below shows the 15-minute chart of the NZDJPY, forex pair, which shows the ranging market, and in range price action gives the five selling and four buying trades. In the ranging market, we suggest you go for the 1:1 RR trades because the price action more often spikes in ranges.

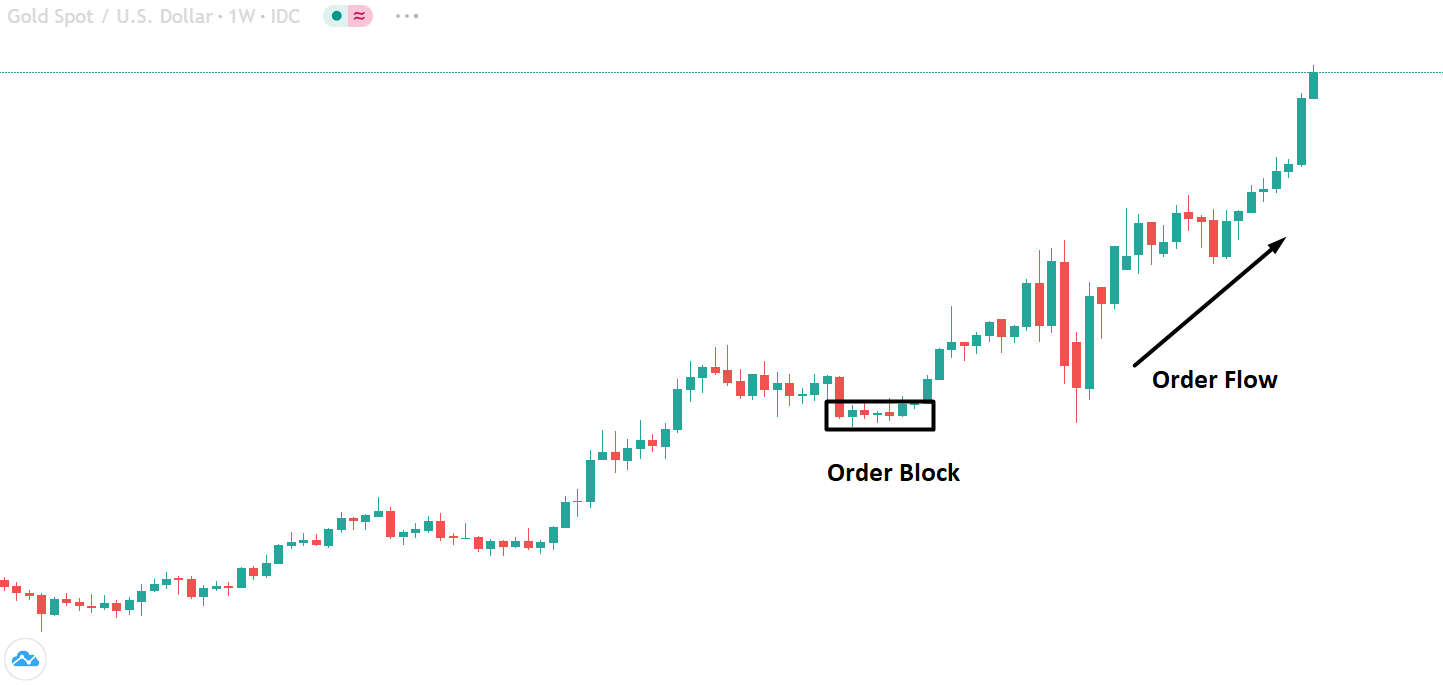

Scalping Trading By Following The Market Trend

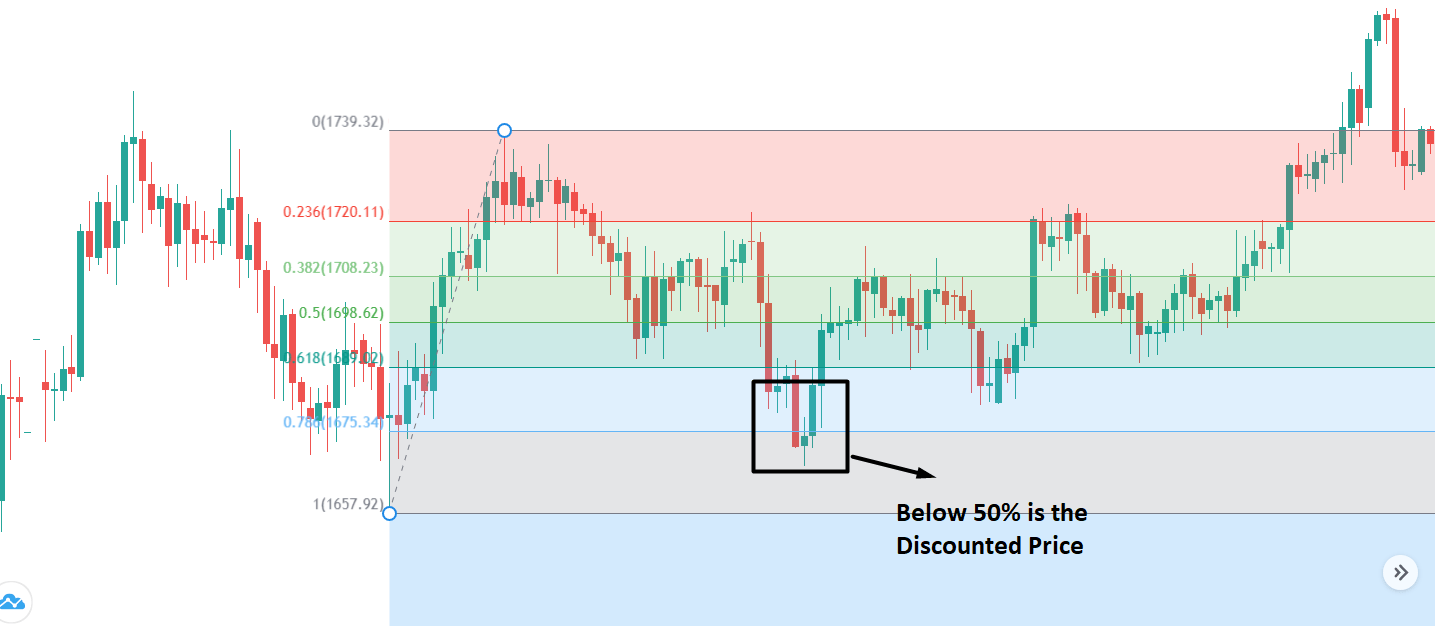

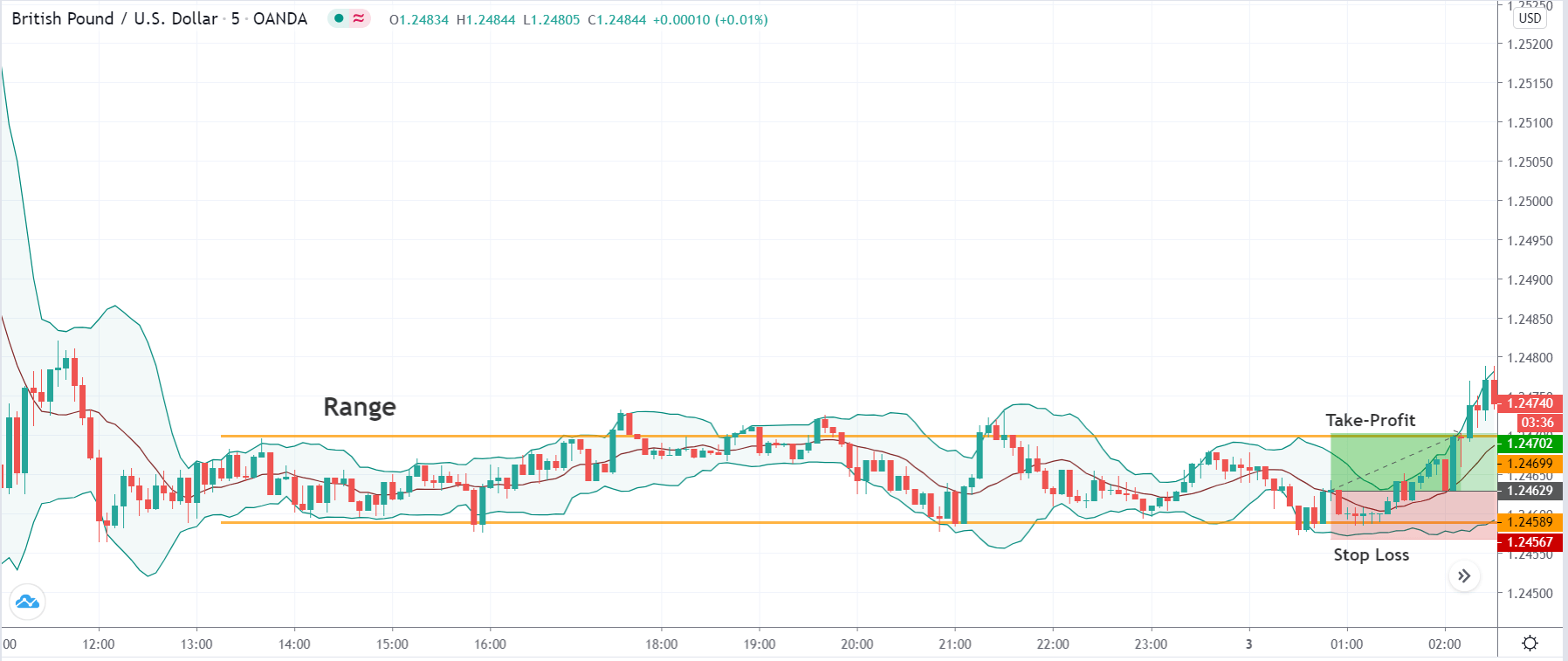

Buy Trade

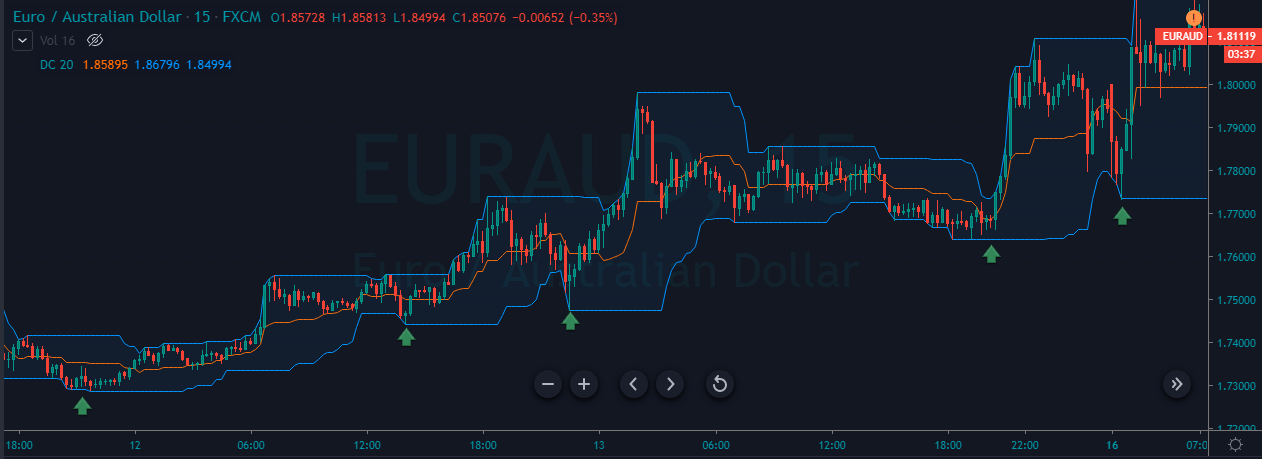

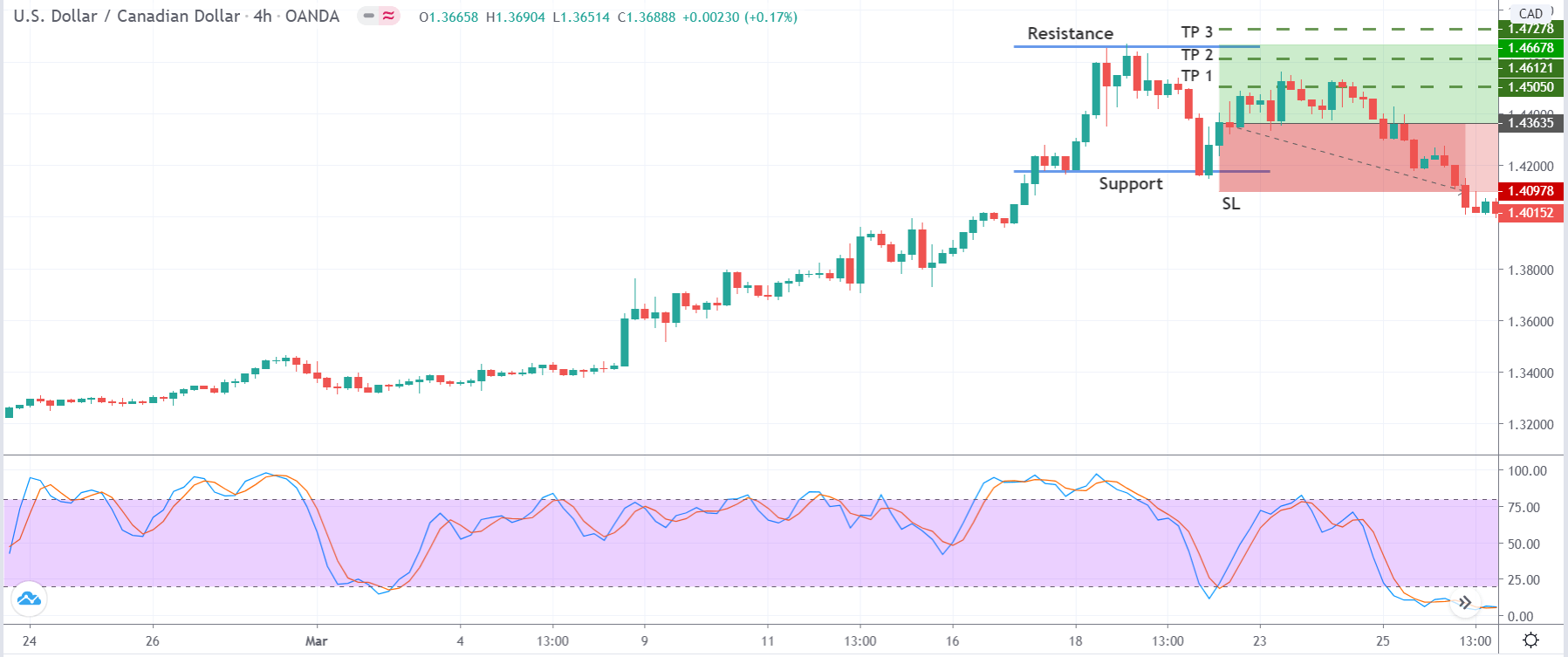

The scalping is all about having a strong and aggressive mind to face the rollercoaster ride in the market, and some of the conservative and confirmation traders want to scalp the market, but they little hesitate to react on every signal, so if you are a conservative or confirmation scalper then here is good news. We specially created a strategy that suits your trading personality. In this strategy, you will find fewer trades, but the trades will be accurate. Apply this strategy only on the fifteen-minute timeframe and avoid trading the ranges and channel markets because both situations have higher chances of fake outs. First of all, on a lower timeframe, find out the clear uptrend in any instrument, and when the price action hits the lower Donchian channel go long and hold your position till the price action hits the opposite channel. Do not go for selling trades in the buying market simply wait for the next buying trade. In the below image, by following the trend of the market, we only got the five buying trades in the EURAUD forex pair. Each of our trade travels a significant amount of time; then the price action generates the next trade. By following this strategy, you will face less mess and good trades in the market.

Sell Trade

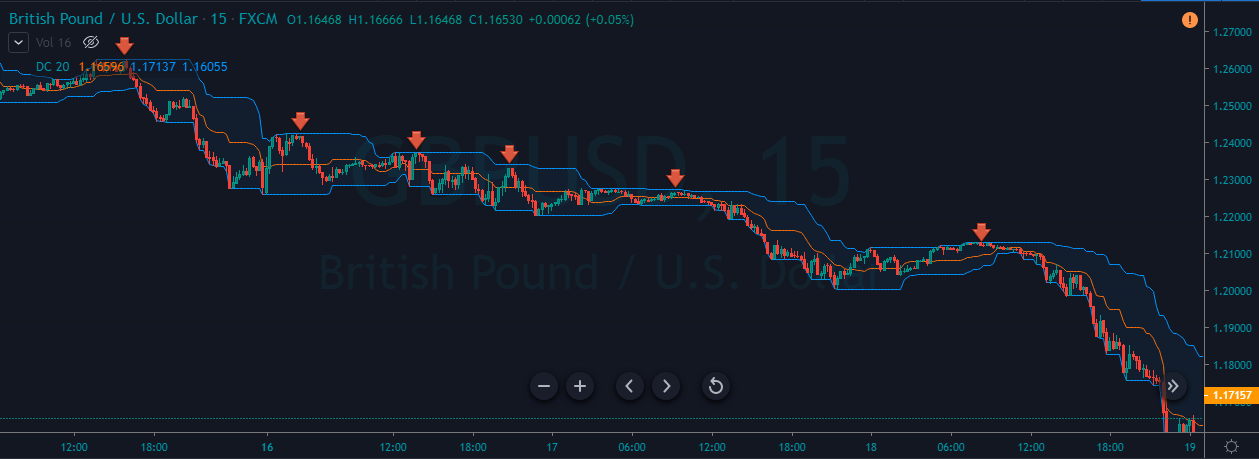

The image below represents the six selling trades in the GBPUSD forex pair, you can see that the downtrend was quite smooth, and after activating our every trade, the price action immediately goes into our favor. In the strong trending market, you can go for the smaller stop loss and book profit when the price action gives the buying signal.

Conclusion

Scalping is not easy, but it is a quick way to make some money from the market. As a scalper does not expect a continuous win, most of the scalpers face the ups and downs in their trading journey. Every trading day awaits a couple of buy and sell trades, do not judge yourself or your strategy according to every single trade, instead of at the end of the day find out how many wins and losses you have. If the end of you have more wins than the losses, then it means you have a successful trading day. Scalping works very well on the lower timeframe and the strategies we show in this article created, especially for the 15-minute trading timeframe.