Blockchain Lockbox is an exclusive hardware wallet that’s specially designed to complement the all-popular Blockchain web wallet. Launched in October 2018, Blockchain Lockbox was designed and created by Blockchain wallet founders in collaboration with Ledger Technology Company. According to Blockchain Wallet CEO, Peter Smith, the hardware wallet is supposed to offer their platform users the option and means to manage their digital assets seamlessly, online and offline.

Blockchain Lockbox is marketed as a security-focused crypto wallet that incorporates the most comprehensive range of highly effective safety and privacy measures. These are then complemented by an equally impactful list of operational features aimed at making the Blockchain Lockbox wallet as easy to use as possible.

In this Blockchain Lockbox review, we detail these features and vet their influence on the hardware wallet’s safety and ease of use. We also look at such other factors as the number of currencies supported by the wallet, its pros, and cons, level of customer support advanced, and compare it with equally popular hardware wallets.

Blockchain Lockbox key features

Compatible with blockchain web wallet: Blockchain Lockbox is ideally supposed to compliment and offer an offline alternative of the already popular Blockchain web wallet.

On-device screen: The USB-like hardware device that takes the shape of Ledger hardware wallets features an on-device OLED screen. The screen comes in handy when activating the wallet, checking crypto balances offline, and authenticating outbound crypto transfers.

Navigation button: In addition to the screen are two on-device buttons supposed to help you navigate the hardware wallet and confirm outbound crypto transfers.

FIDO-Certified: Blockchain Lockbox is a FIDO certified hardware wallet. This means that in addition to keeping the private keys for your cryptocurrencies safe, it can also be used to store the security keys for your Google, Dropbox, GitHub accounts, and more.

Blockchain Lockbox security features

PIN Code: Blockchain Lockbox hardware wallet is secured with a PIN code that you get to create when setting up the crypto vault. This 8-digit PIN not only protects but also encrypts the wallet’s content.

Recovery seed: When activating the hardware wallet, you will also be presented with a 24-word backup seed that you can use to recover your lost wallet or private keys.

Ledger technology: Ledger has a solid reputation for coming up with the most secure crypto hardware wallets. So does Blockchain web wallet, and the fact that Lockbox infuses both Ledger and Blockchain wallet technologies speaks volumes about the hardware wallet’s reliability.

Anti-phishing protocols: Blockchain lockbox is an end-point controlled wallet. It has a unique key embedded within its firmware that will only pair with the legit Blockchain wallet website. This implies that Blockchain Lockbox cannot turn on when connected to a clone website, which goes a long way in defeating phishing.

Non-custodial/Cold storage: Blockchain Lockbox, like the blockchain web wallet, is a non-custodial crypto vault that will not store your private keys on the company servers. Instead, it encrypts all your user data – the private keys and any other personal information stored therein – and holds it in the offline hardware device.

Dual Chip architecture: Unlike most other hardware wallets whose secure element will only feature one encryption chip, Blockchain Lockbox features the ultra-secure ST31H320 and STM32F042 chips. Note that both chips are CCEAL5+ (crypto industry-level) certified.

Key Erasure tool: If you enter your PIN code for the crypto wallet unsuccessfully for three consecutive times, the hardware device will be locked, and any content therein permanently deleted.

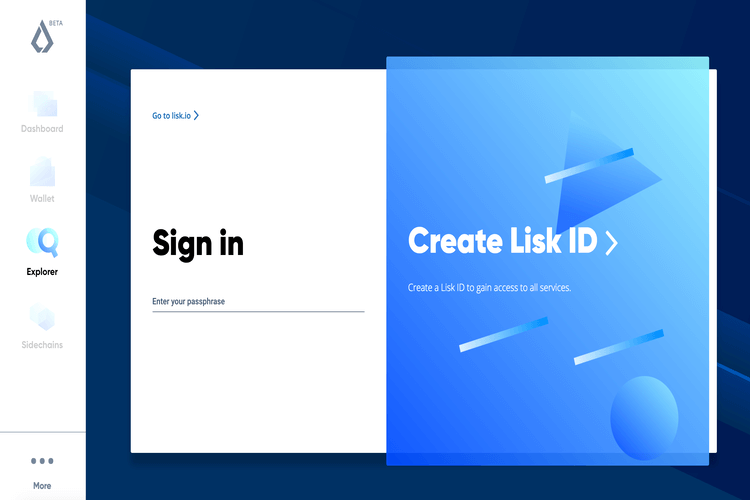

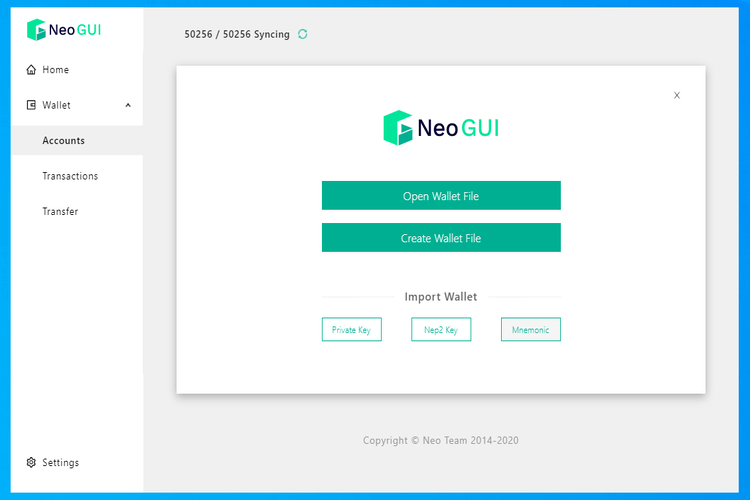

How to set and activate the Blockchain Lockbox wallet

Step 1: Start by ordering your Blockchain Lockbox hardware wallet from the Blockchain wallet official website

Step 2: Open the Blockchain Wallet website and login into your user account or create one.

Step 3: Connect the hardware device to your computer using the USB cable provided

Step 4: On your Blockchain wallet’s user dashboard, tap on the ‘Balances’ tab and select the “Set up now” icon

Step 5: Chose the device you wish to set up – Blockchain Lockbox.

Step 6: Follow the prompts by the setup wizard to complete the process.

Step 7: Once done, the hardware device will display the “Choose a PIN” message.

Step 8: Press both on-device buttons simultaneously to set a wallet PIN. Toggle between the right and left buttons when selecting a number and press both buttons simultaneously once satisfied with your 8-digit PIN.

Step 9: Write down and verify the 24-word recovery seed provided by the hardware device

Step 10: Your wallet is now active and ready for use

How to add/receive crypto into your Blockchain Lockbox wallet

Step 1: Log in to your Blockchain wallet user account and click on the “Request” tab.

Step 2: Select the cryptocurrency you would like to receive on the drop-down menu.

Step 3: Chose Blockchain Lockbox on the “Receive To” drop-down menu.

Step 4: The wallet will automatically generate an address and dynamic QR code that you should now copy and send to the party sending your cryptos

How to transfer coins from blockchain web wallet for Blockchain Blockbox

Step 1: Log into your Blockchain wallet account and click on the “Send” icon.

Step 2: Chose the currency you want to transfer from the drop-down menu and Blockchain Lockbox from the “Receive To” drop-down menu.

Step 3:Chose the sub-wallet on which to deposit the funds to (or simply enter the hardware wallet address) and the number of coins you wish to transfer

Step 4: Select the transaction fee and hit send.

Step 5: The wallet will prompt you to connect the Hardware Wallet

Step 6: Log in to the hardware wallet by keying in the PIN code

Step 7: Press the right on-device button to view the transaction details.

Step 8: After verifying that the transaction is correct, press the on-device button to authorize the transfer

How to send crypto from your Blockchain Lockbox wallet

Step 1: Log in to the Blockchain wallet and click the “Send” tab.

Step 2: Select the currency you what to send in the “Currency” drop-down menu and Blockchain lockbox in the “From” drop-down menu.

Step 3: Enter the recipient’s address and the number of coins you want them to receive

Step 4: Select the transaction fees and click on “Continue.”

Step 5: Connect your lockbox hardware wallet and log in.

Step 6: Check the accuracy of the transaction details on the on-device screen and press the right on-device button to confirm and authorize the transfer

Blockchain Lockbox wallet ease of use

The Blockchain Lockbox wallet has the most effortless onboarding process. The process of receiving and sending cryptocurrencies in and out of the wallet is also relatively straightforward. The on-device screen and buttons and the highly intuitive user interface of the Blockchain wallet web service have also played a key role in easing the interaction with the hardware wallet. And all these make Blockchain Lockbox a beginner-friendly hardware wallet.

The Blockchain Lockbox website is also multi-lingual and available in 20+ international languages.

Blockchain Lockbox wallet supported currencies and countries.

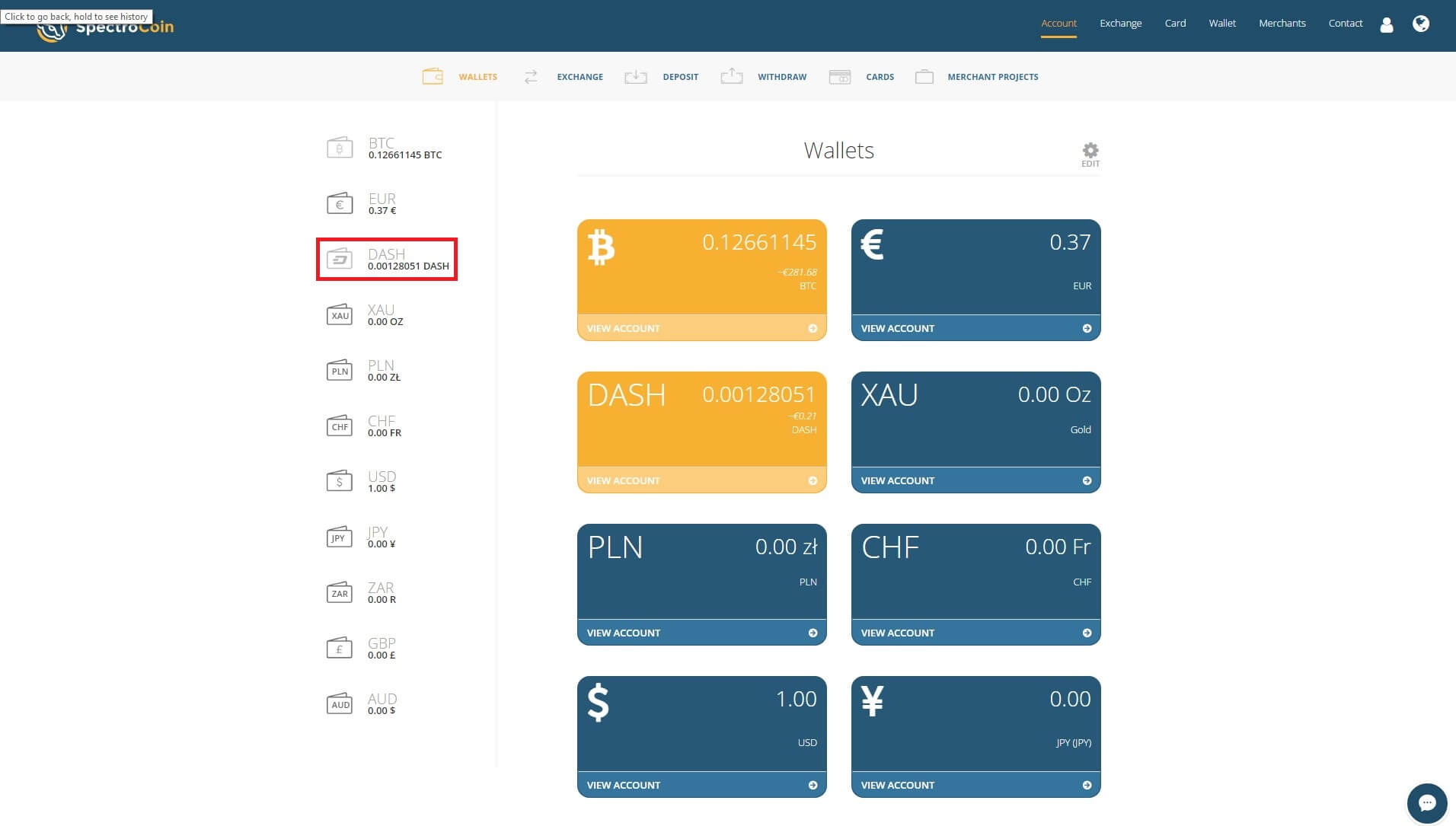

Blockchain lockbox is a multi-currency hardware wallet that currently supports four cryptocurrencies – Bitcoins, Ethereum, Bitcoin Cash, and Stellar Lumens. The wallet developers have nevertheless committed to increasing the number of supported assets in line with user-demands.

The wallet can also be shipped into 140 crypto-friendly countries across the world.

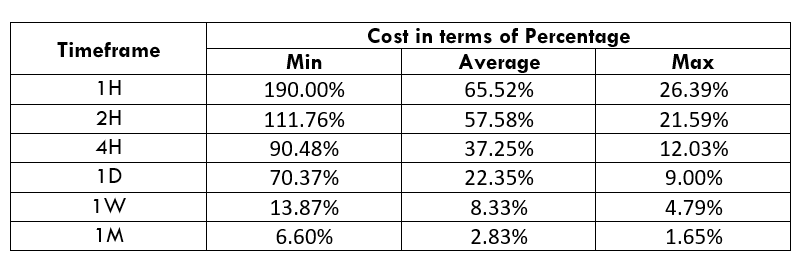

Blockchain Lockbox wallet cost and fees

Blockchain Lockbox currently retails at $59 + free express shipping.

The transaction fee for sending cryptos from the web wallet to Lockbox or other wallets and exchanges is highly dynamic. Priority fees translate to higher transaction fees and faster transaction confirmation, while the basic charge translates to lower costs and slow transaction confirmation speeds.

Blockchain Lockbox wallet customer support

Blockchain wallet has a highly responsive customer support team available via email or social media platforms like Twitter and Instagram.

What are the pros and cons of using the Blockchain Lockbox wallet?

Pros:

- Blockchain lockbox is easy to use and beginner-friendly.

- The hardware wallet is competitively priced.

- The wallet embraces a wide range of highly effective security measures.

- Easily integrates the blockchain wallet.

Cons:

- It can only be used on the Blockchain Lockbox wallet.

- The wallet doesn’t support fiat-to-crypto purchase.

Comparing Blockchain Lockbox wallet with other hardware wallets

Blockchain Lockbox wallet vs. Ledger Nano S wallet

Blockchain Lockbox is technically an offshoot of the Ledger class of hardware wallets given that it was designed and created by Ledger in partnership with Blockchain. They both employ a wide range of security features, including two-factor authentication and recovery seed. Both are also multi-currency hardware wallets that are simple to use and quite beginner-friendly.

But while Blockchain lockbox is only compatible with the Blockchain wallet, Ledger Nano S is versatile and compatible with multiple software and hardware wallets. Additionally, while Blockchain lockbox will only support four cryptocurrencies, Ledger Nano S supports 1000+ cryptos and tokens.

Verdict: Is the Blockchain Lockbox wallet safe?

Blockchain Lockbox is a safe wallet that has put in place multiple advanced security features that include two-factor authentication, dual-chip architecture, and anti-phishing protocols. We also appreciate Blockchain Lockbox’s ease of use, competitive pricing, and beginner friendliness. The only downside to the hardware wallet is its rigidity in that it is compatible with the Blockchain wallet.