Introduction

Fundamental analysis is one of the most reliable forex trading strategies in the world that considers economic releases and events. In fundamental analysis, many indicators provide a possibility of upcoming movement in a currency pair. Besides the economic release, some events like monetary policy decisions create an immediate impact on a currency pair.

What is Monetary Policy?

Monetary policy is an action or decision taken by the central bank to control the money supply and achieve the economic sustainability and macroeconomic goal. Every country has a strategic goal based on the current performance and upcoming economic growth of the economy. Therefore, most of the central bank changes the interest rate based on the economic condition.

Usually, the central bank sits quarterly for a monetary policy meeting to discuss the following four core areas:

- Guideline for the money market

- Interest rate decision.

- Monetary policy measurement.

- The outlook of the economic and financial developments.

How Monetary Policy Affects the Forex Market?

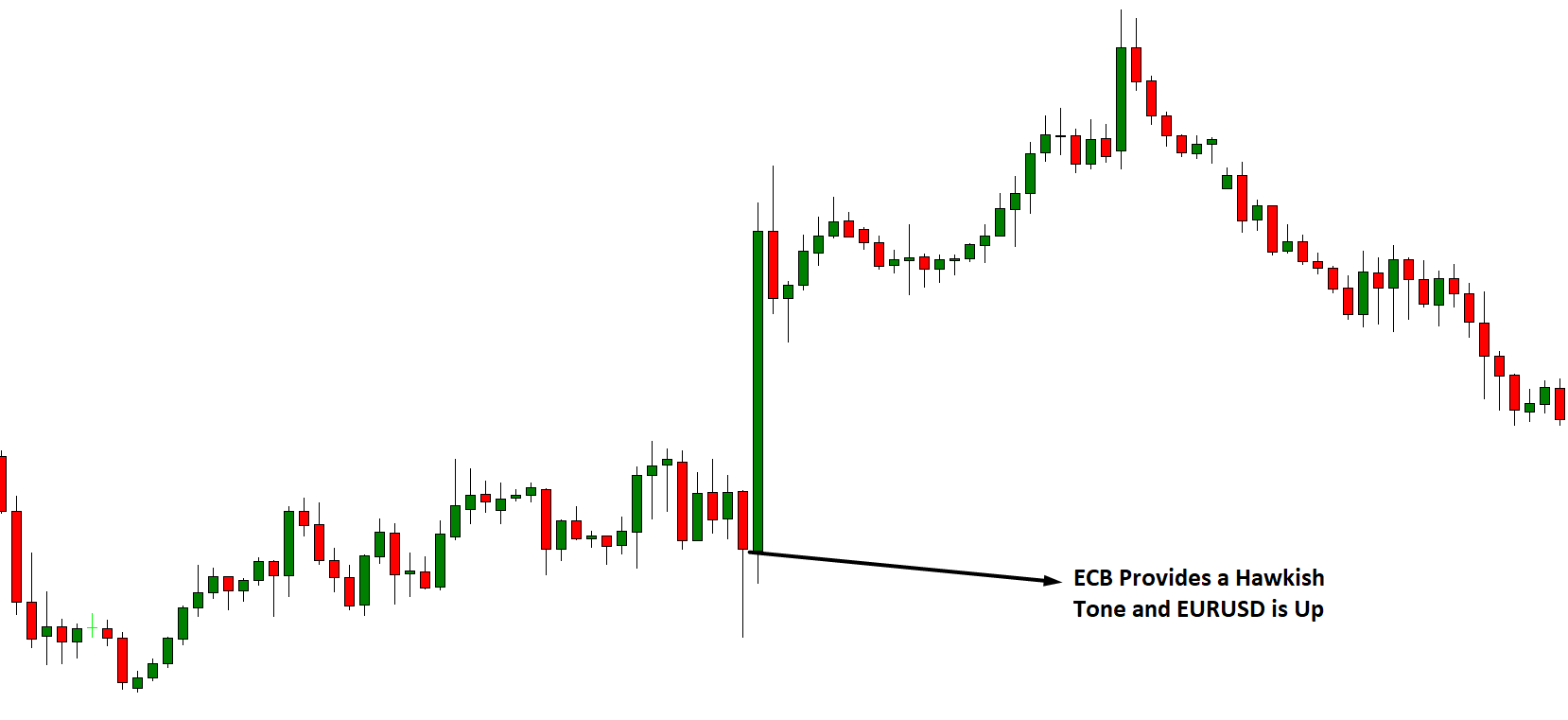

In a monetary policy meeting, the central bank discusses the present economic condition of a country. Therefore, any hawkish tone may create an immediate bullish impact on a particular currency. On the other hand, a dovish tone may create an immediate negative impact on a particular currency in any trading pair.

Besides the immediate effect, there is a long-term impact on the price of a currency pair. We know that any strength in an economy indicates a stronger currency. For example, if the ECB (European Central Bank) provides some consecutive outlook of the European economy saying that the inflation is under control, and the interest rate increased, which is likely to increase again in the next quarter. In that case, the influential European economy may create a Bullish impact on EURUSD, EURAUD, or EURJPY pair.

Moreover, there is some case where the central bank cut the interest rate where traders and analysts were expecting a rate hike. In this scenario, investors may shock at the news, and the effect might be stronger than before.

How to Trade Based on Monetary Policy Statement?

There is two way to trade based on the monetary policy decision. The first one is based on the immediate market effect, which is known as news trading. On the other hand, traders can evaluate the economic condition based on the recent monetary policy statement and see how the economy is growing in the long run. Based on this market scenario, traders can find a long term direction in the market based on economic performance as per the monetary policy statement.

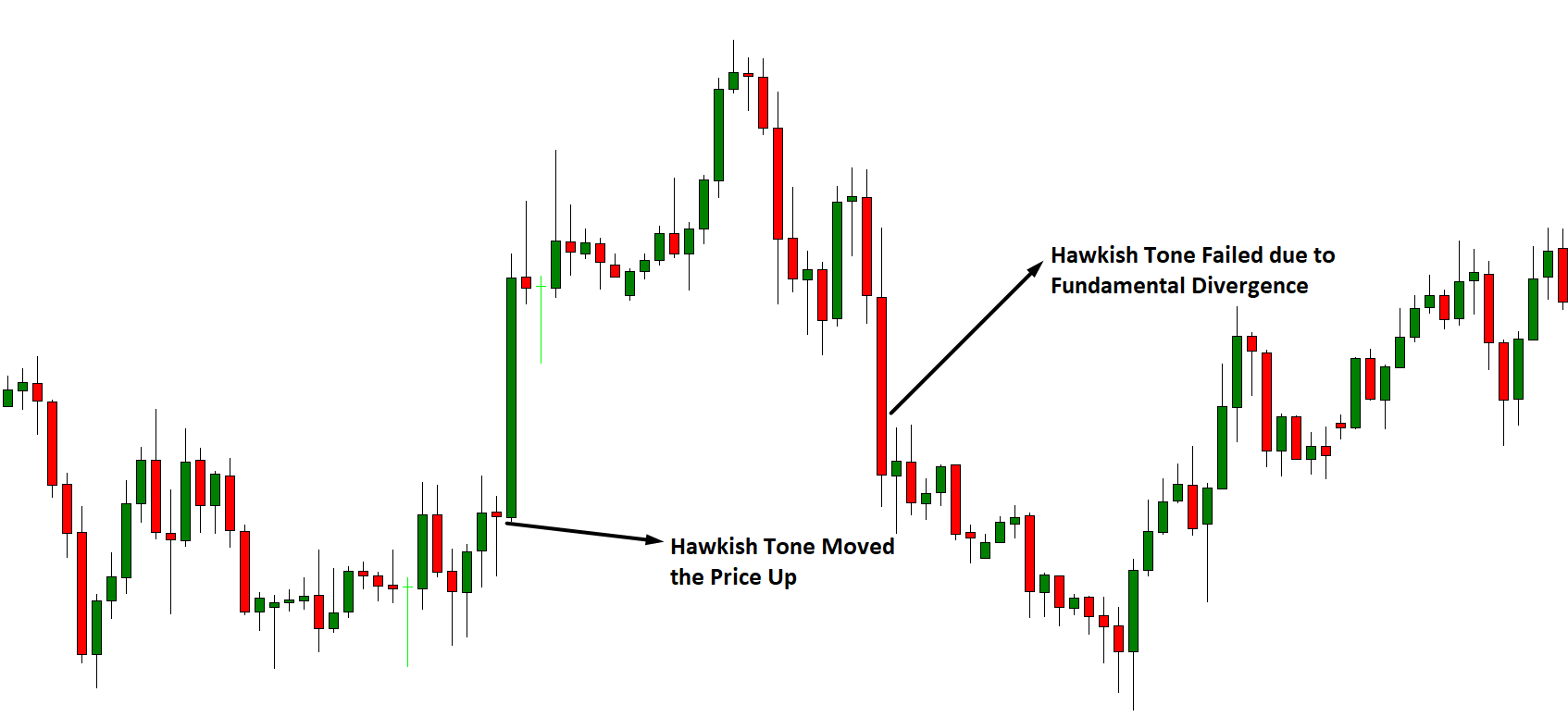

Another way of trading based on the monetary policy decision is the fundamental divergence. If one fundamental indicator does not support another fundamental indicator, it creates fundamental divergence. For example, the US interest rate is increasing based on the strong employment report, but inflation does not support the rate hike. In this situation, traders can take trades with the possibility that the rate hike’s effect will not sustain.

Summary

Let’s summarize the effect of monetary policy in the forex market:

- Monetary policy meeting happens quarterly where the central bank takes interest rate decision.

- In the monetary policy meeting, the central bank provides an outlook of the economic and financial developments.

- A hawkish tone makes the currency stronger, while the dovish tone makes the currency weaker.

- Traders can identify the fundamental divergence based on the decision on monetary policy meeting.