Natrium wallet is a mobile crypto app developed by Appdito and introduced to the Nano community in August 2018. It is an open-sourced mobile app specially designed to further Nano Blockchain’s versatility while guaranteeing the security of the user’s digital assets. Though the community developed it, the wallet app has been subjected to numerous security audits sanctioned by the Nano Foundation that helped push it up the list of most reliable Nano wallets.

On the Natrium wallet website, the crypto app is described as a “Fast, Robust, and Secure Nano Wallet.” But how true is this bold claim? What features make Natrium safe and robust, and how have they influenced its effectiveness? In this Natrium wallet review, we detail its key features and the security measures in place, gauge its ease of use, provide you with a step-by-step guide on how to use the wallet, and tell you if it is the safest Nano Wallet app.

Natrium wallet key features

Mobile wallet: Natrium is a versatile crypto mobile app available for Android and iOS-powered mobile devices. The app can be downloaded from the wallet’s official website, Google play store, or Apple’s app store.

Multi-wallet: Natrium is a multi-account website implying that there is no limit to the number of wallet addresses you can host on the wallet.

Address book: To eliminate the often-costly errors arising from sending cryptos to the wrong address, Natrium has integrated an in-app address book. This allows you to save the wallet address and name of the wallets you interact with regularly.

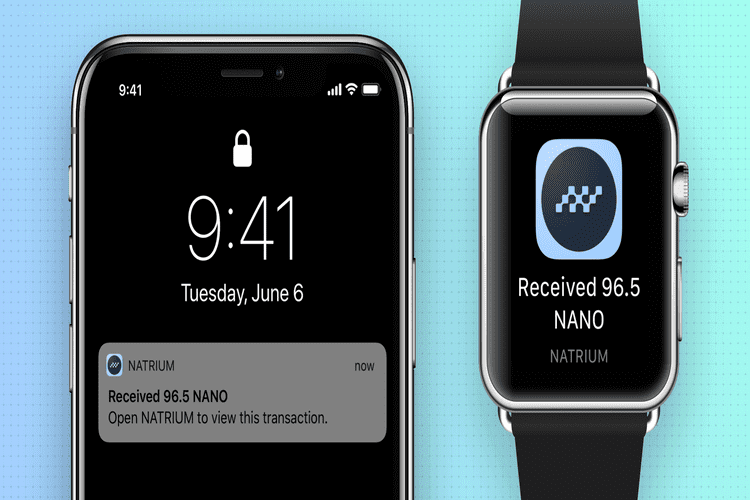

Real-time wallet notifications: You can also activate the push wallet notification for the wallet, which pops up a notification on your phone or smartwatch’s screen every time you receive Nano coins into your wallet.

SPV protocol for transaction validation: Natrium is a light wallet that doesn’t require you to download a blockchain to your phone and synchronize it with the Nano Mainnet. Rather, it embraces the Simplified Payment Verification (SPV) protocol in confirming and validating new transactions.

Security features

Passcode + Biometrics: When creating a new user account for your Natrium wallet, you will be requested to set a unique and multi-character passphrase. But you also have the option of activating the app’s biometric security feature that allows you to log in to your Natrium wallet using a Fingerprint or Face ID.

Open sourced: Natrium wallet app isn’t just community-led but also built on an open-sourced blockchain technology. Wallet users and blockchain experts are advised to view the code, audit, and come up with recommendations and are also encouraged to fork it and create more improved versions of the Nano Wallet.

Non-custodial: Natrium wallet is privacy-oriented. It not only limits the amount of client data it collects but also ensures that none of your sensitive information is stored on their servers. Rather, all your private data, including passwords and private keys, are encrypted and stored within your device.

Hierarchically deterministic: Natrium wallet is also hierarchically deterministic, implying that it will auto-generate a new wallet address every time you transact online. This limits the number of individuals who know your real wallet address and seeks to throw crypto trackers off and mask your crypto activity.

Recovery seed: Natrium has also simplified the process of backing up your wallet by presenting you with a 12-phrase recovery seed that you will need to restore lost wallets and recover lost private keys.

Third-party security audit: In furtherance of Natrium’s transparency guarantee, the wallet isn’t just open-sourced but is also subjected to regular security audits by professional blockchain security audit companies like Red4Sec.

How to set and activate the Natrium Mobile wallet

Step 1: Download and install the Natrium wallet app version that is compatible with your device

Step 2: Once installed, launch the app and select “Create a New Wallet” to start the activation process

Step 3: The wallet will now request you to choose the account’s username and create a password

Step 4: You will then be presented with random phrases that make up your wallet’s recovery seed. Write them down and keep them safe offline.

Step 5: Your wallet is now active and ready to use

How to add/receive crypto into your Natrium Mobile wallet

Step 1: Log in to your Natrium Nano wallet and on the user dashboard, click on the “Receive” tab

Step 2: This opens up the deposit window and reveals your public address and QR Code. Copy either of these and forward it to the party, sending you Nano coins

Step 3: Wait for the funds to reflect in your wallet.

How to send crypto from your Natrium Mobile wallet

Step 1: Log in to your Natrium Nano wallet and tap on the “Send” icon on the user dashboard

Step 2: If you have multiple wallets, select the address from whence you would like to send Nano cryptos

Step 3: On the transfer window, enter the recipient’s wallet address and the amount of Nano coins you wish to send

Step 4: Alternatively, select the recipient’s name from the in-app contacts section

Step 5: Check that the transaction details are correct and hit ‘Confirm.’

Natrium Mobile wallet ease of use

Natrium is a highly intuitive crypto wallet with a clean, easily navigable, and modern interface designed to appeal to both the highly experienced and beginner Nano coin traders. It is also easily customizable and allows you to change the icons’ wallet theme, size, and color.

The process of downloading the app and creating a user account is quite straightforward. So are the processes of sending and receiving Nano coins in and out of the wallet.

More importantly, Natrium is a multilingual crypto wallet app that comes available in over 20 international languages.

Natrium Mobile wallet supported currencies

Natrium is a Nano blockchain specific wallet and will, therefore, only host Nano Coins.

Natrium Mobile wallet cost and fees

Downloading the Natrium wallet, creating a user account, and storing coins therein is free.

The fact that the Nano Blockchain doesn’t charge a network fee to confirm or validate Nano transactions also means that you won’t be charged for sending or receiving cryptos into the wallet.

What are the pros and cons of using the Natrium Mobile wallet

Pros:

- Natrium wallet doesn’t charge network fees for crypto transfers.

- It is highly intuitive and features a simplistic and beginner-friendly user interface.

- The use of the SPV protocol makes transaction processing relatively fast.

- The wallet has embraced highly effective security and privacy measures, including biometrics and anonymous trading.

- Natrium is highly transparent. It is open-sourced and subject to vetting by independent bitcoin security companies.

Cons:

- The wallet doesn’t support the important two-factor authentication and multi-signature security measures.

- Natrium wallet will only support Nano coins.

- Their customer support team may be sluggish in responding to customer queries.

Comparing Natrium Mobile wallet with other Nano wallets

Natrium Mobile wallet vs. NanoVault web wallet

Natrium mobile and NanoVault are both Nano blockchain wallets that were not only developed by the Nano community members but also vetted and recommended by the Nano Foundation. They are both light and don’t require you to download the Nano blockchain to your wallet. Rather, they have embraced the ultrafast SPV transaction validation protocol.

However, while Natrium is a mobile app, NanoVault is a web wallet. And though they only host the Nano altcoin and record almost similar transaction processing speeds, Natrium can be said to host more operational features, especially the support for an address book and its highly customizable user interface.

Verdict: Is Natrium Mobile wallet safe?

Well, the mobile crypto app has put in place several highly effective security and privacy safeguards around the crypto app. We were especially impressed by their integration of the Biometrics security feature and hierarchically deterministic wallets, as well as their support for anonymous trading. But the fact that it is online-based means that it is not immune to the constant threats (hacking and malicious malware) dogging hot wallets.