Introduction

Breakout trading is prevalent among all types of traders. Professional traders make a lot of cash by trading these breakouts, while some novice traders fail to effectively trade them. While trading these breakouts, the pretty basic strategy is to pull the trigger when the price breaks above or below any significant level. But many times, the price tends to reverse its direction and cause immediate losses. This is one of the most frustrating experiences breakout traders go through.

Did this ever happen to you, and did you wonder why this happens? The reason is that you have no pre-planned entries. You are just reacting to the price action and chasing the markets purely based on your feelings, but you must accept that the market has no feelings.

How to Trade the fakeouts?

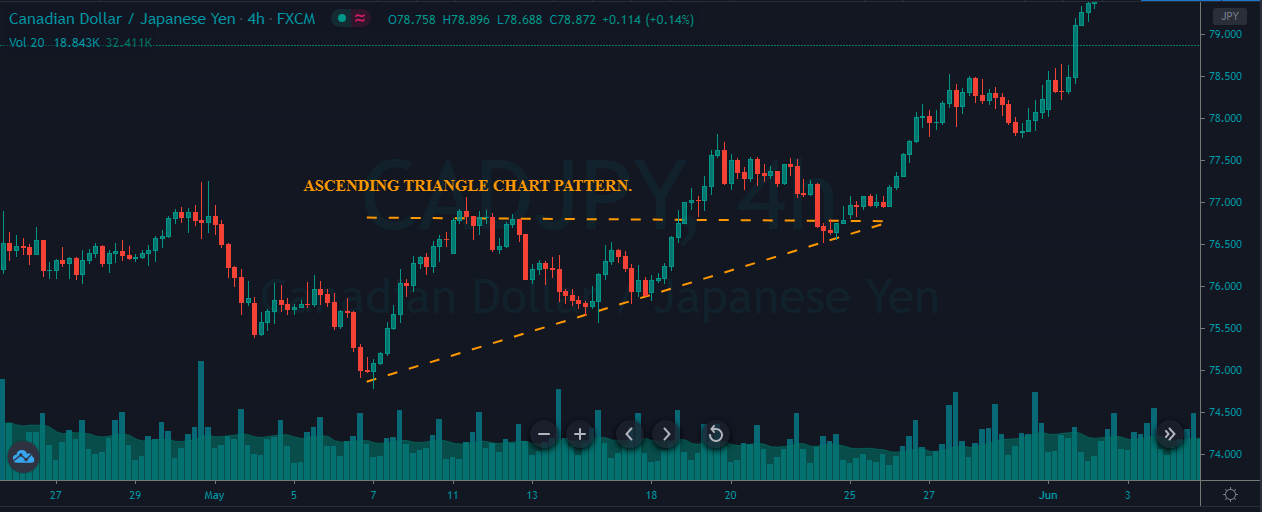

❶ Primarily, find the confluence level on the price chart. This is a place where most of the indicators point towards one direction.

❷ Avoid trading range breakouts as both the parties hold equal power when the market is ranging. In this state of the market, the chance of spikes is very high. So it is always advisable to trade breakouts only in a trending market.

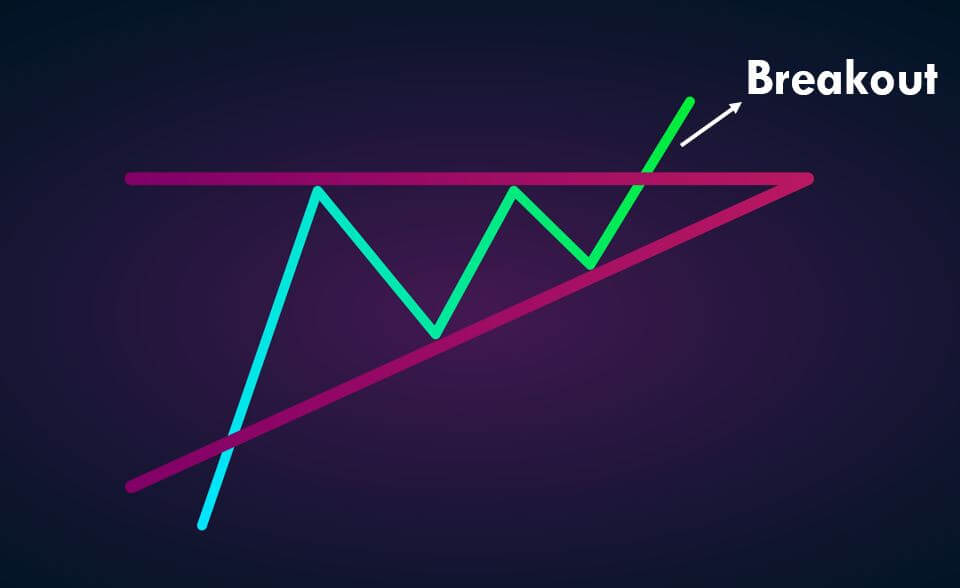

❸ Wait for the price to break above any significant level in an uptrend and break below any major level in a downtrend.

❹ Right after the breakout, wait for the price to test above or below any major level to confirm the breakout’s authenticity.

Trading Strategies

Buy Example

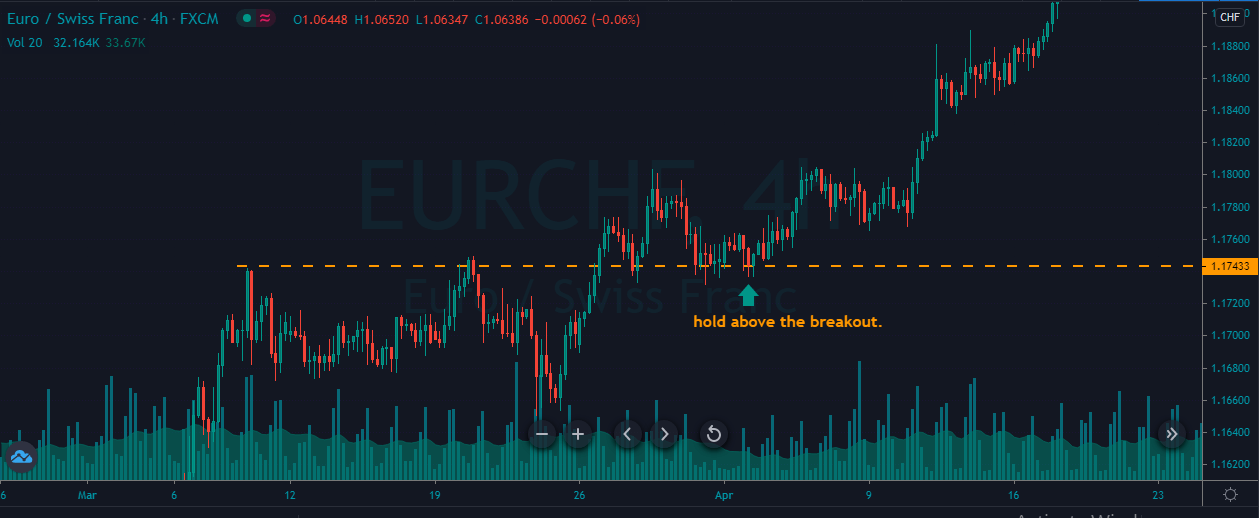

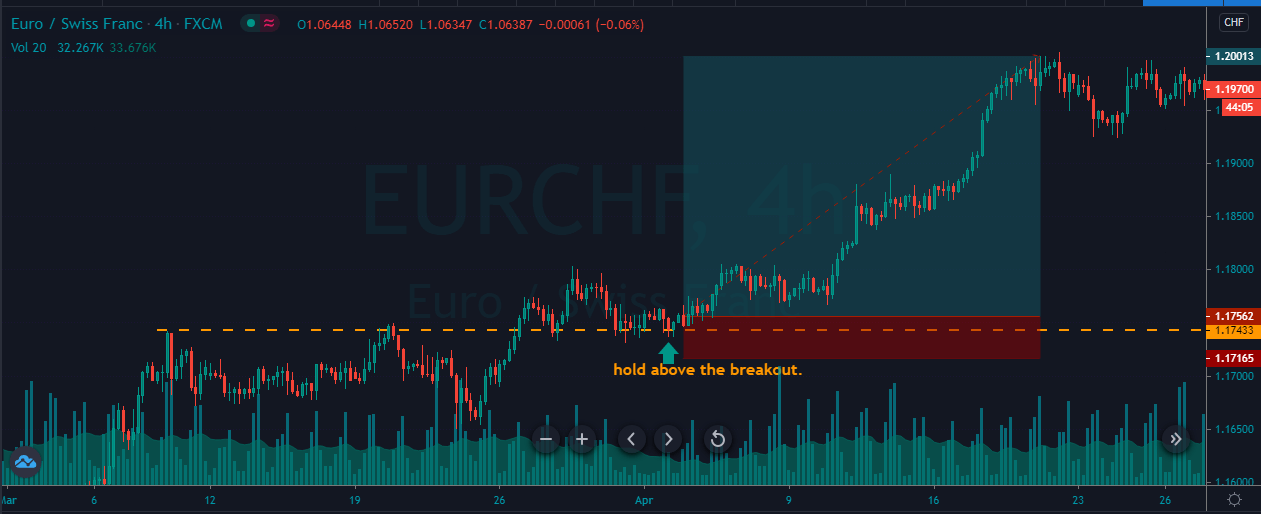

The image below represents a breakout in the EUR/CHF Forex pair.

As you can see in the below chart, we waited for the price action to holds above the breakout line. We have only entered the market after we confirmed the breakout. If the price action fails to hold, it simply means that it was a fakeout, and we can ignore it completely.

In this example, prices held above the breakout, which confirms the validity of the breakout. We took entry at the breakout line and chose to go for a brand new higher high. The exit was purely based on the higher timeframe’s significant resistance area, and the stop loss was just below our entry.

Sell Example

The image below represents a sell breakout in the GBP/NZD forex pair.

In the below image, we can see the price holding below the significant resistance level, which confirms the breakout. Our entry was at the red candle at the significant resistance level. The price sharply rejects to go any higher. Now we can see a brand new lower low forming after our entry.

The stop-loss is placed just above the entry as the seller response was quite aggressive. When the price started to struggle and failed to go down further, we chose to close our trade.

This is one of the best ways to trade the fakeouts in the most conservative way. We hope you got a clear understanding of this concept. Please let us know if you have any questions in the comments below. Cheers!

[wp_quiz id=”92087″]