Fundamental analysis for novices: Dallas Fed Manufacturing Index

Thank you for joining this forex academy educational video. In this session, we will be looking at fundamental analysis for novices and discussing the Dallas fed manufacturing index.

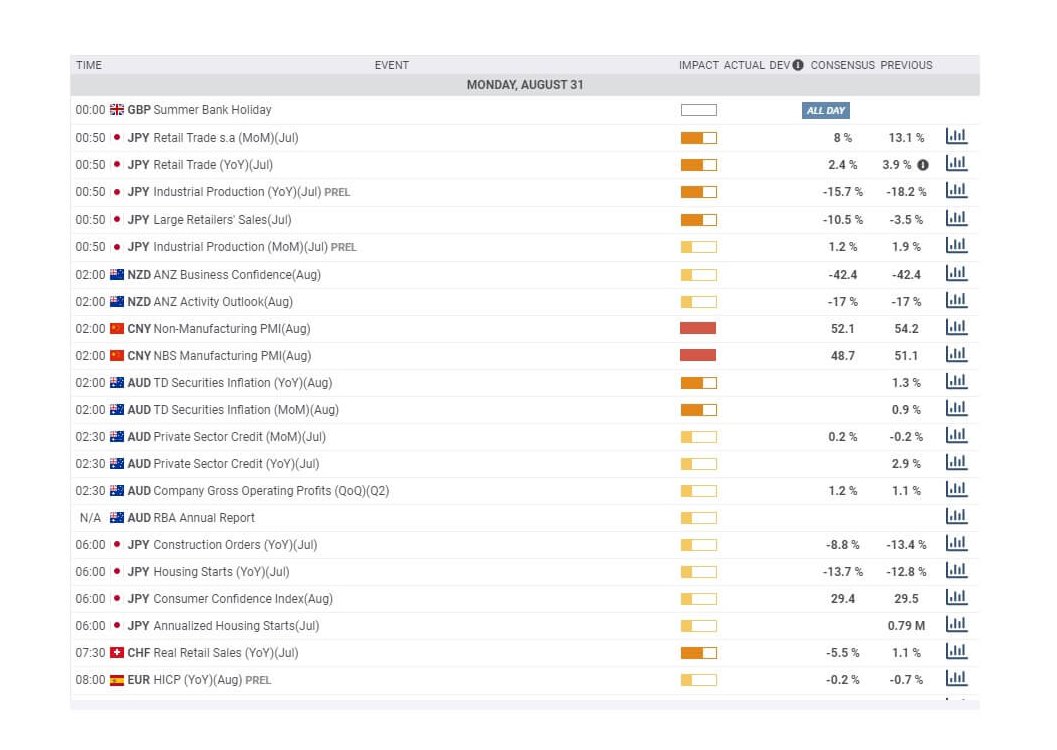

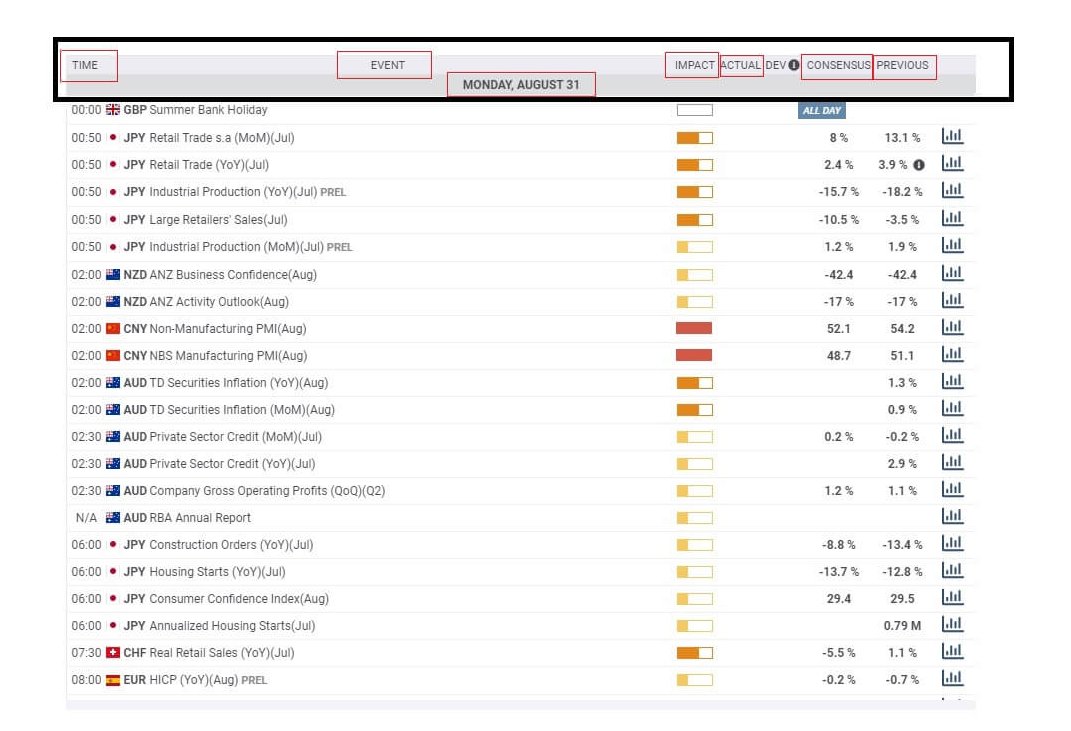

Most brokers offer an economic calendar where you will see economic data release events that fall due daily, weekly, or even monthly.

It is critical that you know when these events are going to occur because many of them cause extreme volatility in the market and may affect any open trades or trades that you are about to take, while not realising that an event is about to happen and where these events might reverse price action, to your trading detriment. Professional traders plan around such events, and you should do the same so that you understand what is going on in the marketplace at all times.

The key components of an economic calendar are the day and the date, the time, the type of event, the impact, which is a barometer of the likelihood of the event causing volatility and which is normally low, medium, or high, and which is measured on this calendar with the strength indicator filling the box, the more likely volatility will occur, and where the high volatility impact releases will typically fill the box in solid red.

Also, the actual data box will be populated very quickly after the embargo announcements, and you can also see a general consensus of what the market believes the data is likely to be as compiled by market analysts and economists. And you will also see the previous data, whether that is for the previous week, month, quarter, or year.

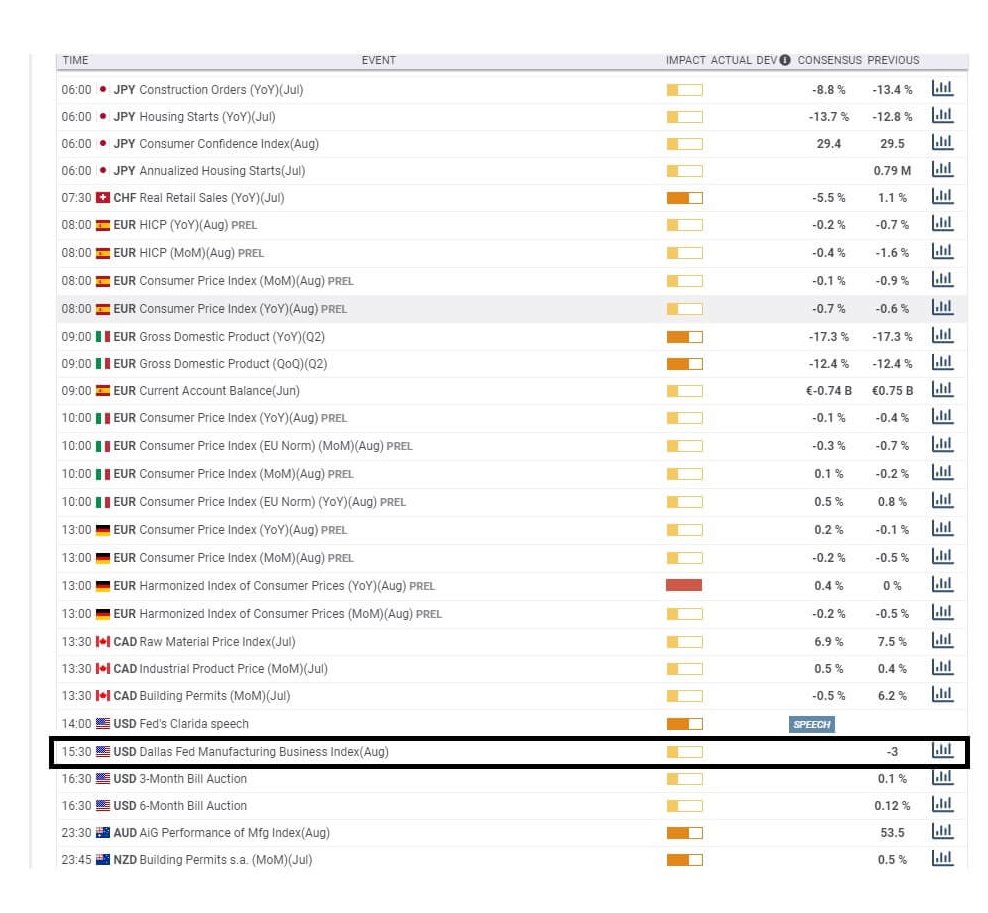

Here we have scrolled forward to Monday the 31st of August, and we can see that at 3:30 BST, the Dallas Fed manufacturing business index for August was due to be released and where the impact value is low, there is no consensus available, and the previous figure was -3.

The United States Dallas fed manufacturing index pertains to the state of Texas, which is the second-largest state in America, with a gross state product of nearly 2 trillion$. Many of the top fortune 500 companies are domiciled in the state of Texas.

The index itself measures the performance of manufacturing in Texas, where the information is taken from around 100 businesses and is based on output orders, and prices, and employment within Texas. Therefore, it is an important indicator of the economic health of one of the largest states in America.

Although no the economic calendar impact box shows this as being low for potentially causing market volatility, the American economy is in a precarious position with the covid virus still highly prevalent across all states, and where the American economy is struggling to regain anywhere near the levels, it reached before the pandemic started.

Therefore, traders should be mindful that any information regarding economic activity in any of the States is likely to cause volatility. Traders will be looking for a figure better than –3, which would be considered to be strong for the United States dollar, which might firm, and if the number is worse than –3, it will be bad for the economy and where you might find the American dollar loses ground against the other major currency pairs.