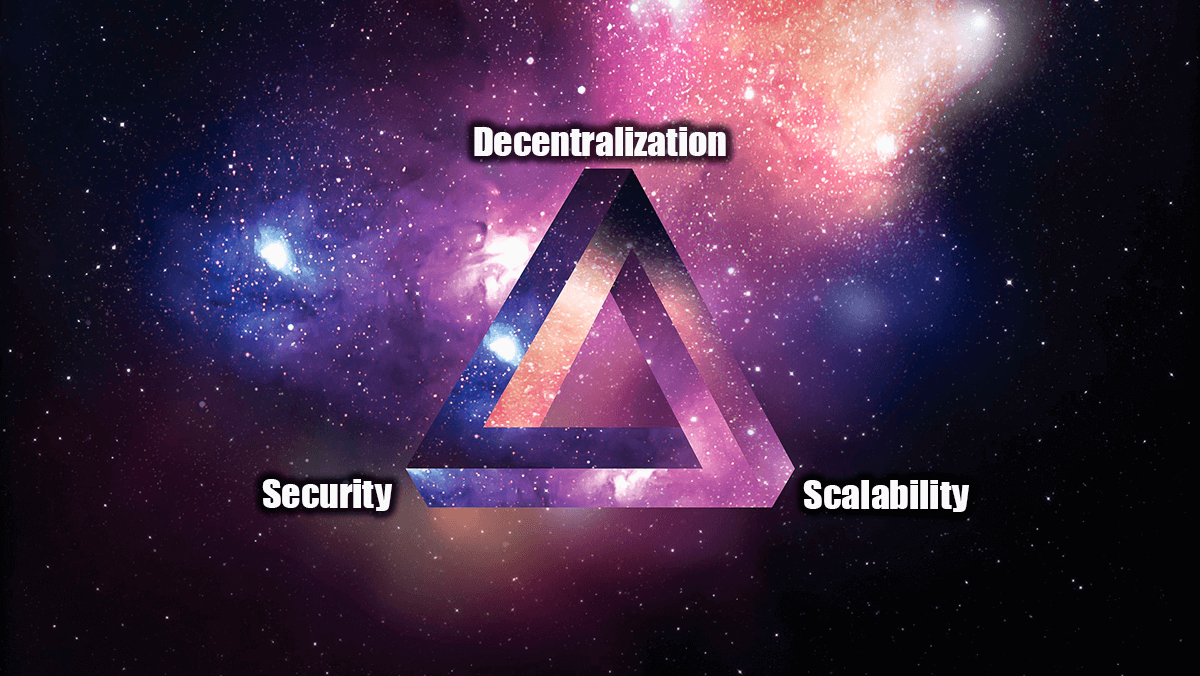

-The idea of crypto is for it to be a decentralized and trustless currency. But since crypto became an idea, users have never been able to exchange it in a decentralized and trustless manner. Today’s cryptocurrency exchanges are just like legacy financial exchanges: centralized, custodial, and prone to regulatory interference. If the means through which users exchange cryptocurrency is centralized, then cryptocurrency is far from reaching its ideal status.

What the crypto world needs is the ability to exchange value in a decentralized manner, and in a way that’s free from the arbitrary decisions of powerful entities.

THORChain is a network that not only does this but is also chain-agnostic, meaning it does not favor or discriminate on any blockchain. This means users can connect to and interact with any blockchain in a cross-chain fashion. On THORChain, you can even earn passive income by simply staking the network’s native currency: RUNE.

THORChain network allows you to do the following: stake money and earn rewards, seamlessly transfer value across chains, and run a validator node, and get paid for it.

THORchain Features

The THORChain protocol has the following key features.

#1. Cross-chain Asset Swaps

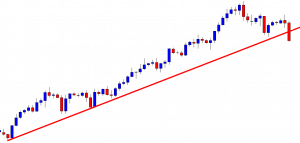

THORChain allows you to swap any supported asset in a peer-to-peer fashion. All you need to do is connect your wallet and follow the prompts for swapping various tokens. Token swaps are carried out instantly at a minimal and transparent fee.

#2. Provide liquidity

Users can stake crypto assets on THORChain and earn fees. Staking assets also gets you paid in block rewards.

#3. Earn Rewards for Running a Node

THORChain users can run nodes (and hence maintain and secure the network) and get rewarded with two-thirds of the collected network fees. Nodes are refreshed every three days to promote the dynamicness and inclusivity of the network. Nodes can also leave at any time after submitting a request. Such a request is processed within a few hours.

Who Created THORChain?

The THORChain team is intentionally pseudonymous in order to “protect the project.” They believe that “figureheads, personalities, and founders undermine the project’s ability to decentralize.” Instead, the team believes that transparency and other facets, such as handling of funds, research, and the THORChain code, are enough to prove the authenticity of the project.

With that, the THOR Chain team began researching the project in June 2018, going on to launch the first testnet in the fourth quarter of that year. After the testnet, the team continued researching and went on to launch the first bridge in the second quarter of 2019. The network went live in the first quarter of 2020.

The project’s native token, RUNE, was launched on the Binance blockchain in June 2019. 500 million tokens were issued, after which the token was listed on Binance’s decentralized exchange. The token was also distributed for free community members who promoted the project in various ways.

Where does RUNE fit in the THORChain Ecosystem?

The RUNE plays various key roles in the THORChain ecosystem. From staking to covering transaction fees to providing liquidity, RUNE is essential to the running of the system.

- Staking – Network participants who wish to become nodes must first stake RUNE tokens. Staking is required for a certain period of time to prevent nothing-at-stake attacks.

- Payments – Users engaging with the THORChain network pay fees in RUNE – whether it’s a transaction, trading, bridging or liquidity fees

- Backing liquidity – When you add liquidity to the THORChain network, that liquidity is backed by RUNE in what’s known as ‘Continuous Liquidity Pools.’ In this way, RUNE acts as a settlement currency for the network

- Block Rewards – Block validators are rewarded in RUNE for protecting the network.

- RUNE is required as liquidity to join Liquidity Hubs

Products by THORChain

THORChain supports a few powerful products, which include the following:

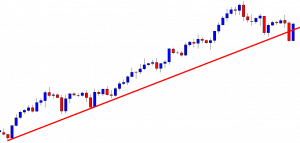

#1. BEP Swap

This is an application powered by THORChain that allows Binance coin (BNB) BEP2 token holders to swap assets or deposit them for liquidity and earn commissions from trades. It also enables traders to stay on top of pool prices and trade them more profitably.

#2. Flash Network

Flash Network is a layer-2 network that supports instant asset swaps on the THORChain network. It supports exchanges across multiple tokens and liquidity pools. Also, Flash Network is compatible with other layer-2 solutions such as Lightning Network, Raiden, and Bolt.

#3. RUNEVault

This is a staking interface that allows THORChain users to stake in and earn more RUNE. The team created RUNEVault to observe user behavior interactions and learn how to make an improved project for THORChain’s mainnet launch. When the mainnet launches, the platform will be retired.

#4. Bitfröst Protocol

The Bitfröst Protocol is a cross-chain protocol that facilitates connectivity between disparate blockchains. It solves one of blockchain’s most persistent problems: interoperability. This way, THORChain users can seamlessly trade assets across any blockchain.

THORChain Nodes

These are individuals who maintain and secure the network by verifying the authenticity of transactions. Other duties include monitoring transactions on external chains, approving outgoing transactions, and operating the network protocol.

To run a validator node, you need to have high-performance software and hardware, as well as stake a minimum of 1 million RUNE. Though that’s a bit on the high end, RUNE validators are compensated in RUNE for their work. They receive what’s known as ‘bond rewards’ – which is 67% of the system’s revenue, while liquidity providers get 33% of the share.

If node operators do not perform any of their duties the right way or attempt to defraud the network, they will be penalized.

How to Earn RUNE

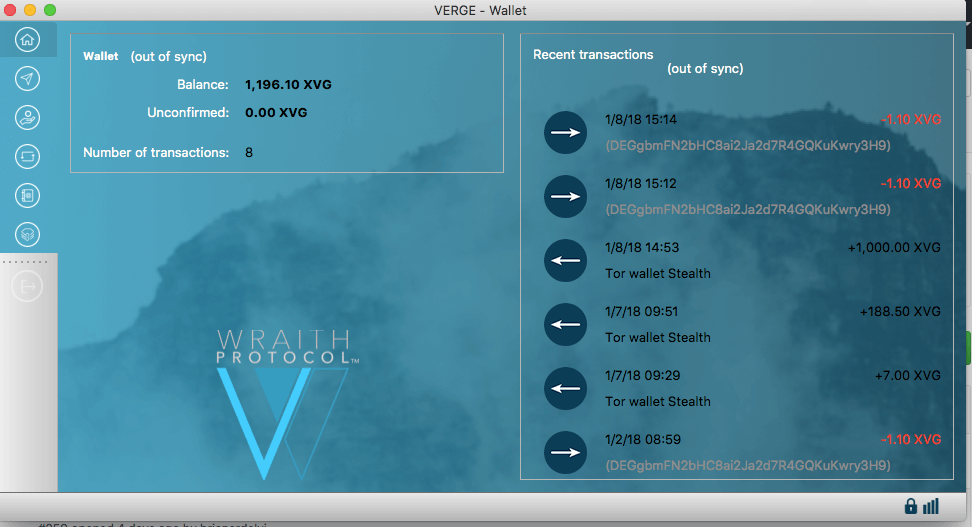

You can earn RUNE in two ways: running a validator node and staking in RUNE. RUNE holders can currently stake the token in RUNEVault and earn a share of 1 million RUNE that’s being distributed weekly.

You can also earn RUNE by running a validator node. Validator nodes maintain the blockchain and earn in the form of liquidity fees and block rewards.

Where to Buy and Store RUNE

The safest way to acquire summer RUNE would be through a cryptocurrency exchange. You’ll find RUNE paired with either BTC, BNB, USDT, ETH, EUR, and BUSD at any of the following exchanges: Binance, FTX, Hoo, Bilaxy, Eterbase, BitMax, and Binance DEX.

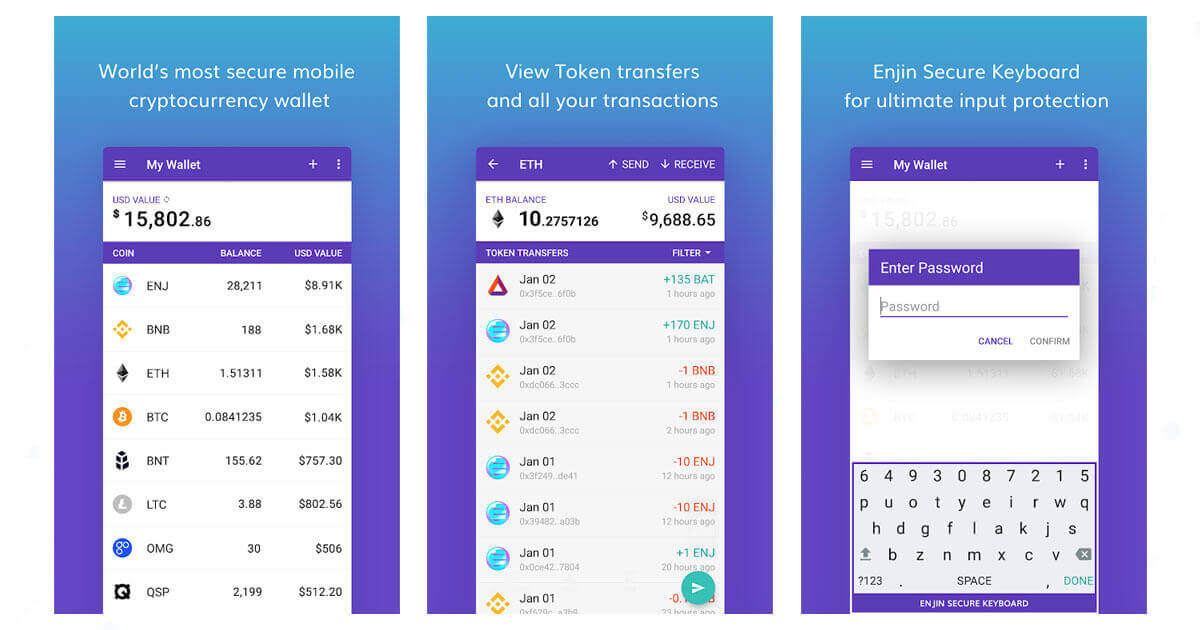

RUNE is a BEP-2 compliant token, which means you can store it in any Binance supported wallet. Popular options include Trust Wallet, Guarda, Atomic Wallet, Binance Chain Web Wallet, Ledger, and RUNEVault (which allows you to stake and earn more RUNE).

Key Metrics of RUNE

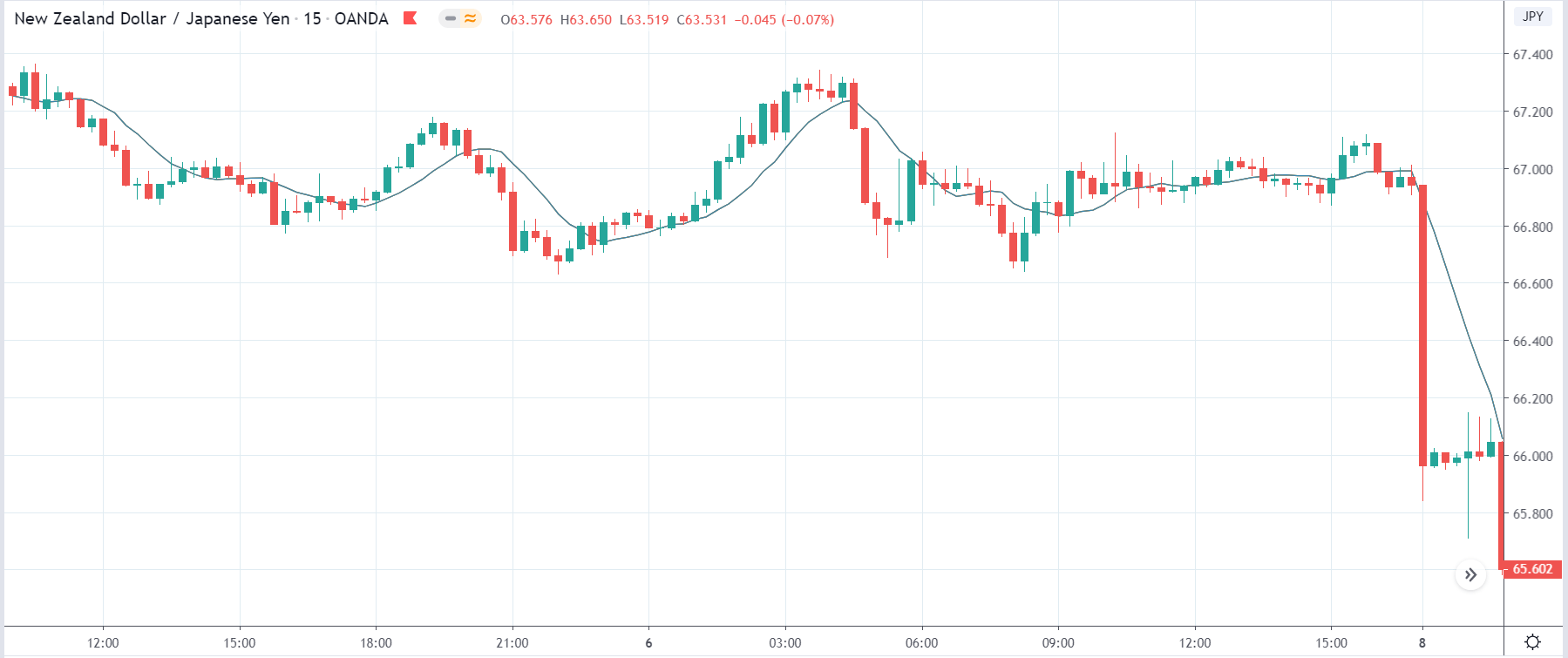

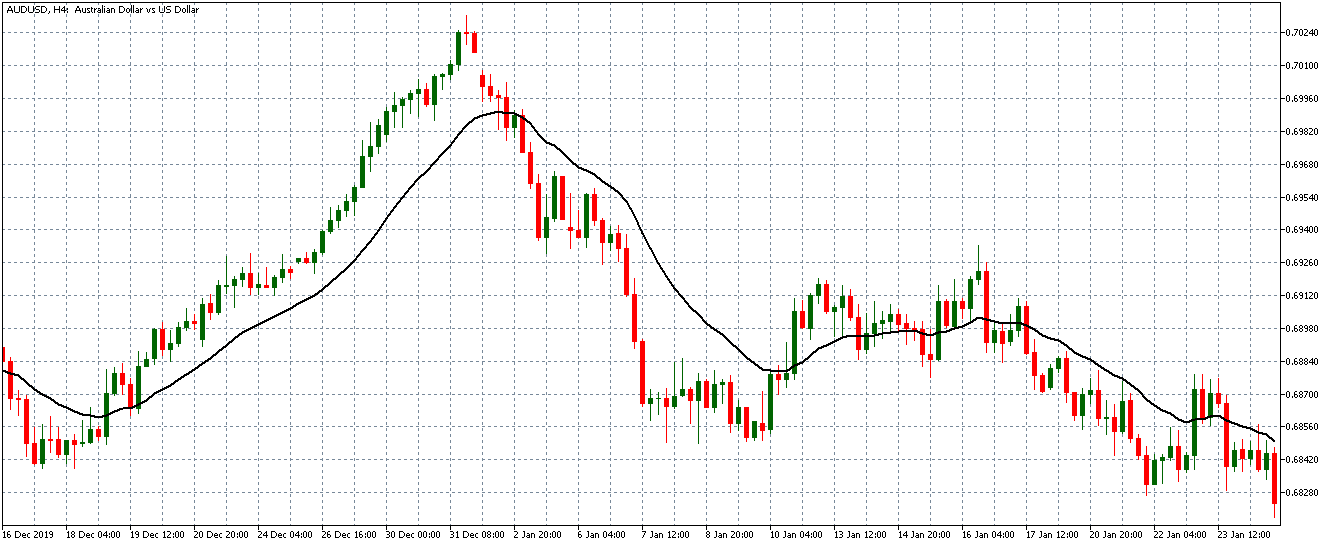

At the time of writing, RUNE is trading at $0.682046, with a market cap of $108, 058, 013 that places it at position 89 in the market. The token has a 24-hour volume of $5, 077, 431, a circulating supply of 158, 432, 088, and a total supply of 500 million. RUNE’s highest and lowest price ever was $0.719599 (July 24, 2020), and 0.007939 (Sep 27, 2019).

Closing Thoughts

The THORChain team has made a product that truly works – and benefits the DeFi space. Few protocols have what DeFi has – an in-house DEX, the ability to swap assets cross-chain safely and securely, as well as enabling users to earn by simply staking their idle funds. THORChain has already carved out space for itself in the DeFi world, and if it keeps the same level of innovation, it will even be a bigger force to reckon with.

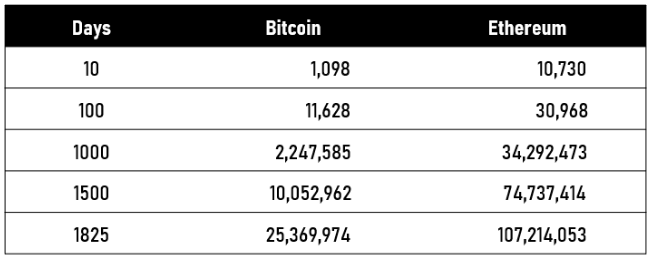

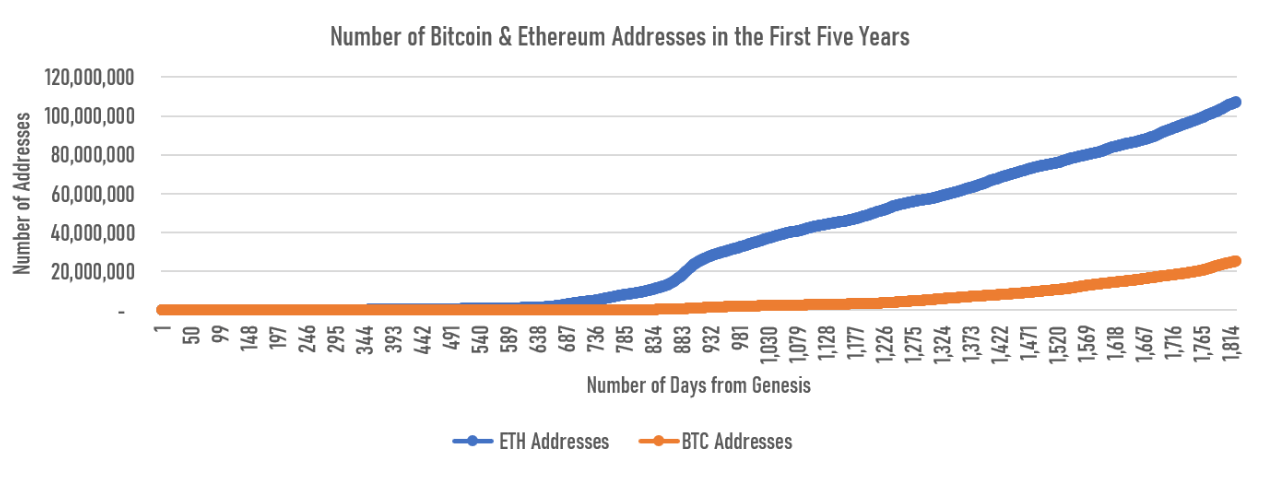

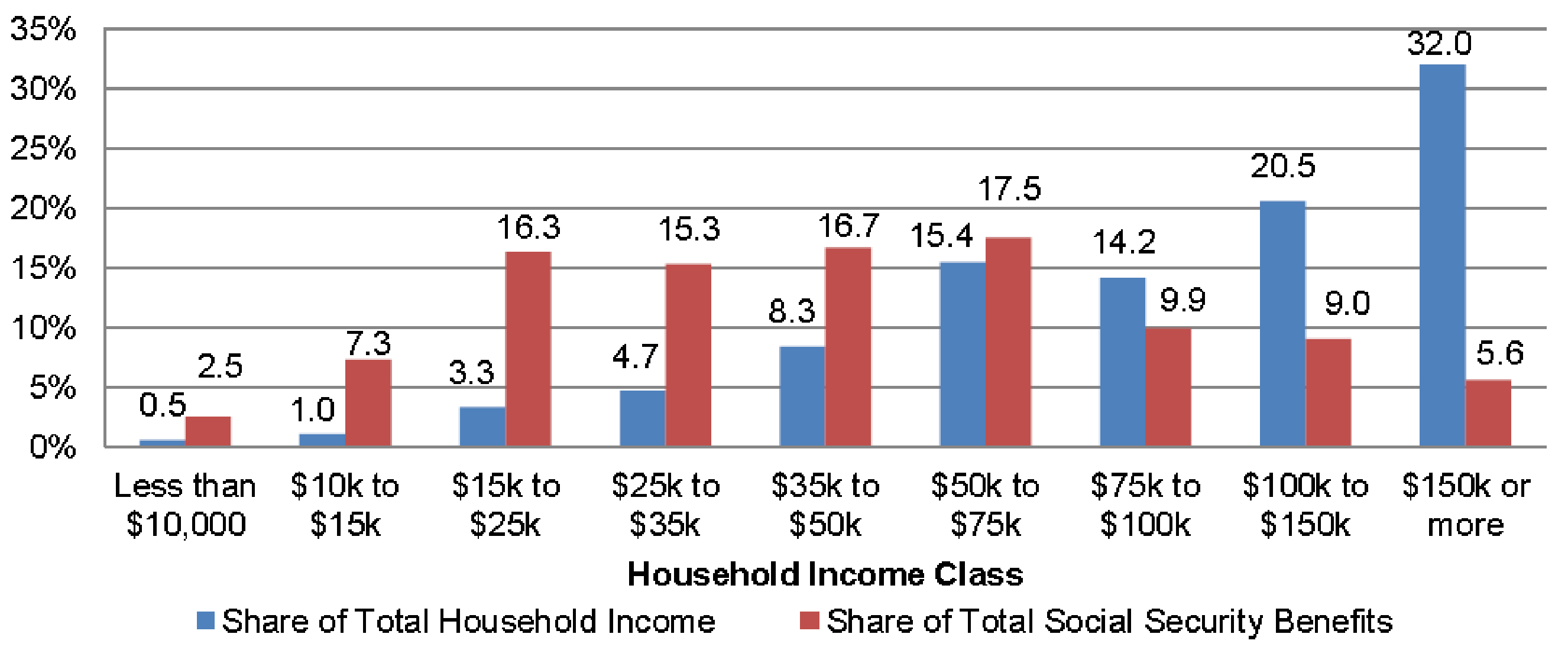

One key metric suggests that Ethereum has enjoyed a much faster adoption rate as well as the growth rate in the first five years of its existence than Bitcoin.

One key metric suggests that Ethereum has enjoyed a much faster adoption rate as well as the growth rate in the first five years of its existence than Bitcoin.