WinFinance is a foreign exchange broker based in the Marshall Islands, the company was founded in 2013 and aims to provide an unequaled value to their clients. They claim to offer an outstanding customer support team, a host of tradable assets, advanced trading platforms, tight spreads, and an experienced team. We will be looking into the services on offer to see how they stand up next to the competition.

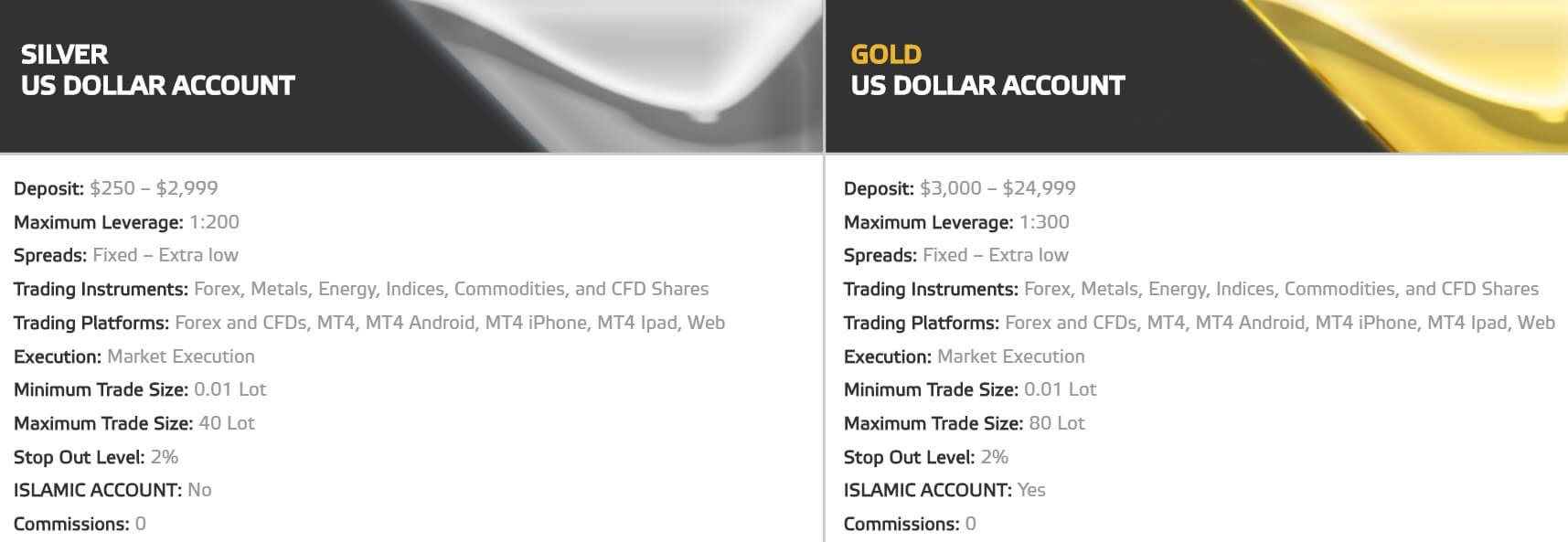

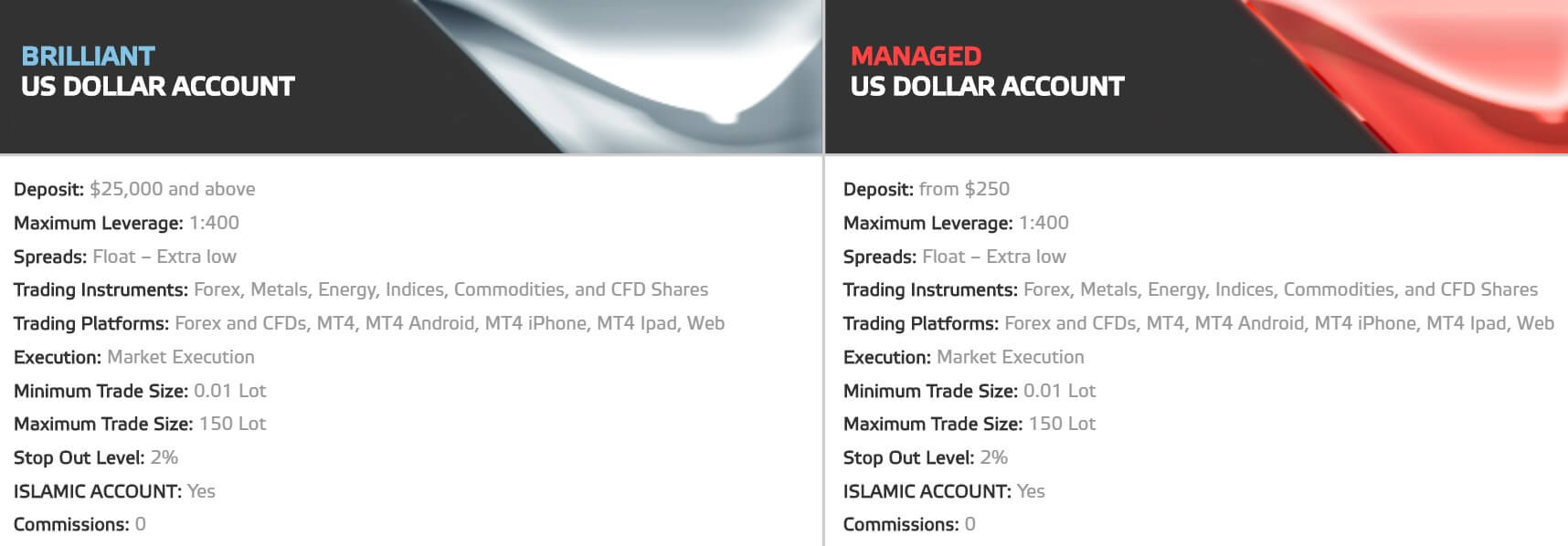

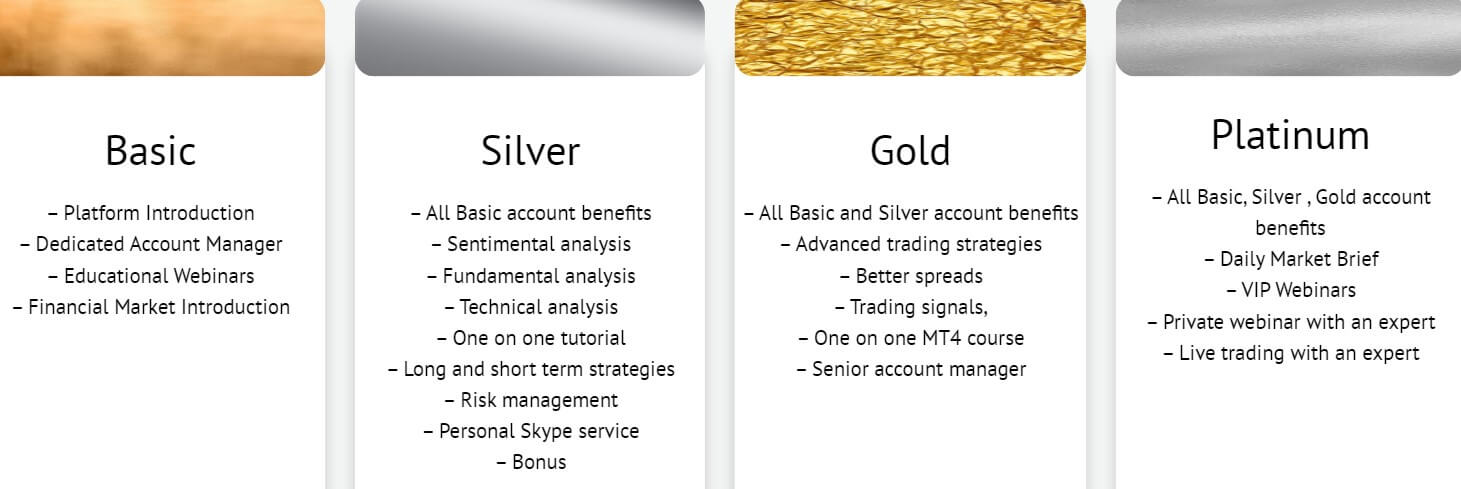

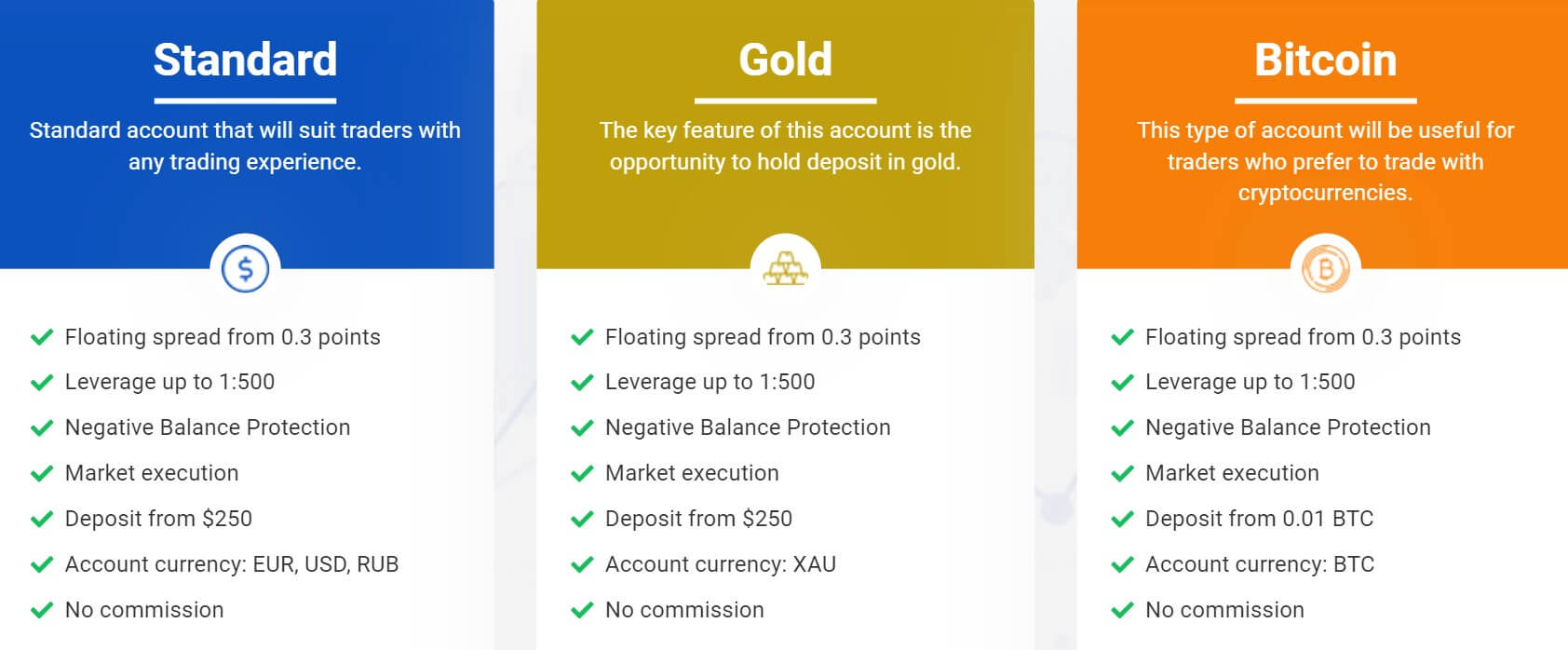

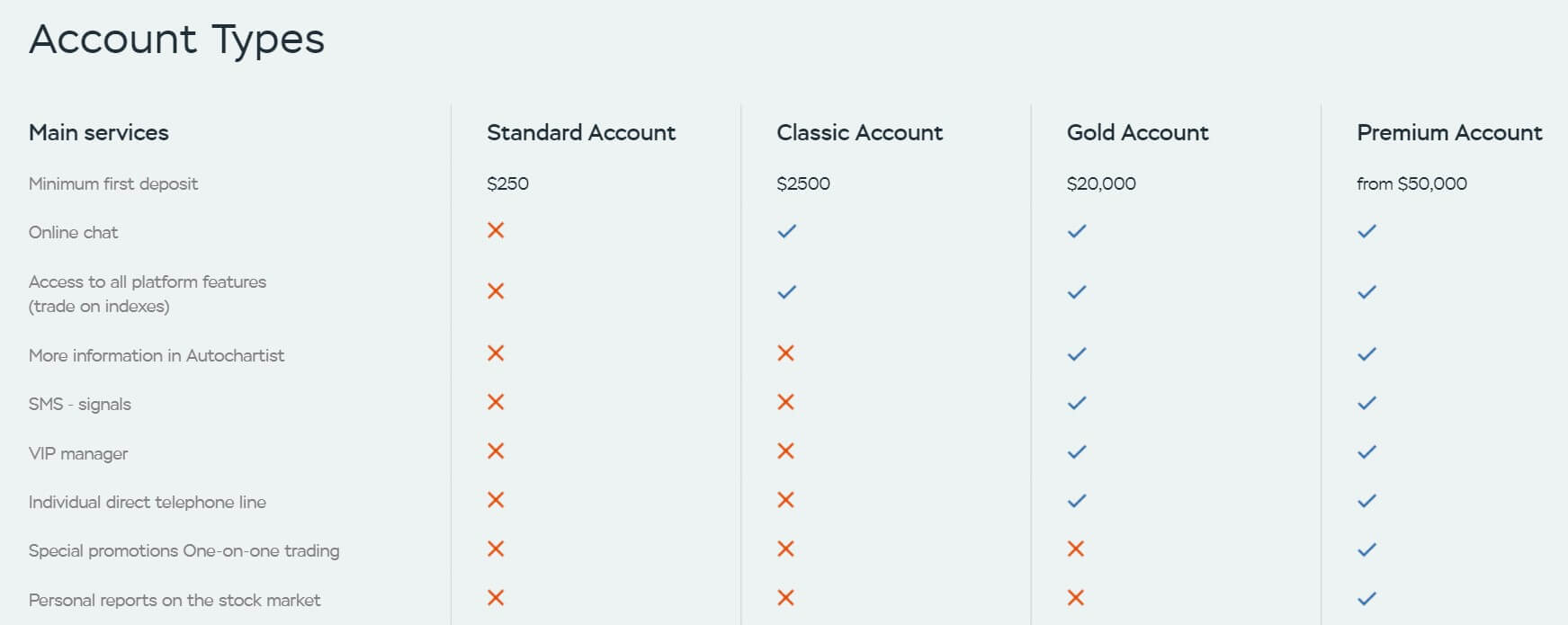

Account Types

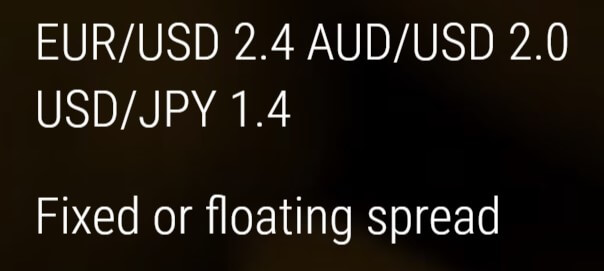

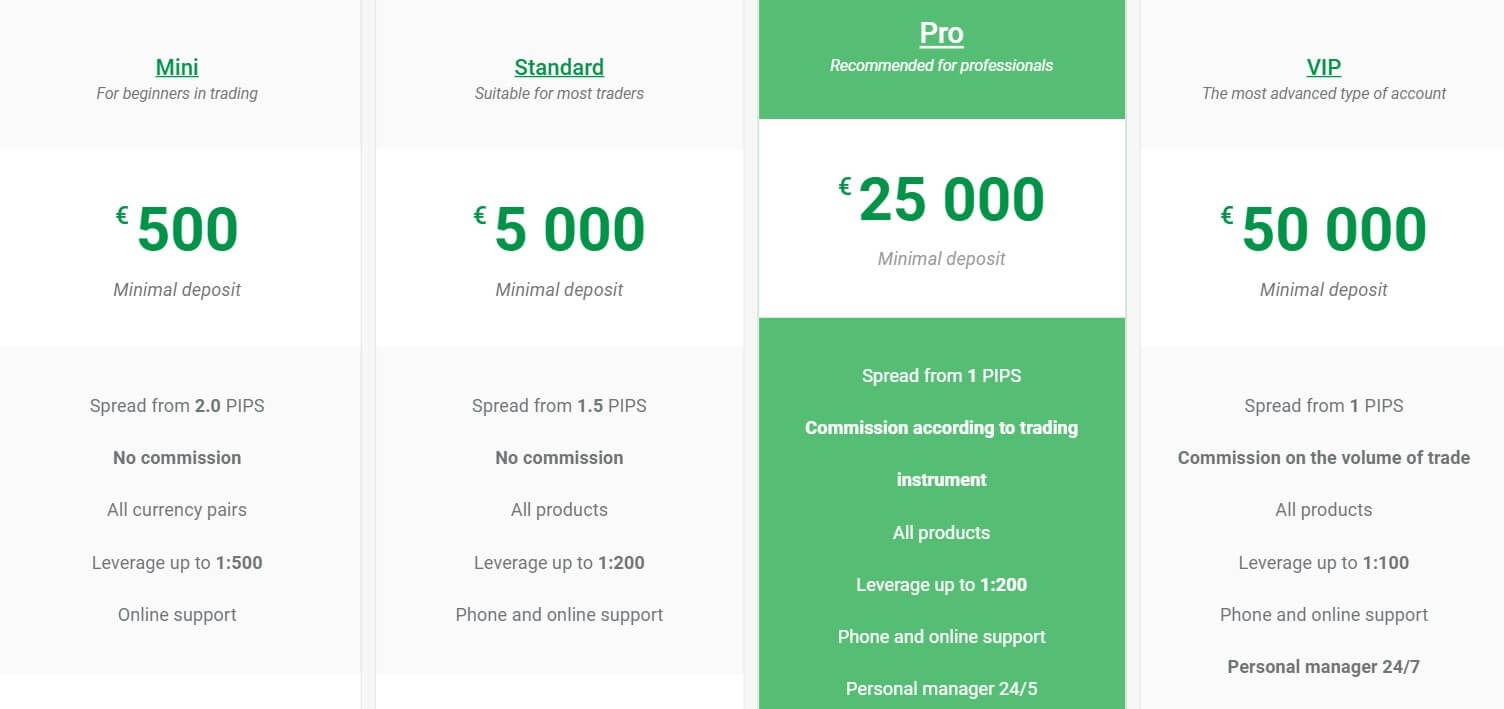

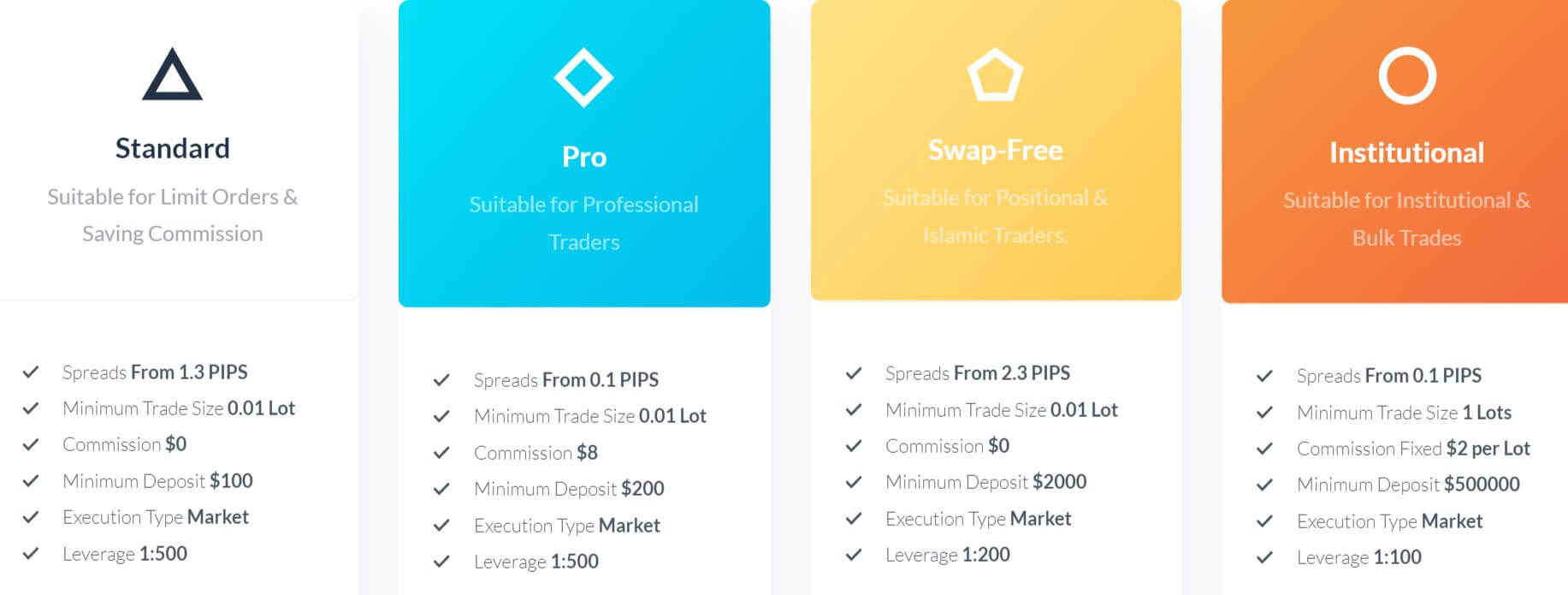

There are four different accounts available to use from WinFinance, we have outlined some of their main features below.

Standard Account: This account requires a minimum deposit of $250, it allows you to trade forex and uses a desktop and mobile platform. It gives part access to video tutorials and has access to a support team 24 hours a day 7 days a week. It can trade base currencies and typical spreads range from EUR/USD 2.4 pips, AUD/USD 3.3 pips, and USD/JPY 2.8 pips. The account has a fixed spread, access to an account manager and can be leveraged up to 1:200.

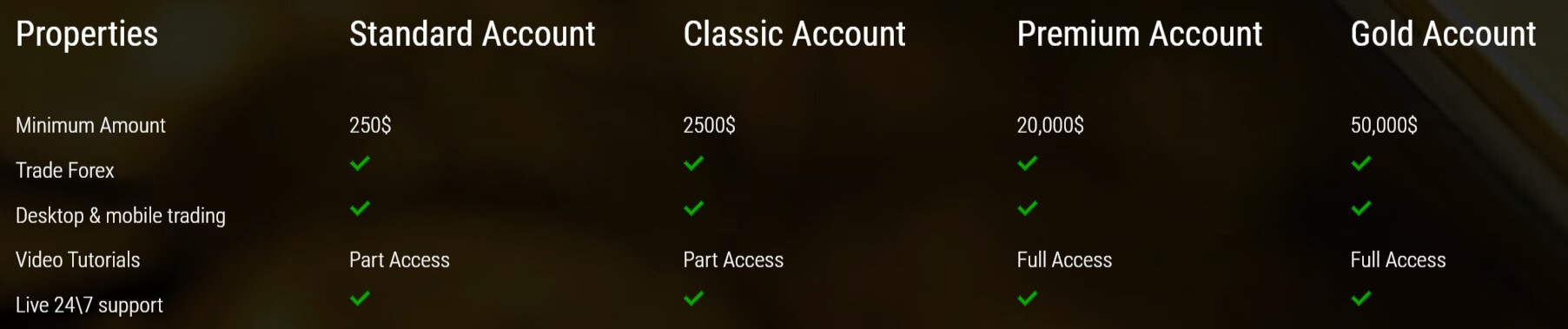

Classic Account: This account requires a minimum deposit of $2,500, it allows you to trade forex and uses a desktop and mobile platform. It gives part access to video tutorials and has access to a support team 24 hours a day 7 days a week. It can trade base currencies, Gold, Silver and Oil and typical spreads range from EUR/USD 2.4 pips, AUD/USD 2.0 pips, and USD/JPY 1.4 pips. The account has a choice of fixed or floating spread, access to an account manager and can be leveraged up to 1:200.

Premium Account: This account requires a minimum deposit of $20,000, it allows you to trade forex and uses a desktop and mobile platform. It gives full access to video tutorials and has access to a support team 24 hours a day 7 days a week. It can trade all currencies, indices, and shares and typical spreads range from EUR/USD 0.6 pips, AUD/USD 1.3 pips, and USD/JPY 0.6 pips. The account has a choice of fixed or floating spread, access to an account manager and can be leveraged up to 1:200.

Gold Account: This account requires a minimum deposit of $50,000, it allows you to trade forex and uses a desktop and mobile platform. It gives full access to video tutorials and has access to a support team 24 hours a day 7 days a week. It can trade all instruments and typical spreads range from EUR/USD 0.6 pips, AUD/USD 1.3 pips, and USD/JPY 0.6 pips. The account has a choice of fixed or floating spread which is adjustable, access to premium customer support and has adjustable leverage.

Platforms

Just the one platform available to use is xStation, xStation was designed for advanced currency traders who prefer more control, flexibility, customizations, and speed than traditional retail trading software packages. It provides true one-click trading on Level 2 market depth/order book views, built-in trading calculator, in-platform economic calendar, customizable layouts saved in the cloud, and a direct connection to the WinFinance liquidity infrastructure. It was designed from the ground up as an ECN/STP platform. It is usable as a desktop download, mobile application and as a web trade.

Leverage

The Standard, Classic and Premium accounts all have a maximum leverage of 1:200, the Gold account doesn’t have a set limit, it instead can be selected when creating an account. All accounts can have their leverage (up to the maximum) selected when opening up an account and can have it changed by sending a request to the customer service team.

The Standard, Classic and Premium accounts all have a maximum leverage of 1:200, the Gold account doesn’t have a set limit, it instead can be selected when creating an account. All accounts can have their leverage (up to the maximum) selected when opening up an account and can have it changed by sending a request to the customer service team.

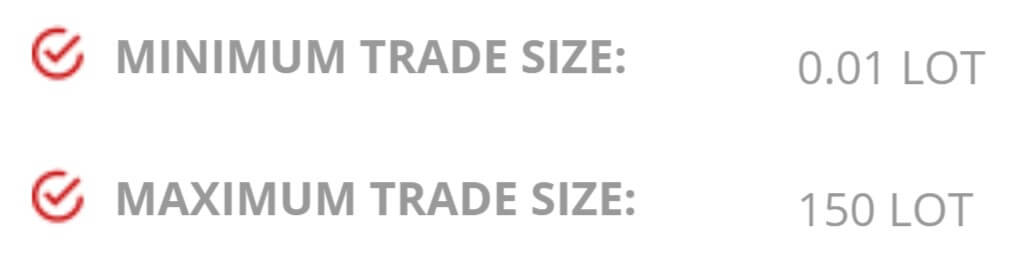

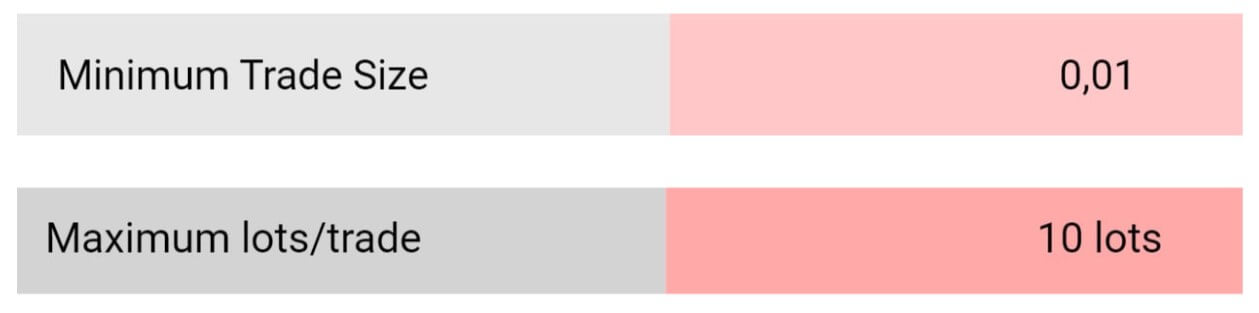

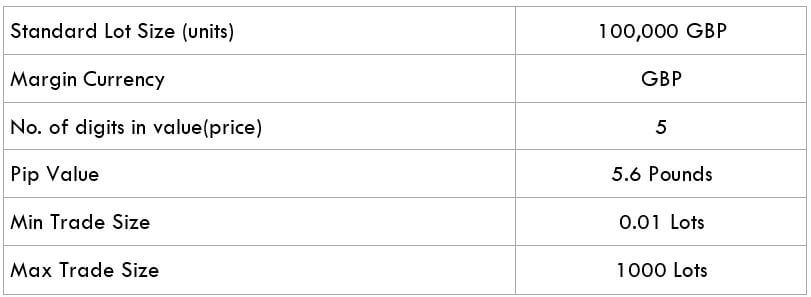

Trade Sizes

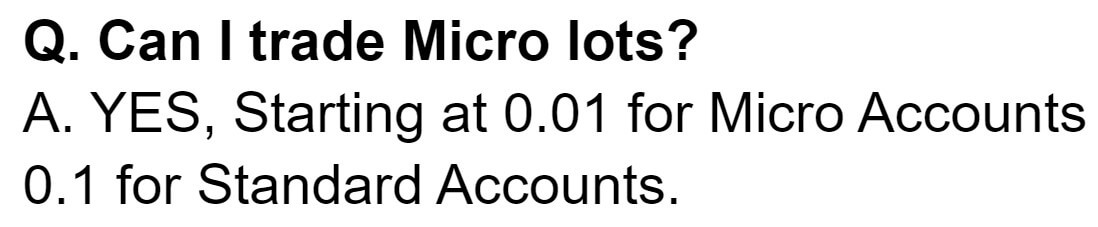

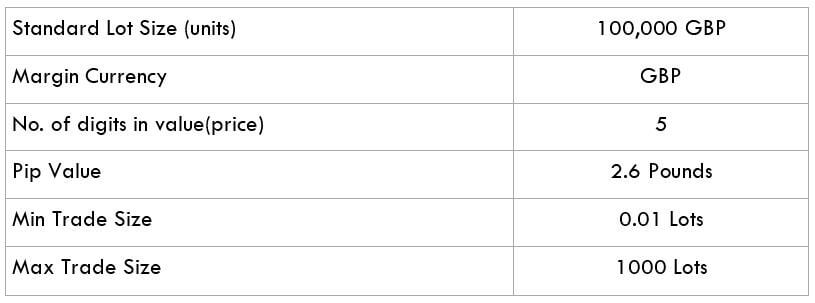

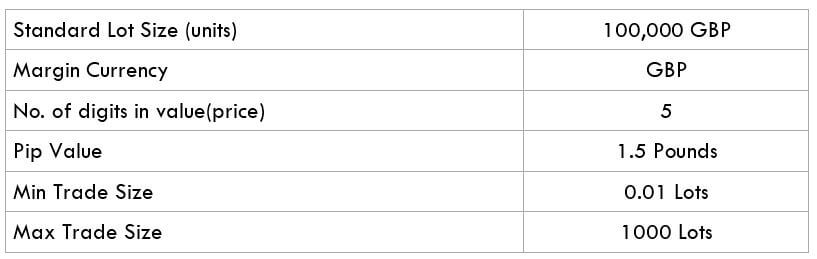

Trade sizes start from 0.01 lots on all accounts, they then also go up in increments of 0.01 lots so the next trade size would be 0.02 lots and then 0.03 lots. Unfortunately, we do not know what the maximum trade size is or how many trades/orders you can have open at any one time.

Trading Costs

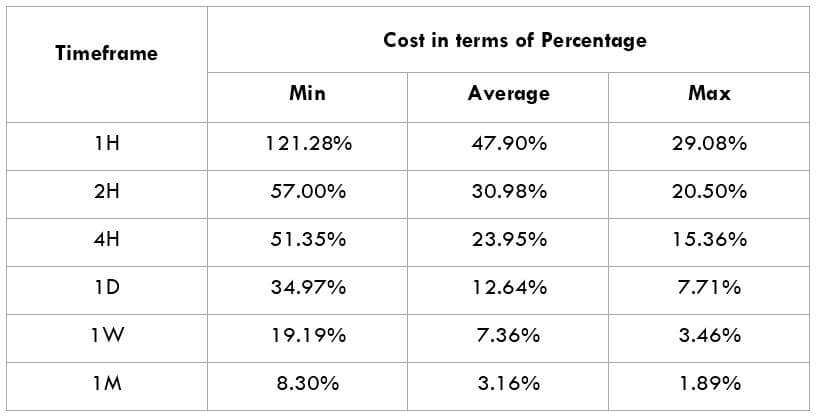

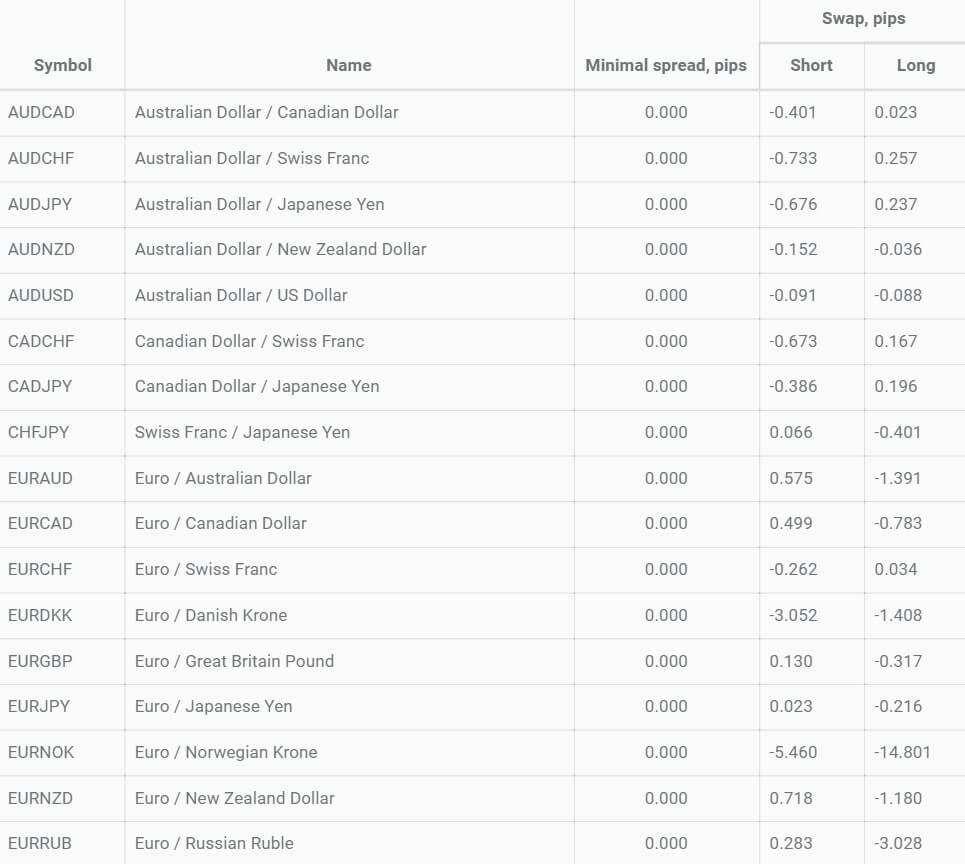

There doesn’t appear to be any added commission on any of the accounts as they all use a spread based system that we will look at later in this review. There are however spread fees, these are interest charges that take effect when holding trades overnight, they can be both positive or negative and can be viewed from within the trading platform you are using.

Assets

Unfortunately, there isn’t a full breakdown or any sort of product specification so we cannot see exactly which assets or instruments are available to trade, this is disappointing as many potential clients will look to see if their preferred assets are available, the last thing they want is to sign up and find that they cannot trade it.

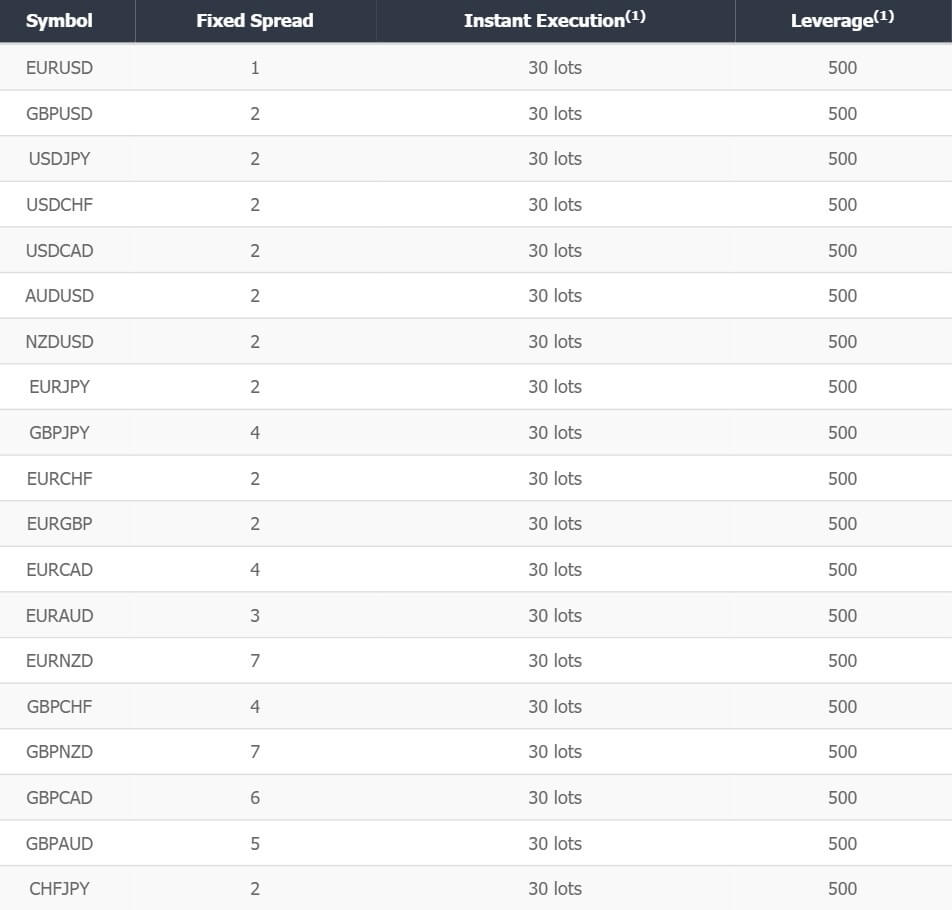

Spreads

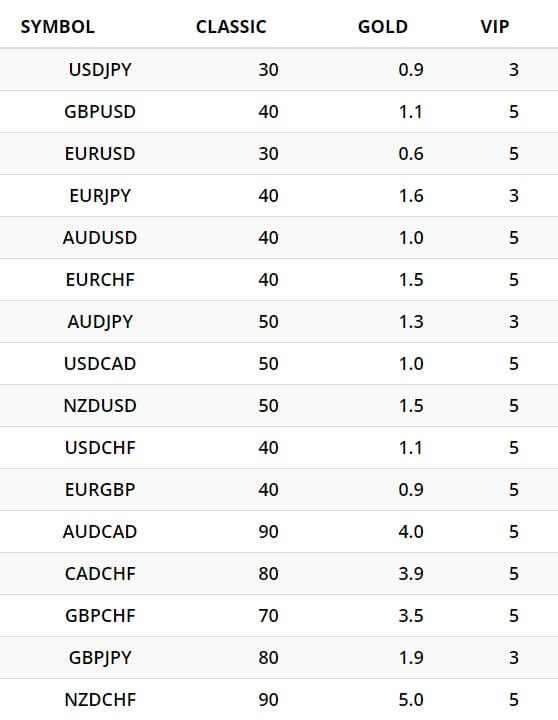

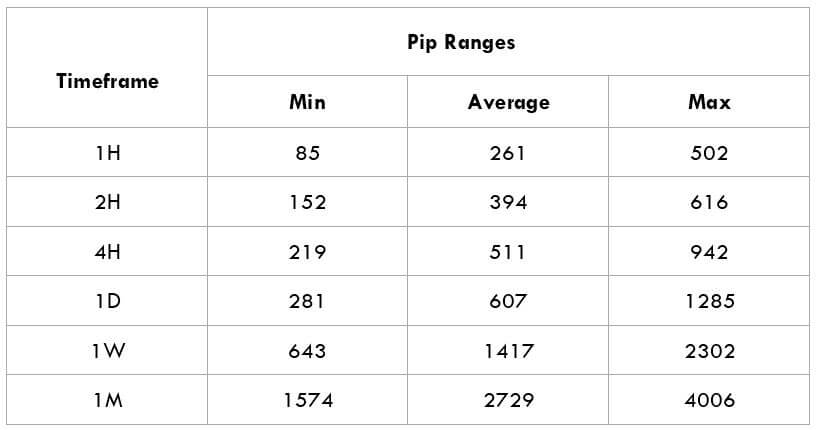

The spreads are based around the account that you use. The Standard account has spread starting at EUR/USD 2.4 pips, AUD/USD 3.3 pips, and USD/JPY 2.8 pips. These spreads are fixed which means they will never change, no matter what is happening in the markets or how volatile they are.

The Classic account has spreads ranging from EUR/USD 2.4 pips, AUD/USD 2.0 pips, and USD/JPY 1.4 pips. These spreads can be either fixed or variable, variable spreads mean they move with the markets, the more volatility there is the higher they will be, the starting figure for variable spreads is often lower than fixed spreads.

The Premium and Gold accounts also have a choice of fixed or variable spreads and start at around EUR/USD 0.6 pips, AUD/USD 1.3 pips, and USD/JPY 0.6 pips.

Minimum Deposit

The minimum amount required to open up an account with WinFinance is $250, this allows you to use the Standard account, if you want a higher tier account you will need to deposit at least $2,500. We do not know if this amount reduces once an account has already been opened.

Deposit Methods & Costs

Sadly there isn’t any information on the site regarding deposit methods or anything to do with them except for three little images of Visa, MasterCard, and Maestro, so we will be confident to say that they will be available, but we cannot say about any other methods. We also cannot comment on whether there are any added fees for depositing by WinFinance.

Withdrawal Methods & Costs

As we do not know how you can deposit we also do not know how you can withdraw, the same three images are available but that is it. Just like with the deposits we do not know if there are any added fees when withdrawing.

Withdrawal Processing & Wait Time

Unfortunately, we also do not have any information on this topic, we would hope that any withdrawal requests would be fully processed between 1 to 7 working days after the request is made depending on what methods are available to withdraw with.

Bonuses & Promotions

We had a good look around the site and could not see any indications of an active promotion or bonus so we do not believe there are any. This does not mean that there won’t be any in the future, if you are interested in bonuses we would suggest contacting the customer service team to see if there are any coming up that you could take part in.

Educational & Trading Tools

There doesn’t appear to be any educational material or tools on the site which is a shame as a lot of modern brokers are now trying to help their clients improve, so it would be good to see WinFinance add something to help their clients.

Customer Service

The customer service page states that the team is available from Sunday to Friday 10 am – 8 pm GMT, however, the account page states that there is 24/7 support available, so they contradict each other.

You can use the online submission form to send in your query and then you should get a reply via email. There is also a postal address available along with two emails and two phone numbers.

Address: Trust Company Complex, Majuro, MH 96960, Marshall Islands

Support Email: [email protected]

Marketing Email: [email protected]

Great Britain Phone: +442036082593

Italy Phone: +97316195023

Demo Account

There isn’t any information surrounding demo accounts on the site, however, we do not have a full account so we cannot see if there are any available in there if there aren’t then it is a shame as demo accounts allow clients to test out the trading conditions and new strategies without risking any real capital.

Countries Accepted

This information is not present on the site so we would suggest contacting the customer service team to find out if you are eligible for an account or not.

Conclusion

The four different accounts offer some variety especially when it comes to the choice of fixed or variable spreads. Sadly, that is about where all the positives end, there is no information about what assets and instruments are available to trade or how you can deposit and withdraw your funds., This information is vital if a company is going to be holding onto your money, you need to know how you can move it about and also if it will cost you to do so, without this information being available is it hard for us to recommend them as a broker to use, and would instead suggest looking somewhere that is being a little bit more transparent.

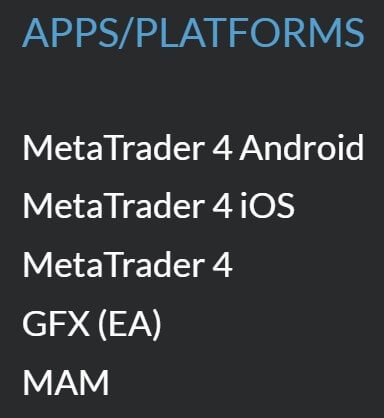

The only platform available to use with Traderia is MetaTrader 4, the good news is that it is an extremely popular and versatile platform. It is accessible anywhere as it can be used as a desktop download, mobile application or as a web trader. You can execute trades manually or with preloaded indicators and automated robot trading strategies (or Expert Advisors). Alternatively, MT4’s highly customizable, advanced software allows you to create your own trading strategies using its unique MQL4 programming language. Take advantage of MT4’s one-click functionality to make sure your trades are executed fast, every time.

The only platform available to use with Traderia is MetaTrader 4, the good news is that it is an extremely popular and versatile platform. It is accessible anywhere as it can be used as a desktop download, mobile application or as a web trader. You can execute trades manually or with preloaded indicators and automated robot trading strategies (or Expert Advisors). Alternatively, MT4’s highly customizable, advanced software allows you to create your own trading strategies using its unique MQL4 programming language. Take advantage of MT4’s one-click functionality to make sure your trades are executed fast, every time.

The minimum deposit depends on the funding account used but the bare minimum is 250 USD, EUR or GBP. It seems that this amount remains even after an account has been opened rather than reducing for top-up payments.

The minimum deposit depends on the funding account used but the bare minimum is 250 USD, EUR or GBP. It seems that this amount remains even after an account has been opened rather than reducing for top-up payments.

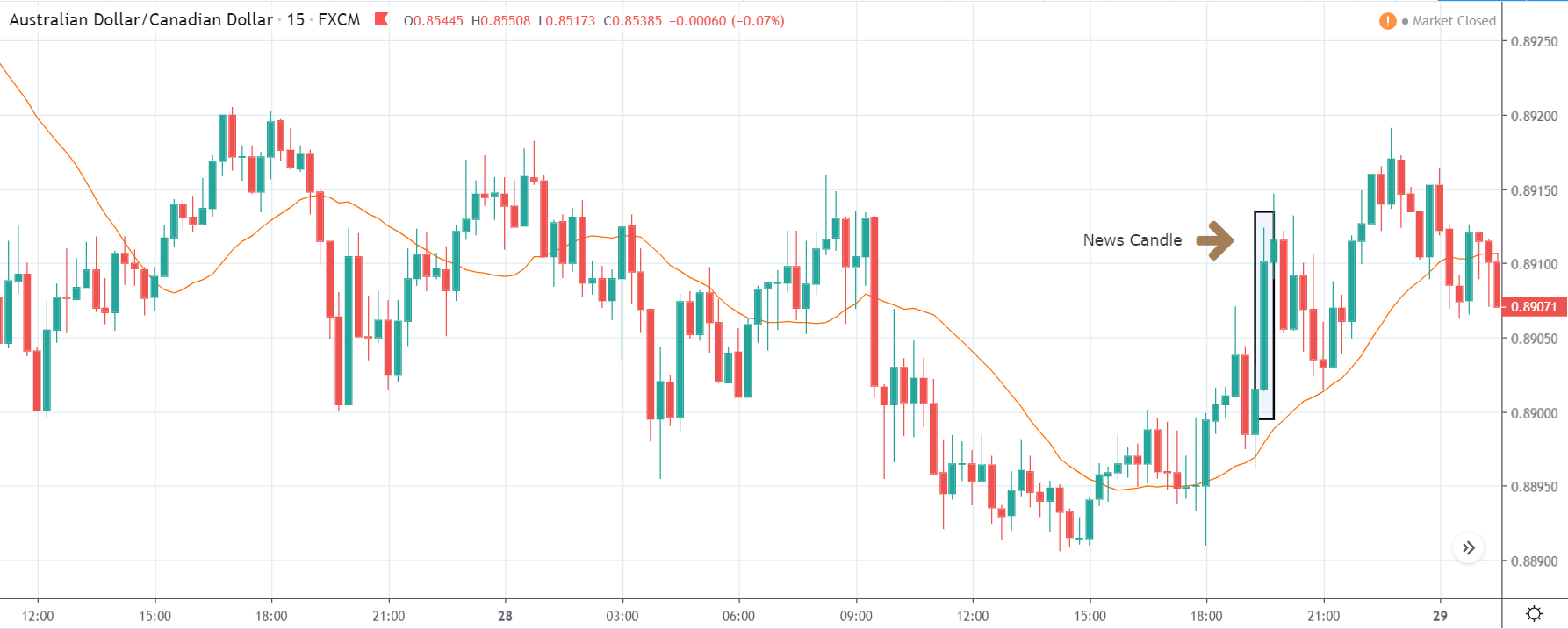

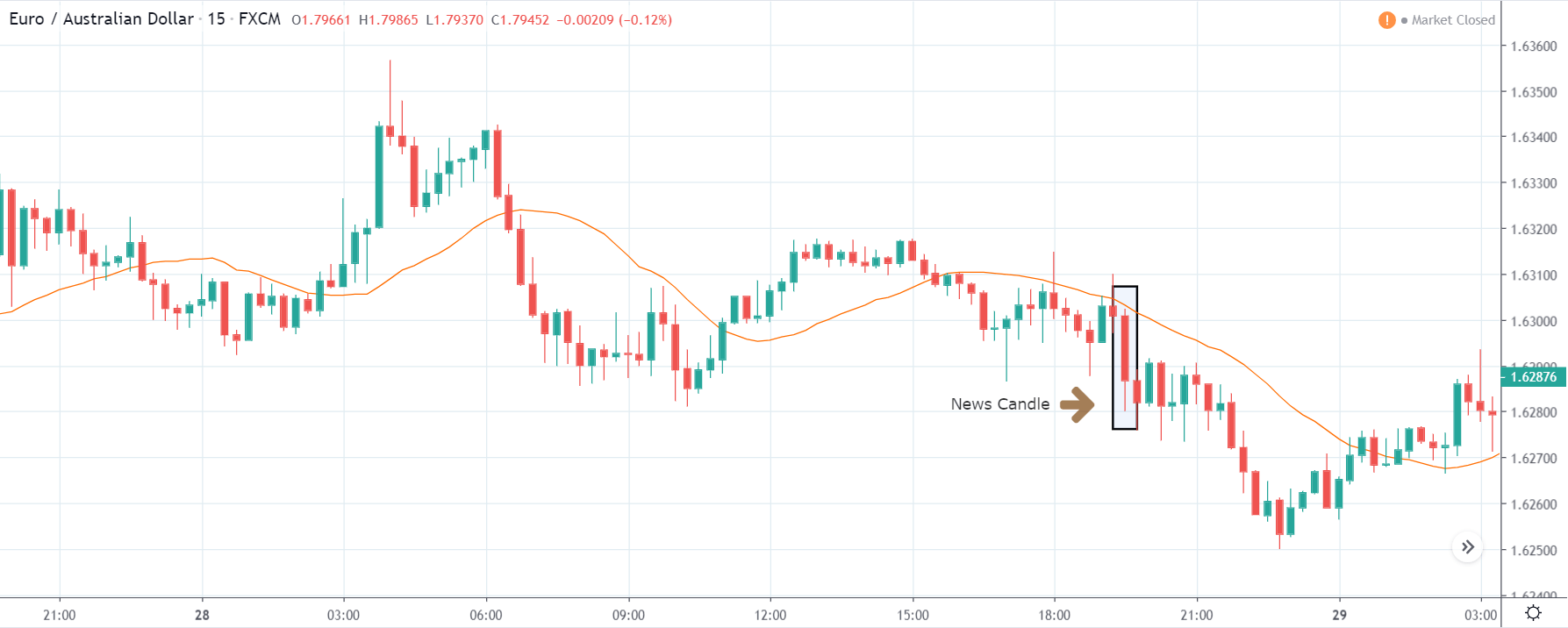

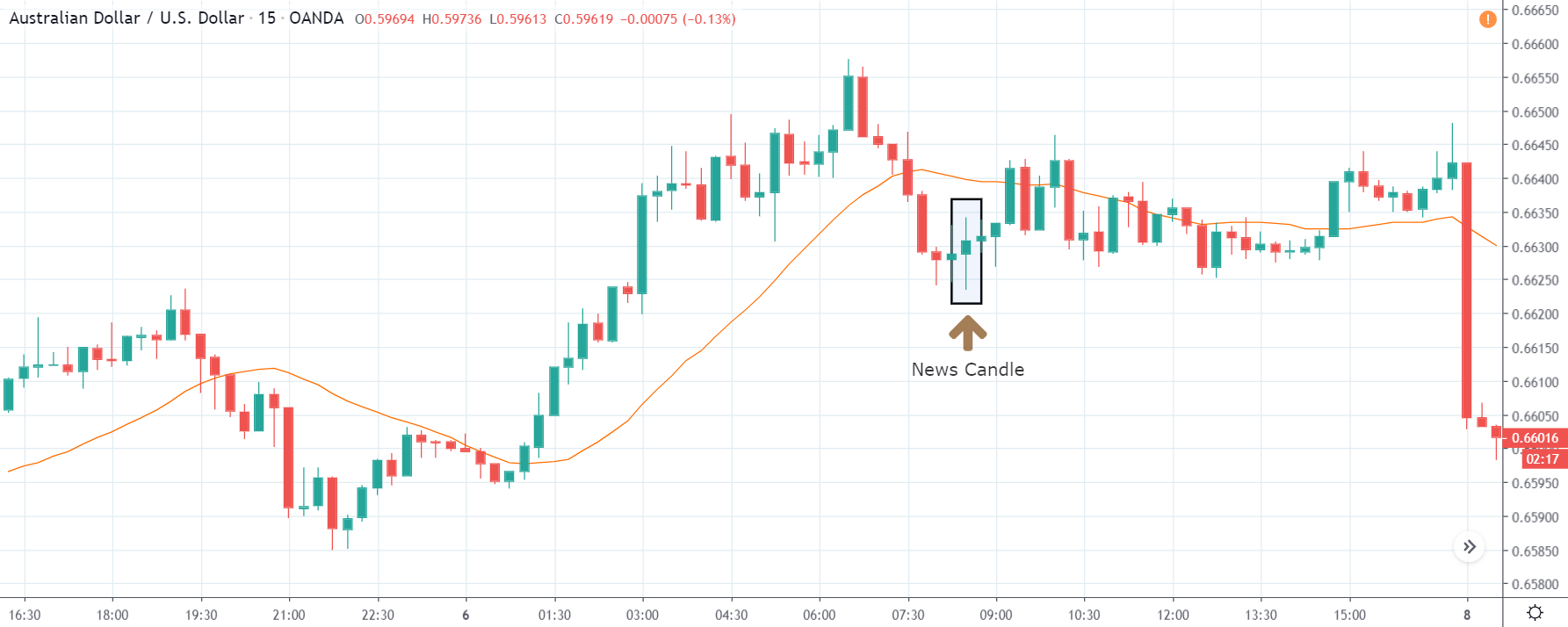

Looking through the platform it looks like the spreads for all currencies are set at 1 pip, the FAQ on the sites states that the spreads are fixed so this means that they will not change and the FAQ also said that they will remain fixed even during news events.

Looking through the platform it looks like the spreads for all currencies are set at 1 pip, the FAQ on the sites states that the spreads are fixed so this means that they will not change and the FAQ also said that they will remain fixed even during news events. There is not a minimum amount required to open up an account as you automatically get access to the lowest tier account, the overall minimum deposit requirement is $10 which is the lowest that the payment methods available allow.

There is not a minimum amount required to open up an account as you automatically get access to the lowest tier account, the overall minimum deposit requirement is $10 which is the lowest that the payment methods available allow.

Volumes Forex Group offers just MetaTrader 5 as its trading platform. It offers instant execution and request execution, complete technical analysis package: wide range of inbuilt indicators and charting tools, the ability to create various custom indicators, different time periods (from minutes to months), inbuilt program language

Volumes Forex Group offers just MetaTrader 5 as its trading platform. It offers instant execution and request execution, complete technical analysis package: wide range of inbuilt indicators and charting tools, the ability to create various custom indicators, different time periods (from minutes to months), inbuilt program language

We do not know if there are any added commission on the trading account as there is no mention of it anywhere, there are also no mentions of swap charges, looking a the Arabic version of the site the only account available is an Islamic account, however, we do not know what sort of account the English version uses, we would expect the same but cannot say for sure.

We do not know if there are any added commission on the trading account as there is no mention of it anywhere, there are also no mentions of swap charges, looking a the Arabic version of the site the only account available is an Islamic account, however, we do not know what sort of account the English version uses, we would expect the same but cannot say for sure.

The two methods mentioned on the site are Bank Wire Transfer and PayPal, so it does, in fact, seem like PayPal is available. Volume Groups FX Does not charge any fees or commission for withdrawing funds. However, please note that PayPal and the banks that they deal with usually charge fees/commission for their services.

The two methods mentioned on the site are Bank Wire Transfer and PayPal, so it does, in fact, seem like PayPal is available. Volume Groups FX Does not charge any fees or commission for withdrawing funds. However, please note that PayPal and the banks that they deal with usually charge fees/commission for their services.

There are a few different aspects to the educational side of the site, there is a training section but this is just a signup form, no real information about the training. There is also some training based on the different platforms but again we did not get to experience any of this. Finally, there are some signals for both MT4 and via SMS, they seem to be showing some growth, but we do not know the full extent of their accuracy or profitability.

There are a few different aspects to the educational side of the site, there is a training section but this is just a signup form, no real information about the training. There is also some training based on the different platforms but again we did not get to experience any of this. Finally, there are some signals for both MT4 and via SMS, they seem to be showing some growth, but we do not know the full extent of their accuracy or profitability.

The spreads that you receive are dependent on the account that you are using, the mini account has spread starting from 2 pips, the standard account has spread starting from around 1.5 pips and the Pro and VIP account have spread as low as 0 pips. The product specification page unfortunately just has all instruments set as a minimum 0 pips so we can not see what they actually might be. What we do know though is that the spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads, so while EURUSD may start at 2 pips, other assets like GBPJPY may start slightly higher, 2.5 pips (numbers are estimated).

The spreads that you receive are dependent on the account that you are using, the mini account has spread starting from 2 pips, the standard account has spread starting from around 1.5 pips and the Pro and VIP account have spread as low as 0 pips. The product specification page unfortunately just has all instruments set as a minimum 0 pips so we can not see what they actually might be. What we do know though is that the spreads are variable (also known as floating) so this means that when the markets are being volatile, the spreads will often be seen higher. It is also important to note that different instruments and assets have different starting spreads, so while EURUSD may start at 2 pips, other assets like GBPJPY may start slightly higher, 2.5 pips (numbers are estimated). Minimum Deposit

Minimum Deposit

Educational & Trading Tools

Educational & Trading Tools

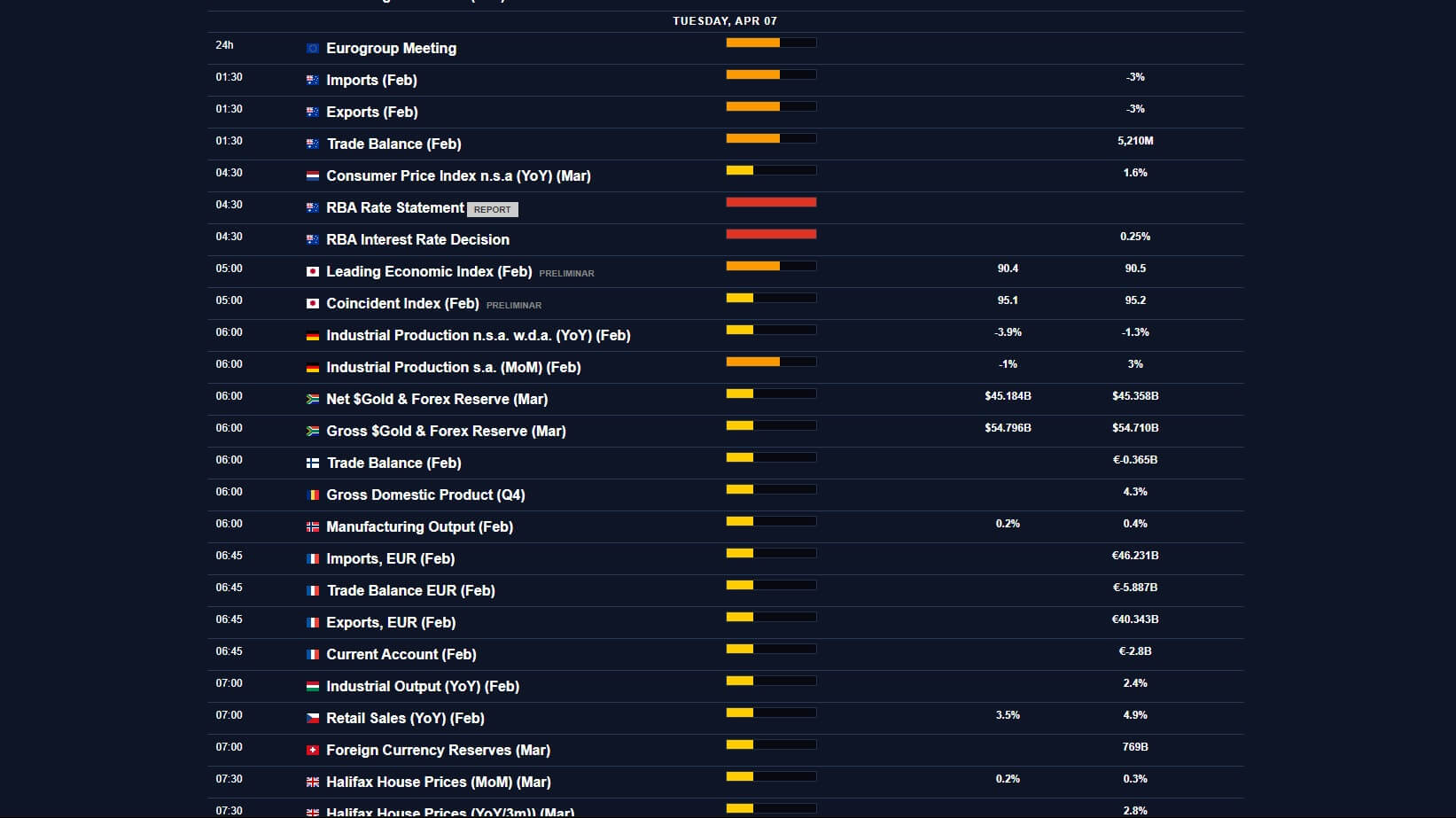

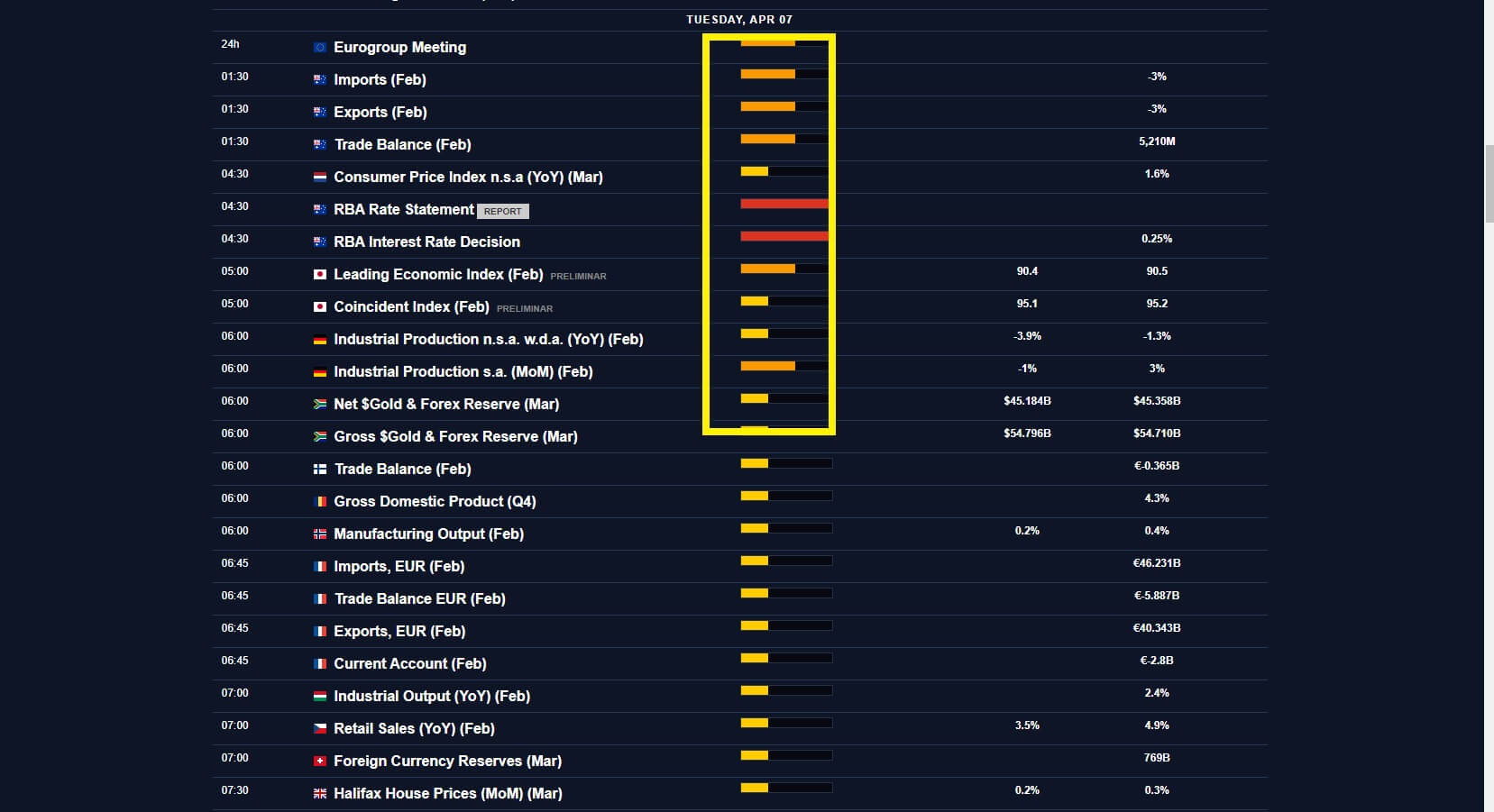

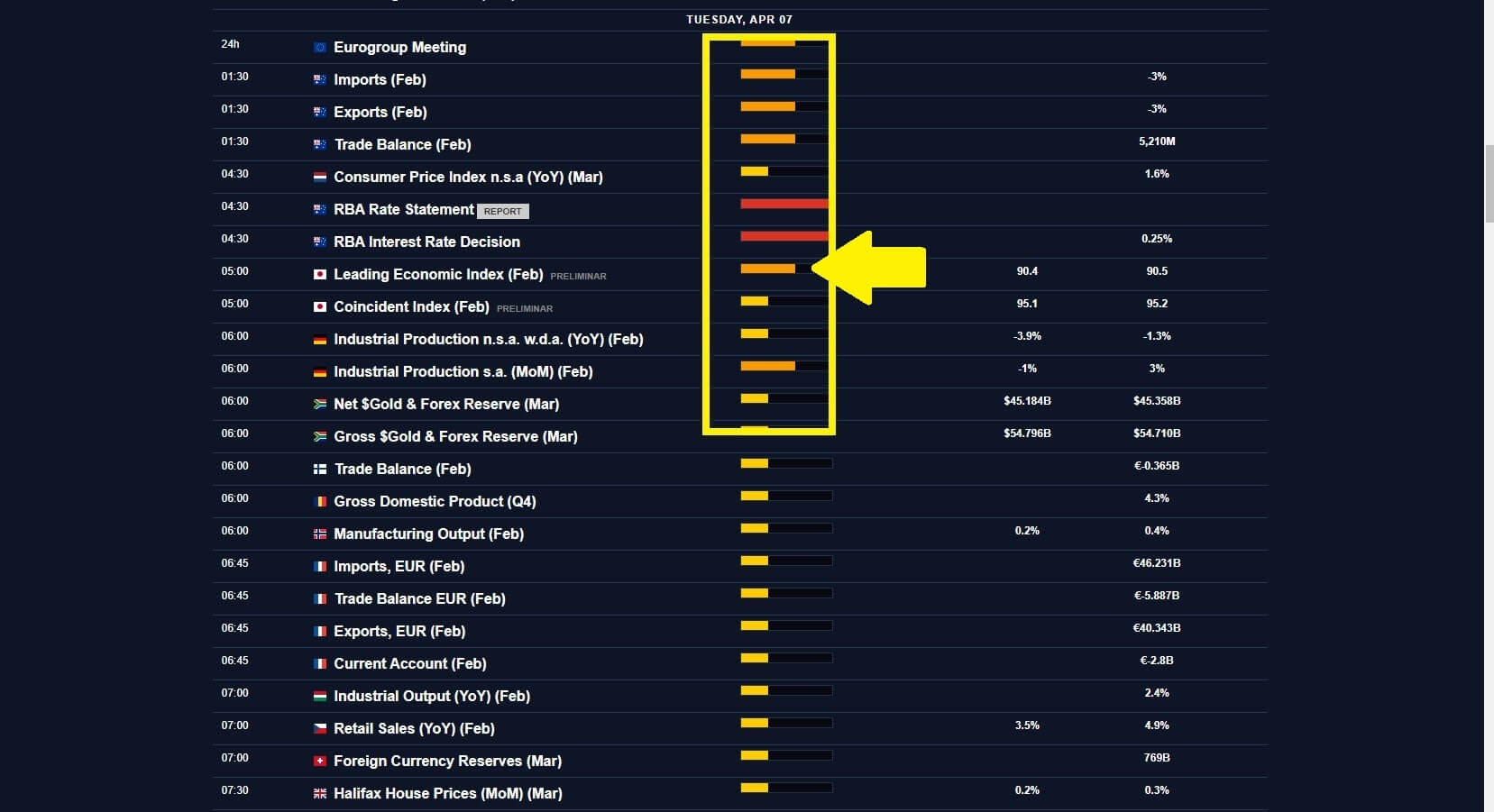

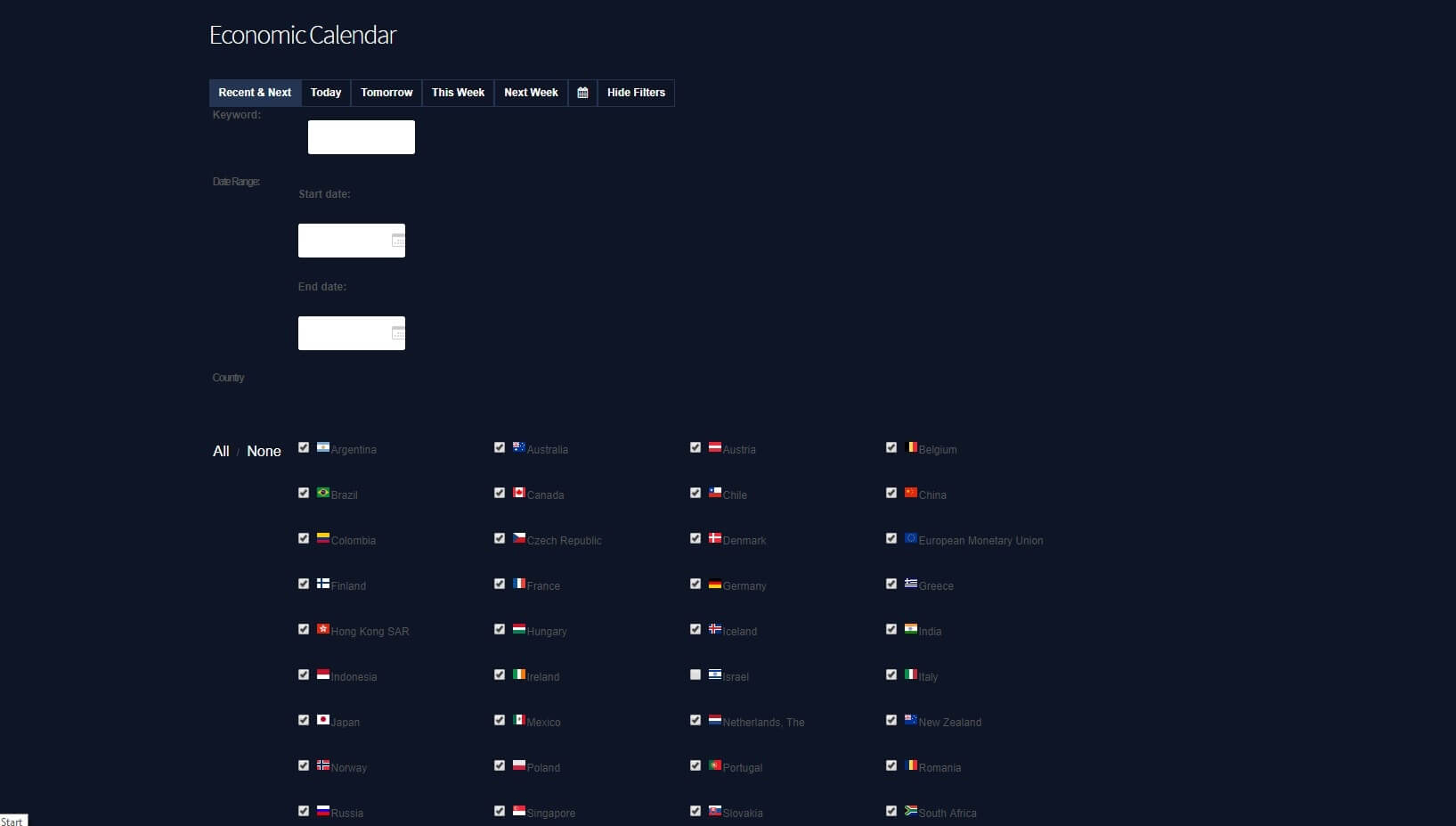

There are a few aspects to the educational side of the site, there are some 1-on-1 forex instructions for people with accounts larger than $1,000, there are also some webinars but we don’t really know how good they are. There is then an economic calendar, this shows you upcoming news events and also indicates which markets the news may affect. Next up is a glossary of trading-related terms, there is a page for video tutorials but the page currently states that it is coming soon. The final section is trading for beginners, but there isn’t much information on it so it isn’t the most helpful page you will come across when trying to educate yourself.

There are a few aspects to the educational side of the site, there are some 1-on-1 forex instructions for people with accounts larger than $1,000, there are also some webinars but we don’t really know how good they are. There is then an economic calendar, this shows you upcoming news events and also indicates which markets the news may affect. Next up is a glossary of trading-related terms, there is a page for video tutorials but the page currently states that it is coming soon. The final section is trading for beginners, but there isn’t much information on it so it isn’t the most helpful page you will come across when trying to educate yourself.

Platforms

Platforms The maximum leverage seems to be 1:200, however, there are mentions of 1:1000 on the site for example which is a little strange and could cause some confusion. For clarification, the

The maximum leverage seems to be 1:200, however, there are mentions of 1:1000 on the site for example which is a little strange and could cause some confusion. For clarification, the

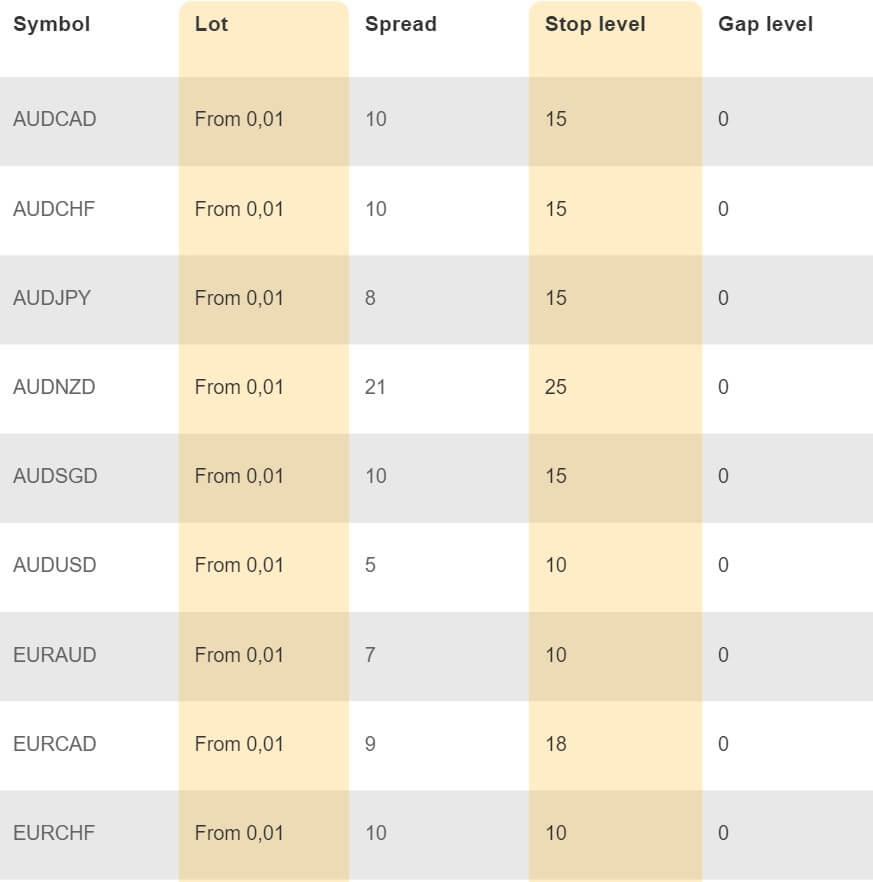

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURSGD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPSGD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDSGD, NZDUSD, USDCAD, USDCHF, USDDKK, USDJPY, USDMXN, USDNOK, USDSEK, USDSGD.

Forex: AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDSGD, AUDUSD, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURSGD, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPSGD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDSGD, NZDUSD, USDCAD, USDCHF, USDDKK, USDJPY, USDMXN, USDNOK, USDSEK, USDSGD. The spreads on the account page state that they start from 2 pips fixed, however looking at the actual spreads the lowest available is 3 pips which are on the EURUSD pair. The spreads are fixed so they do not change and will always remain the same no matter what is happening on the markets. Different instruments will also have different spreads, so while EURUSD has a fixed spread of 3 pips, different pairs such as

The spreads on the account page state that they start from 2 pips fixed, however looking at the actual spreads the lowest available is 3 pips which are on the EURUSD pair. The spreads are fixed so they do not change and will always remain the same no matter what is happening on the markets. Different instruments will also have different spreads, so while EURUSD has a fixed spread of 3 pips, different pairs such as

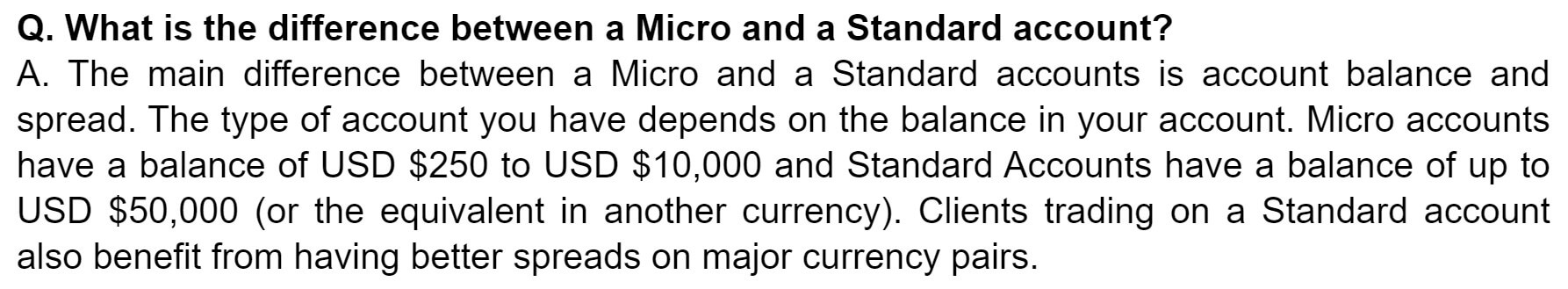

The minimum deposit required to open up an account is $100 which allows you to open up a Micro account, we do not know if the minimum amount reduces once an account has been opened.

The minimum deposit required to open up an account is $100 which allows you to open up a Micro account, we do not know if the minimum amount reduces once an account has been opened.

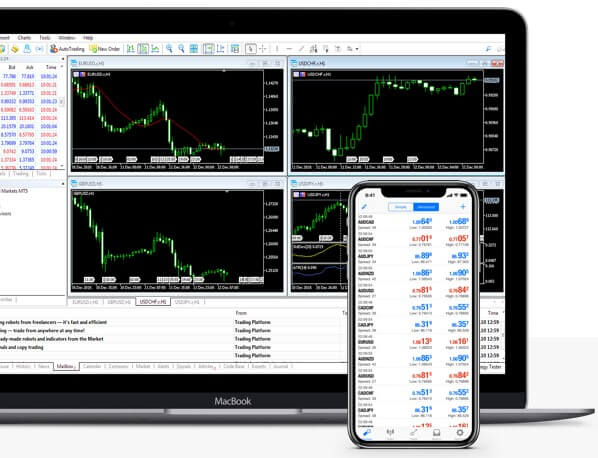

TP Global FX uses MetaTrader 4 as their trading platform which is available as a desktop download, mobile application or web trader. It is one of the world’s most used trading platforms hosting the trades of over 1,000,000 traders worldwide. Some of its many features include that it is available in 30+ languages, allows the use of EA’s & Robots for trade automation, has options to choose from instruments such as Commodities, Indices, and Forex, has requirement based customization with multiple charting as well as analysis, it also offers daily statement for an account, has the availability of analytical tools those are pre-programmed and had real-time account summary for clients which includes floating profit/loss and account equity, etc.

TP Global FX uses MetaTrader 4 as their trading platform which is available as a desktop download, mobile application or web trader. It is one of the world’s most used trading platforms hosting the trades of over 1,000,000 traders worldwide. Some of its many features include that it is available in 30+ languages, allows the use of EA’s & Robots for trade automation, has options to choose from instruments such as Commodities, Indices, and Forex, has requirement based customization with multiple charting as well as analysis, it also offers daily statement for an account, has the availability of analytical tools those are pre-programmed and had real-time account summary for clients which includes floating profit/loss and account equity, etc.

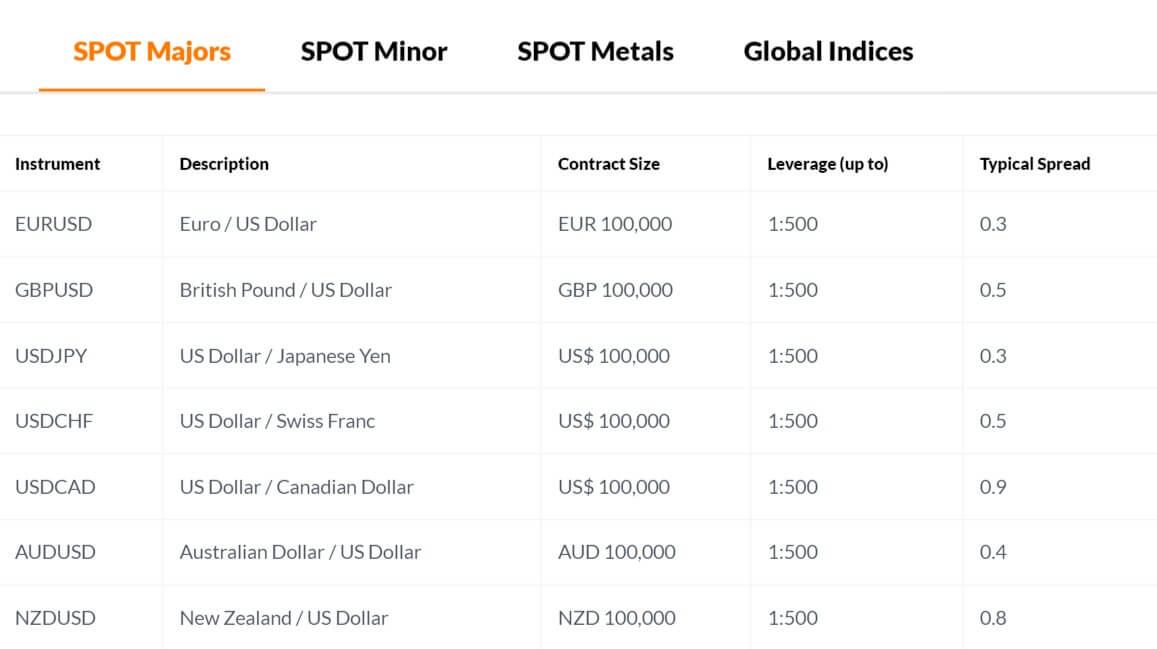

Forex Majors: EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, NXDUSD

Forex Majors: EURUSD, GBPUSD, USDJPY, USDCHF, USDCAD, AUDUSD, NXDUSD

Educational & Trading Tools

Educational & Trading Tools

WesternFX is offering MetaTrader 5 as their sole trading platform, so let’s see what the platform actually offers.

WesternFX is offering MetaTrader 5 as their sole trading platform, so let’s see what the platform actually offers.

Just the one platform available which is X-Web, the platform is easy to use and does not require any installation or download it can be accessed by clients through a PC or Laptop from anywhere in the world. A few of its many features are its customization, chart analysis, and trading, news and analysis, one-click trading, built-in the economic calendar, and automated trading. It also comes as a mobile application that offers the ability to trade on the move, it’s easy to use and is optimized for mobile devices.

Just the one platform available which is X-Web, the platform is easy to use and does not require any installation or download it can be accessed by clients through a PC or Laptop from anywhere in the world. A few of its many features are its customization, chart analysis, and trading, news and analysis, one-click trading, built-in the economic calendar, and automated trading. It also comes as a mobile application that offers the ability to trade on the move, it’s easy to use and is optimized for mobile devices.

There are a few different promotions, however, the majority are based around referring people so we are not really interested in those types of promotions. There is one other type of bonus that is related to getting a 50% bonus on your first deposit up to $500. We, unfortunately, do not have knowledge of the terms of promotions such as how to convert the bonus funds into real funds.

There are a few different promotions, however, the majority are based around referring people so we are not really interested in those types of promotions. There is one other type of bonus that is related to getting a 50% bonus on your first deposit up to $500. We, unfortunately, do not have knowledge of the terms of promotions such as how to convert the bonus funds into real funds.

There are a few different aspects of the educational side of the CapitalXP site. There is a video course, which has a number of different videos going over various subjects such as forex trading, market analysis, trading strategies and more. There is also a webinar page, however, the calendar shows that there aren’t any coming up so we do not know if this part of the site is still active. You are able to download a number of ebooks which include subjects like “succeeding with Forex trading”, and “ Trading cryptocurrencies: the basics”. There is also a glossary of trading terms which you can refer back to if you come across something that you do not know the meaning of.

There are a few different aspects of the educational side of the CapitalXP site. There is a video course, which has a number of different videos going over various subjects such as forex trading, market analysis, trading strategies and more. There is also a webinar page, however, the calendar shows that there aren’t any coming up so we do not know if this part of the site is still active. You are able to download a number of ebooks which include subjects like “succeeding with Forex trading”, and “ Trading cryptocurrencies: the basics”. There is also a glossary of trading terms which you can refer back to if you come across something that you do not know the meaning of.

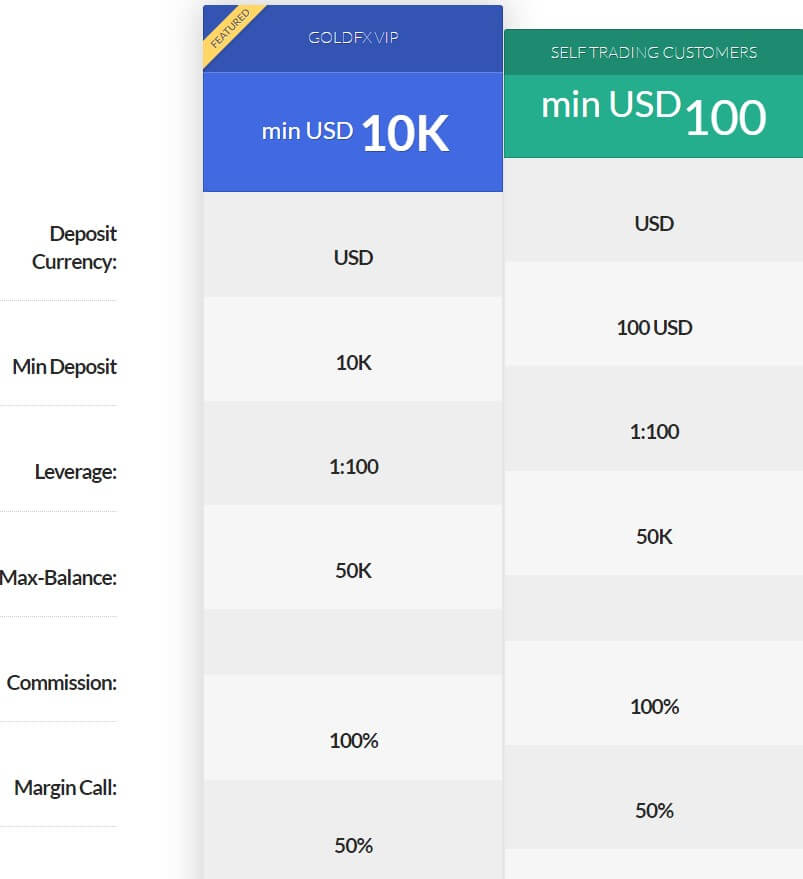

The use of MetaTrader 4 is available with Gold FX and for good reason, it is one of the most accessible platforms with a desktop download available as well as mobile applications and a web trader. Some of its other features include it being user-friendly, it has multiple languages, its equipped with advanced communication tools, provides personal information such as account balances, trade history, it works with all kind of currency, has advanced real-time charts, provides indicator, technical analysis, order management tools and customizable high tech chart, its a highly secure platform, and has the use of thousands of expert advisors and indicators to help with your trading and analytical needs.

The use of MetaTrader 4 is available with Gold FX and for good reason, it is one of the most accessible platforms with a desktop download available as well as mobile applications and a web trader. Some of its other features include it being user-friendly, it has multiple languages, its equipped with advanced communication tools, provides personal information such as account balances, trade history, it works with all kind of currency, has advanced real-time charts, provides indicator, technical analysis, order management tools and customizable high tech chart, its a highly secure platform, and has the use of thousands of expert advisors and indicators to help with your trading and analytical needs.

There are a few different aspects to the education and trading tools side of the site. The first section is some videos based on different strategies and how to trade them. There is also a section detailing a few different trading strategies. There is some research and analysis information, but this is pretty irrelevant as it has not been updated for 2 years now. Finally, there is an economic calendar, this details upcoming news events and also shows which markets they may affect.

There are a few different aspects to the education and trading tools side of the site. The first section is some videos based on different strategies and how to trade them. There is also a section detailing a few different trading strategies. There is some research and analysis information, but this is pretty irrelevant as it has not been updated for 2 years now. Finally, there is an economic calendar, this details upcoming news events and also shows which markets they may affect.

The maximum leverage available is 1:200, we believe that all accounts use the same leverage so they all have access to this amount. It can be selected when opening up an account, we are not sure if it can be changed once an account has been opened.

The maximum leverage available is 1:200, we believe that all accounts use the same leverage so they all have access to this amount. It can be selected when opening up an account, we are not sure if it can be changed once an account has been opened.

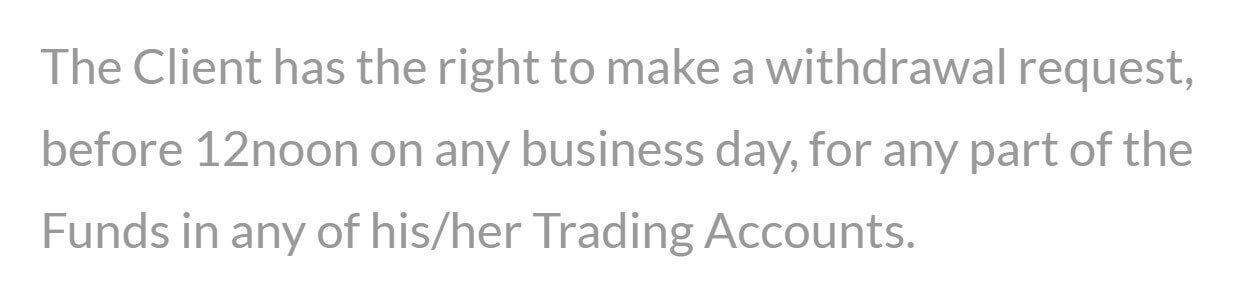

There is not a dedicated page for funding, the only information we have is some images at the bottom of the website, they indicate that Visa, Maestro, MasterCard, Neteller, and AstroPay are available to use, but we have no confirmation of this, we also do not know if there are any added fees when depositing but you should check with whatever method you are using to see if any are added by them.

There is not a dedicated page for funding, the only information we have is some images at the bottom of the website, they indicate that Visa, Maestro, MasterCard, Neteller, and AstroPay are available to use, but we have no confirmation of this, we also do not know if there are any added fees when depositing but you should check with whatever method you are using to see if any are added by them.

There is a 30% bonus available, the only details about the promotion are on the account sign up page which states that you can get a 30% bonus on your first deposit. There is no more information surrounding it such as how to convert the bonus into real funds or what the maximum bonus available is.

There is a 30% bonus available, the only details about the promotion are on the account sign up page which states that you can get a 30% bonus on your first deposit. There is no more information surrounding it such as how to convert the bonus into real funds or what the maximum bonus available is.