Introduction

The expansion of GBP is the Great Britan Pound, and this currency is very well known as the Pound Sterling. It is the official currency of the United Kingdom and many other countries like British Overseas Territories, South Sandwich Islands, etc. Where in PHP is known as the Philippine peso and generally referred to as the Piso. It is the official currency of the Philippines, and it is printed by The Central Bank of the Philippines.

GBP/PHP

In the Forex market, currency pairs of any two countries are coupled for being exchanged in reference to each other. GBP/PHP is the abbreviation for the Pound sterling against The Philippine peso. In this case, the first currency (GBP) is the base currency, and the second (PHP) is the quote currency. The GBP/PHP is classified as an exotic-cross currency pair.

Understanding GBP/PHP

As we know, the trading of currencies in the Forex market typically happens in pairs. One currency is quoted against the other, and to find out the relative value of one currency, we need another currency to compare. The market value of GBP/PHP determines the strength of PHP against the GBP. This can be easily understood as 1 GBP is equal to how much PHP. So if the exchange rate for the pair GBP/PHP is 63.377. It means 1 GBP is equivalent to 63.377 PHP.

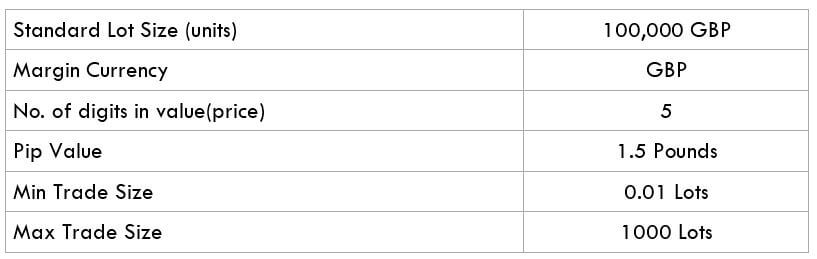

Spread

Forex brokers have two different prices for currency pairs, and they are the bid and ask prices. The bid is a selling price while the ask is a buy price. The difference between the ask and the bid price is called the spread. The spread is how most of the brokers make their money. The spreads of GBP/PHP in both ECN & STP brokers can be found below.

ECN: 45 pips | STP: 48 pips

Fees

When we execute a trade, we need to pay the broker some commission. A Fee is that commission we pay to the broker each time we execute a position. There is no fee on STP account models, but ECN brokers charge some pips as a trading fee.

Slippage

Sometimes while trading in a volatile market, we won’t be able to execute a trade at the price we want it to get executed. Slippage is the difference between the trader’s expected price and the actual price at which the trade is executed. It may occur at any time but mostly happens when the market is fast-moving and volatile. It can also happen when we place a large number of orders at the same time.

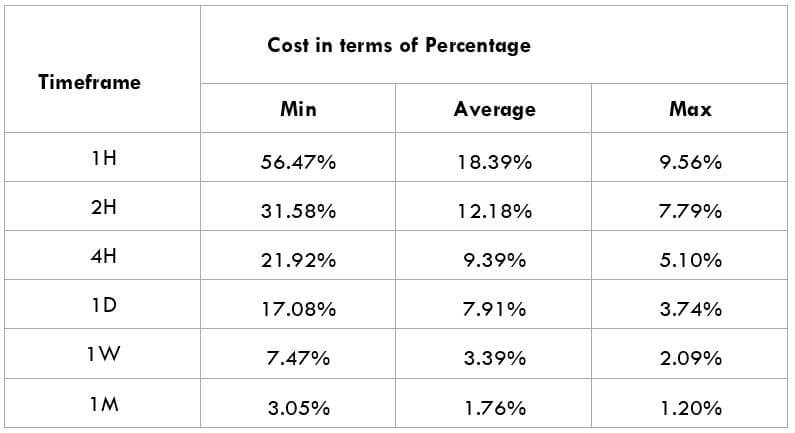

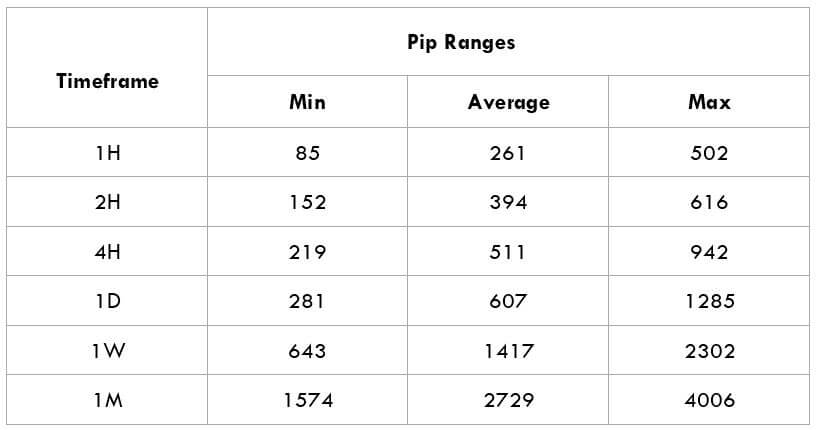

Trading Range in GBP/PHP

The amount of money we will win or lose in a given amount of time can be assessed using the trading range table. It is a representation of the minimum, average, and maximum pip movement in a currency pair. This can be evaluated by using the ART indicator combined with 200-period SMA.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a significant period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

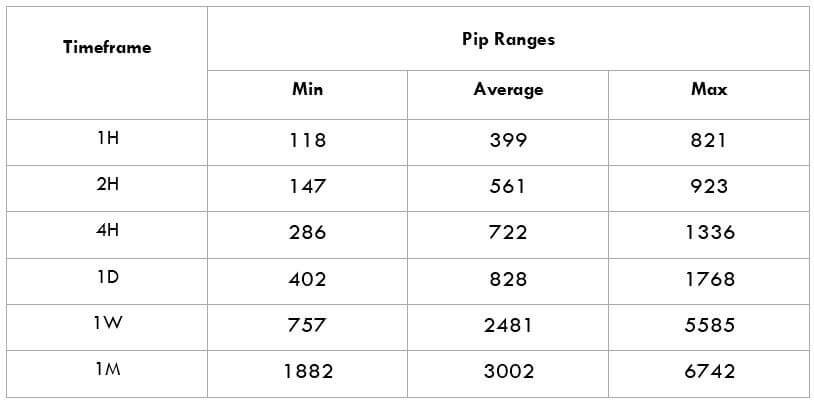

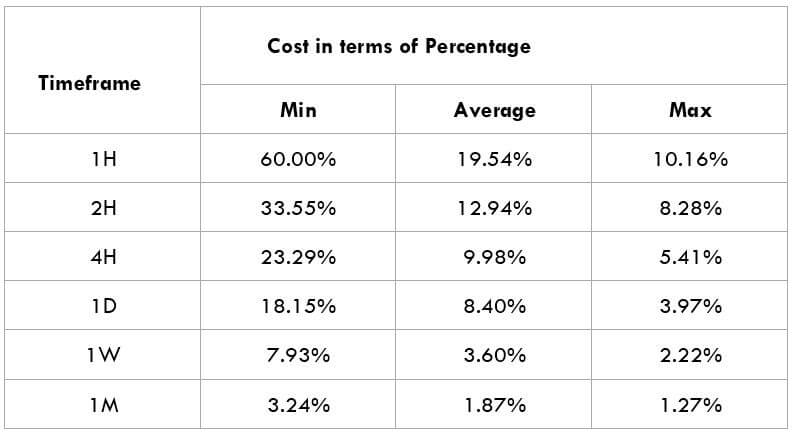

GBP/PHP Cost as a Percent of the Trading Range

The cost of trade mostly depends on the broker and varies based on the volatility of the market. This is because the total cost involves slippage and spreads apart from the trading fee. Below is the representation of the cost variation in terms of percentages. The comprehension of it is discussed in the following sections.

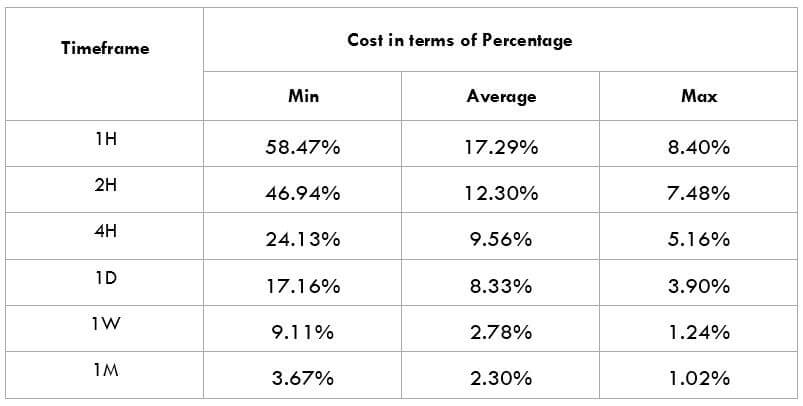

ECN Model Account

Spread = 45 | Slippage = 3 |Trading fee = 5

Total cost = Slippage + Spread + Trading Fee = 3 + 45 + 5 = 53

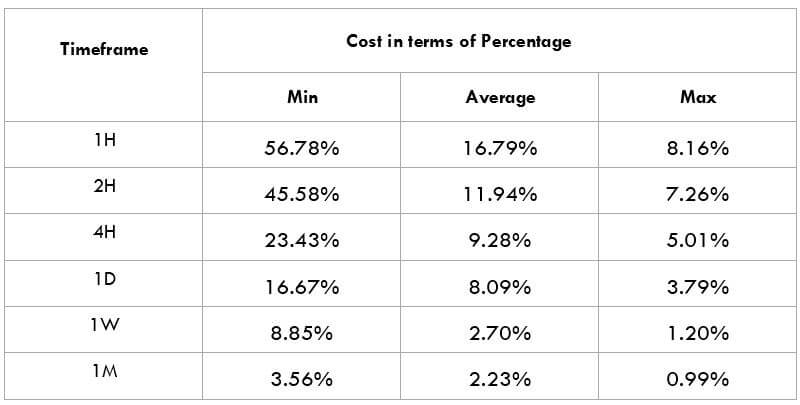

STP Model Account

Spread = 48 | Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 48 + 0 = 51

Trading the GBP/PHP Forex Pair

The GBP/PHP is an exotic-cross currency pair with great volatility. For instance, the average pip movement on the 1H timeframe is 261 pips. As a matter of fact, PHP is one of the most emerging currencies in the previous year. We can find amazing trading opportunities in this currency pair if observed correctly.

When the volatility is high, the cost of trade will always be less. It is vice versa when the volatility is low. But this should not be considered as an advantage because it is always risky to trade when the volatility is high. To comprehend the above tables, higher percentages mean the costs of trade in the corresponding time frames are high. And when the percentages are low, trading costs are relatively low in those time frames.

Generally, it is recommended to take trades when the volatility of the market is around minimum to average values. Because, at min values, the volatility of the market will be low. But the costs are a bit high here when compared to the average and the maximum values. Trading at max values will reduce your trading costs but increase the risk of the trades. So we suggest you take a call according to the market situation.

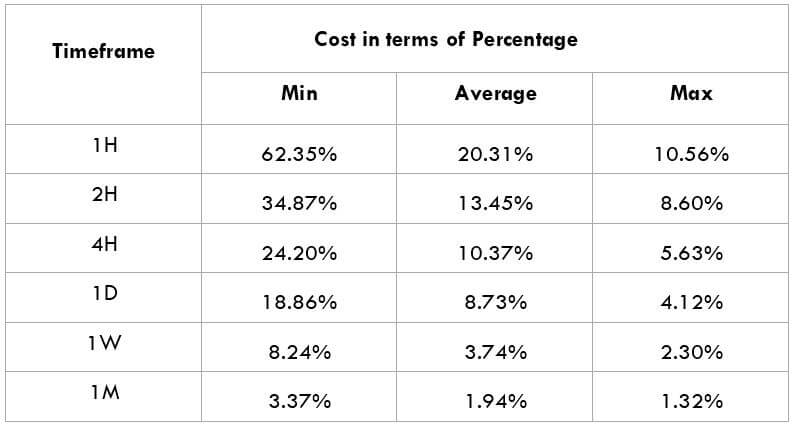

There is another way to reduce the cost of trades, i.e., by using Limit Orders over Market Orders. By using these limit orders, slippage can completely be eliminated and thereby reducing the overall trading costs. In the below table, you can see how the costs have reduced by using limit orders with an STP broker.

STP Model Account (Using Limit Orders)

Spread = 48 | Slippage = 0 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 0 + 48 + 0 = 48