Introduction

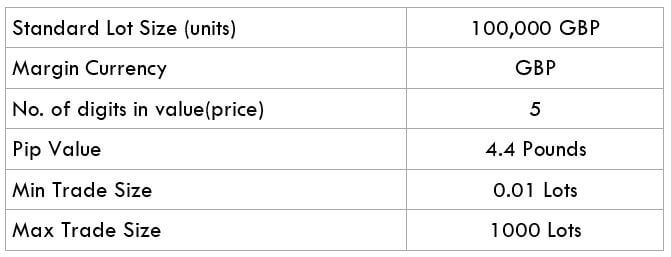

GBP/BRL is the abbreviation for the Pound sterling against the Brazilian real. As we know, GBP is the official currency of the United Kingdom, Jersey, Guernsey, and others, whereas BRL is the official currency of Brazil. In Forex trading, currencies are always traded in pairs. The primary currency in the pair is known as the base currency, while the second one is the quote currency.

Understanding GBP/BRL

To find the relative value of one currency, we compare that with another currency in the Forex market. The market value of GBP/BRL helps us to understand the strength of BRL against the GBP. If the exchange rate of the pair GBP/BRL is 6.5415. It means that to buy 1 GBP, we need 6.5415 BRL.

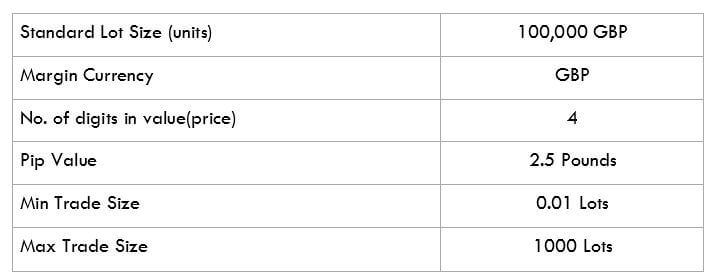

Spread

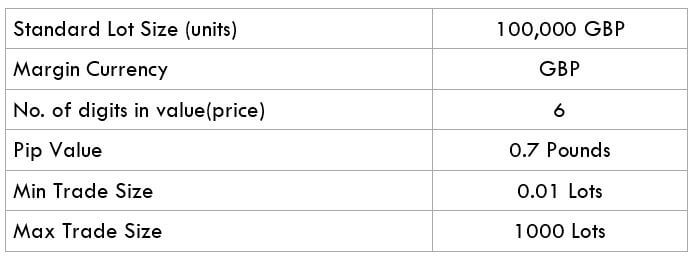

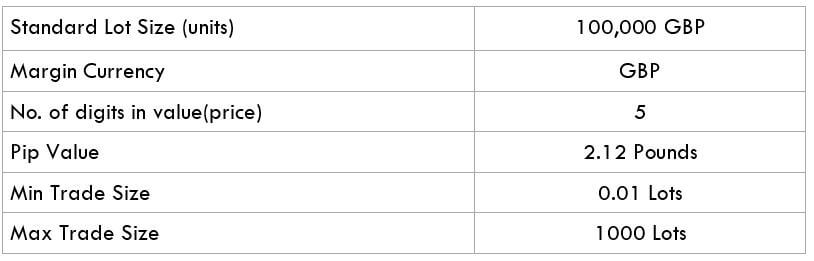

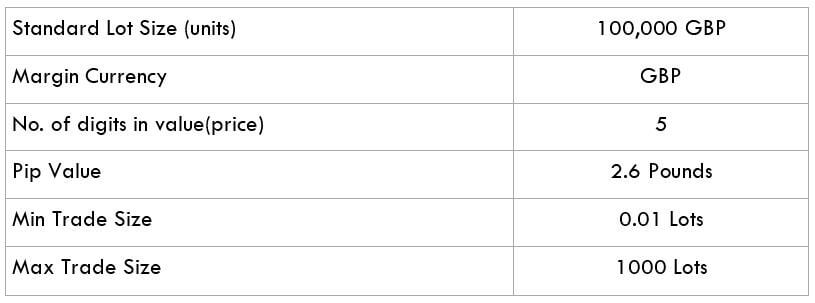

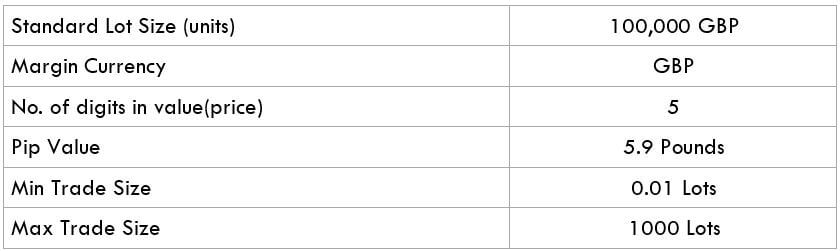

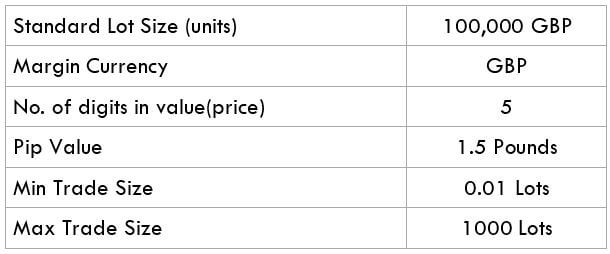

Forex brokers have two prices for currency pairs. They are the bid and ask prices. The difference between this bid and the ask prices is known as the spread, and this is how Forex brokers profit for the services they provide. Some brokers include the costs in the buy and sell prices of the currency pairs instead of charging spreads. Below are the ECN and STP spread values for the pair GBP/BRL.

ECN: 41 pips | STP: 44 pips

Fees

A Fee is a commission we pay to the broker for executing our trades. It differs for different types of brokers. For instance, there is no fee charged by the STP brokers, but for ECN accounts, a few pips are charged a fee.

Slippage

It is the difference between the expected price and the price at which the trade gets executed. Slippage can occur at any time, but it mostly happens when the market is highly volatile.

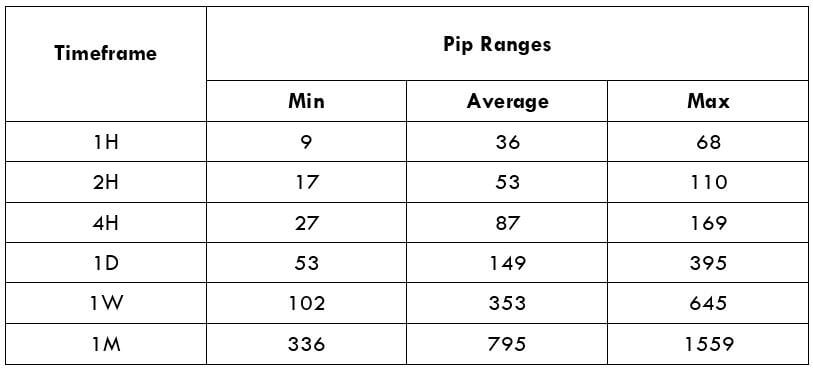

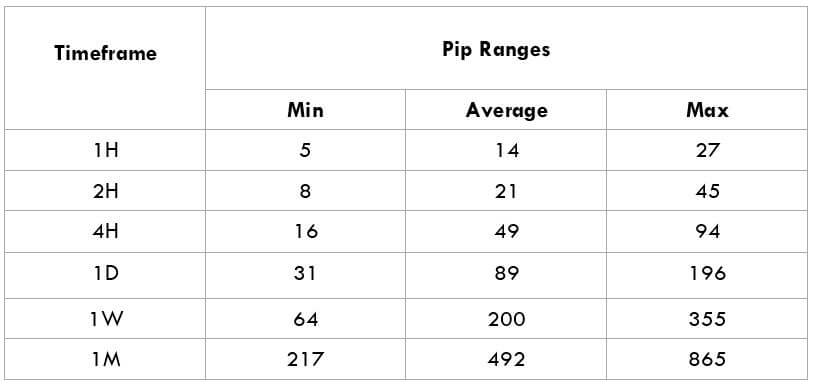

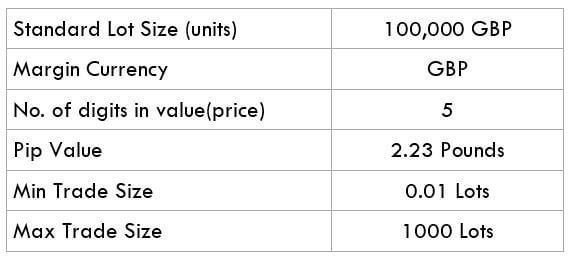

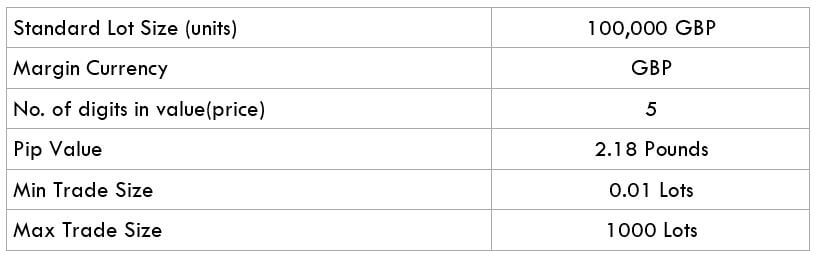

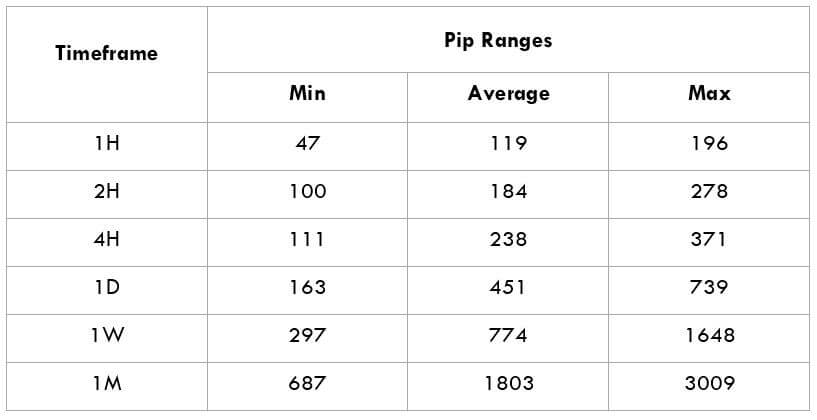

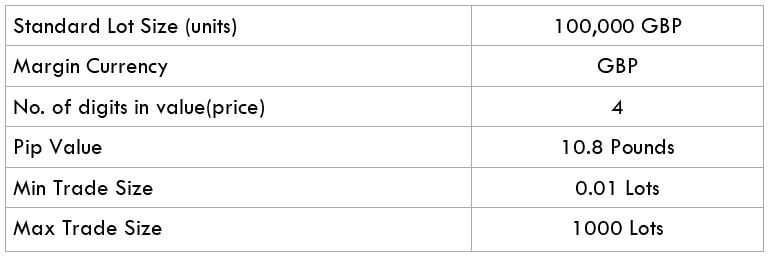

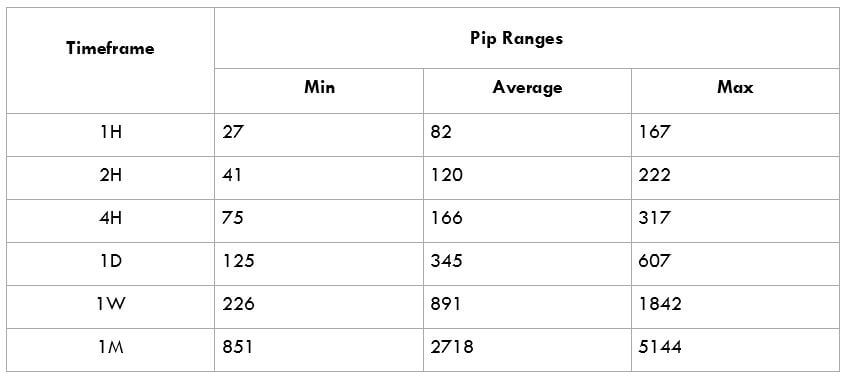

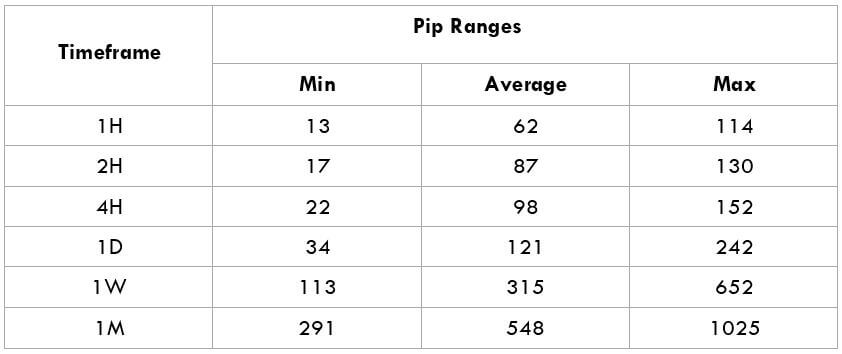

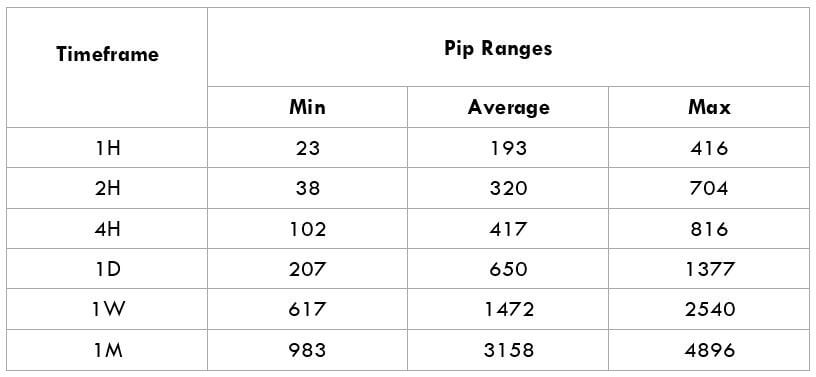

Trading Range in GBP/BRL

Being aware of the volatility of a particular currency pair before placing the trade is very important for every aspiring trader. The trading range here is useful to measure the volatility of the GBP/BRL pair. The amount of money we will win or lose in a given amount of time can be assessed using the below trading range table.

Procedure to assess Pip Ranges

- Add the Average True Range indicator on your price chart

- Then, set the period to one

- Add a 200-period Simple Moving Average to the ATR indicator

- Shrink the chart to assess a significant period

- Select the desired timeframe

- Measure the floor level and set this value as the minimum

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

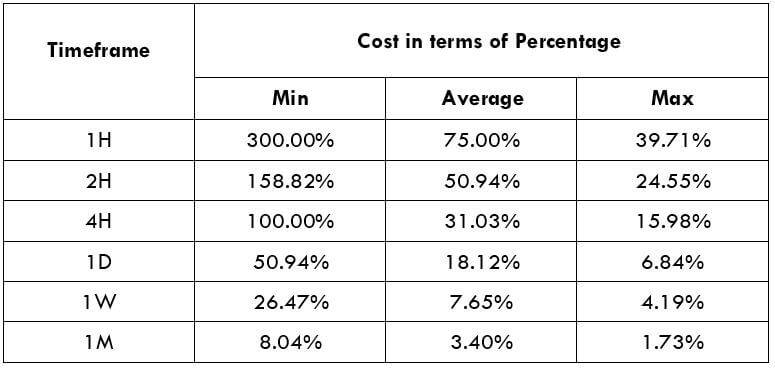

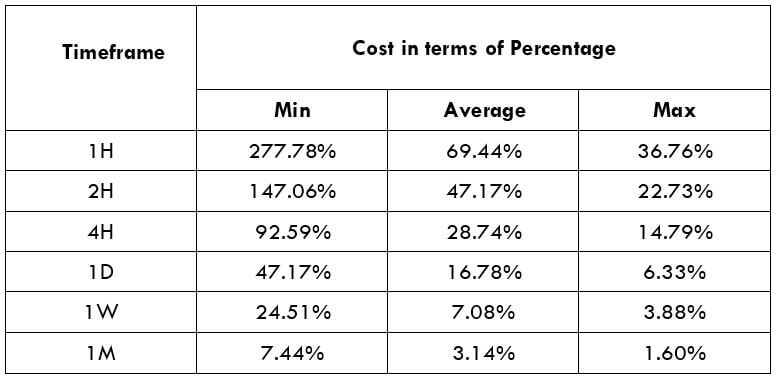

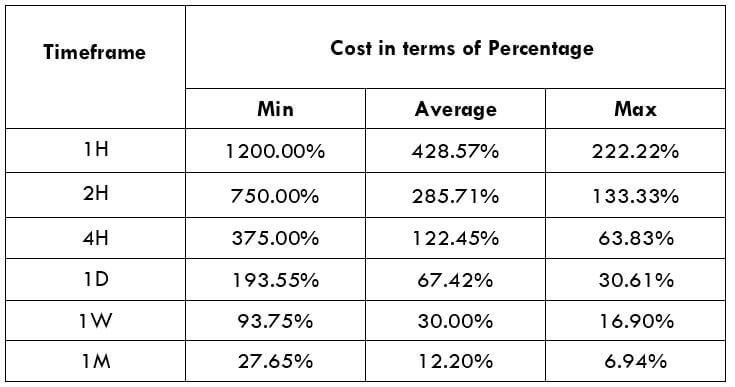

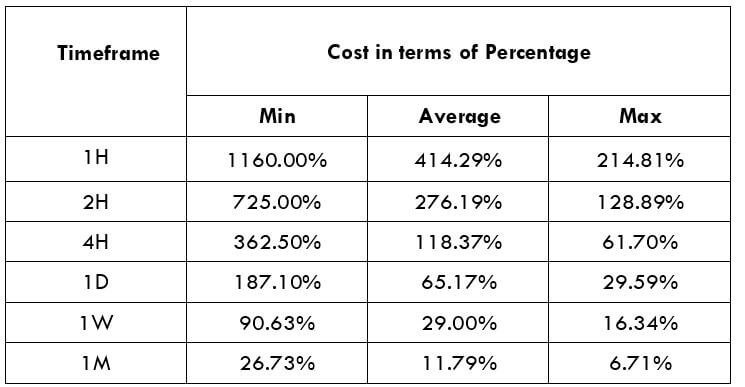

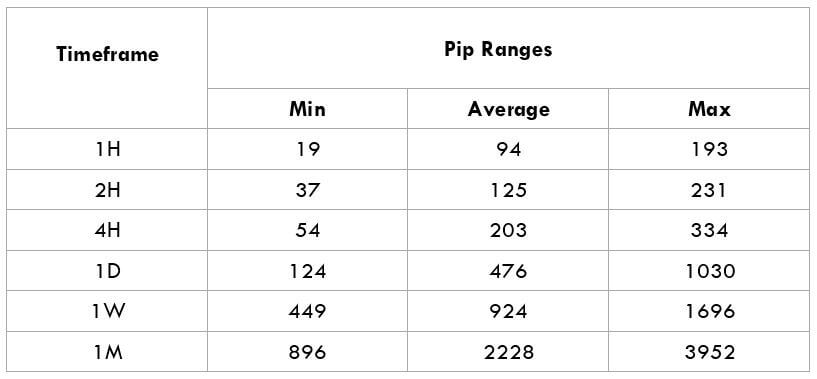

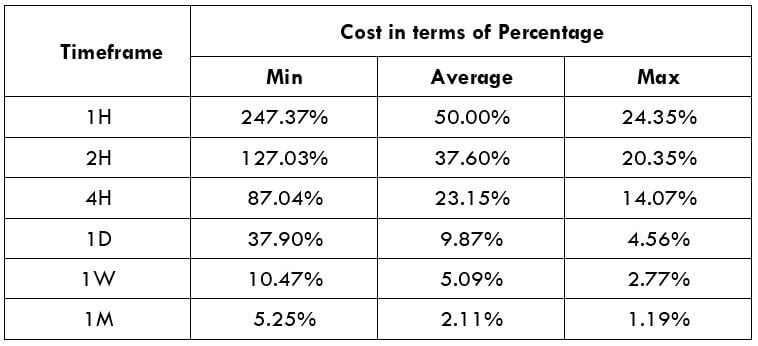

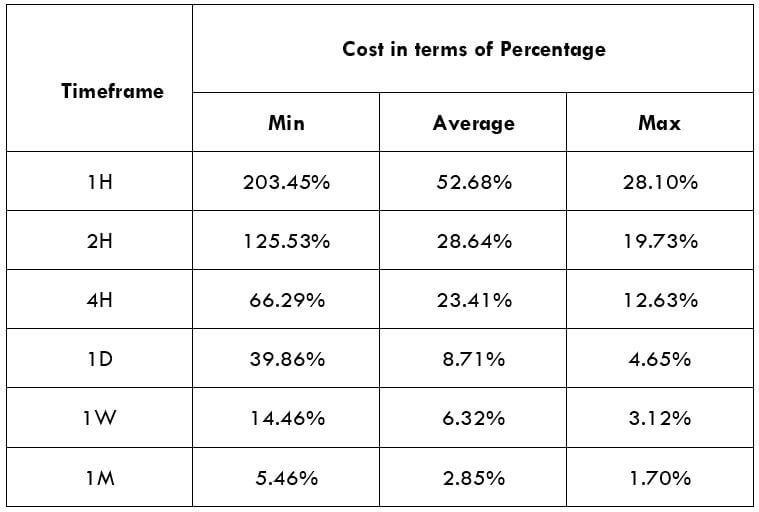

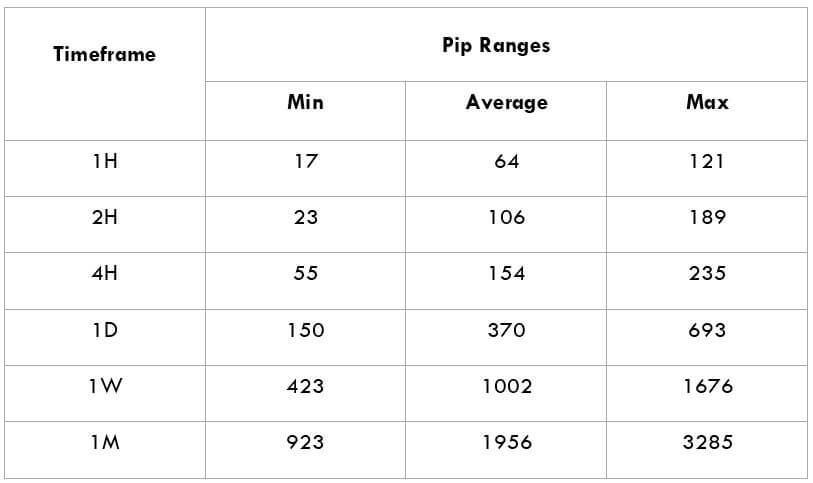

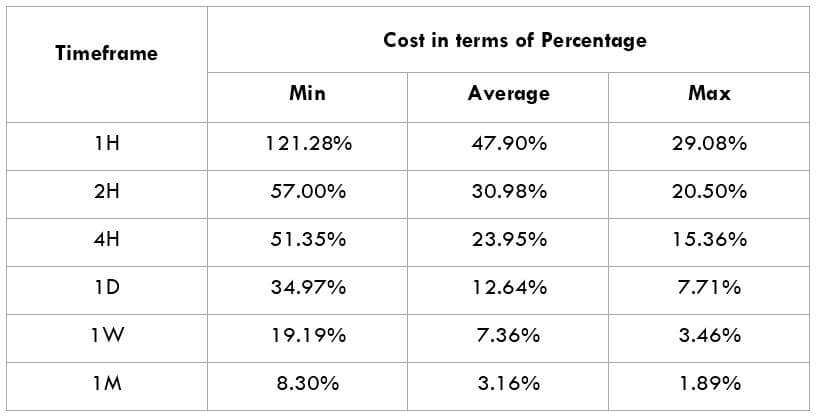

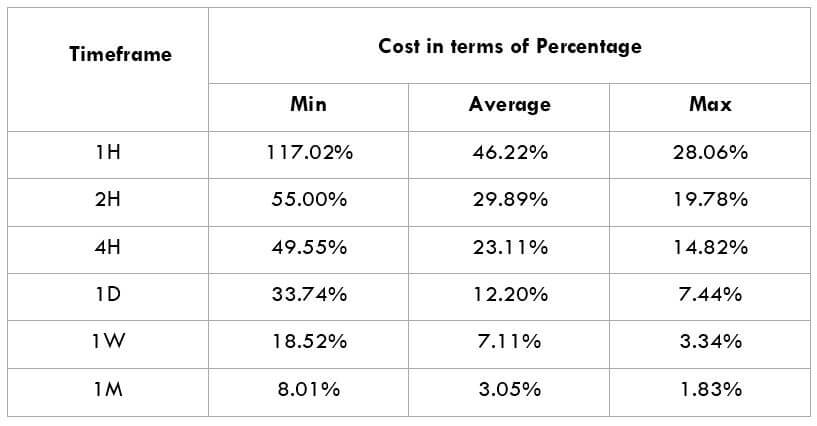

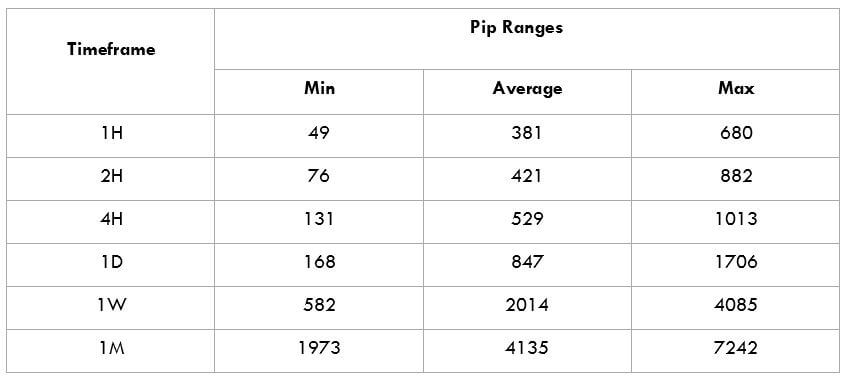

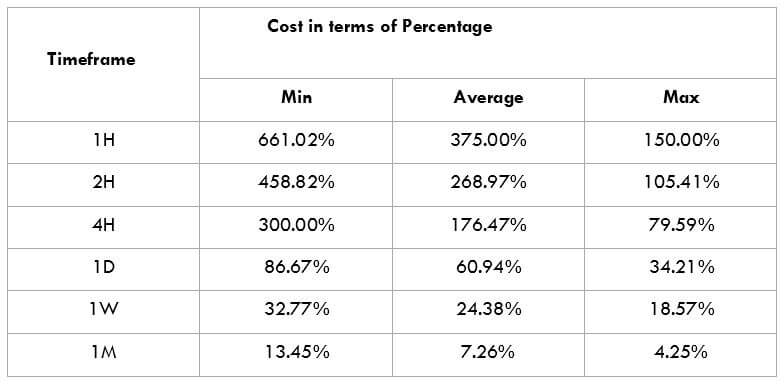

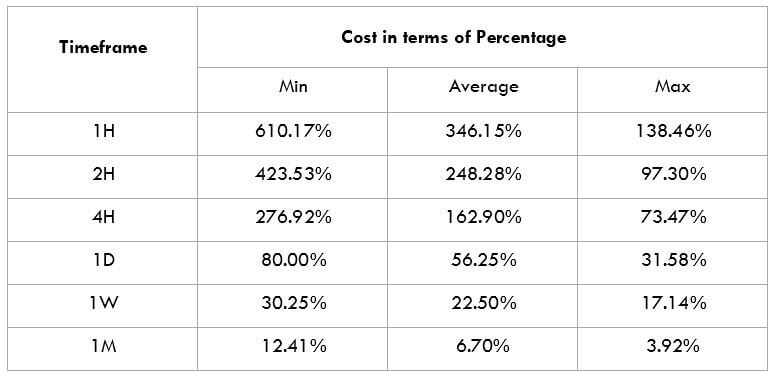

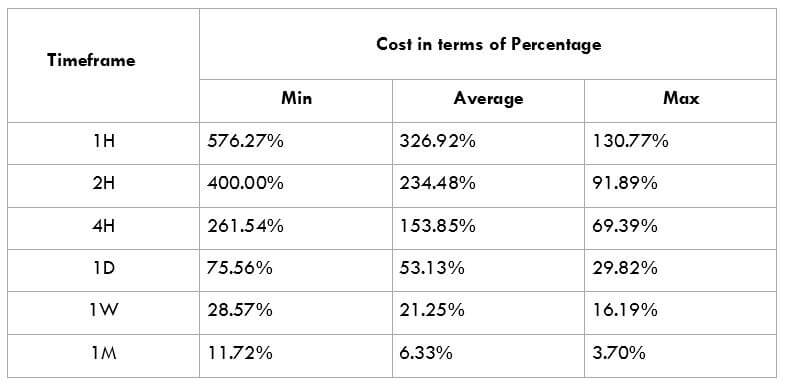

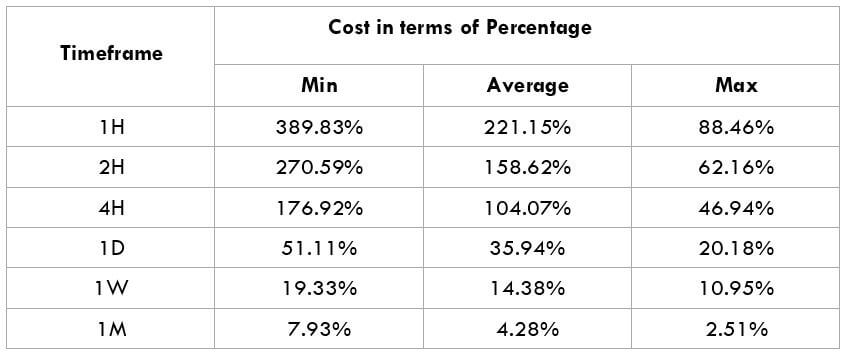

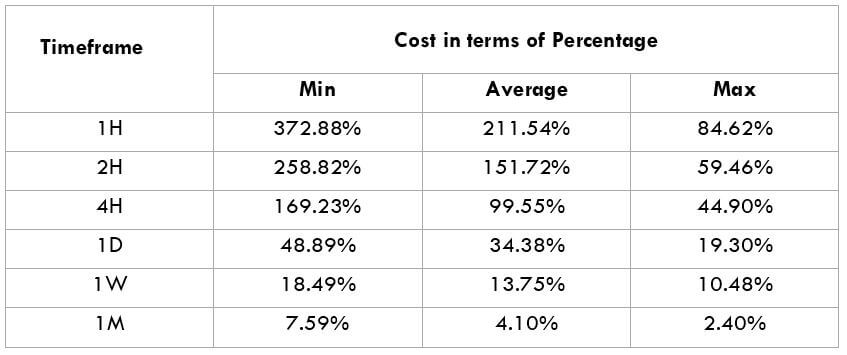

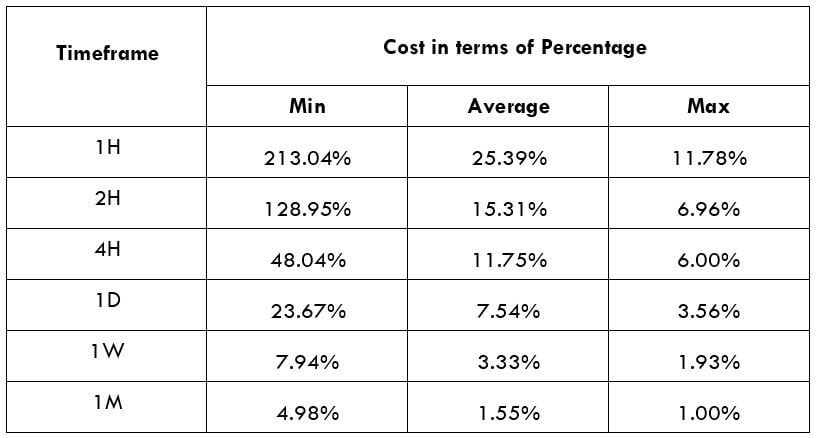

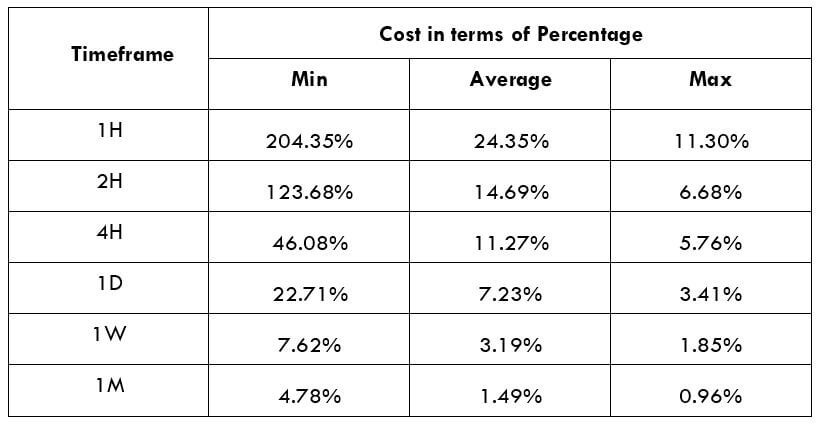

GBP/BRL Cost as a Percent of the Trading Range

The cost of trade depends on the broker type and varies based on market volatility. The total cost of trade involves spreads and slippage apart from the trading fee.

ECN Model Account

Spread = 41 | Slippage = 3 |Trading fee = 5

Total cost = Slippage + Spread + Trading Fee = 3 + 41 + 5 = 49

STP Model Account

Spread = 44| Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 44 + 0 = 47

Trading the GBP/BRL

There are a few currencies that are hardly traded in the foreign exchange market. These currencies are called exotic-cross currency pairs, and the GBP/BRL is one such exotic pair.

These pairs have less market depth, less volume, and are also illiquid. GBP/BRL is a trending market. Further, the average pip movement on the 1H timeframe is 198 pips, which is considered to be volatile. Higher the volatility, lower is the cost on a trade. However, this should not be considered an advantage as it is risky to trade in highly volatile markets.

Let’s take, for example, in the 4H time frame. The Maximum pip range value is 816, and the minimum is 102. When the comparison of the fees for both the pip movements is made, we find that for 102pip movement, fess is 46.08%. But for the 816pip movement, fess is only 5.76%.

So, we can confirm that the prices are higher for low volatile markets and low for highly volatile markets. We recommend trading when the volatility is around the average values. Experienced traders who strictly follow money management can trade in a highly volatile market.