Introduction To GBP/XPF

The abbreviation of GBP/XPF is British Pound vs. the French Pacific Franc. Here GBP is the official currency of the United Kingdom, and many others, it is also proven to be the fourth most traded currency in the forex market after USD, EURO, and JPY. In contrast, The CFP franc is the currency used in French overseas.

Understanding GBP/XPF

We know that in currency pairs, the first currency is the base currency, and the second currency is the quote currency. Here, the market value of GBP/XPF helps us to understand the strength of XPF against the GBP. So let’s take if the exchange rate for the pair GBP/XPF is 135.984, it means we need 135.984 XPF to buy 1 GBP.

Spread

We have two different prices for currency pairs in forex, the bid and ask price. Here the “bid” price at which we can SELL the base currency, and The “ask” price is at which we BUY the base currency. The difference between the ask price and the bid price is called the spread. Below is the spread for ECN and STP broker for the GBP/XPF pair.

ECN: 52 pips | STP: 55 pips

Fees

A Fee in forex is simply the commission we need to pay to the broker for opening a particular position. The fees depend on the type of broker we use. Like for example, we don’t have any fees for ECN, but we have some for STP.

Slippage

Slippage is the difference between the trader’s anticipated price and the actual price at which the trade is executed. It mostly occurs when the volatility of the currency pair is high and also, sometimes, when a large number of orders are placed at the same time.

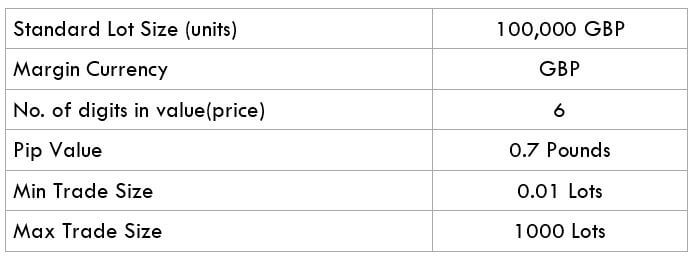

Trading Range in GBP/XPF

Volatility is an essential factor that every trader should take into consideration before entering the market. The amount of capital we will win or lose in a given amount of time can be evaluated using the trading range table. Here, the trading range is a representation of the minimum, average, and maximum pip movement in a currency pair. This can be evaluated simply by using the ATR indicator combined with 200-period SMA.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a significant period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

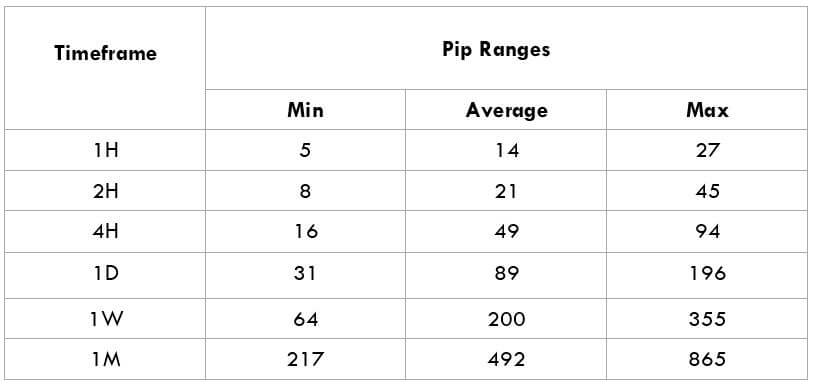

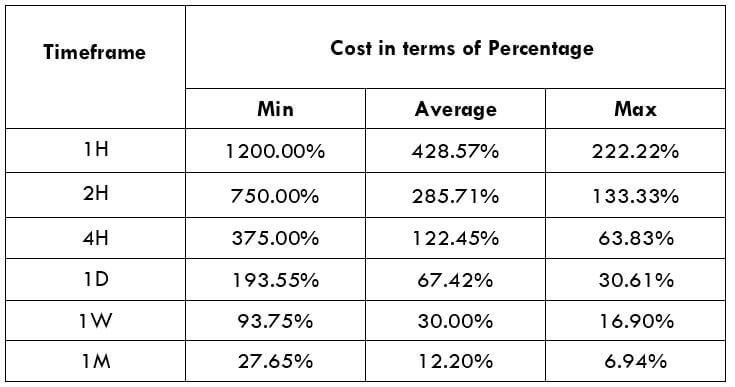

GBP/XPF Cost as a Percent of the Trading Range

The cost of trade depends mostly on the broker and also varies based on the volatility of the market. We have various costs involved in the overall trading cost that includes slippage, spreads, and sometimes the trading fee. Below is the calculation of the cost variation in terms of percentages. The conception of it is discussed in the following sections.

ECN Model Account

Spread = 52 | Slippage = 3 |Trading fee = 5

Total cost = Slippage + Spread + Trading Fee = 3 + 52 + 5 = 60

STP Model Account

Spread = 55| Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 55 + 0 = 58

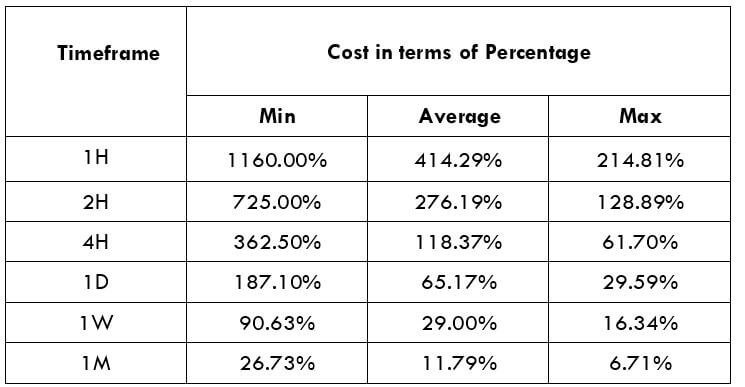

Trading the GBP/XPL

There are some currencies that are very less traded in the foreign exchange market. These currencies are called exotic-cross currency pairs. GBP/XPL is one such exotic currency pairs. Further, the average pip movement on the 1H timeframe is only 14 pips, which is considered to be very less volatile.

We also have to note that if we trade in a low volatile market, our trading will be very expensive. However, It is recommended to trade in a currency pair with medium volatility. To comprehend this better, we will try to understand this with the help of an example.

As we can see in the 1M time frame, the Maximum pip range value is 865, and the minimum is 217. Now when we compare the trading cost in accordance with the pip movement, we note that in 217pip movement fess is 26.73%, and for 865pip movement, fess is only 6.71%. So overall we can conclude that trading this pair will be very expensive.