Hello, and welcome to this latest edition of courses on demand, brought to you by Forex Dot Academy. So, in this course, we’ll be looking to provide you with a pretty comprehensive introduction to what’s called Elliot wave theory. So, just before we begin, there is, of course, inherent risks involved in trading the financial markets. So, please do take a brief moment to familiarise yourself with our disclaimer, if you do need to stop or pause this recording do feel free to do.

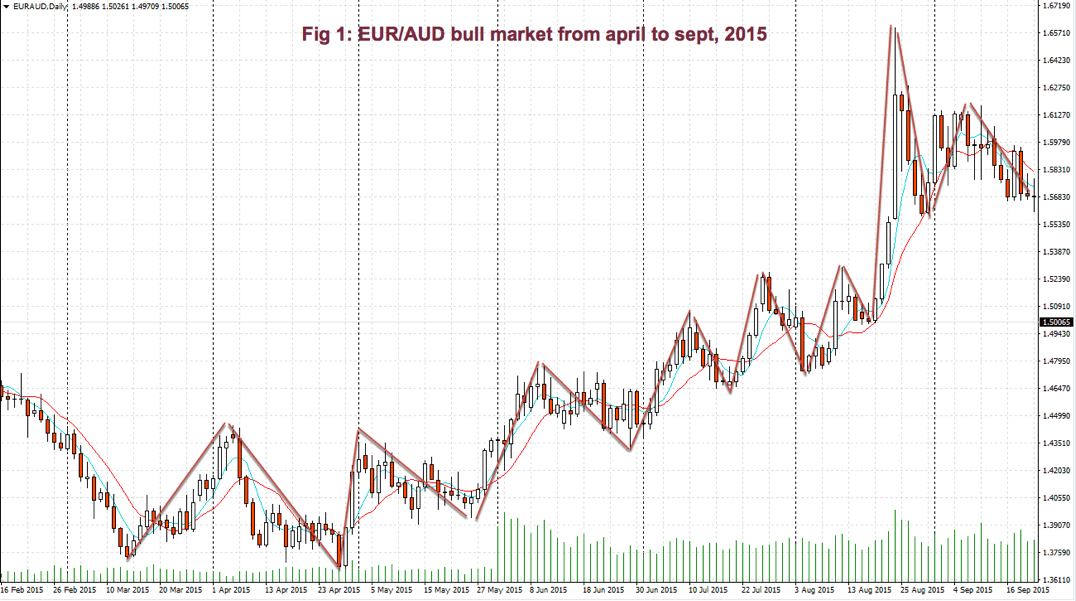

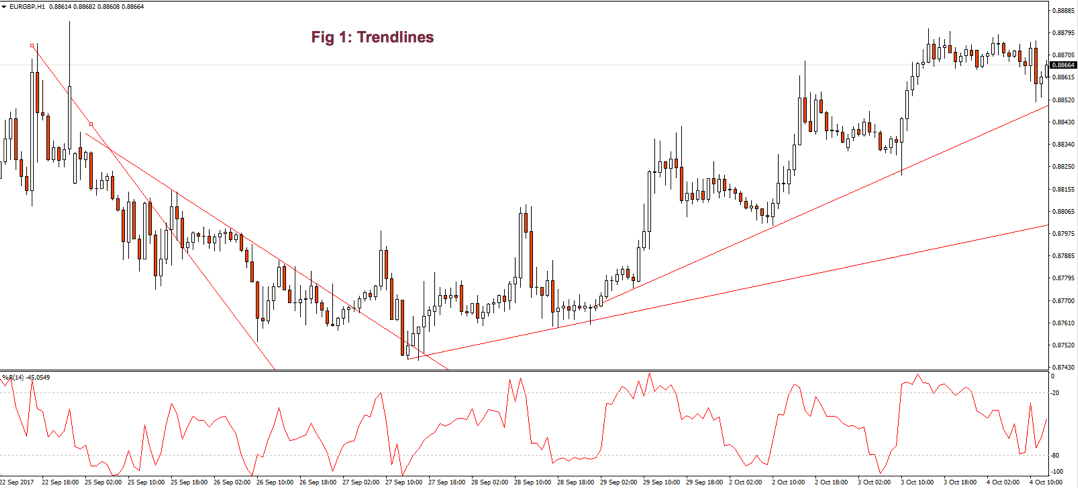

So, okay, let’s start with a very brief webinar outline we’ll start by giving you an introduction to Elliot wave theory! We will explain the origin of Elliot wave theory, and a little bit about the creator, and how this whole theory came about. Then we’ll have a look at the actual Elliot wave theory itself, and it’s referred to as the five-wave pattern. Now, within that there is what’s called impulsive waves we’ll have a look at those we’ll have we’ll have a look at corrective waves, and the fact that these wave patterns do repeat themselves, and of course there are variances on these waves as well. So, you can have a situation where you can have a series of waves even within waves. So, all this will become very transparent very shortly, and we’ll have a look at Elliot wave theory in practice as well. So, you can see it on a price chart, and we’ll finish by just looking at some of the difficulties that traders can have when applying Elliot wave theory okay. So, let’s start with an introduction to Elliot wave theory then. So, what’s important to be aware of it is that Ralph Nelson Elliot, and I put a picture of him up on the screen, and developed the Elliot wave theory in the late 1920s. Now, he believed that the markets who many believed behave in a very erratic manner actually trades in more of a repetitive cycle. So, to give you a bit of background behind Ralph Nelson Elliot he was born 1871, and he died in 1948 he was a US Treasury accountant. Now, in his 50s he began to study stock market data looking at price action, and he observed that stock market prices trend, and reverse in recognisable patterns, and this of course then was able to give birth to his Elliot wave theory and. So, to just encapsulate what the Elliot wave theory is. Now, this is a theory which suggests that market moves in clearly defined sequences of highs, and lows in a very repetitive manner and. So, the Elliot wave theory studies the movements of these sequences. So, at this point, I’d like to bring up just a fairly generic price chart, and because there is a couple of things before we begin that we would just need to point out to you. So, firstly it’s just important to know that our to recognise Elliott wave theory as a technical tool effectively which is used exclusively by technical traders, and what it sets out to do is also as well, it’s important to embrace the fact that markets are continually prone to trending, and reversing am I even in a linear fashion, and this particular chart is just a typical example it is a US dollar monthly price chart but what you can see is that this chart can move in a particular pattern either to the downside or to the upside. So, it can go through periods of trending lower in a very repetitive fashion, and of course, you can get slight reversals of that where you’re getting pullbacks in price action off those levels, and then you can reestablish these trend patterns. So, this is what Elliot was interested in is identifying, and trying to understand what is going on with these market movements, and of course the same applies to the upside you can go through periods of price action, and of course, be able to identify the pullbacks as well.

So these markets constantly go through periods of trending either to the upside or to the downside. So, you could have this just trending market on a number of occasions trending to the downside, and therein lies potential opportunities for your bears to look to the seller’s market, and you also get these opportunities to buy these markets as well, for your Bulls. So, markets never move in a linear fashion; they do not move in straight lines. So, we have to acknowledge that markets move in trends, and they reverse, and then they can move in trends as well, they can go through also periods of consolidation and. So, this is just the nature of the way that the markets operate. So, that’s just a little bit about just a brief introduction to Elliott Wave, because we’ll explain it. Now, in considerable more detail, and we’ll start with the basic principle of the Elliot wave theory is the five-wave pattern. Now, what this suggests is any major movement will unfold in a pattern of five waves, and in turn will be corrected via a pattern of three waves going in the opposite direction. So, just imagine this diagram here in the middle of your screen represents price action, and the movement of price, and we can identify that this market creates a high price point number one you can see it then pulls back to two it moves higher to three it then pulls back again to number four, and then we this market seems to peak at the fifth wave which is the fifth impulse pushing prices higher then look what happens, because the five-wave movement can be split into two distinctive segments, and we look at each segment very carefully but what happens after we see a price point they’re on-screen at five at the fifth wave we can then see that the market makes a reverses, and it makes a low at Point, and it then tries to push higher fails to make a new high, and makes a high at point B, and of course makes a third wave pattern to the downside in the opposite direction of the initial move. So, this is your impulse, and this is your correction. So, what Elliott would do, and he’ll be analysing a lot of price data is he’d be identifying these patterns existing in the markets either on the impulse side, and then looking at the correction side, and what he suggested was there’ll be interesting opportunities at these points, if you can identify them for opportunities to buy these markets at these levels and, if you can identify one three, and five what it will do for traders is potentially give them an opportunity in this case to sell the market, and benefit from this reduction or pullback in price action, and you can use this five-wave pattern to do that followed by a three-wave correction, and that is the basic premise behind Elliott’s wave theory. So, we will apply this technically in a chart very shortly, but I do want to just focus a little bit more on the impulse wave, and it’s being able to identify these one two five waves which we’ve just highlighted there in the box. So, this trend phase is known as the impulse phase. So, we’re getting impulses to the upside on again on numerous occasions, and I shall just briefly change the -colour. So, we’re getting these impulses pushing prices higher from these points on a price chart, and this is the end of the essence of the impulsive segment of this particular wave. So, we’re getting that trending price action pushing prices higher. So, this is the numbered phase. So, the first five phases are actually broken down as the numbered phase.

So, you’re looking for one two three four five-wave patterns on a chart, and an impulsive segment one two five is itself constructed as a series of five waves of which one three, and five impulses are of a minor degree. So, we’re experiencing a nice sizeable move in price action from the low to the outright high, and we’re able to identify with our understanding of this impulsive segment or the impulse waves, and we’re identifying potentially tradable opportunities within that okay. So, that’s just a little bit about the impulse wave. So, moving on to. Now, the corrective wave, and which we’re again going to look at the same representation of price action but actually there’s a little bit more to the corrective segment the corrective part of the corrective wave and elements of this particular Elliot wave theory. So, trends move in a series of peaks, and troughs or highs, and lows, and other technical analysts would refer to one as a high would refer to as a low would refer to three as a higher high will doing a slightly bigger would refer to for as a higher low. So, really it’s just a chain a slight change in terminology, and this number five would be a higher high once more. So, as price drives to the upside in phase one up to phase three, and up to phase five this the corrective wave actually focuses on the parts of the wave which result in prices pulling back. So, we also have the lettered phase as well, is known as the corrective segment, and has always counted in threes. So, whereas we’re looking for five waves to the upside, and we would also be looking, if you’re applying Elliot wave theory three waves to the downside in this particular example, and they’re always counted in threes, and to differentiate between the impulsive and the corrective wave we’re. Now, looking at ABC in terms of a price move. So, highlighting wave number two, and number four of the impulsive phase are also corrective waves, because those are the lows that are created, because of a correction of price, and that’s just means we get a pullback to that to that low, and that creates our wave number two, and wave number four. So, once we’ve satisfied that we see wave 1 then we see wave 2 we see a push higher at wave 3 we see the pullback at bay 4 then this constitutes Elliot the Elliot wave theory, and where you make a higher at 5, and then you see the reversal in that price action or the corrective second or the corrective wave. So, in addition to that waves 2, and 4 as a result of the impulsive phase are also corrective waves wave 2 corrects wave 1. So, we’re getting this push higher. So, this lower here correct the price action, because we don’t see price action moving in a linear fashion, and it does move in this impulse to the upside followed by a pullback followed by a further impulse followed by a pullback. So, it’s just following that as a narrative but being able to visually identify it on a price chart we have a look at some price charts very shortly to show you this in a little bit more detail. So, just be aware that wave 2 corrects wave 1, and of course wave number 4 corrects wave 3. So, the correction always comes after the impulse, and ABC is the corrective phase of waves 1 to 5. So, this is the corrective segment. Now, wave 2, and 4 is the individual correction, and then we enter once the price peak at 5, we then enter the corrective segment creating an A, B, and C corrective wave in this example. Now, other tools can be used to help identifying where a market will pull back, for example, at fib levels. So, you know those that that trade the market using technical indicators that may use fib levels they might draw a fib from the low the recent low to the recent high, and they might be able to gauge where this price action will actually pull back to even at Point a the first corrective wave or Point C which is the second corrective wave pushing lower. So, that can just present with opportunities for traders to actually look to engage with the fib, and there’s obviously many other trading indicators as well, which can be used in a similar fashion that can support the understanding as well, of Elliot wave theory.

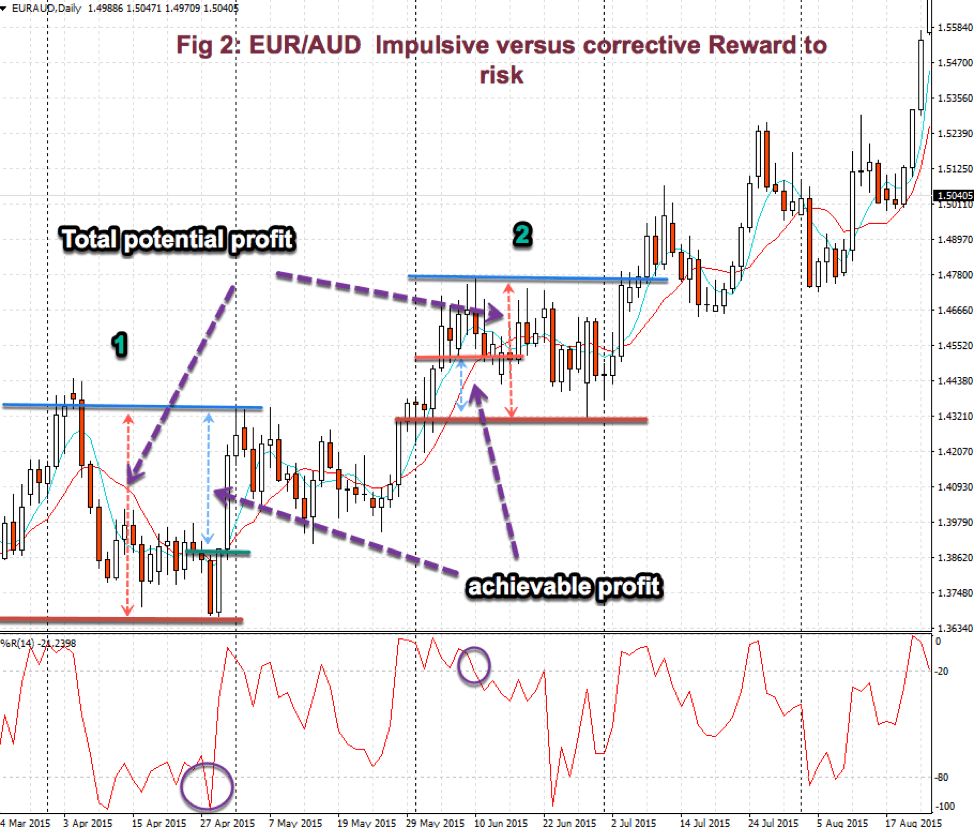

So, moving on then to the fact that what’s important, when you understand the complete structure, and you identify you can identify these five-wave patterns, and you can see them in every chart in some capacity it’s important to understand that you know week you can experience with a very volatile moving chart that waves can repeat themselves on multiple occasions and. So, you can get these smaller waves existing, and these you get your 5 wave impulse followed by your ABC wave correction, and this has the tendency to repeat itself on many occasions especially, if we’re seeing, if we’re in a bit of a trend, and prices are pushing higher again followed by your three-phase correction and. So, the idea is that you can actually get many multiple opportunities of wave repetition, and it can effectively give you a little bit of foresight it’s important to notice what happens in this little phase in here, because what we’re seeing is a reversal in price action where we’re actually creating a series of repetitive waves to the upside followed by a series of repetitive waves to the downside in this particular side of the 5 wave pattern. So, this time we’re creating a five-wave pattern to the downside followed by again just to reiterate myself a three-wave corrective ABC pattern, and then that rolls in once more to an additional impulsive wave but this time to the downside. So, it is important to take on board the Elliott Wave it could be very useful in certain capacities to be able to analyse, and see what’s going on, and of course what you can also, and this is where Elliott Wave can start getting a little bit more difficult, but you can also have larger Elliott Wave signals even over, and above your smaller waves. So, this is effectively a five-way signal, for example, perhaps even on a much bigger timeframe, and you get your corrective phase as well. So, it’s just basically having an understanding of all of these aspects of the five-wave pattern, when it comes to Elliot wave theory okay. So, moving on then to the principle of, and we’ve kind of alluded to it already it’s the fact that you can find waves within waves. So,, if you look at this particular chart here it could be a one-day chart for example will have an impulsive segment where you can clearly identify the waves wave 1 2 3 4, and wave 5, and then you identify the corrective phase of ABC, and that could be on a one-day chart but. Now, you decide to have a look at a one-hour chart at this point, and what you can see even within one of these phases from 0 to 1 let’s say you can you can really experience on a smaller time frame many more opportunities which exists that that replicate this kind of wave pattern in a form of a phase whereas what you can see on a bigger timeframe is more of a linear move let’s say before you get that corrective pullback, and but you know you can always find waves within waves, because this theory can be applicable to any particular time frame on a price chart, and as the market moves it in favour you can see that this market would look at this kind of phase and will be able to contribute or correlate the impulsive wave followed by again just to repeat myself the corrective wave, and this can happen over, and over, and over. So, just bear in mind the principle of the fact that you can see experience, and identify waves within waves, and that does arm you with a lot of the knowledge, and understanding about Elliot wave theory, and how to go about applying it okay. So, what we want to do is exactly what we want to show you the five-way pattern in practice you know how can you go about identifying you know these levels, and these waves, and what decisions kind of trade, and make to try, and capitalise on them. So, what we’re going to do is we’re going to identify some significant areas we can see that we’re getting a little bit of an uptrend impulse here two-point number one. So, that would be a potential starting point for those traders that study Elliot wave theory creating a corrective wave at point number two then we’ll see that thrust, and this market creates another impulse driving prices to the upside once more at point number three before we would then get a slight corrective wave in this particular market before we get a really nice explosive move in this market to the upside, and what a trader who looks to apply Elliot wave theory does is potentially look to get into these markets at the pullback. So, they’d be looking very closely at this price action here, and determine whether they would look to get in to this market, and again, if we identified a fourth wave pattern they’d be looking for opportunities to buy this market, and as you can see you know that can be to varying degrees of success you might take a small winner, if you took a trade from the corrective wave number two, and as you can see, if you got into these prices at corrective wave number four you would have experienced a really explosive move to the upside.

So, so that is your five-way pattern but in addition to that you will also experience a pullback off the high they’re at five. So, you get your you know your corrective pattern falling into place where you get your low price at a then the markets try to push higher, and they fail to do. So, creating point number B a corrective wave B, and finally, we will see our corrective wave at Point C as well. So, that is the Elliot wave theory in a very practical sense. So, those that trade price action to the upside might then look to look for opportunities to maybe buy at this point or potentially sell at point number B. Now, they have a variety of different decisions to be made around C. So, this is where you know this is obviously an introduction to Elliot wave theory. So, there is a lot more to Elliot wave theory. So, hopefully, we’re just giving you a basic sort of introduction to what Elliot wave theory is. So, then what we can see just from this general price section as we start entering, and we can see that price has moved to the upside. So, again we start the Elliot wave process potentially giving opportunities for traders at this point to maybe look to buy at these levels at two, and four, and of course it’s a riskier trade but as opportunities to sell at one, and three as well, however, you must bear in mind that there are consequences, when it comes to risk-reward as well, depending on whether you’re trading the impulsive phase or whether you’re trading the corrective phase. So, that’s just the potential application of Elliot wave theory to a price chart was moving which is moving to the upside, and which happens to be the current pound dollar price chart, and let’s show you the same situation, and this just happens to be the dollar-yen price chart very current price chart, and what we can see from this is we can see that prices are this time moving lower. So, we create the first wave we get a pullback we get a corrective pullback at point number two the markets then move lower at three they pull back to four, and they create a low this time, because whereas before we were looking for a trending market to push lower sorry higher. Now, we’re looking for a trending market to actually push lower. So, in this example. Now, we’d be looking for maybe opportunities to sell at two, and four. So, and again identifying these opportunities can be somewhat difficult, you might be presented with opportunities to buy off these lows; however, again that can impact a trader’s ability to manage risk effectively. So, we will discuss a few of these difficulties very shortly but that is the Elliott Wave pattern, and applying it to a market that is moving to the downside, and of course, we get that corrective phase once more. So, we get to pull back to point a prices try to break lower, and they fail to do. So, we get a point B, and then we get our final point C in this market again presenting some very interesting opportunities to different traders at different price points, and different wave points as well, whether it’s impulsive or whether it’s corrective okay. So, let me just take this off the screen, and let’s discuss some of their the difficulties that traders can experience, when they look to apply Elliot wave theory, and there’s just a few of them to be aware of just going through the last couple of examples there I’m sure you may be sitting there looking at our screen, and perhaps suggesting right well, how, and why did you decide on those particular points?

And how would a trader actually truly look to capitalise on it, because the reality is there’s actually a lot more to Elliot wave theory in terms of your practical application, and, because of that it can be very difficult to use, and interpret for new experience traders. So, it is definitely more for those that have a little bit more experience understanding seeing and identifying price movements. So, there it is regarded that those that have considerably more experience of understanding price movement, and price action might be in a position to be able to apply Elliot wave theory in a little bit of an easier format it can also be difficult to identify the beginning of a wave as well. So, again I’m sure you’ve probably looked at those charts, and said why did you start a point one and. Now, we do. So, for very specific reasons but again a lot of that is more of an advanced sort of aspect to Elliot wave theory traders can struggle to identify entries, and exit prices as a result of identifying perhaps a corrective low point two or point four whatever the case may be, and actually looking to trade that signal is a little bit more difficult, and finally traders do not always understand the effectiveness as a tool from a risk management perspective, and actually that’s a really quite important one because, if you create a corrective low at 0.2 or 0.4, and then those lows can be used as very accurate price points to utilise from a risk management perspective only, if that trader is has a comprehensive understanding of risk management because, if you get a break of those corrective lows then the principal of the Elliott Wave no longer exists this is this really with some of the difficulties that traders can have it would create what’s called structural failures in these markets, and that would actually imply that something else is going to happen in that market, ie that first corrective phase fails in terms of impulsing, and driving prices to the upside it actually turns around reverses it creates that structural failure, and actually then that market is the likely or outcome is for that market to actually be pushing lower instead of initially pulling higher, if we replying Elliot wave theory okay. So, that just about concludes this introductory session – Elliot wave theory. So, we’ve had a brief introduction. So, hopefully, you. Now, know who he is, and what the basic principle of the theory is about we’ve had a look at the five-wave pattern, and that’s broken down in impulsive waves corrective waves, and wav now repetition, and also the understanding that you, you may be able to identify and see waves within waves, and Elliot wave theory as well, in practice applying it to a price chart, and then just touching upon some of the difficulties that traders can have, when applying Elliot wave theory. So, on that note that does conclude this particular webinar. So, thank you very much for joining us on this installment of courses on demand brought to you by Forex dot Academy, and we do hope to see you all very soon. Bye for now.

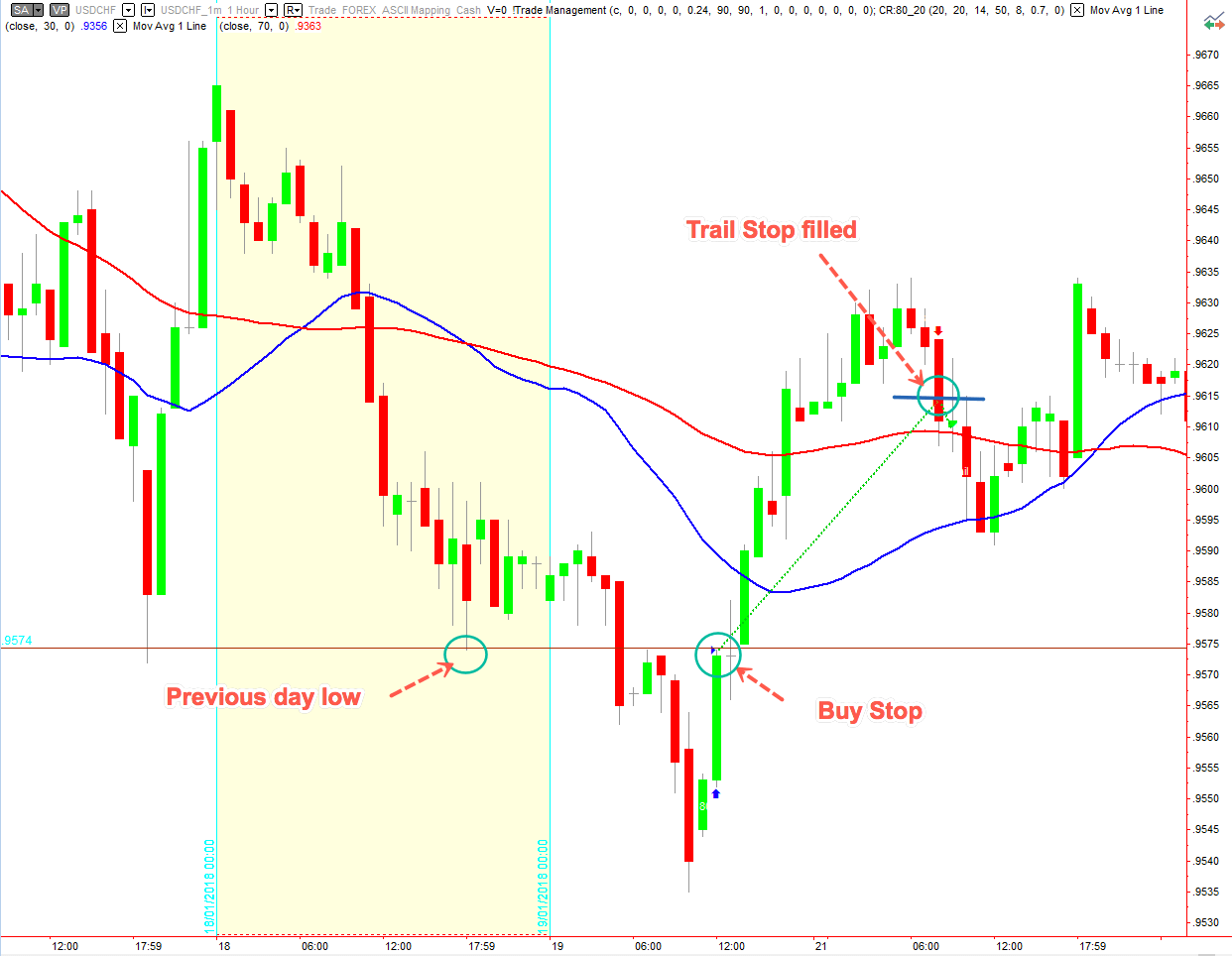

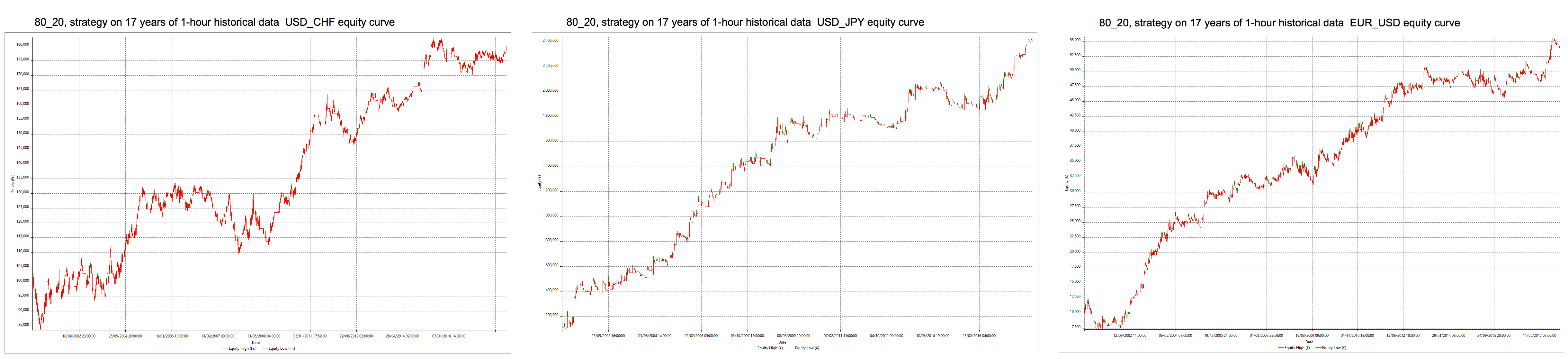

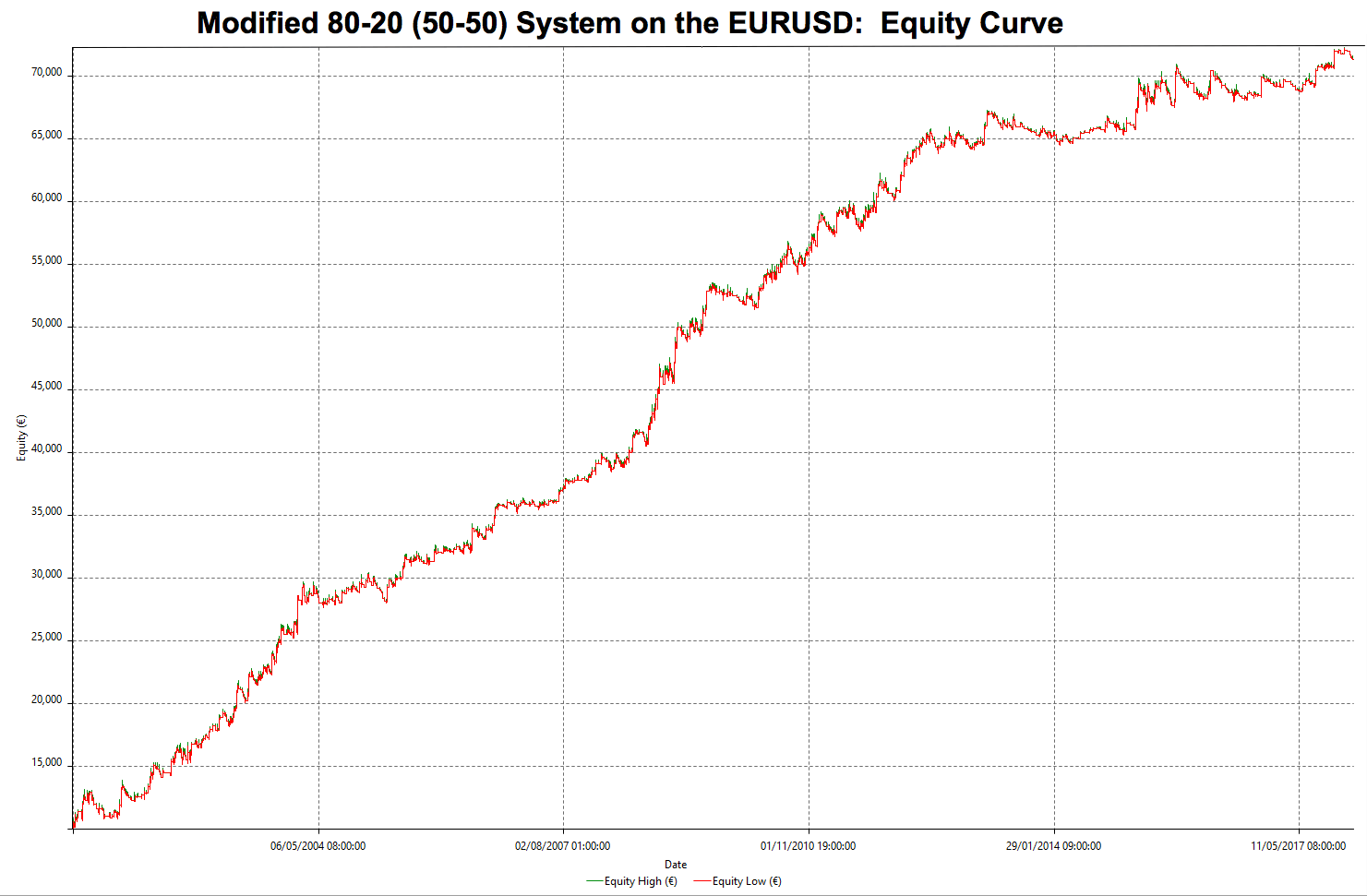

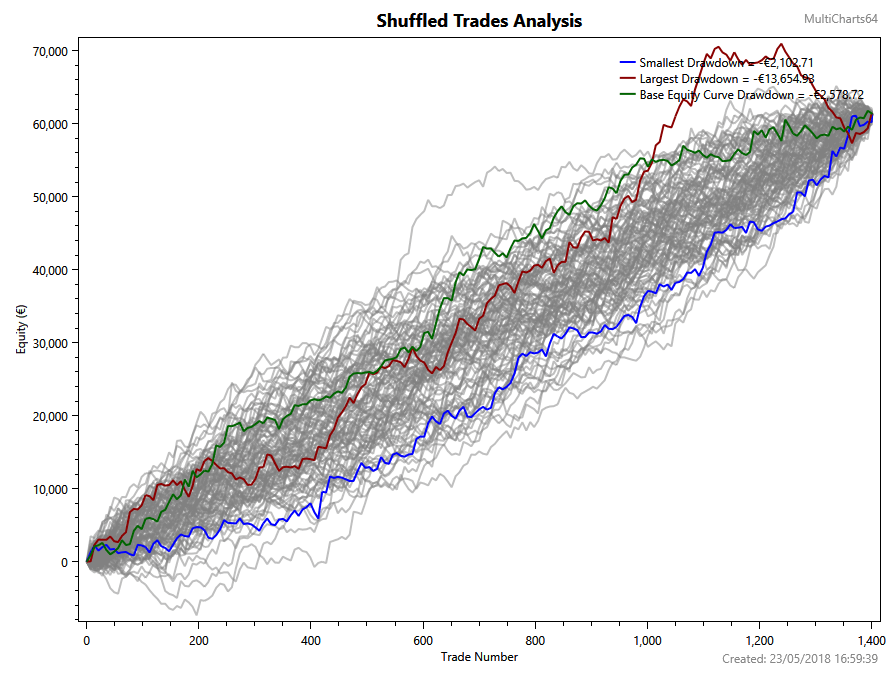

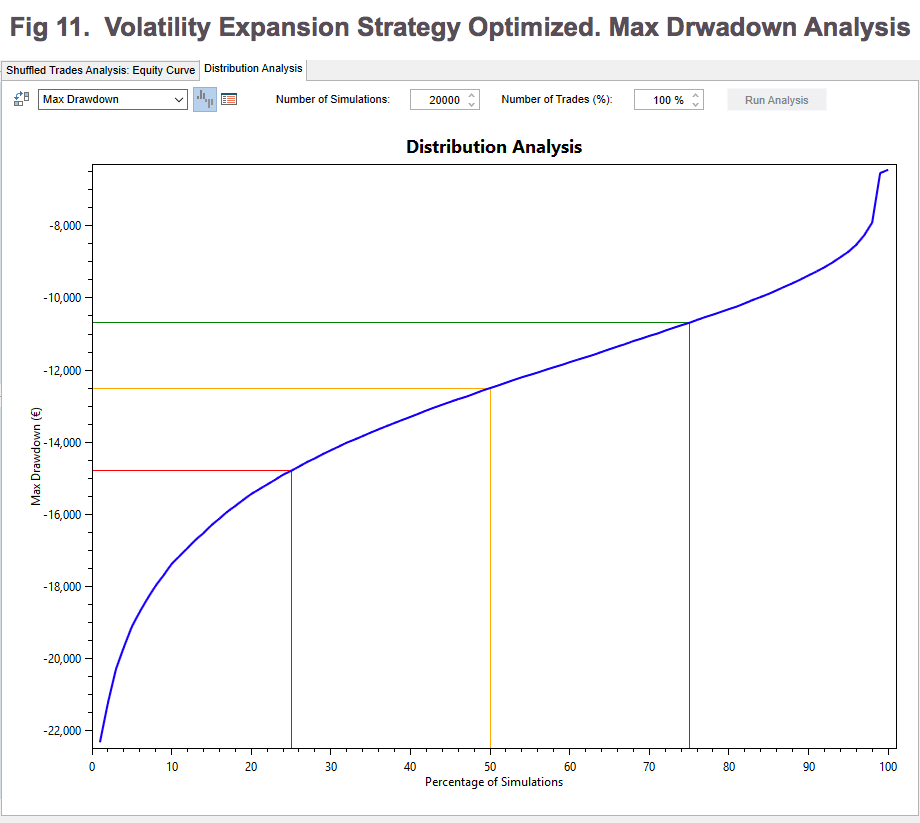

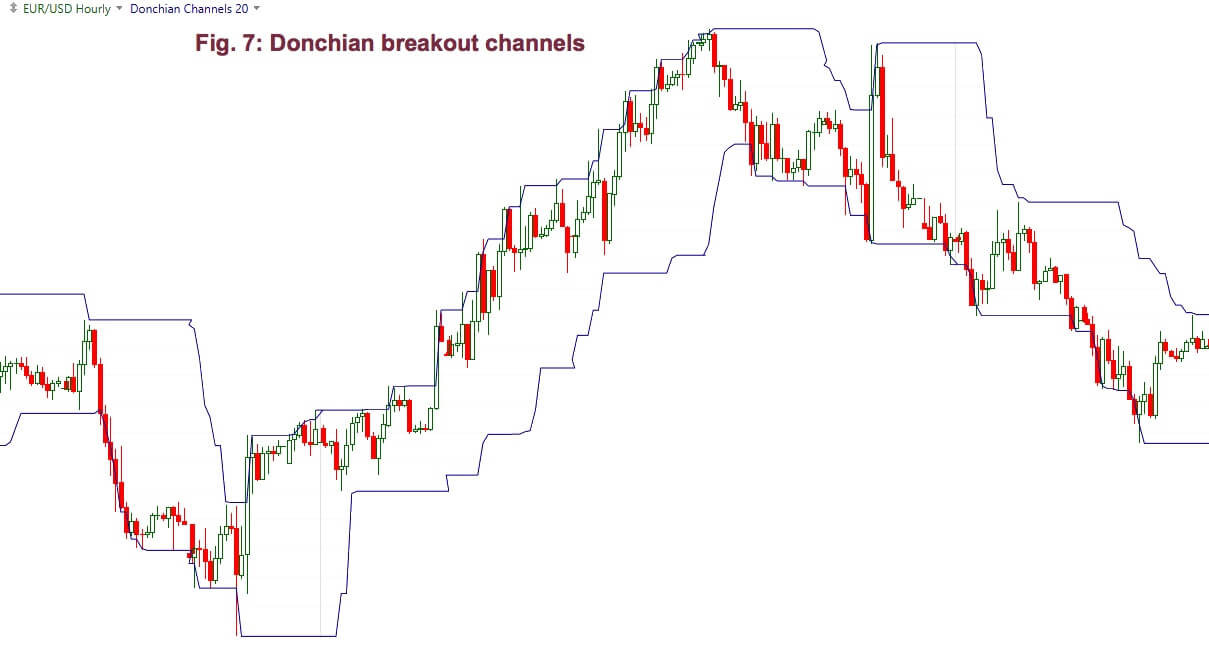

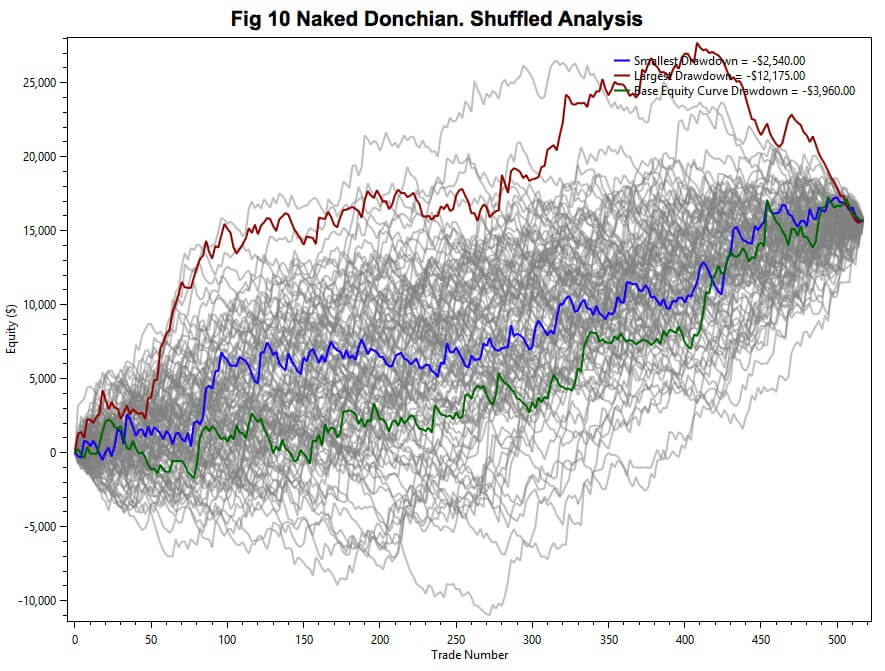

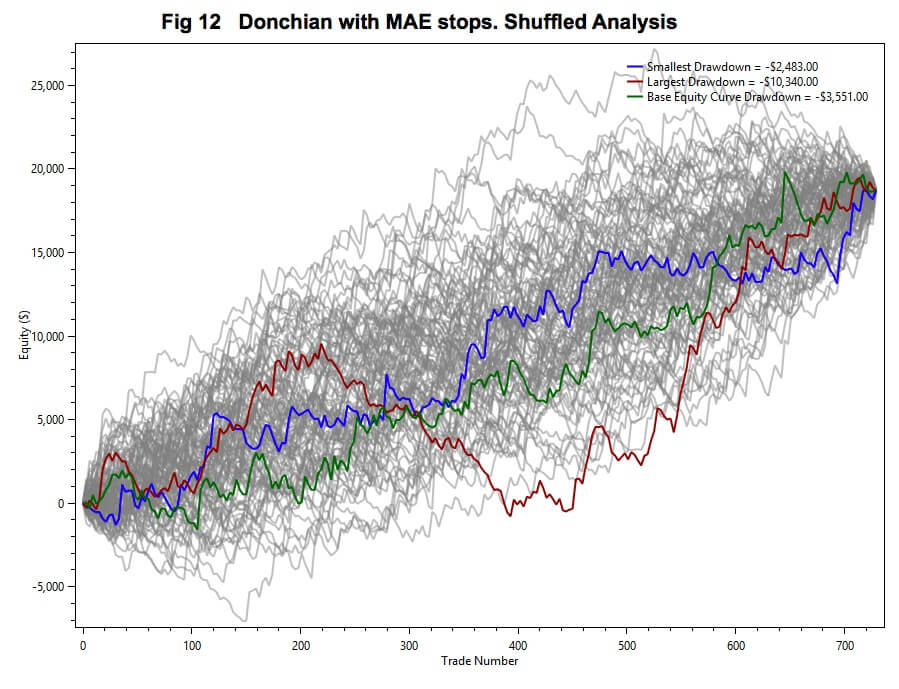

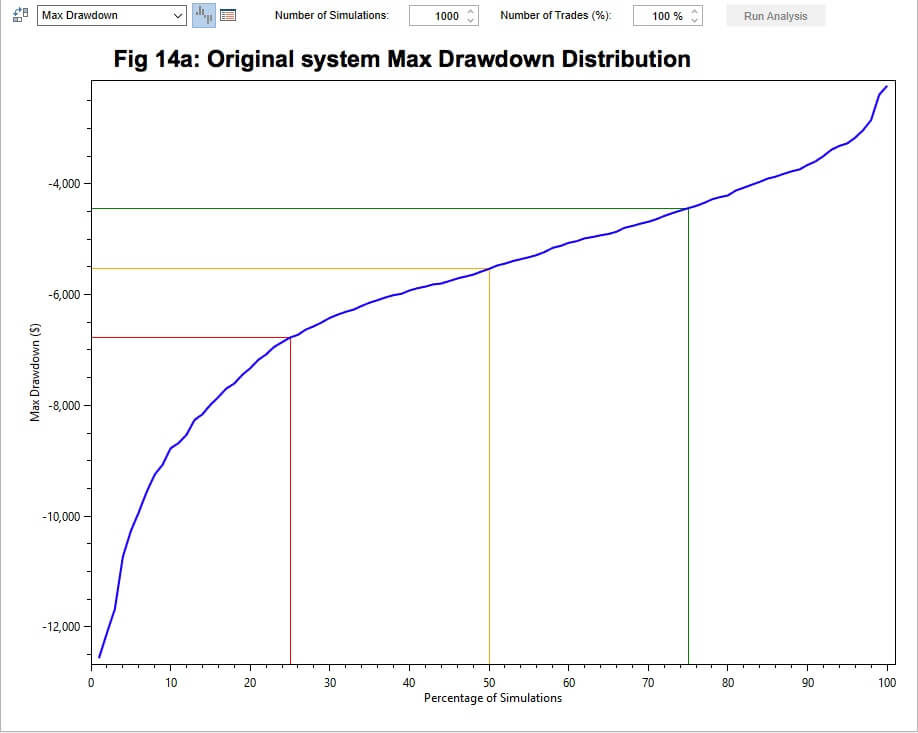

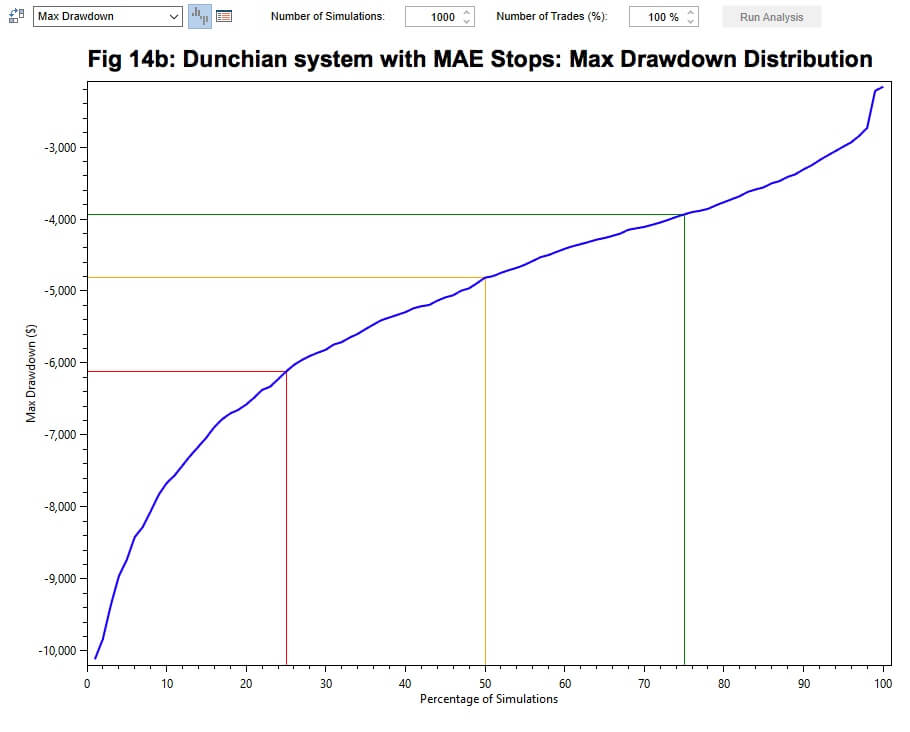

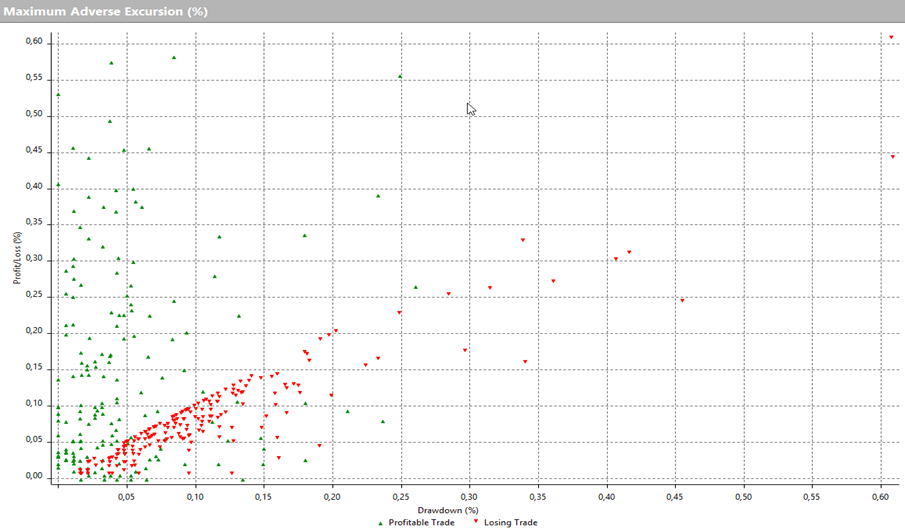

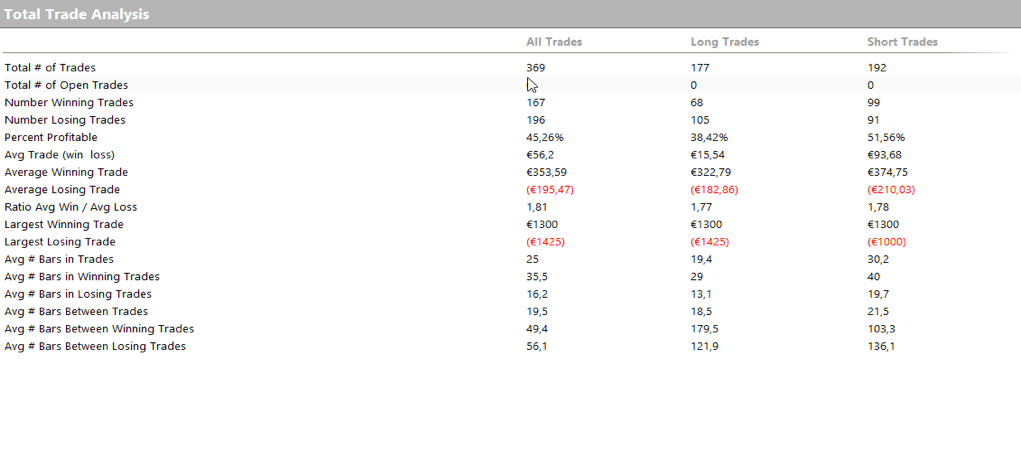

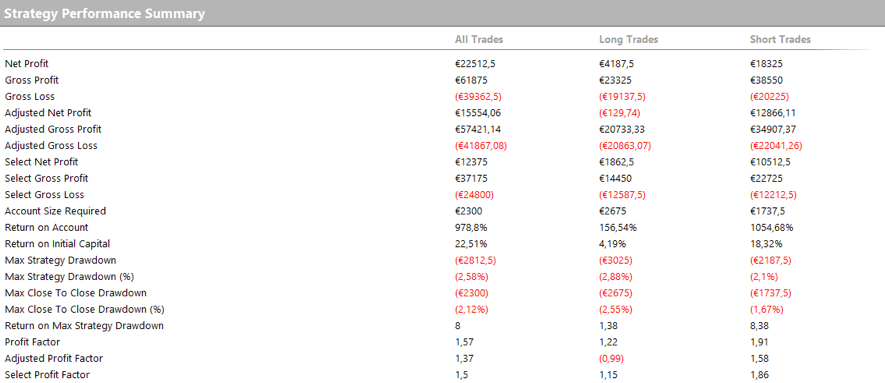

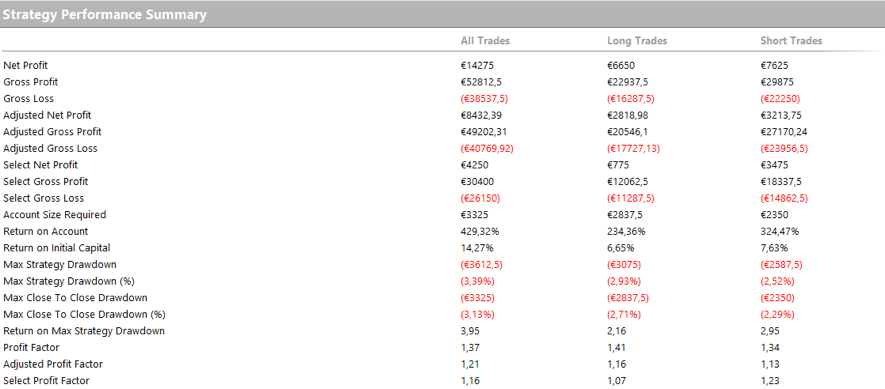

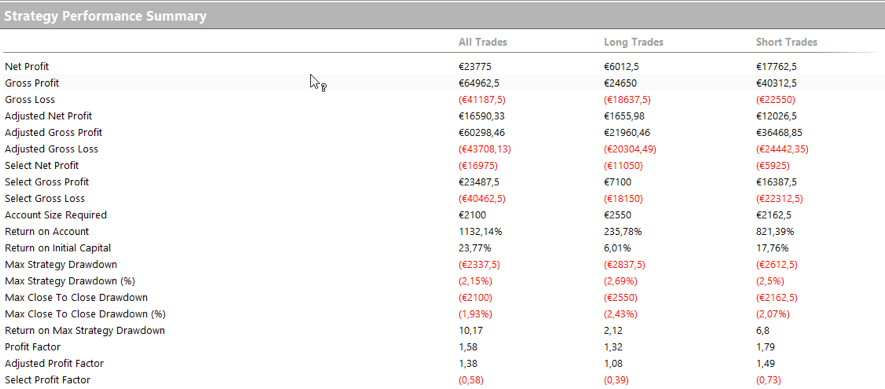

Based on the above results, we set the stop at 0.105% of retraction, and now it looks like this.

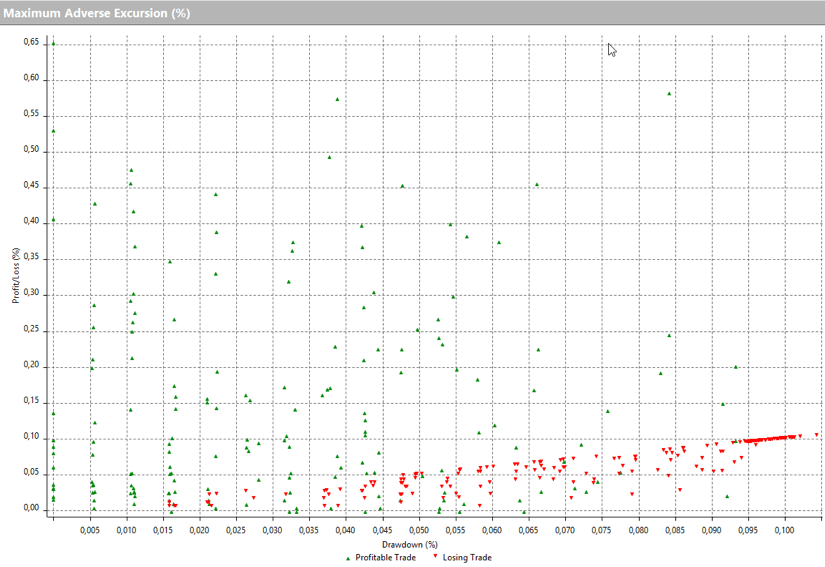

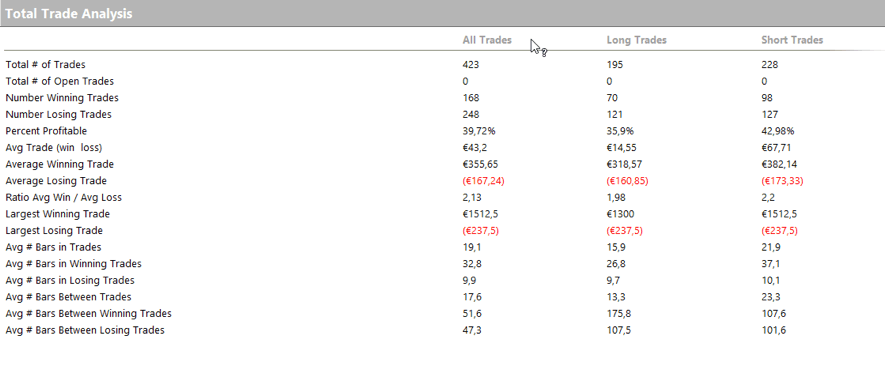

Based on the above results, we set the stop at 0.105% of retraction, and now it looks like this.

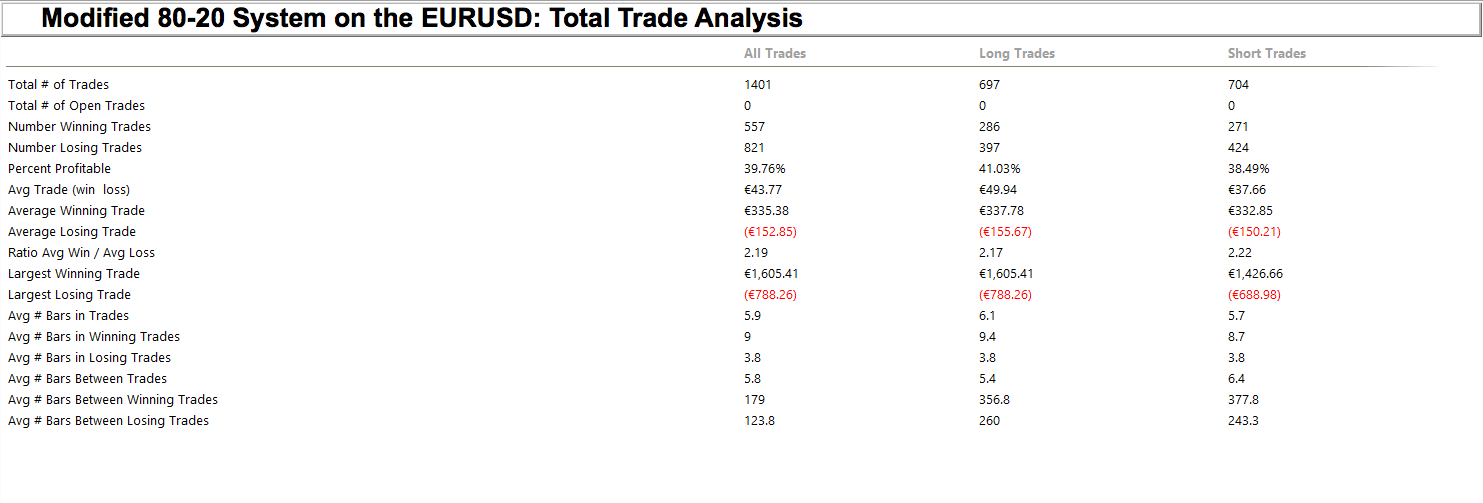

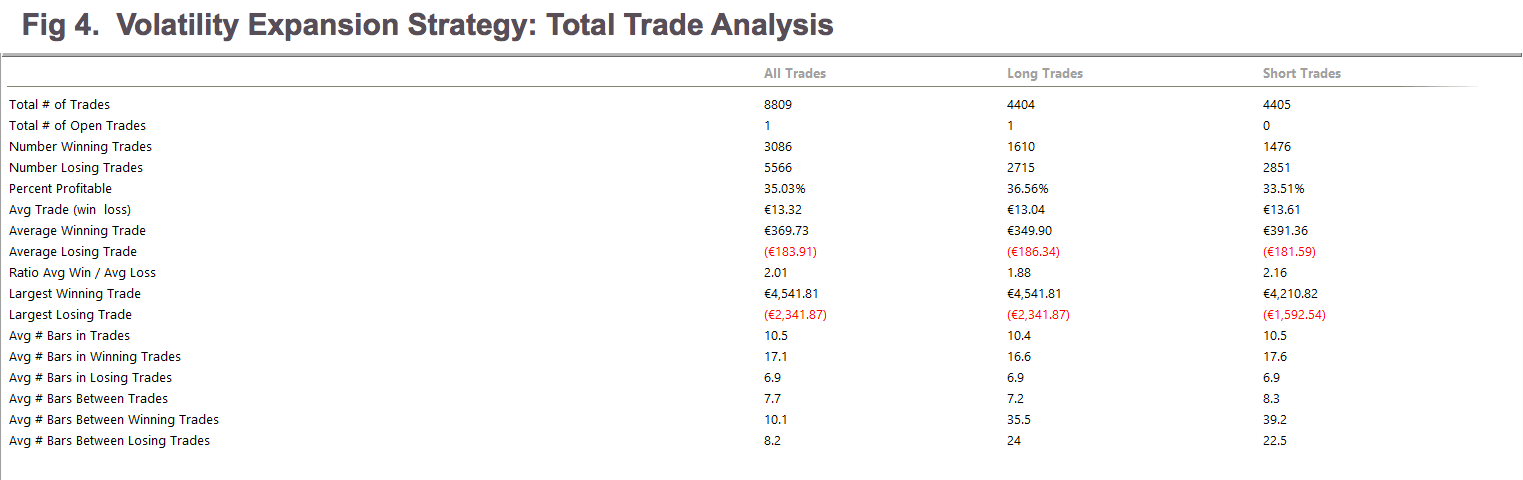

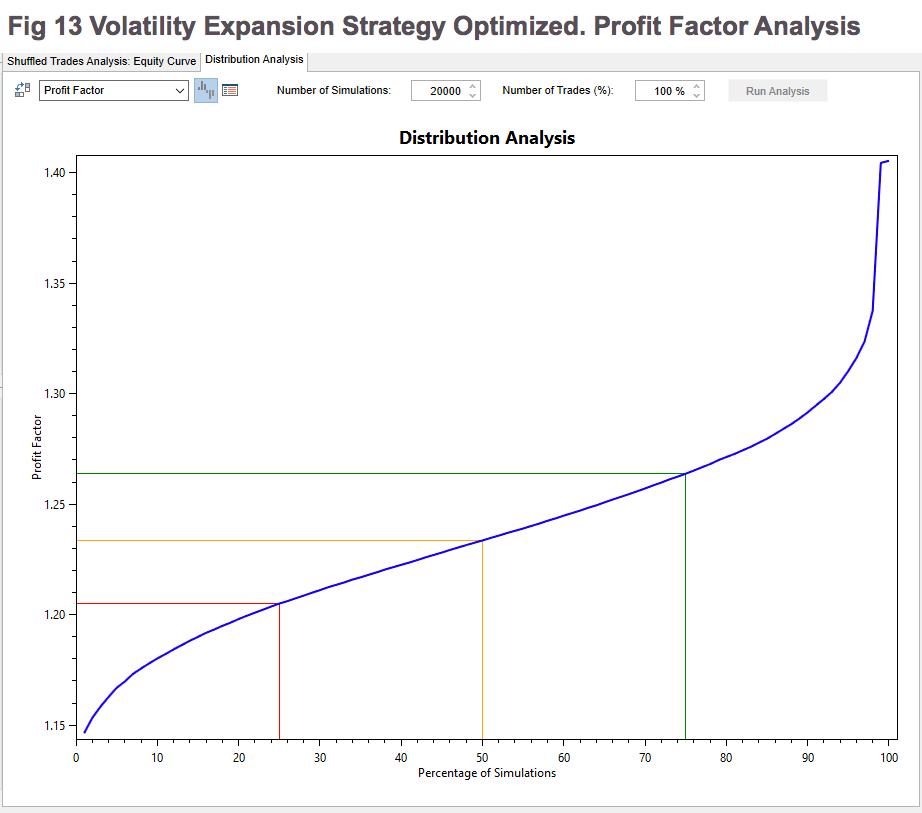

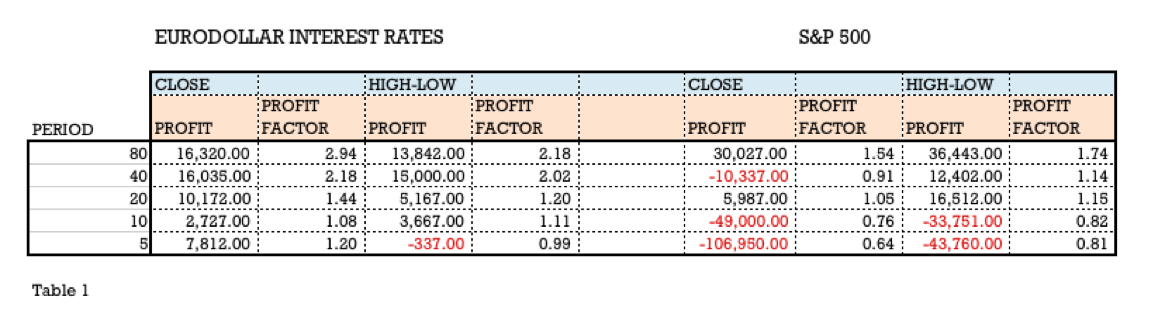

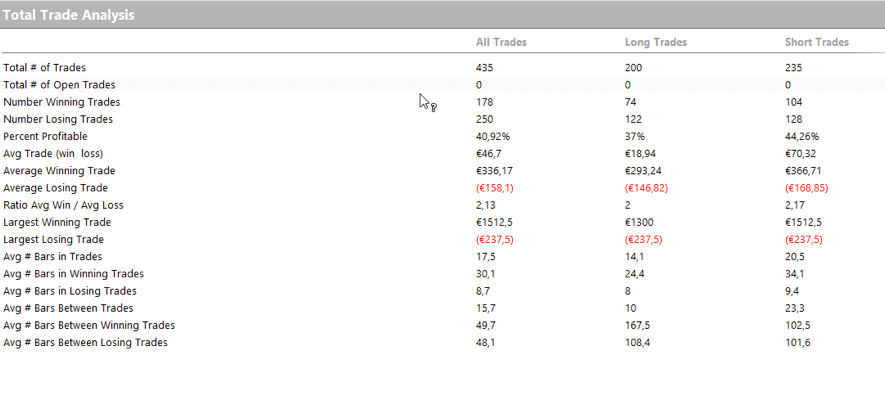

The statistics are as follows:

The statistics are as follows:

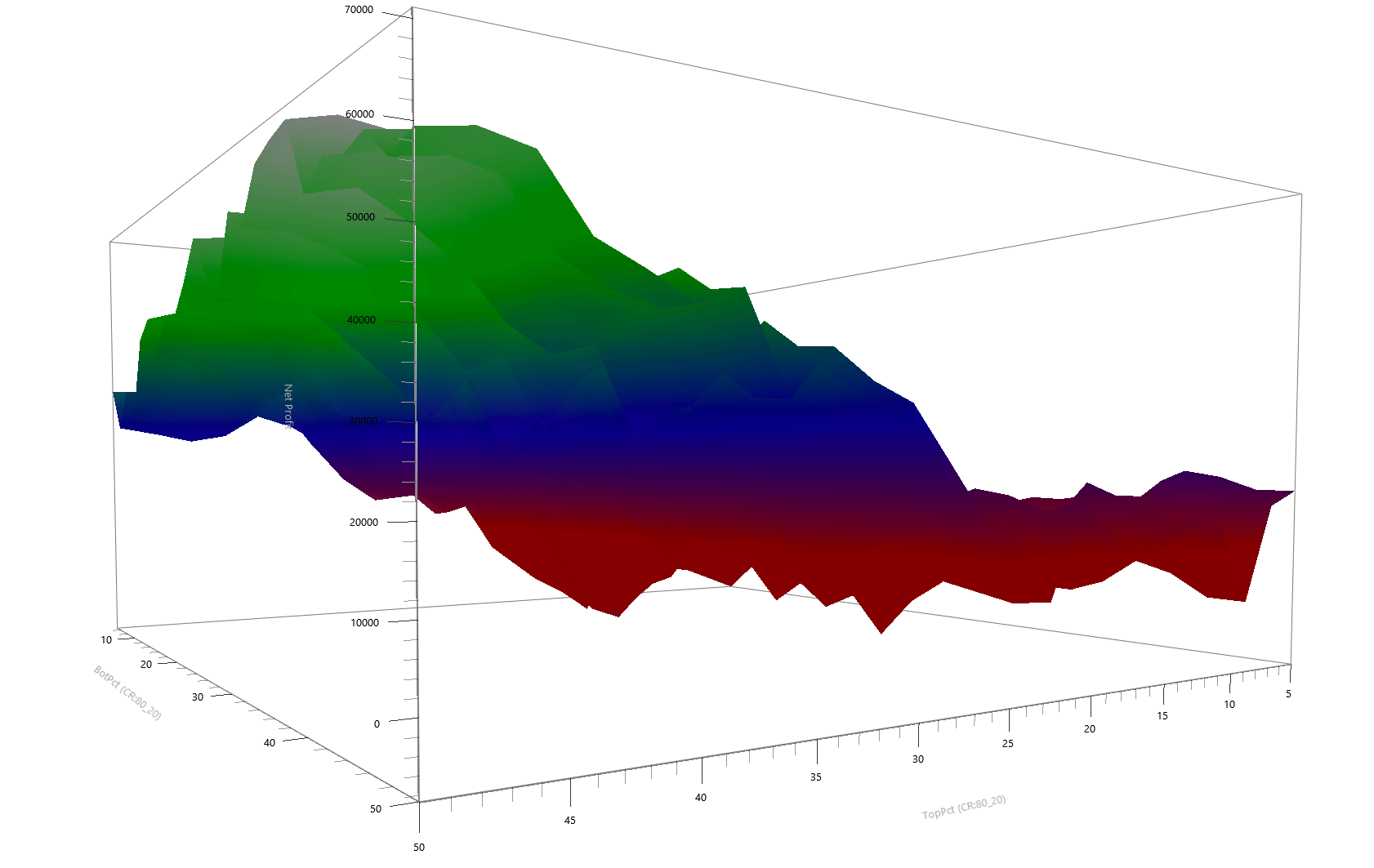

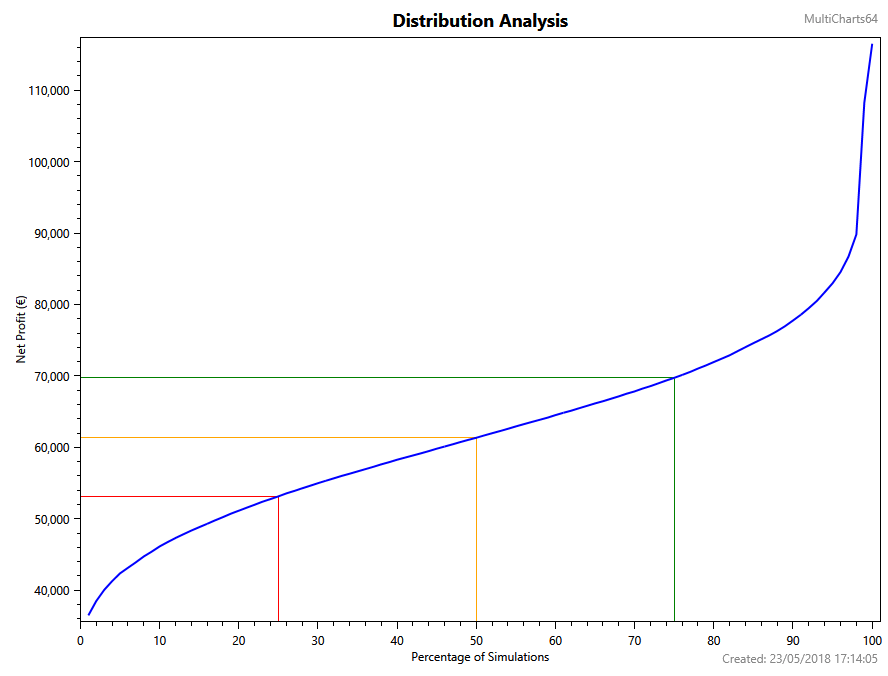

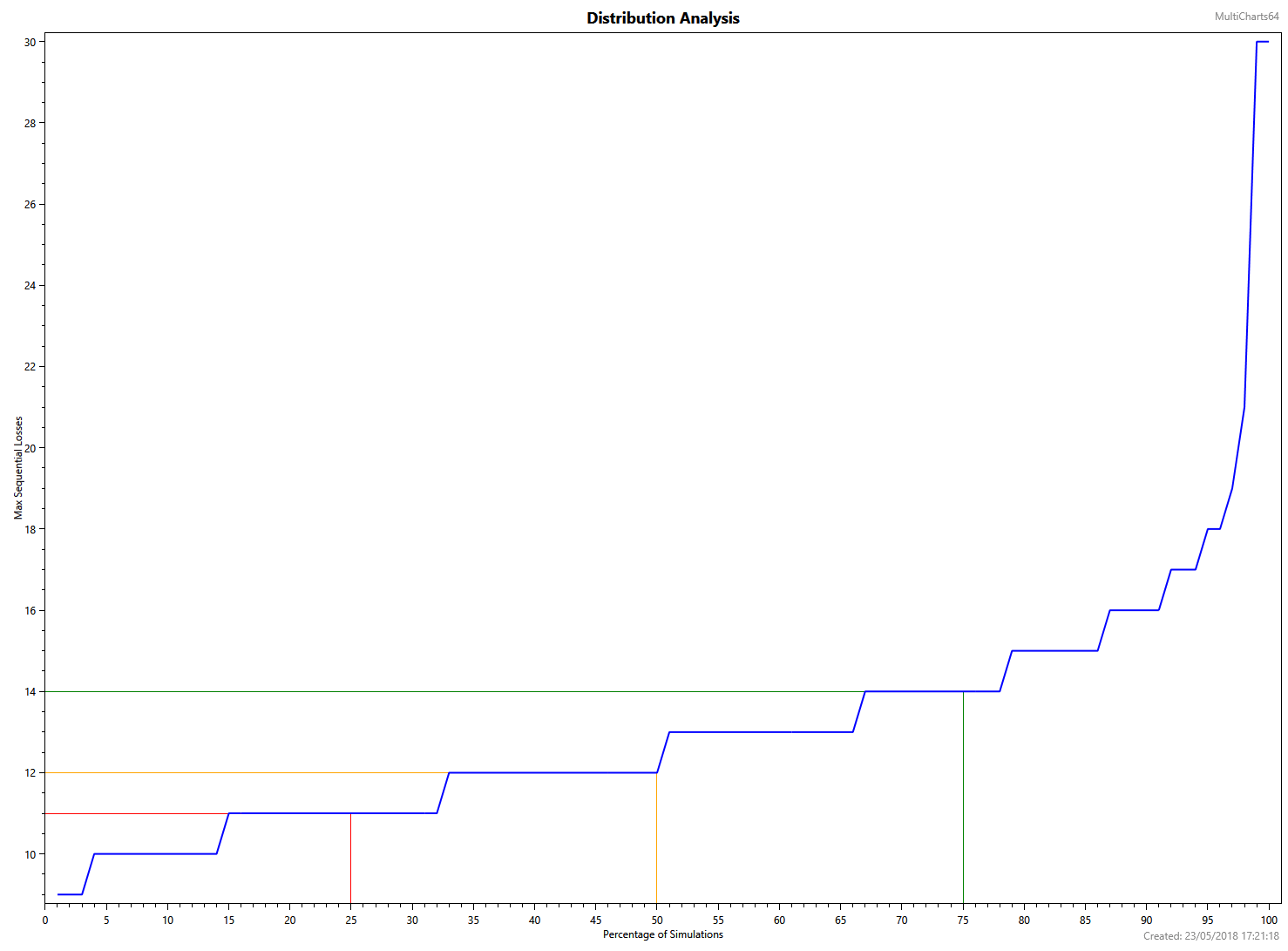

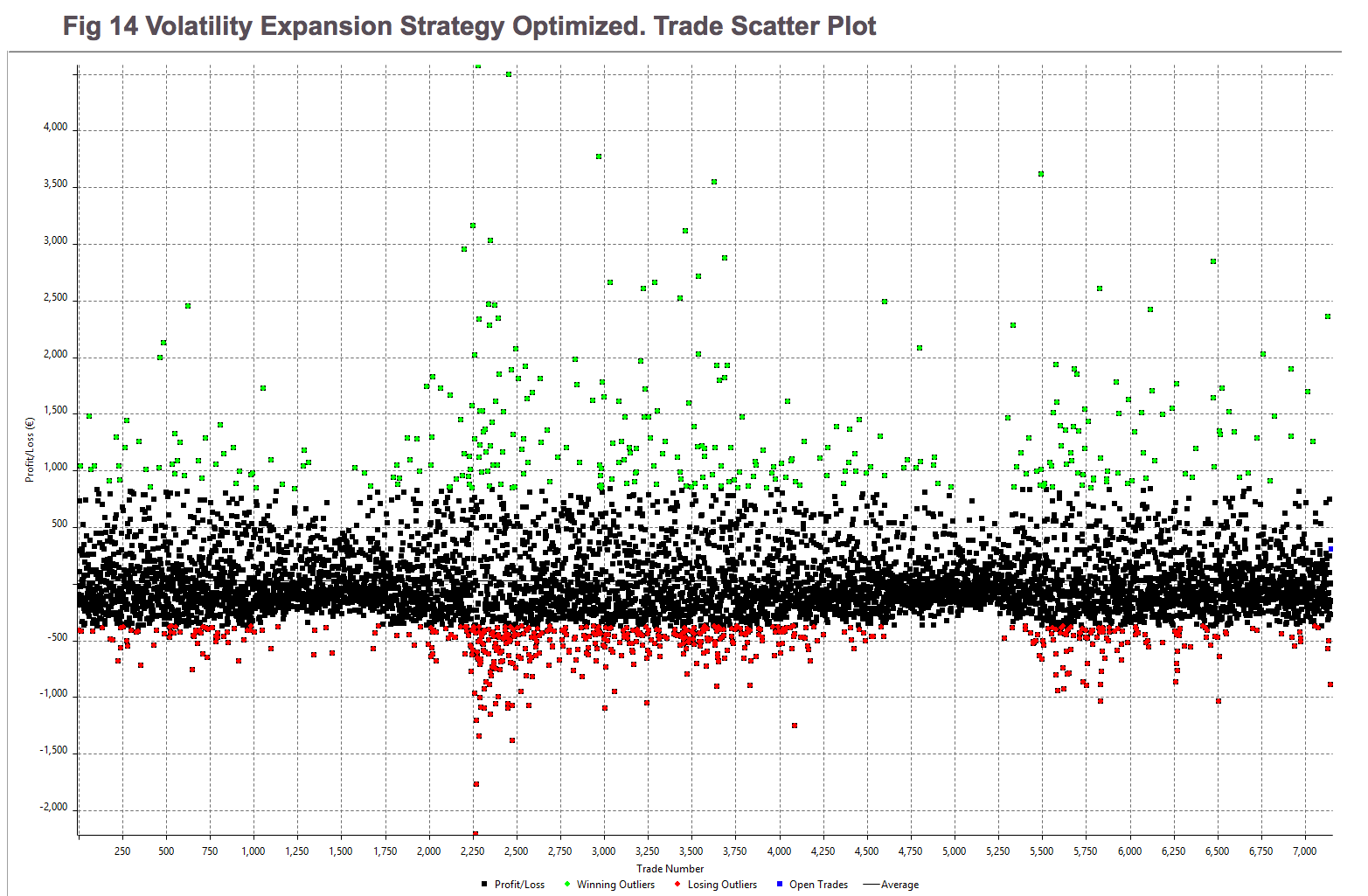

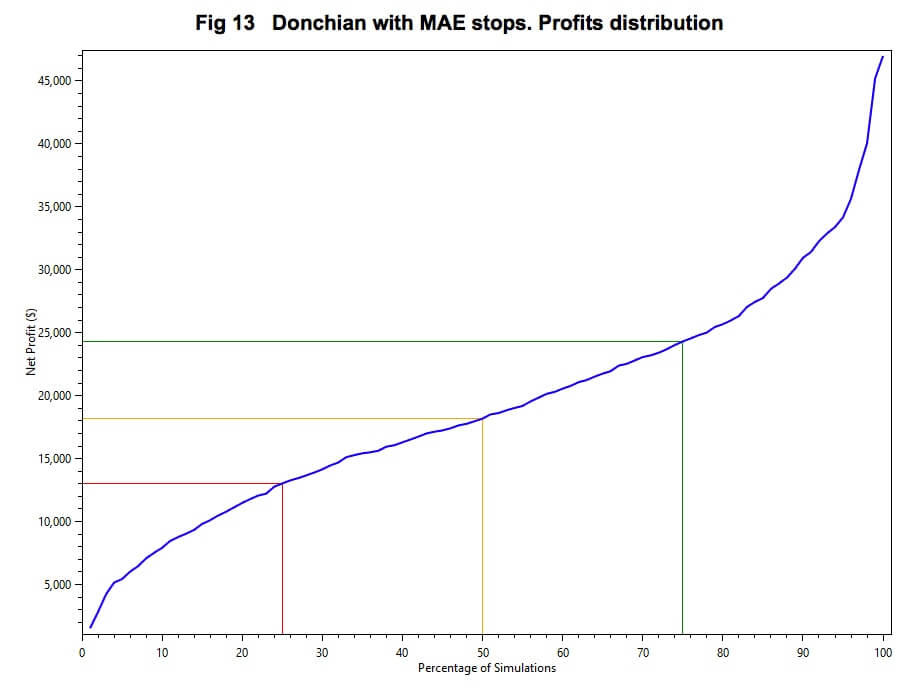

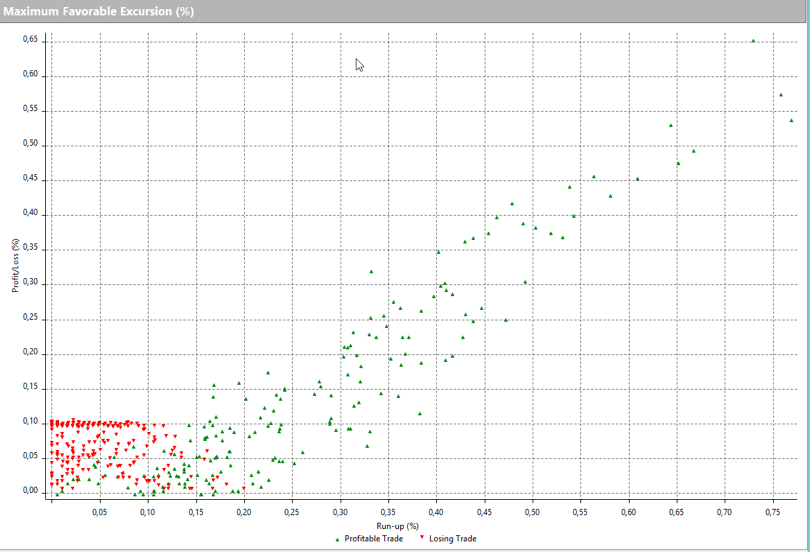

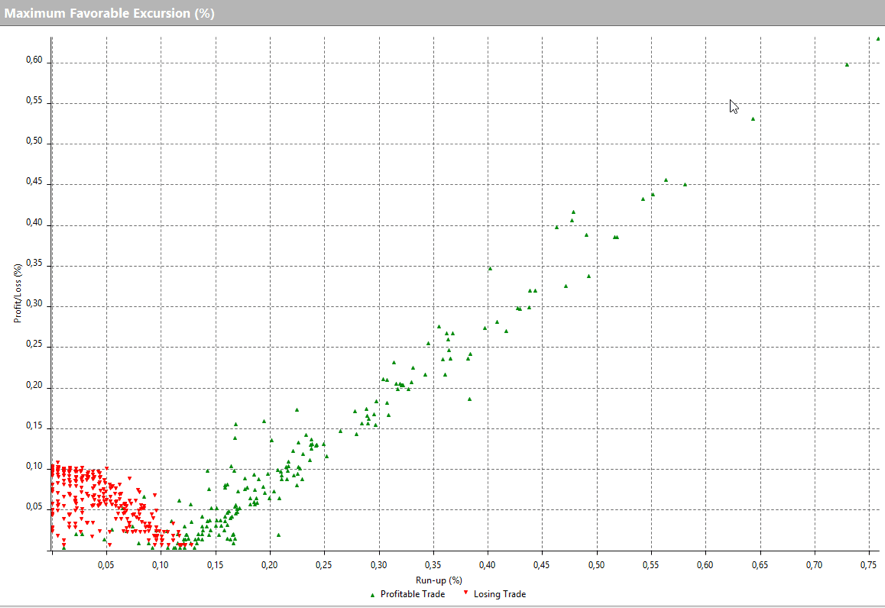

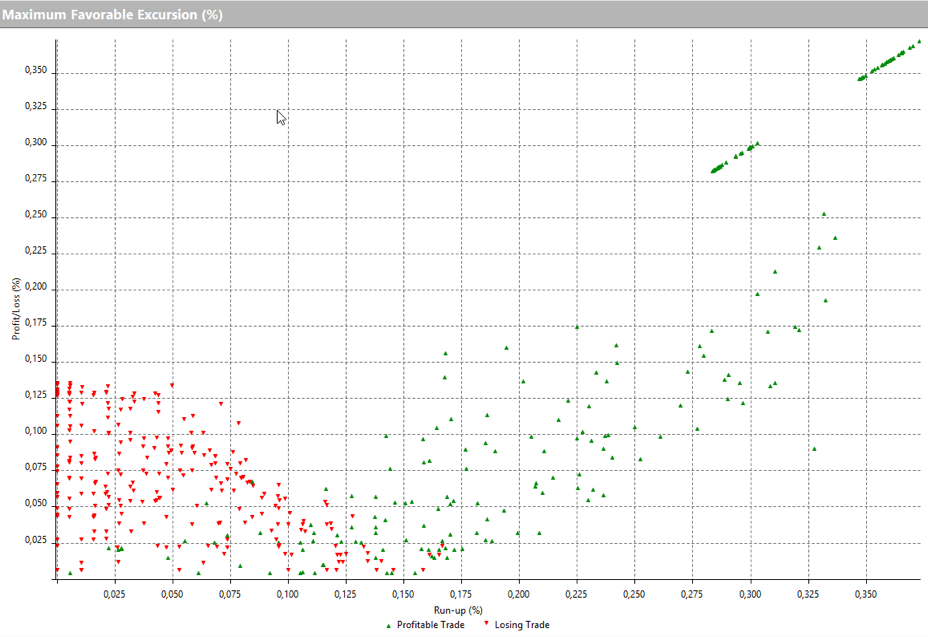

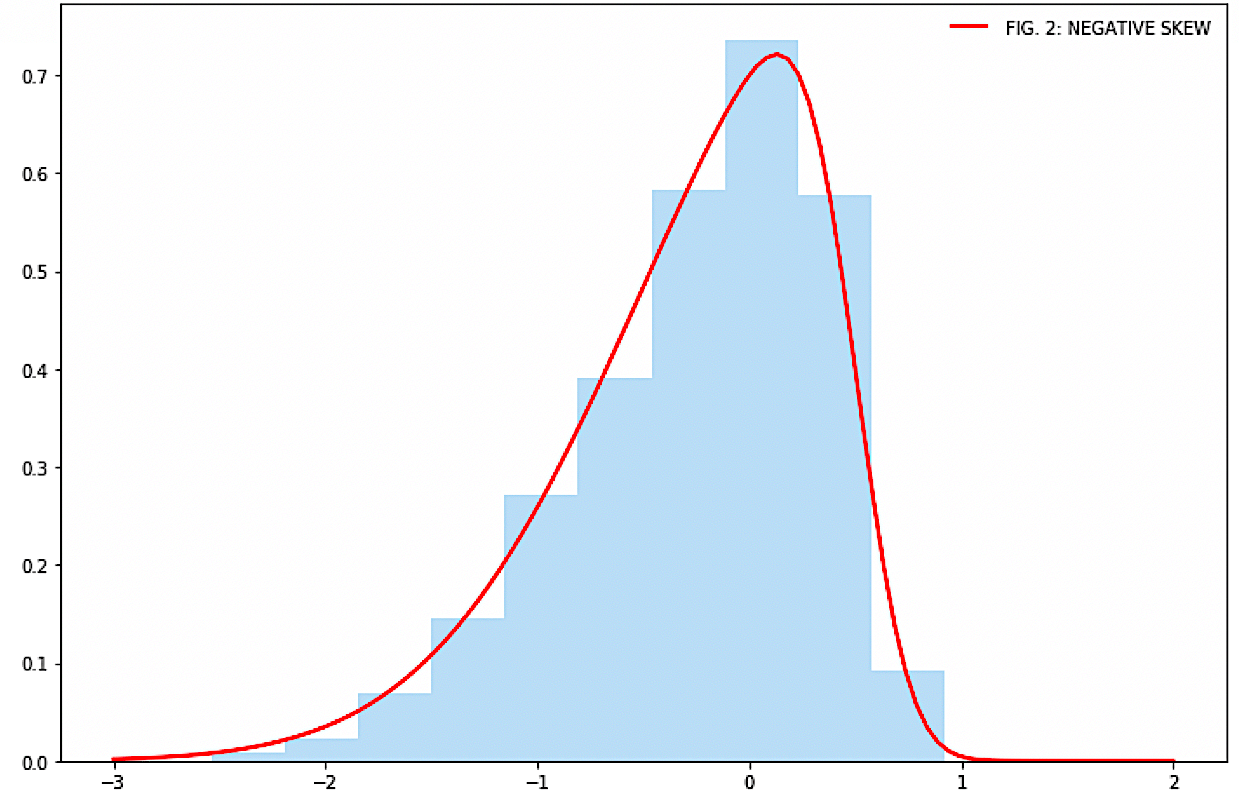

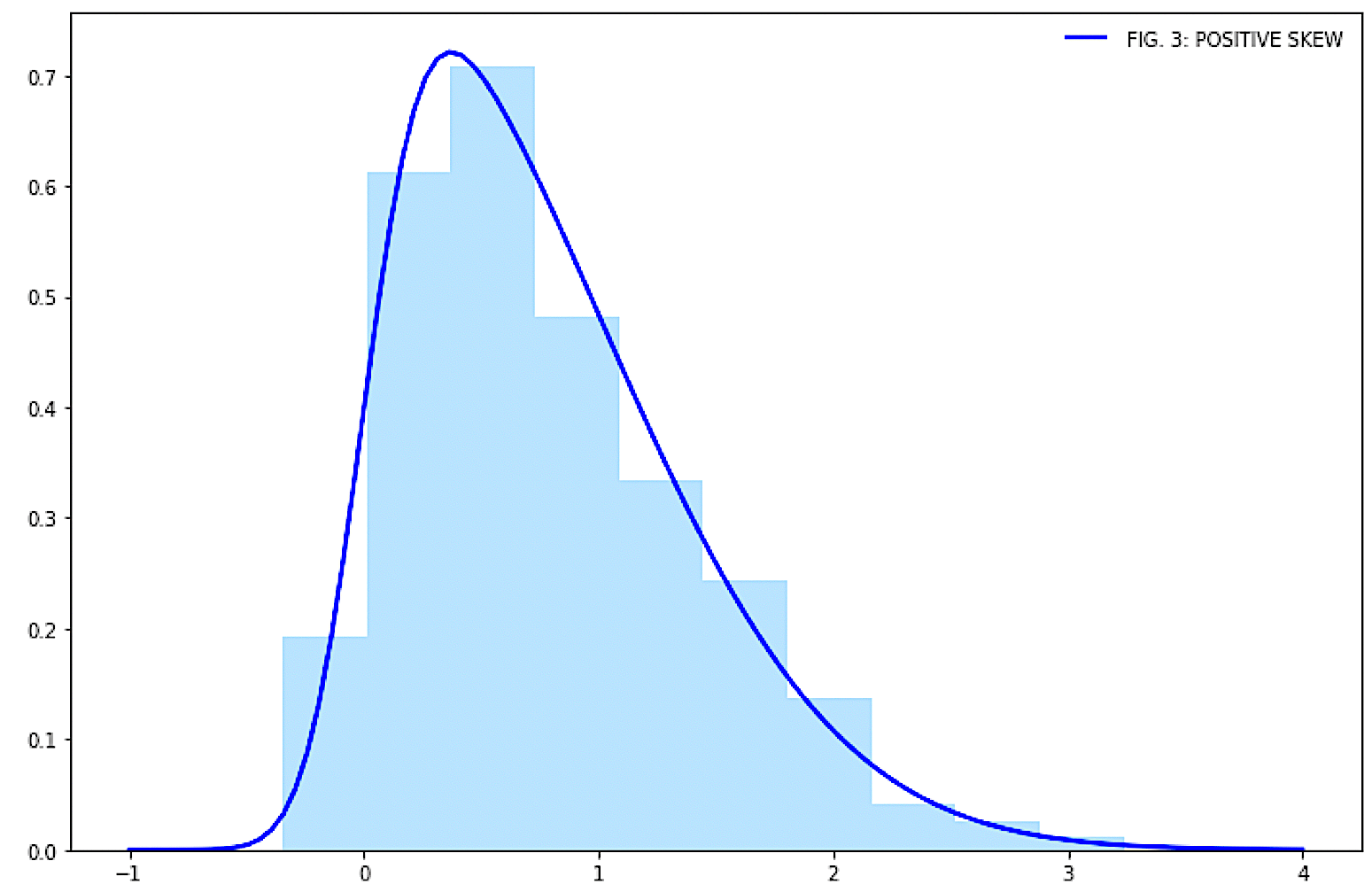

Now to advance the robustness of the system, let’s look at the Maximum Favorable Excursion (MFE) by looking at the following graph.

Now to advance the robustness of the system, let’s look at the Maximum Favorable Excursion (MFE) by looking at the following graph.

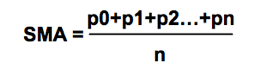

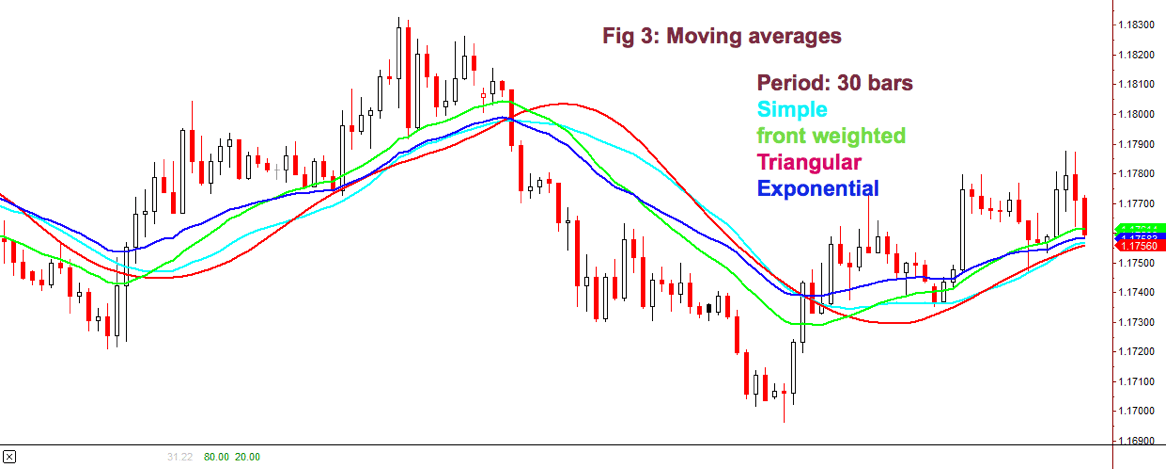

The main issue with the SMA is its sudden change in value if a significant price movement is dropped off, especially if a short period has been chosen.

The main issue with the SMA is its sudden change in value if a significant price movement is dropped off, especially if a short period has been chosen. Weighted moving average

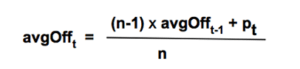

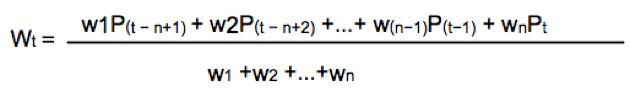

Weighted moving average

Since we divide by the sum of weights, they don’t need to add up to 1.

Since we divide by the sum of weights, they don’t need to add up to 1.

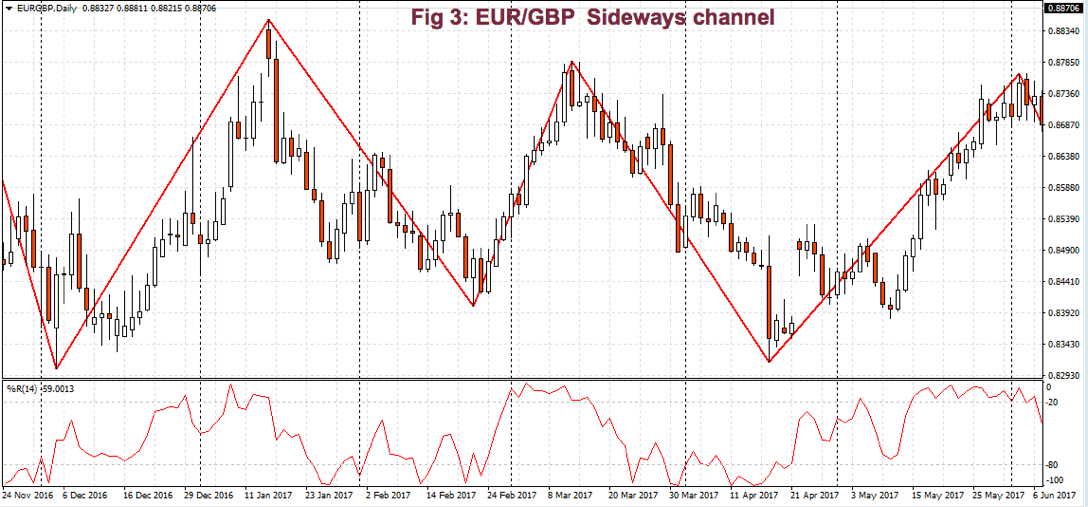

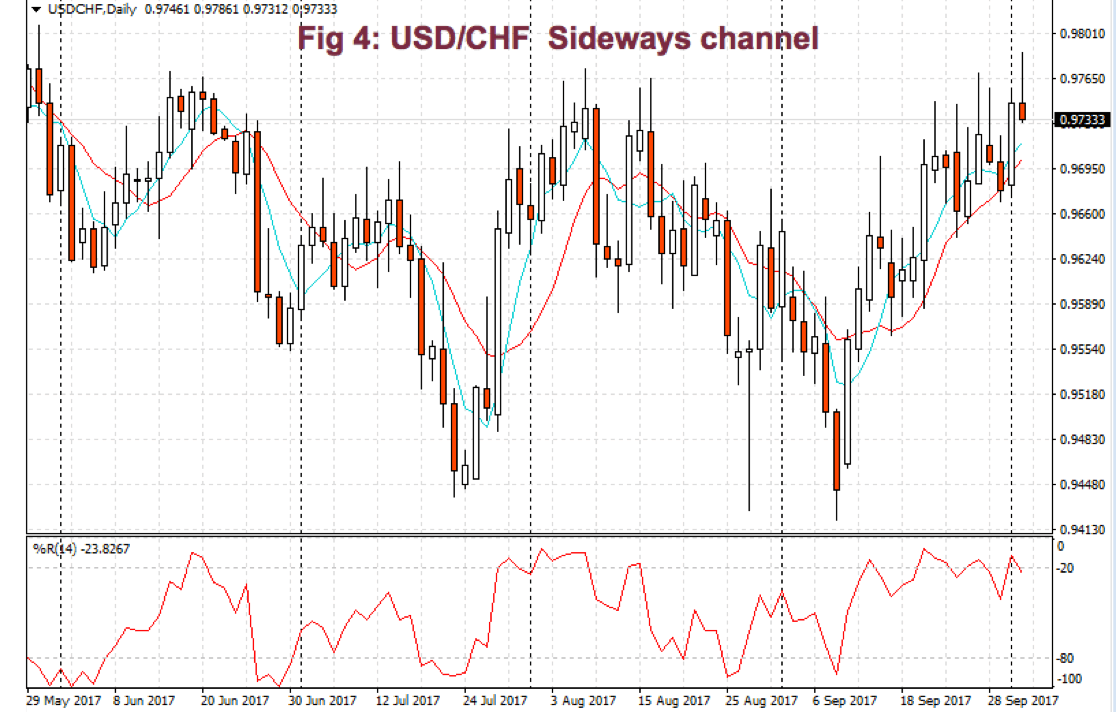

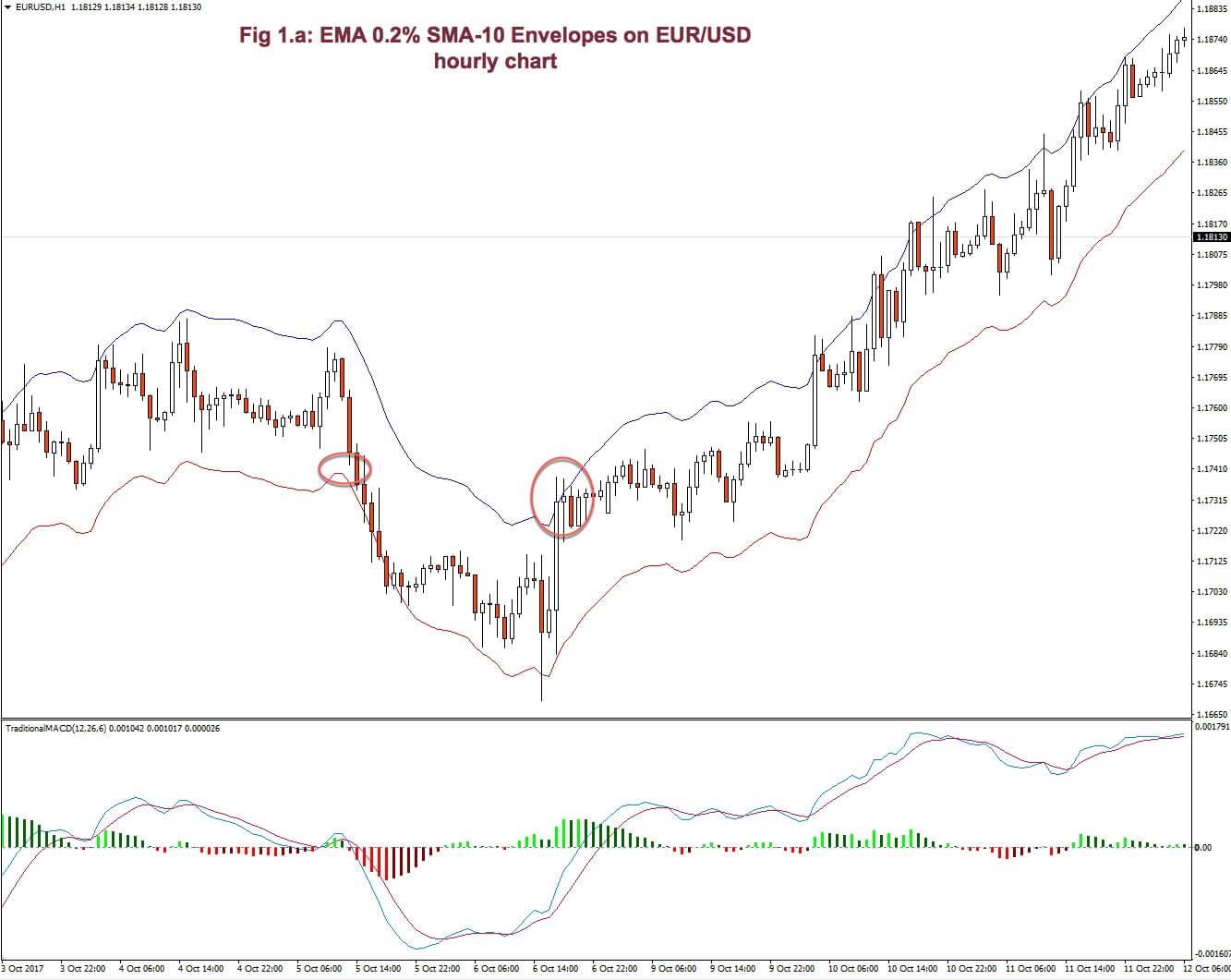

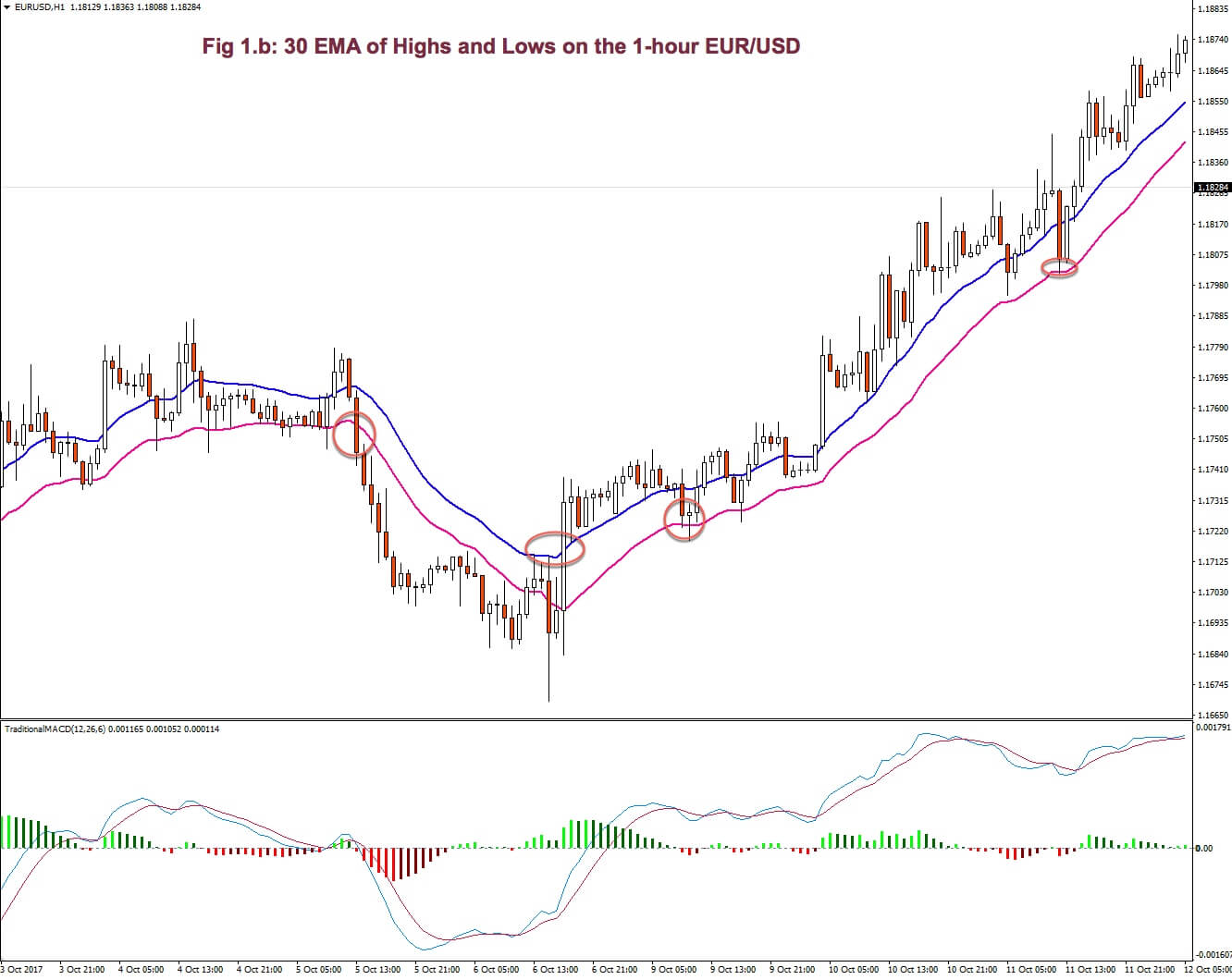

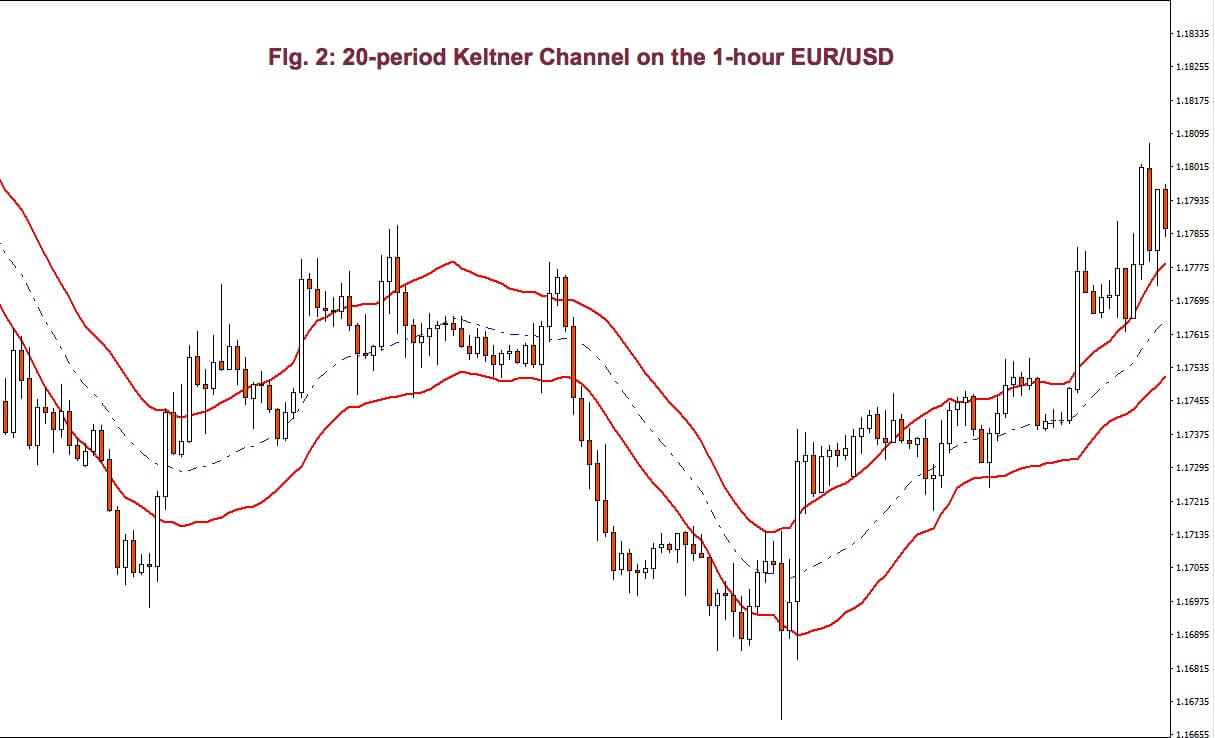

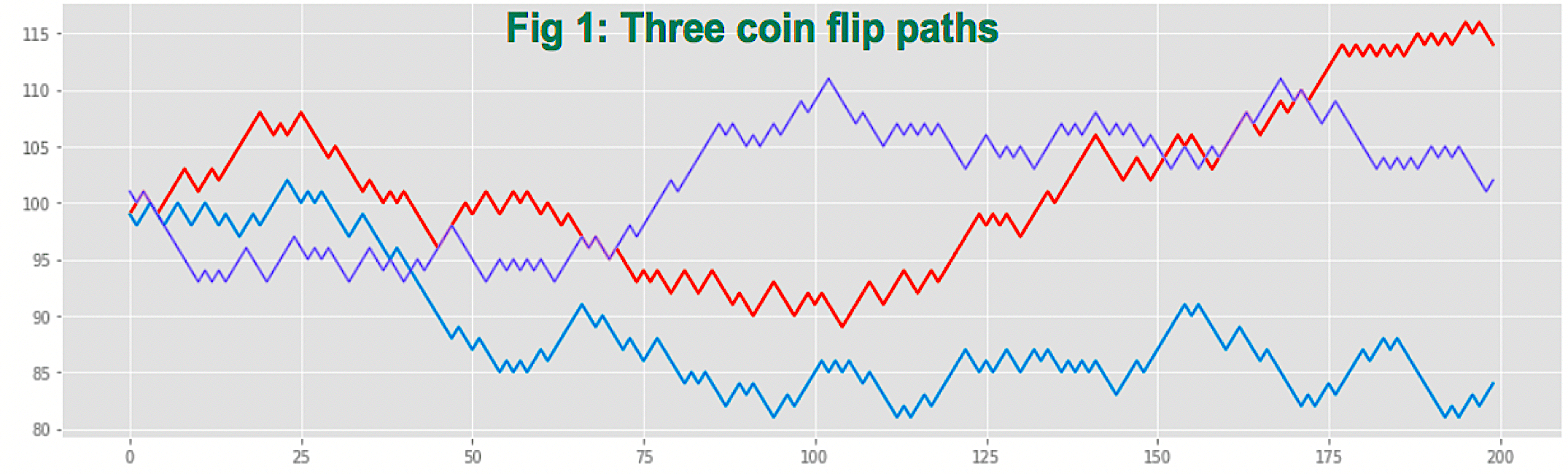

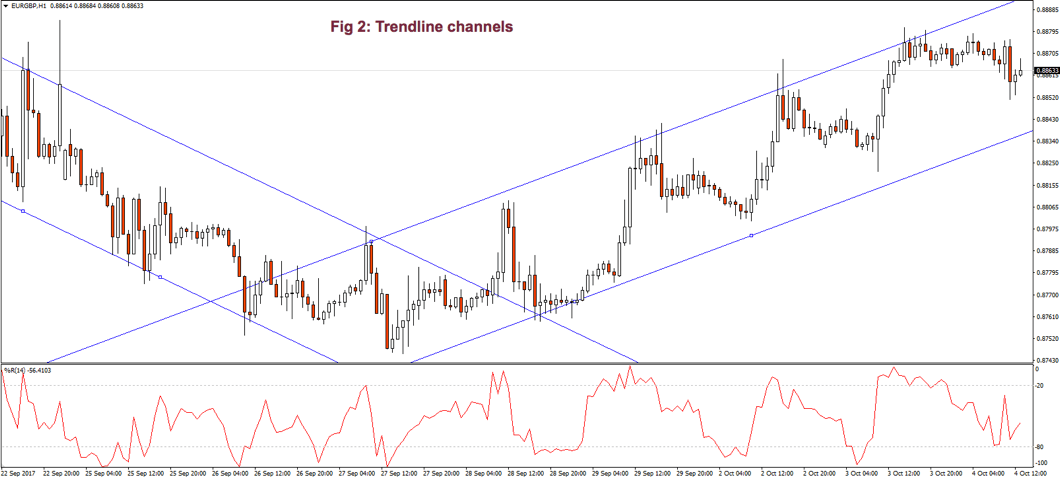

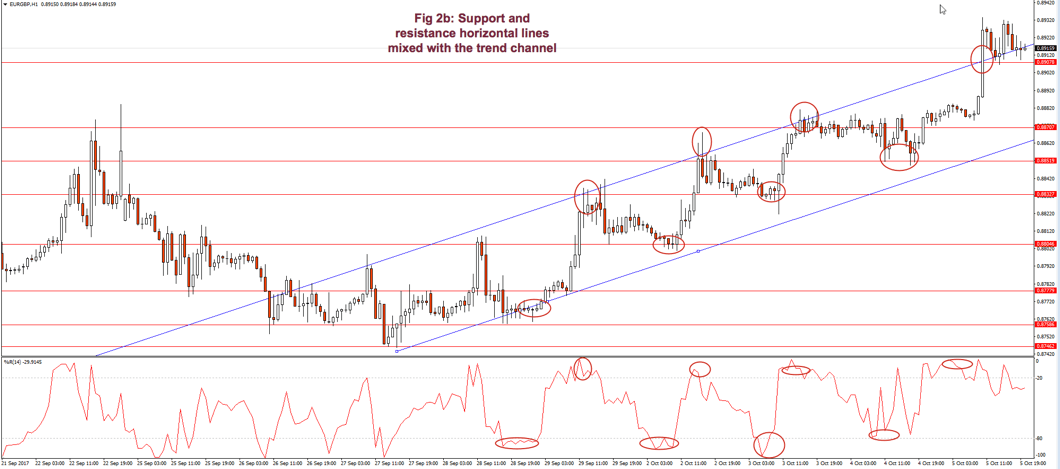

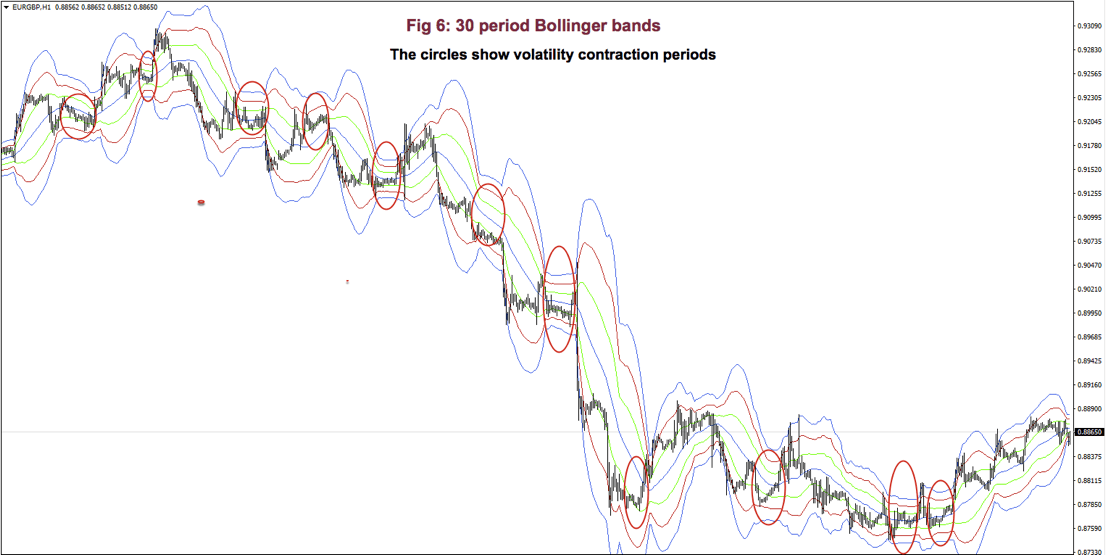

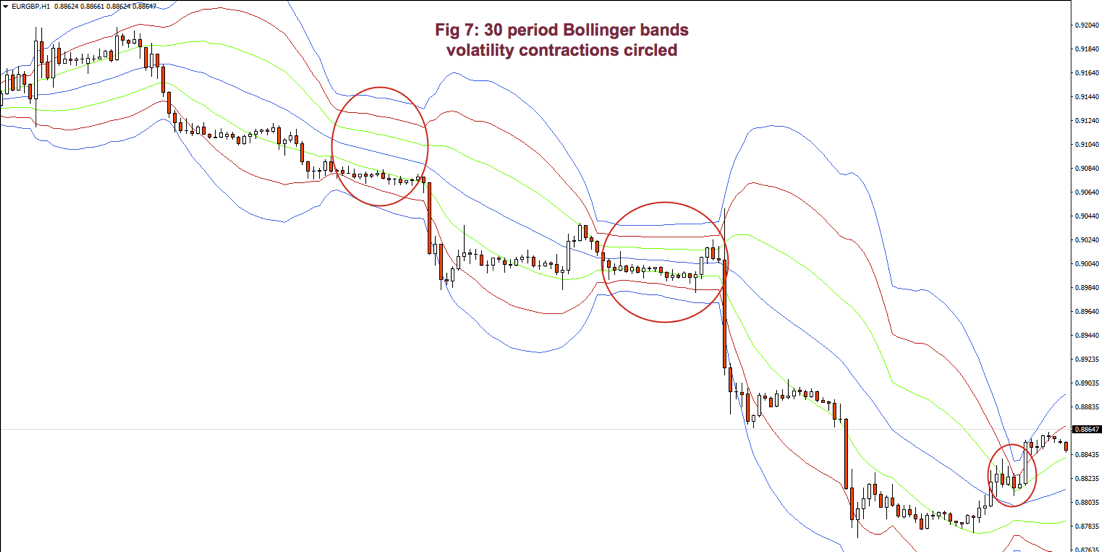

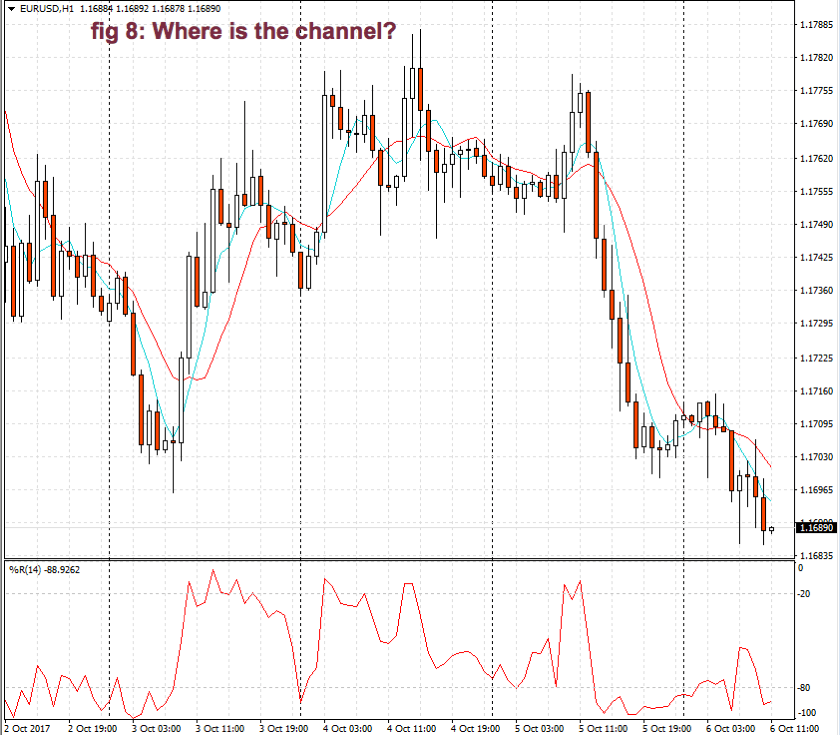

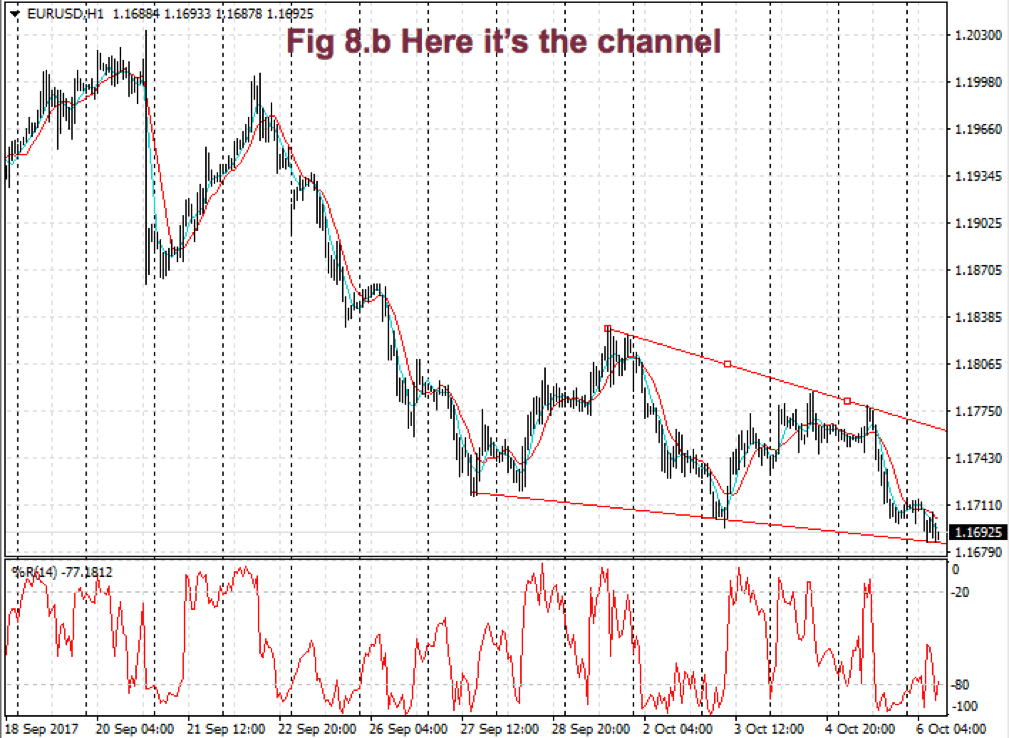

According to Elder’s classification, any trade that takes 30% or more of a channel is credited with an A. If you make between 20 and 30%, your grade will be B. Between 10 and 20% you’re given a C and a D if you make less than 10%. So, in this case, your grade is C.

According to Elder’s classification, any trade that takes 30% or more of a channel is credited with an A. If you make between 20 and 30%, your grade will be B. Between 10 and 20% you’re given a C and a D if you make less than 10%. So, in this case, your grade is C.