Time frames And Trading Windows Tricks – Maximize Opportunities With Overlap

In this video presentation, we are going to be looking at time frames and trading windows. Although these two subjects are separate by looking at them together, we hope you will see the importance of combining them in one section.

When it comes to time frames, new traders are often confused about which time frames to trade and why. So let’s look at three different types of time frames and traders who prefer to use them.

You will most likely be trading on a short-term, medium-term, or long term time frame, depending on your preferences, including your strategy, lifestyle, and the size of your trading account. Everybody is different, and some traders may use a one-time frame or a combination of all three.

But this can cause a lot of confusion for new traders when they begin to develop their trading strategy. Many new Traders tend to want to be in and out of a trade very quickly, which means they fall into the group known as scalpers and tend to use 1-minute and 5-minute time frames.

Other traders tend to want to look for longer-term trends, but do not want their trades to roll over from one day to the next, in which case they might prefer to use 15-minute to 1-hour time frames, and these are known as intraday traders, and larger professionals, including institutional traders, will have a longer-term view and look at 4 hour time frames up to daily, weekly and even monthly time frames. These are commonly referred to as swing traders.

Scalpers team to only use 1-minute and 5-minute they might only be in a trade for 1 to 2 minutes. Whereas day traders might be in a trade all day long, and institutional long-term or swing traders might be in a trade for days, weeks, months, or even years.

One of the reasons why trading can be inherently difficult is because all of these traders have different ideas about where the price of a pair is heading based on the various time frames that are used by the various groups of time frames, and therefore the majority of them will all be trading at odds with each other, not only within their own time frame but the other time frames as well.

No matter what time frame you choose to use, it is always advisable to look at the longer-term time frames before you place a trade and then filter down to the time frame that you want to use because a great deal of price action sentiment can be gained from doing so. This is the only way that you will be able to see if trends are developing and trade accordingly. You may have heard of the phrase let the trains be your friend, well this is the best way to find a trend, by looking at a higher time frame than the one you want to use and then filter down once you have established what is happening to price action overall.

Example A. Traders can look to the higher time frame, such as the daily or weekly charts.

Example B. In order to establish what is happening with price action and to find out if trends are available or forming and then simply move down to their preferred time frame. By doing this, they will also be able to more clearly see prominent support and resistance areas which may be being observed by institutional traders, because, after all, this is where the real money is. Institutional traders are the ones that move the market. And so it is always advisable to know what they are doing at the higher time frames.

In summary, the type of time frame that you choose is dependent on the type of trader that you want to be, whether it is a quick in and out scalper style, or perhaps to take a longer longer-term view. But however, you trade it is always advisable to look at other time frames especially, especially longer-term ones than your preferred time frame, in order to help you pick your trade entry more easily.

Next, we are going to look at trading sessions. The forex market is broken up into major trading sessions.

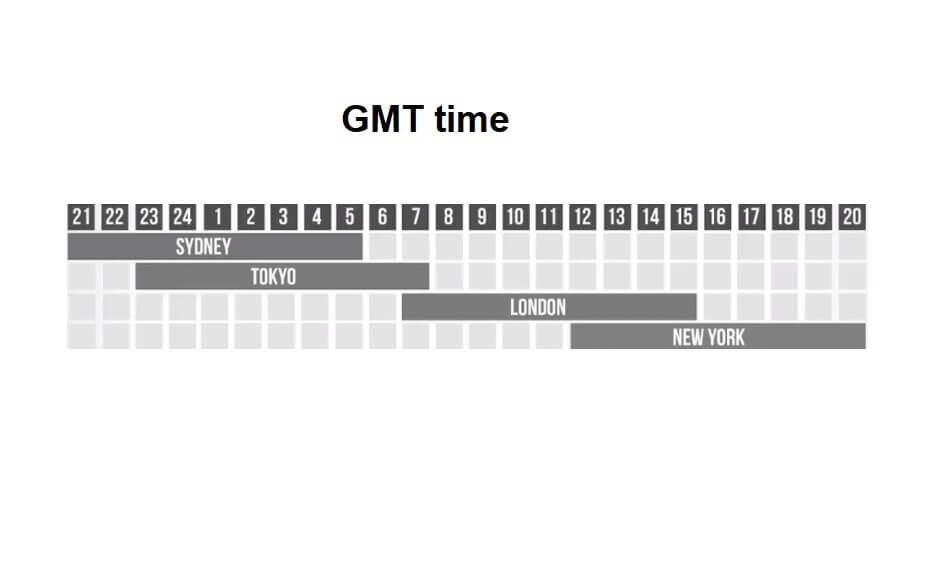

Example C. The Sydney session, the Tokyo session, the London session, which includes Frankfurt and a New York session. The forex market is open between 10 p.m. Sunday evening GMT and runs all the way through until 10 p, GMT on Friday, non-stop. However, the main centers will typically open at around 7 a.m. their time and finish at around 5 p.m. In other words, business hours. And where we can see on the graph that some of the sessions overlap.

That more centers overlap means that there are more players in the forex market at that time, and this means extra volume and liquidity and, therefore, greater moves in price action or potentially happen during these overlaps.

In summary, the best times I’m two trees are when two sessions overlap, and most volume and liquidity is provided during the London session, which includes Frankfurt and is also known as the European session, and where this overlaps with New York. This is the time of most activity. Generally speaking, in the forex market. Please remember to adjust your trading to reflect the seasonal changes due to daylight saving hours. The middle of the week tends to be the busiest because this is where we find more economic data releases normally. These affect market volatility.

With the worst times to trade being Sundays and Fridays, especially after the US session, public holidays where markets are thin, and volume is low, which means spreads will be at their widest, and during major news events where the markets can be extremely volatile.