Introduction

The NFP is one of the most important fundamental indicators in the Forex market, which causes large price movements in currency pairs. This article will explain the basics of NFP, the role of NFP in economics, and how to interpret the NFP data after its release.

What is the Nonfarm Payroll (NFP)?

The Nonfarm Payroll report gives the number of jobs added or lost in a country compared to the previous month. These numbers do not include agricultural farmers, employees belonging to the non-profit organization, self-employed individuals, private households, and employees of military agencies. NFP also provides the statistics of the long-term employment and youth unemployment rates. This indicator tells which sector of the economy is generating jobs and which are not. The government investigates these numbers carefully and takes appropriate actions to improve the employment situation of that sector.

The economic reports of NFP

The ‘Employment Situation’ report is a monthly report that is released by the Bureau of Labor Statistics (BLS) on the first Friday of every month. The report is released at approximately 8:30 in the morning. The NFP report is a comprehensive report that is made after the survey of two major sectors of the economy. The two sectors are the ‘Household Sector’ and the ‘Establishment Sector.’ The ‘Household Survey’ gives the employment rate of individuals in various categories, and the ‘Establishment Survey’ provides the number of new nonfarm payroll jobs added within the economy.

Survey of the ‘Household Sector’

Key components of this survey include

- The total unemployment rates

- Unemployment rate based on Gender

- Unemployment rate based on Race

- Unemployment rate based on Education

- Unemployment rate based on Age

- Reason behind unemployment

- Participation (for employment) rate by individuals

Survey of the ‘Establishment Sector’

Key components of this survey include

- The total nonfarm payrolls added by industries of durable goods, non-durable goods, services, and government

- Hours worked by employees

- Average hourly earnings of employees

Analyzing the Data

The economic report of NFP is an essential factor of fundamental analysis that investment managers evaluate before making investment decisions. This data is crucial when determining the strength of the economy and, thus, the value of the currency. One can analyze the data by comparing the release of the current month to that of the previous month. This comparison helps to determine if the country has generated more jobs for its people or have, they lost more jobs compared to the previous month.

Based on the month on month numbers, we can conclude if the economy is strengthening or deteriorating. We can also anticipate if the US economy will perform at the expected growth rate, or there will be a reduction in the GDP.

Impact on currency

When unemployment rates are low, banks and institutions gain confidence in that economy and will be willing to invest in that country. When several other banks invest in the country, it leads to an appreciation of the currency and the economy. Forex traders and investors consider this factor as a very important indicator for predicting the future value of a currency.

NFP data has a direct impact on most of the asset classes, including Forex, commodities, equities, and Index CFDs. It is seen that the market reacts quickly to the data with a huge rise in volume. During the news announcement, all major market players and institutions take new positions in the market or exit their existing positions. As millions of positions are created and removed at the same time, one can witness heavy volatility during the news release. The condition of the job market has a direct link to consumer spending, which represents the health of the economy. When people of a nation are employed, they use their wages for purchasing various goods and services to fulfill their needs. This means the consumer spending automatically increases.

Sources of information on NFP

The Bureau of Labour Statistics (BLS) releases the typical NFP data on the first Friday of each month. However, the first round of data is released on the third Friday after the end of the reference week. But as traders, we need to focus on the data that is released on the first Friday of each month and monitor it carefully. We also need to keep with us the previous month’s data and the forecast for the current month. There are many financial websites that give a graphical representation of the historical data that will give a clear understanding of how the NFP data has changed over time.

Sources of information for major economies

Nonfarm Payroll is vital because it is released monthly and is a very good indicator of the current state of the economy. This data can be found on the ‘economic calendar’ of every broker. When the unemployment rate is high, policymakers tend to have a monetary that will increase economic output and increase employment. There are timely revisions that take place to review the components of NFP, and the components may change if necessary. Another aspect of unemployment is the number of working hours and hourly wages. It is possible that people are employed but will be working part-time or earning less for that work.

The NFP data release is accompanied by increased volatility and widened spreads, which means in order to avoid getting stopped out, we recommend using larger stop loss without changing the risk to reward ratio. This is possible is we use no leverage at all during NFP news release and enter with a smaller position in the market. We need to do 90% of the analysis even before the news is released so that when the actual data is out, we should quickly be able to decide if we have to go ‘long’ or ‘short’ in any given Forex pair.

Impact Of NFP News Release On The Forex market

The non-farm-payroll (NFP) is a key economic indicator that measures the health of the economy for the United States. The NFP represents the number of jobs added in a period of one month that excludes farmers, government employees, and employees of other non-profit organizations.

So, a higher than expected reading should be taken as positive for the US dollar, while a lower than expected reading is taken to be negative for the US dollar. NFP releases generally cause large movements not only in the forex market but also in the commodity and stock market. In this section of the article, we will explain the impact of NFP on the price chart and see how to apply the NFP data in our trading strategy.

The below image was taken from Forex Factory, and the red indication there implies that this Fundamental Indicator’s new release will have a strong impact on the Forex price charts.

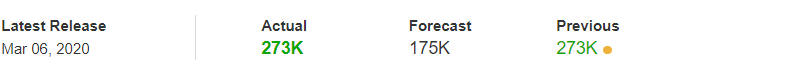

![]()

The below image shows the latest NFP data that was collected for the month of February. The NFP data is published by the Bureau of Labor Statistics (BLS), which also carries out surveys across the country. Based on the NFP data, traders and investors from all over the world take suitable positions in the market, which is the reason behind increased volatility. The expected NFP results for March 8, 2020, was around 175k (job additions), and the actual data came out to be 273K (job additions), which was much better. Even though this should be positive for the US economy, let us see how the market reacted.

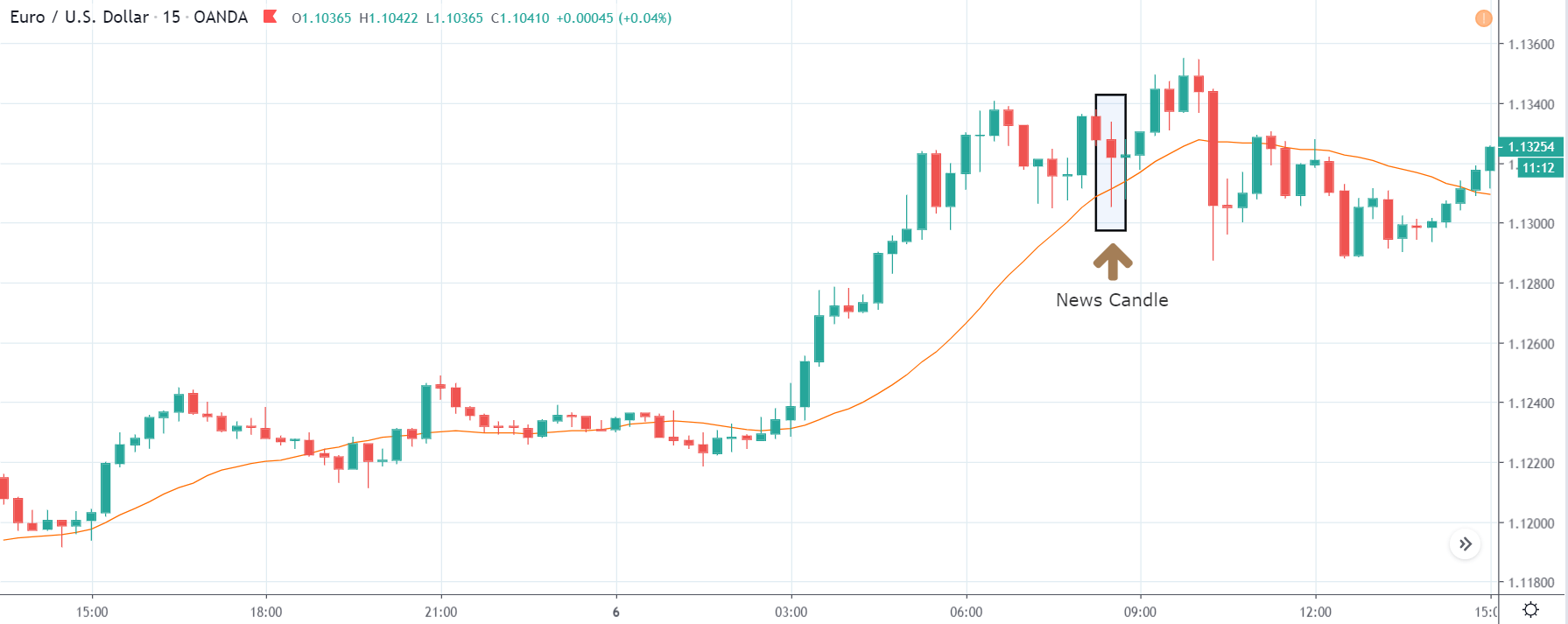

EUR/USD | Before the announcement | March 6th, 2020

We shall start with the most liquid currency pair in the world and see the impact of NFP news release on it. In the above chart, EUR/USD is in strong uptrend signifying the weakness of the US dollar. One of the reasons behind the weakness is lower NFP expectations from economists as compared to the previous data. The market feels that there were fewer job creations in the month of February, and hence they don’t want to buy US dollars. From a technical perspective, the market is just going up without a retracement, and we cannot take a position on any side at this point. When there is constant movement on one side, it is better to wait for the news outcome, and then based on the data, one can enter the market.

EUR/USD | After the announcement | March 6th, 2020

The NFP numbers were the same as before, and an equal number of jobs were created this time too. This was more than what the market was expecting and optimistic data for the US dollar. In the above chart, we see that the price falls soon after the NFP data was announced, and the US dollar strengthens all of a sudden. The volatility expands on the downside as NFP data was above expectations, but it could not result in a reversal of the trend. The ‘news candle’ leaves a wick on the bottom, and the price rallies further up. Since the current data was no better than previous data, some traders consider it to be negative for the economy and hence sell US dollars. Until one gets clear reversal patterns, he/she should not go ‘short’ in the market, thinking that the data is positive.

USD/JPY | Before the announcement | March 6th, 2020

USD/JPY | After the announcement | March 6th, 2020

The above images represent the chart of the USD/JPY currency pair, where the market is in a strong downtrend, again showing the weakness of the US dollar. Since the impact of NFP is high, robust data can result in a reversal of the trend, and a weak to not-so-positive data can result in trend continuation. For risk aversion, one needs to go ‘long’ in the market with a great amount of caution, and we need to combine the news outcome with technical analysis. However, it is much easier to go ‘short’ in the pair if the NFP data is not good. After the news announcement, we see the bullish candle and witness increased volatility on the upside. But this NFP data was not sufficient to talk the price even to the recent ‘higher high,’ this means the data was mildly positive for the US economy.

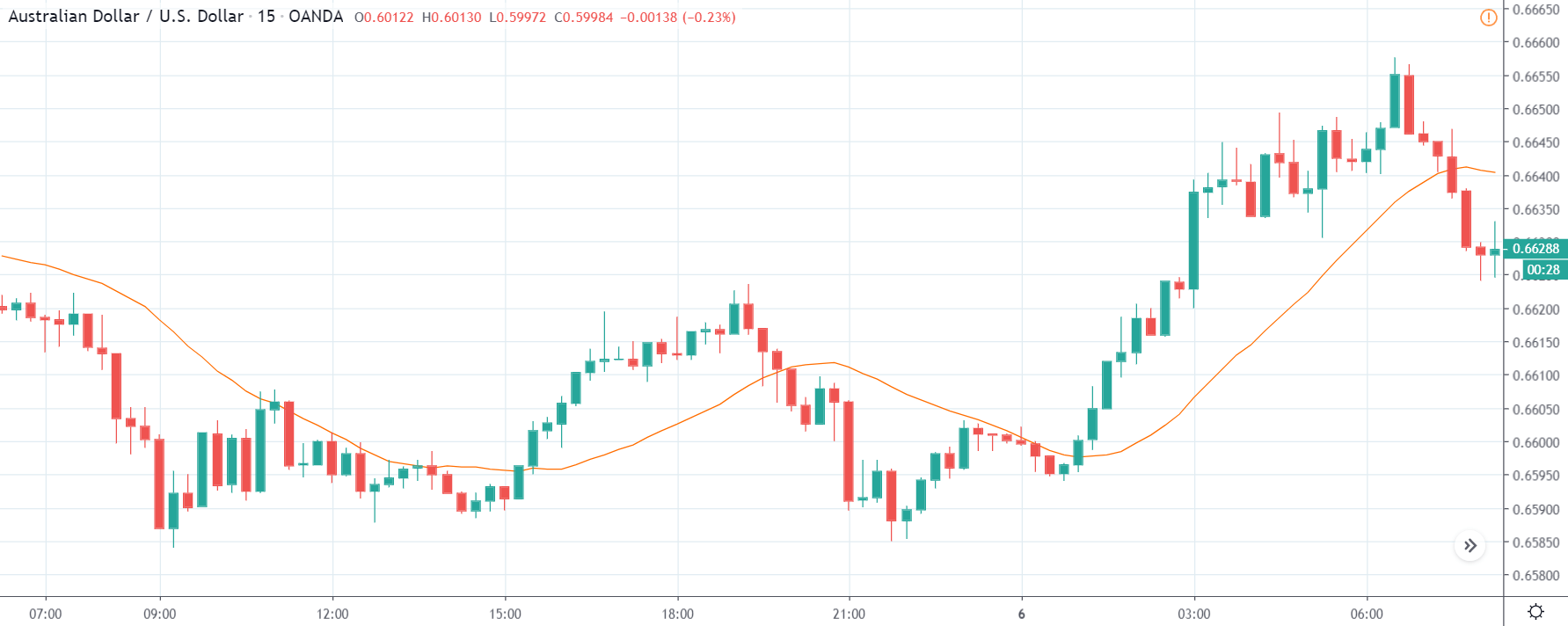

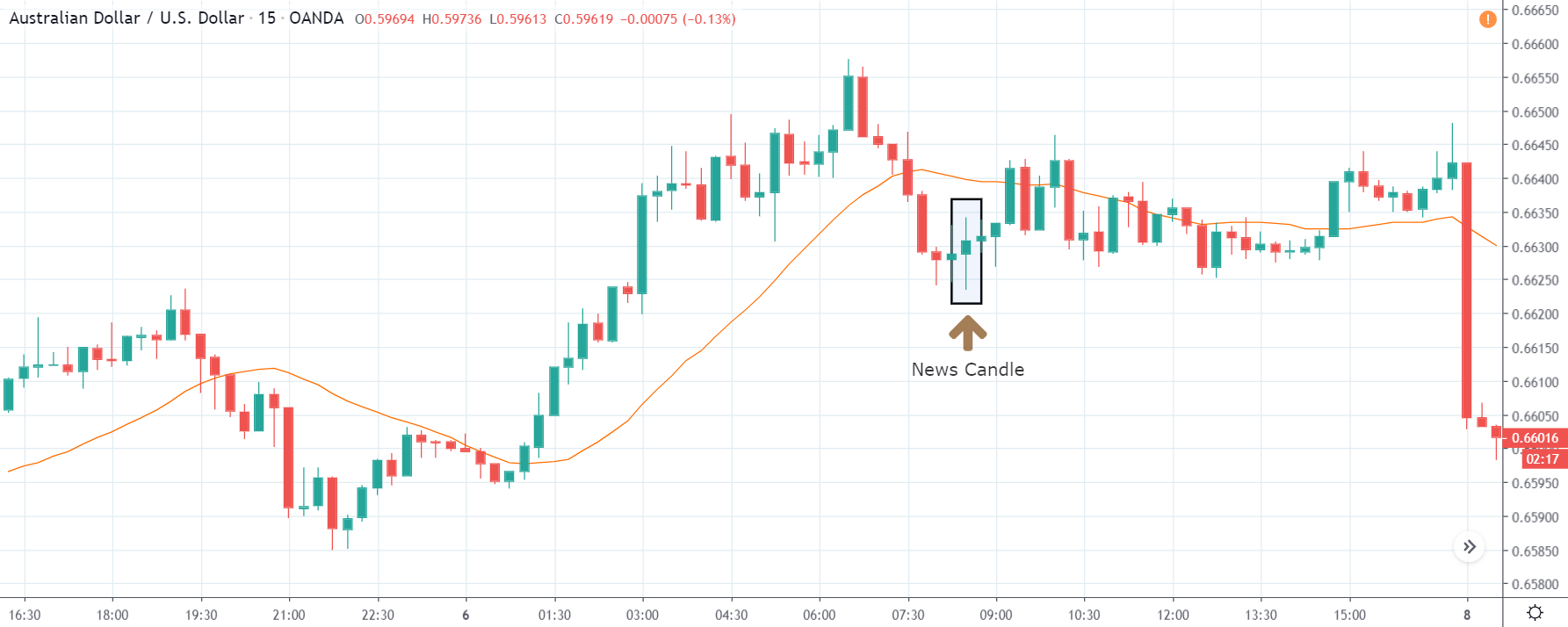

AUD/USD | Before the announcement | March 6th, 2020

AUD/USD | After the announcement | March 6th, 2020

In the AUD/USD currency pair, the US dollar is much stronger than other pairs where the price is below the moving average before the news announcement. Since the US dollar is already showing strength, we can say that a mildly positive data can take the currency lower and result in an extended downward move. And only a negative NFP data can result in an up move. After the NFP data is released, we see a formation of the ‘Doji’ candlestick pattern, indicating indecision in the market. As the price continues to remain below the moving average, we can expect the volatility to increase on the downside.

That’s about Nonfarm Payrolls and its impact on the Forex market. If you have any questions, let us know in the comments below. Cheers.