Introduction

The abbreviation of GBP is the Great British Pound, and this currency is mostly known as pound sterling across the globe. It is one of the most-traded currencies in the Forex market and stands at the fourth position right after USD, EUR, & JPY. Whereas the abbreviation of BND is the Brunei Dollar, and it has been the currency of the Sultanate of Brunei since 1967. The Monetary Authority of Brunei Darussalam issues the Brunei Dollar.

GBP/BND

In the Forex market, currencies of the two countries are paired for being exchanged in reference to each other. GBP/BND is the abbreviation for the Pound Sterling against The Brunei Dollar. In this case, the first currency (GBP) is the base currency, and the second (BND) is the quote currency. The GBP/BND is classified as an exotic-cross currency pair.

Understanding GBP/BND

In the Forex, one currency is quoted against the other. To find out the relative value of one currency, we need another currency to compare. If the value of the base currency goes down, the value of the quote currency goes up and vice versa.

The market value of GBP/BND determines the strength of BND against the GBP. This can be easily understood as 1GBP is equal to how much BND. So if the exchange rate for the pair GBP/BND is 1.7660, it means 1GBP is equal to 1.7660 BND.

Spread

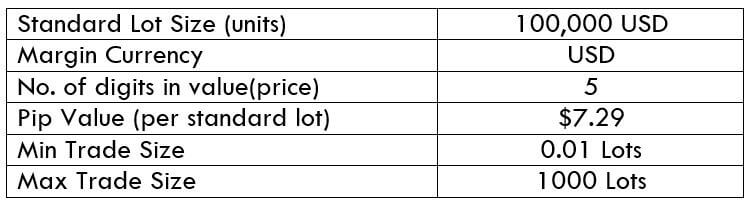

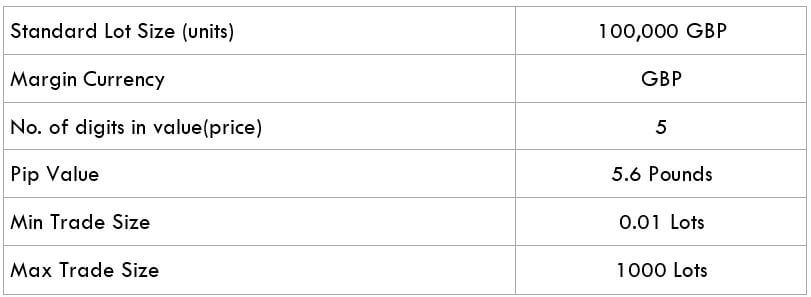

Forex brokers set two different prices for the currency pairs – Bid & Ask prices. Here the ‘bid’ price is at which we can sell the base currency, and the ‘ask’ price is at which we can buy the base currency. The difference between the ask and the bid price is called spread. The spread is how brokers make their money. Some brokers, instead of charging a separate fee for trading, they already have the fees inbuilt in the form of spread. Below are the ECN & STP spread values for GBP/BND Forex pair.

ECN: 12 pips | STP: 15 pips

Fees

A Fee is simply the commission we pay to the broker each time we execute a position. There is no fee on STP account models, but a few pips of the trading fee is charged on ECN accounts.

Slippage

Slippage refers to the difference between the expected price at which the trader wants to execute the trade and the price at which the trade gets executed. The slippage can occur at any time but mostly happens when the market is fast-moving and volatile in nature. Slippage also occurs when we place a large number of orders at the same time.

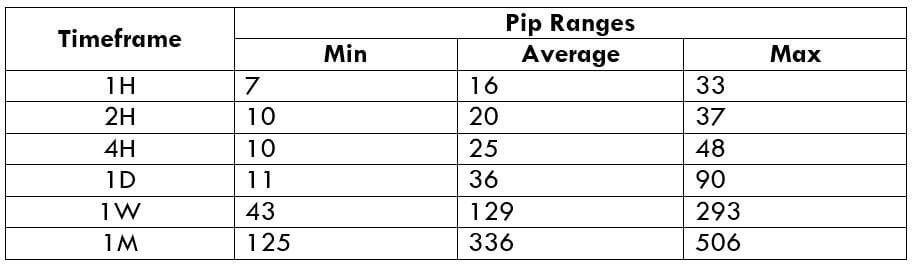

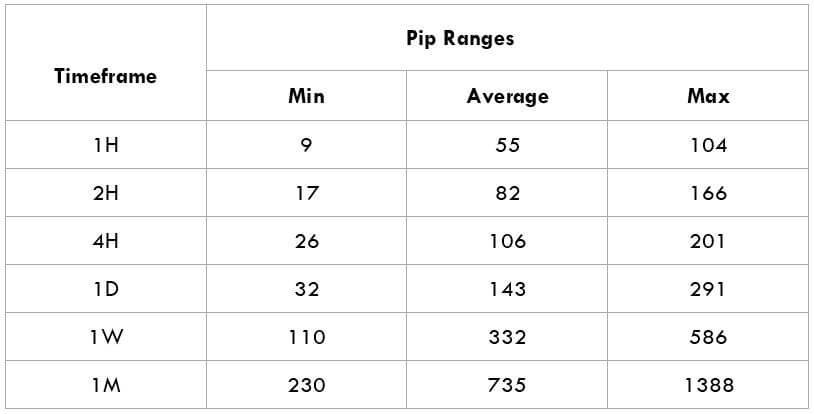

Trading Range in GBP/BND

The amount of money we will win or lose in a given time can be assessed by using the trading range table. It is a representation of the minimum, average, and maximum pip movement in a currency pair. This can be evaluated easily by using the ART indicator combined with 200-period SMA.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a significant period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

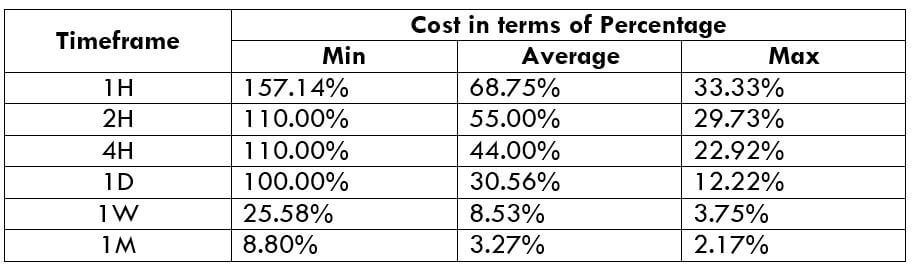

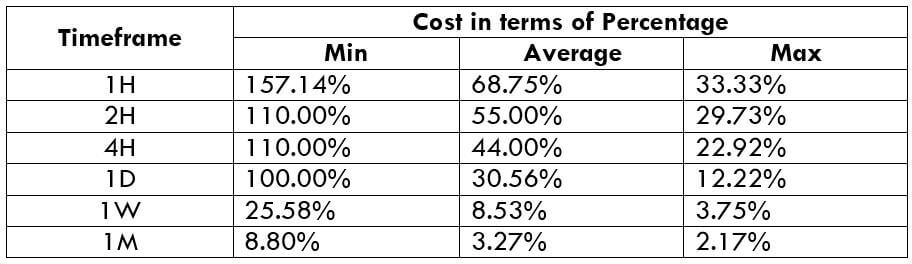

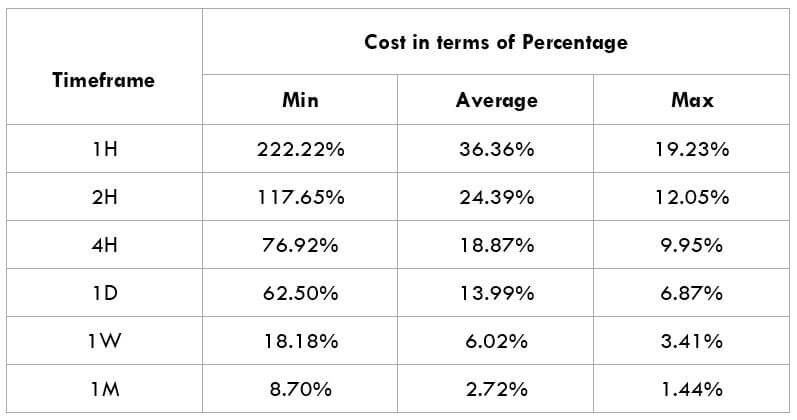

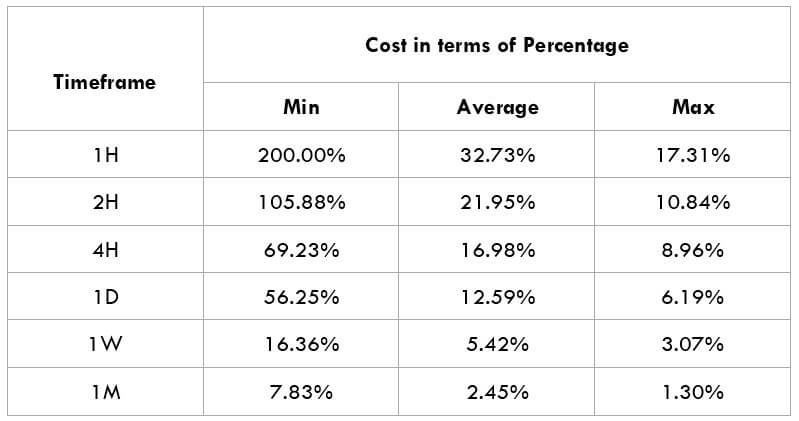

GBP/BND Cost as a Percent of the Trading Range

The cost of trade mostly depends on the type of broker we chose and also varies based on market volatility. This is because the total cost involves slippage and spreads apart from the trading fee. Below is the representation of the cost variation in terms of percentages. The comprehension of it is discussed in the following sections.

ECN Model Account

Spread = 12 | Slippage = 3 |Trading fee = 5

Total cost = Slippage + Spread + Trading Fee = 3 + 12 + 5 = 20

STP Model Account

Spread = 15 | Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 15 + 0 = 18

Trading the GBP/BND

The GBP/BND is an exotic-cross currency pair and it is typically a Ranging market. The average pip movement of this pair on the 1H timeframe is 55 pips. Since the market is ranging, the volatility is less and the trading costs are relatively high while trading the GBP/BND pair. Always remember that cost of trade increases as the volatility decreases and vice versa.

Conservative traders who don’t mind spending more on trading fees can trade this pair on all the timeframes as the volatility is moderate. Comprehending the above tables, we should note that the costs on the trade are high when the volatility is less. But traders who don’t prefer spending more on trading costs can trade this pair when the volatility of the market is around the maximum values. Cheers!