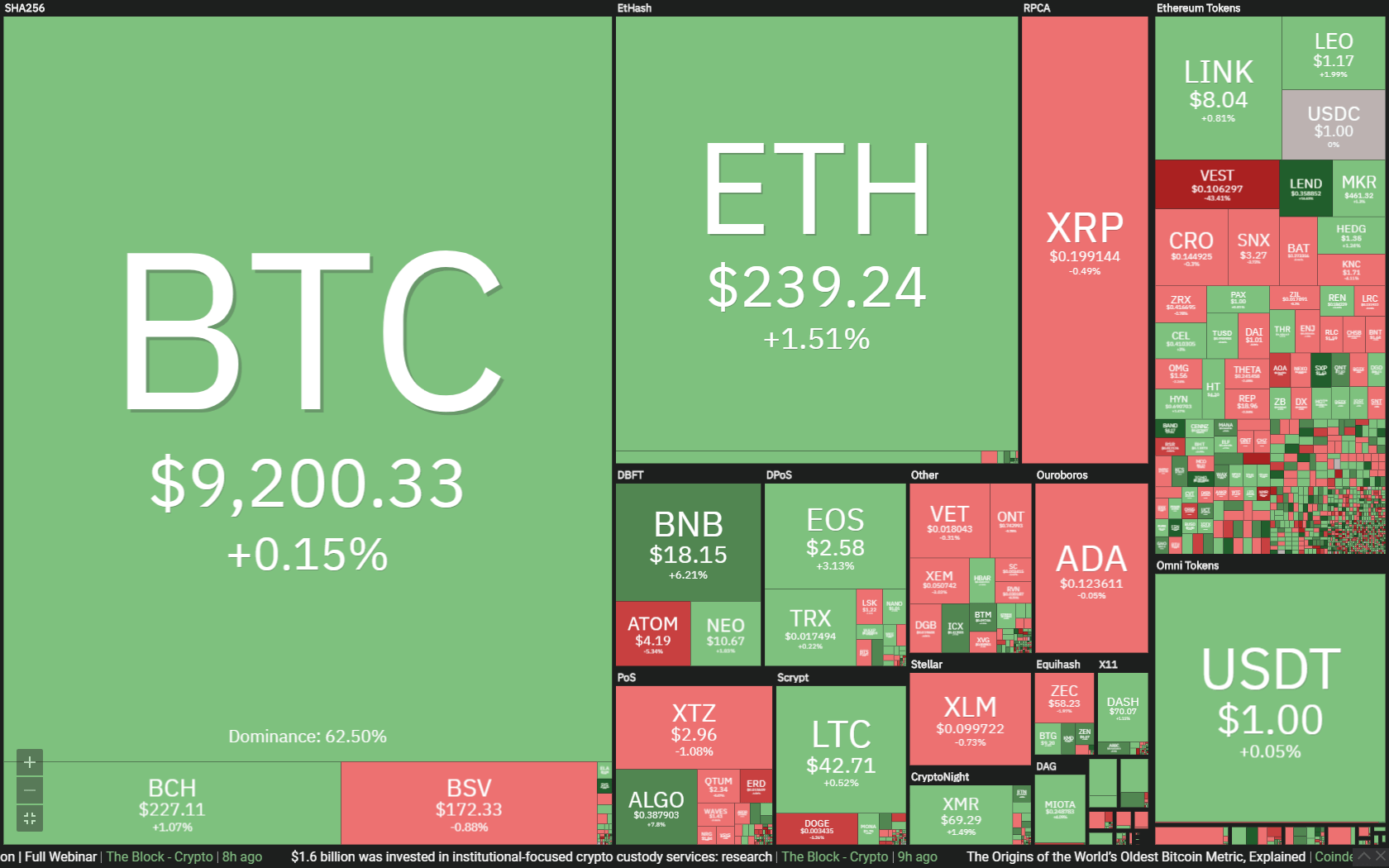

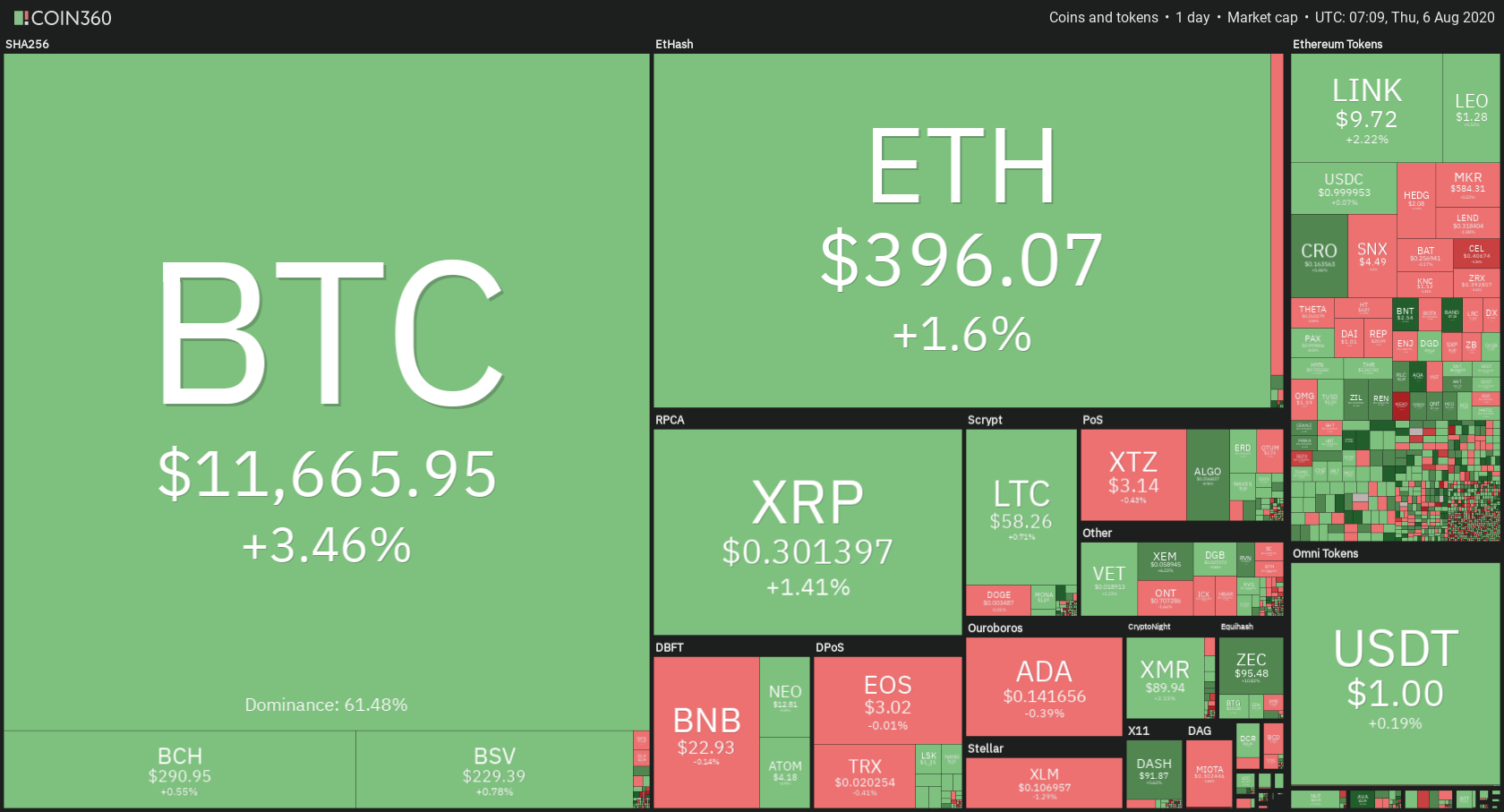

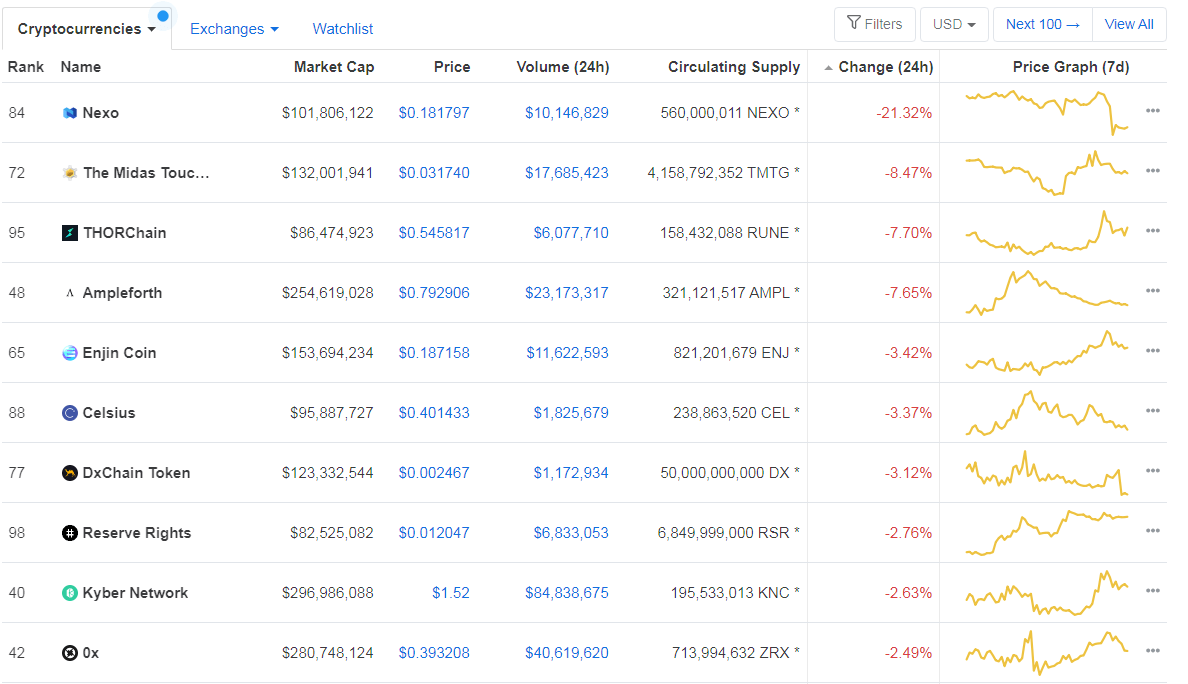

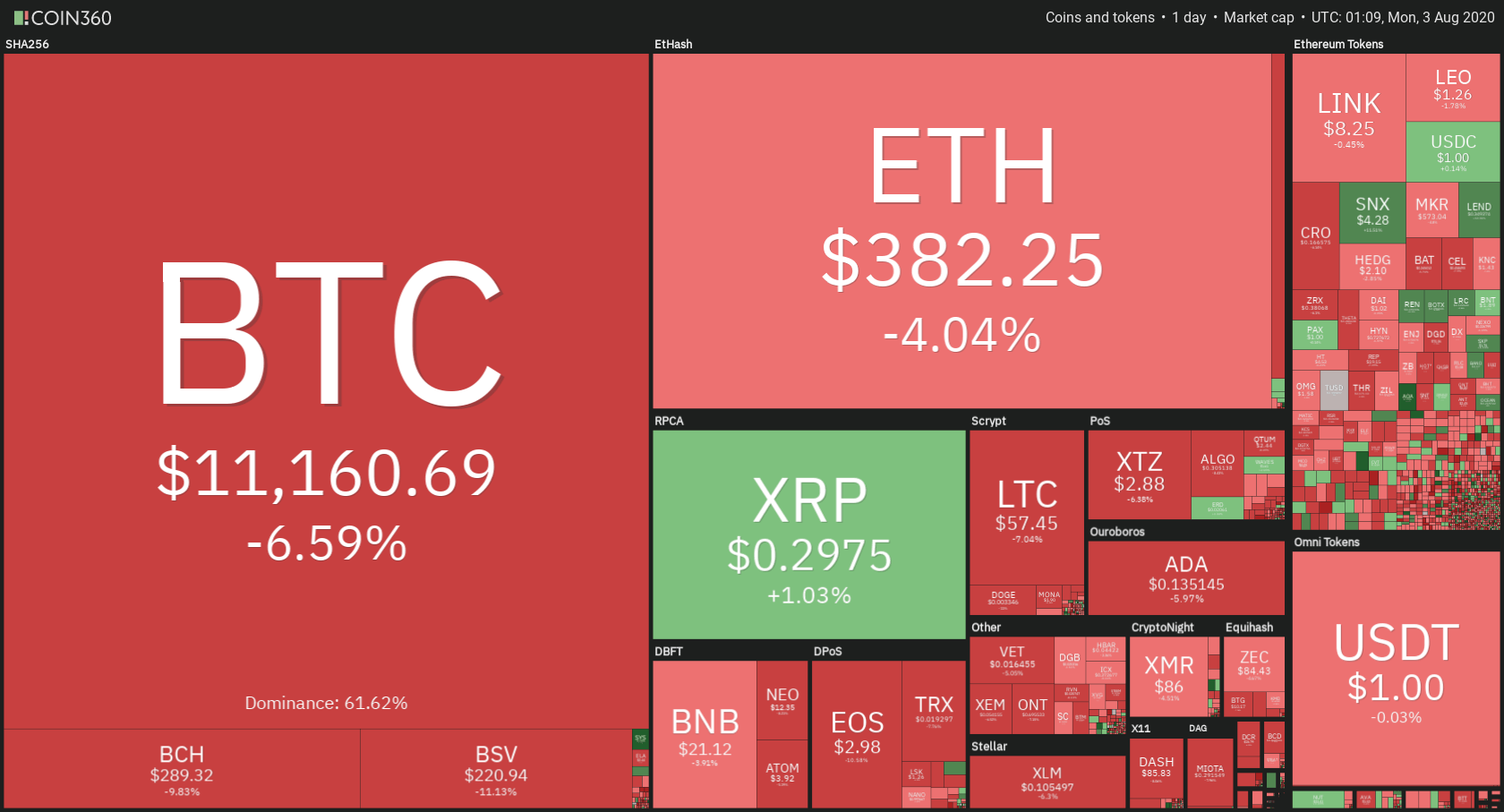

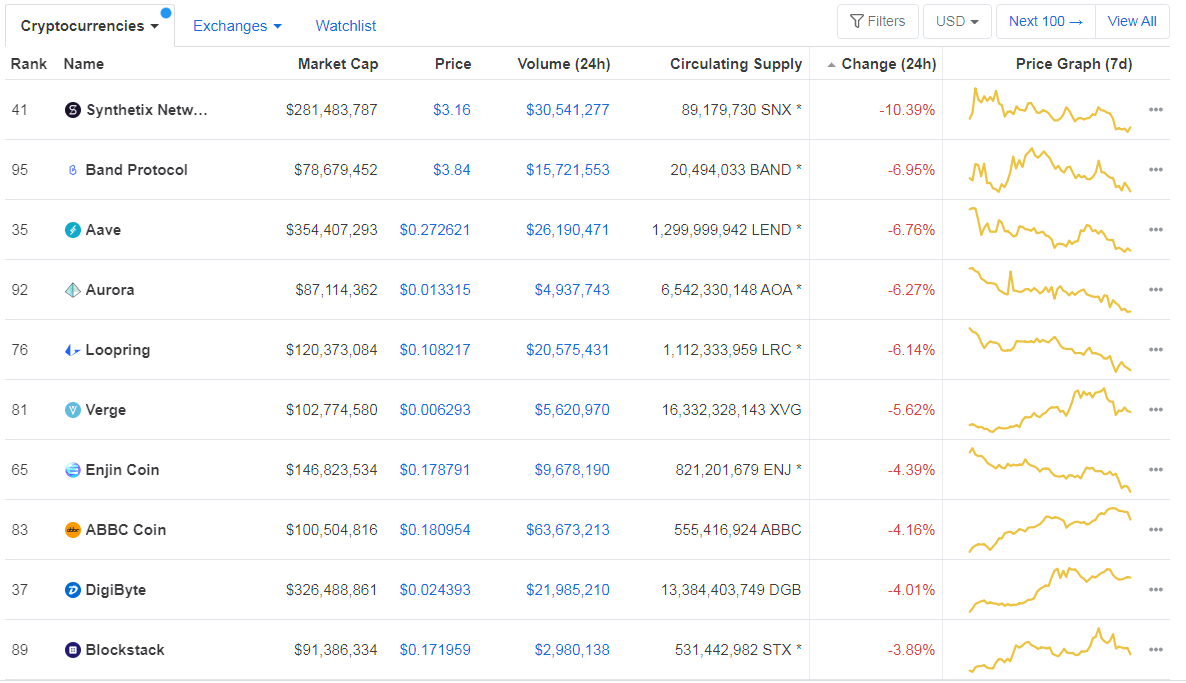

We know how certain markets, such as the crypto market, foster the culture of sharing news and exchanging information. The spot forex market, however, appears to be calling for a different approach for traders to truly master the skill of trading currencies, building the very needed psychological resilience along with one’s trading account. Some of the market’s most prominent traders even fervently support the idea that trading news is one of the least effective strategies forex traders could ever implement. While a number of traders keep striving to find a way to trade news, a portion of successful traders insists on employing another method. Today, we are trying to understand whether traders should necessarily avoid every type of news, and how reliance on such information affects trading, analyzing claims against incorporating news events in trading currencies.

When we think of news, we should first differentiate between the types of information which can have an impact on forex traders and the second type that has no influence on their trading. The forex community consists of traders, which is distinctly different from investors, which why a number of news announcements on websites such as Bloomberg or CNBC simply do not apply to the currency market. Various sources entirely disregard the forex-related news, whereas other media provides information that is simply not very useful and thus should not constitute a part of traders’ daily routine. In comparison to the previous group, news that forex traders should concern themselves with is economic indicators, which are scheduled news events. These pieces of information always come in advance several times a year (e.g. every two or three months, each quarter, etc.). Of course, traders may suddenly receive some unexpected news at times, but such cases are exceptionally rare and seldom. The benefit of having such transparent information ahead of time is to know factors that can actually affect the market in some way and along with the time of these events’ occurrences.

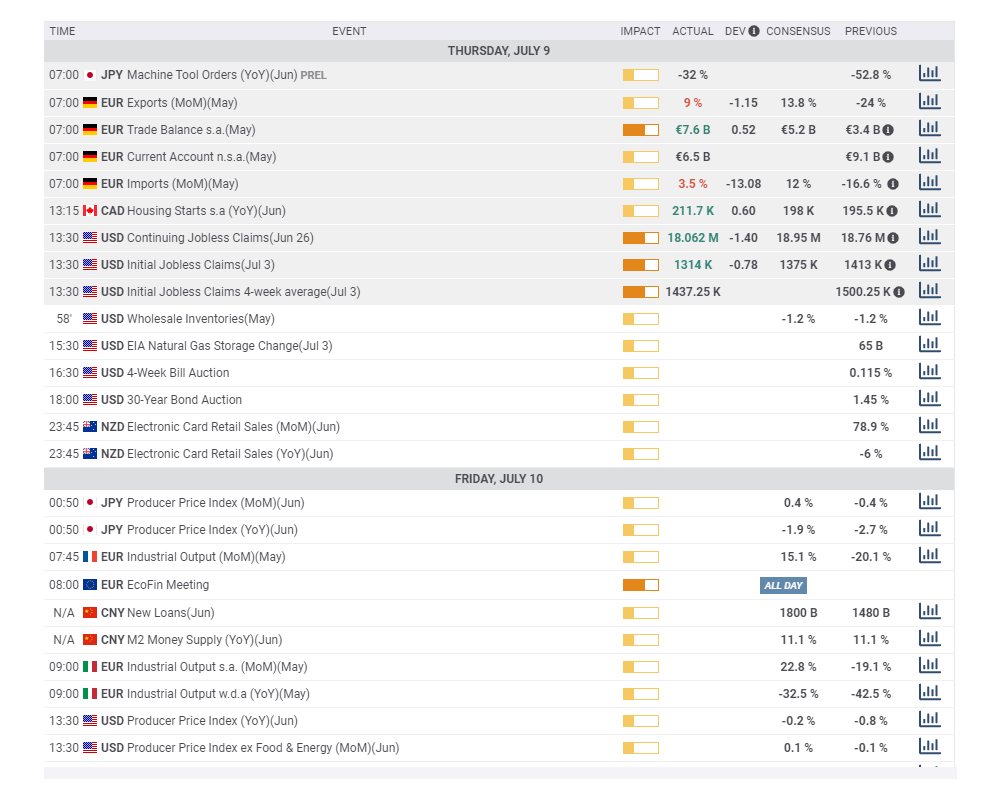

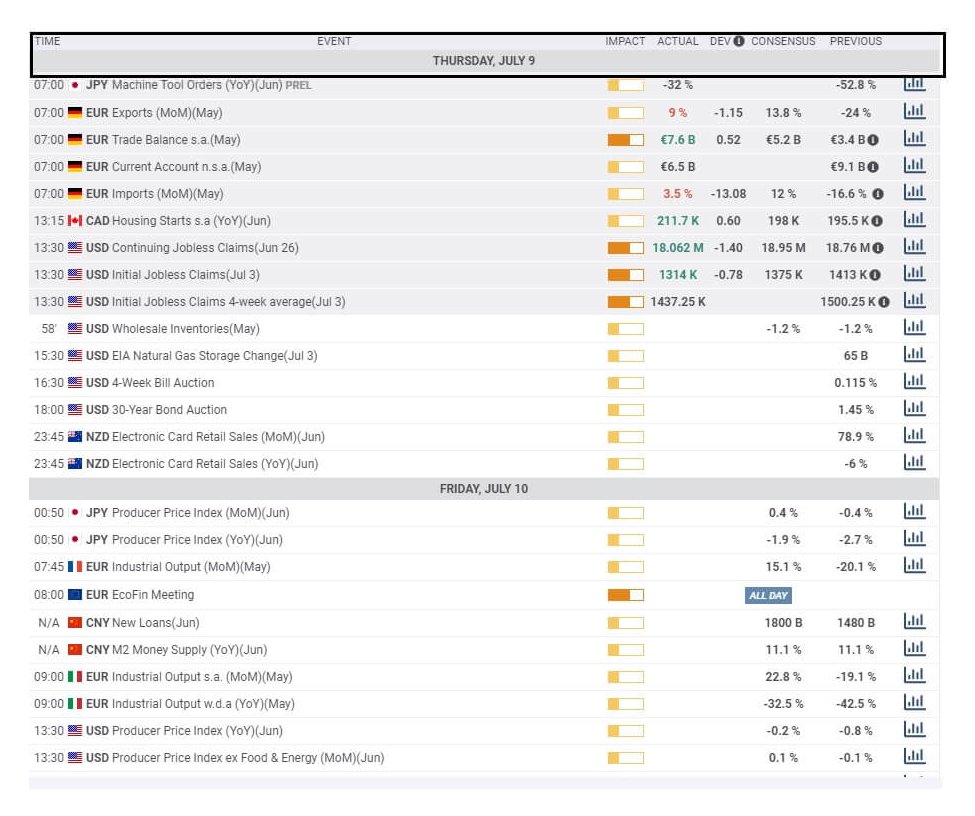

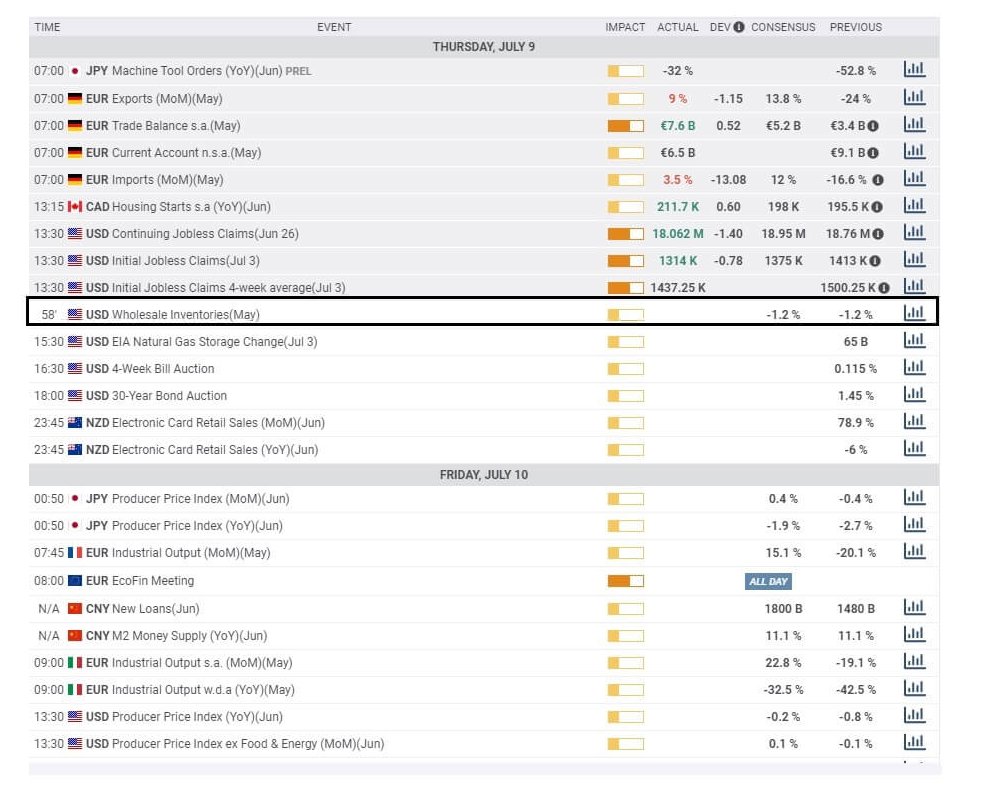

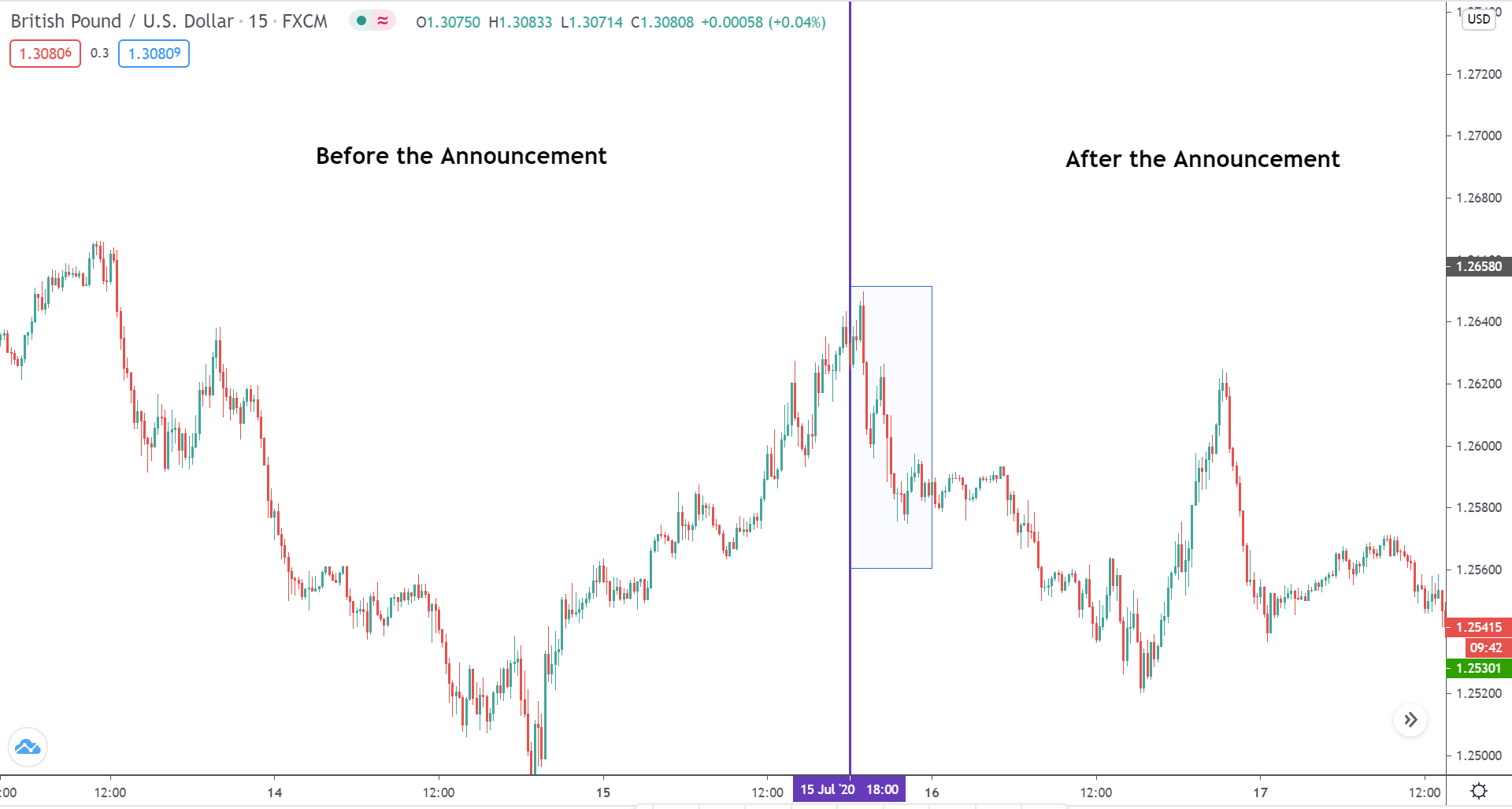

For traders to be able to make use of such pieces of information, they should first access news calendars, which are available online (e.g. https://www.forexfactory.com/calendar?week=jan13.2019 and https://www.dailyfx.com/economic-calendar). These calendars are an excellent source of information because they offer traders the possibility to protect themselves against any potential pip falls in advance. Nonetheless, even if some of the existing economic indicators or news events lack to provide any information a trader may find relevant, they still have a great impact on trading overall. What often happens is that certain pieces of news alarms people and, as you may already know, the more traders react, the faster will the banks get involved. When the big banks overreact, it usually entails some important market activity ending with the price changing direction. Therefore, consulting news calendars before entering a trade is a crucial part of trading in the spot forex market because traders need to have any available information at their disposal as early as possible.

Some traders assume that managing news events is possible, believing that by possessing these information items gives them control over the market, to the extent that they deem generating a great number of pips in little time possible. Their viewpoint on news events boils down to the idea that the moment such news comes out, they will take specific action accordingly. Should the news be strong, they will go long on their chosen currency and vice versa. They believe that any timely reaction will easily bring them many pips, and we cannot but confirm that such a belief is based on solid grounds. Nonetheless, the fact that some traders managed to achieve this does not prove its quality. Not only does it happen occasionally, which immediately introduces a higher than necessary risk, but it also leads to false conclusions. Wanting to stay on top of news events is equal to trying to beat the traders’ main opponent, the big banks, and attempting to fight the one who decides how the prices will move is a very bad idea in the long run. Failure is inevitable when your adversary is unbeatable, so any attempt to control the news already implies more risk than anyone should have to take on.

Some traders assume that managing news events is possible, believing that by possessing these information items gives them control over the market, to the extent that they deem generating a great number of pips in little time possible. Their viewpoint on news events boils down to the idea that the moment such news comes out, they will take specific action accordingly. Should the news be strong, they will go long on their chosen currency and vice versa. They believe that any timely reaction will easily bring them many pips, and we cannot but confirm that such a belief is based on solid grounds. Nonetheless, the fact that some traders managed to achieve this does not prove its quality. Not only does it happen occasionally, which immediately introduces a higher than necessary risk, but it also leads to false conclusions. Wanting to stay on top of news events is equal to trying to beat the traders’ main opponent, the big banks, and attempting to fight the one who decides how the prices will move is a very bad idea in the long run. Failure is inevitable when your adversary is unbeatable, so any attempt to control the news already implies more risk than anyone should have to take on.

Since traders already have no power over the price, they may need to consider the role of the big banks on a deeper level. These banks can choose to redirect the market in any desired way and, even if they ever get fined for manipulating prices, which does happen from time to time, they have enough financial support to withstand and last. You may have already noticed how certain decisions they have made in the past have always been justified in the media, regardless of how incomprehensible or unreasonable those may be. Often when traders receive some positive news regarding a particular currency, a pair involving the currency will suddenly go short and keep the same direction for a long period of time. The forex news media (for example Twitter and Bloomberg, among others) always appears to be prepared under any circumstances, providing some vague explanations such as claiming how the news has already been priced in. Traders, unfortunately, do not possess this information beforehand and each time a price moves in an unusual fashion, traders are made to believe it was them who failed to read through the news or take the right steps. Therefore, going against this powerful opponent is sheer luxury traders need not indulge in for the sake of keeping their accounts.

While the price may at times take a strange direction, there are times when they move in an expected manner. Traders may have witnessed how, when some positive news came out on a particular currency, it become more expensive as a result. News events have the power to dictate whether a price will become higher or lower, but you should know that it is the big banks pulling the strings from the shadow. The news may say where the price will go, but these banks alone will ultimately decide when such action will take place and what will happen with the price before it gets there, moving it up and down to their liking. Apart from special permissions, the big banks also have access to exclusive tools that allow them to see orders, stop losses, and whether traders are going long or short. As they have the ultimate power, they can trigger traders’ stop losses and manage the market as they like. What the big banks especially look forward to is seeing where the majority of traders are going because it is the moment that is the most rewarding for them. The ability to see retail money only helps them earn more by moving the prices against the majority. Therefore, when any big news comes out, they immediately know where the price will have to end up for them to reap the benefits, leaving most traders on the other end of the spectrum.

Some traders may still want to make money trading while the big banks are busy, but this approach will only bring random wins. Unfortunately, this game was designed so that there is always only one winner and traders are not meant to be the ones taking the prize home. You should not, therefore, feel confused or surprised if you realize that the price did not act the way you imagined it would, as this market will never let you build your account this way. While you may have previous success with handling news, you should know that the likelihood of maintaining the same approach long term is rather low. Because many successful traders have already failed to try to play these games in the past, they understand that the best solution is to not get involved. Traders need to seek actions that will grant them control and they definitely cannot control the big banks’ decisions, the news events, or the manner in which the masses are going to reach them. By willfully taking part in the attempt to manipulate news events, you are in fact giving u control over your own money.

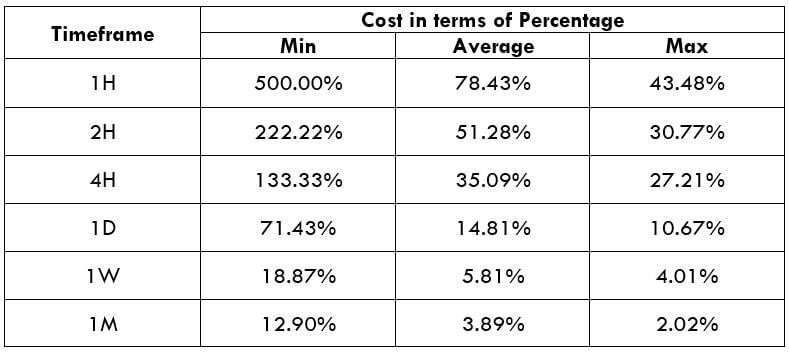

The reason why so many traders get involved in such activities is the rush of instant gratification, which practically boils down to the urge to satisfy the greed for becoming rich fast. The best strategy for any trader dealing with such compulsive need is to learn how to properly address the news, and to be able to do that will then require them to have a set plan in place. You do not have to go to great lengths to be able to secure financial stability. Trading five-minute charts, managing numerous screens, and making rash decisions upon entry and exit will not necessarily lead to any lucrative outcomes. By trading the daily chart, for example, you can successfully evade the impact of news events. Just by looking at the news calendars, you can develop insight into the substantial quantity of news happening on a daily basis. You can also, therefore, grasp how many pieces of information the traders using the five-minute chart, which is a stressful endeavor alone, need to manage at the same time. Trading smaller timeframes, hence, does not necessarily imply having more benefits, but quite the contrary.

Traders have probably seen cases of important news going against the majority of people trading smaller time frames that inevitably produce disastrous outcomes for the group in question. Forex traders using the daily chart, however, may occasionally experience some drawdown, but with the right approach and direction as well as technical skills and tools, it is more often than not only going to be a temporary setback until the price eventually returns to its previous course. Even in the case of some unfavorable news, daily chart traders only need to patiently wait out the interim periods and have a ready plan they will see through until the transition is complete. This further entails that traders are required to be prepared in advance in order to protect their trades from any major events by knowing how they will address any type of news they come across. Luckily, traders have such information at their disposal well in advance in most cases and, what is more, these events often concern only one or two currencies, further reducing their impact.

Although these events rarely affect daily chart traders, as described above, they still need to be wary of going in blindly or unprepared. By being cautious and attentive, traders will establish a firm foothold and withstand any alternating circumstances. Furthermore, they may escape a series of unnecessary yet painful losses and build on the momentum of accumulating wins rather than the opposite. To grow an account, you need to think of potential failure ahead of time because in the world of trading currencies you essentially win by not losing. If you drag your account down by taking unwise steps, allowing yourself to be compelled by any upcoming news event, you willfully and consciously engage in activities that will ultimately cost you your account and financial stability. The main benefit of adopting an observant and focused mindset, you prime yourself for success and give your account the opportunity to be much bigger at the end of the year.

An excellent example of the events requiring such a regimented approach is the times of elections when the market behaves in an unusual and uncontrollable manner. Whenever traders attempt to stay on top of those events, they eventually help banks gloat over the results. The U.S. presidential elections and Brexit are the very proof of how external circumstances and unexpected turns of events affect trading because not only did traders witness exceptional turmoil in the market but they also often had their stop losses passed. The market is not intended to act according to traders’ needs and desires, especially under such circumstances, so if you aspire to trade during the times of utter commotion, you are entering a game you cannot control. Some traders may have had some success while trading during elections, but such wins can hardly be more than exceptionally random and rare instances of gaining the upper hand. If you are ready to commit to a disciplined approach, you may need to reconsider trading elections and thus substantially reduce the risk levels.

Certain news events affect the market long term, leading to more lasting changes. When Greece was undergoing major challenges with the overdue debt burden, the European Union was weighing a decision whether to provide further assistance or refrain from lending any more money to such a greatly weakened economy. Through the course of this long period, a plethora of varying news events would suddenly come out, rendering traders confused and lost. They could not know what the news would indicate, how the market would react, or the direction EUR would take. The same scenario repeats itself every time we face any major transformation, directly affecting the market and the related currency. Therefore, the best strategy any trader could adopt in these long and unpredictable periods is to avoid trading the currencies in question. Eliminating additional risk and ignoring all pop-up news for as long as it takes for the dust to settle provides traders with real control in tumultuous times. Fortunately, with having the option of trading eight major currencies, you still have enough room to keep your account active and earn a profit in a safe and sustainable manner.

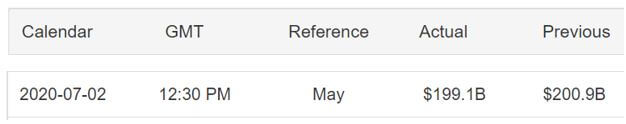

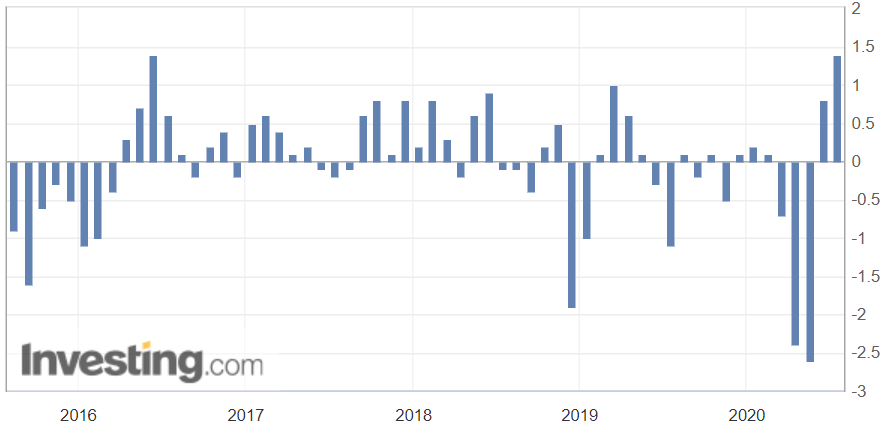

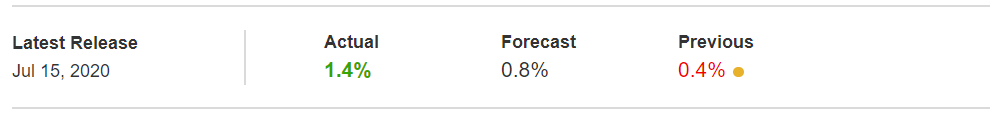

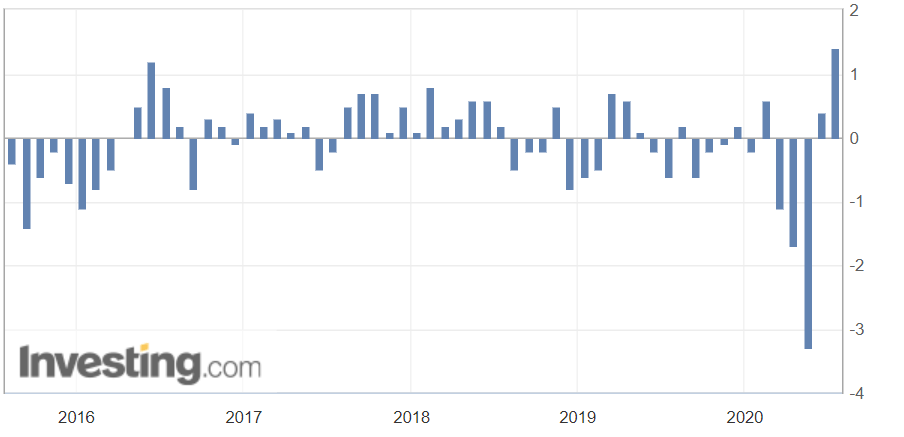

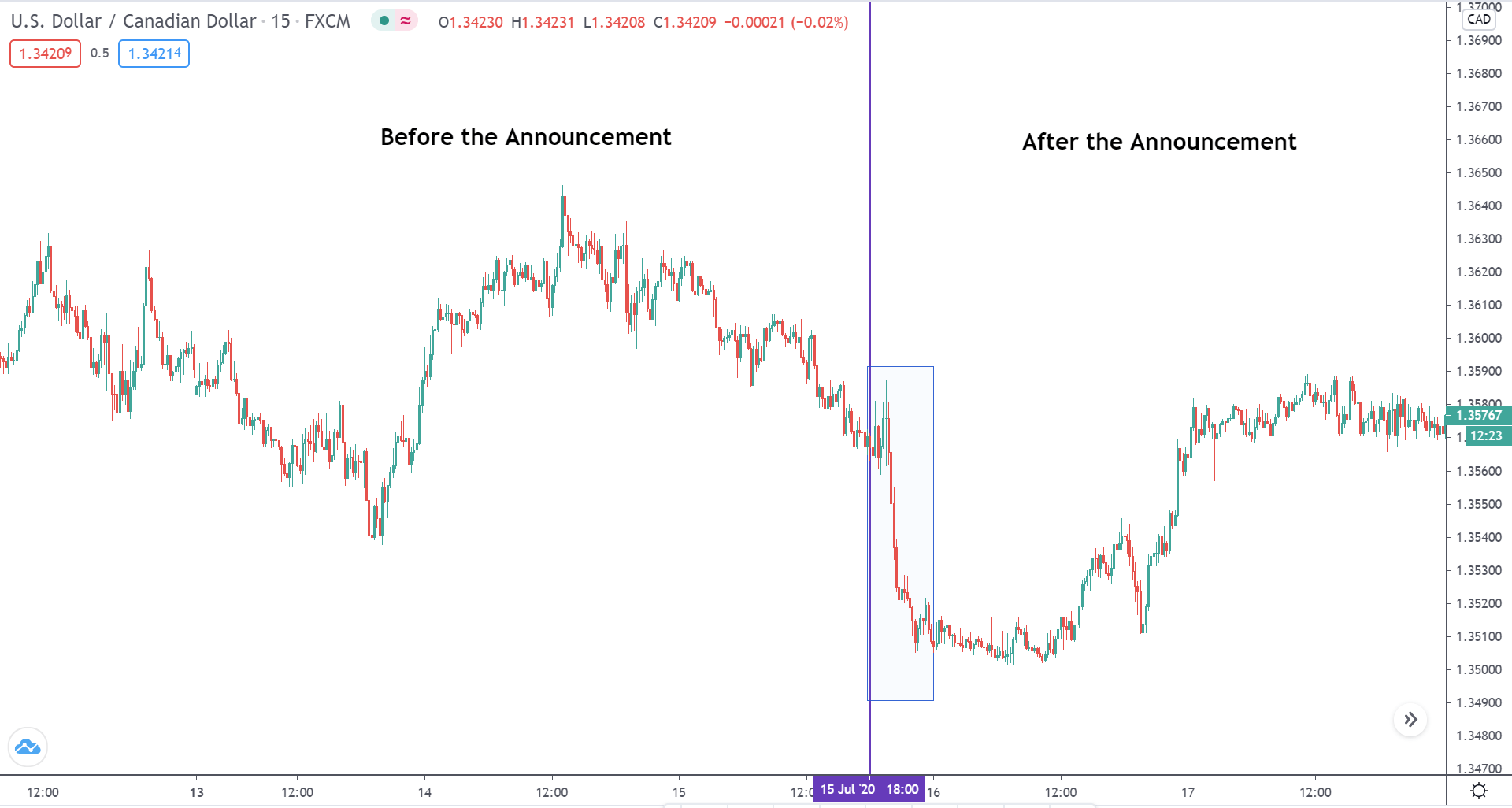

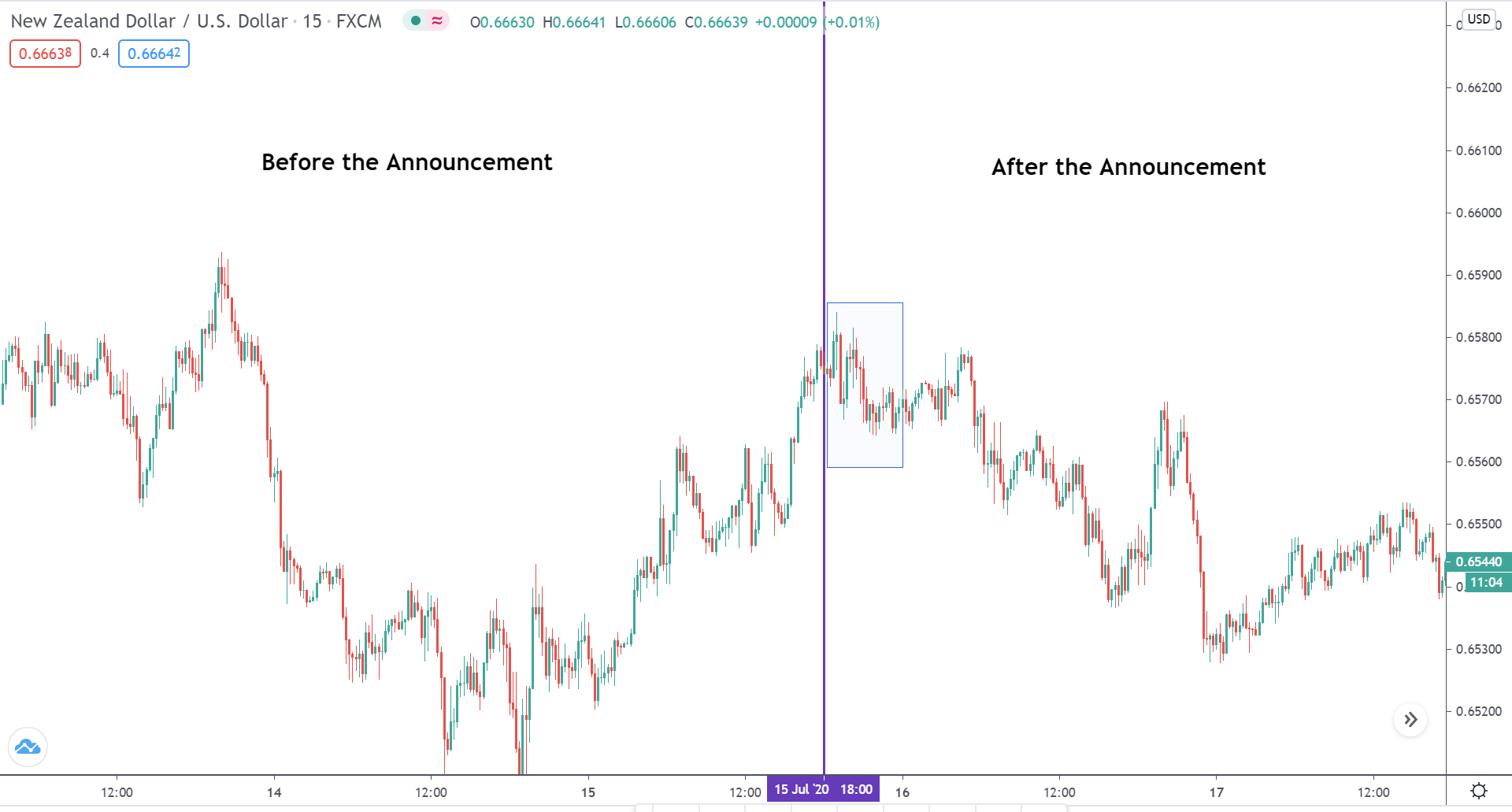

With regard to short-term events, it is always best to consult a news calendar prior to entering a trade, making it an essential part of one’s daily routine. There is a great number of events traders can ignore; however, a portion of news events has proved to trigger trading by knocking individual stop losses. NewsImpact.com, for example, is an excellent resource offering a historical overview of how prices moved when news came out in previous years. It provides into how an event that occurred two years ago may not have the same effect at present and vice versa. The impact of events can change substantially, where something traders found to be entirely unimportant before can gain importance in time. Nonetheless, what we can control and use as a relevant piece of information is the knowledge of events that historically elevated risk levels for traders, which is why understanding how each currency is particularly susceptible in a specific situation is crucial for both avoiding volatile market activity and maintaining control over one’s trades.

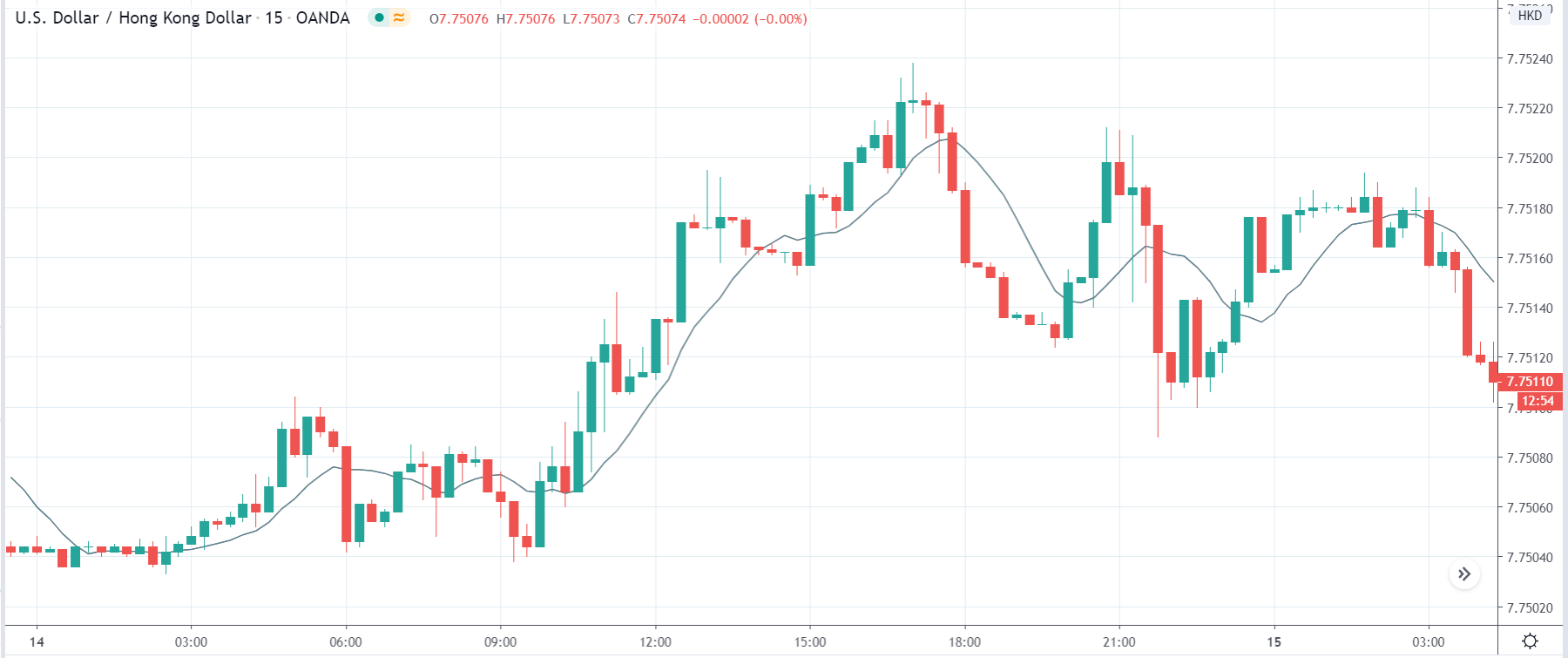

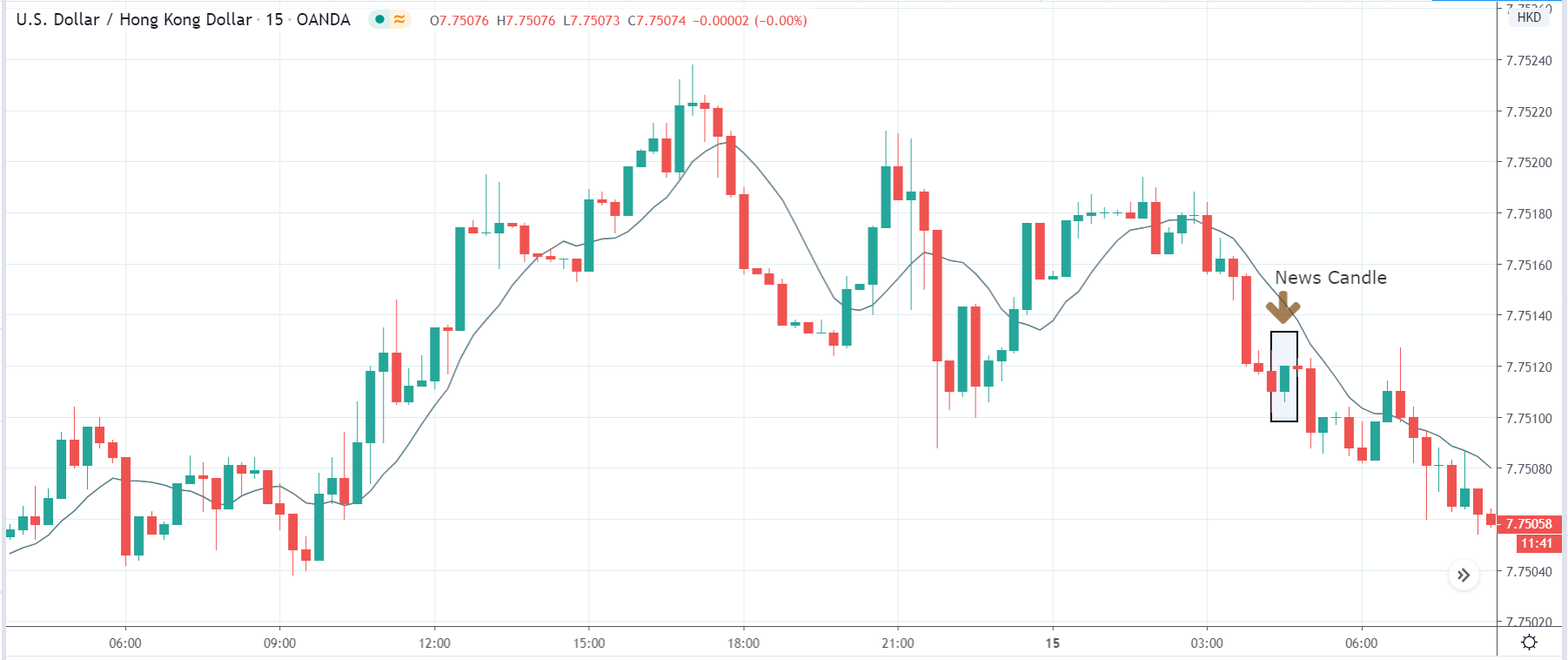

USD

The correlation between nonfarm payroll (NFP) data and the strength of USD proves how trading during this biggest news event of each month is an unwise decision, especially due to its tendency to bring about quick and erratic market activity. The circumstances involving interest rates and The Federal Open Market Committee (FOMC) also require special attention because each time interest rates rise or fall, so does the people’s interest in those currencies. Whenever there is an increase in interest rates, traders look forward to investing their money in the currencies in question owing to the potential of getting a bigger return. Likewise, in the scenario where interest rates decline, traders will inevitably search for better places to direct their money.

Furthermore, each time certain prominent figures decide to speak publicly, their words appear to have a bigger impact on the market. Jerome Hayden “Jay” Powell, the current Fed Chair, is an epitome of a public persona whose apparent disagreements with President Trump may be the source of additional concern because of the number of different interpretations people can derive. When we are assessing words, we are not dealing with any quantitative data, so the result of the manner in which the majority of people conceptualize what was said may lead to some unexpected changes the markets will undergo. From the side of quantitative factors, traders should pay attention to the Consumer Price Index (CPI), which measures price level changes, and these numbers have only recently started to have an impact on USD. As said before, the news impacting this currency may vary and change in relevance over time, but their current impact should not be disregarded.

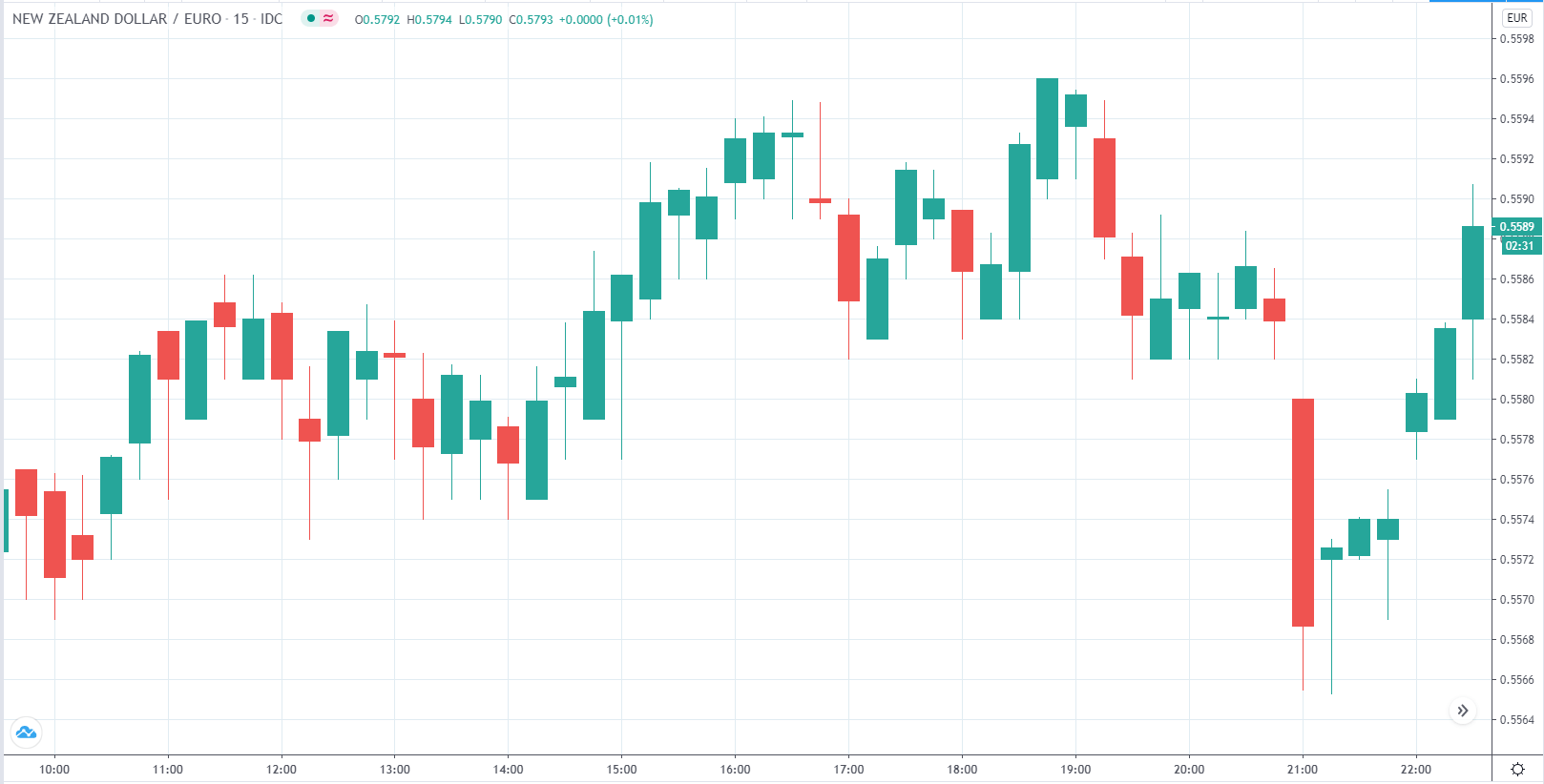

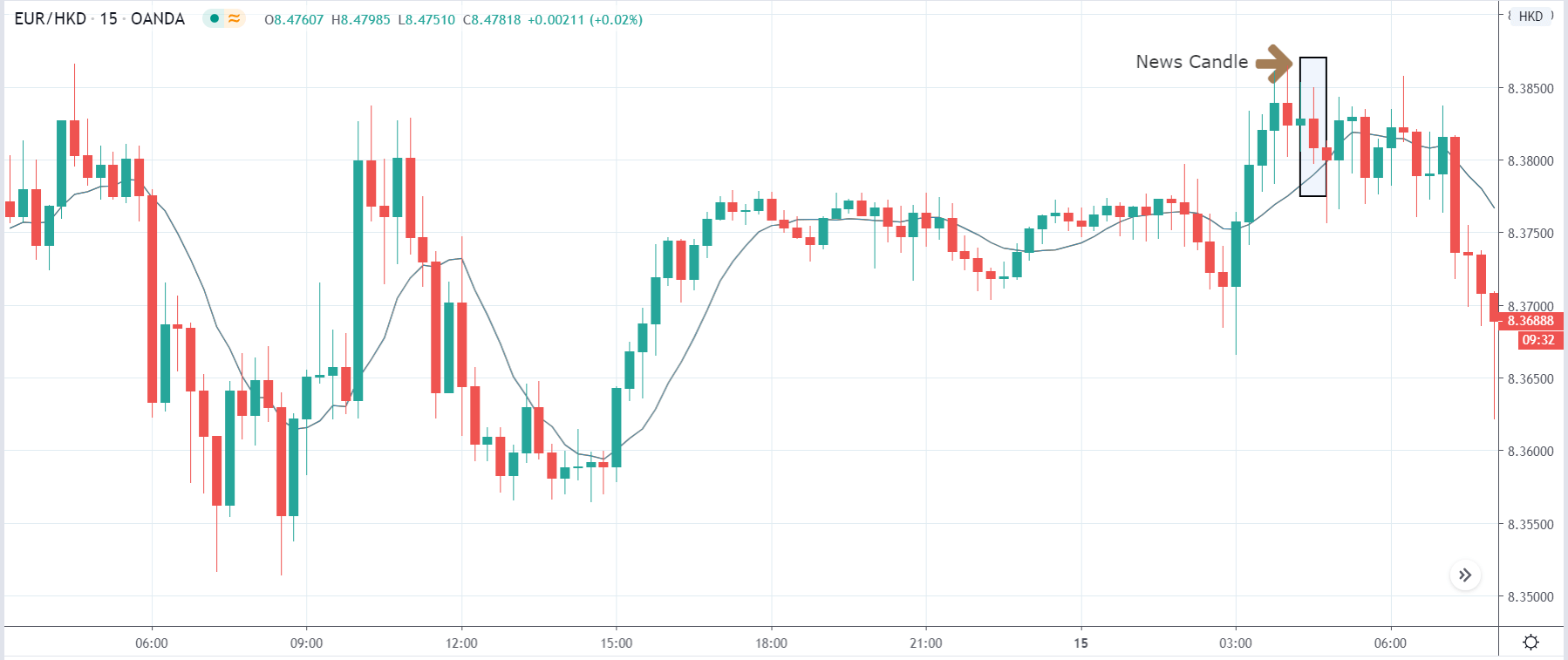

EUR

Due to the fact that this currency spans across several countries, the impact of the news is of a lesser degree than it would be in case of a currency dominating a single country. Apart from interest rates, which prove to be a common factor among all currencies, people trading EUR should pay additional attention to the news coming from the European Central Bank (ECB) because the previous President Mario Draghi’s seldom statements often caused quite a commotion with regard to EUR.

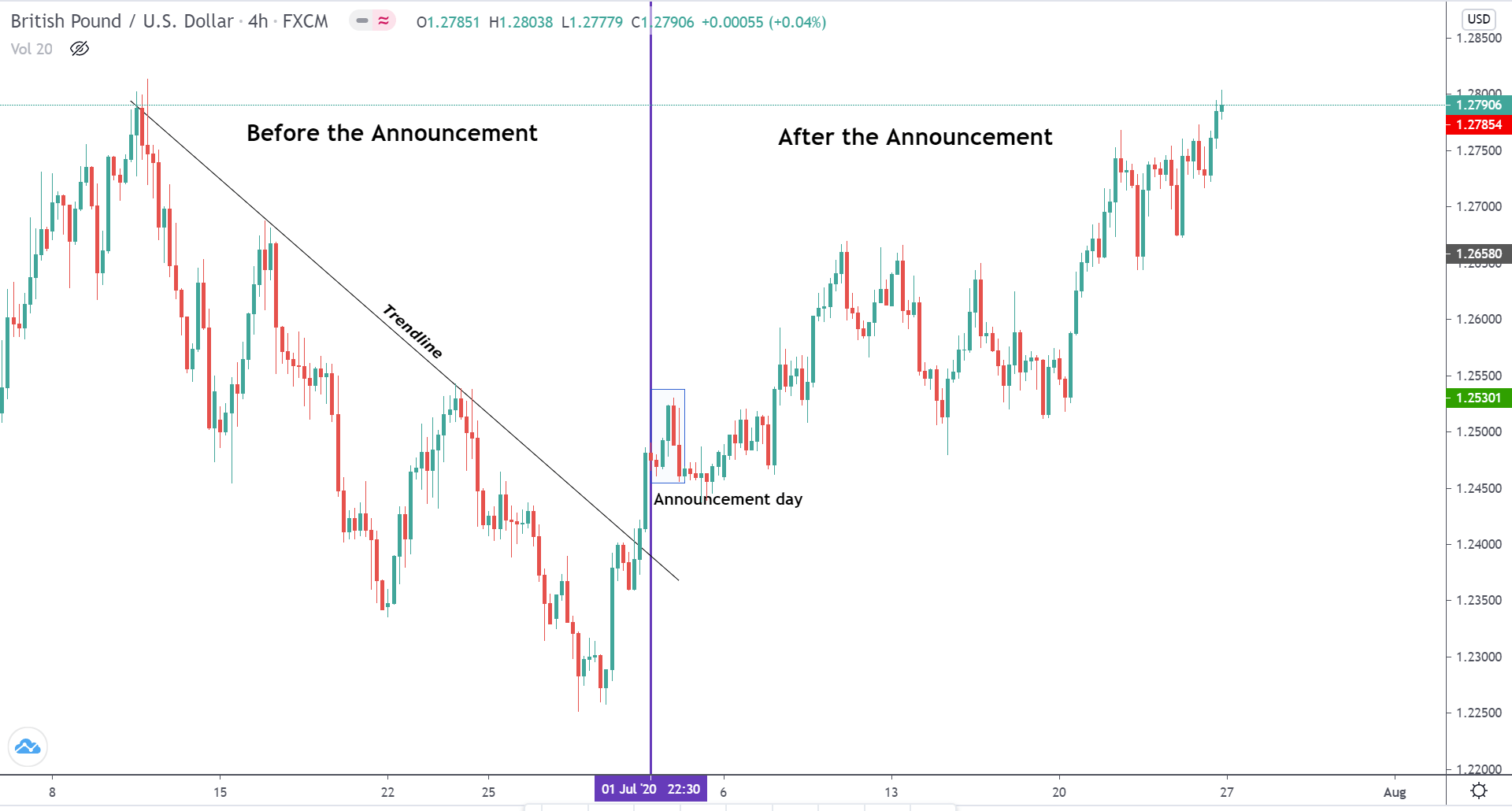

GBP

One would expect economic indicators to have a stronger impact on a country that is as small as the United Kingdom but appears to be irrelevant in this case. Interest rates in this country depend on the Monetary Policy Committee or MPC whose nine members’ vote determines the timing and the direction of interest rates. News calendars will typically disclose information of a uniform nature, where all nine members agree on the same decision. Nonetheless, should this ever change, it may cause GBP to act strangely causing traders to feel alarmed. Another important news concerning the currency is GDP owing to the fact that a country smaller in size is naturally more affected by its gross domestic product than in the case of larger countries.

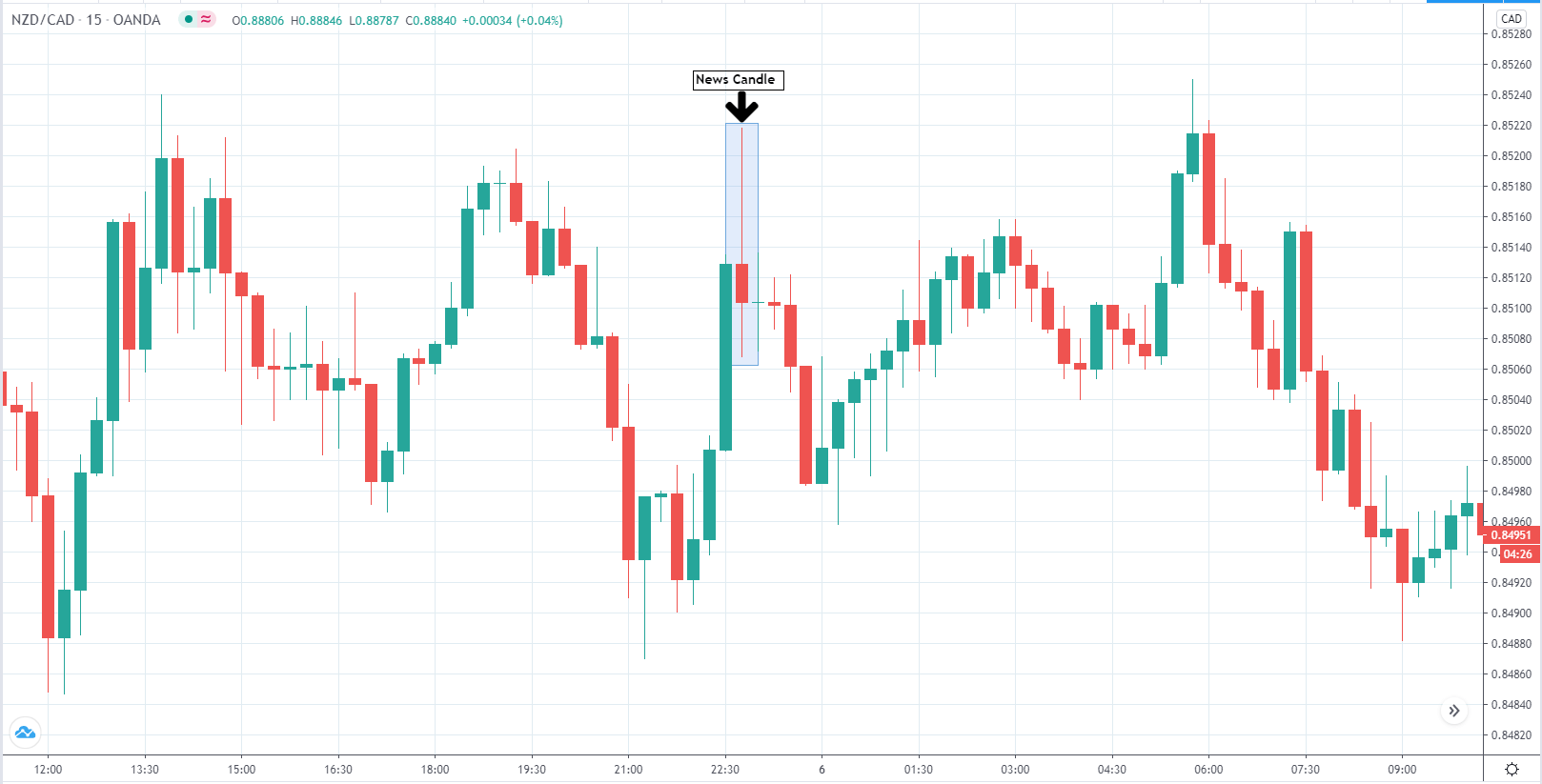

CAD

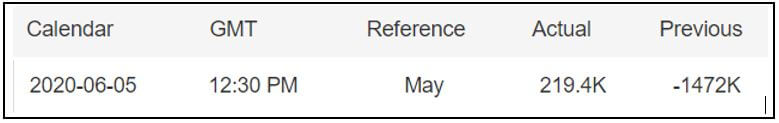

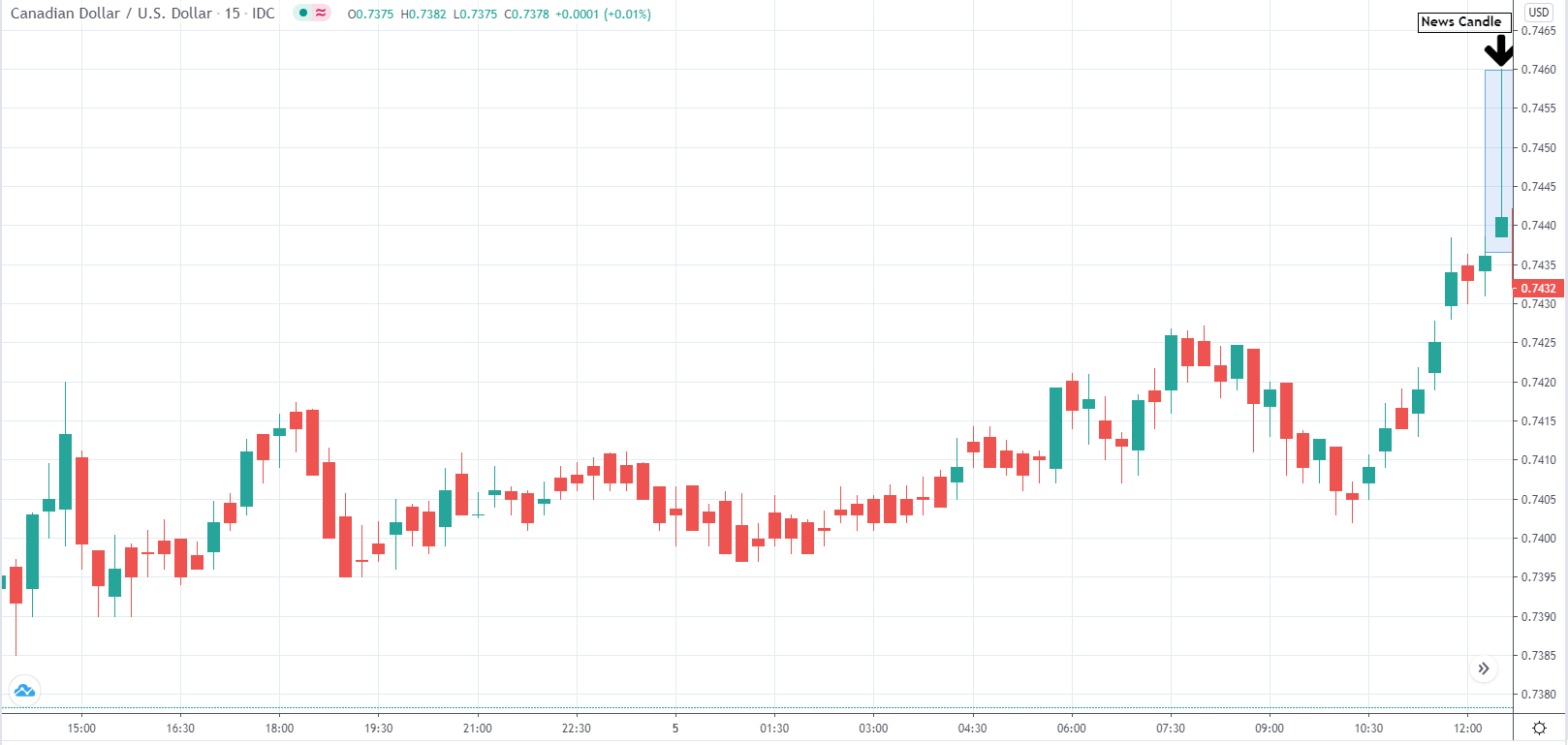

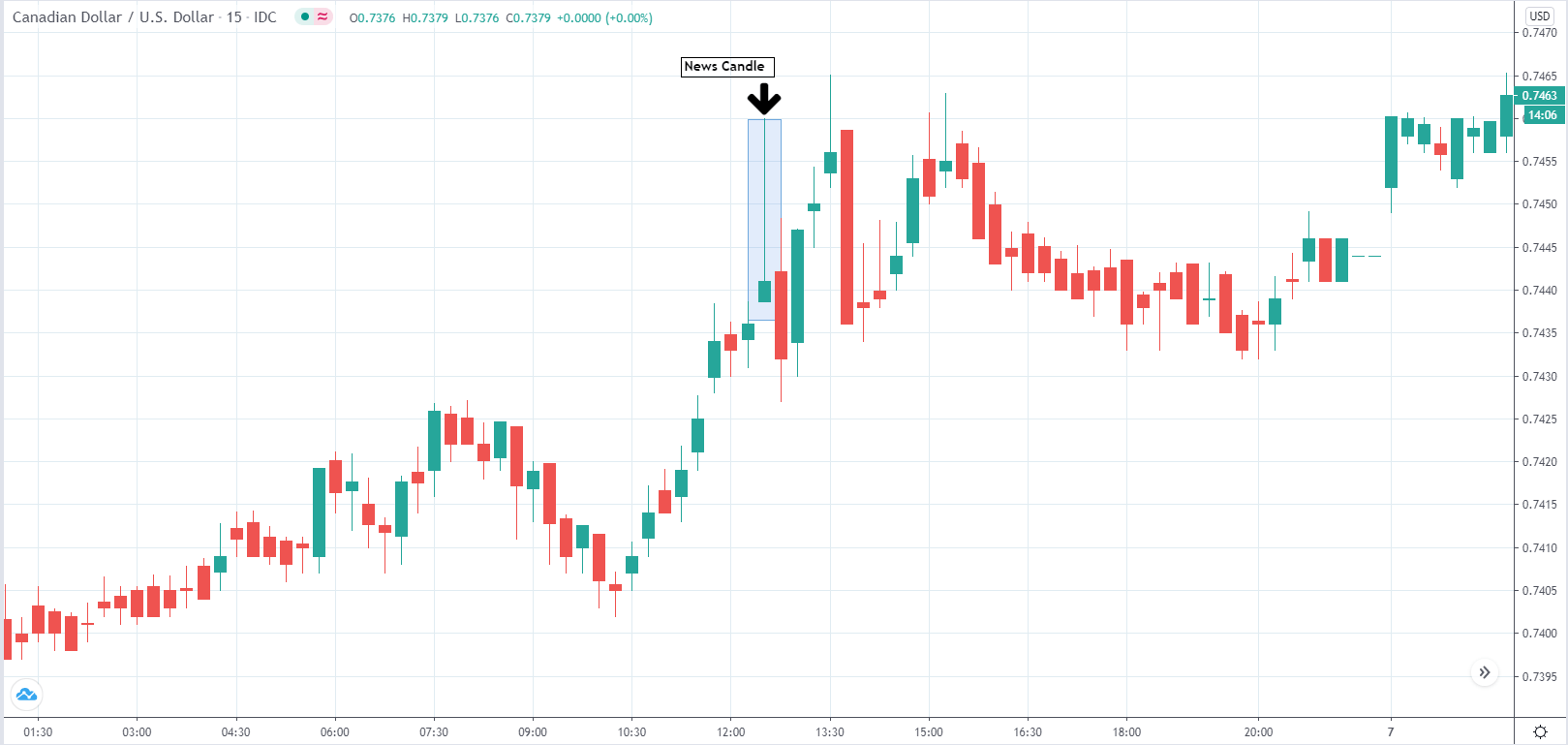

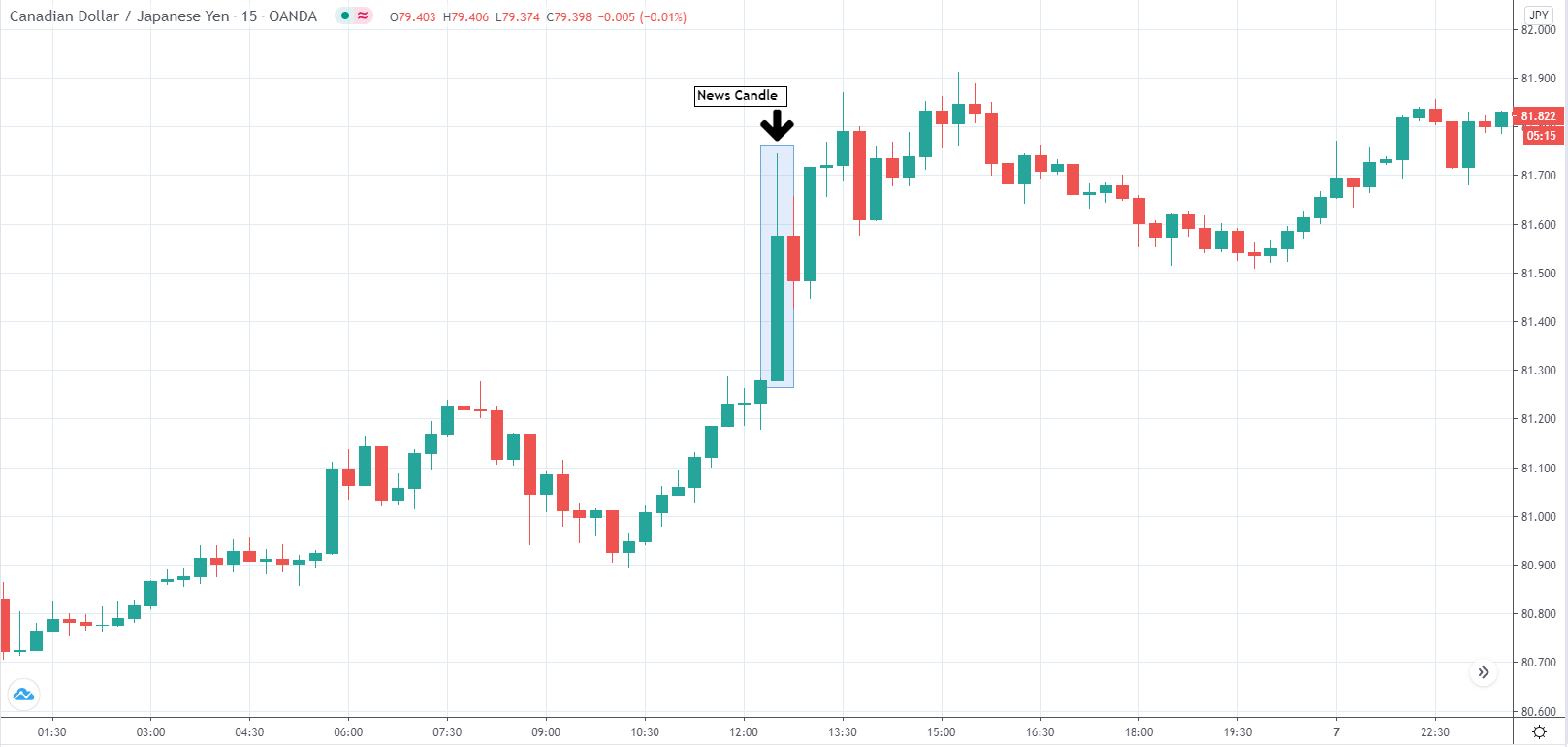

Aside from interest rates, the Canadian market has proved to be vulnerable when it comes to the employment rate, with these numbers often oscillating at the same time as nonfarm payroll which allows traders to tackle two factors simultaneously. Retail sales should be included in the traders’ assessment of the market’s stability and their next move. The last factor in terms of news events relevant for this currency revolves around CPI, whose significance has grown as of recently.

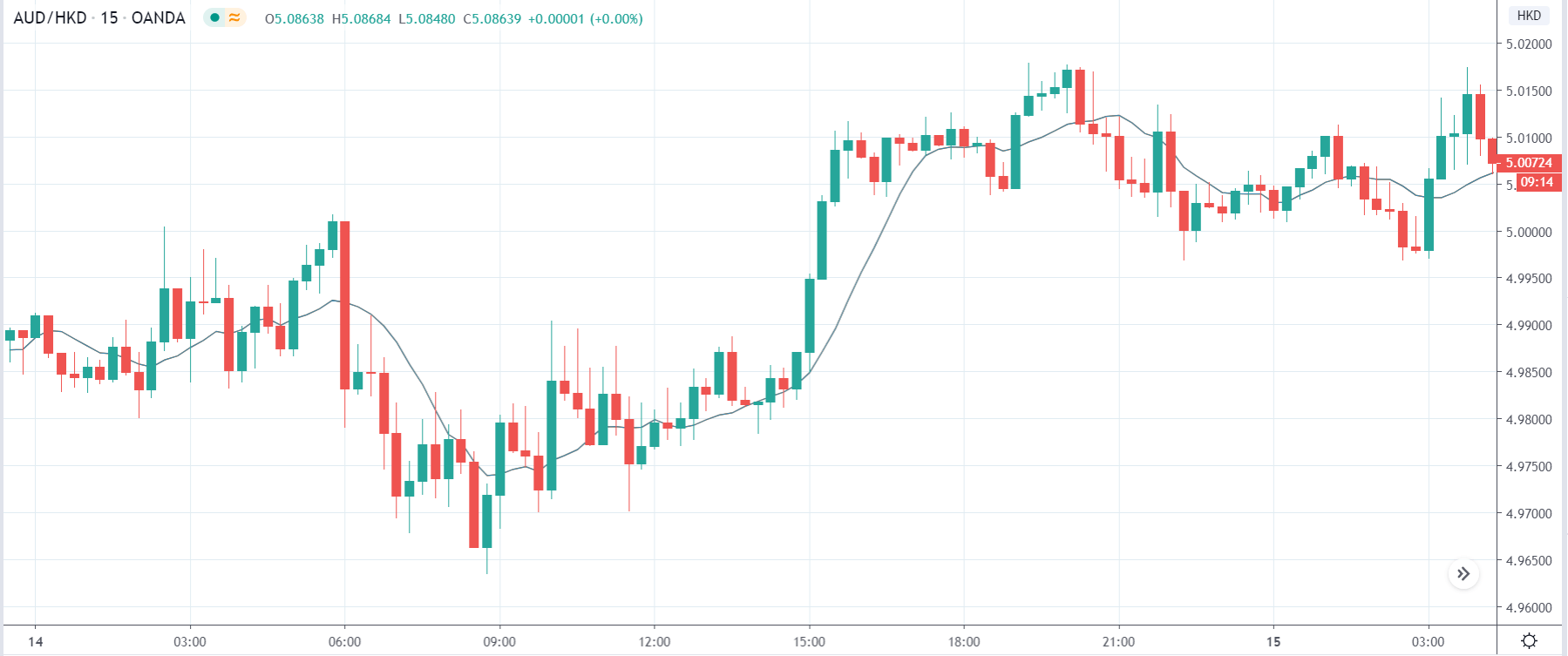

AUD

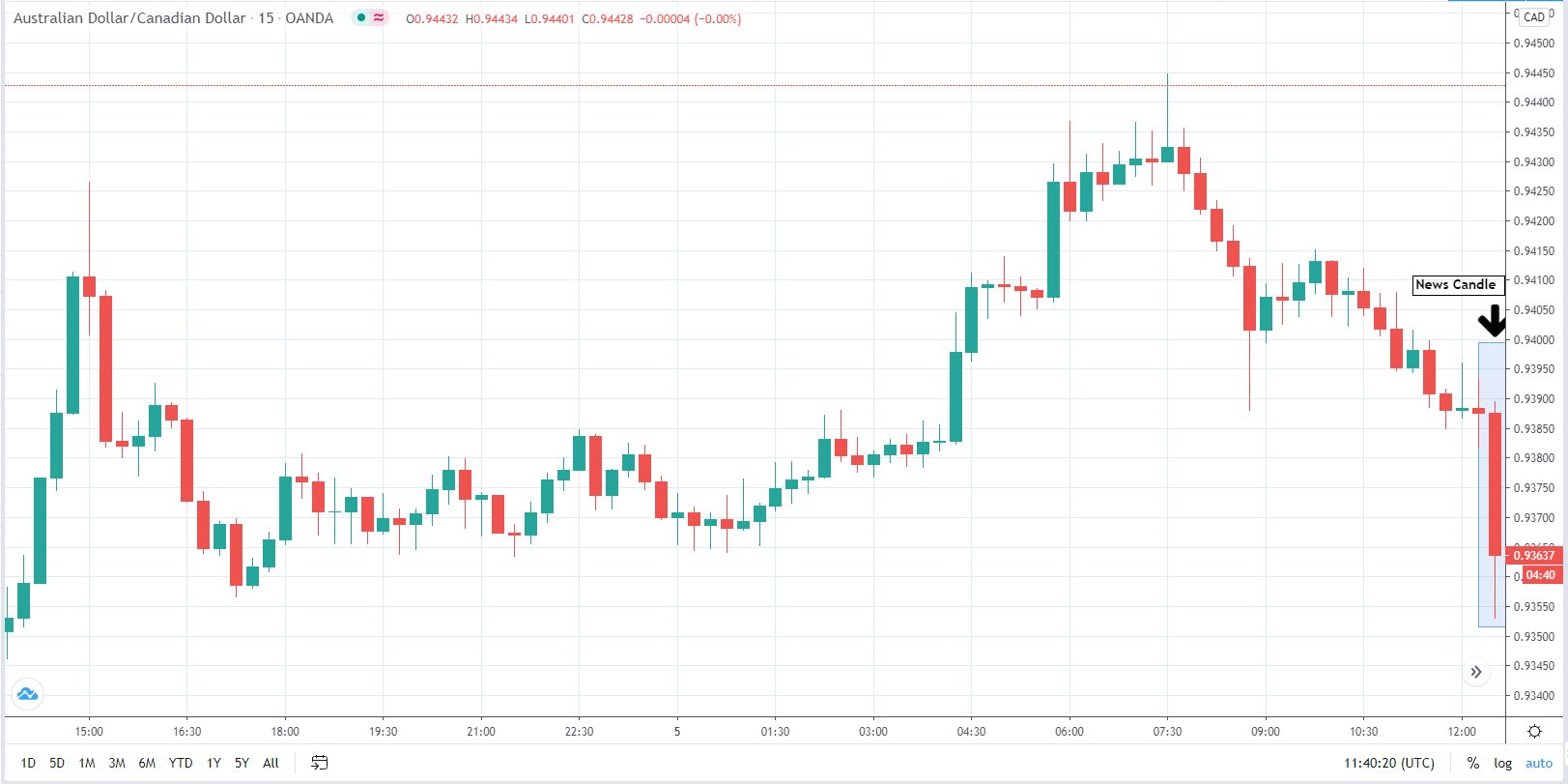

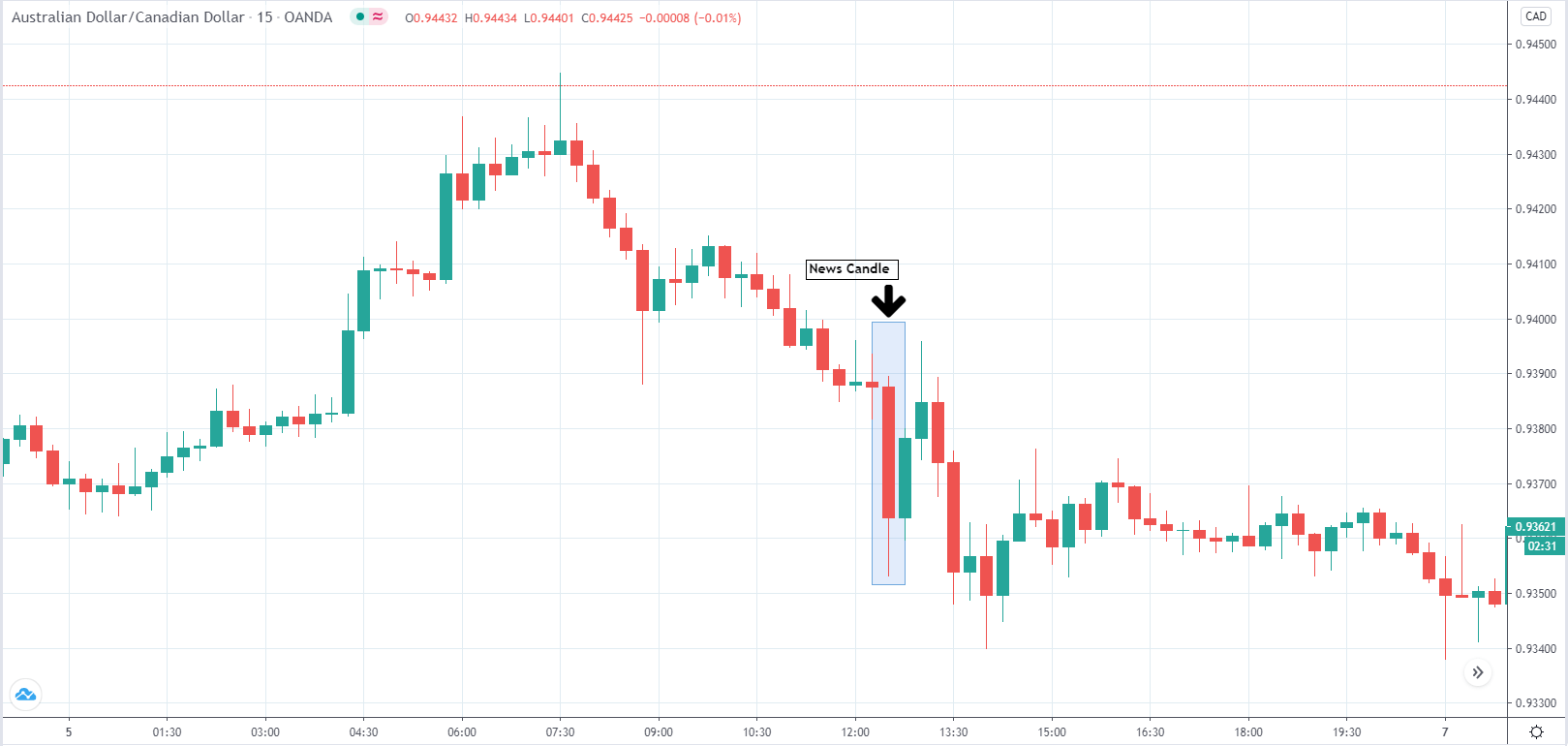

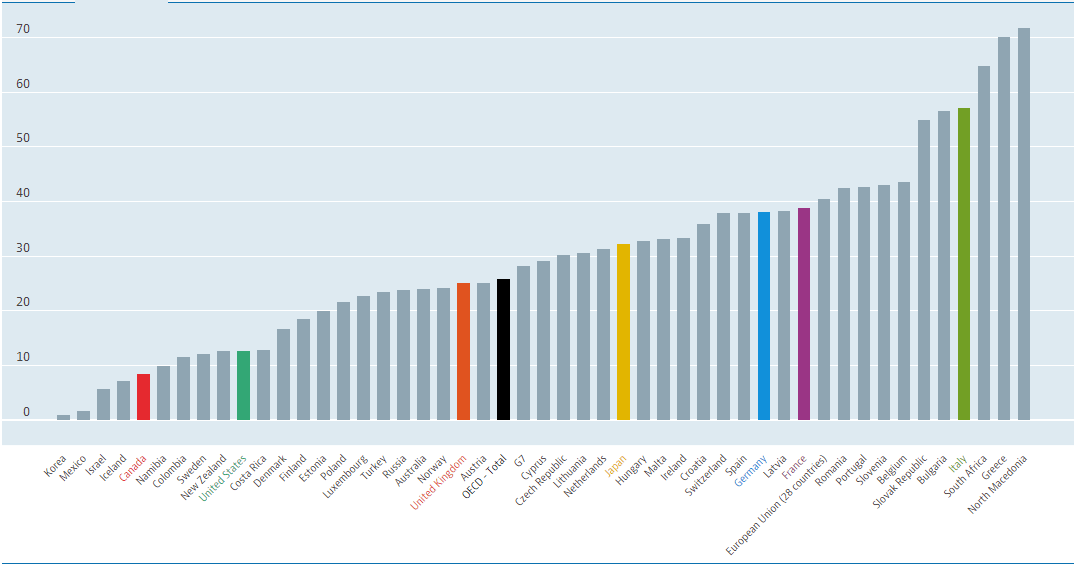

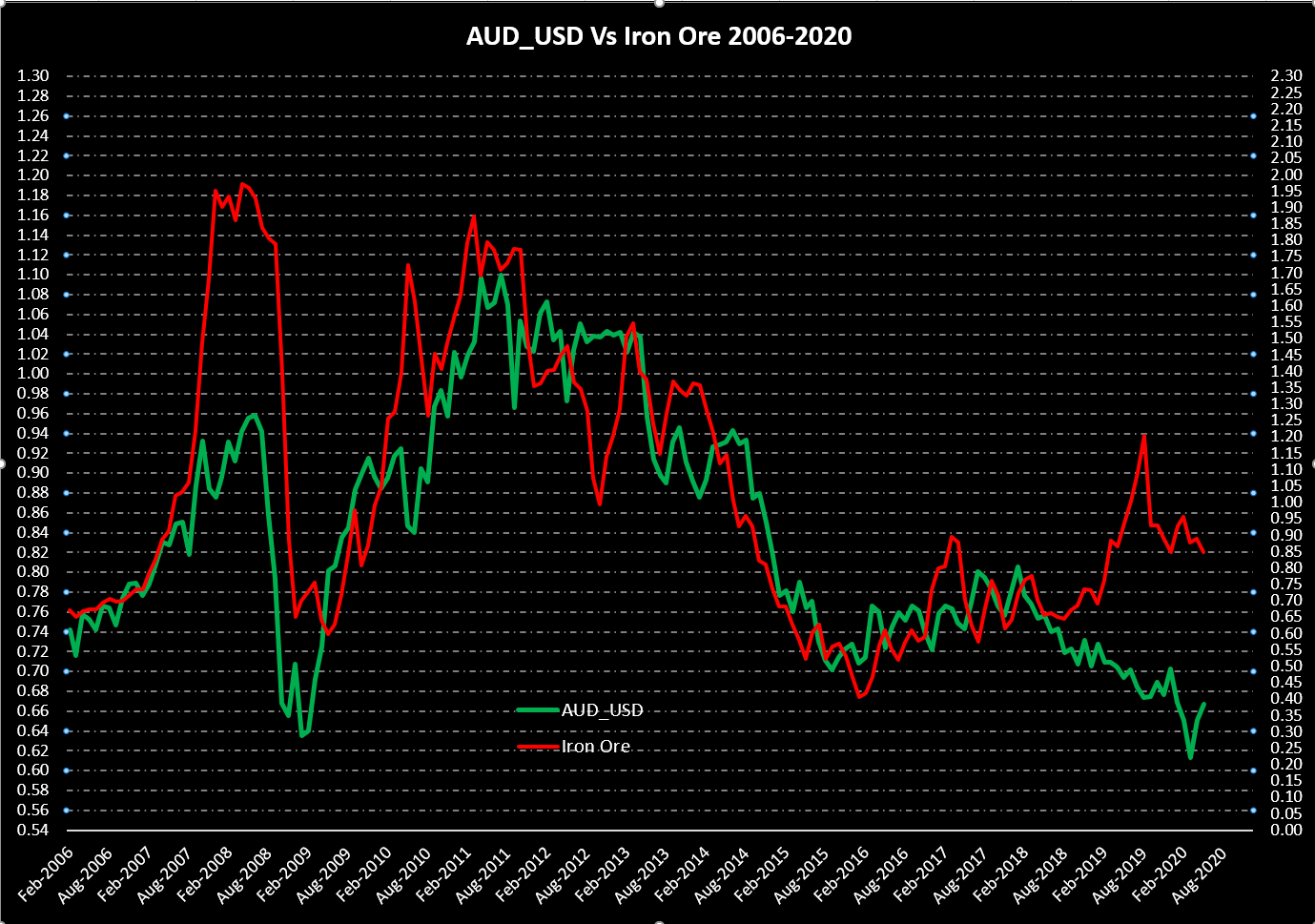

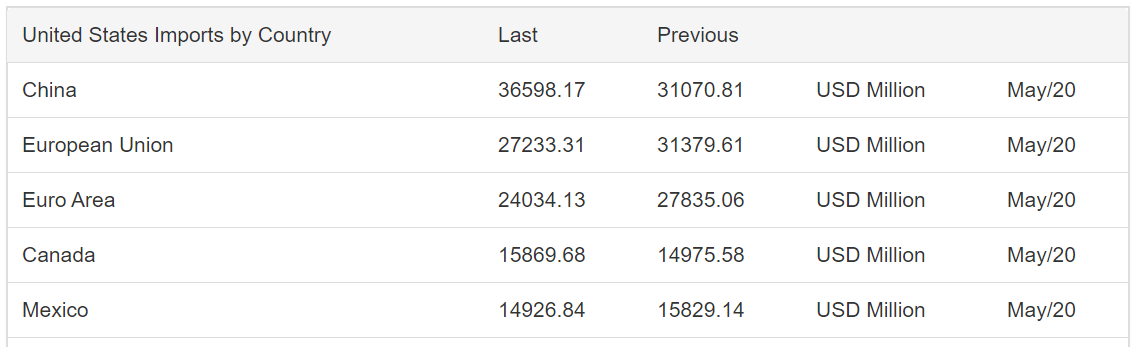

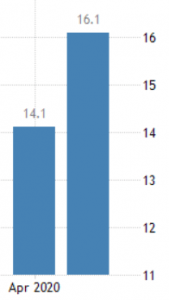

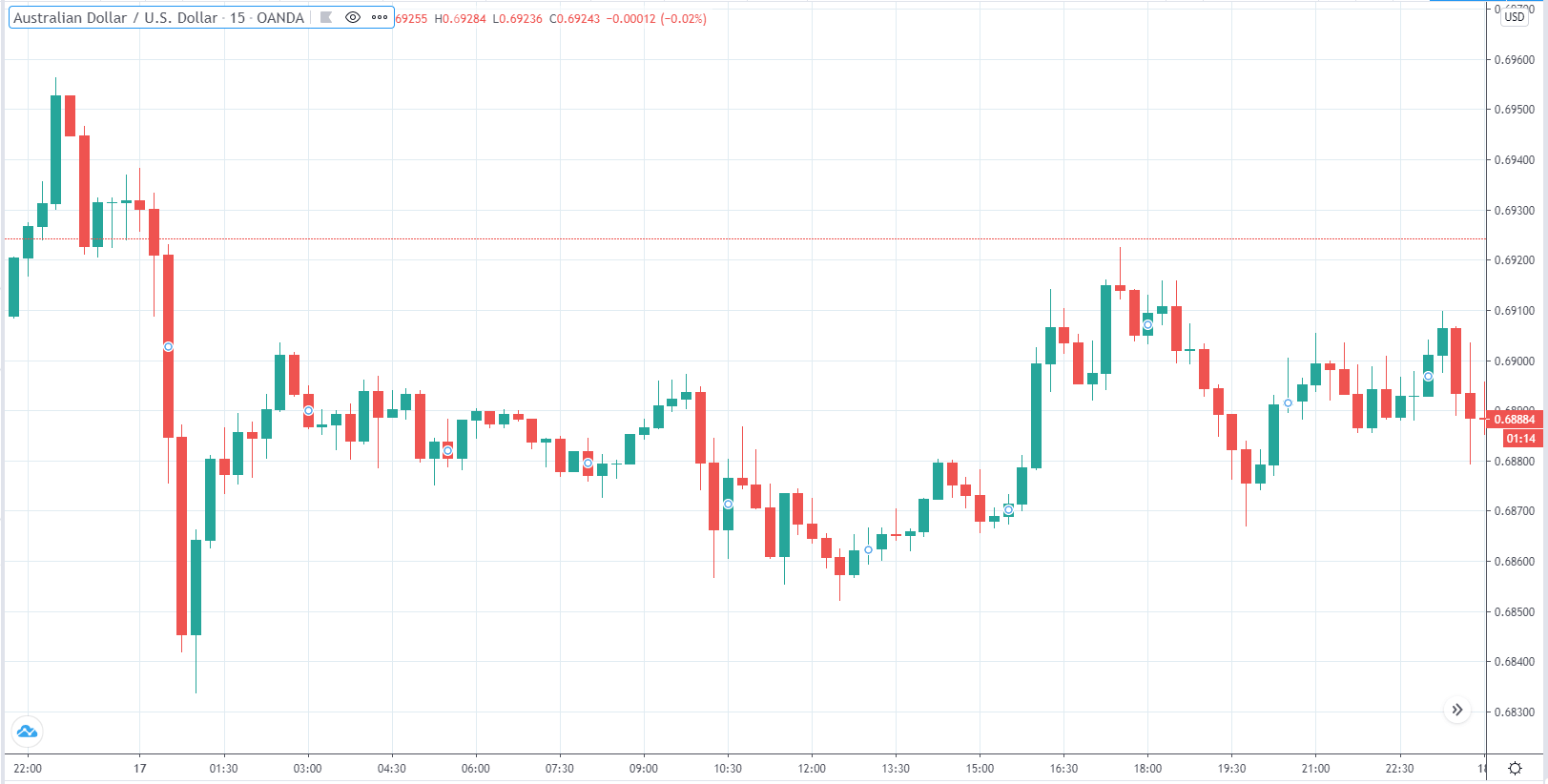

Interest rates and employment numbers also affect this currency as they do some of the previous ones. Yet, what is different about AUD as opposed to other currencies is the impact of the news coming from China. As Australia’s favored trade partner, events occurring in China would naturally impact AUD. Nowadays, however, due to the fact that the Chinese economy has subsided in the recent years, they are not going to buy as many minerals and materials from Australia as before when the country was in the building stage, which lessens the overall impact of news events originating from China on AUD.

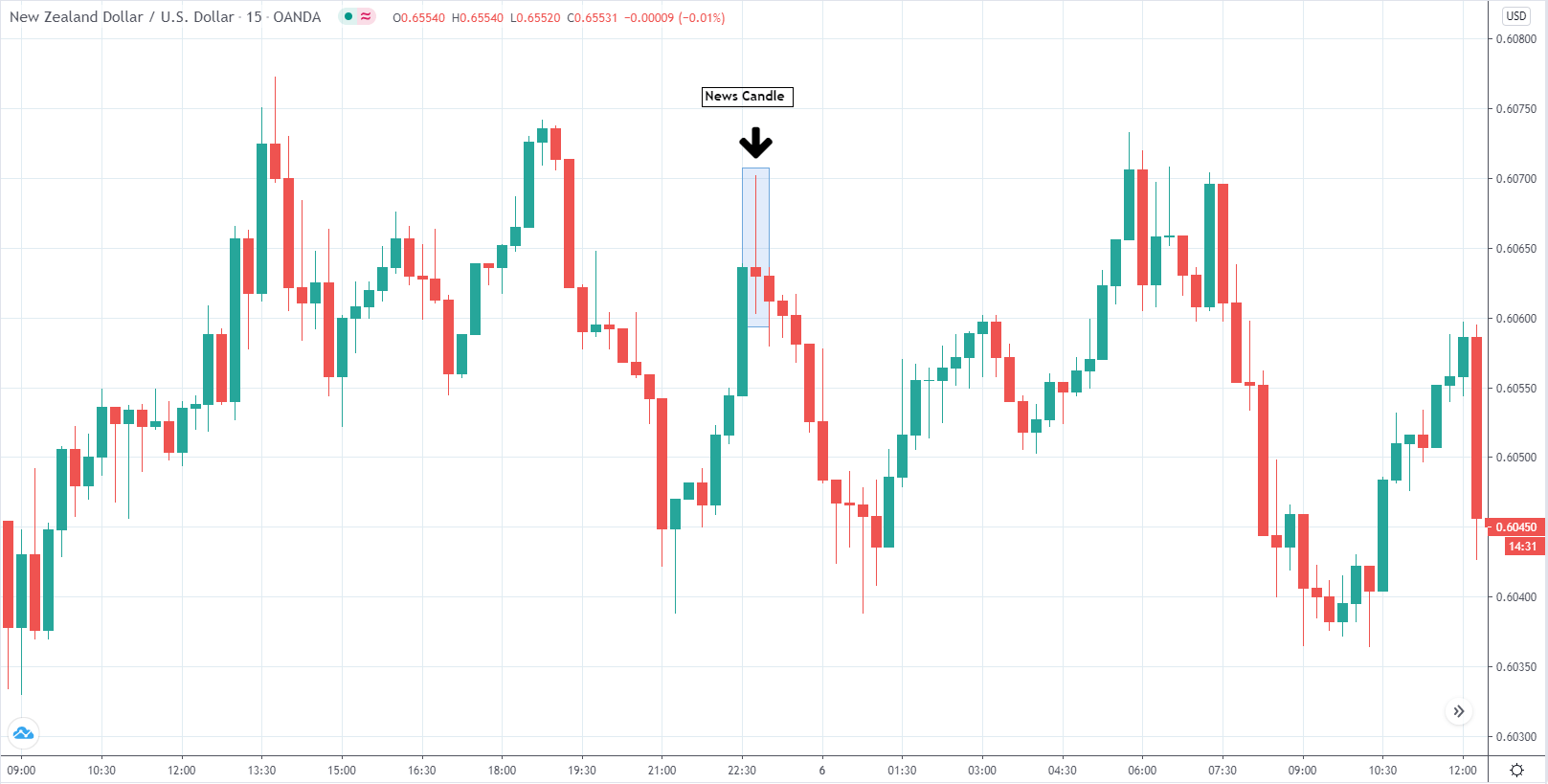

NZD

New Zealand’s currency is affected by a number of factors discussed above, such as the employment rate and GDP. However, we also need to introduce GDT, global dairy trade, as dairy does constitute an important part of the country’s economy. Therefore, whenever the news of GDT comes out, it naturally makes a difference in the market of the Kiwi dollar. It is important to remember that some news calendars may not detect or disclose this, or any other piece of information for that matter, which further entails that you may need to consult several news calendars (consider the previously-mentioned options) in order to put together the complete picture. Interestingly enough, interest rate appears to not have had a major impact on the currency in question in years, which certainly does not indicate that it will not become an important factor once again in the future.

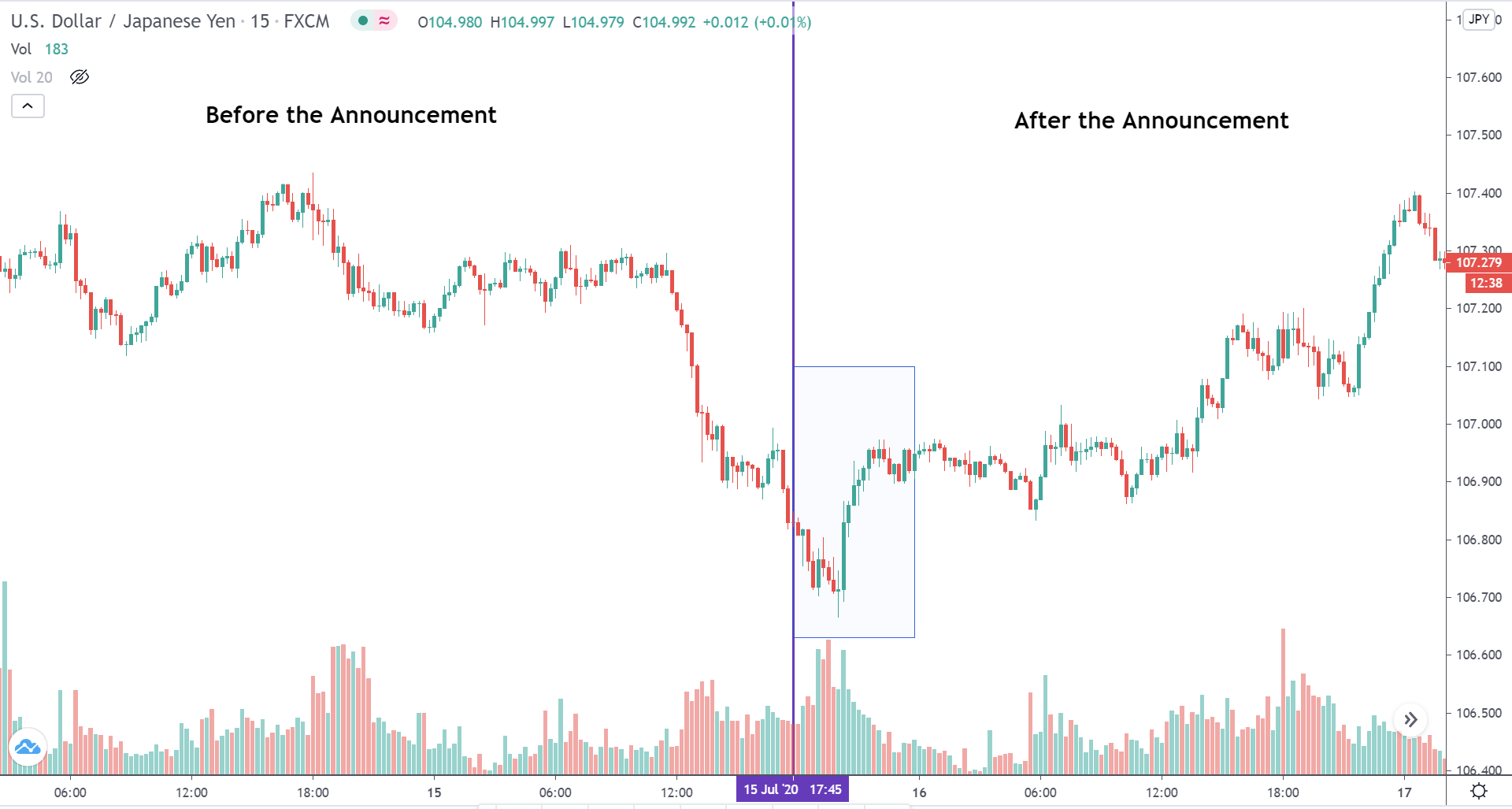

JPY

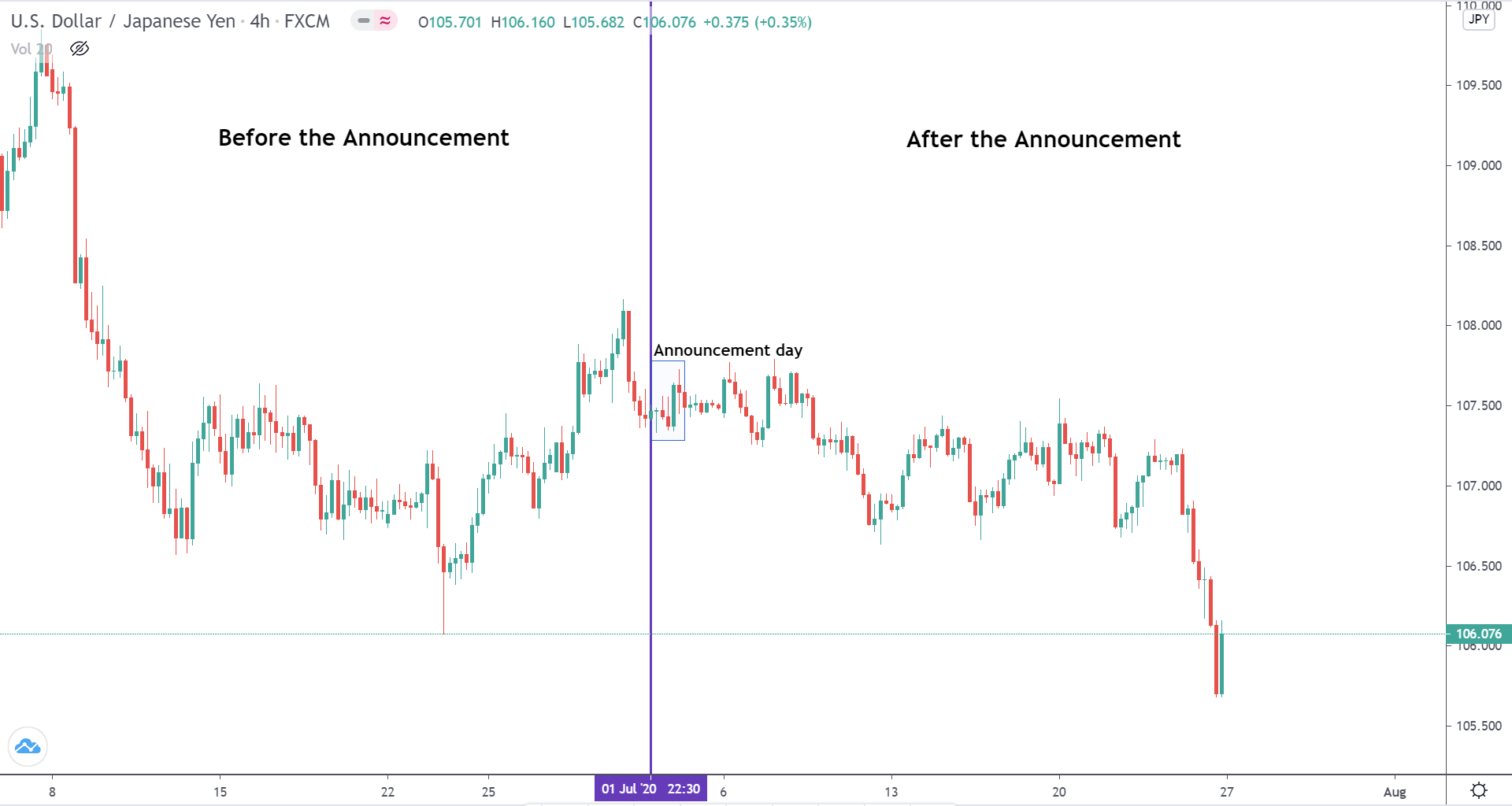

One of the last two currencies which seem to undergo little impact of news events is JPY. As with NYD, the Japanese currency has also not seen any activity worth mentioning in terms of interest rates since they seldom change, but they may pose a threat in the future when they do. Luckily, it a single piece of news that comes out only once each month, which does make it easy for traders to monitor and detect any news-worthy changes.

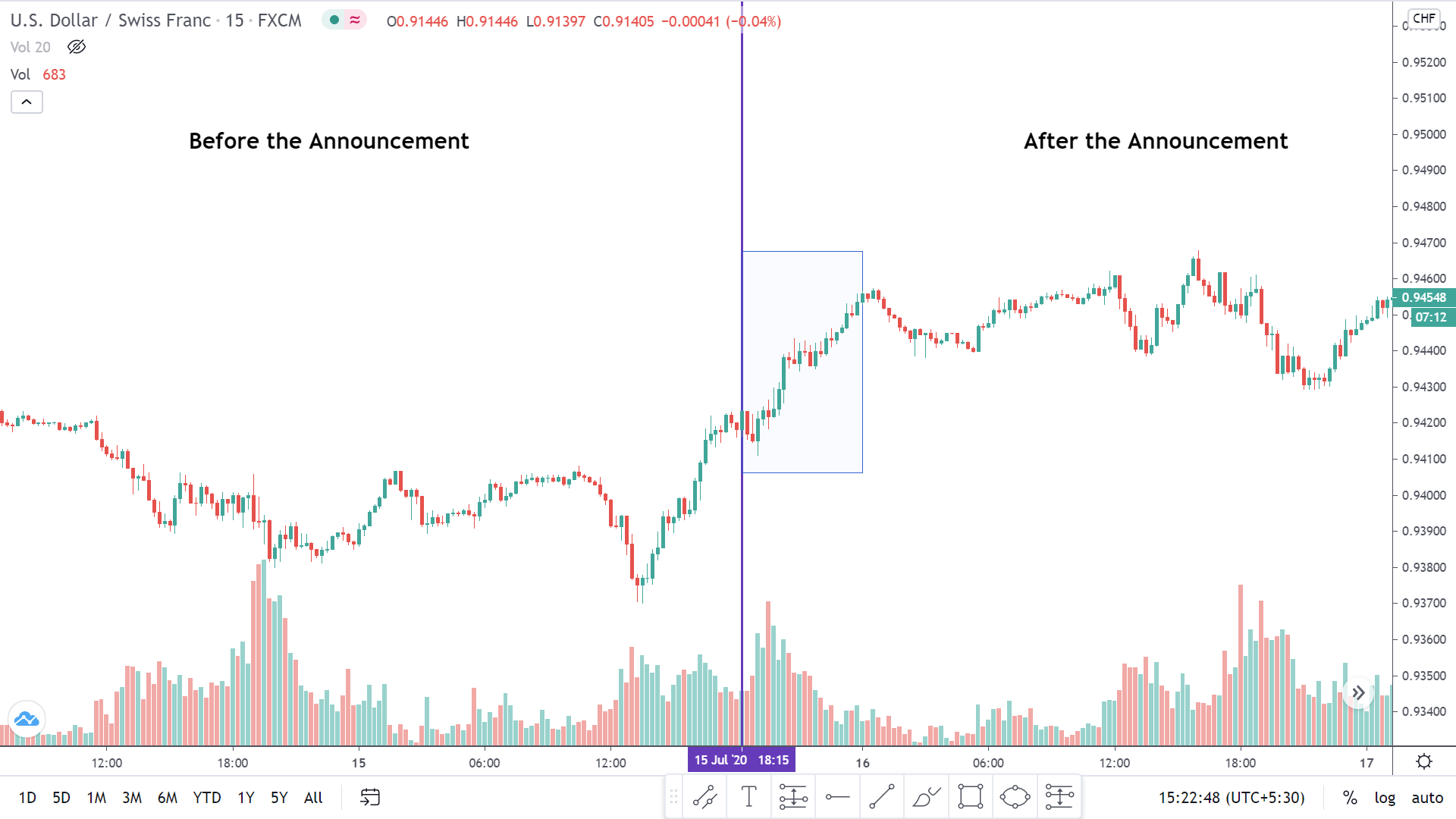

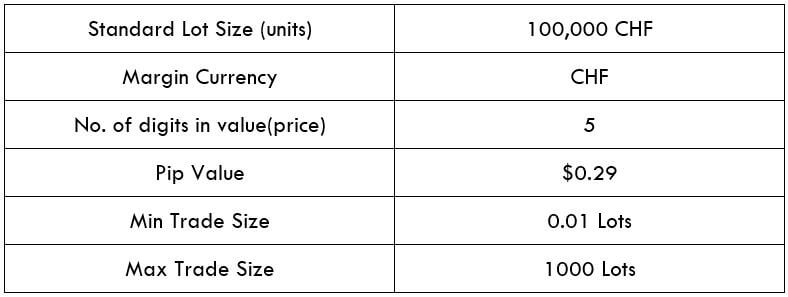

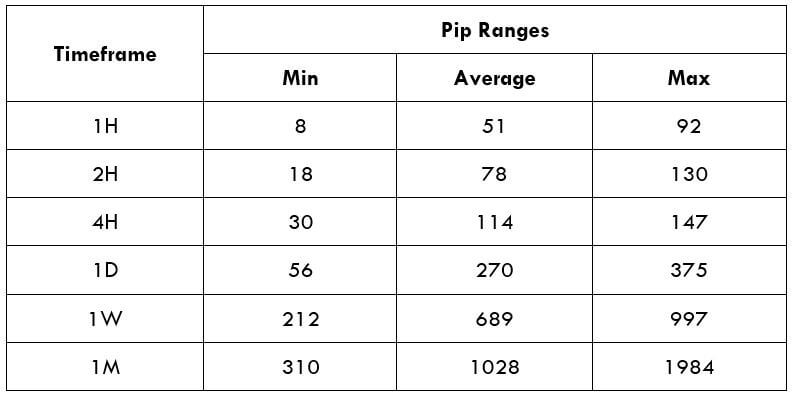

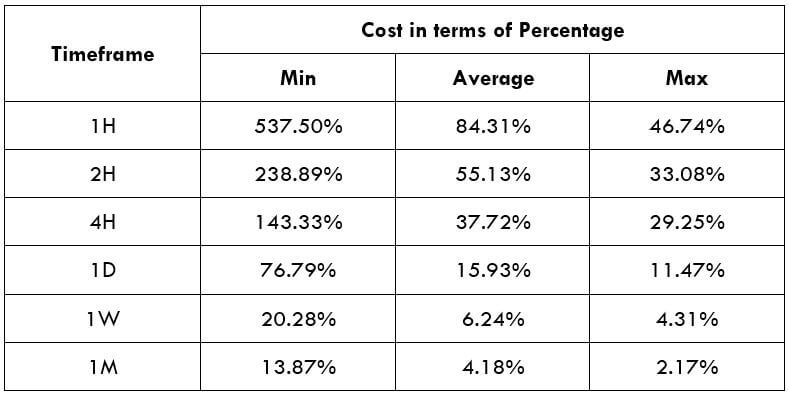

CHF

The Swiss currency, similar to the ones before, may one day start depending on the fluctuations of interest rates, named the London Interbank Offered Rate or LIBOR in Switzerland when traders are advised to sit out and patiently wait for the currency to stabilize.

While we have analyzed the main news which may have an impact on the major eight currencies at present time, you may come across other news events as the nature of the market is to always grow and change is naturally an inherent part of such growth. We also need to mention that both banks and people trading in the currency market can choose how they will react regardless of individual expectations and/or needs. The example of the 2019 flash crash should serve to teach traders a lesson that even if we know some information in advance like we knew how Apple sent out a warning concerning the Chinese economy, big banks still allowed the market to go into a craze. News, be it small such as this one or a more sizeable piece of news, can at times stop traders. However, we need to accept it as an integral part of the forex market and decide to move on. While there is a vast number of aspects to trading currencies traders cannot control, what they can in fact do is devise a plan that will serve to protect and support them on their path of growing accounts and finances.

For every news event coming out, each trader should be mindful of the available steps he/she can take so as the secure the best possible position at the time. If, for example, traders are not trading a specific currency pair while receiving some important news, they are advised to refrain from entering any trade involving the currency in question should the news event be occurring within the following 24 hours. If there is a possibility of securing any candles prior to the time frame we have just mentioned, you may freely do so. As long as the trade falls under the period of one day, you are entering the market at the risk of endangering your finances and your account at the same time. This rule will surely introduce more control over news events and limit the urge to trade recklessly, thus providing the necessary stability all people trading in the spot forex market should strive to ensure.

If the news event, however, involves the currency you are trading at the time, you will be able to apply a few different strategies depending on the stage of the trade you are in. In case you are in a trade where you are slightly losing (e.g. 50 pips), but your stop loss has still not been hit, and a big news event is about to take place within the 24-hour period, you will need to exit the trade so as to protect yourself. Taking such loss may be difficult, but considering the fact that by staying you would in fact be open to facing an even bigger loss, this option is the safest it can possibly be. While it may not happen very often, you do not have to get yourself to the stage where the price passes your stop loss without having been triggered. Hoping that the price will go back your way immediately involves too much risk and the cons are simply incomparably higher than the pros. The only way to eliminate a risk this big is to close these trade because the likelihood of your account recovering afterward could be highly questionable otherwise.

If you have entered a trade that is now winning, there are several important facts you should take into consideration. Firstly, regardless of the fact whether you have already taken any profit, using the ATR indicator as your take-profit point is always advised. We can typically see two scenarios unfolding in this case: either a trader has entered a trade but no profit has been collected yet or they have already taken some profit off the table but the price is now falling. In either case, there is only one solution that will mitigate the risk that comes from trading under the impact of an upcoming (or very happening) news event. The only solution here is to take whatever profit you have made so far and exit the trade at peace. There will surely be people who earned a big profit during the time of an important news event, but what this approach is about is limiting the losses. If a trader was lucky enough to go unharmed once, the same circumstance may not play out again which is why this risky approach is then not your best long-term strategy. Even if a trader chooses to move their stop-loss to the break-even point, the odds of a stop-loss being taken out under such circumstances are higher than they may realize. Whatever preventative measure you think you have included in your trade does not truly mitigate the risk, which is why exiting such trades is the only logical and safe solution.

The very last context we will be analyzing today concerns trades that have already scaled out and are still winning. If you have taken your profit at the ATR value, for example, and you are satisfied with how the trade is progressing, you should carry on as if it were any other normal circumstance despite the big news event approaching. You have probably moved your stop-loss point to the break-even or you are relying on a trailing stop, so there is no need to include any other measure at this point. This scenario has several benefits starting with dealing more pips due to trading the daily chart. Moreover, there is a chance that the price does not hit your trailing stop, but keeps moving in the desired direction even further instead. Be it this best-case scenario or a somewhat different one, your trailing stop will always provide the protection you need under these circumstances. Regardless of which scenario you get to experience among the ones discussed in this article, you should always assess the risk levels and take any preventative measure you can so as not to end up where the majority of traders do.

Finally, the notion of going against the big banks is a losing game and the game which will inevitably, sooner or later bring about massive failure. Your job is not to play the game where everyone is meant to lose, but to navigate around the challenging circumstances the best you can. Recognize the repetitive cycles and acknowledge the news events in a rational, non-compulsive fashion. Learn how to read through the news and understand how some events will take months to fully play out, along with taking a number of traders off the trading scene. Whenever you notice the tension building up in the market, the best strategy is to simply be patient and wait for the turmoil to pass. You cannot predict how any participant in the market is going to react, which is why getting involved in any of the events you cannot control is a risky decision. Use wisely the knowledge on the events you should consistently avoid and keep researching the market and the currencies in the context of the states they govern.

Include news calendars in your daily routine and adopt a healthy, sustainable action plan which you can call upon at every trade stage or in any circumstance. Whatever action you are planning to take, you should always rely on the system you developed because it will provide you with technical support this line of business heavily requires. Lastly, while the effect of having such a comprehensive approach to trading may not help you see any immediate results, by the end of the year your account will provide transparent and tangible proof of how having a structured plan supported by technical tools and factual knowledge always leads to success.

Some traders assume that managing news events is possible, believing that by possessing these information items gives them control over the market, to the extent that they deem generating a great number of pips in little time possible. Their viewpoint on news events boils down to the idea that the moment such news comes out, they will take specific action accordingly. Should the news be strong, they will go long on their chosen currency and vice versa. They believe that any timely reaction will easily bring them many pips, and we cannot but confirm that such a belief is based on solid grounds. Nonetheless, the fact that some traders managed to achieve this does not prove its quality. Not only does it happen occasionally, which immediately introduces a higher than necessary risk, but it also leads to false conclusions. Wanting to stay on top of news events is equal to trying to beat the traders’ main opponent, the big banks, and attempting to fight the one who decides how the prices will move is a very bad idea in the long run. Failure is inevitable when your adversary is unbeatable, so any attempt to control the news already implies more risk than anyone should have to take on.

Some traders assume that managing news events is possible, believing that by possessing these information items gives them control over the market, to the extent that they deem generating a great number of pips in little time possible. Their viewpoint on news events boils down to the idea that the moment such news comes out, they will take specific action accordingly. Should the news be strong, they will go long on their chosen currency and vice versa. They believe that any timely reaction will easily bring them many pips, and we cannot but confirm that such a belief is based on solid grounds. Nonetheless, the fact that some traders managed to achieve this does not prove its quality. Not only does it happen occasionally, which immediately introduces a higher than necessary risk, but it also leads to false conclusions. Wanting to stay on top of news events is equal to trying to beat the traders’ main opponent, the big banks, and attempting to fight the one who decides how the prices will move is a very bad idea in the long run. Failure is inevitable when your adversary is unbeatable, so any attempt to control the news already implies more risk than anyone should have to take on.

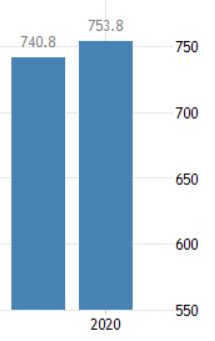

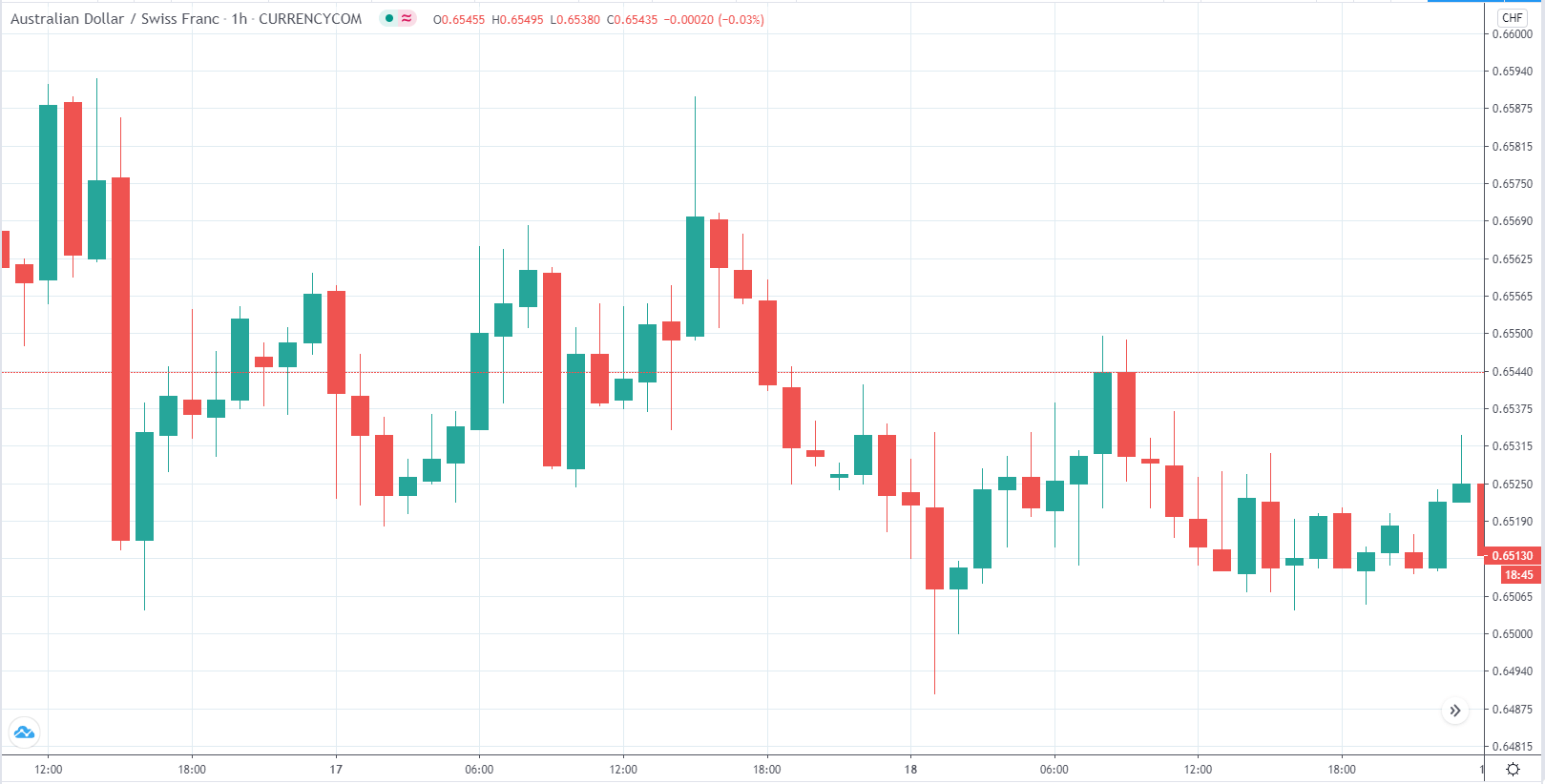

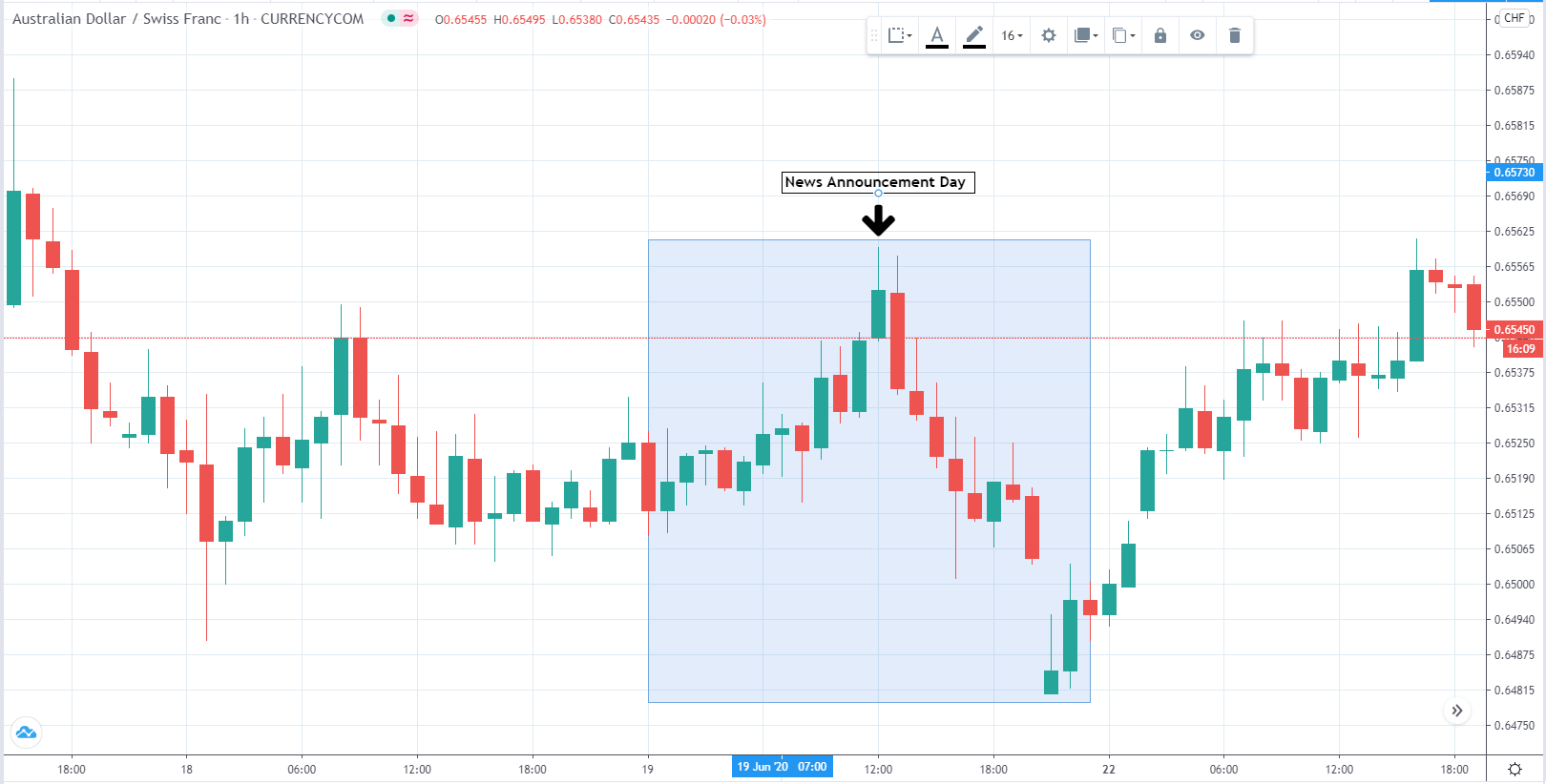

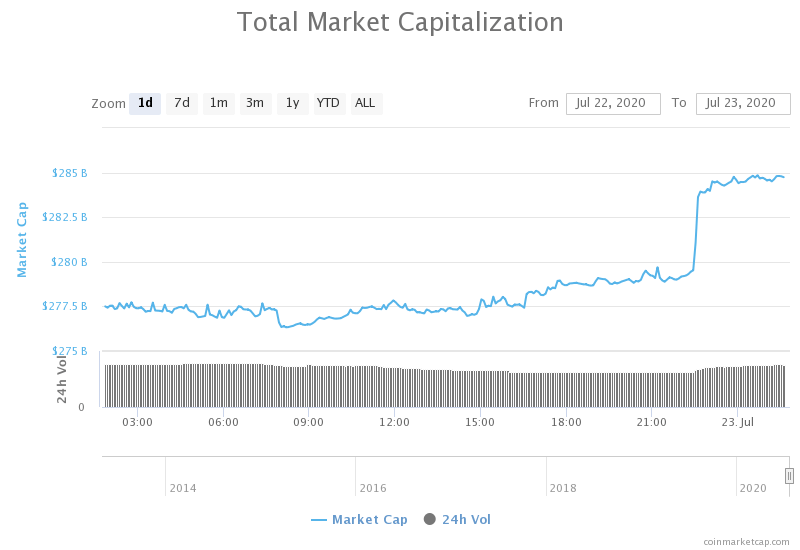

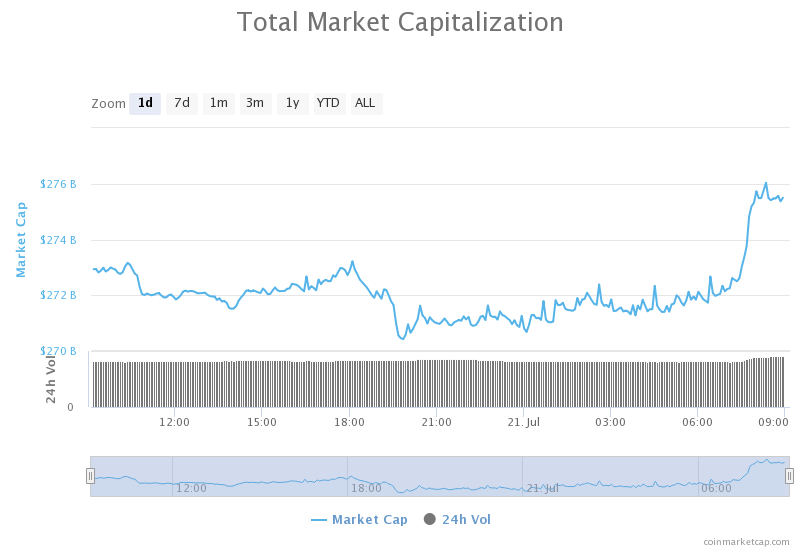

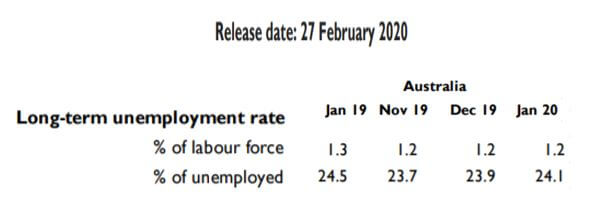

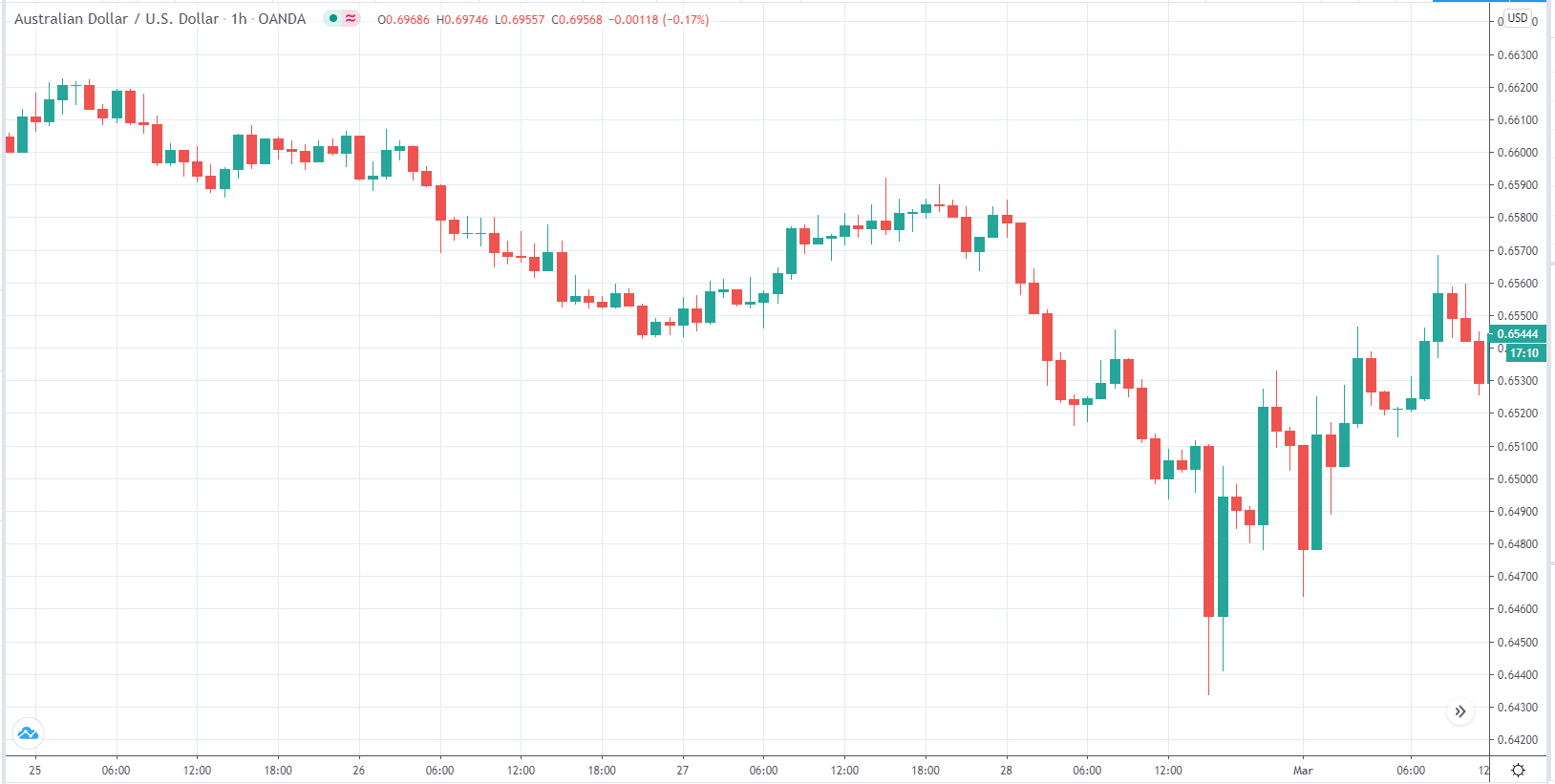

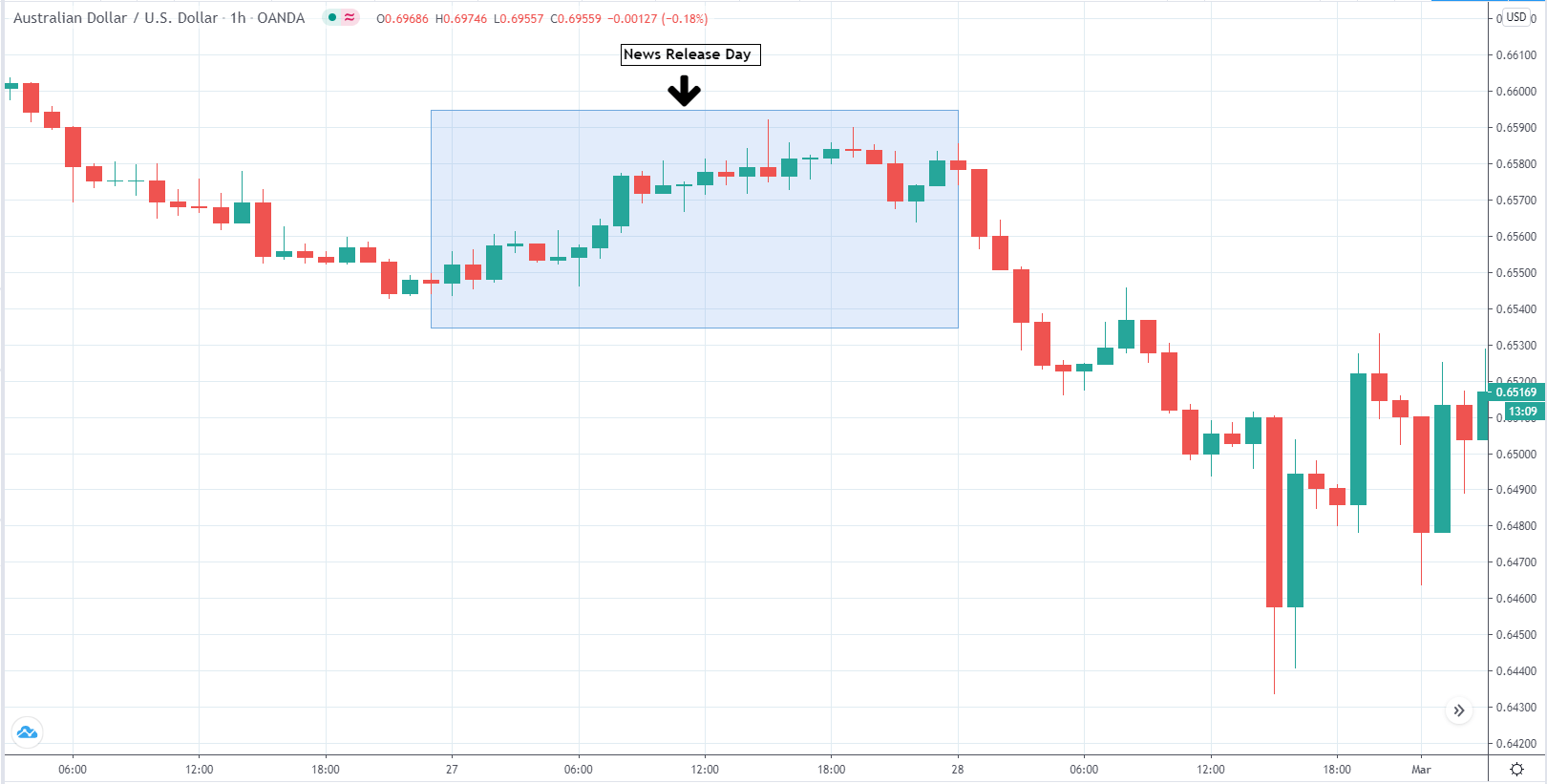

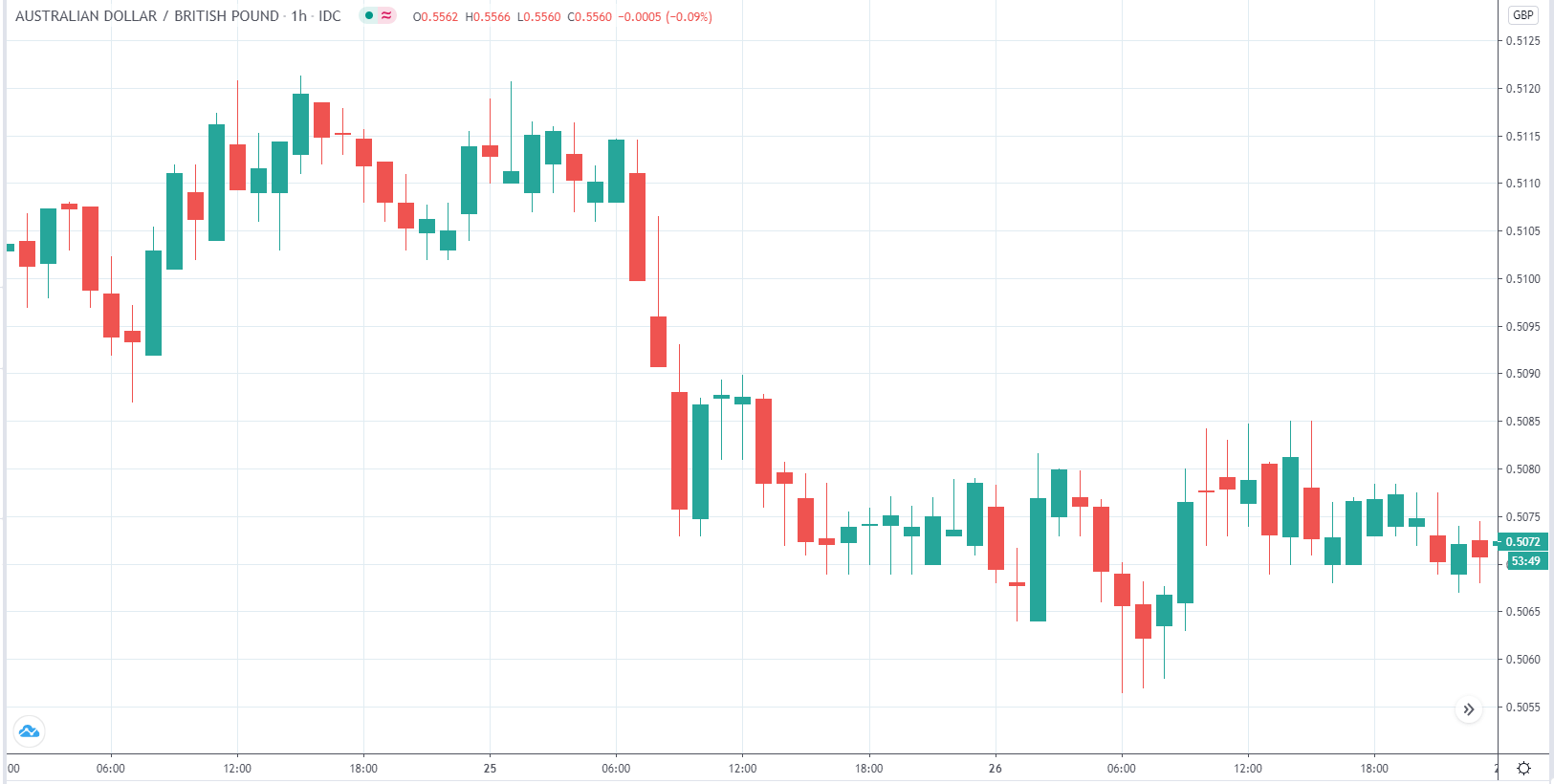

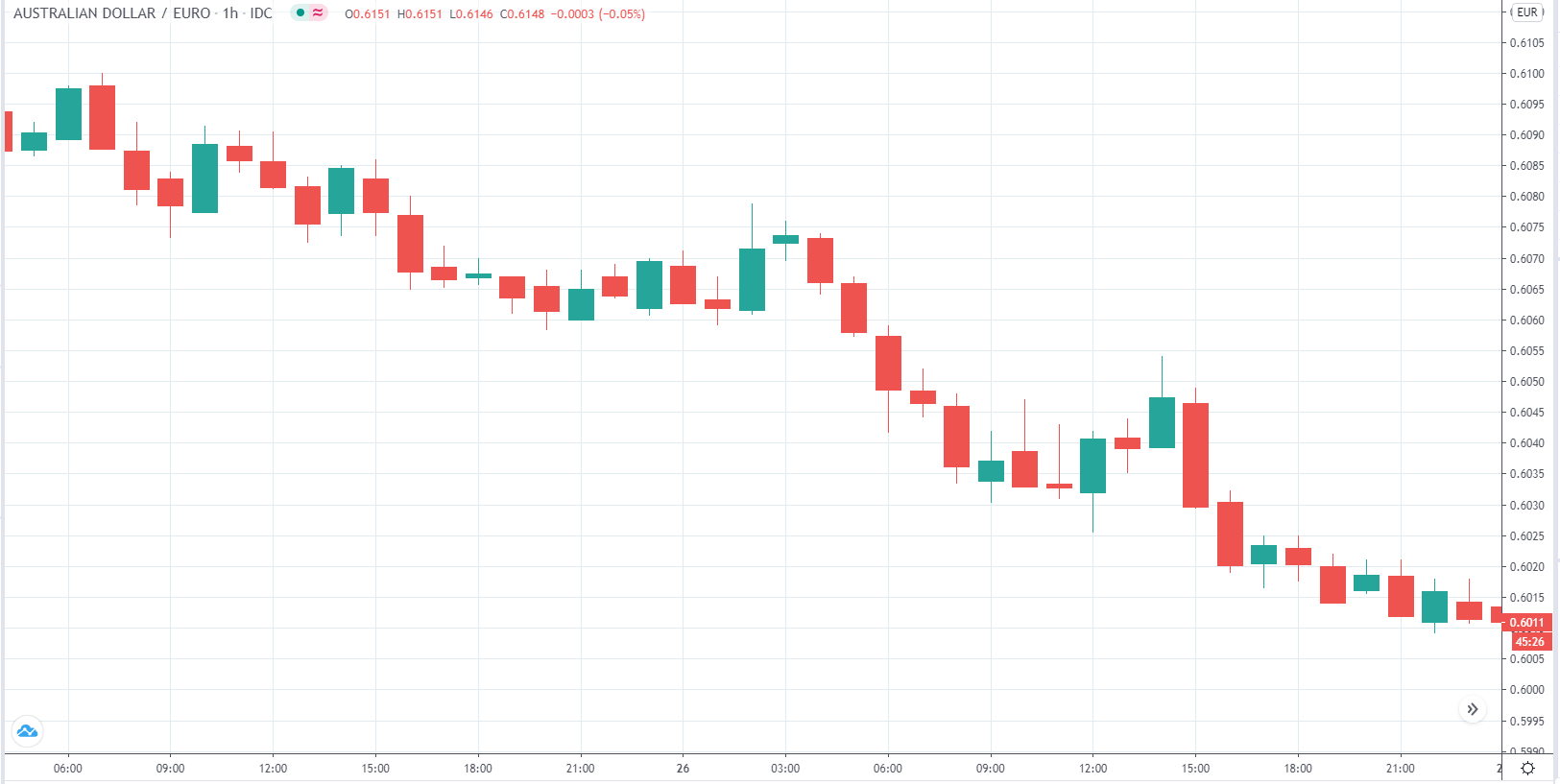

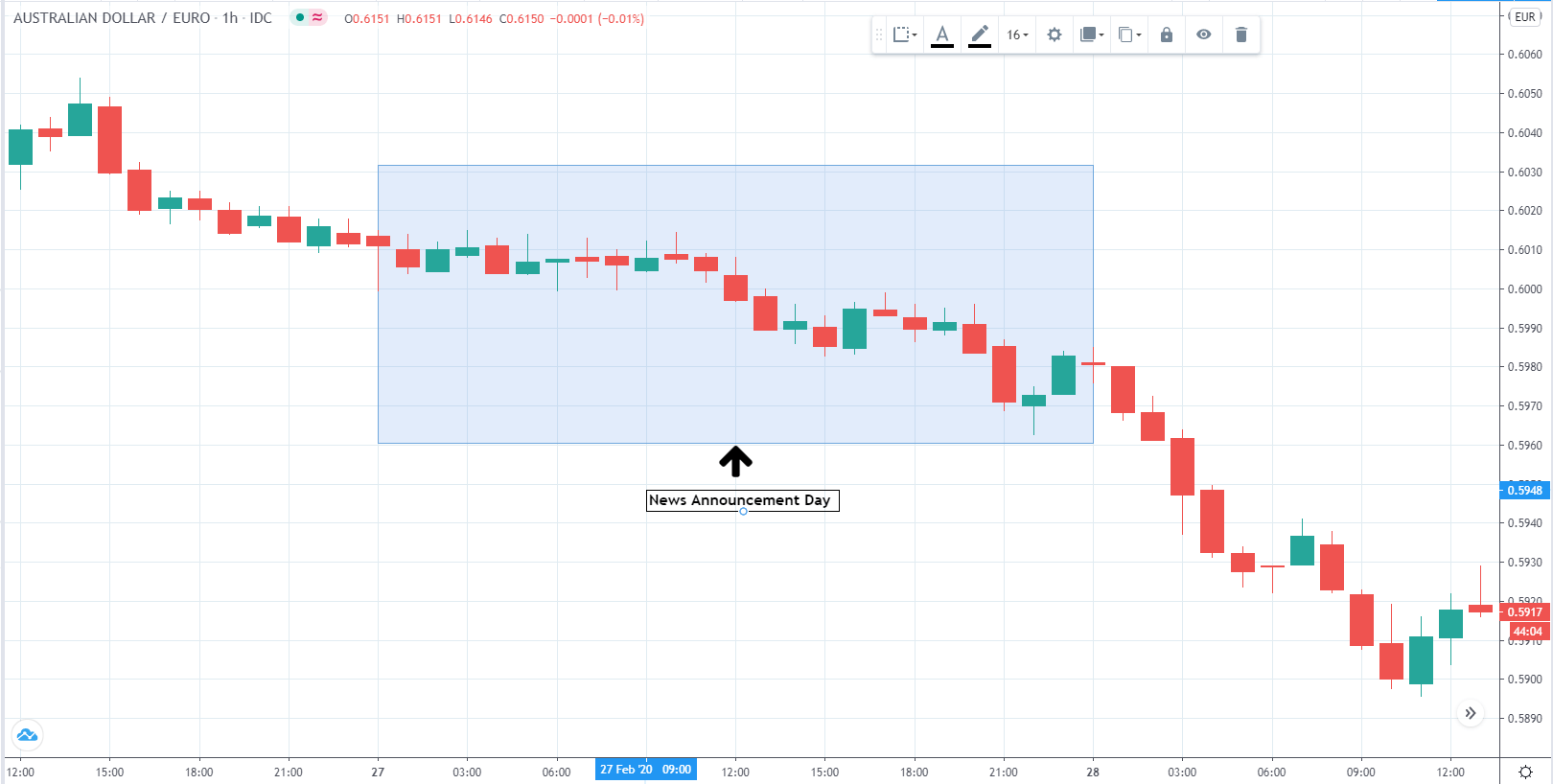

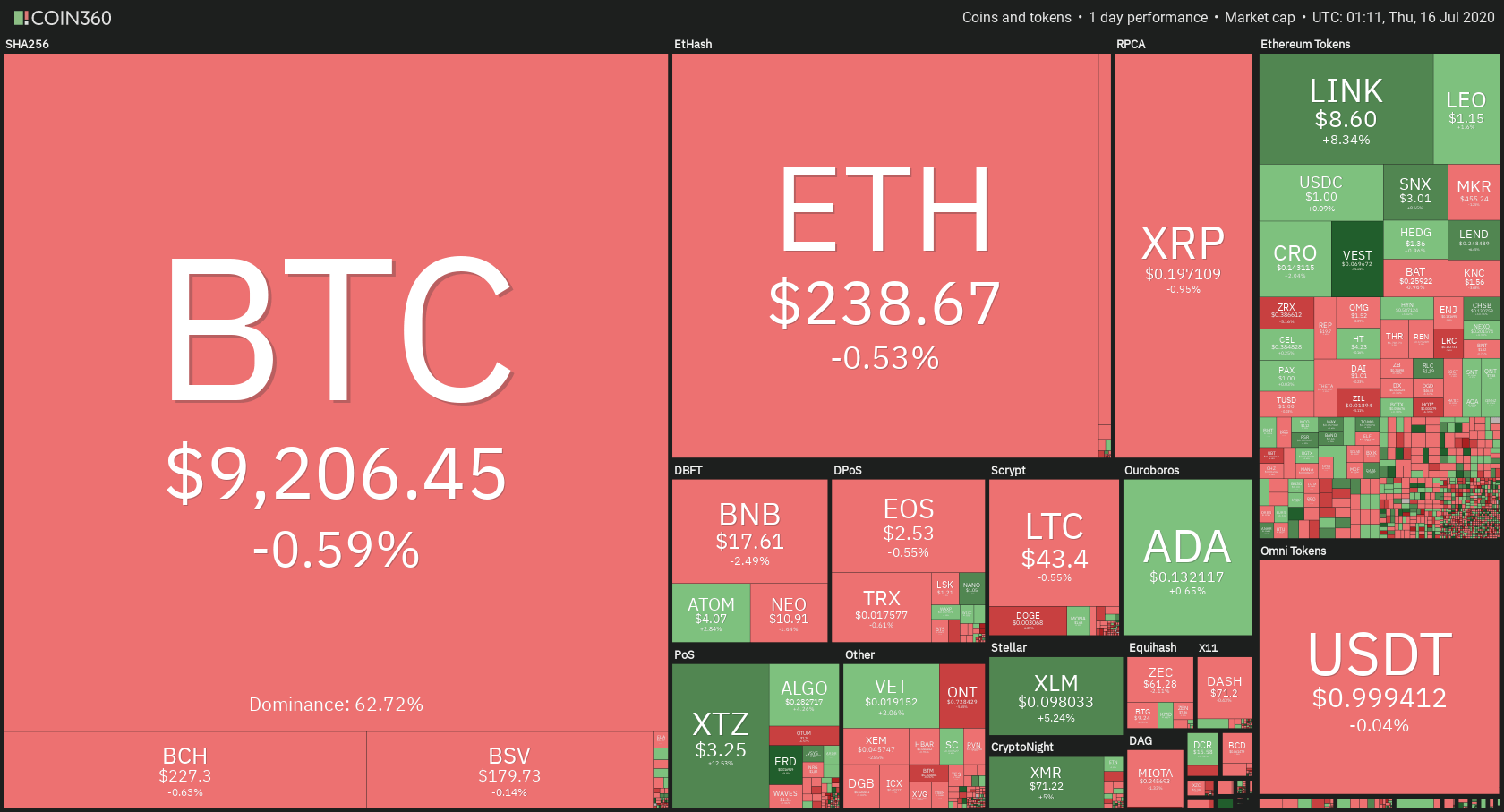

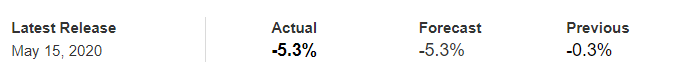

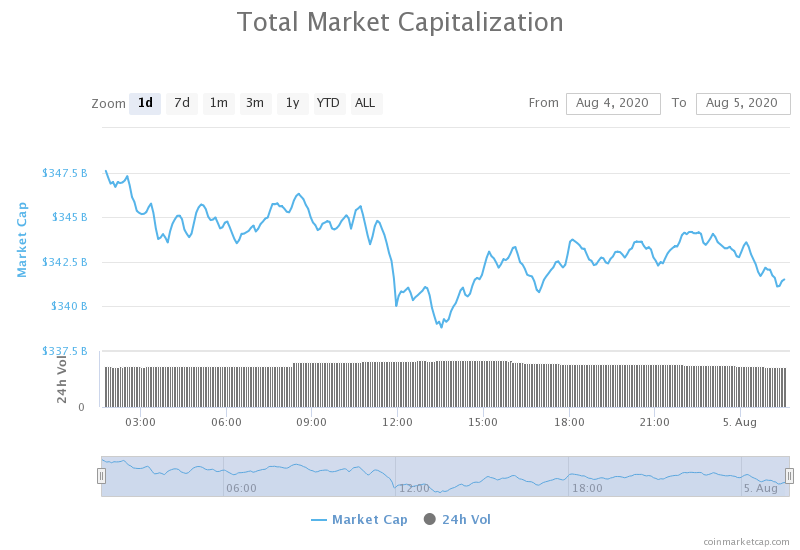

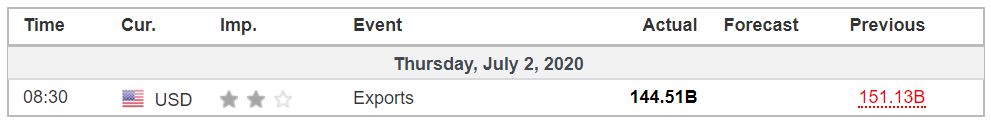

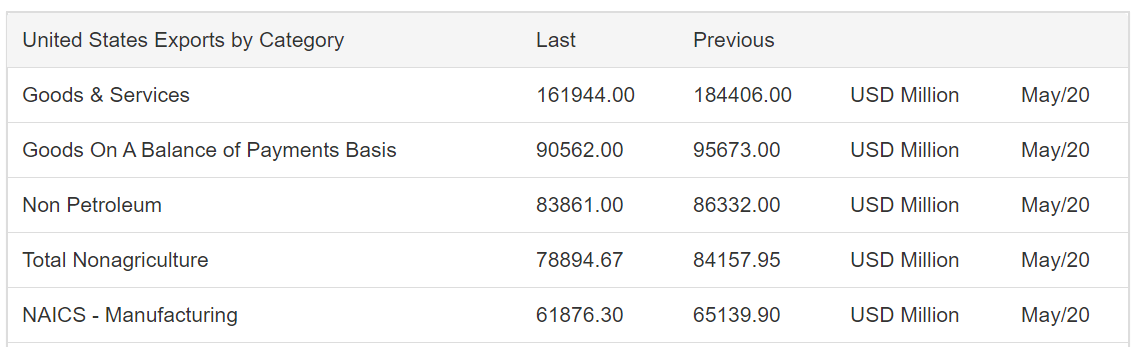

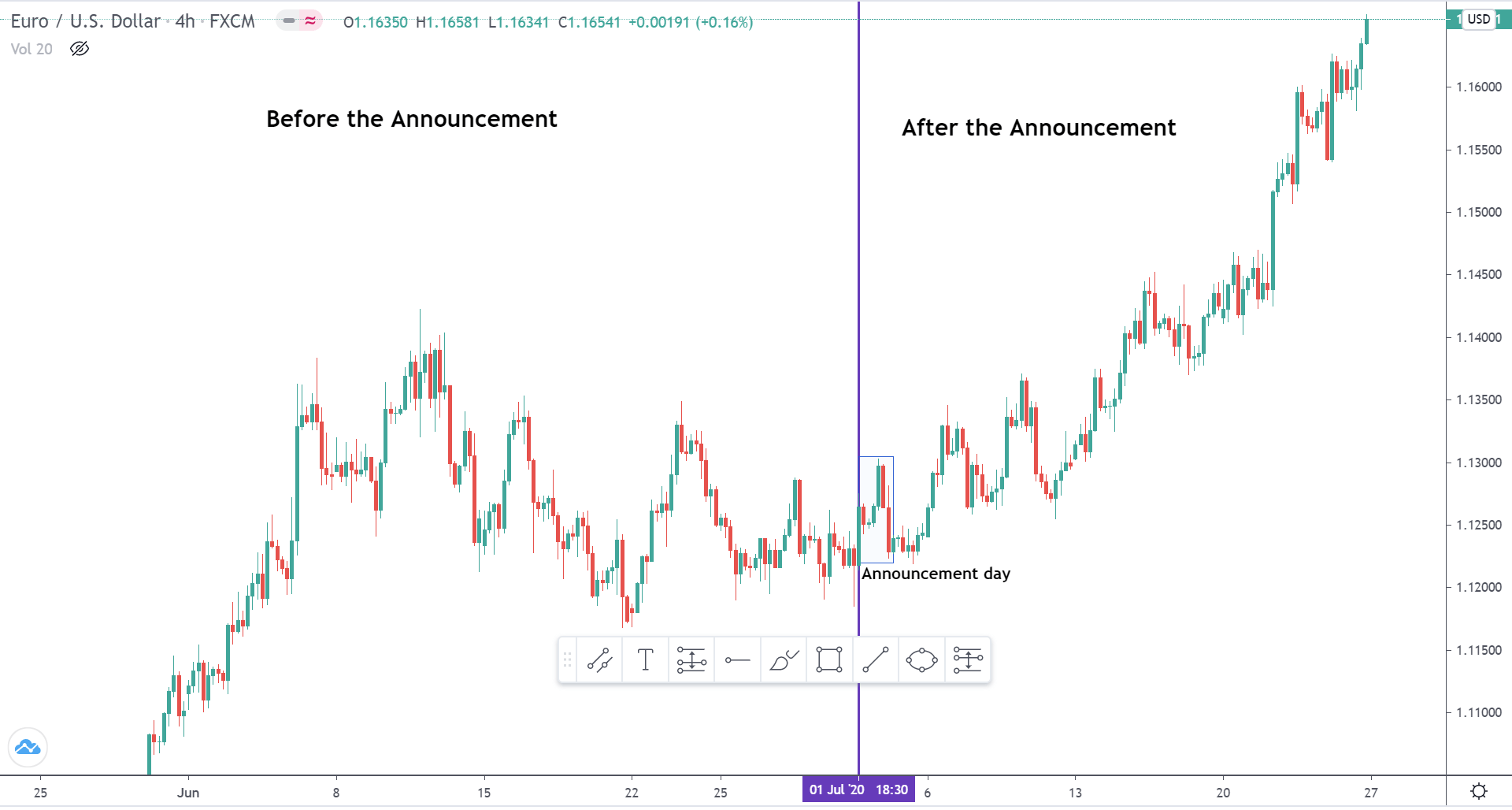

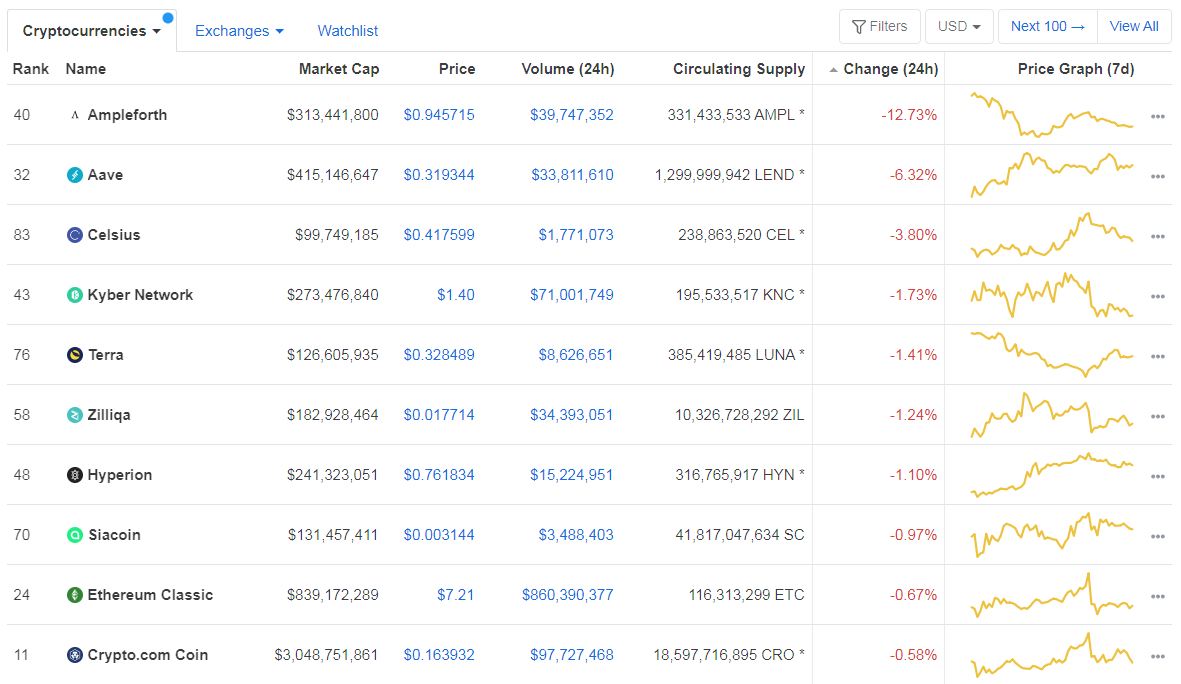

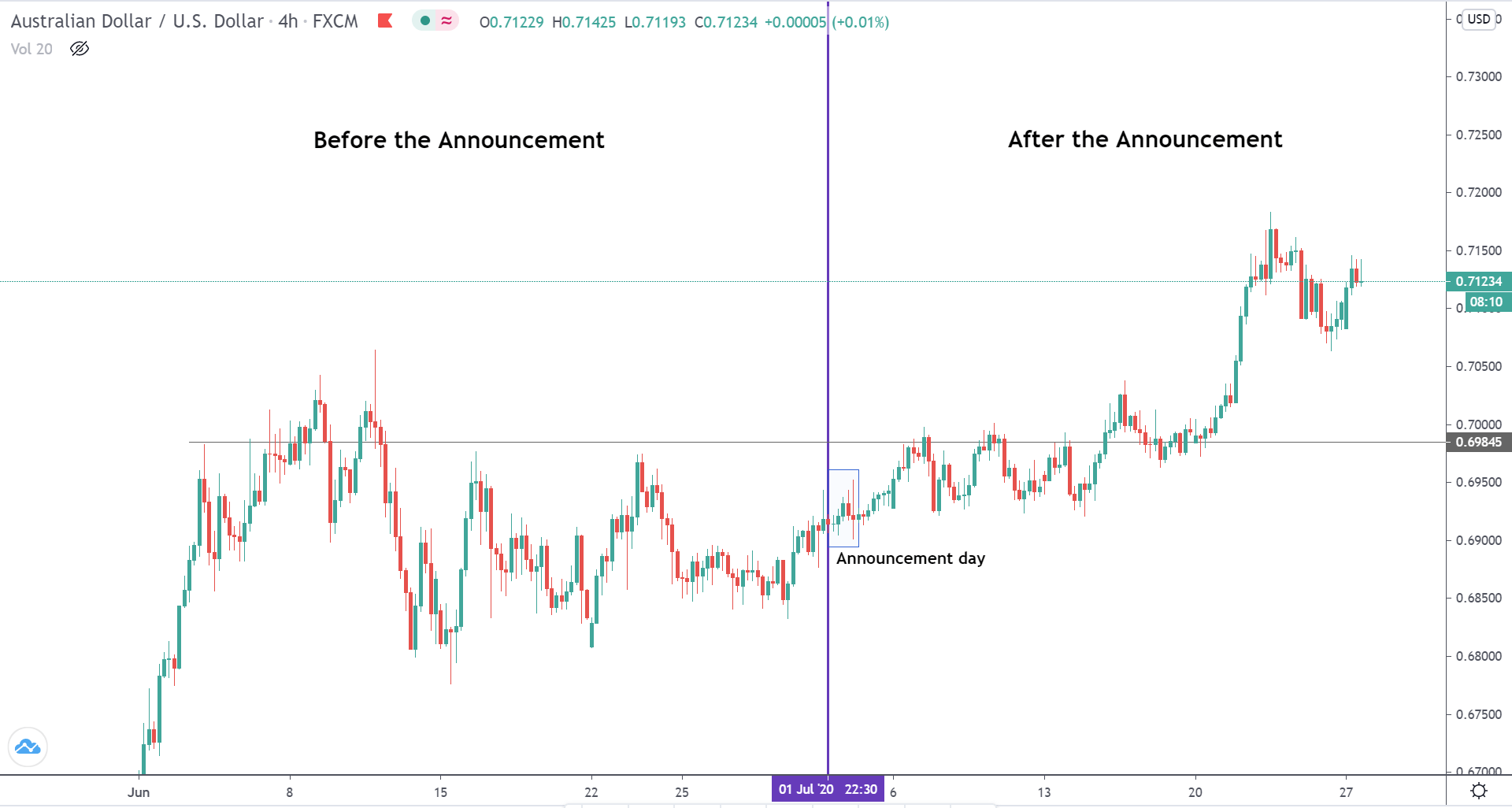

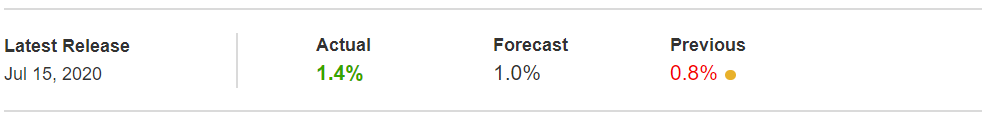

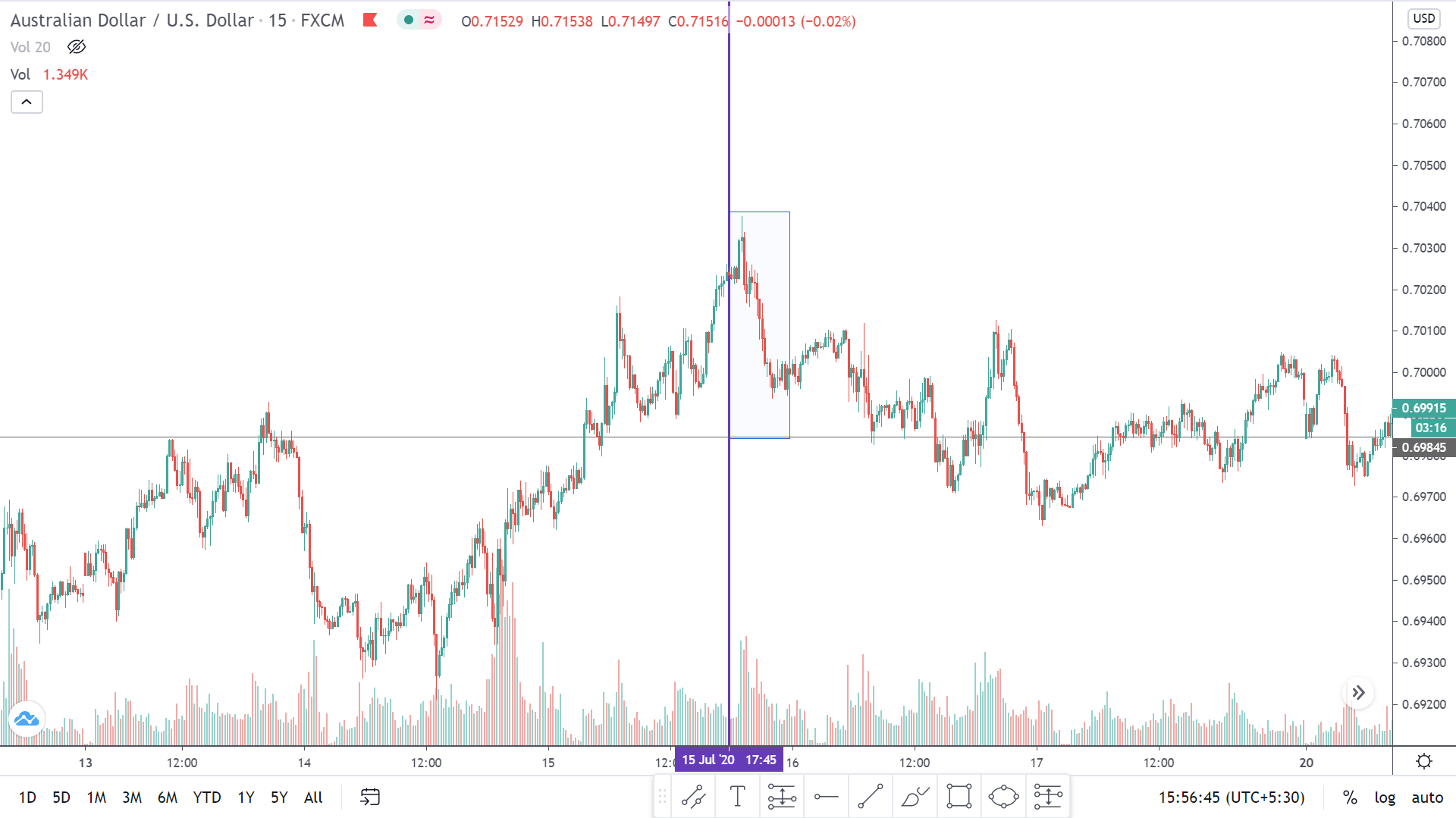

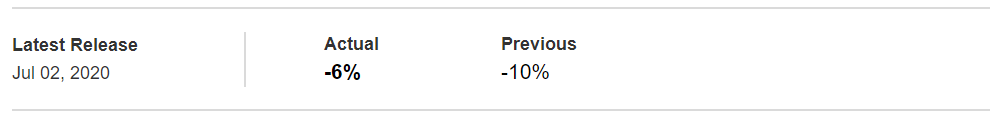

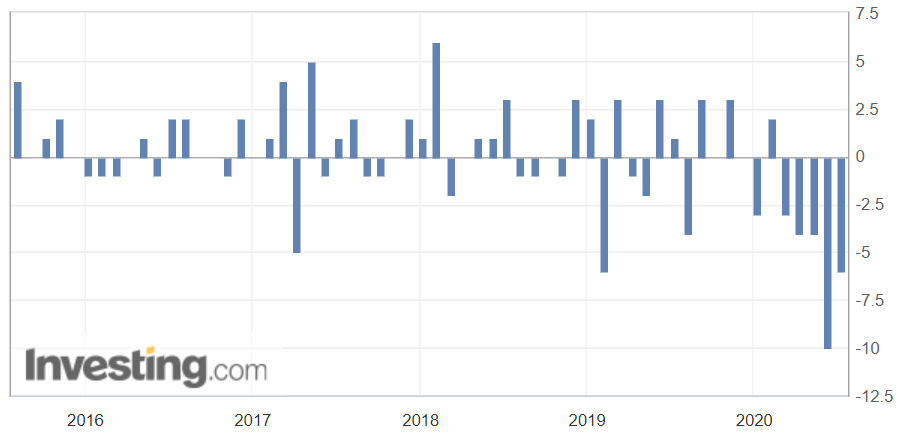

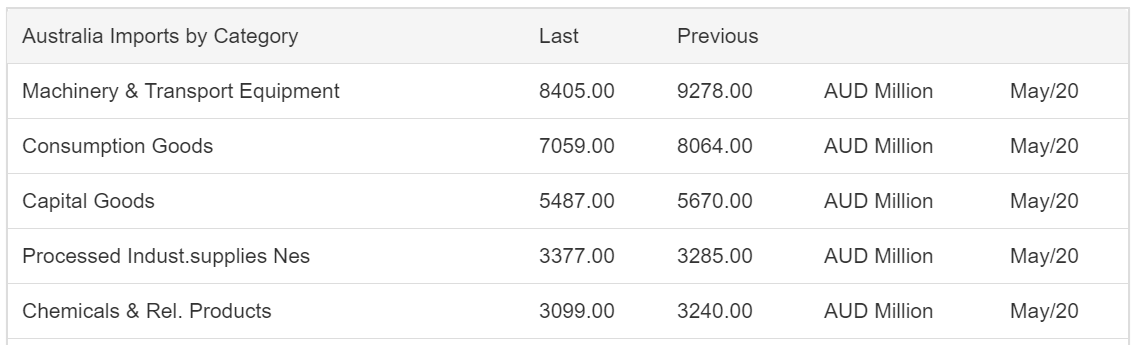

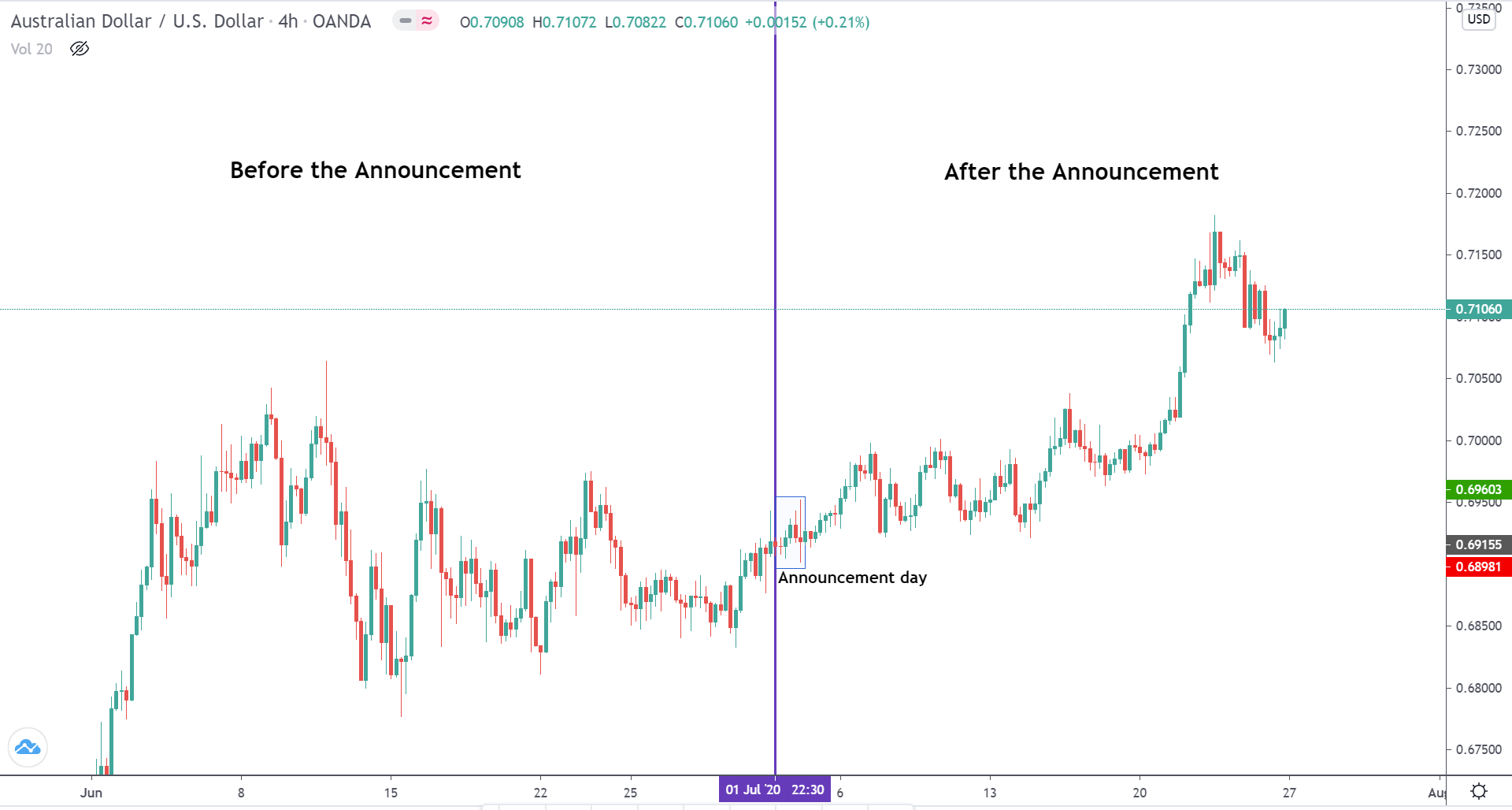

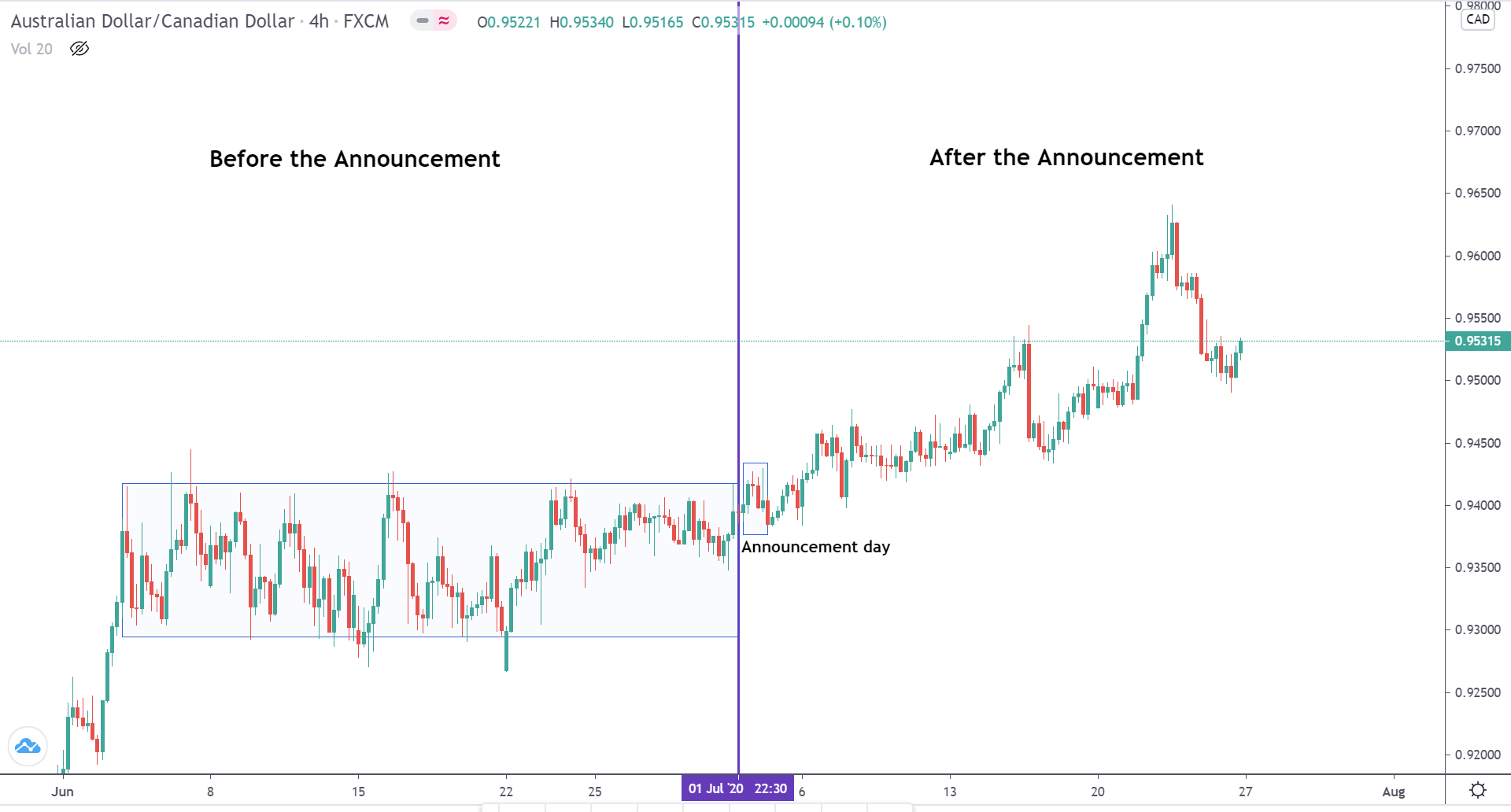

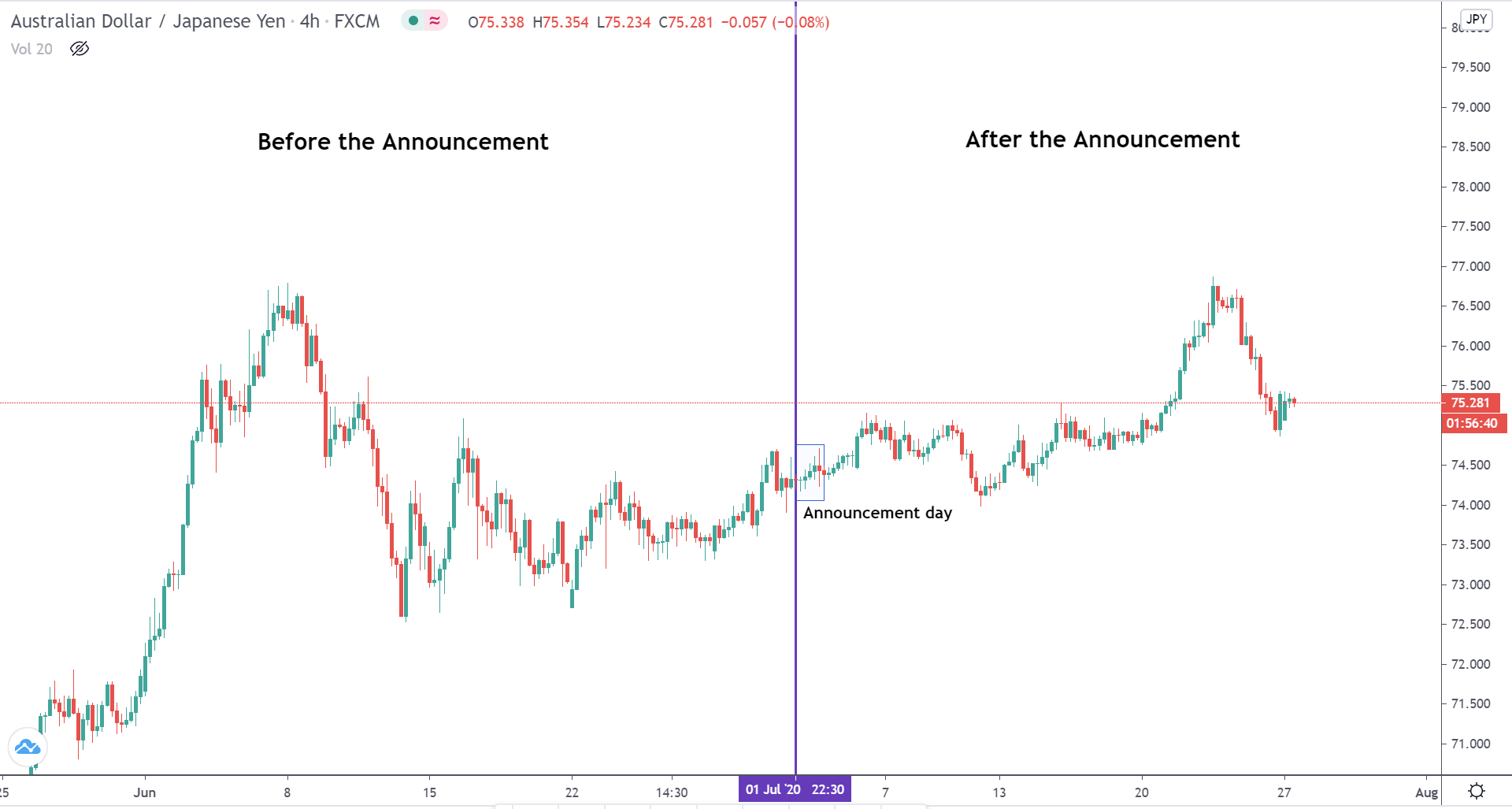

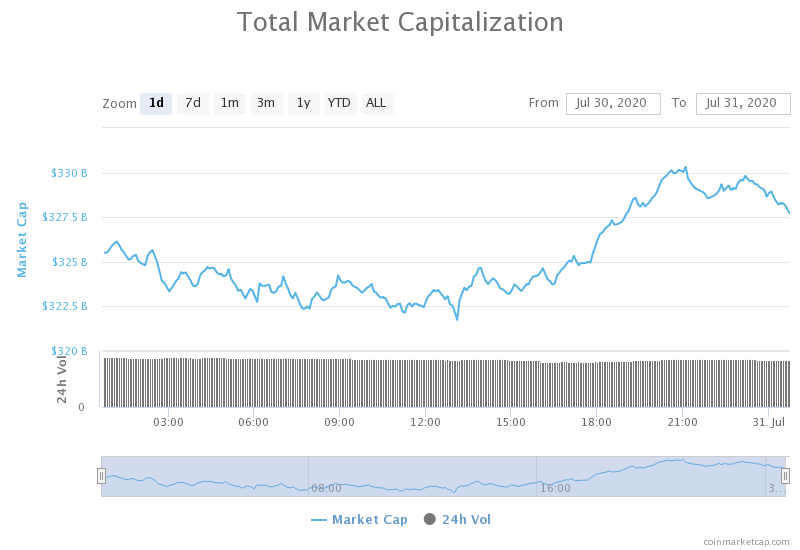

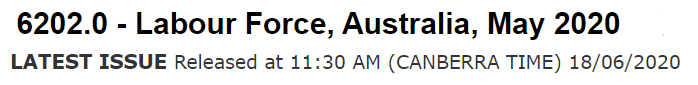

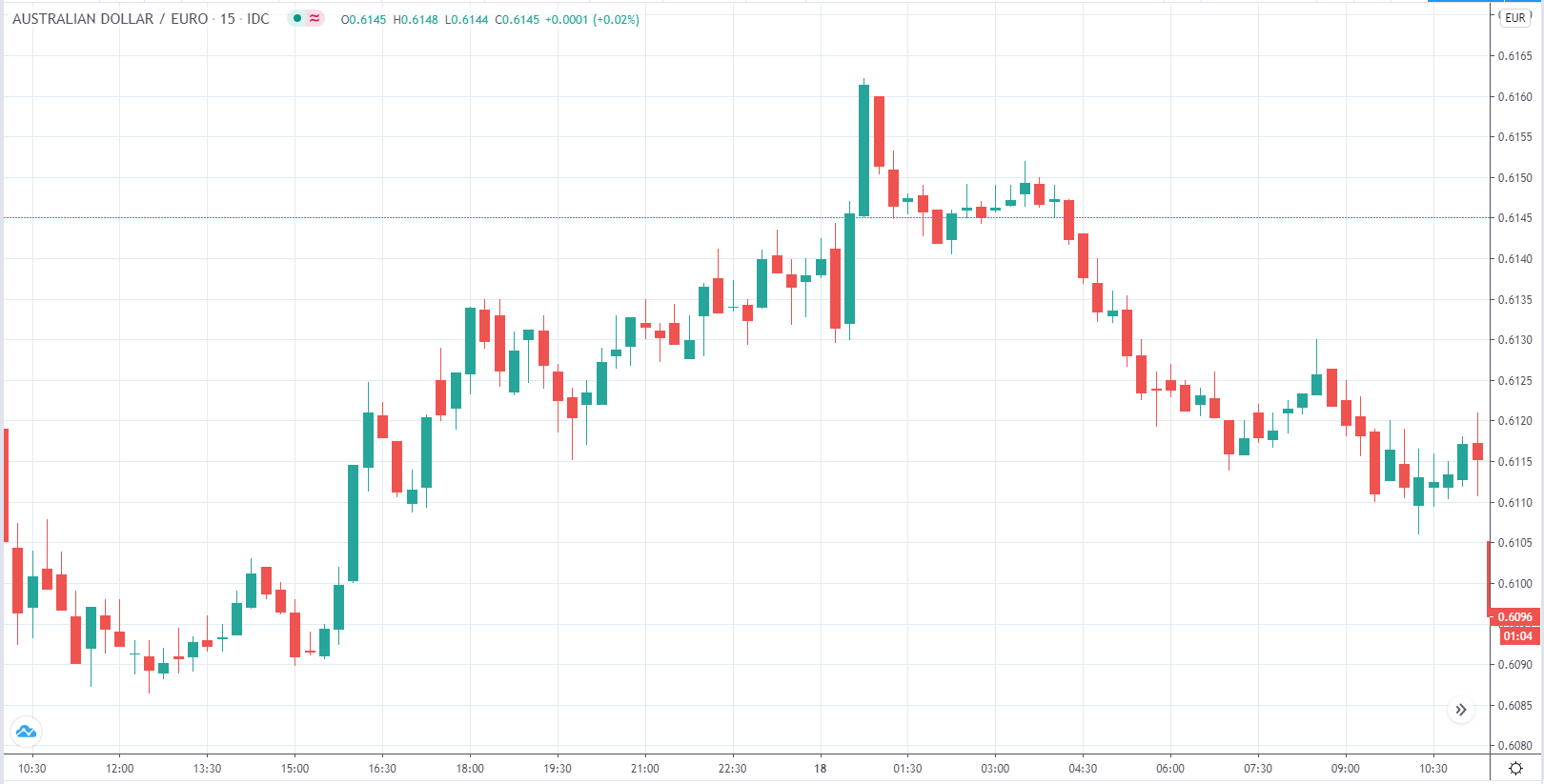

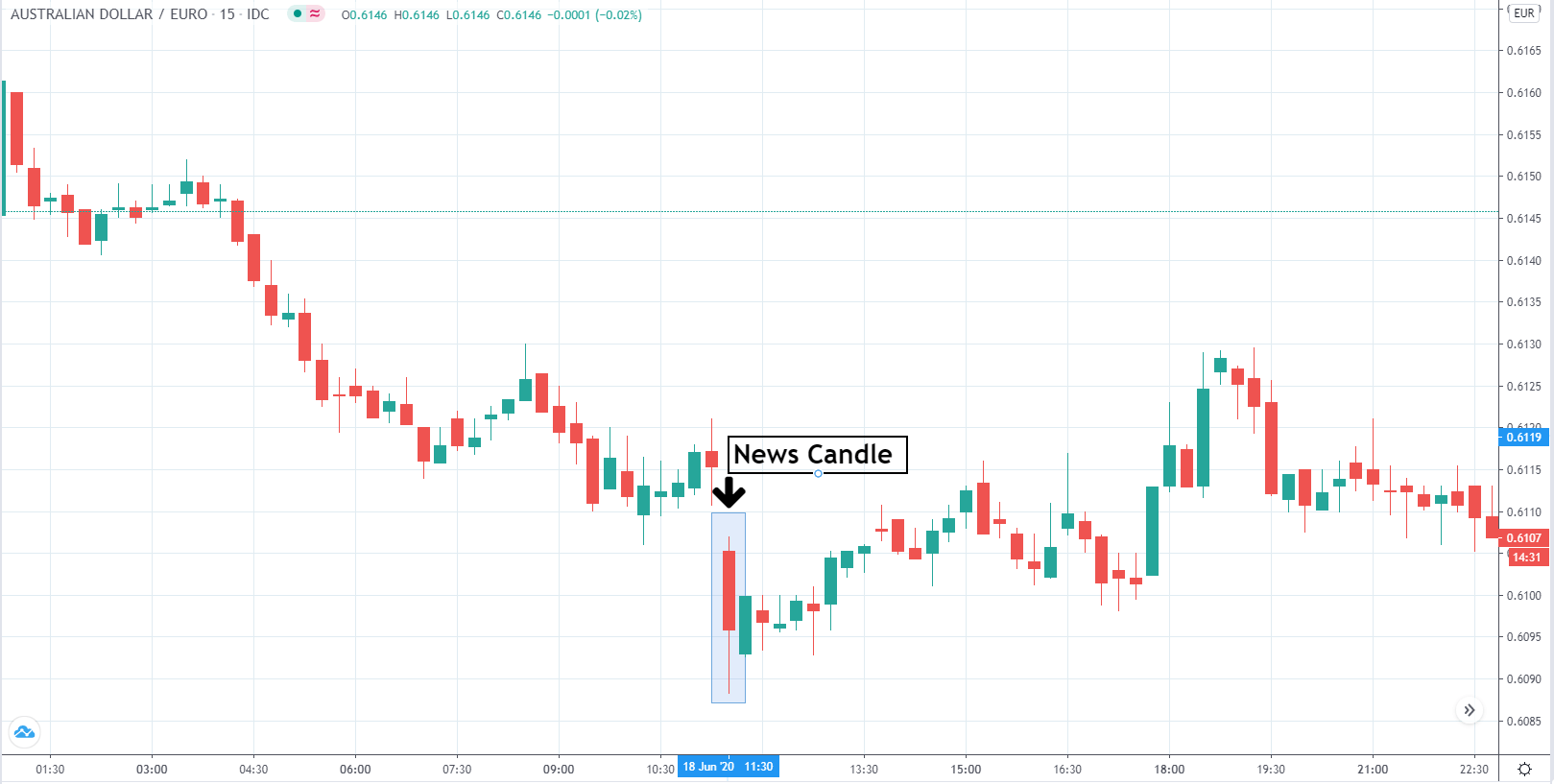

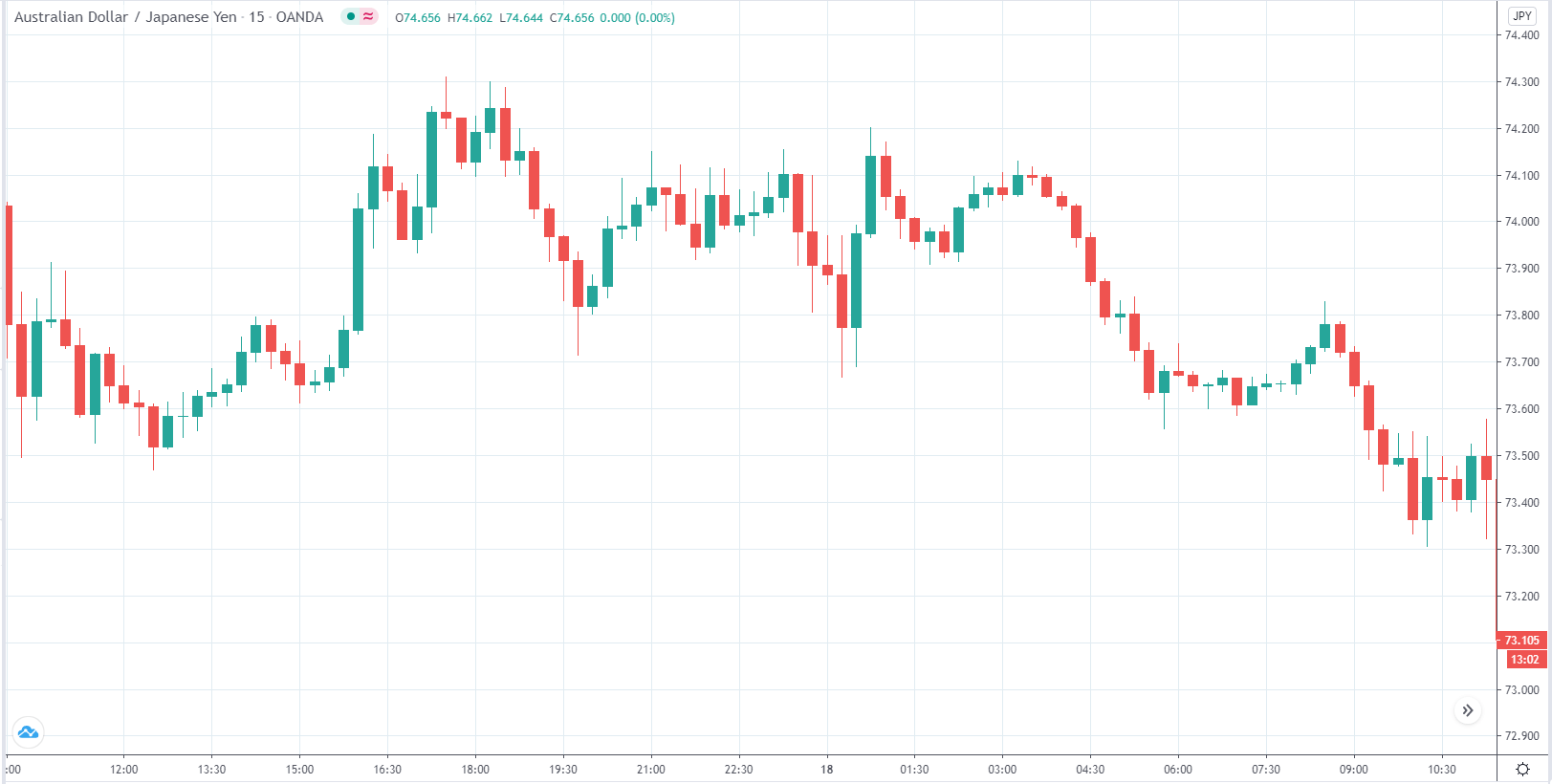

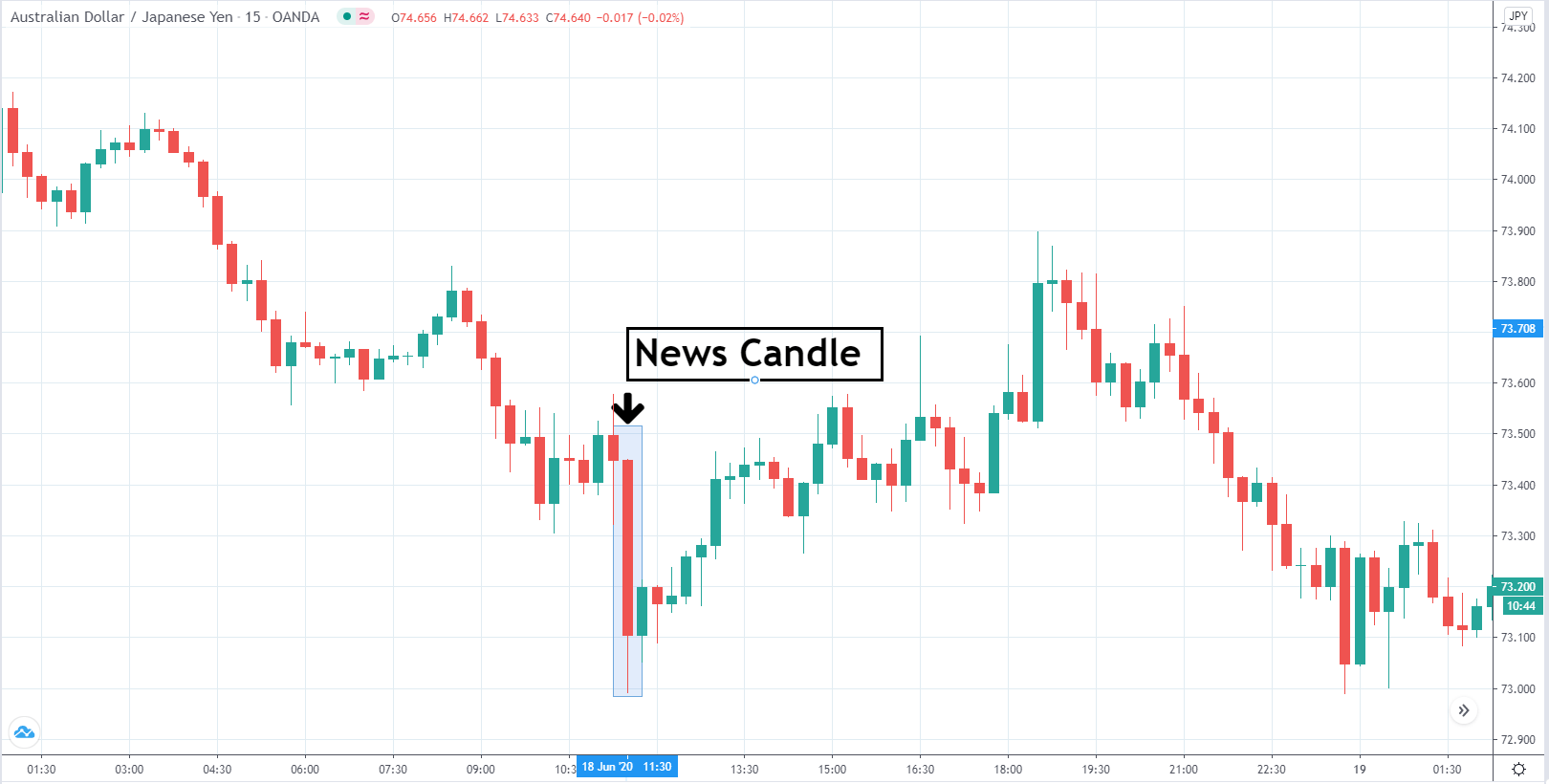

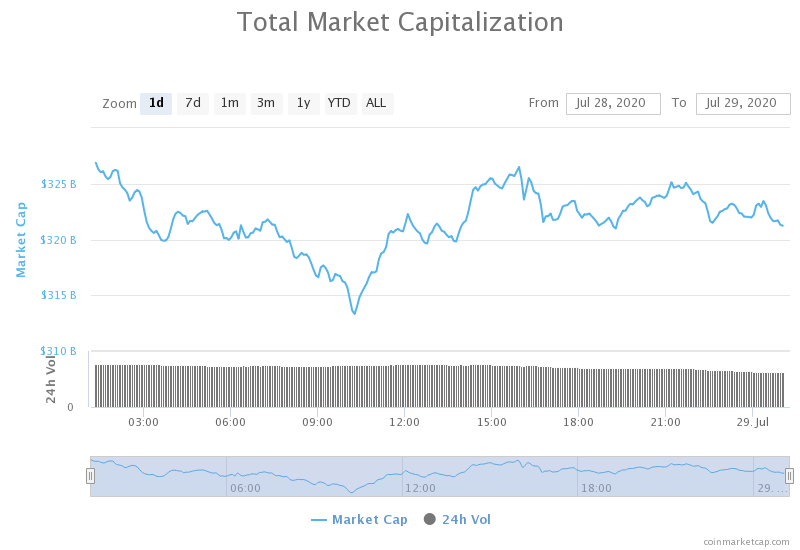

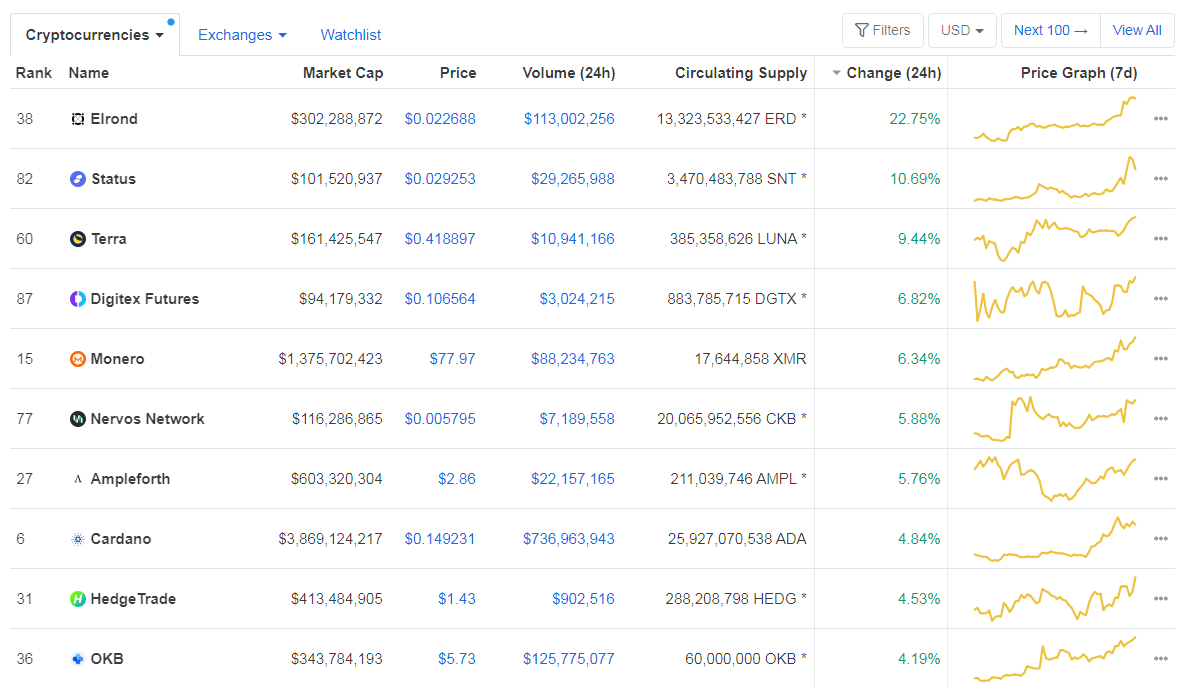

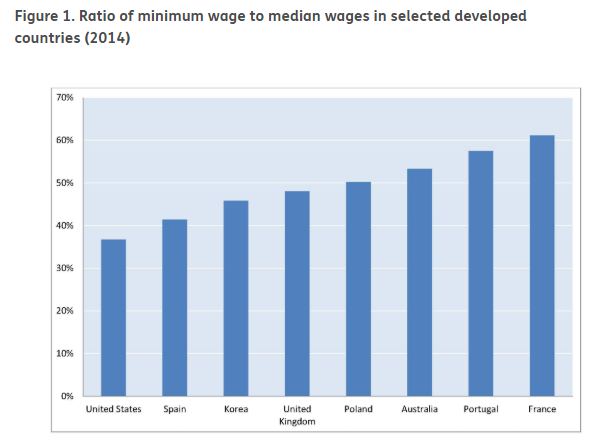

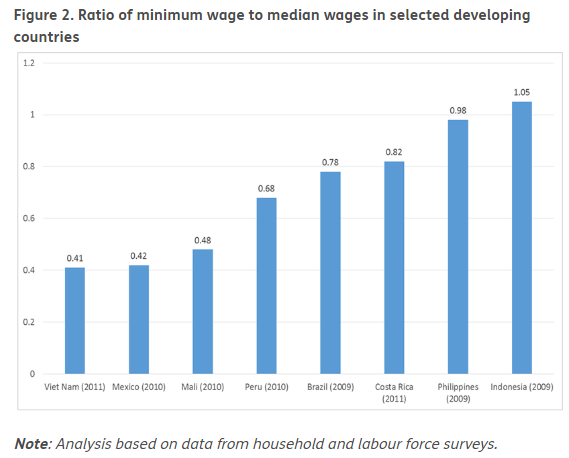

The below image shows that the weekly wages were increased for Australian employees in 2020. Although the difference is not huge, it still is a positive step taken for the daily wage workers. Looking at the data, we should not expect significant volatility in the currency pairs during the announcement.

The below image shows that the weekly wages were increased for Australian employees in 2020. Although the difference is not huge, it still is a positive step taken for the daily wage workers. Looking at the data, we should not expect significant volatility in the currency pairs during the announcement.