Introduction

Labor Cost is a critical element affecting business profitability and sustainability. Labor costs have a direct feedback effect on inflation rates. Understanding its effect on the labor force, economic growth, and inflation helps understand how market forces act.

What are Labor Costs?

It is defined as the total cost of labor used in a business. It is the sum of all wages paid out to the employees of business by the employer. Labor costs include payroll taxes and employee benefits also. Hence, from a business standpoint, it is part of business expenditure dealing with human resources. It can also be defined as the wages cost paid to workers during an accounting period, including taxes and benefits.

Most often, countries measure Unit Labor Cost, which is the labor compensation for a unit of business value produced. It is also a measure of international competitiveness amongst different labor markets throughout the world. Many companies in the United States have shifted their production plants to countries like Mexico, China, and India, where labor cost is relatively lower than the United States.

Labor costs are broadly categorized into the following two categories:

Direct cost: It is the cost of labor that can be traced to produce. It is the labor cost of employees that produce a product. It is a tangible measure. For example, if forty employees are working on assembling and packing an automobile engine, then the labor cost can be traced to the engine’s sale prices.

Indirect cost: It is the labor cost that cannot be traced to any tangible business produce. For instance, building security does not contribute to business output but ensures the safety of the place. It is generally associated with support labor that maintains business activity.

Businesses price in the labor costs, material charges, and overheads, if any, into the final sales price of the product or service they produce. The final product must factor in all the costs incurred; otherwise, it can hurt the company’s profit margin.

While it is easier to evaluate direct costs, indirect costs are a little trickier to evaluate due to their intangible nature. Undervaluation or overvaluation of costs drives the actual price of products away from correct prices. Undervaluation can force employees to quit for better opportunities. Overvaluation can hurt business profit or translate those prices into the end product. When overvalued products hit markets, they lose out to competition and hurt business. Hence, correctly modeling labor costs is vital for business sustenance.

Labor costs are sometimes also classified as fixed and variable costs. Variable costs change based on the amount of work done or business production. For instance, workers working on the production line can see reduced or increased work during business cycles. In such instances, workers are paid for the hours worked, or the output produced. Fixed costs do not vary over the entire business cycle. For instance, a contract with a maintenance company for a year would be fixed for repairs throughout the year.

How can the Labor Costs numbers be used for analysis?

Labor costs are affected by the following factors:

Labor Availability: The supply and demand for labor will drive labor costs. Lack of availability of the required skilled laborers for a particular business can drive up the labor costs due to demand outweighing supply. Conversely, when the market is saturated, labor costs go down due to market forces.

Workplace Location: The cost of living varies across different regions. Businesses having multiple branches can offer different pay for the same work in different areas due to differences in living costs. Wages are generally high in metropolitan cities and lower in semiurban areas.

Task Complexity: The more complex the work, the more a business pays out for it. The task difficulty drives up the labor cost.

Efficiency and Productivity: Efficiency can improve productivity for the same hours of work and workforce. It can increase business profits that can translate into higher labor wages also.

Worker Unions: Hiring a union member ensures that the wages are above a particular minimum pay set by the union. Unions have control over demand and supply of workers, thereby having the power to negotiate labor wages.

Legislation: With many countries adopting minimum wages, and having dedicated acts and laws to protect labor exploitation, labor costs have a price floor below which it cannot drop.

Employer’s idealogy: Some business owners place more emphasis on its employees and view them as the heart of the business. Such people pay higher wages compared to other businesses that emphasize more on profit.

Labor costs are directly proportional to inflation. As prices rise, the cost of living increases and laborers demand higher wages. When labor costs increase, the profit margin of the company decreases. To avoid a reduction in profits, companies may employ cost-cutting mechanisms or lay-offs to accommodate the new wage hike. A significant increase in labor costs can increase unemployment.

On the flip side, the increased labor cost may translate to the product’s end sale price, giving a feedback loop to price inflation. It continues until market equilibrium is achieved through the open demand and supply market forces.

Impact on Currency

Significant and quick increases in the labor market induce inflation, which is depreciating for the currency. Labor cost in itself does not directly affect the country’s currency worth. It is part of a more extensive system. Labor costs are seen from the business point of view and are associated more with inflation.

Overall, labor costs are low impact lagging indicators that do not have a significant effect on currency market volatility. It is deemed more useful for businesses and policymakers to balance laborer’s well-being and business sustainability.

Economic Reports

In the United States, the Bureau of Labor Statistics releases quarterly “Labor Productivity and Costs” that details the Unit Labor Cost also. The report is released in the following mid of the month for the previous quarter.

Sources of Labor Costs

The BLS Labor Productivity and Costs report contains the Unit Labor Cost reports.

The OECD also maintains data of the Unit Labor Cost data of its member countries.

Consolidated Labor Costs data is also available on Trading Economics for most countries.

Labor Costs Announcement – Impact due to news release

In the previous section of the article, we understood the labor costs economic indicator, which essentially measures the change in the price companies pays for labor, excluding overtime. It is a leading indicator of consumer inflation. High labor costs make workers better off, but they reduce companies’ profits and net cash flow.

Policies that increase labor costs can significantly affect employment and working standards, which has an indirect impact on the overall economy. Since labor costs are a company-specific factor, its impact is primarily felt on the company’s stock price and the stock market. Hence, currency traders do not give much importance to the official labor costs news release.

In today’s article, we will be analyzing the latest labor costs data of New Zealand that was released in May. In the below image, we can see that labor costs were slightly lower than last time and almost equal to market expectations. Let us find out the market’s reaction to this data.

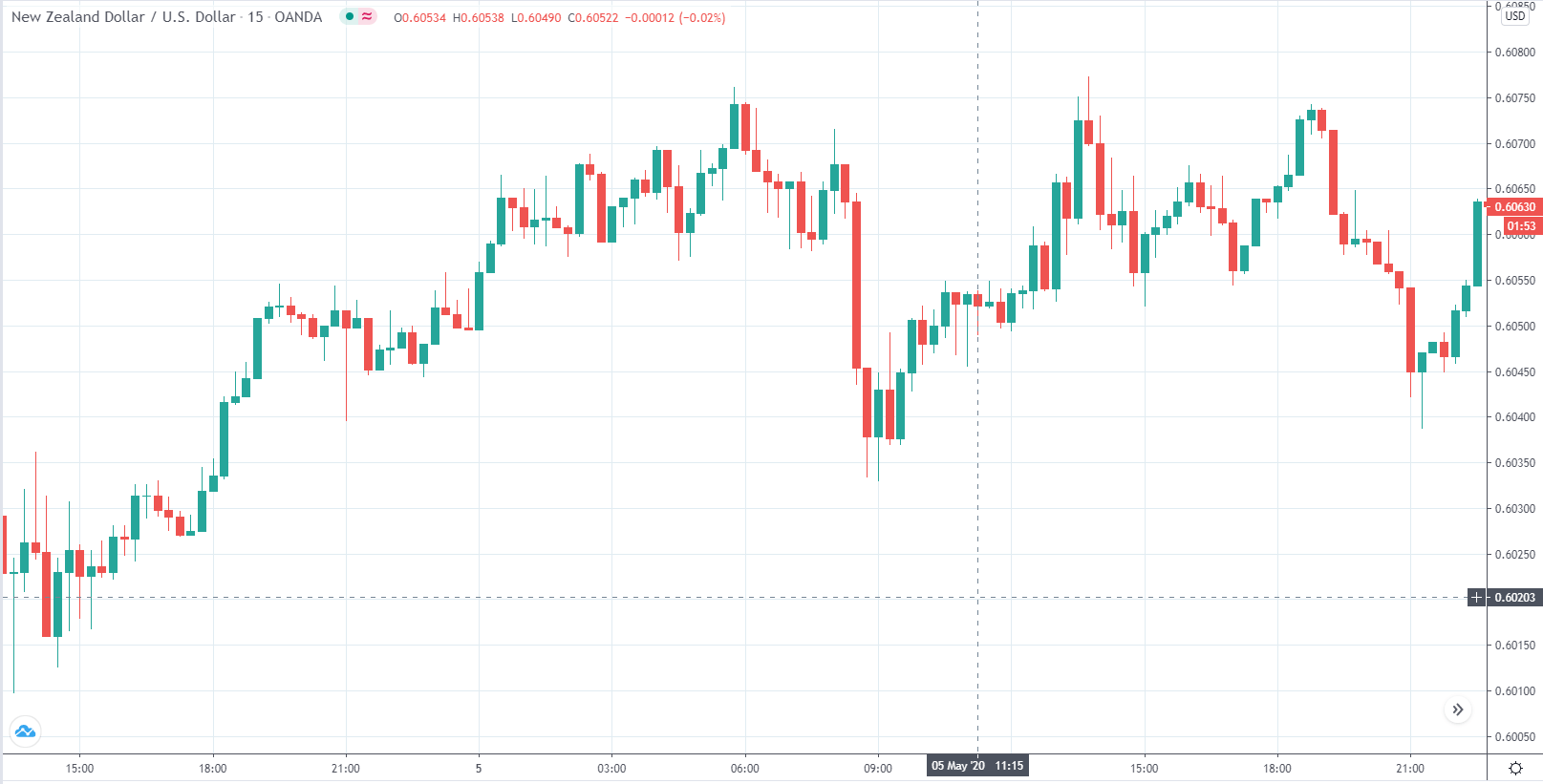

NZD/USD | Before the announcement

The above image shows the NZD/USD 15-minute timeframe chart right until 22:30 GMT. The news release is at 22:45 GMT. Before the news release, the market has no clear pattern and maintains a range with no clear uptrends or downtrends.

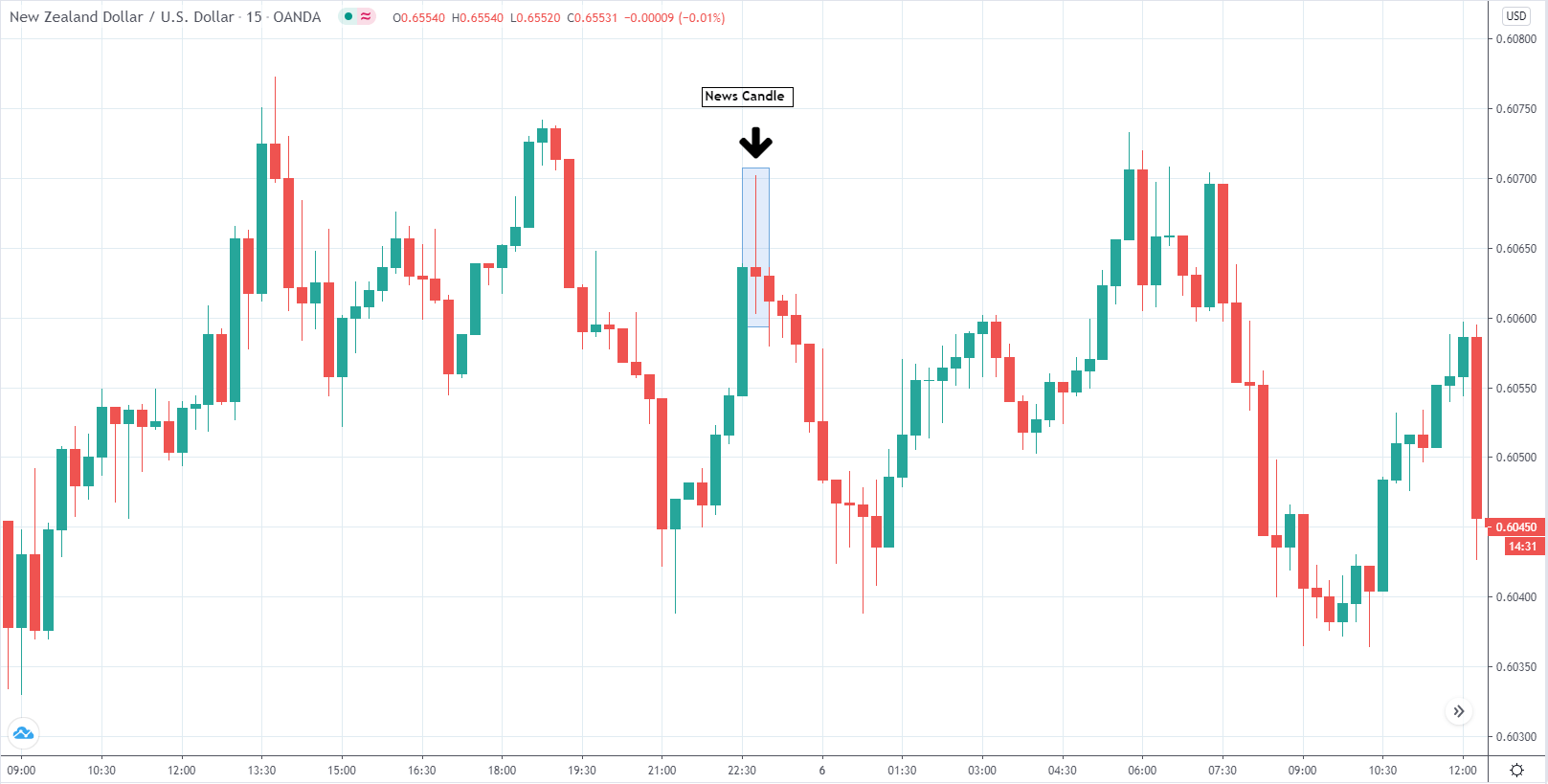

NZD/USD | After the announcement

After the news announcement at 22:45 GMT of labor costs Index quarterly reports, which came a little lower than the forecast, no new trends developed. The pair kept its ranging trend before, during, and after the news release.

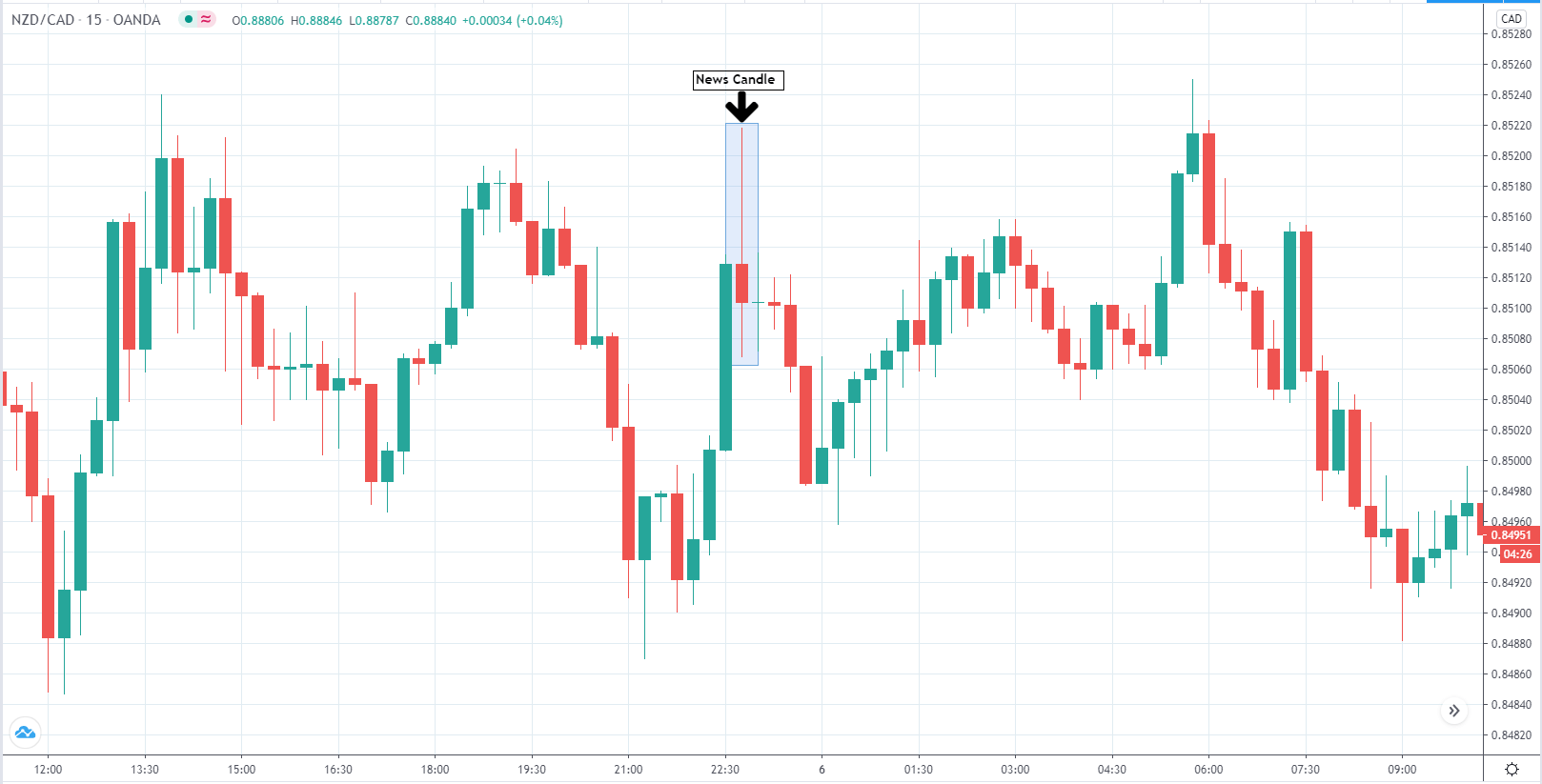

NZD/CAD | Before the announcement

The above image is the NZD/CAD 15-minute timeframe chart, and we can see here also there is no clear trend building up throughout the day. The currency pair has been in a ranging trend throughout the timeline.

NZD/CAD | After the announcement

After the news announcement, there seems to be no significant volatility in either direction. The news did not create enough volatility to bring about any trend.

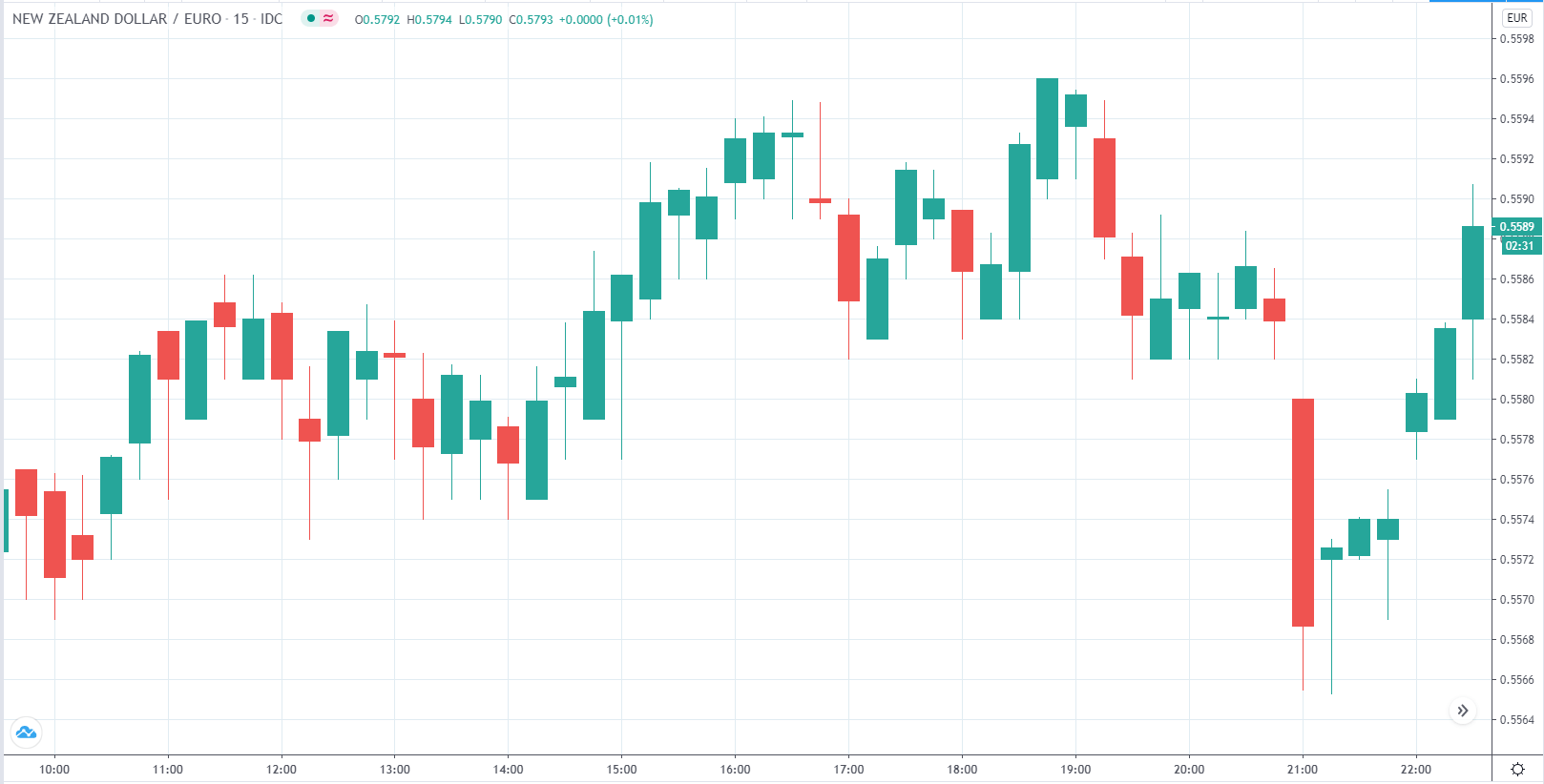

NZD/EUR | Before the announcement

The above chart is the NZD/EUR 15-minute time frame chart, and there have been here also no trends building up before the news announcement. There are no potential trade signals here until now.

NZD/EUR | After the announcement

After the news announcement, there seems to be no volatility around the candle. The pair did not build any momentum after the announcement also.

In conclusion, even though the news announcement came slightly less favorable to the NZD currency, we did not see any downtrends for NZD currency against any other currency. The market ignored the news, and there was no impact significant enough to move the currency in either direction. All of this again firmly establishes our fundamental conclusion that the labor costs economic indicator is a low impact indicator in the currency markets and can be overlooked for the fundamental analysis of currencies.