Introduction

Import and exports make up a country’s trade balance that primarily drives currency value and economic growth. The two-way feedback between imports and exchange rates is critical to understand and how the trade balance affects currency value. Understanding changes in import prices can help us deepen our understanding of macroeconomic fundamentals of every country.

What is Import Prices?

Import prices are the cost at which foreign goods are purchased in the international market. Import prices are measured through import price indexes. Import price indexes measure the change in prices paid for goods imported to the domestic country. The import price index figures for a reference period relate to the prices of goods that have come into the country during the period.

Import prices are essential to a country’s trade balance. A country’s trade balance is the difference between its total exports and imports and is an economy’s major composition.

How can the Import Prices numbers be used for analysis?

The international market always tends to stay in an equilibrium of currencies. When a country’s currency is flooded into the forex market, its relative value falls against other currencies. On the contrary, when a particular currency leaves the international market and goes into the country, the deficit increases its value against other currencies. Hence, excess reduces value, and scarcity increases value.

In this sense, when a country imports goods and services, it does so by paying out or sending out its domestic currency into the international market. When a country exports a good or service, it sends out the product in return for dollars coming into the country. Hence, overall the total worth of exports and imports should be balanced to maintain the currency’s current value.

When a country imports more than it exports, it faces a trade deficit, and as a result, its currency value falls relative to other currencies. When imports exceed exports, it means the country is a net consumer of goods and services in the global economy. It is negatively contributing to global economic growth. When a country exports more than it imports, it faces a trade surplus, and as a result, its currency rises relative to others. When a country is a net exporter or provider, it is contributing positively to global economic growth.

In general, countries prefer to maintain a trade surplus, but may intentionally maintain a trade deficit by importing, to increase their exports and overall economic growth in the future. Countries in today’s modern world have increasingly become dependent on international trade for both imports and exports.

Countries that do not have a competitive edge in specific sectors prefer to import goods and services from other corners of the world where they may be more efficiently produced and are cheaper. Businesses rely on importing raw materials or intermediate goods for producing finished goods and services, or even consumption.

A strong currency will favor imports as more goods can be procured for a unit of currency. Prolonged deficits (imports exceeding exports) devaluate the currency, which is not suitable for the economy. Hence, countries’ central authorities closely monitor the import and export price changes to draw out policies or reforms if needed to ensure a trade balance. In a crude sense, a country’s exports are its income, and imports are its expense. Increasing imports and declining exports ultimately drive a country into a debt trap.

Import prices are useful for negotiating future trade contracts, tracing global price trends for certain goods and services, predicting future prices, and domestic inflation. It is also used to deflate trade statistics published by the government. Import price also helps the central authorities to decide which and how much of a fiscal or monetary lever is to be used to manage exchange rates.

Import prices are especially valued in the bond markets because of its direct impact. As importing prices become too high, it deteriorates the importing company’s profit margin, ultimately decreasing corresponding bond prices. Hence, bond prices decrease when import prices substantially increase. On the other hand, when import prices decrease, the profit margin for companies increases, and correspondingly the bond prices also rise, seeing the increased margin.

Impact on Currency

The currency markets are always focused on macroeconomic indicators and do not focus on indicators that focus on specific parts of the economy. However, import prices affect trade balance, bond markets, and even stock markets. The overall net import and export figures and trade balance reports constitute more precedence than the individual import prices report for the currency markets. Hence, it is a low-impact indicator in the currency markets and can be overlooked for other macroeconomic indicators.

On an absolute basis, significant increases in import prices for prolonged periods, deteriorate currency, and economic growth. In practice, multiple forces act for and against such figures, and import prices alone are insufficient to determine currency’s future direction.

Economic Reports

In the United States, the Bureau of Labor Statistics publishes monthly import prices as part of its “Import/Export Indexes (MXP).” It is released every month around the second week for the previous month on its official website.

Sources of Import Prices

The Bureau of Labor Statistics Import/Export Indexes (MXP) is primarily used. It is also categorized into subtables by End-Use, NAICS (North American Industry Classification System), Harmonized System, and Origin. Consolidated Import prices for most countries is available on Trading Economics. The World Bank also maintains international trade data in terms of import value and export value indexes.

Import Prices – Effect on Price Charts

Import Prices is an important element in understanding the trade balance of an economy. However, it alone cannot affect the economic condition of a nation. It is combined with the Export Prices, and the difference between the two is what makes it vital.

Coming to the currency market, the Import Prices report mildly affects the volatility of a currency. If immediate volatility on the time of release is not observed, it could be reflected in the short term.

Import Prices Report

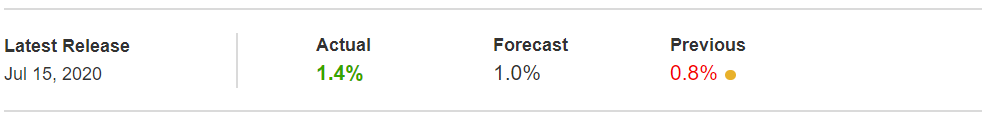

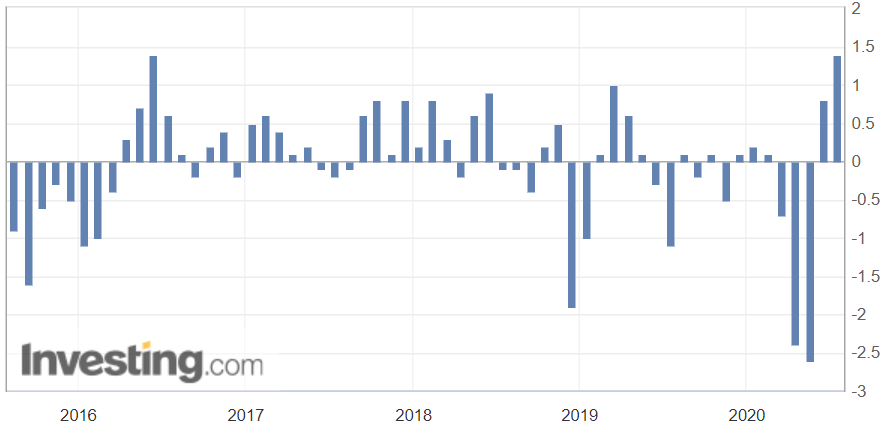

The below report represents the Import Prices of the US for the month of June. According to the data released on July 15, the Import Prices increased by 1.4% month-on-month, after a decline of 0.8% the previous month. Also, it beat the forecasted value of positive 1.0%.

Historical Impact Prices Report

Impact Level

The US Import Prices released by the US Department of Labor has a moderate impact on the currency market (USD).

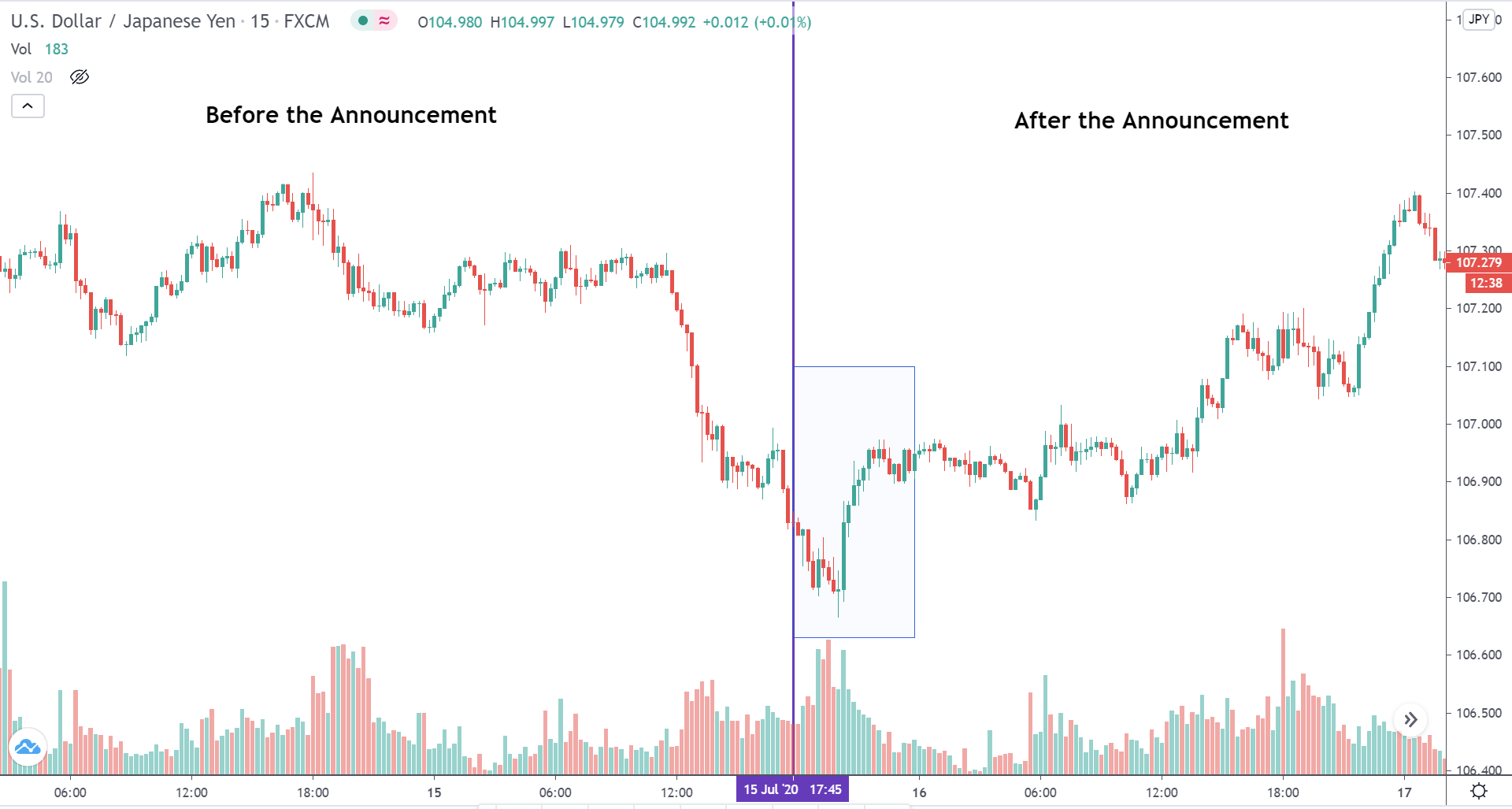

USDJPY – Before the Announcement

Below is the price chart of USDJPY on the 15mins time frame. Before the report was released, the market was in a strong downtrend representing USD weakness.

USDJPY – Before the Announcement

When the news was released during the open if the New York session, the trading volume considerably increased, and the price continued to move south. However, later in the session, the prices reversed in favor of USD. This indicates that the market did have an impact on the report.

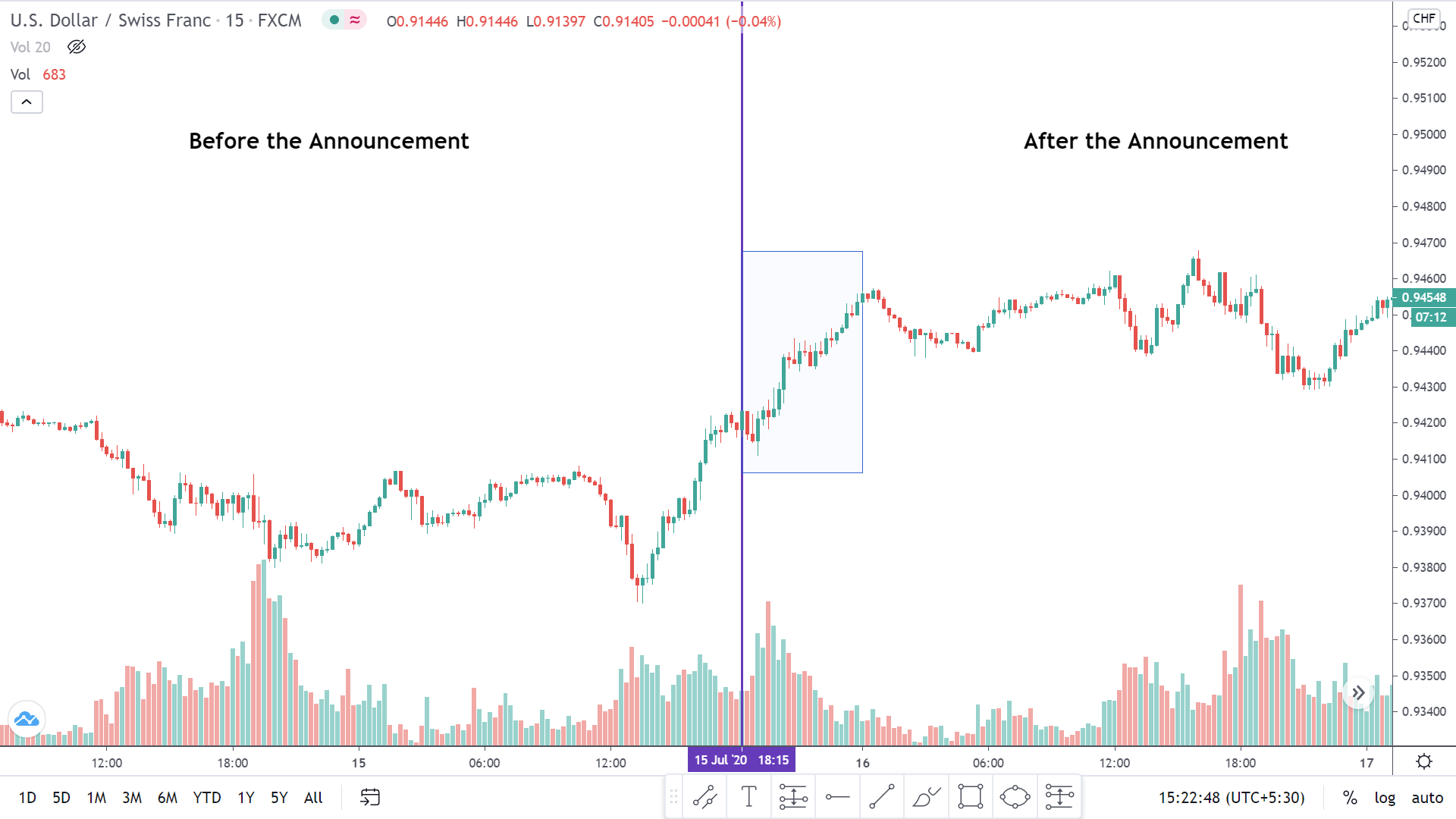

USDCHF – Before the Announcement

Before the news announcement, the volatility of the market was feeble. The price which was inclined down initially, but had begun to move switch direction during the release of the news.

USDCHF – After the Announcement

When the Import Prices news report was announced, the volatility was moderate in the beginning but reduced later in the day. The price which was showing bullishness prior to the news continued with the same sentiment. Thus, traders can follow their strategy without any hesitation as the news barely induce high volatility.

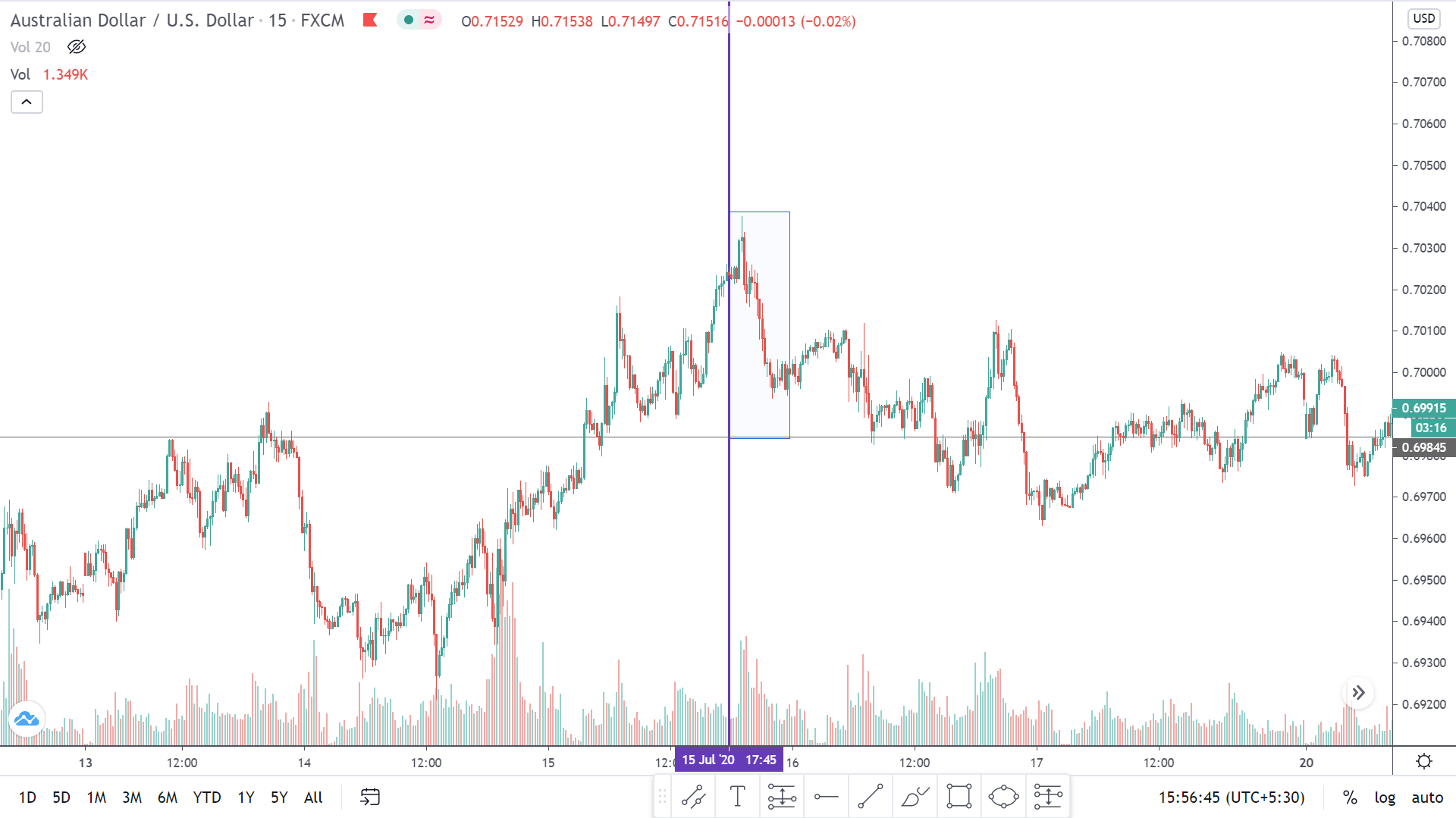

AUDUSD – Before the Announcement

Before the announcement of the report, the market was in an evident uptrend making higher highs.

AUDUSD – After the Announcement

Right when the report was announced and the North American session began, the market reversed direction from an uptrend to a downtrend. However, the price failed to make a higher high. The volatility increased significantly, which can be seen from the volume indicator.

The Import Prices is an essential indicator in as it is a factor of calculation for fundamental drivers. As we saw, even though this indicator did not really bring in volatility in the market, it indirectly does significantly affect the currency prices when combined with other drivers. Cheers!