Introduction

In the early days of technical analysis, charts were drawn by hand. Personal computers came much later. Traders and investors patiently drew their charts one day, hour or minute at a time. Indicators such as moving averages were calculated by hand. Sophisticated indicators- MACD, Bollinger bands- were mostly absent.

Under those conditions, traders focused on chart patterns for clues about market turns or continuations. Thus, patterns such as head and shoulders, triple bottoms, triangles, flags and so forth started being part of traders’ arsenal.

Actually, computer-oriented traders pay more attention to sophisticated indicators than to patterns, but there are many successful traders that sing praises to the good old method of pattern trading, because, they say, it’s faster than those lag-ish indicators.

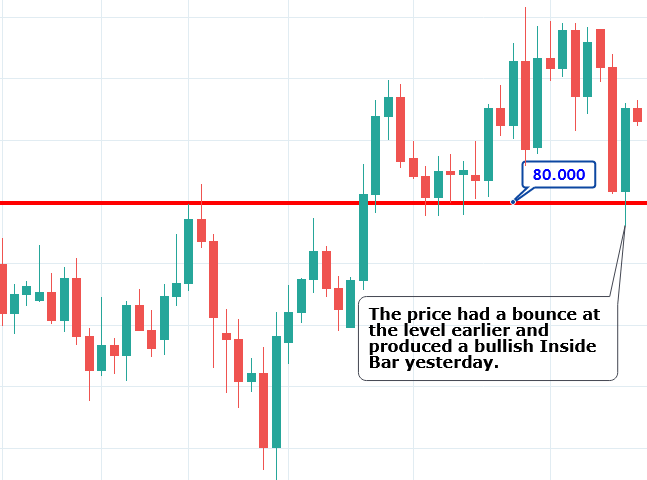

One bar patterns

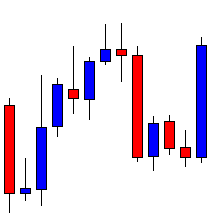

The easiest to recognize, of all chart patterns, is one bar patterns: Gaps, one bar reversal, spikes, inside and outside days.

Gaps and spikes

Gaps don’t occur in the 24/7 currency markets. Or do they? That depends on how we define a gap.

And what is a gap: Technically it is a hole in the prices due to a price change that happened between the previous close and the open.

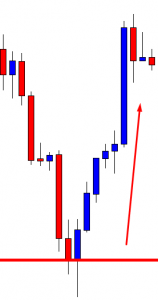

In order to make it extensive for its use in the currency markets lets define gap as a price shock. An extensive bar or a spike such as one that is caused by a news event.

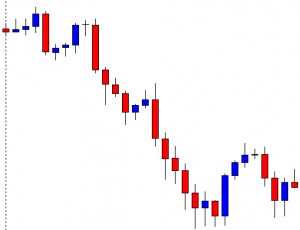

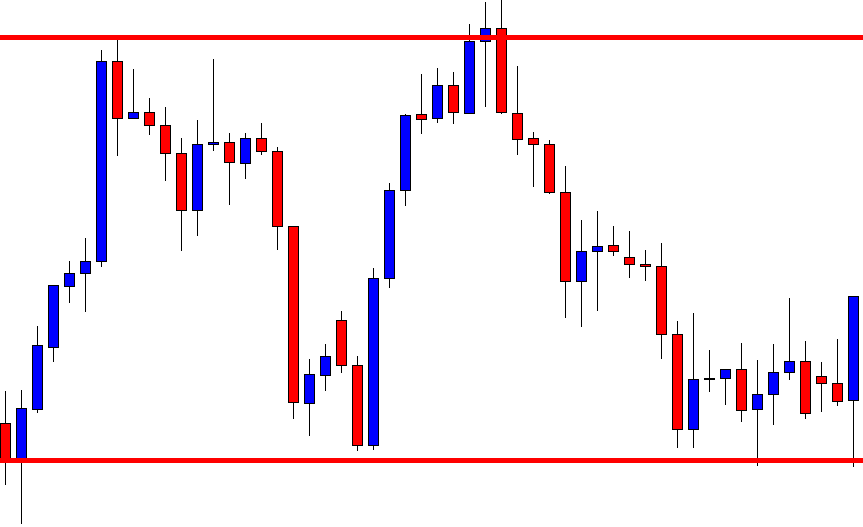

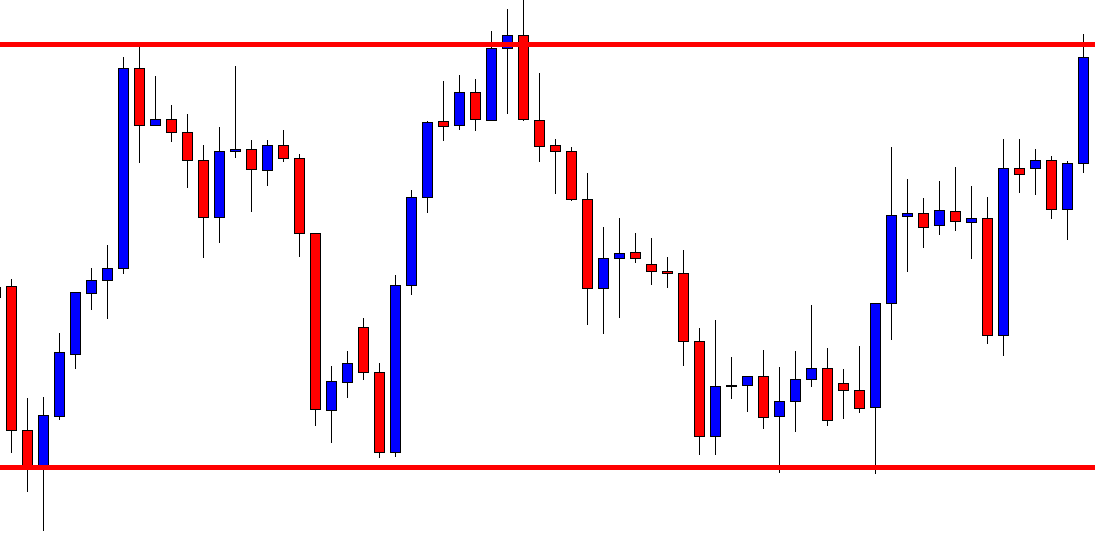

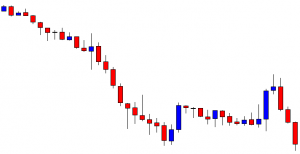

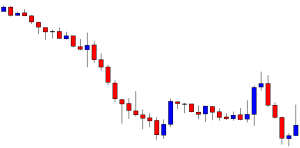

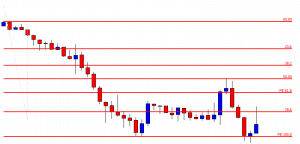

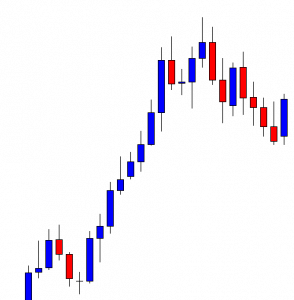

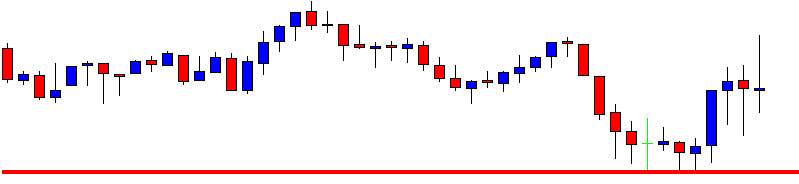

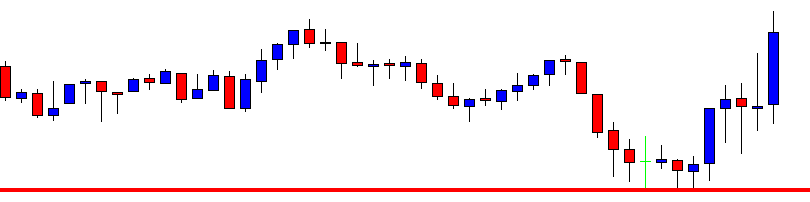

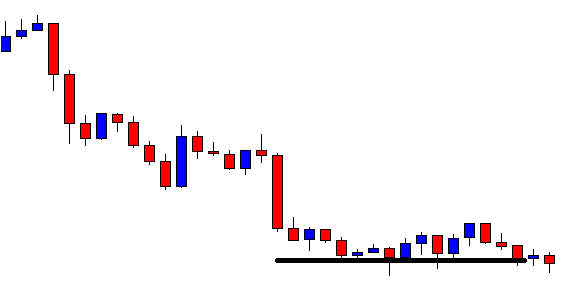

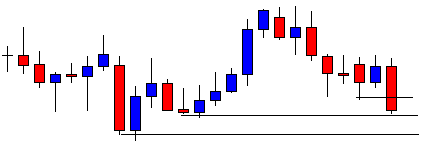

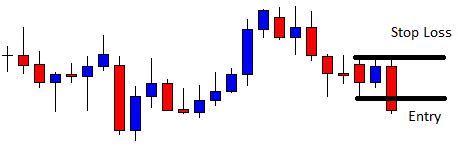

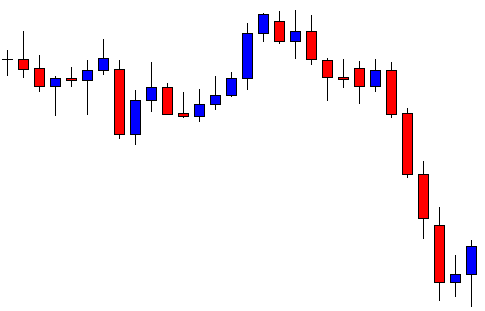

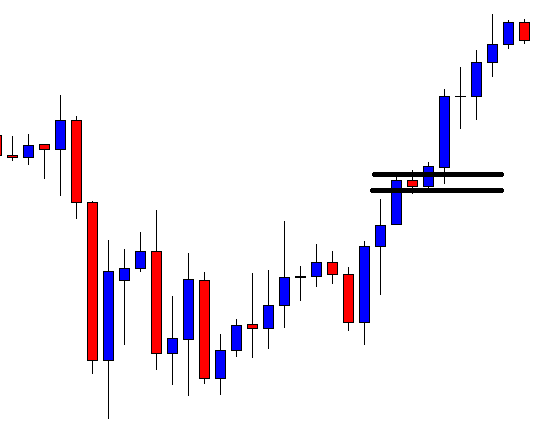

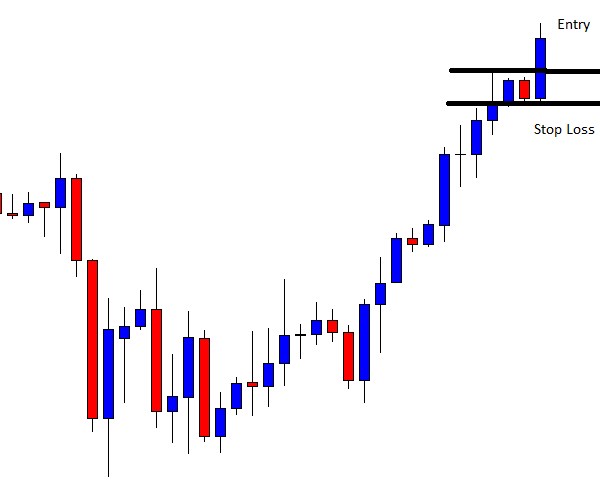

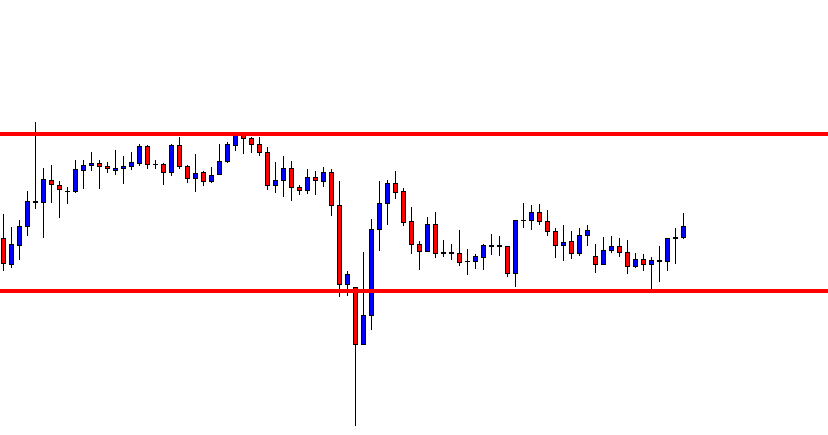

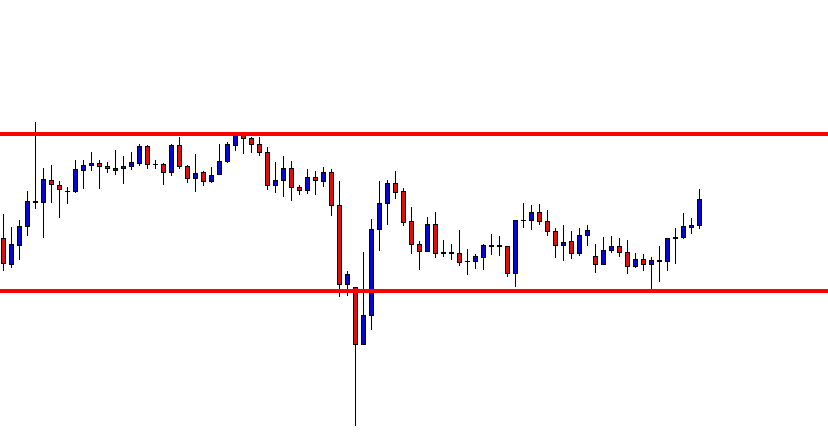

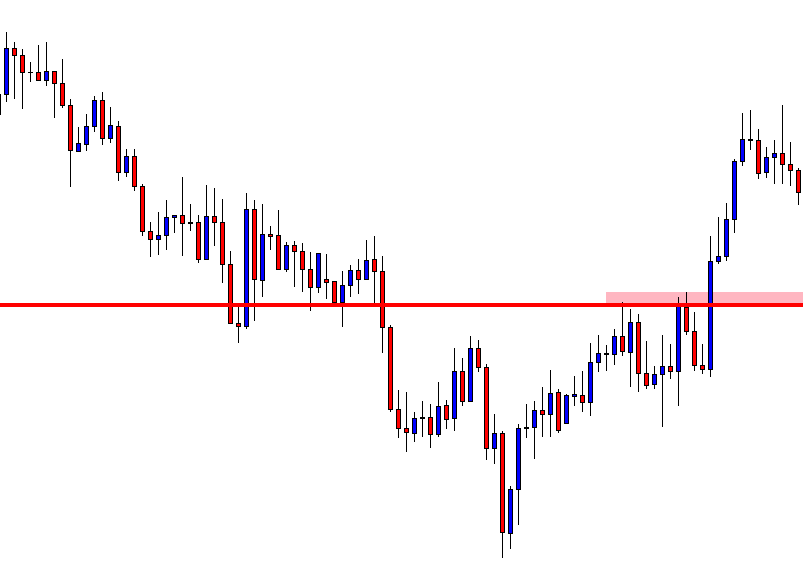

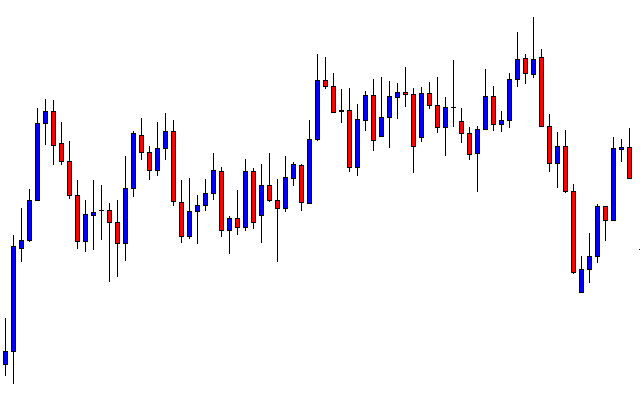

Fig 1.a shows a gap on a daily chart of a stock. Fig 1.b shows the same gap on a weekly chart as an elongated candle. It would be an elongated candle on its daily chart, too, if its open were drawn near the previous close.

The important factor is the traders’ sentiment about the price shock, not the way we draw it on a chart.

Using our brand new definition, a gap in the currency markets is a spike, a huge candle, produced by a news event that might have been a hole if the market had been closed during that event.

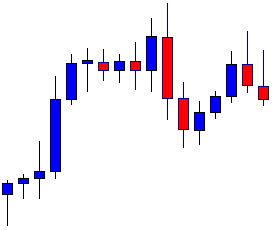

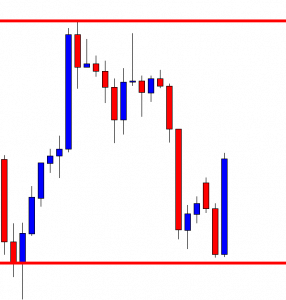

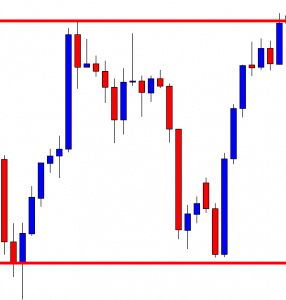

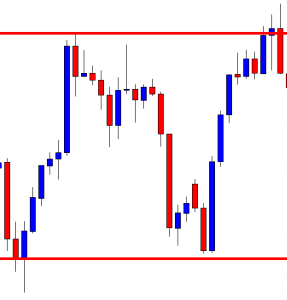

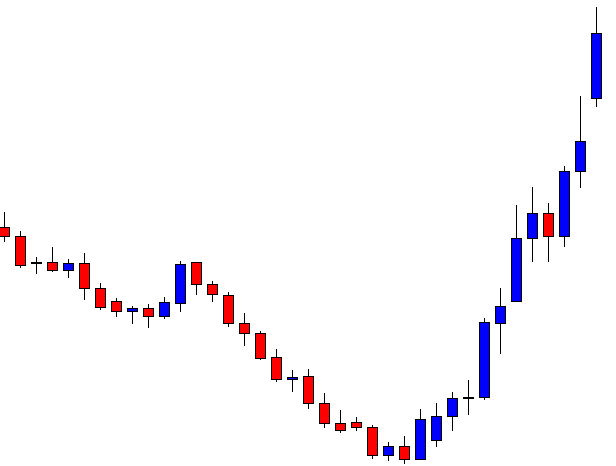

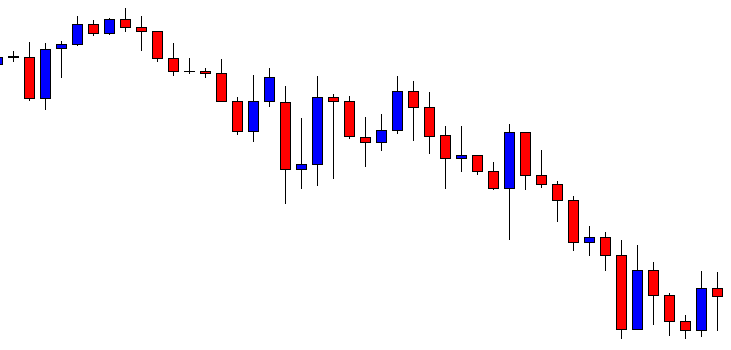

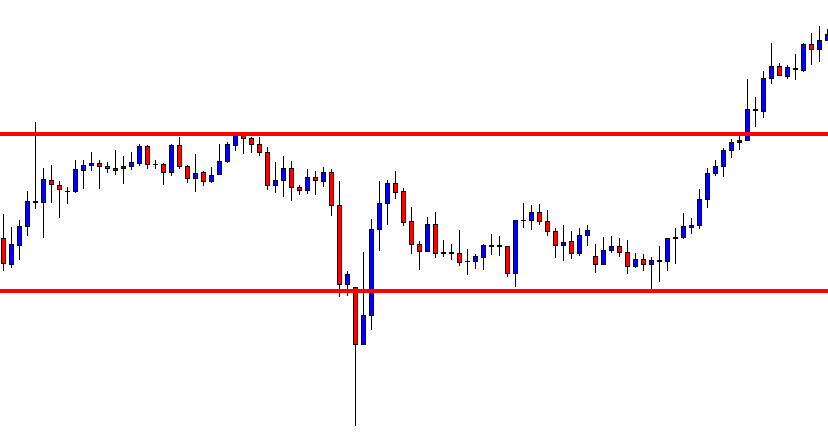

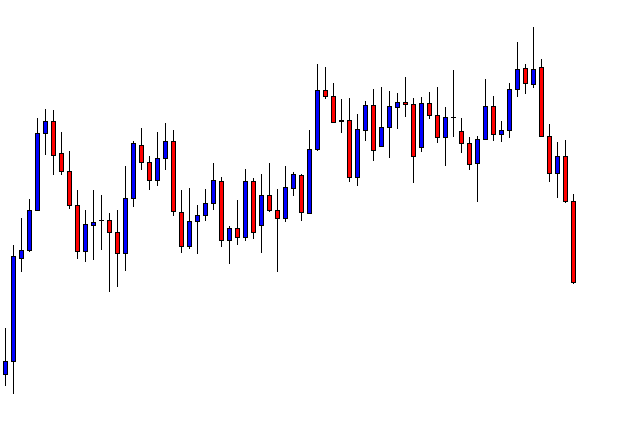

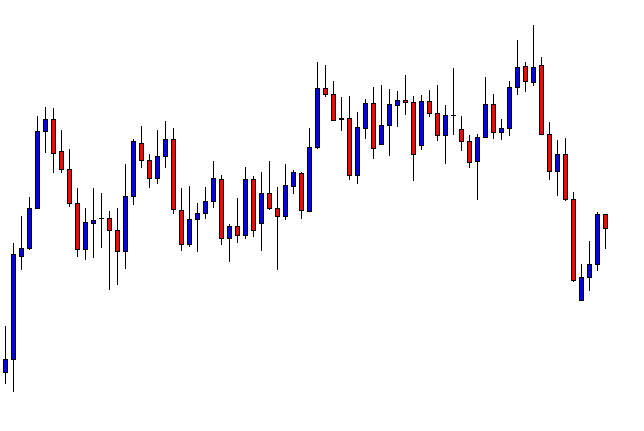

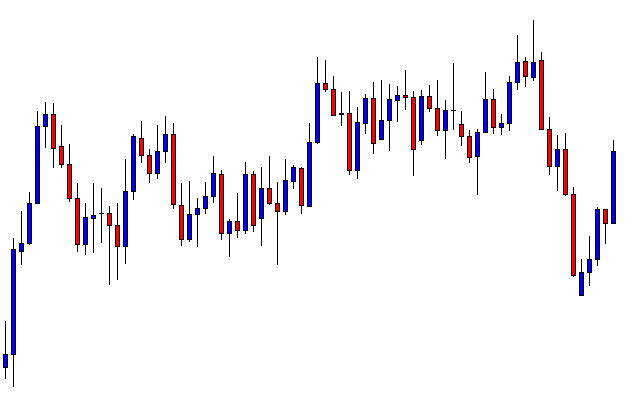

This pattern is the product of a large volatility jump, and it’s usually a local top or bottom. Thus, it’s often followed by a pullback, sometimes very large, as we may see in fig 1.d.

The majority of spikes show the direction of a future leg. It may be the same as the current leg or opposite to it. In any case, the gap is an indication of trend direction, at least mid-term. Although, the intelligent trader knew he must wait for a low-risk entry on a breakout or breakdown of the pullback leg.

Unexperienced traders must avoid trading events such as these. Money is made with method and discipline, not by greedy entries.

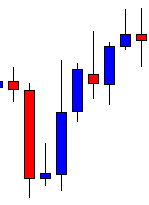

Reversal bars

A bullish reversal bar is a bar with its low making a new low but closing higher. A bearish reversal is a bar where there’s a new high but with the closing lower. Those reversals aren’t significant unless in context with highly oversold or overbought situations.

A bullish reversal bar is a bar with its low making a new low but closing higher. A bearish reversal is a bar where there’s a new high but with the closing lower. Those reversals aren’t significant unless in context with highly oversold or overbought situations.

A bullish key reversal is a bar with new lows and then making a high higher high, closing, also, higher than the previous bar’s

close. The bearish key reversal is its specular pattern.

Important reversal patterns

From lower to higher or vice versa.

The most important pattern for determining a trend reversal has already been dealt with. Since a trend reversal -for instance from bear to bull trend- is going from lower highs and lows to higher highs and lows, this is a pattern, and it’s one of most important for the detection of a trend change.

It’s possible that we may detect a failure to new lows, but we don’t start getting higher highs and lows. Thus, we have shifted from a downtrend to a sideways market, that may resume a downtrend or break up. We still don’t know. But the bear trend has stopped.

Head-and-Shoulders

It’s a top formation. The inverted Head-and-Shoulders is its specular counterpart as a bottom formation.

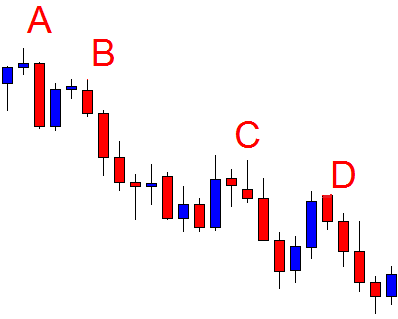

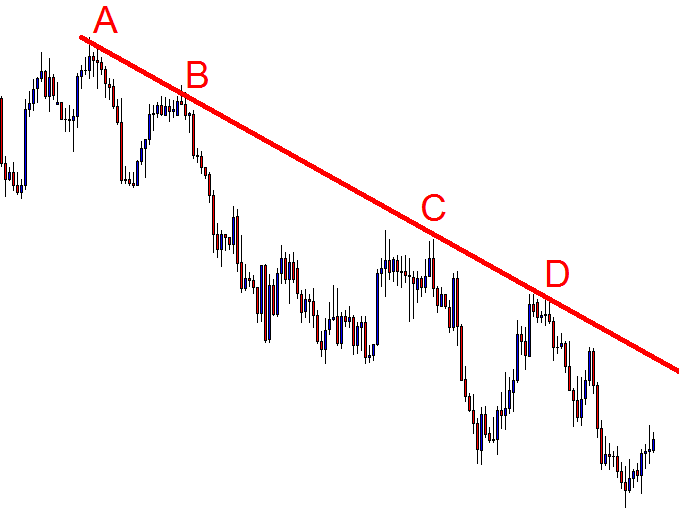

Stages of a Head-and-Shoulders pattern

- A strong rally followed by a minor pullback forms the left shoulder.

- Another high-volume rally reaches a higher high and, then, pulls back to or near to the previous low

- A third rally that doesn’t make new highs with a downward leg that push prices below those two previous lows, to D

- Prices are below the neckline that acts as resistance. Prices go up a bit, touching the neckline but failing to hold and descending to fresh lows.

Breakout: The confirmatory stage is D, with prices below the neckline failing to go back up.

The importance of the volume:

The majority of the volume appears during A and B legs, the highest occurring during B rally, and greatly diminished volume during the formation of the right shoulder.

Fig.4.b shows an inverted head-and-shoulders bottom, where the neckline isn’t horizontal, and a typical volume pattern of stronger trading before B and lightening after it.

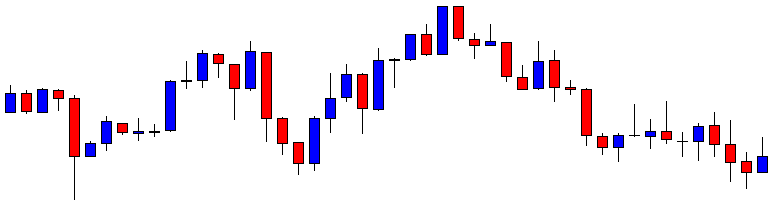

Broadening bottoms

Appearance: Drawing trend lines at tops and bottoms of the formation it gives the impression of the silhouette of an ancient turntable’s horn.

Identification:

Price Trend: declining.

Shape: Price seems an oscillating pattern with increasing amplitude.

Trend lines: The two trend lines across minor tops and bottoms diverge from each other. The upper trend line must be ascending or horizontal. The bottom one should be pointing down.

Touches: According to Thomas N. Bukowski’s book on patterns, a broadening bottom needs at least two minor highs and two minor lows to validate the pattern.

Volume: Volume follows price. When the price falls so does volume, and when price moves up volume increases, as well.

How to trade it: When the channel is wide enough, buy near the lower trend line and sell on weakness or when it touches the higher trend line. Also buy a pullback after the breakout or breakdown, if it fails.

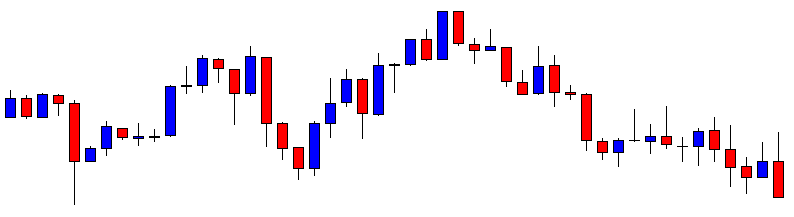

Broadening tops

Appearance: Similar to a widening bottom.

Identification:

Price Trend: Ascending.

Shape: Price seems an oscillating pattern with increasing amplitude.

Trend lines: The two trend lines across minor tops and bottoms diverge from each other. The upper trend line must be ascending. The bottom line should be pointing down or horizontal.

Touches: According to Thomas N. Bukowski’s book on patterns, a broadening top needs at least two minor highs and two minor lows to validate the pattern.

Volume: Volume follows price. When the price falls so does the volume, and when price moves up volume increases, as well.

How to trade it: This formation may show a trend change, but sometimes is just a trend continuation. When the channel is wide enough, sell near the higher trend line and buy when it touches the lower trend line. Also, buy the breakdown from the lower trend line.

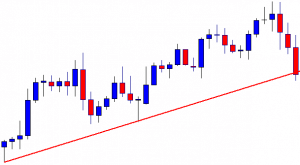

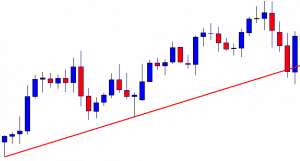

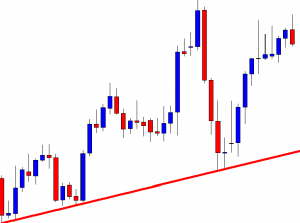

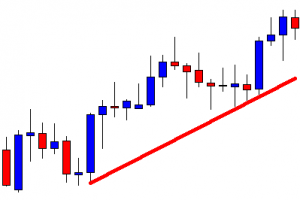

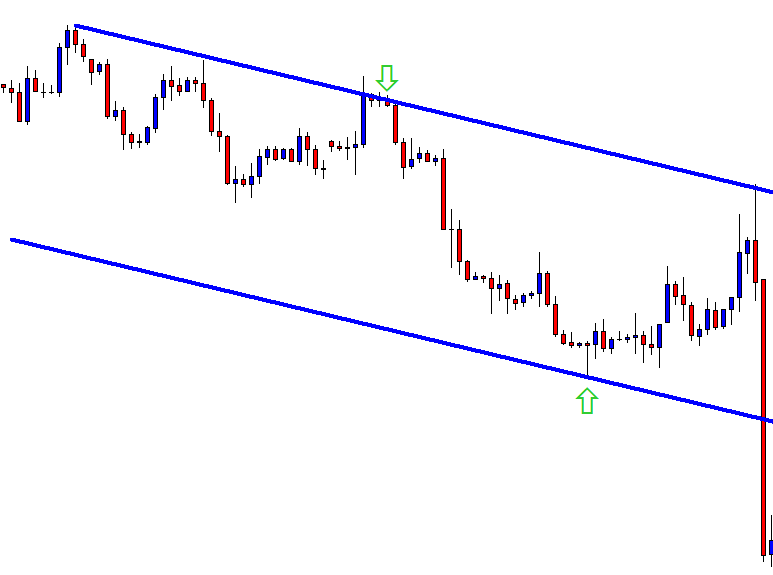

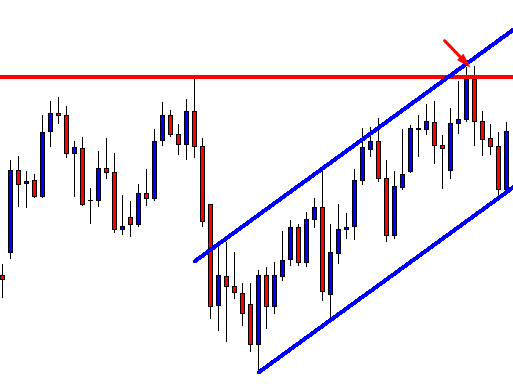

Broadening ascending wedges

Appearance: similar to a broadening top, but the lower trend line is, also, ascending.

Identification:

Price Trend: ascending.

Trend lines: The top line is steeper but the lower one is also trending up.

Touches: It needs at least three distinct touches (or close to it) on each of the lines.

Breakdown: In the majority of times there is a breakdown.

How to trade it: As in the case of the other broadening tops, sell near the higher trend line. Also, sell if it fails to make a new high. Sell the breakdown, as well.

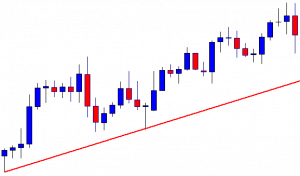

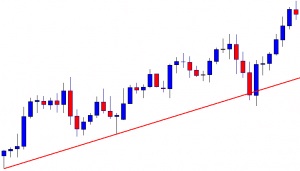

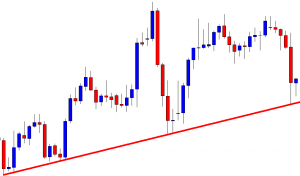

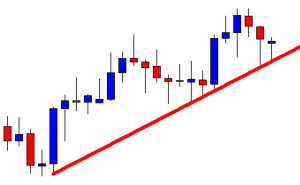

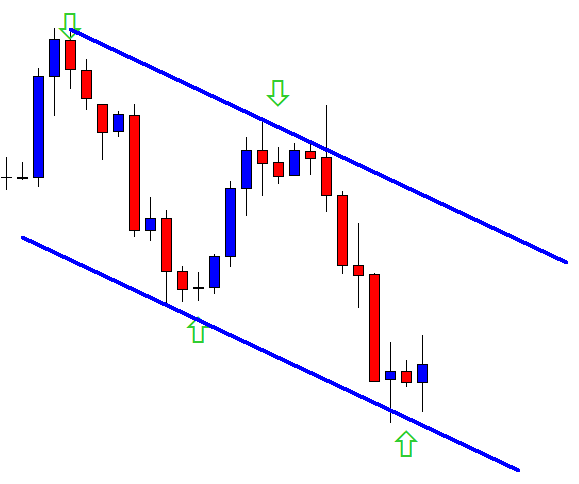

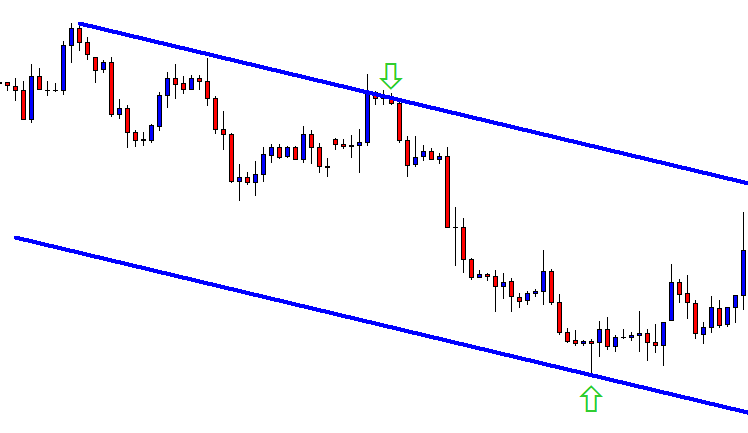

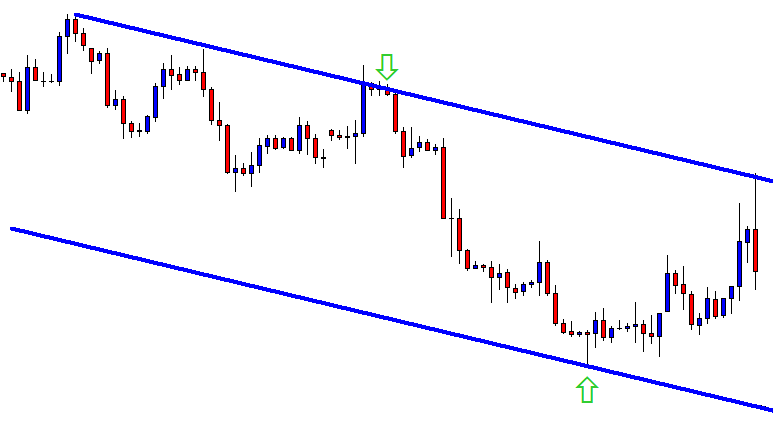

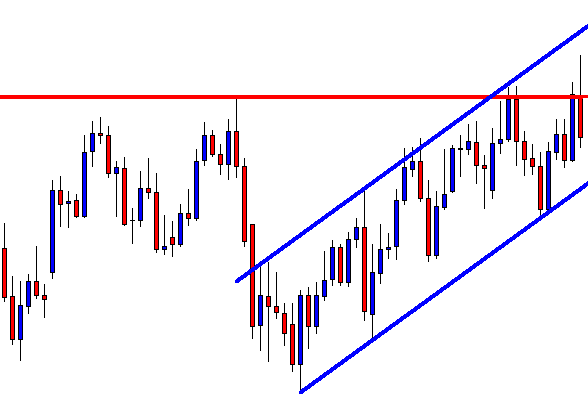

Broadening descending wedges:

Appearance: similar to a broadening bottom, but the higher trend line is, also, descending.

Identification:

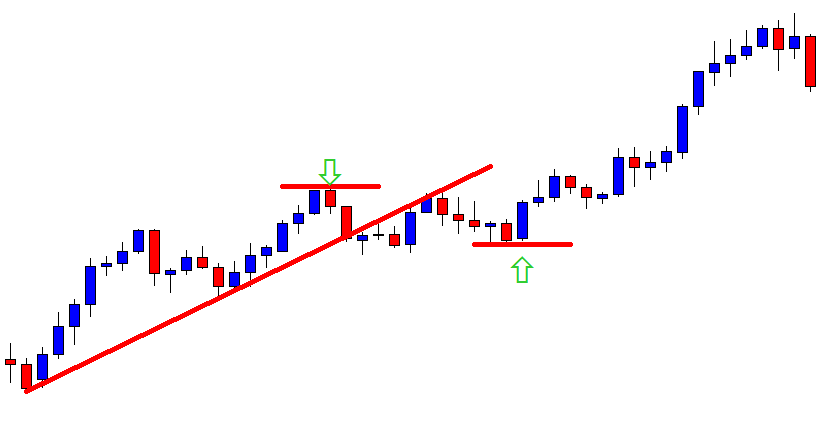

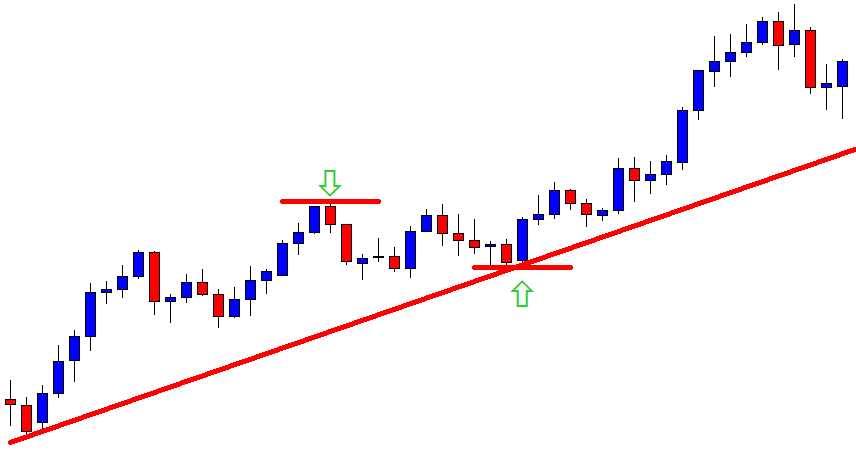

Price Trend: It usually acts as consolidation of an upward trend.

Trend lines: Both head down, but the bottom line is steeper.

Touches: It needs at least two distinct touches on each line.

Breakout: In the majority of times there is a breakout.

How to trade it: As in the case of the other broadening bottoms, buy near the lower trend line. Also, buy if it fails to make a new low. Buy the breakout, as well.

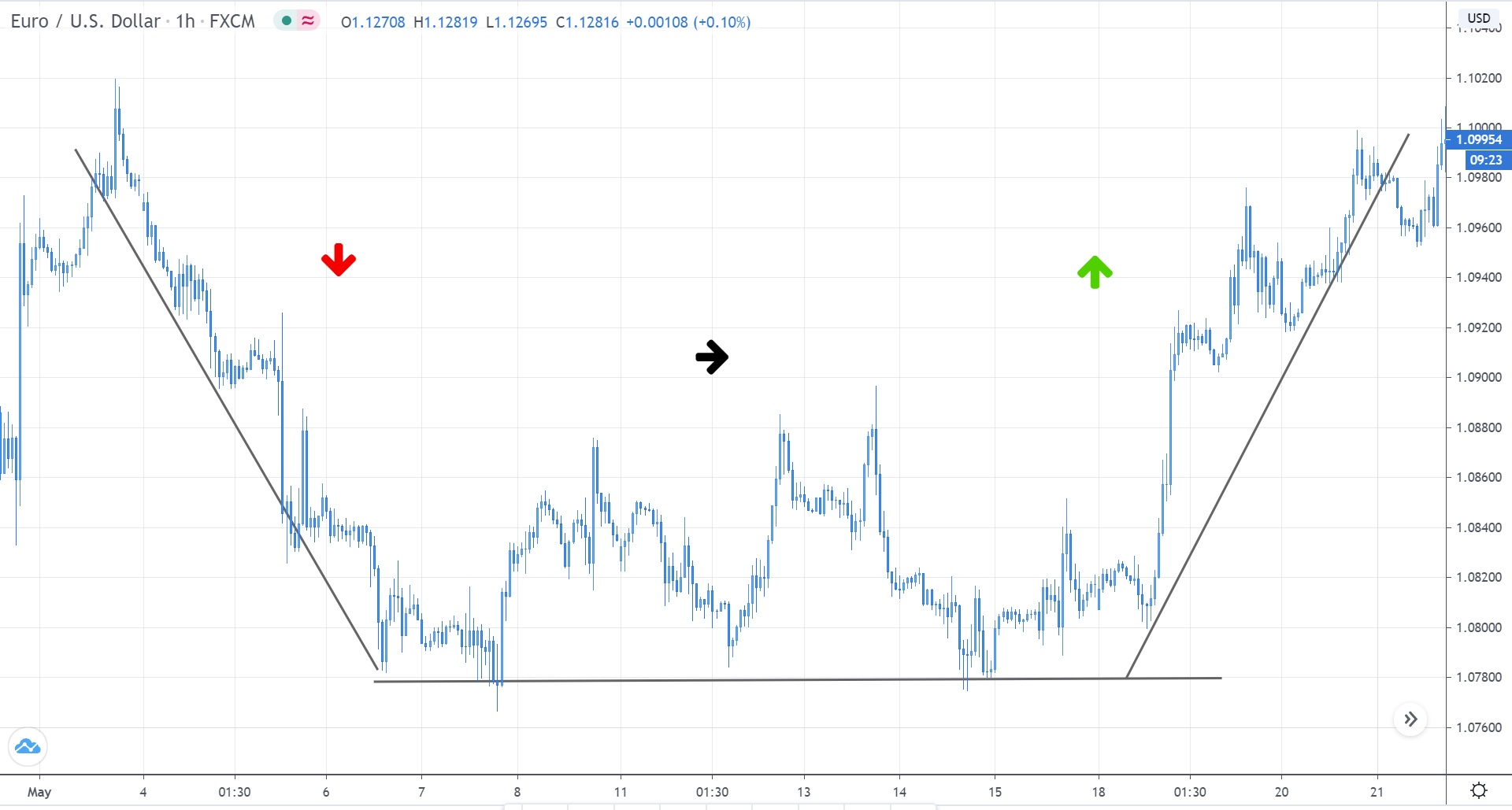

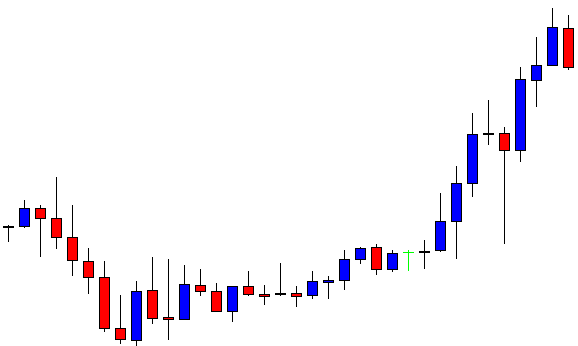

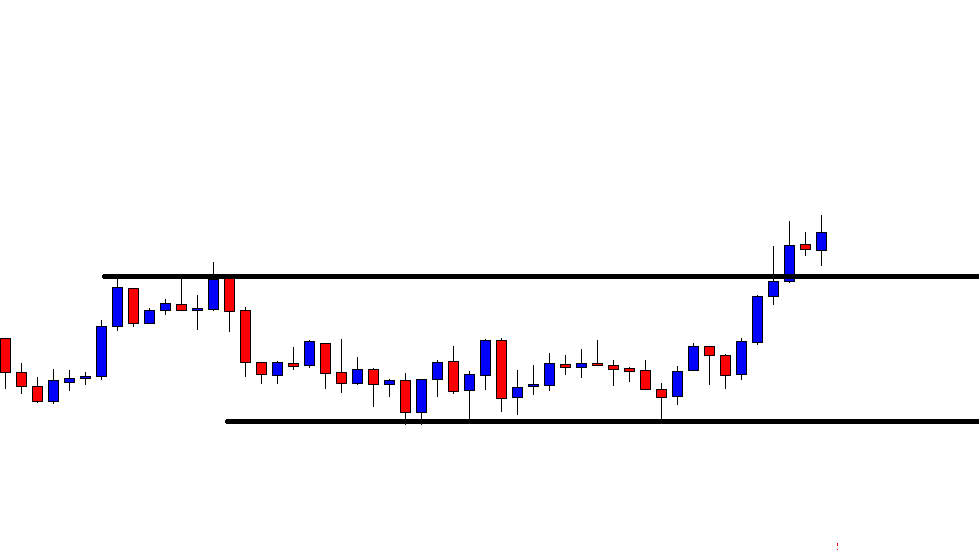

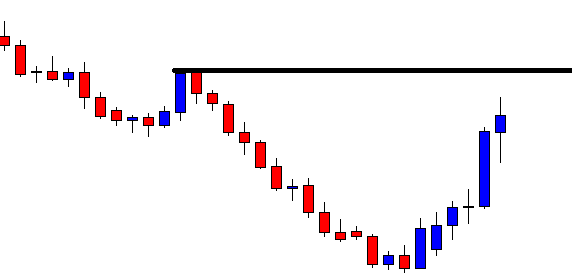

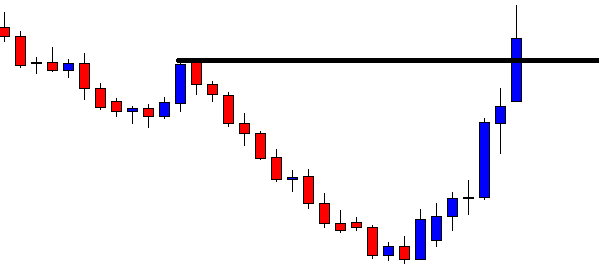

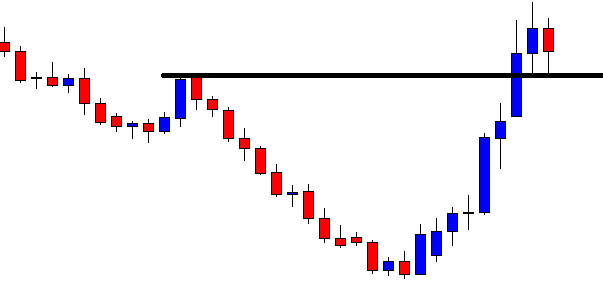

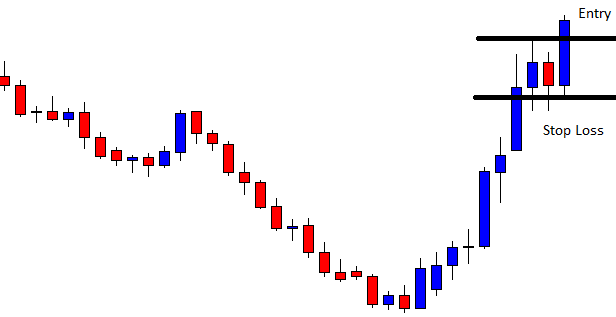

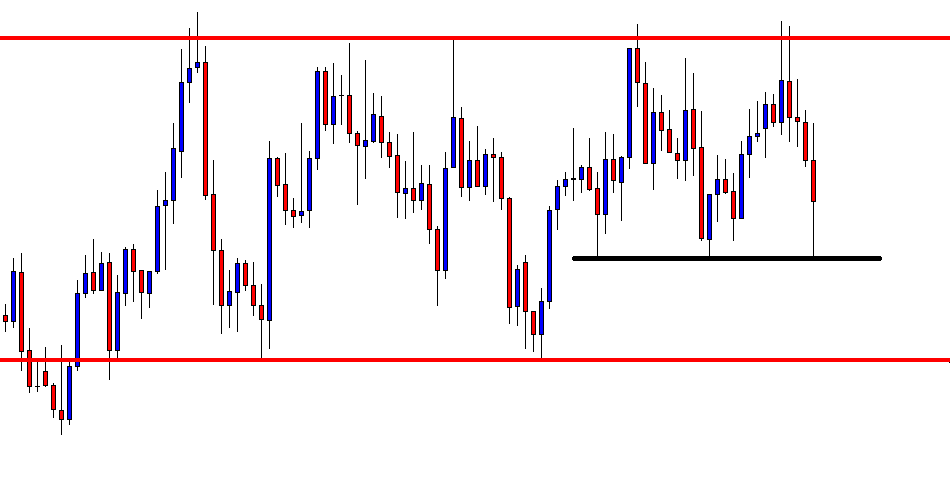

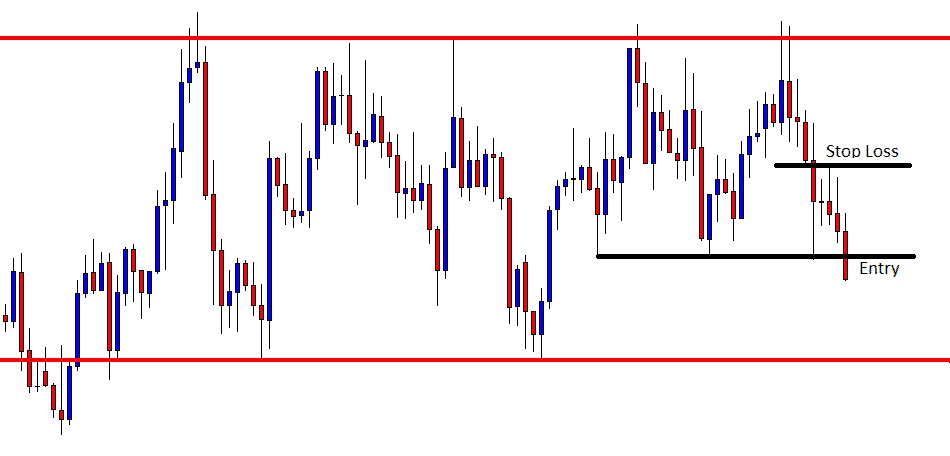

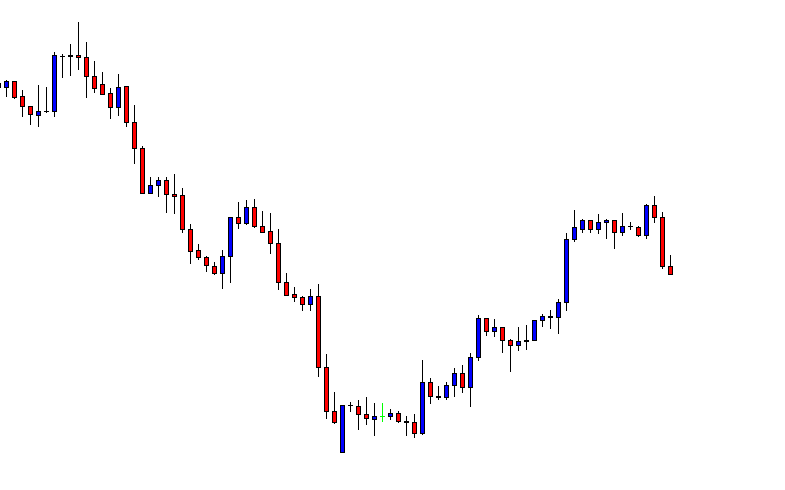

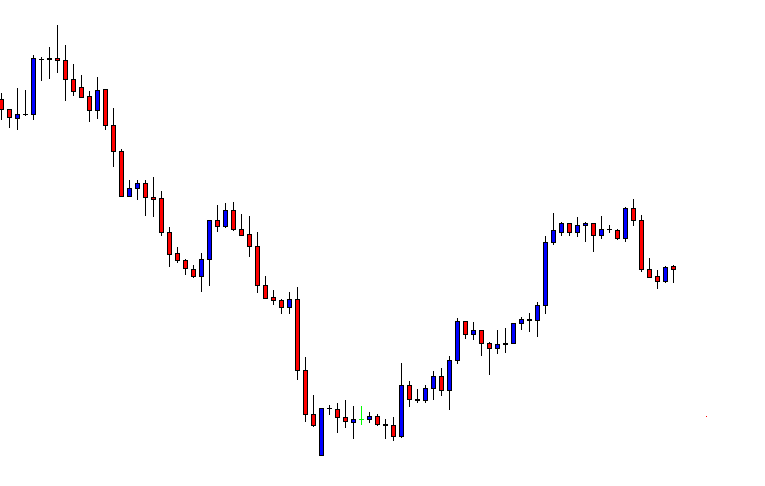

Double bottoms

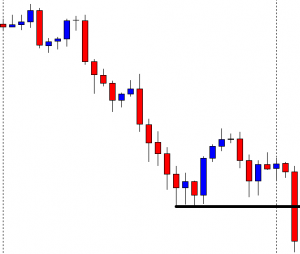

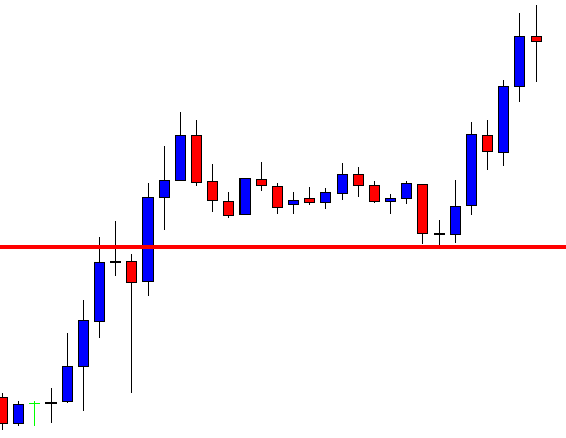

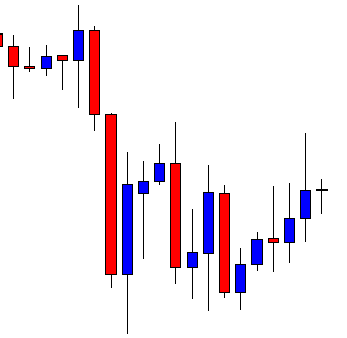

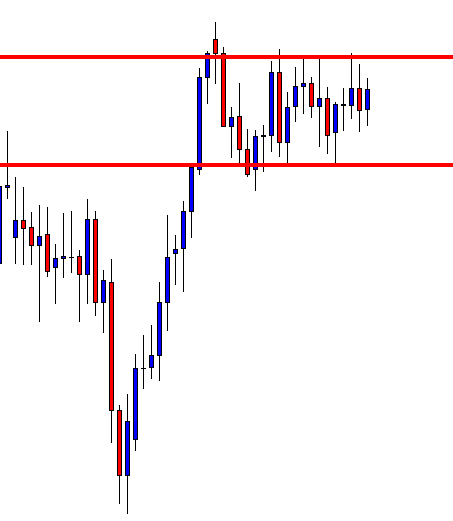

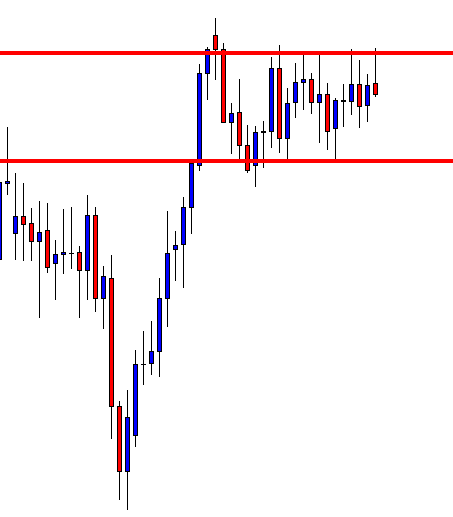

A double bottom is the first confirmation that the trend has stopped making new lower lows and lower highs. After a new low is made, the following bars draw a small rally to the recent highs.

Then, the price experiences a pull-down from that resistance level, to test the recent lows: The test resolves to the upside, breaking the recent resistance up to fresh highs, starting an upward trend.

Identification:

Price Trend: downward.

Bottom shape: Both bottoms are at the same level or close to it. The shadow of the second low may be below the first low, but it closes above it or the next candle does it.

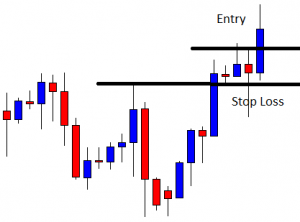

Confirmation: The double bottom is confirmed by a breakout of the resistance level of the formation.

How to trade it: Buy the breakout.

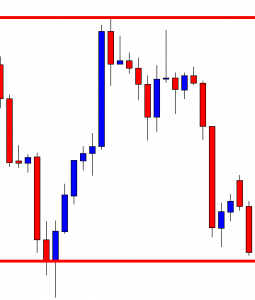

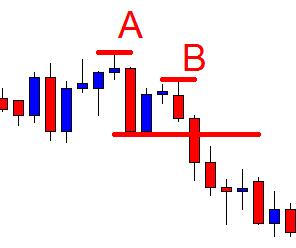

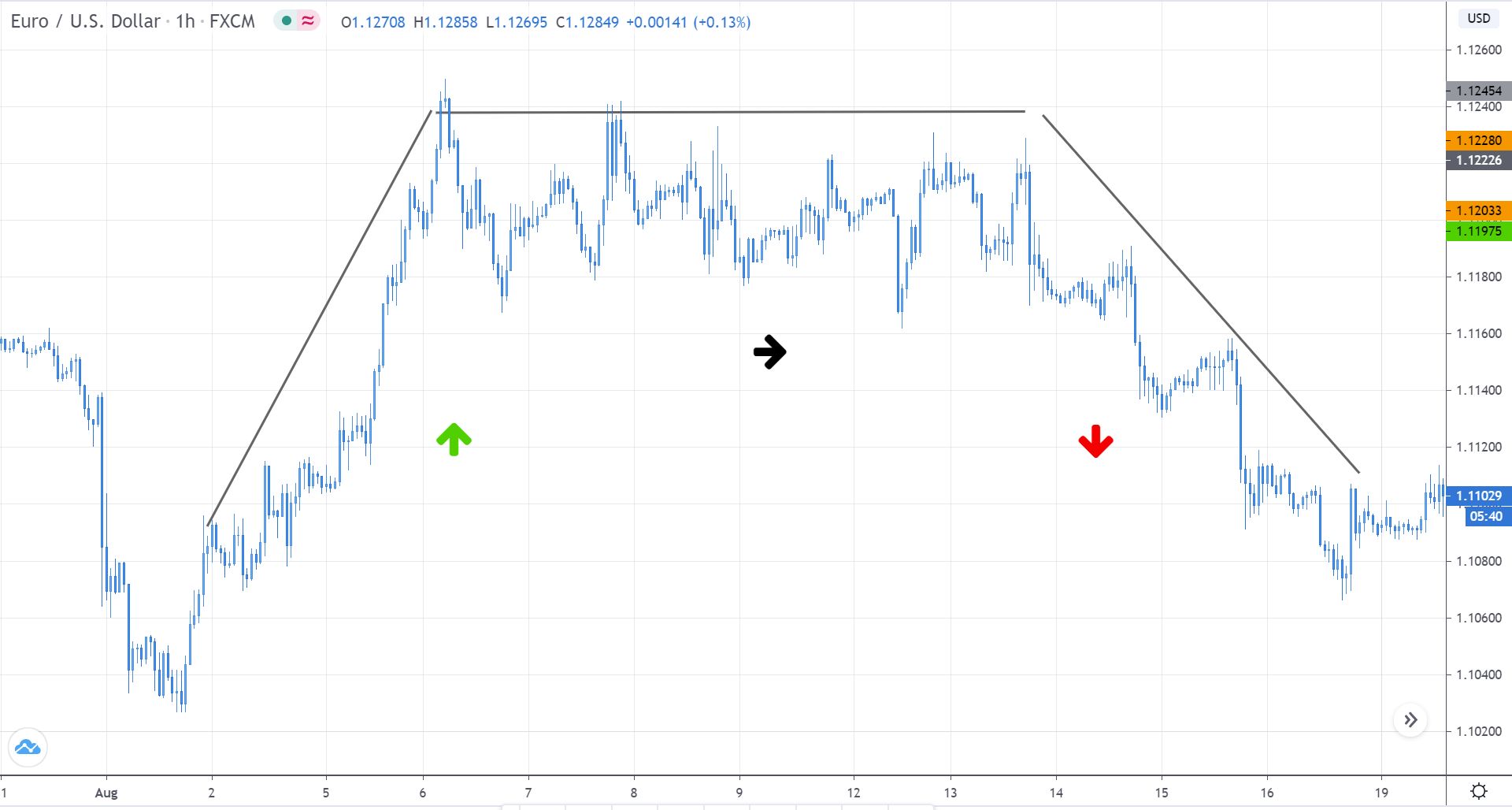

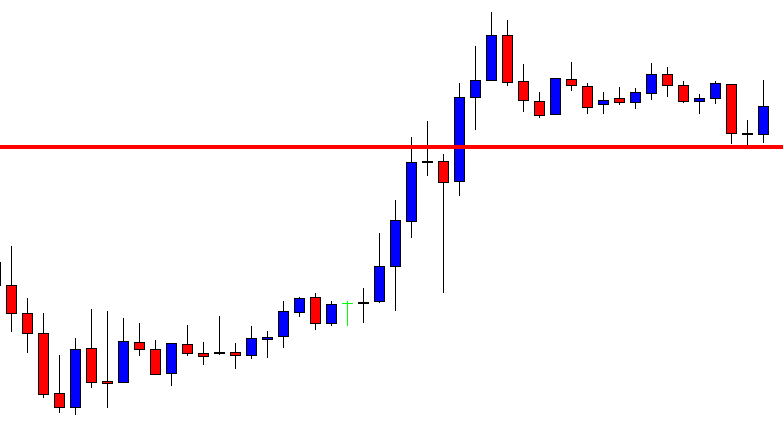

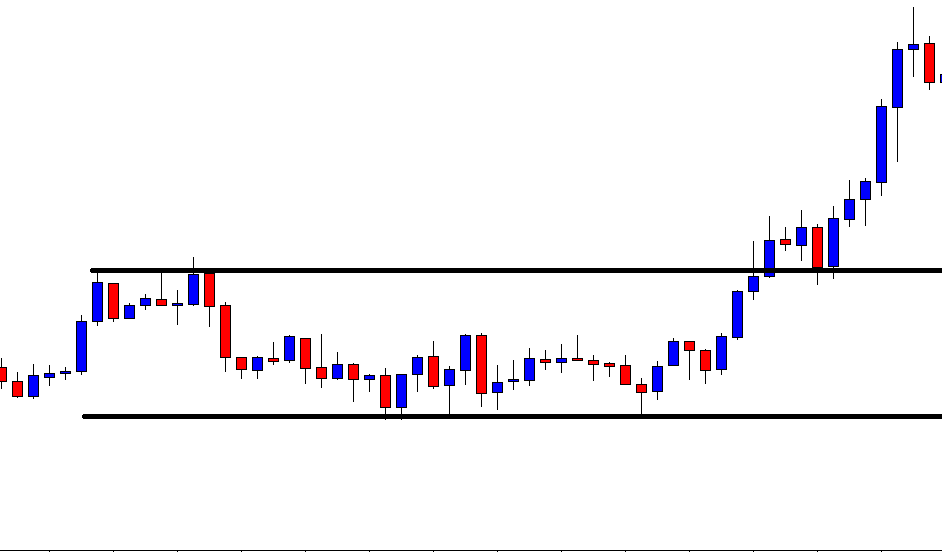

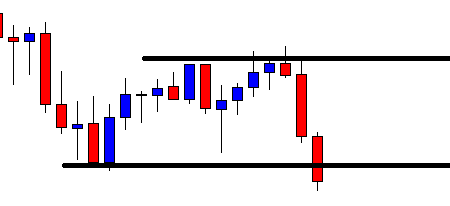

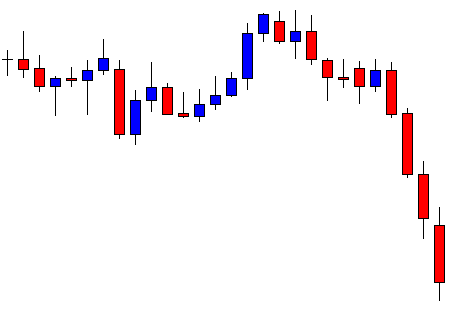

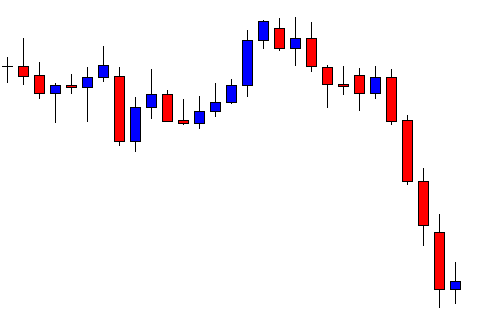

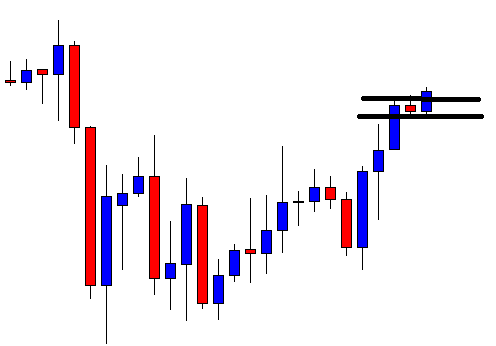

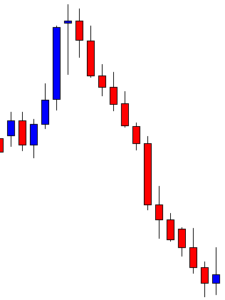

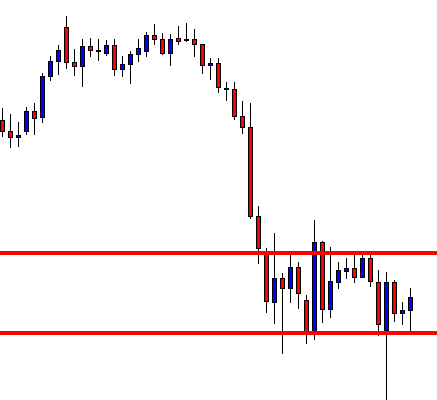

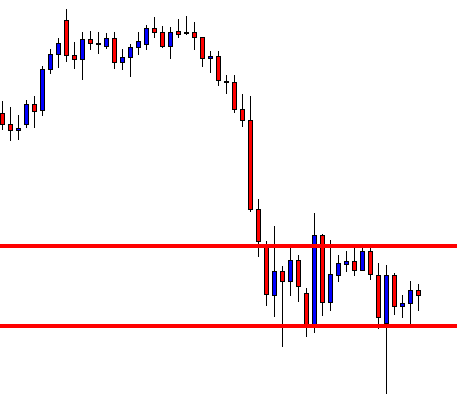

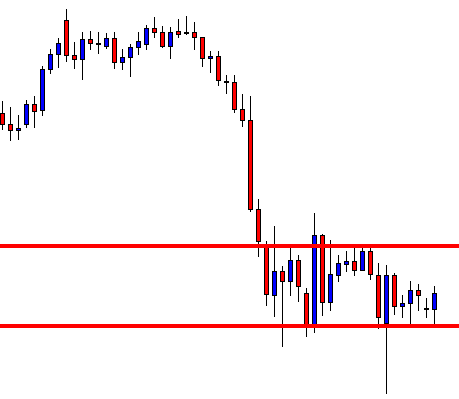

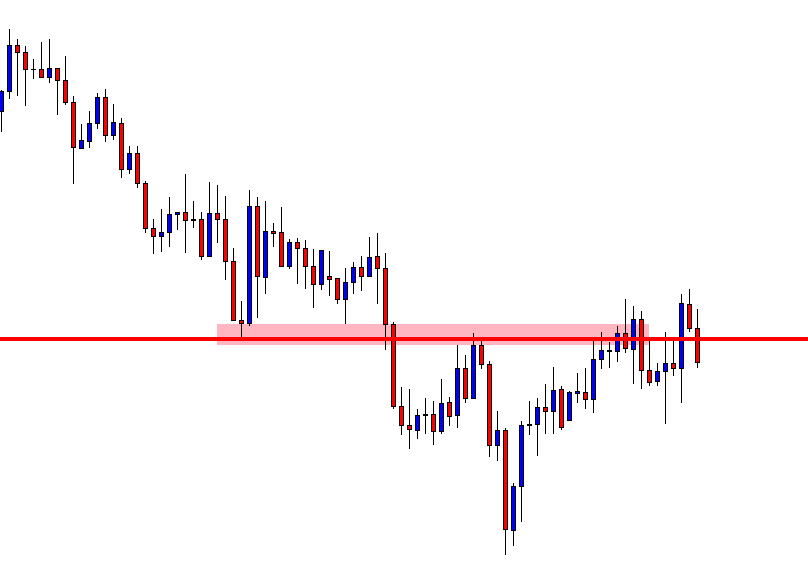

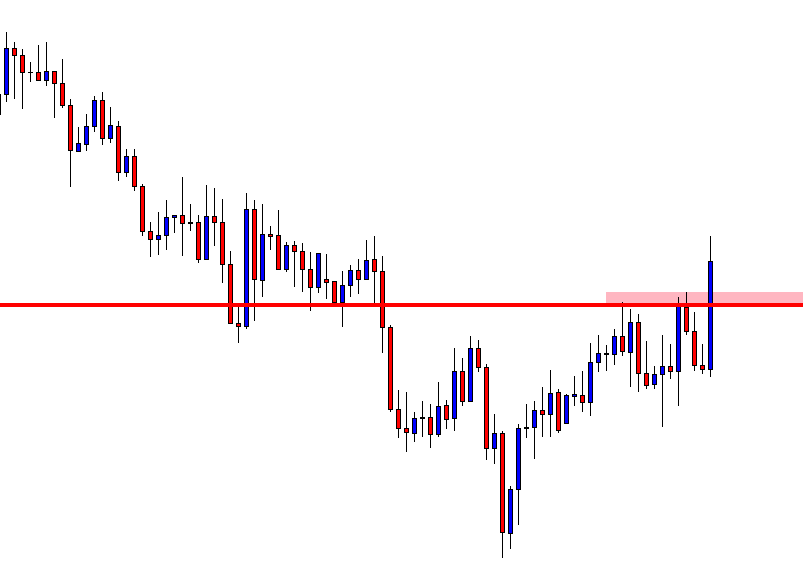

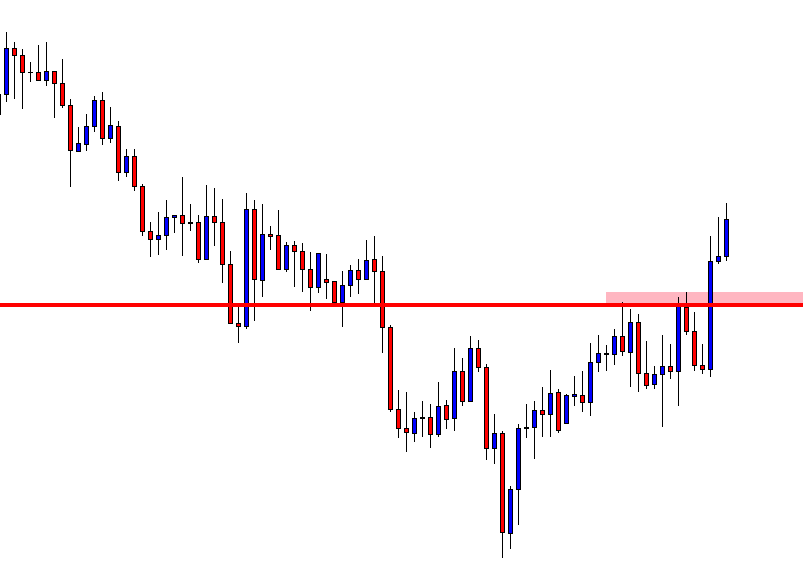

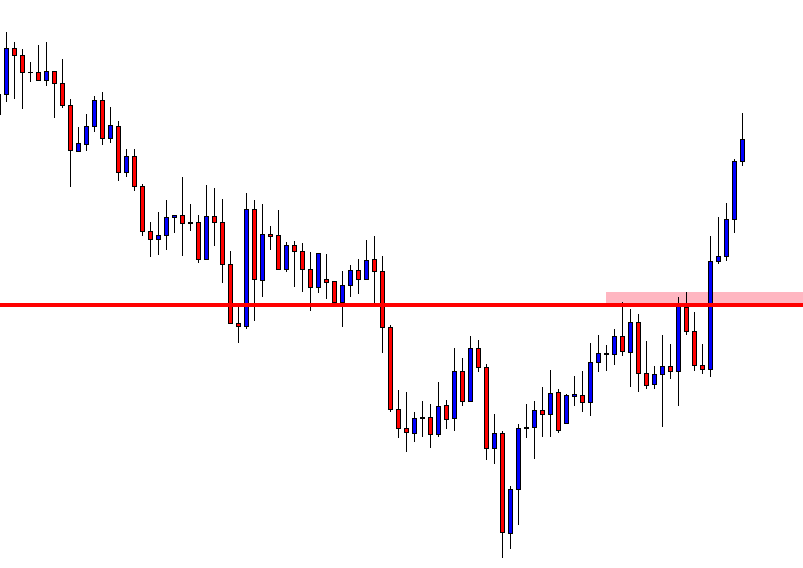

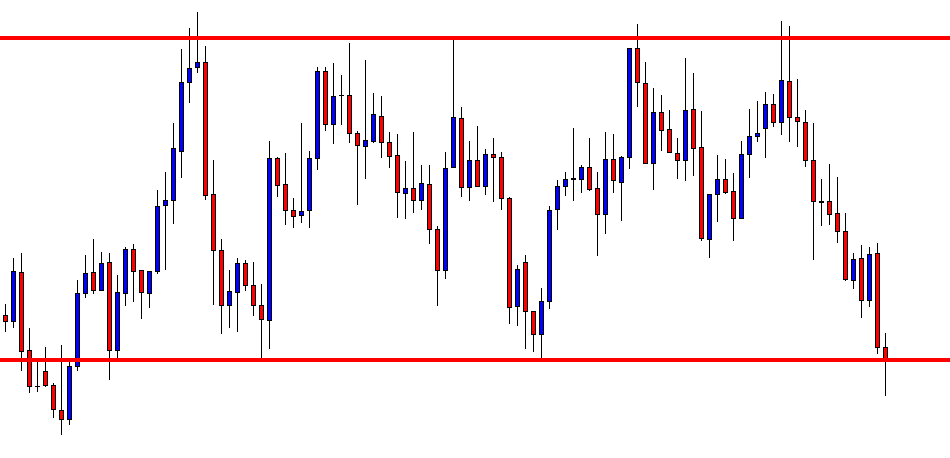

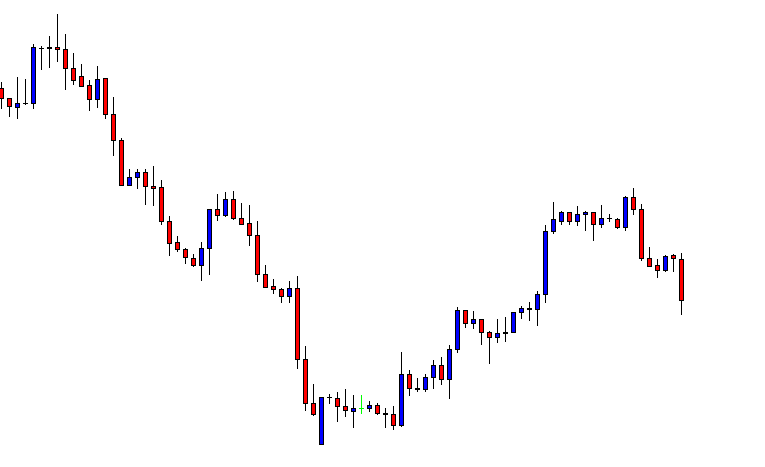

Double tops

A double top is the specular image of a double bottom. Price was on an uptrend and made a new local top. Then it pulled back to a local support level, and, after, it rallied again but failed to break the recent top and fell down, breaking down that local support to make fresh lows.

A double top is the specular image of a double bottom. Price was on an uptrend and made a new local top. Then it pulled back to a local support level, and, after, it rallied again but failed to break the recent top and fell down, breaking down that local support to make fresh lows.

Price trend: upward.

Top Shape: both highs are at the same level or close to it.

Confirmation: The double top is confirmed when the support level is broken down.

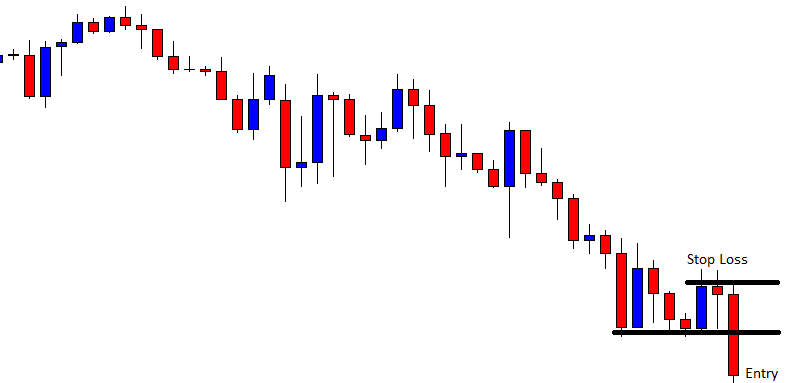

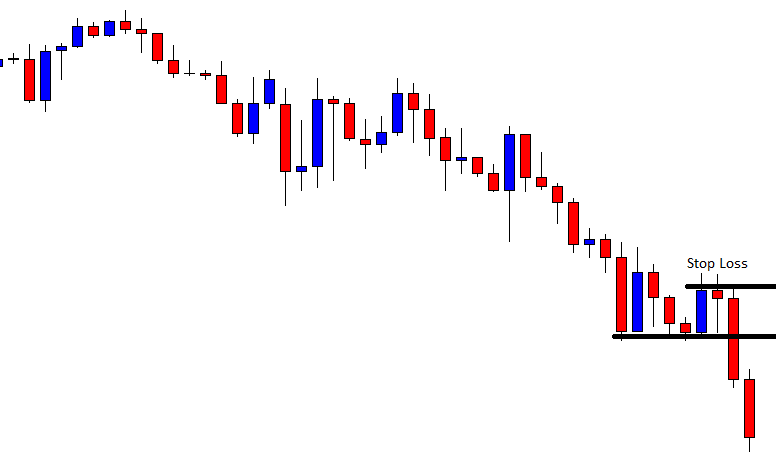

How to trade it: Sell the breakdown.

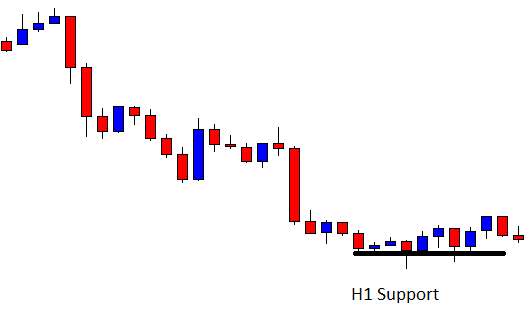

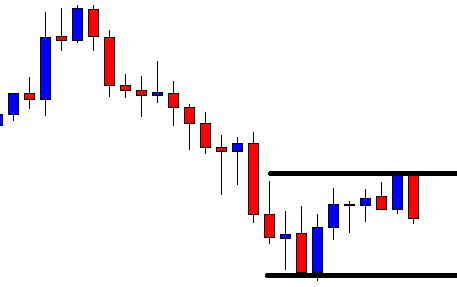

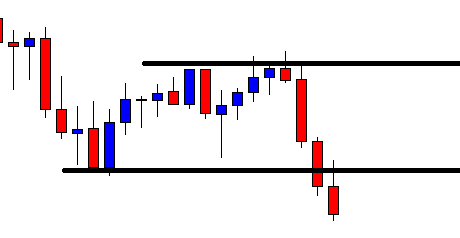

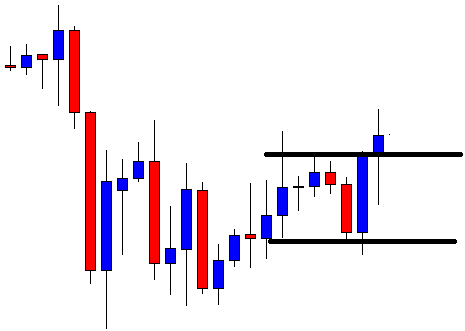

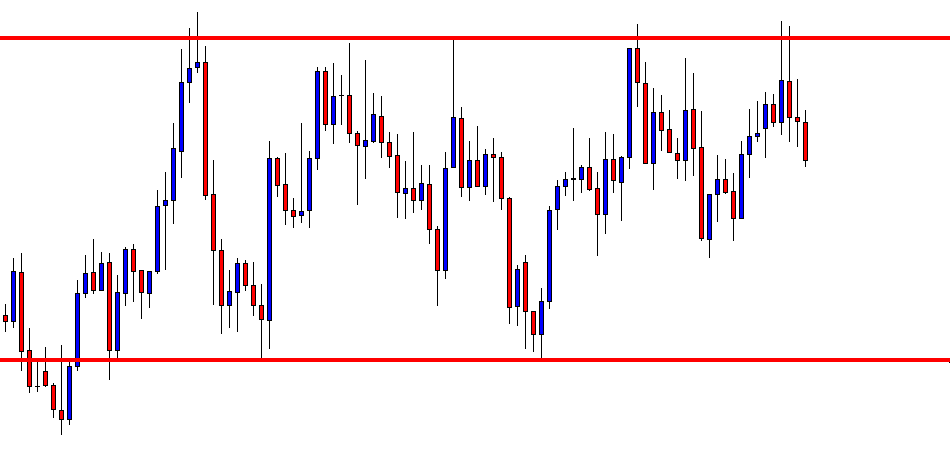

Triple Bottoms

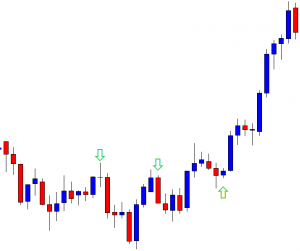

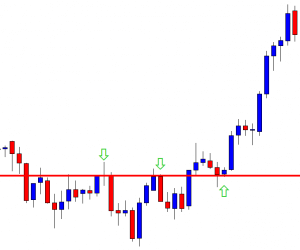

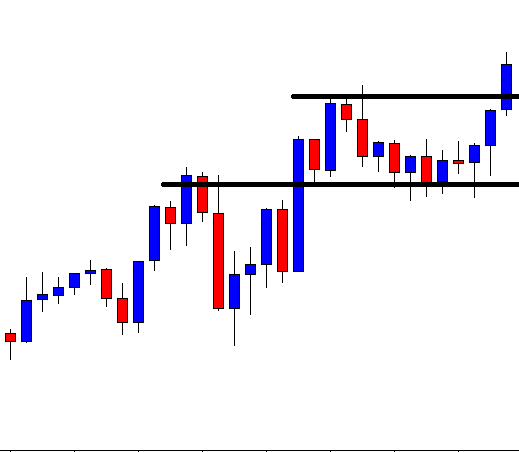

Triple bottoms are a form of oscillation. Not only present themselves after a long downward trend, but it’s usually three or more bottoms in sideways channels, or in reactive legs during an uptrend.

They are more reliable as a continuation pattern, on a bull trend than as counter-trend signal in bear markets.

Price trend: Preferably upward

Bottoms: Three bottoms at similar levels. It helps that the second and third bottoms didn’t touch the first one.

Confirmation: Price breaks up the confirmation line.

How to trade: Wait for a pullback to support (confirmation line) and buy the second breakout.

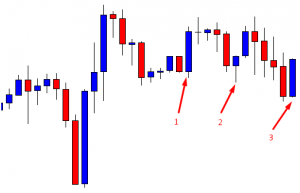

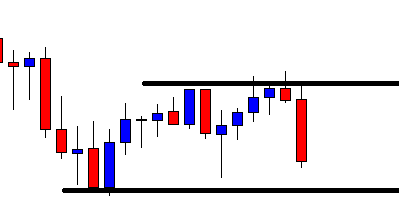

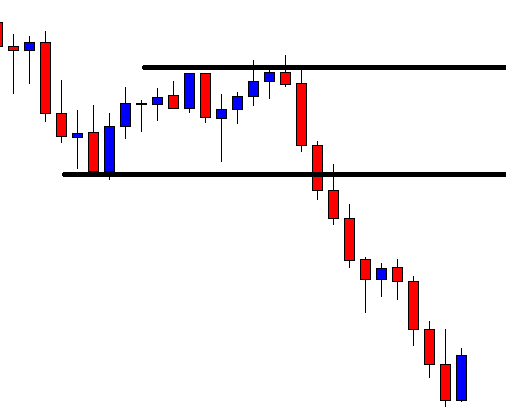

Triple tops:

A Triple top is good trend continuation signal on a bear trend, after a pullback rally.

Appearance: Three distinct highs well separated. The peaks present sharp spikes.

Tops: The price variation between peaks is minor.

Confirmation: Prices must go below the lowest low in the formation.

How to trade: The breakdown risk is too high. Wait for a pullback to trade.

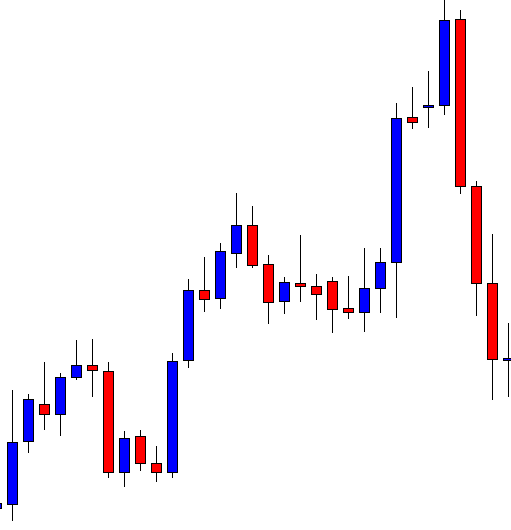

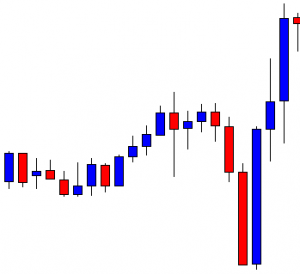

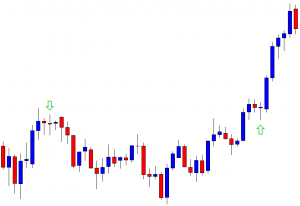

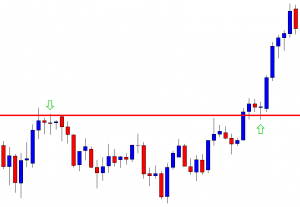

Rounding bottoms

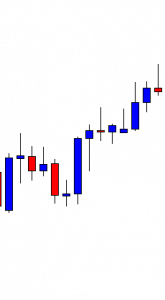

Rounding bottoms and saucers are synonyms. This pattern, that’s supposedly trend reversal is so plagued by “surprise” failures that we hardly may call them “bottoms” at all. More usually, these formations appear during uptrends as a pullback, after which the trend resumes.

Bottom Shape: The bodies on the downtrend candle get smaller, and then a bottom is formed (no fresh lows). Then a breakout happens with a tiny rally that holds the breaking level. Forming higher lows. A potential pattern of higher highs and higher lows emerges.

Confirmation: The second breakout to new highs, confirms the new leg.

How to trade it: Buy the first or the second breakout, after the small pullback. The second one is safer.

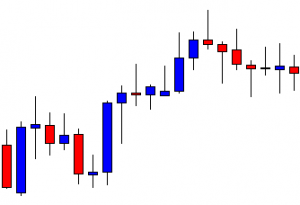

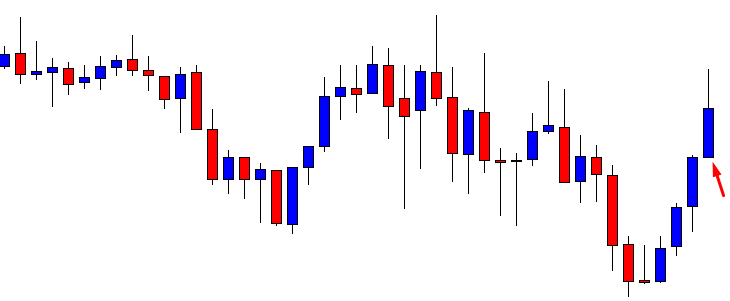

Rounding tops:

Yet another false pattern. Thomas Bulkowski writes about this pattern: “When is a top not a top? When it is a rounding top and prices break out upward 53% of the time. I like to refer to this pattern not as a rounding top, but as a rounding turn (RdT).”

Appearance: After a rally lost its steam, price moves on a pullback that erases most of it. The last local bottom holds. A rally move proceeds up again.

Confirmation: Prices break the resistance of a confirmation line drawn at the high of the rounded formation.

How to trade it: To me, it’s a reactive leg in an uptrend, thus, if a new leg is confirmed by breaking a trend line drawn on the highs of the pullback segment, then a buy order may be entered at a breakout of recent highs. Taking the breakout of the confirmation line is too risky because we still don’t know if it will repeat the previous pullback by forming a sideways channel. Therefore, it’s better to wait for another pullback past the breakout of the confirmation line. See Fig. 13 for clarification.

Continuation patterns

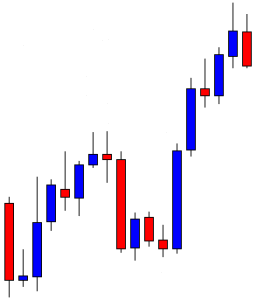

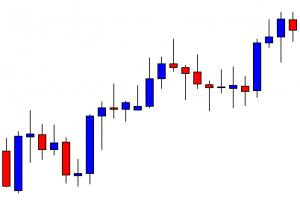

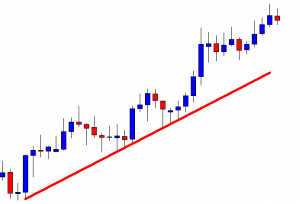

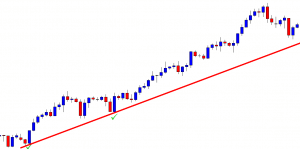

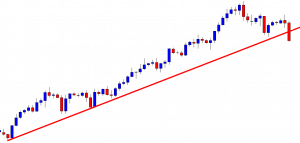

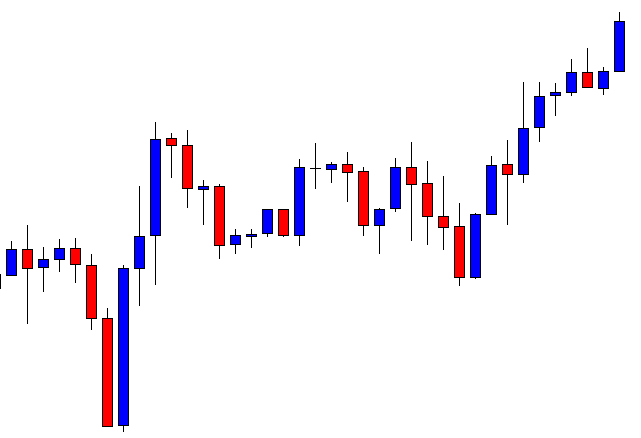

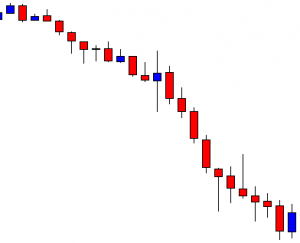

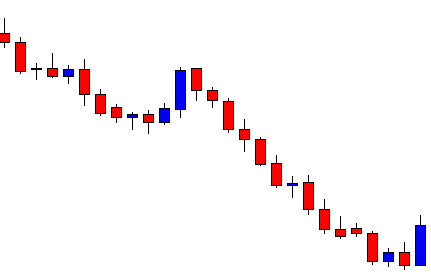

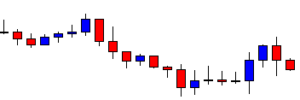

Flags

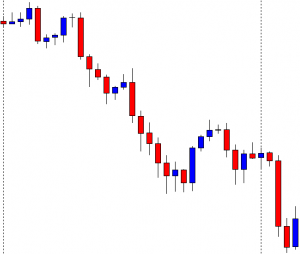

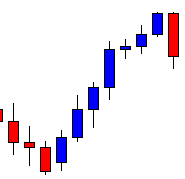

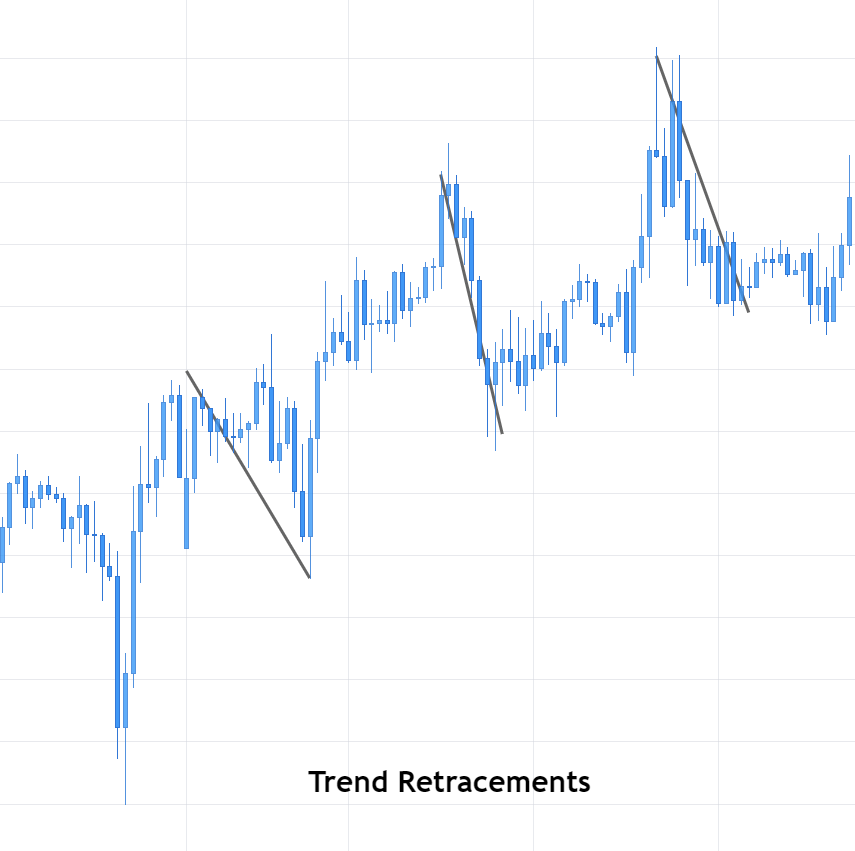

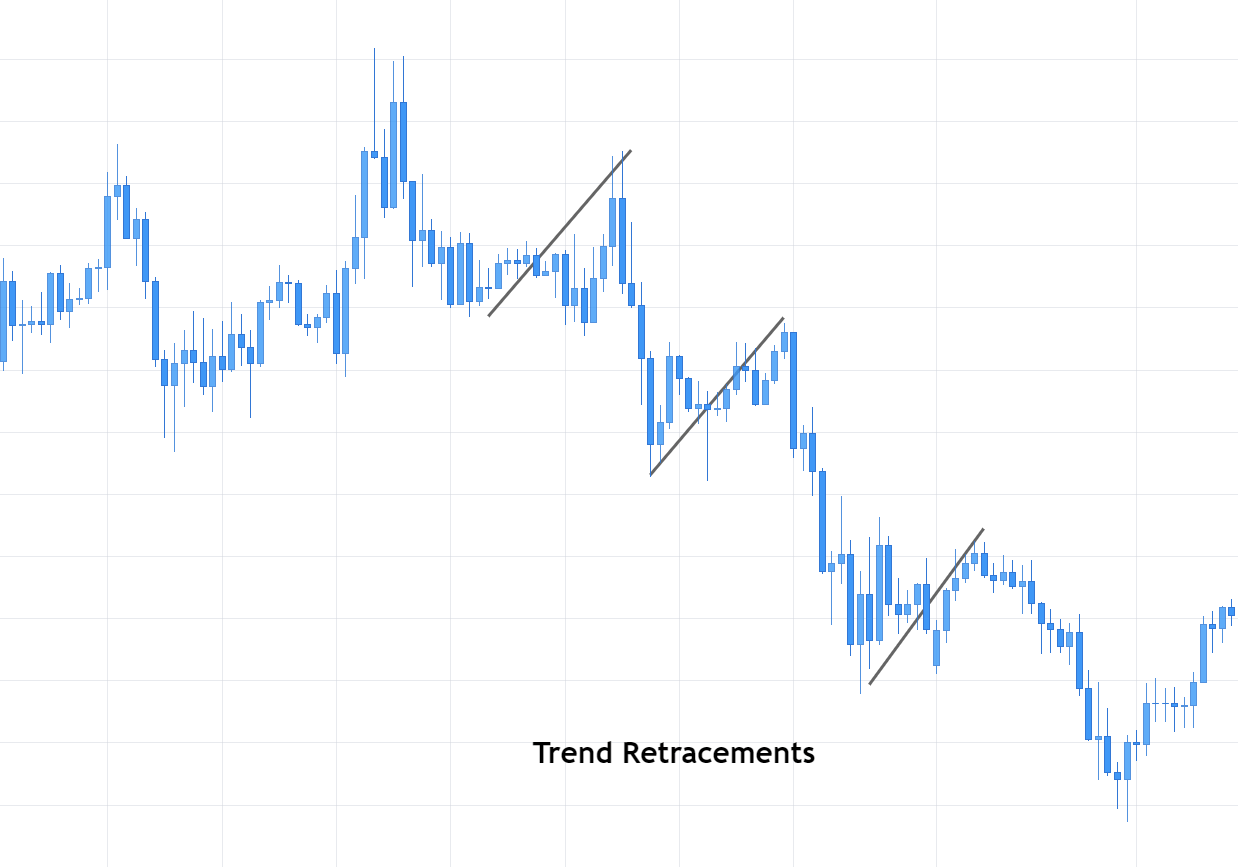

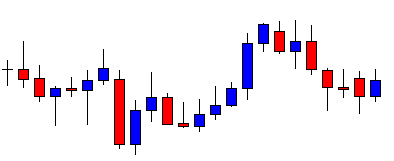

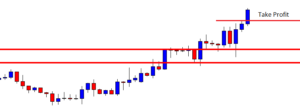

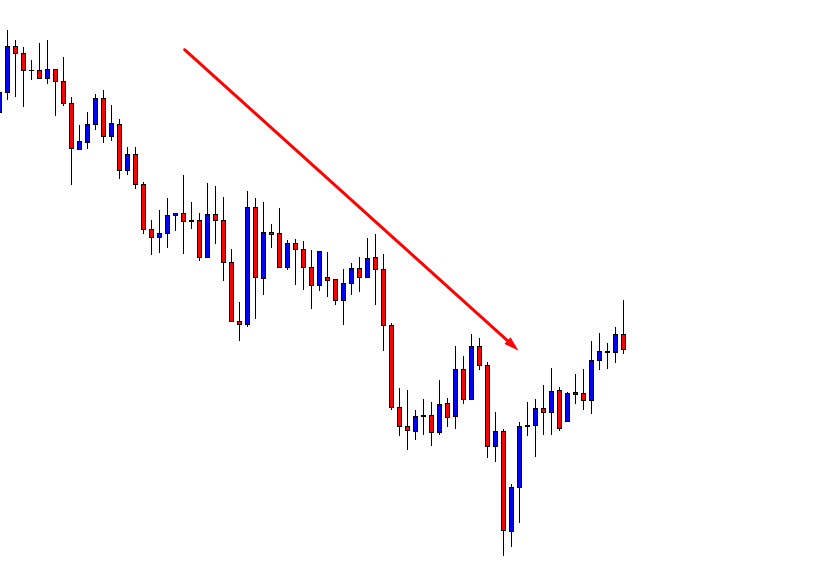

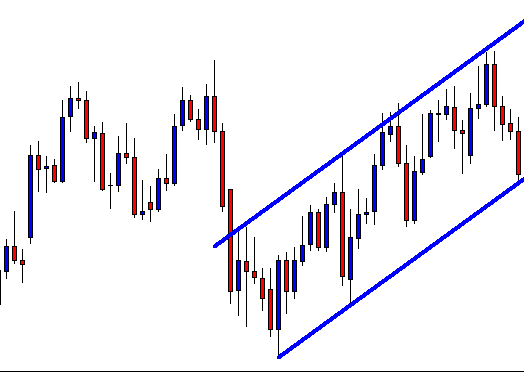

A typical continuation pattern. After an impulsive leg a pause in the opposite direction. It’s usually a nice entry point after an impulsive leg.

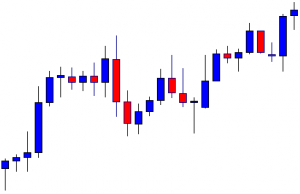

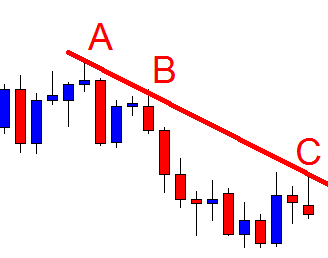

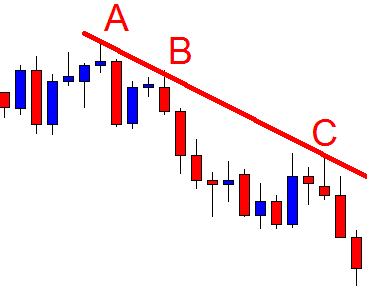

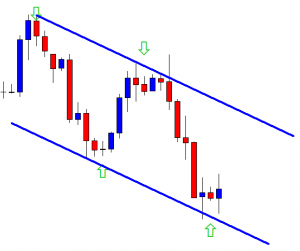

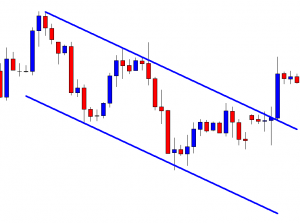

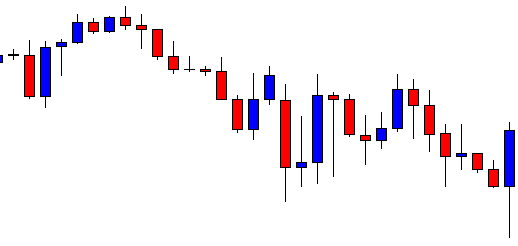

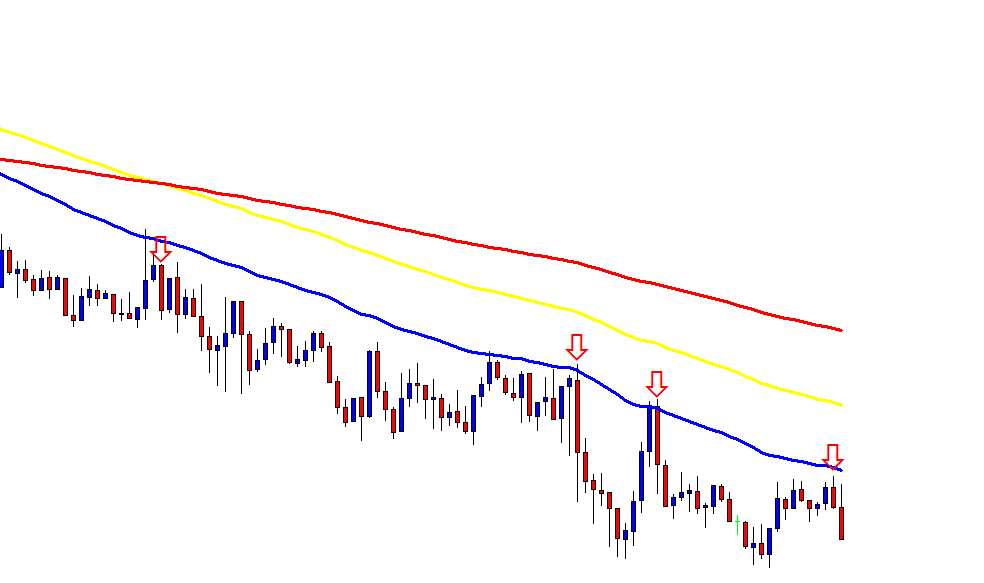

Appearance: Flags are fast oscillating symmetrical patterns with a downward slope in bull trends and upward one in downtrends. A typical corrective leg.

Volume: Volume fades, receding with the trend.

Confirmation: Breakout, during uptrends, or breakdown on downtrends.

How to trade it: Enter the breakout, following the previous trend. Do not enter if it’s in opposite direction to the trend, such as, in fig.14, the 4th ascending flag.

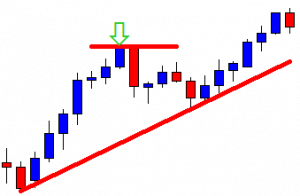

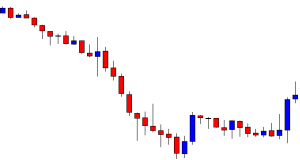

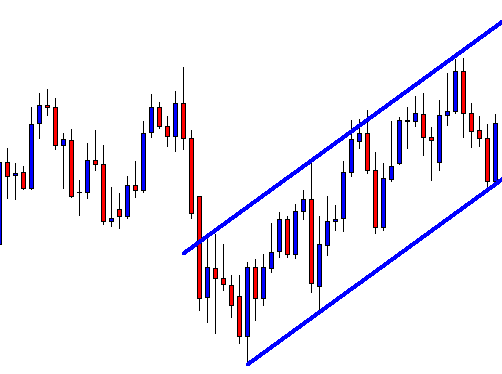

Pennants

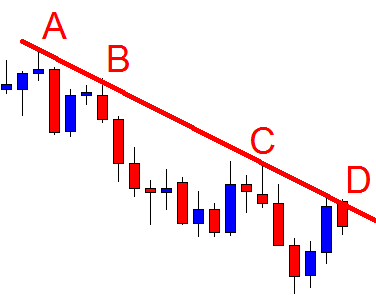

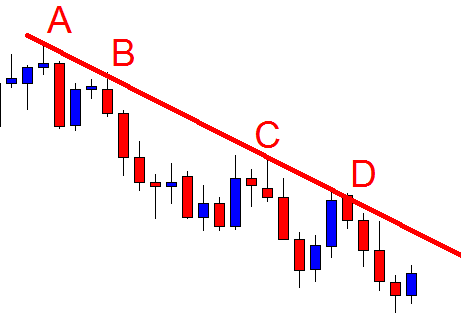

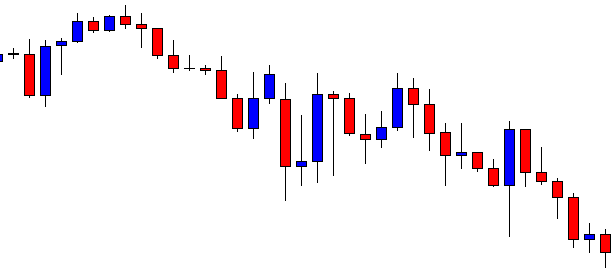

Pennants are a flag variation, but with its trend lines converging.

The fact that the volatility fades on a pennant, makes it an excellent spot for good reward to risk trades.

Appearance: Flags are fast oscillating converging patterns. The slope usually is contrary to the main trend, but it may be horizontal or in the same direction to the main trend.

Volume: Volume fades, receding with the trend.

Confirmation: Breakout, during uptrends, or breakdown on downtrends.

How to trade it: Enter the breakout, following the previous trend.

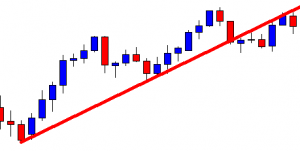

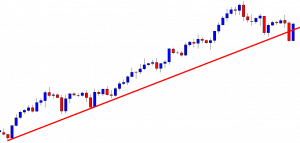

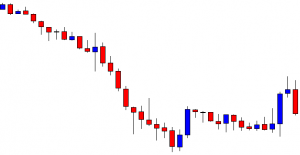

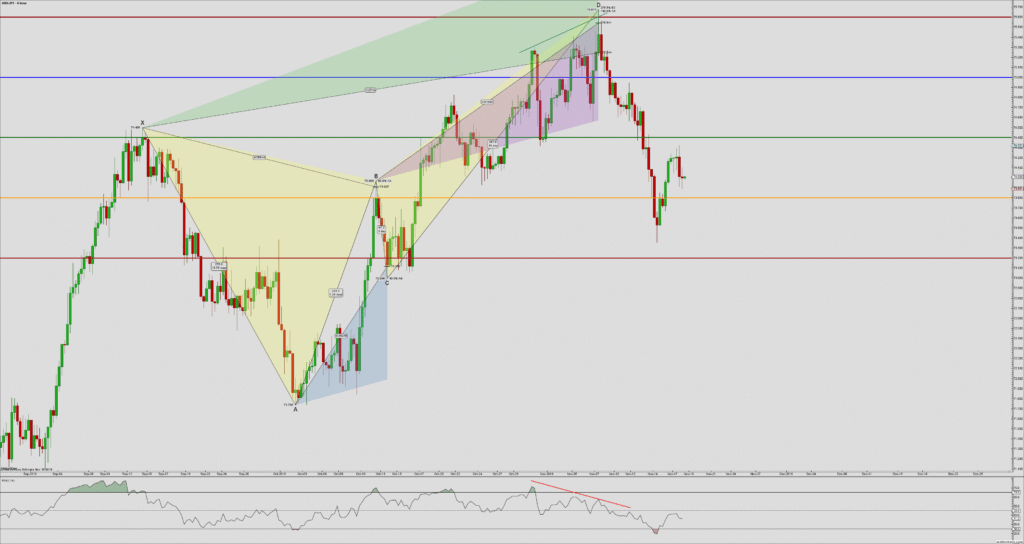

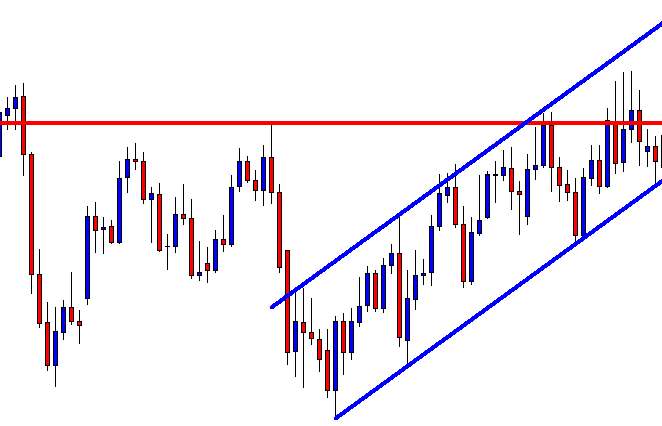

Triangles and Wedges:

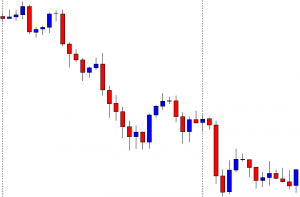

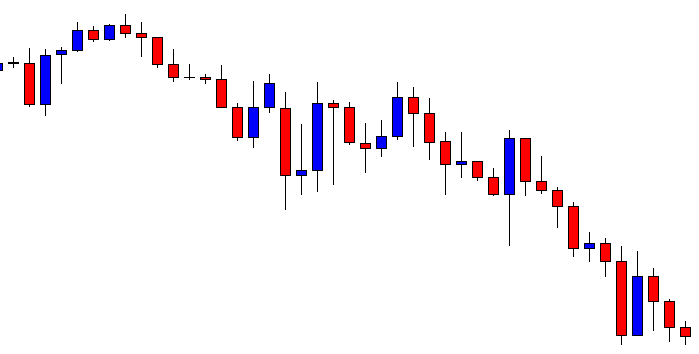

Triangles and Wedges are like flags and pennants. The difference is the undulations are more noticeable and wide, so they take longer to develop. The difference between triangles and Wedges is a bit arbitrary: Triangles have lower highs and higher lows. Wedges may not because their tilt is higher, upward or downward.

They are reactive waves that, usually, end with the burst of another impulsive wave in the same direction as the previous one. Anyhow beware: All reactive waves, including wedges, are fights between bulls and bears, so its ending is uncertain.

There are upward and downward wedges. The fact that it usually breaks out in the opposite direction of its own is its reactive nature that opposes the main trend.

Appearance: Undulations with fading strength. Its upper and lower trend lines converge

Volume: Volume fades, receding with time.

Confirmation: Breakout, during uptrends, or breakdown on downtrends.

How to trade it: Enter the breakout, following the previous trend.

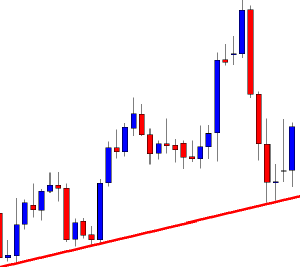

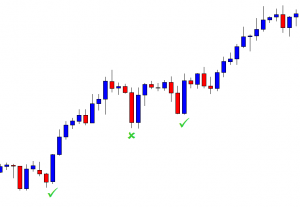

This covers all important chart patterns and formations available.

The main common feature is an ending with a breakout. To trade them we must evaluate carefully the reward-to-risk situation and, if not satisfactory, wait for the end of the first impulse and enter at the end of a continuation pattern – usually a flag or pennant.

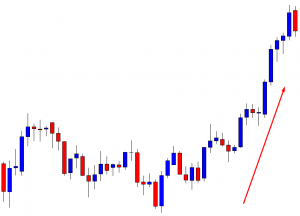

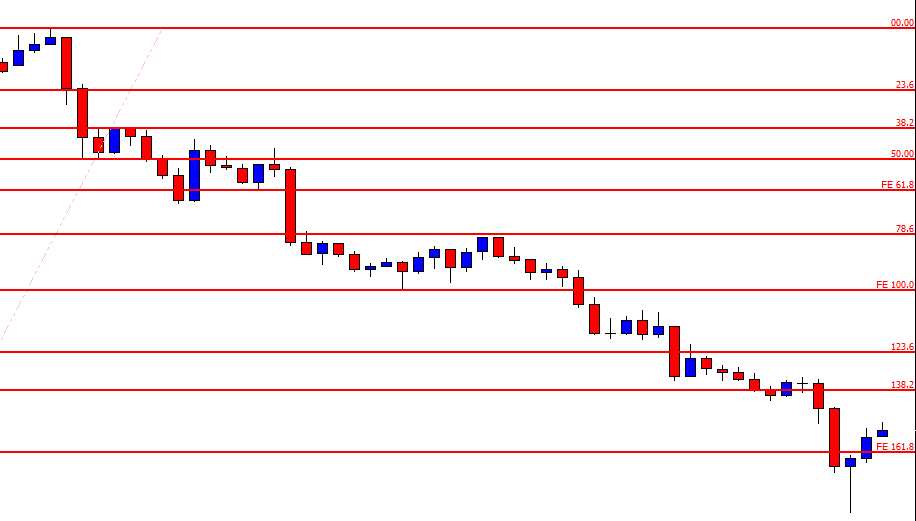

There are plenty of variations of these patterns, and, sometimes, they’re very hard to spot. But if we keep our trendlines touching the local tops or highs on downward legs, and at the local lows during uptrends, we’ll be able to spot trend breakouts, judge where we are, and if it’s a good risk to reward, take appropriate actions. See fig 19.

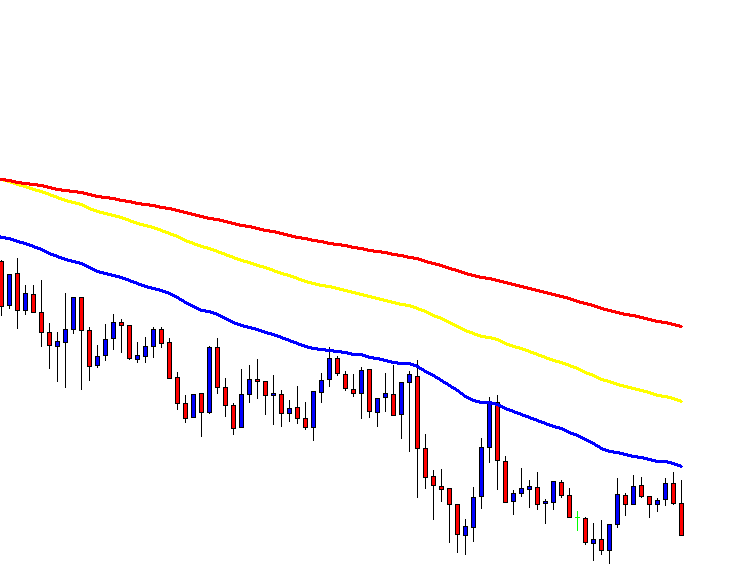

Next chapter, well be dealing with computerized indicators, such as MACD, RSI, Stochastics, Williams %R, On balance Volume, Parabolic SAR a so on.

References:

Encyclopedia of Chart Patterns 2nd edition, Thomas N. Bulkowski

Trading systems and Methods 5th edition, Perry Kaufman

©Forex.Academy

A bullish reversal bar is a bar with its low making a new low but closing higher. A bearish reversal is a bar where there’s a new high but with the closing lower. Those reversals aren’t significant unless in context with highly oversold or overbought situations.

A bullish reversal bar is a bar with its low making a new low but closing higher. A bearish reversal is a bar where there’s a new high but with the closing lower. Those reversals aren’t significant unless in context with highly oversold or overbought situations.