AlphaBeta FX (or, in short, ABFX) was founded in 2009. Their first office was based out of India, but this broker quickly expanded and operated as the first market-making firm to service the greater Asian region. ABFX has a physical presence in 7 different countries, mainly thanks to its technologically enhanced experience, precise execution methods, and advantageous trading conditions.

AlphaBeta FX (or, in short, ABFX) was founded in 2009. Their first office was based out of India, but this broker quickly expanded and operated as the first market-making firm to service the greater Asian region. ABFX has a physical presence in 7 different countries, mainly thanks to its technologically enhanced experience, precise execution methods, and advantageous trading conditions.

In this review, we will cover the parts that matter most to traders, including ABFX’s spreads, leverage levels, resources, bonuses, and much more. What does this broker have to offer? What are the pros and cons of opening an account? Read this article and find out.

Account Types

Traders can choose between 6 account types that ABFX offers. One of the main positive aspects of this is that you can choose the portfolio that best suits your strategy, especially since most of them have a relatively small minimum deposit requirement. Generally speaking, ABFX’s accounts offer a tradeoff between spreads and commissions.

Micro Account:

Minimum Deposit: $5

Spreads: From 1.9 pips

Commission: $0

Standard Account:

Minimum Deposit: $100

Spreads: From 1.4 pips

Commission: $0

Zero Spread Account:

Minimum Deposit: $1,000

Spreads: From 0 pips

Commission: $10 per lot

Alpha ECN Account:

Minimum Deposit: $1,000

Spreads: From 0.5 pips

Commission: $5 per lot

Alpha Pro Account:

Minimum Deposit: $15,000

Spreads: From 0.1 pips

Commission: $5 per lot

Alpha Custom Account:

Minimum Deposit: $1,000

Spreads: From 0 pips

Commission: NA

As we can see above, the accounts that have no spread charge or commissions. Alpha Zero Spread, from its name, has a 0-pip difference between the bid and ask prices. However, traders do incur a $10 commission on each lot that they trade. Alpha ECN and Alpha Pro have very tight spreads at 0.5 pips and 0.1 pips, respectively. The $5 per lot commission for both of them is lower than the Zero Spread Account. Micro and Standard account holders do have a relatively wider spread (although it is still much lower than what other brokers offer), but you pay no commission fees.

In essence, if you are a new trader or have a small amount of capital, the Micro and Standard might be the most suitable options. Although they have a wider spread than the rest, the associated costs are minimized when you open smaller positions. In addition, not paying commissions gives you time to test your strategy and enter/exit trades without incurring too many fees.

If you are a more experienced trader or want to invest a large amount of capital, the Zero Spread, ECN, or Pro Account might suit you best. First, your profits will not be diminished due to tight or nonexistent spreads. This is especially useful for those who rely on scalping strategies. Second, you have the option of choosing between a 0 spread and a higher commission or a minimal spread and discounted trading fees per lot. In other words, you enjoy flexibility in terms of the account’s features and how it fits in with your trading style.

Platforms

All 6 account types enable you to trade through either MetaTrader 5 (MT5) or cTrader. The platforms are available on both desktop and smartphone devices (Android and iOS alike). You can download them directly from ABFX’s website. MT5 is one of the most sophisticated and advanced platforms on the market. You can easily manage your account, access a large number of technical indicators, and create your own trading algorithm so that positions are opened/closed automatically when an instrument meets your desired conditions.

Other key features of MT5 include viewing up to 100 different charts on 1 screen, getting support in different languages, and customizing trade alerts or notifications. CTrader, on the other hand, is especially suitable for those who rely on scalping strategies and intra-day activity. Mainly, this is thanks to the platform’s speedy order execution process, which usually happens within milliseconds. Just as importantly, cTrader’s custom support services are available in 16 different languages. The platform can be downloaded on desktop and smartphone devices.

Leverage

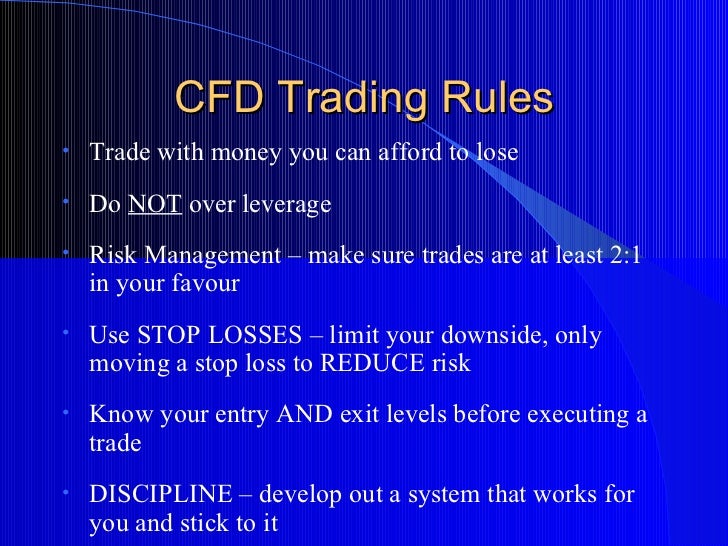

As is the case with many other brokers, ABFX’s maximum leverage goes down as you deposit more funds into the account. Micro and Standard have up to 1:1000 and 1:500 in leverage, respectively. This number is incredibly large and it is rare to find brokers that provide you with a leverage of 1:500, let alone 1:1000. For the other account types, Zero Spread has 1:300 in leverage, ECN gets up to 1:200, while Alpha Pro traders have a maximum of 1:100. Alpha Custom, which has the same $1,000 required minimum deposit as Zero Spread, also provides you with up to 1:300 in leverage.

On face value, some traders might not appreciate seeing their permissible leverage go down as they deposit more funds. However, ABFX structured their buying power levels this way in order to minimize risk. To clarify, this allows traders to realize meaningful profits (even if they have a small account) without having to worry about losing all of their deposited funds in case things go against them. Otherwise, account holders could rapidly lose a lot of money when they use a lot of leverage and the markets swing downwards (or upwards if they are short-selling).

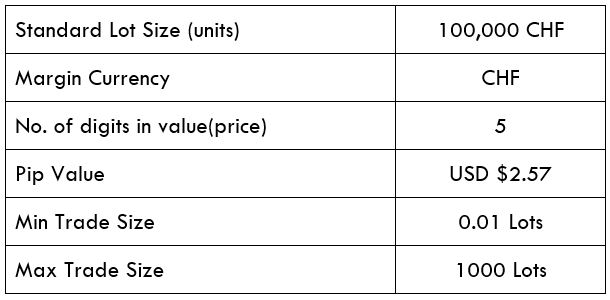

Trade Sizes

The minimum trade size, across the board, is 0.01 lots (1,000 in the base currency). The only exception is the Alpha Zero Spread Account, which has a minimum trade size of 0.1 lots (10,000 in the base currency).

-Margin Call: 20% (Alpha Pro) and 40% (all other accounts).

-Stop-Out: NA

While ABFX doesn’t have a specific stop-out point, their margin call policy encompasses that aspect. Firstly, when your balance goes below the margin call level (which depends on your account type), this broker will not allow you to open any new positions. They will also ask you to deposit additional funds and/or close losing trades in order to bring your balance above the required margin percentage. If a trader fails to do so or their position quickly loses more funds, ABFX will automatically liquidate all their current trades.

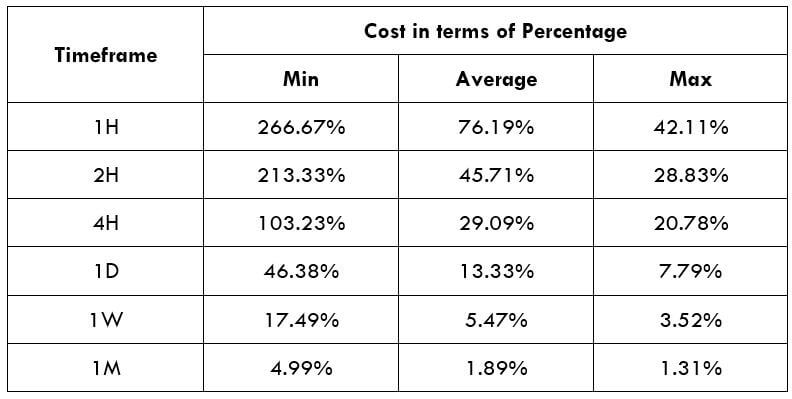

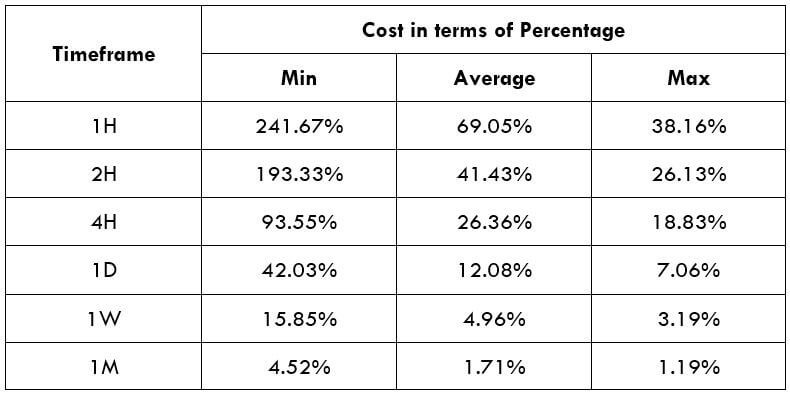

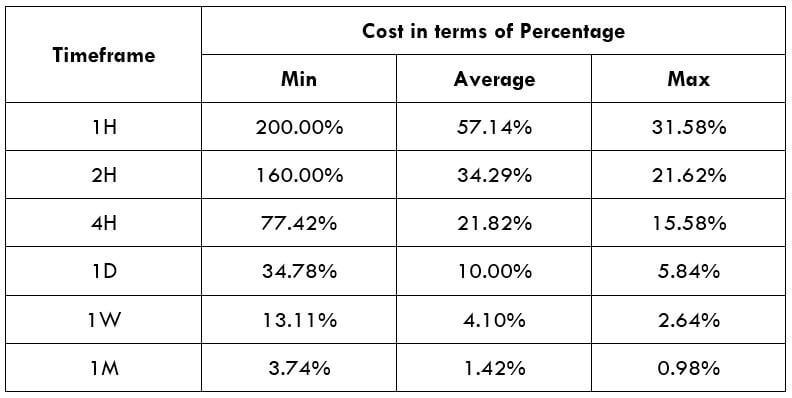

Trading Costs

ABFX offers very competitive and notably low trading costs. First, none of the accounts incur a swap fee on overnight positions. Almost all other brokers will charge you for doing this. Meanwhile, ABFX’s commissions are only paid by ECN ($5 per lot), Pro ($5 per lot), and Zero Spread ($10 per lot). The rest enjoy $0 commissions. Having said that, Micro and Standard are charged spread fees. Zero Spread doesn’t incur this cost. Similarly, the bid/ask price variations are minimal for Pro and ECN.

Assets

This broker’s account holders have access to almost 55 different forex pairs. Furthermore, ABFX allows you to trade cryptocurrencies, namely Bitcoin, Bitcoin Cash, Dash, Ethereum, and Litecoin. Digital currencies have up to 5:1 in leverage. Other than that, this broker offers commodities, indexes, and metals, which are exchanged as CFD contracts.

This broker’s account holders have access to almost 55 different forex pairs. Furthermore, ABFX allows you to trade cryptocurrencies, namely Bitcoin, Bitcoin Cash, Dash, Ethereum, and Litecoin. Digital currencies have up to 5:1 in leverage. Other than that, this broker offers commodities, indexes, and metals, which are exchanged as CFD contracts.

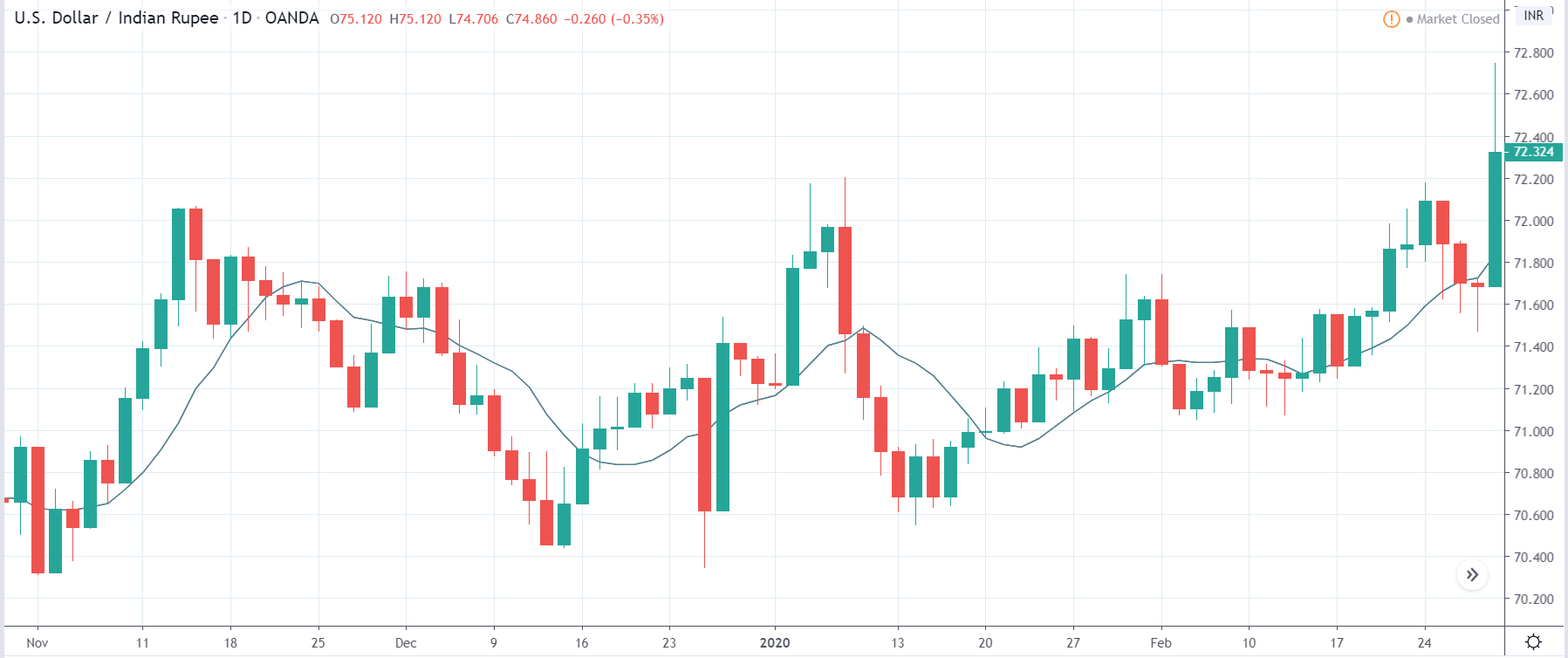

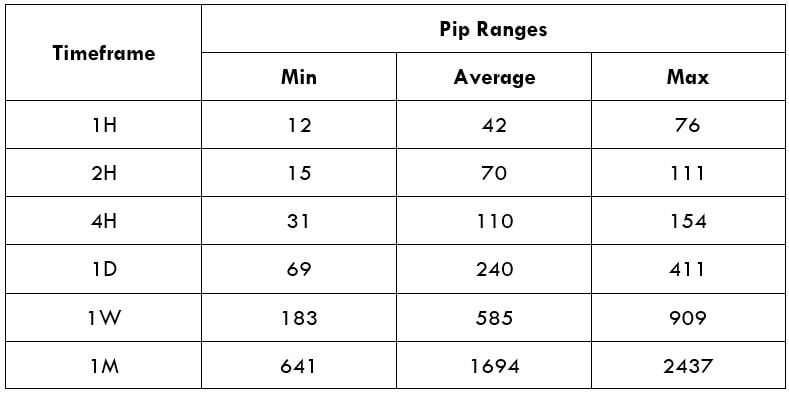

Spreads

Zero Spread account holders have a $0 difference between the bid and ask prices. The Pro Account’s spread is only 0.1 pips, while ECN’s is 0.5 pips. Micro and Standard have them at 1.9 and 1.4 pips, respectively. These numbers are low when compared to the general brokerage market. However, since AFBX offers floating spreads, they are subject to change from one situation to another. More specifically, the gap between the bid an ask prices could become undesirably large when markets are volatile in a certain country or on a global level.

Minimum Deposit

The minimum funding requirement is only $5 and $100 for the Micro and Standard Account, respectively. It is $1,000 for each of the Zero Spread, Alpha ECN, and Alpha Custom types. To open an Alpha Pro Account, however, traders need a minimum of $15,000.

Deposit Methods & Costs

Another incredibly advantageous feature that ABFX has is that they don’t charge any transfer fees on any of their various deposit and withdrawal methods, alike. Across the board, the minimum amount that you can transfer per transaction is only $5. This broker accepts several credit/debit cards, including Visa, MasterCard, and China Union Pay. The maximum amount that you can transfer in a single transaction is $50,000 (MasterCard and China Union Pay) or $10,000 (Visa). Account-holders may also apply for a broker-issued Alpha MasterCard and use it to make withdrawals/deposits.

Another option is to fund your account via a bank wire transfer. Both the Alpha MasterCard and bank wires have a maximum deposit amount of $50,000 per transaction. When it comes to electronic payment methods, ABFX works with Neteller, Skrill, and WebMoney. The broker’s website doesn’t specify how long it takes for deposits to go through, apart from bank wire transfers (which are processed within 2 to 4 business days). Nevertheless, deposits via Fasa Pay, Money Polo, OK Pay, Perfect Money, and Solid Trust Pay are instant. All deposits/withdrawals can be made in the US Dollar, Australian Dollar, British Pound, Euro, Japanese Yen, and Swiss Franc.

Withdrawal Methods & Costs

All of the methods above can be used to withdraw money from your ABFX account. Outbound transfers are also free.

Withdrawal Processing & Wait Time

The same processing times apply to withdrawals, as well. That is to say: Bank wires take 2 to 4 business days and electronic wallet transfers (apart from Neteller, Skrill, and WebMoney) are instantly processed. ABFX’s website doesn’t mention how long it takes for MasterCard, Visa, China Union Pay, Neteller, Skrill, and Web Money withdrawals to go through.

Bonuses & Promotions

ABFX is running several promotional offers. First is their cash-back promotion, which is available for 6 months after you open an account. For every trade you make, ABFX will reward you with cash. In a way, they are paying you the commissions, which is great. How much you get will depend on your deposit and where it falls under 1 of 5 levels.

Level 1:

Account Balance: $1 to $15,000

Rebate Cash-Cack: $2 per closed lot

Level 2:

Account Balance: $15,001 to $30,000

Rebate Cash Back: $3 per closed lot

Level 3:

Account Balance: $30,001 to $60,000

Rebate Cash Back: $4 per closed lot

Level 4:

Account Balance: $60,001 to $120,000

Rebate Cash Back: $5 per closed lot

Level 5:

Account Balance: $120,001+

Rebate Cash Back: $5 per closed lot

The broker will deposit these rebate amounts each Monday into your account. However, the maximum payouts per transaction are $500, $1,500, $3,000, $5,000, and $10,000 for Level 1, 2, 3, 4, and 5, respectively. Equally as important, there is another cash back bonus offered by ABFX. If you refer another trader and they open an account, you would receive a 10% bonus of whatever your referral’s initial deposit is. For example, if they deposit $2,000, you get $200. However, the minimum deposit that your friend or family member has to make is $1,000. Otherwise, you aren’t eligible for this bonus.

ABFX also offers a rewards program, where you earn a certain number of points every time you make a trade, deposit money, have a referral open an account, and engage in other activities. The more points that you get, the more rewards and features that you can access, such as gift cards, participation in weekly contests, and support from a personal account manager. Lastly, ABFX sends its clients free branded merchandise, including shirts, coffee mugs, calendars, and more.

Educational & Trading Tools

This broker’s educational and practical services fall under 3 categories: Education, events, and automated trading. First, the educational videos walk you through every detail related to the forex market. In fact, they are expansive enough to even benefit experienced traders who want to enhance their strategy and incorporate new methods. The initial videos cover the process of creating a trading plan, managing risk, controlling psychological impulses, and other basics. After that, each video is specifically dedicated to a certain technical indicator or chart pattern. ABFX’s other educational content includes brief written lessons (broken up into 4 chapters) and a glossary that defines common forex concepts.

The automated trading service is mostly for account holders who prefer to code their own robot, which would buy/sell currency pairs if the price and volume levels meet certain algorithmic conditions. The offerings include an MQL programming system (to create the said algorithms) and enhanced software that supports it. When it comes to events, ABFX hosts webinars and seminars. Lastly, this broker provides account holders with a blog about the forex markets, an economic calendar, three calculators (Fibo, Pivot Point, and Risk Percentage Calculator).

Customer Service

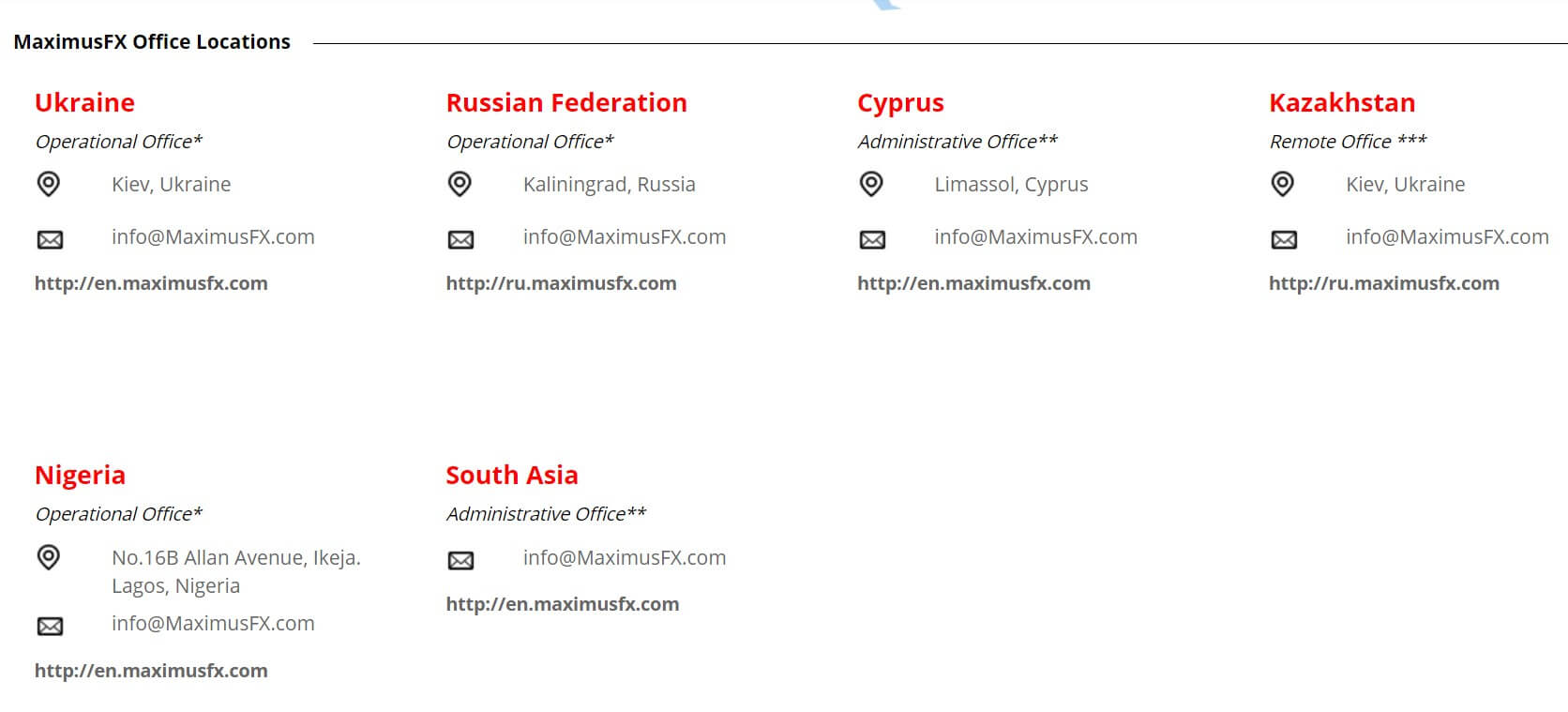

Remarkably enough, this broker serves account holders out of 7 different office locations. Each of them has its own phone number, email, and physical address. ABFX is present in Bangalore (India), Beachmont (St. Vincent and Grenadines), Dubai, London, Hong Kong, Kuala Lumpur (Malaysia), and Vake (Georgia).

Phone: +44-2036958896 (London), +971-43306363 (Dubai), +852-58085566 (Hong Kong)

Email: [email protected] (London), [email protected] (Dubai), [email protected] (Hong Kong)

This broker’s customer support staff speak multiple languages and local offices can communicate with traders in the home country or region’s language. You may also get in touch with them via Skype, although this feature is only available through firms in certain cities. For the full list of ABFX’s contact information, traders can look at the broker’s website to find their local office’s email, phone number, Skype, and physical address.

Demo Account

A demo portfolio is perfect for traders who want to practice trading with paper funds before putting their real money on the line. The same applies to account holders who are transitioning from one trading platform to another since each one has its own order types and methods of calculating the returns on investment. Demo accounts that you open through the platforms that ABFX works with (MT5, for instance) are exposed to live market prices and real-time trading conditions, which enhances their practical value.

Countries Accepted

ABFX’s is a formally registered ‘International Broker Company’ in St. Vincent & the Grenadines. While their organizational structure allows them to serve traders from all around the world, those who are located in the United States and Japan cannot open an account with ABFX. This is mainly due to local restrictions and regulations that are related to CFDs and other financial assets.

Conclusion

To summarize this broker’s offerings and services, here are the key advantages that ABFX’s account holders enjoy: Flexible deposit requirements, tight spreads, little to no commissions (with a few exceptions), various transfer methods, local support, and an expanded array of trading tools. On the downside, nonetheless, ABFX doesn’t serve traders in the United States or Japan. The broker also lowers your leverage when you deposit additional funds and some of their withdrawal/deposit methods don’t have a defined processing time. Having said all that, every brokerage firm has its own pros and cons. What makes ABFX unique is that its flexible offerings allow traders to pick the option that aligns with their preferences the most.

For example, two people had $1,000 each and one of them is a frequent intraday trader while the other relies on leverage and scalping strategies. The frequent trader would want to minimize their commissions. They can do so by opening a Micro or Standard Account (if they are okay with a spread that starts at 1.4 pips) or an ECN type (if they can afford a low commission in exchange for a much tighter spread of 0.5 pips). The scalper, on the other hand, would open a Zero Spread Account, especially because the bid/ask price difference would impact their returns, even more so than the $10 commission. Above all else, both of these traders may get started with ABFX and open the account type that they prefer for the same $1,000 deposit or less. The only exception is the Alpha Pro portfolio and its $15,000 minimum funding requirement.

Which account type suits your strategy and trading methods best? Do you prefer the nonexistent commissions or a low spread? How much money can you deposit? The best part about ABFX is that they will most likely provide you with what you need, regardless of how you answered any of these 3 questions. In short, this broker is truly inclusive and trader-oriented.

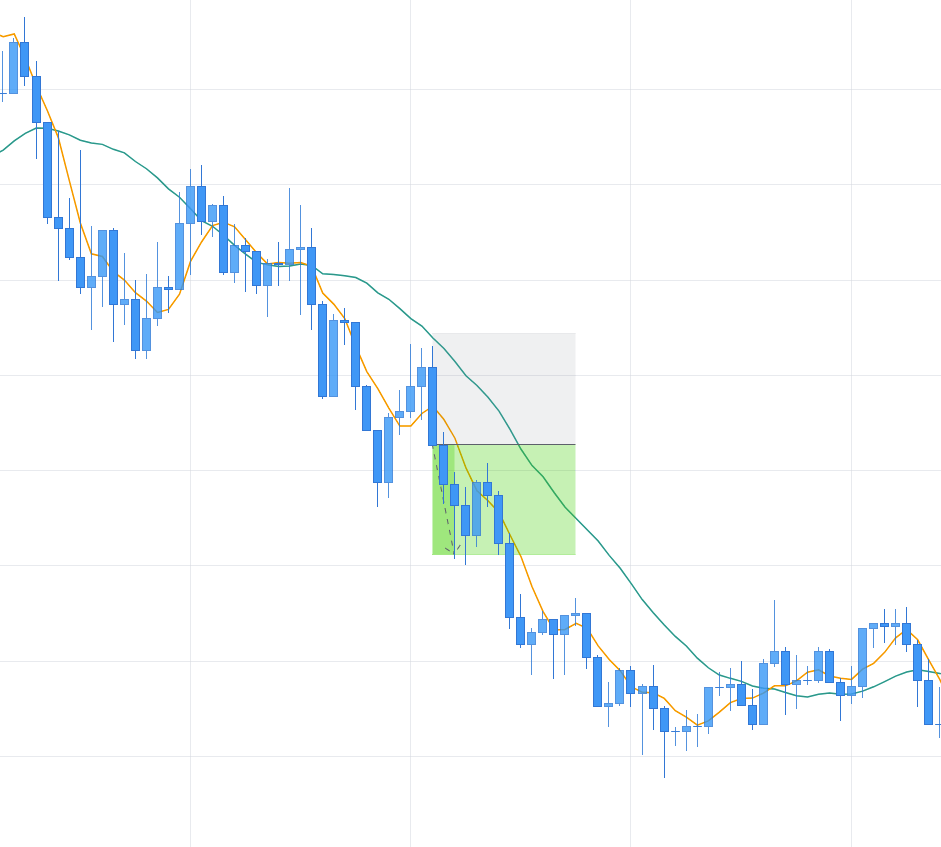

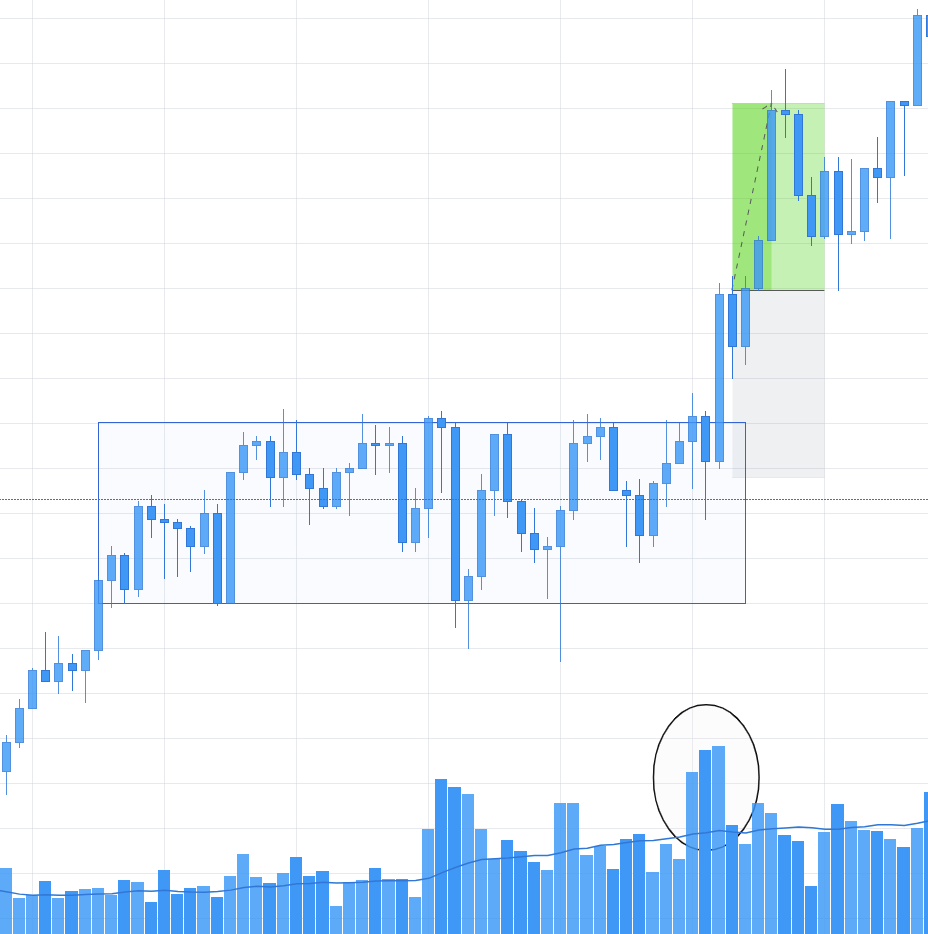

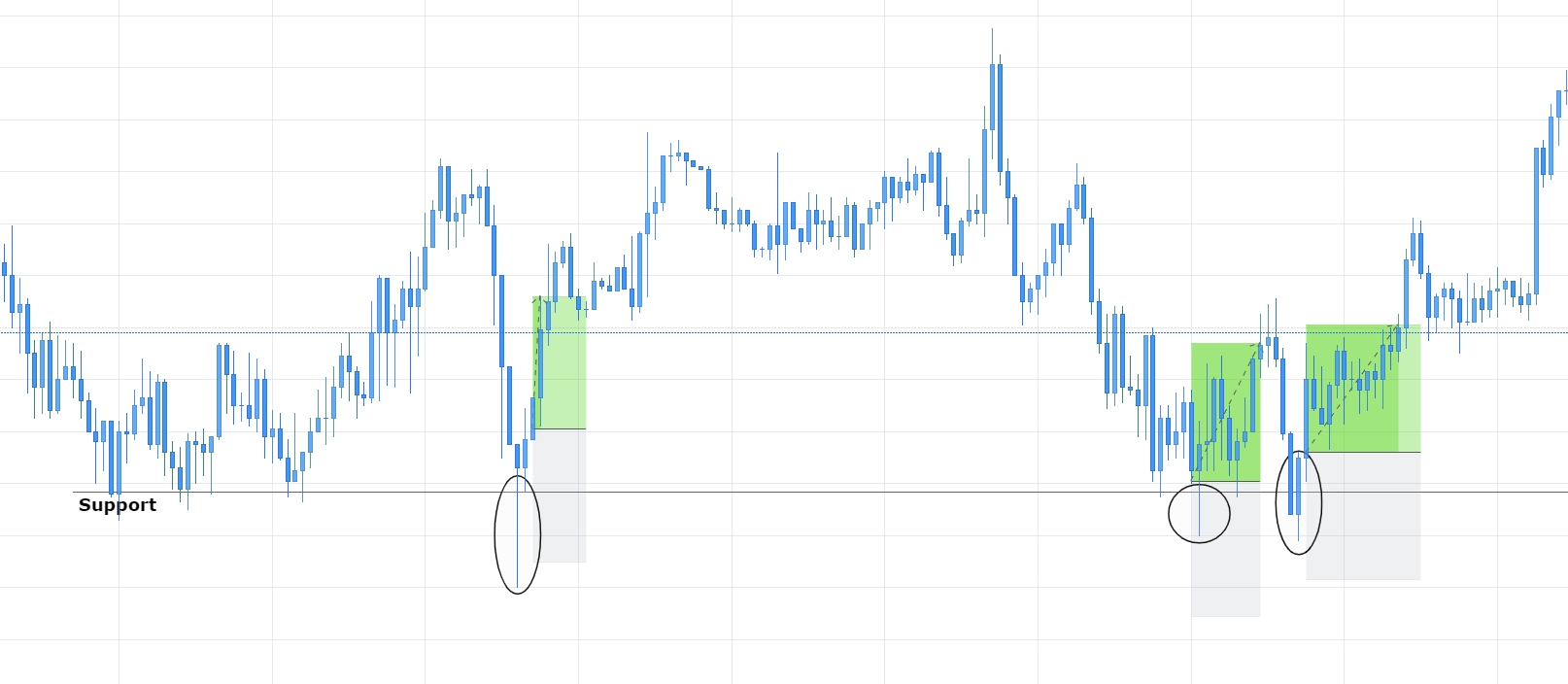

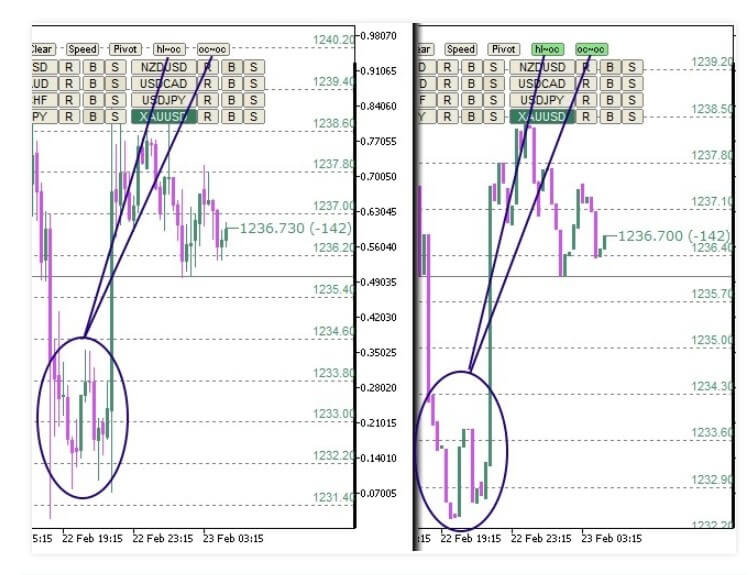

There is no guesswork with indicators and you can customize settings. Adjust it in the way you like it and make it better than it already is. This cannot be done with Support and Resistance line, right? The best option is that you can combine indicators, and by this, make better results. Everything is going around choosing the right indicators and combining them together to make the system more accurate. One stand-alone indicator will not get anyone anywhere, what is recommendable to do, is to create algorithms – the system of rules to point out to the same signal at the time, which can be used and traded upon.

There is no guesswork with indicators and you can customize settings. Adjust it in the way you like it and make it better than it already is. This cannot be done with Support and Resistance line, right? The best option is that you can combine indicators, and by this, make better results. Everything is going around choosing the right indicators and combining them together to make the system more accurate. One stand-alone indicator will not get anyone anywhere, what is recommendable to do, is to create algorithms – the system of rules to point out to the same signal at the time, which can be used and traded upon.

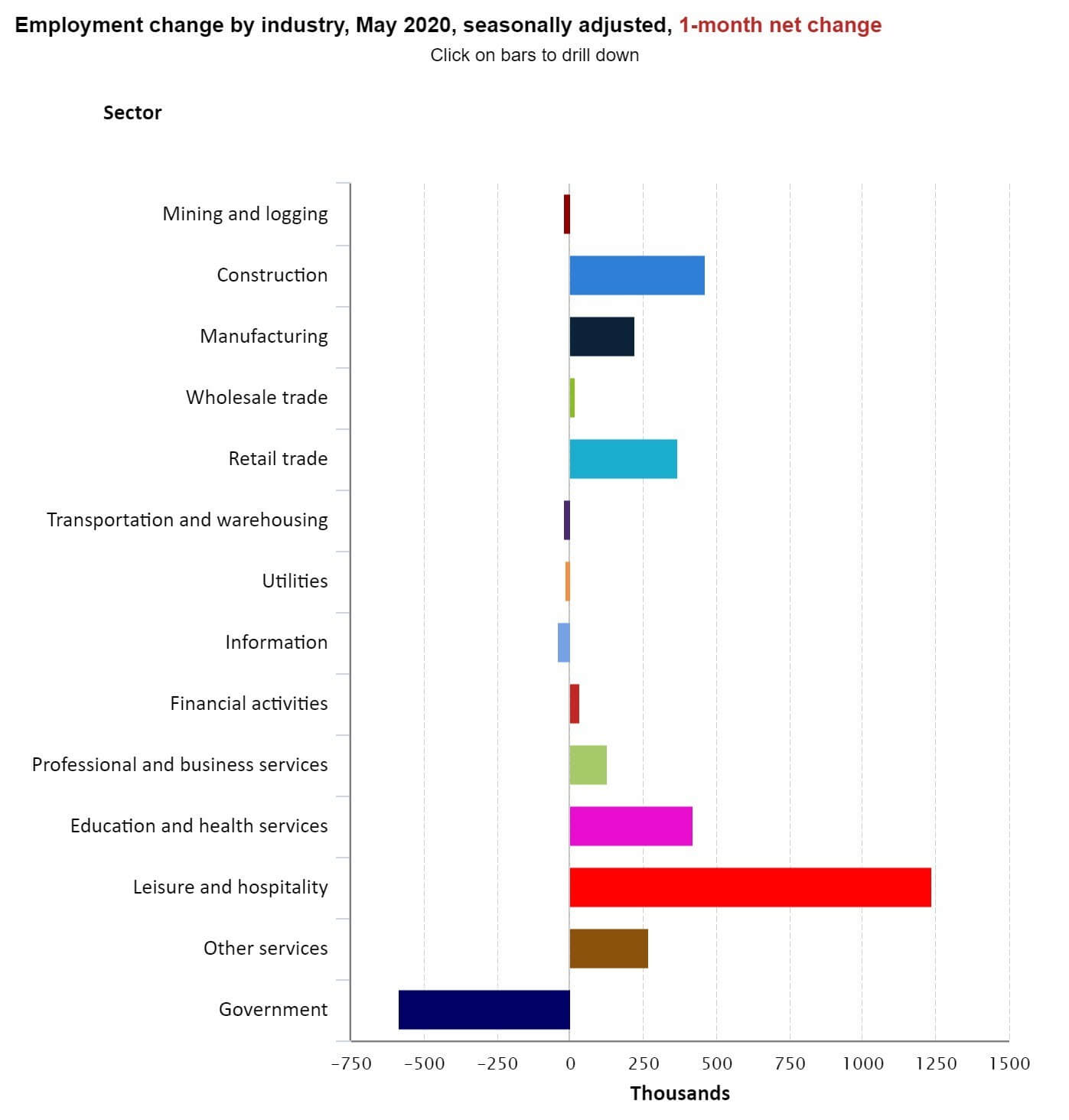

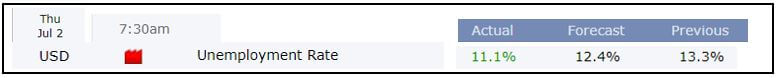

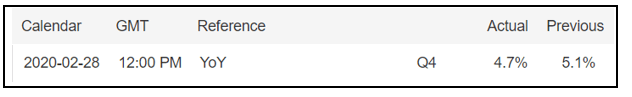

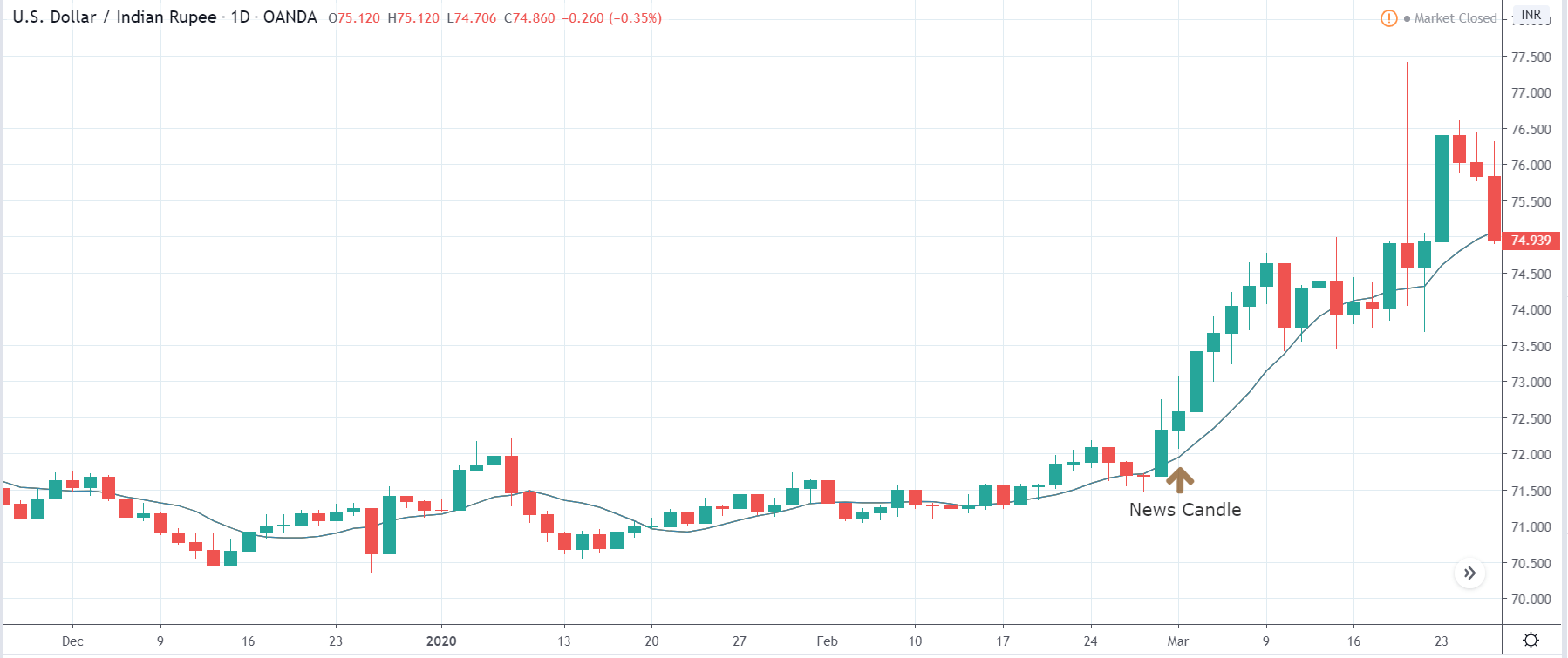

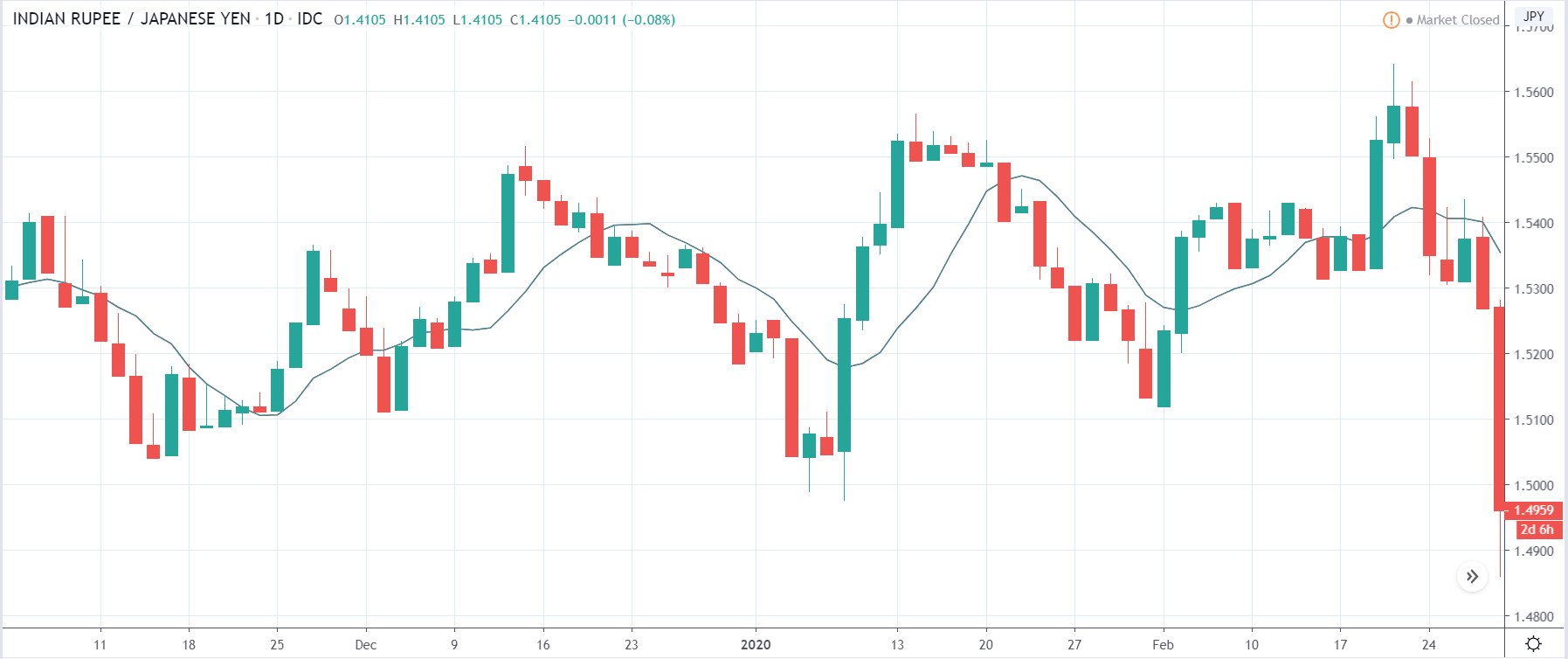

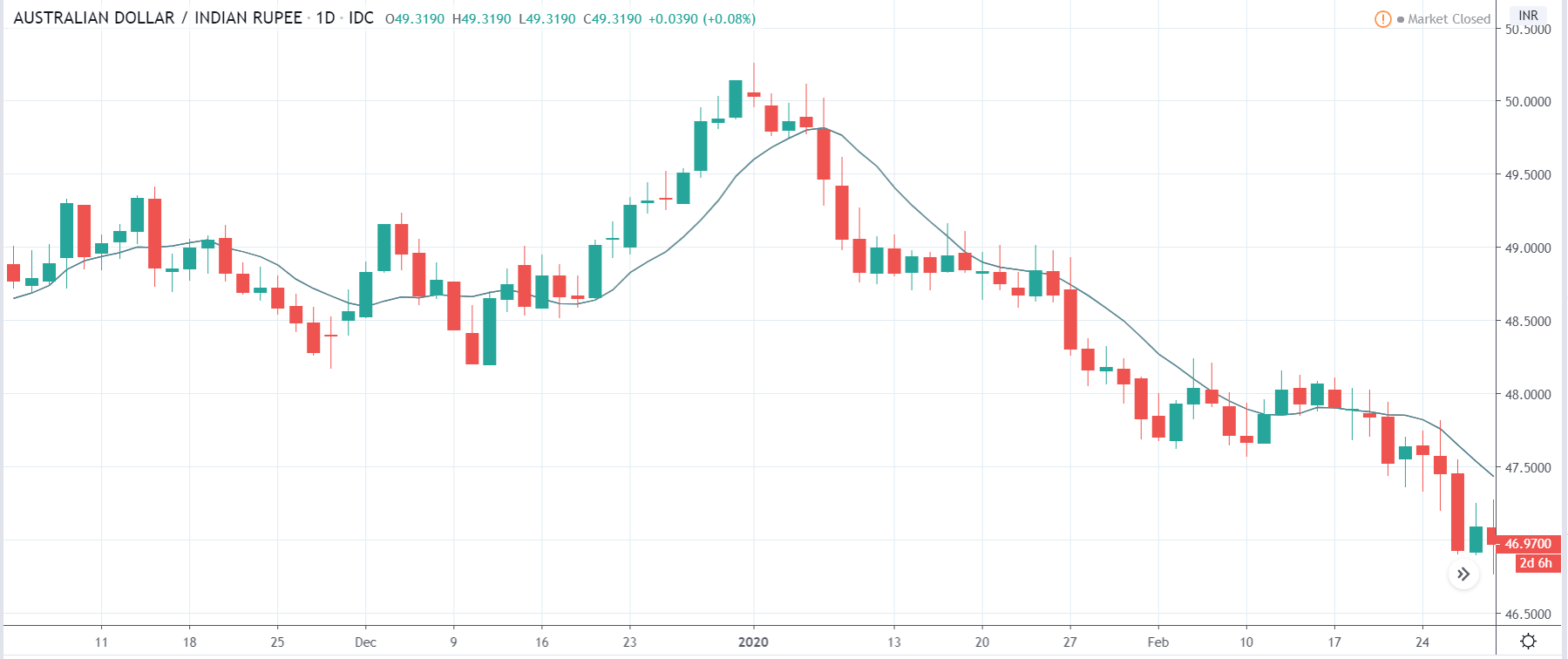

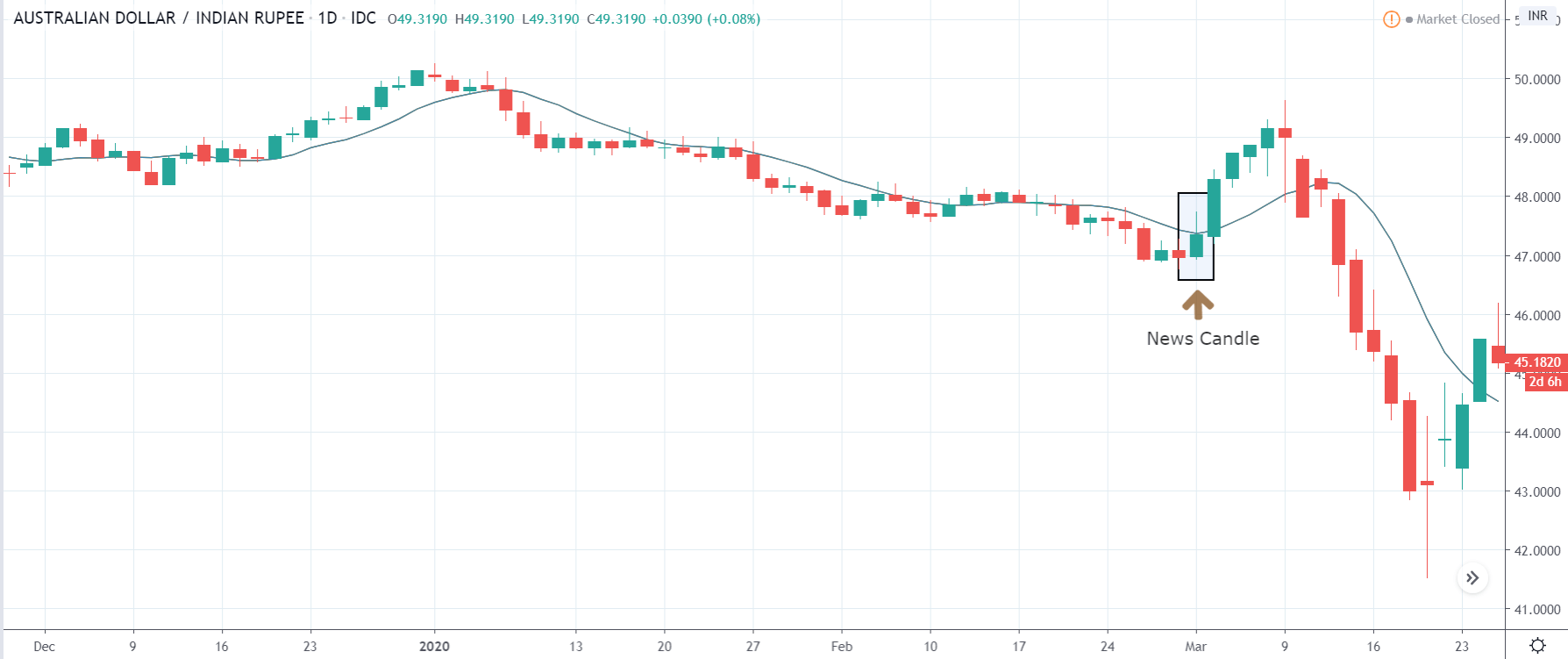

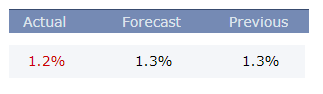

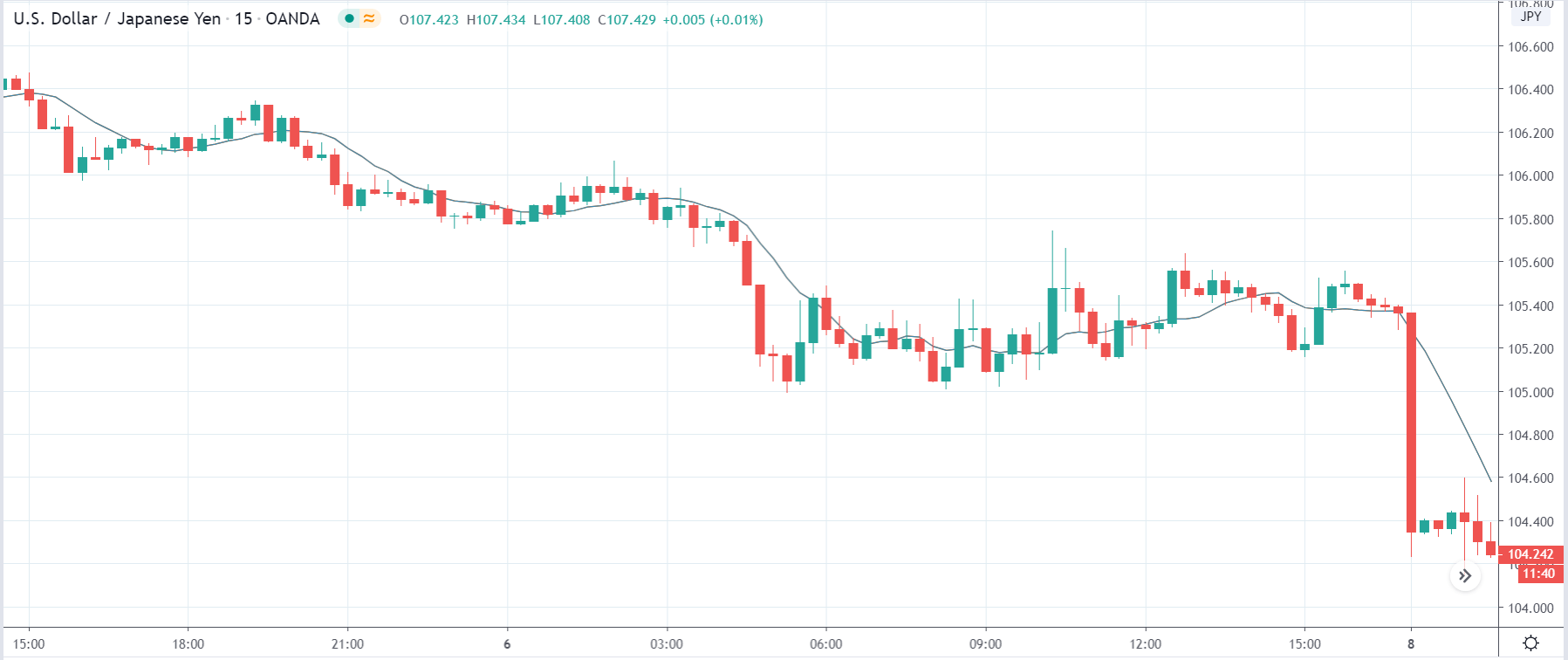

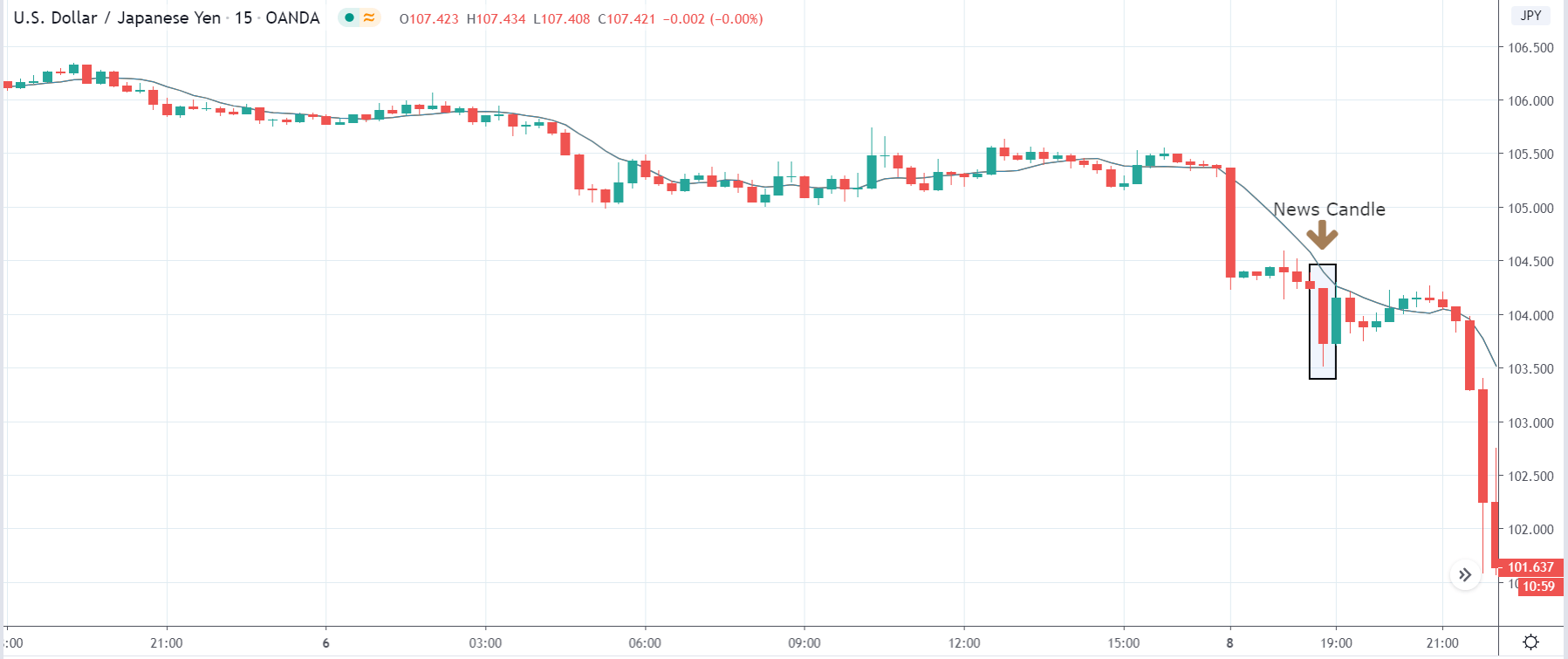

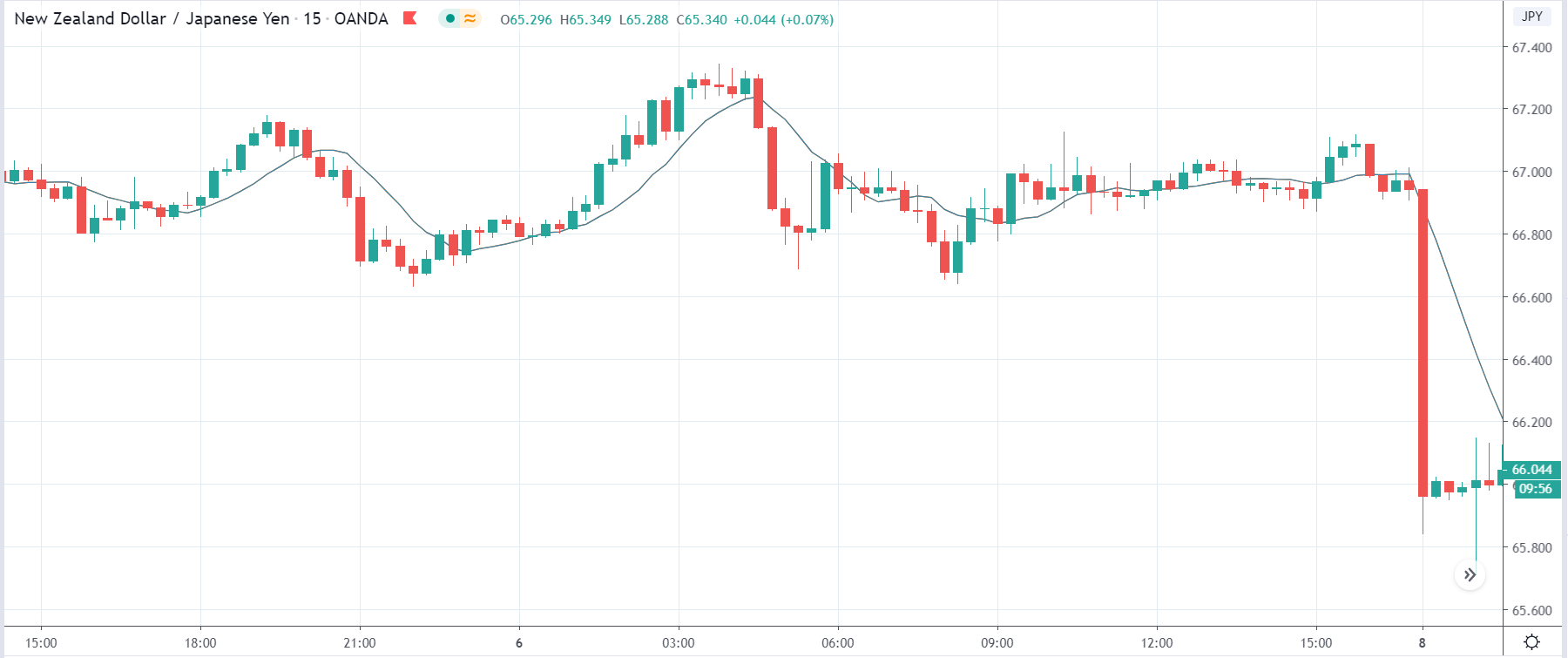

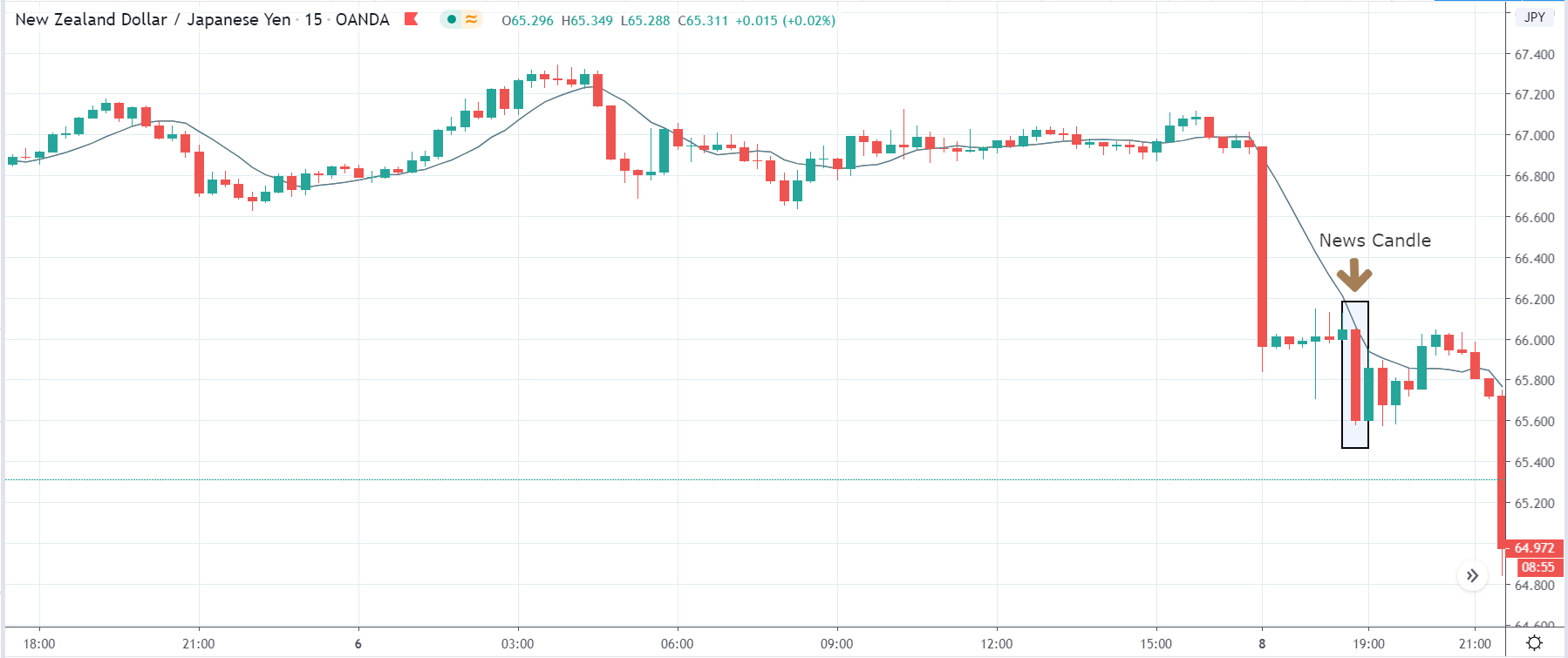

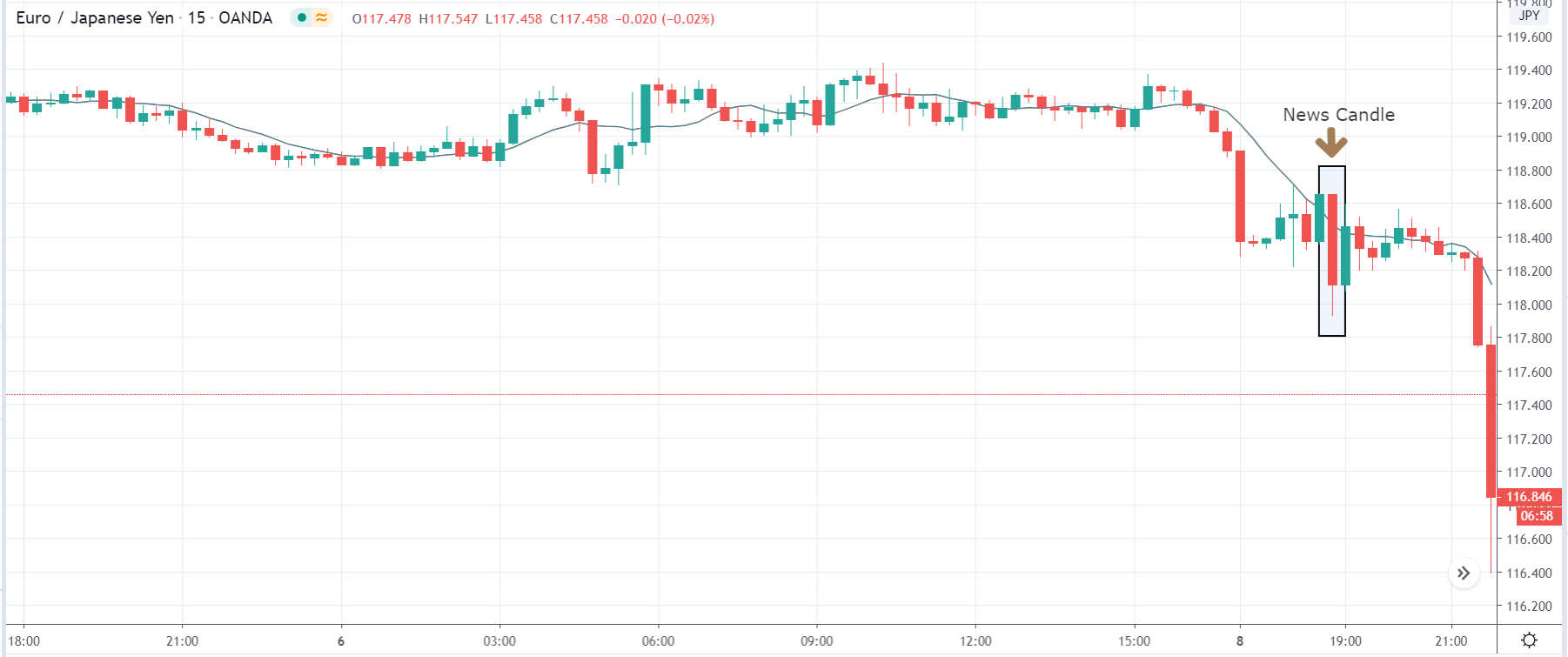

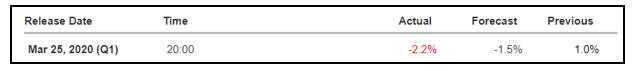

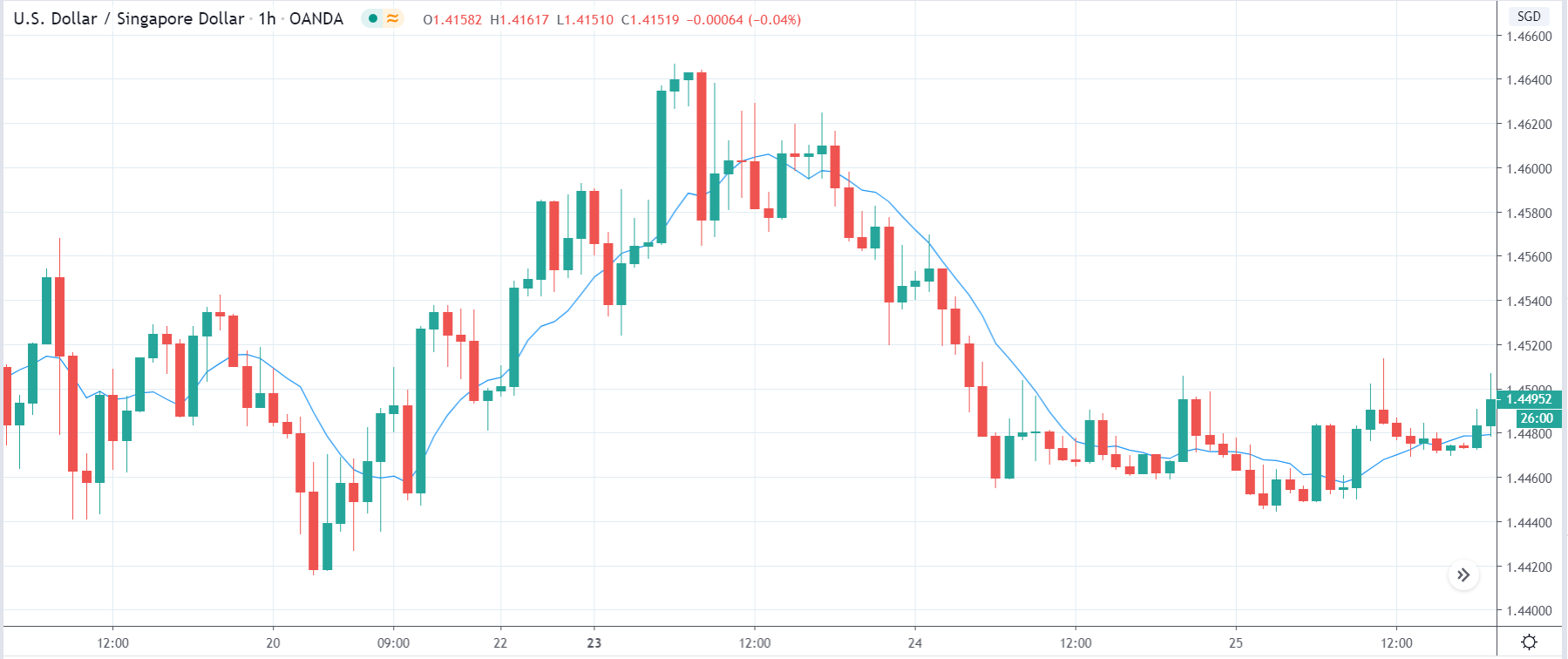

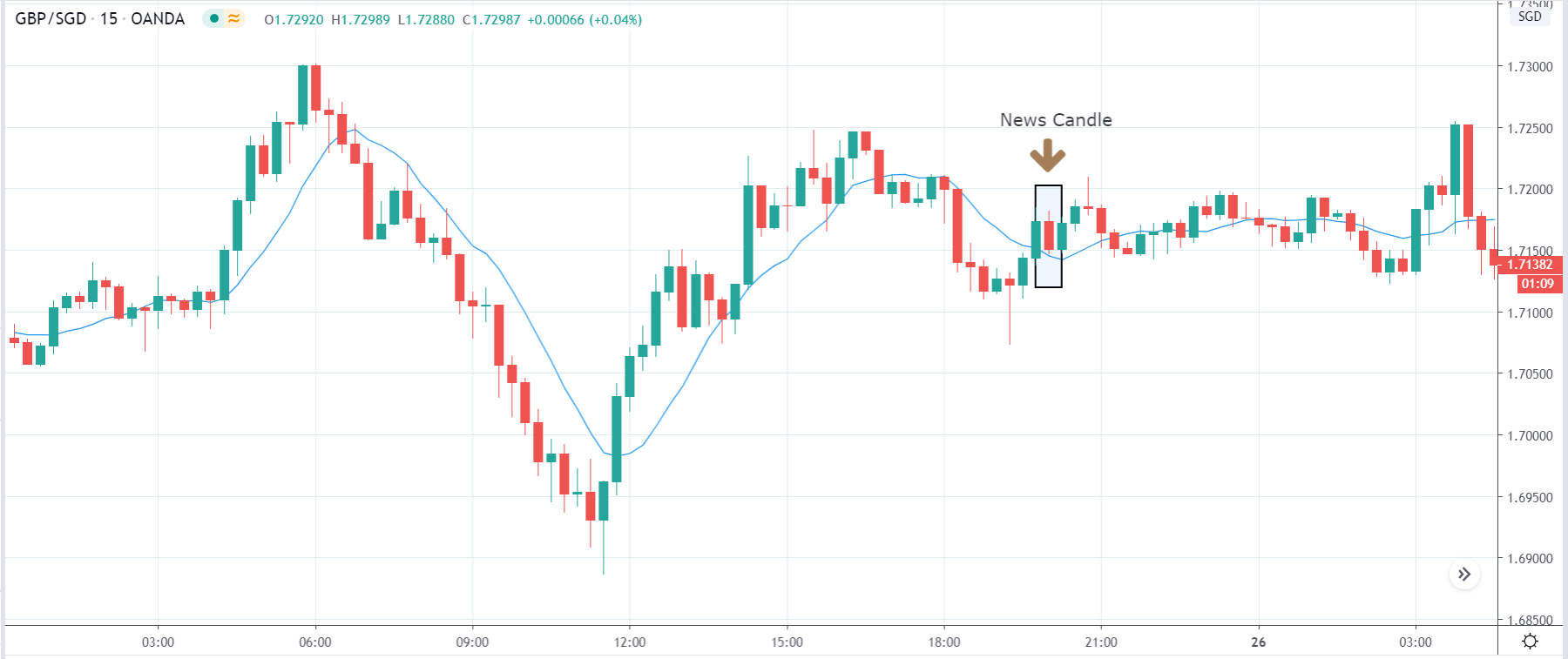

Some traders assume that managing news events is possible, believing that by possessing these information items gives them control over the market, to the extent that they deem generating a great number of pips in little time possible. Their viewpoint on news events boils down to the idea that the moment such news comes out, they will take specific action accordingly. Should the news be strong, they will go long on their chosen currency and vice versa. They believe that any timely reaction will easily bring them many pips, and we cannot but confirm that such a belief is based on solid grounds. Nonetheless, the fact that some traders managed to achieve this does not prove its quality. Not only does it happen occasionally, which immediately introduces a higher than necessary risk, but it also leads to false conclusions. Wanting to stay on top of news events is equal to trying to beat the traders’ main opponent, the big banks, and attempting to fight the one who decides how the prices will move is a very bad idea in the long run. Failure is inevitable when your adversary is unbeatable, so any attempt to control the news already implies more risk than anyone should have to take on.

Some traders assume that managing news events is possible, believing that by possessing these information items gives them control over the market, to the extent that they deem generating a great number of pips in little time possible. Their viewpoint on news events boils down to the idea that the moment such news comes out, they will take specific action accordingly. Should the news be strong, they will go long on their chosen currency and vice versa. They believe that any timely reaction will easily bring them many pips, and we cannot but confirm that such a belief is based on solid grounds. Nonetheless, the fact that some traders managed to achieve this does not prove its quality. Not only does it happen occasionally, which immediately introduces a higher than necessary risk, but it also leads to false conclusions. Wanting to stay on top of news events is equal to trying to beat the traders’ main opponent, the big banks, and attempting to fight the one who decides how the prices will move is a very bad idea in the long run. Failure is inevitable when your adversary is unbeatable, so any attempt to control the news already implies more risk than anyone should have to take on.

-Avoid. Avoidance is one of the best measures in your strategy. Avoid the news.

-Avoid. Avoidance is one of the best measures in your strategy. Avoid the news.

Let’s be completely honest, trading forex can be an expensive business, the problem is, that it has been made so accessible with accounts being able to be opened from as low as $10. The problem with this is that $10 is just not enough money to trade with. It’s fantastic that it is so accessible, allowing those to trade who never would have been able to 10 years ago, but what they do not tell you about these low deposits is that it just is not enough to

Let’s be completely honest, trading forex can be an expensive business, the problem is, that it has been made so accessible with accounts being able to be opened from as low as $10. The problem with this is that $10 is just not enough money to trade with. It’s fantastic that it is so accessible, allowing those to trade who never would have been able to 10 years ago, but what they do not tell you about these low deposits is that it just is not enough to

The Mobile trader enables customers to stay up to date with the most recent market rates. Some key features of this platform are, the ability to trade over 200 stocks, indices, currency pairs and commodities, the ability to constantly monitor positions, complete access to balance sheets, equity and margin details, and customizable layout for easy usage.

The Mobile trader enables customers to stay up to date with the most recent market rates. Some key features of this platform are, the ability to trade over 200 stocks, indices, currency pairs and commodities, the ability to constantly monitor positions, complete access to balance sheets, equity and margin details, and customizable layout for easy usage.

Educational & Trading Tools

Educational & Trading Tools

Preservers find themselves worrying about their losses too much and can fall victim to making trading choices out of fear or anxiety. These traders need to understand that you won’t win every time, and that’s perfectly fine.

Preservers find themselves worrying about their losses too much and can fall victim to making trading choices out of fear or anxiety. These traders need to understand that you won’t win every time, and that’s perfectly fine.

AlphaBeta FX (or, in short, ABFX) was founded in 2009. Their first office was based out of India, but this broker quickly expanded and operated as the first market-making firm to service the greater Asian region. ABFX has a physical presence in 7 different countries, mainly thanks to its technologically enhanced experience, precise execution methods, and advantageous trading conditions.

AlphaBeta FX (or, in short, ABFX) was founded in 2009. Their first office was based out of India, but this broker quickly expanded and operated as the first market-making firm to service the greater Asian region. ABFX has a physical presence in 7 different countries, mainly thanks to its technologically enhanced experience, precise execution methods, and advantageous trading conditions.

Although it doesn’t hurt to have good trading results, today’s firms will not even ask for it, since many people can produce fake good resumes, you just have to be a good trader. But, if you do have the experience, all that learning and testing won’t go to waste, as firms today tend to release you into the wild, they will test you through their platform and trading. If you produce good results under pressure they will hire you for a long time. Everyone’s experience is different. These lines are just recommendations, showing you options, providing you with more chances for success.

Although it doesn’t hurt to have good trading results, today’s firms will not even ask for it, since many people can produce fake good resumes, you just have to be a good trader. But, if you do have the experience, all that learning and testing won’t go to waste, as firms today tend to release you into the wild, they will test you through their platform and trading. If you produce good results under pressure they will hire you for a long time. Everyone’s experience is different. These lines are just recommendations, showing you options, providing you with more chances for success.

The lack of patience, it’s something that we all are affected with, more or less. There is one feature of impatience, that is the killer – desperation. That is what is blocking us from achieving success. Something that we need to discard. It is, more than anything, negative that is impeding progress in trading. Desperation causes us to make irrational decisions. Extreme decisions. What would you do if someone would offer you a job that would satisfy you professionally and economically, but only after 5 years building on it with lots of crashes and self-doubts? Would you still be interested?

The lack of patience, it’s something that we all are affected with, more or less. There is one feature of impatience, that is the killer – desperation. That is what is blocking us from achieving success. Something that we need to discard. It is, more than anything, negative that is impeding progress in trading. Desperation causes us to make irrational decisions. Extreme decisions. What would you do if someone would offer you a job that would satisfy you professionally and economically, but only after 5 years building on it with lots of crashes and self-doubts? Would you still be interested?

Why would you choose to do that? There are two main reasons. The first is that by diversifying your sources of income, you can insulate yourself from any future shocks. The more streams of income you have, the better protected you are from things like the economy tanking or your company going under and leaving you unemployed. The second, perhaps more convincing reason is that you are almost sure to end up making more money this way. The greater the number of income streams you introduce into your life, the greater the odds are that one of them will become a runaway success.

Why would you choose to do that? There are two main reasons. The first is that by diversifying your sources of income, you can insulate yourself from any future shocks. The more streams of income you have, the better protected you are from things like the economy tanking or your company going under and leaving you unemployed. The second, perhaps more convincing reason is that you are almost sure to end up making more money this way. The greater the number of income streams you introduce into your life, the greater the odds are that one of them will become a runaway success.

Money is tied to emotions. It will be our Subjectivity versus Objectivity. The separation of emotions from this is impossible according to the professional prop traders. It is very common to see a trader have great results on a demo account and collapse when trading with real money. They cannot trade the same way. If we can get to the point where we trade more on objectivity than on subjectivity, we are steps closer to consistent successful trading. This is one of the reasons trading systems are very helpful to see the objectivity.

Money is tied to emotions. It will be our Subjectivity versus Objectivity. The separation of emotions from this is impossible according to the professional prop traders. It is very common to see a trader have great results on a demo account and collapse when trading with real money. They cannot trade the same way. If we can get to the point where we trade more on objectivity than on subjectivity, we are steps closer to consistent successful trading. This is one of the reasons trading systems are very helpful to see the objectivity.

Judging a traders’ strengths can be very beneficial for trading. As masters of decision making, they will not hesitate. They will take action, complete, push to the goal. The plan will be followed to the letter, and the plan itself will be clear. There is only right and wrong, black and white, nothing in between. Their mindset does not allow doubts, any contrarian opinion will bounce off it. This manifests in the weakness of not taking advice. Additionally, low flexibility is another consequence of this mindset. Thus, traders of this type may have a steep learning curve.

Judging a traders’ strengths can be very beneficial for trading. As masters of decision making, they will not hesitate. They will take action, complete, push to the goal. The plan will be followed to the letter, and the plan itself will be clear. There is only right and wrong, black and white, nothing in between. Their mindset does not allow doubts, any contrarian opinion will bounce off it. This manifests in the weakness of not taking advice. Additionally, low flexibility is another consequence of this mindset. Thus, traders of this type may have a steep learning curve.

Now, starting with demo accounts or small accounts is beneficial to smooth out the trading process, see where you are thin, and to show that you can do good trading in the long run with steady results. This is how we want to present ourselves to trading companies. When they engage you, trading companies will arrange their own tests. They will set a test period and see how you do under pressure, which is usually about 6 months. Don’t be upset by this time period, there is no other way for them to expose lesser traders that can’t maintain steady results. Constant results are hard to achieve, and that will separate a “trader” from a professional trader.

Now, starting with demo accounts or small accounts is beneficial to smooth out the trading process, see where you are thin, and to show that you can do good trading in the long run with steady results. This is how we want to present ourselves to trading companies. When they engage you, trading companies will arrange their own tests. They will set a test period and see how you do under pressure, which is usually about 6 months. Don’t be upset by this time period, there is no other way for them to expose lesser traders that can’t maintain steady results. Constant results are hard to achieve, and that will separate a “trader” from a professional trader.

Sometimes, you will not have the opportunity to find resources you may need, which only implies that you will need to come up with a solution yourself. It often happens that we are forced to become creative in our careers, which can eventually set you apart from the competition. What is more, if you are truly seeking to become an expert earning

Sometimes, you will not have the opportunity to find resources you may need, which only implies that you will need to come up with a solution yourself. It often happens that we are forced to become creative in our careers, which can eventually set you apart from the competition. What is more, if you are truly seeking to become an expert earning

/GettyImages-164127912-56b6b5125f9b5829f8341f6c.jpg) Many come into trading with a small amount, while it is possible to be profitable with a small amount, it will be a very slow process and there is a far greater risk that you could blow your account and lose your initial deposit. Like many things in life, you need money in order to make more money. The more that you have the more likely and also the easier it will be for you to make money. With a larger amount, you can use far better risk management techniques, and also each trade will ultimately bring in more profits.

Many come into trading with a small amount, while it is possible to be profitable with a small amount, it will be a very slow process and there is a far greater risk that you could blow your account and lose your initial deposit. Like many things in life, you need money in order to make more money. The more that you have the more likely and also the easier it will be for you to make money. With a larger amount, you can use far better risk management techniques, and also each trade will ultimately bring in more profits. The markets are a 24-hour opportunity, unfortunately, you are not. There will be a lot of times when there are some big movements in the markets that are perfect for your strategy, the only problem is that you are at work or asleep. It is important to understand that you won’t be able to get on every opportunity, it is important that you do not look at the things that you missed, they have already gone, you need to continue to focus on what is coming up. If you have just missed something, do not jump in anyway, the opportunity has gone so let it go, there will be plenty more for you to trade. If you are up and trading during the busier London or New York sessions then you will be able to sharpen your skills a lot quicker as the markets are often moving at a much faster pace.

The markets are a 24-hour opportunity, unfortunately, you are not. There will be a lot of times when there are some big movements in the markets that are perfect for your strategy, the only problem is that you are at work or asleep. It is important to understand that you won’t be able to get on every opportunity, it is important that you do not look at the things that you missed, they have already gone, you need to continue to focus on what is coming up. If you have just missed something, do not jump in anyway, the opportunity has gone so let it go, there will be plenty more for you to trade. If you are up and trading during the busier London or New York sessions then you will be able to sharpen your skills a lot quicker as the markets are often moving at a much faster pace.

Of course, learning per se will not get you far on its own. Reading and watching can also be quite limiting without allowing yourself to practically apply the theoretical knowledge you have acquired. Playing safe, without allowing yourself to learn more about betting and trading, is also going to be insufficient if you desire to multiply your gains. Let’s say that you have done some sports betting in the past, so now may be the time to diversify. Learn about different sports and see how the system you have relied upon stands in comparison. The same applies to forex – consider different currencies and markets you can explore to widen your list of experience and achievement. Diversification will not prevent you from making mistakes, but it will allow you to grow your skillset and widen your perspective.

Of course, learning per se will not get you far on its own. Reading and watching can also be quite limiting without allowing yourself to practically apply the theoretical knowledge you have acquired. Playing safe, without allowing yourself to learn more about betting and trading, is also going to be insufficient if you desire to multiply your gains. Let’s say that you have done some sports betting in the past, so now may be the time to diversify. Learn about different sports and see how the system you have relied upon stands in comparison. The same applies to forex – consider different currencies and markets you can explore to widen your list of experience and achievement. Diversification will not prevent you from making mistakes, but it will allow you to grow your skillset and widen your perspective.

Here we are going to try to pull back the curtain a little bit on a lifestyle of someone who trades daily, and who is close to understanding and anticipating the landscape of forex trading. We’ve been listening to all the time about different daily routines. About waking up early, trading, drinking coffee, going to the gym, taking our vitamins, reading news, trading again, and that’s it. That doesn’t tell us a lot, to be frank. What we can expect from this lifestyle and what it is? For all of you flashy people who think that lives of traders are super glamorous, if you think that every day is going to be a P. Diddy video, hot girls wearing bikinis, drinking cocktails, riding around the pool on roller skates, you better think twice. There are a bunch of traders around wearing Rolex watches, driving Bugatti cars, having the latest gadgets, and owning multi-million dollar houses, but we need to be reasonable and put those commodities on aside for a bit.

Here we are going to try to pull back the curtain a little bit on a lifestyle of someone who trades daily, and who is close to understanding and anticipating the landscape of forex trading. We’ve been listening to all the time about different daily routines. About waking up early, trading, drinking coffee, going to the gym, taking our vitamins, reading news, trading again, and that’s it. That doesn’t tell us a lot, to be frank. What we can expect from this lifestyle and what it is? For all of you flashy people who think that lives of traders are super glamorous, if you think that every day is going to be a P. Diddy video, hot girls wearing bikinis, drinking cocktails, riding around the pool on roller skates, you better think twice. There are a bunch of traders around wearing Rolex watches, driving Bugatti cars, having the latest gadgets, and owning multi-million dollar houses, but we need to be reasonable and put those commodities on aside for a bit.

If you’ve attended trading training or if you’ve done your research online, you’ve heard of strategies, how to identify them, when to apply them and how to manage them once they’ve been applied. Strategies are nothing but a list of rules that help you to recognize and apply your methods for making a trade profitable.

If you’ve attended trading training or if you’ve done your research online, you’ve heard of strategies, how to identify them, when to apply them and how to manage them once they’ve been applied. Strategies are nothing but a list of rules that help you to recognize and apply your methods for making a trade profitable.

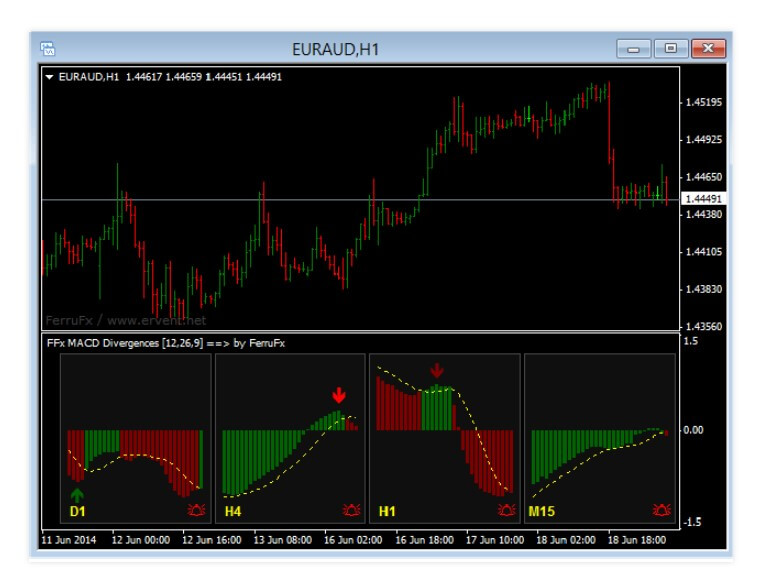

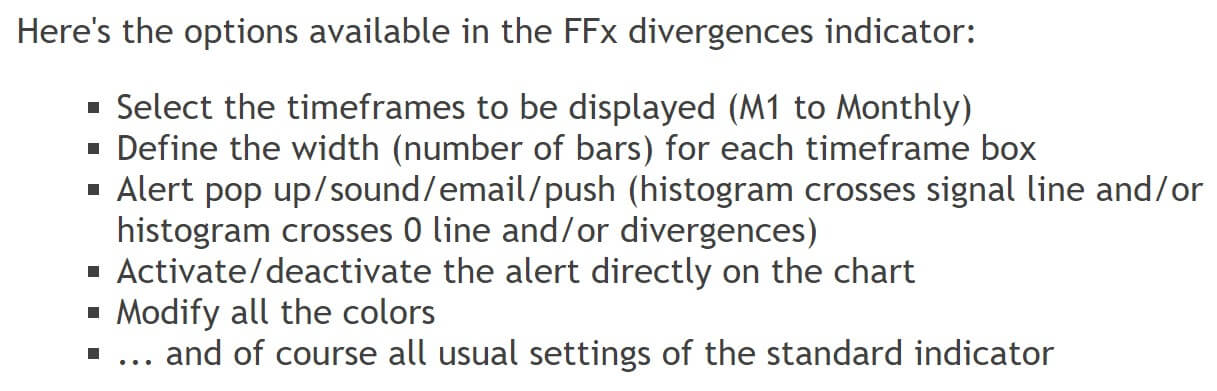

The MetaTrader 4 and 5 platforms come with one of the most popular indicators known to traders – MACD. FFx MACD Divergences build upon the already integrated indicator in the MT4 platform, extending the functionality especially useful for divergence strategy traders. This paid indicator is published on 4th July 2014 on the MQL5 repository and since then has no received much attention. The latest version has not changed since the initial placement and remains at 1.0. The author of this extension tool is Eric Venturi-Bloxs from Thailand. This author has no less than 52 products on the mql5.com, a good portion of that is free.

The MetaTrader 4 and 5 platforms come with one of the most popular indicators known to traders – MACD. FFx MACD Divergences build upon the already integrated indicator in the MT4 platform, extending the functionality especially useful for divergence strategy traders. This paid indicator is published on 4th July 2014 on the MQL5 repository and since then has no received much attention. The latest version has not changed since the initial placement and remains at 1.0. The author of this extension tool is Eric Venturi-Bloxs from Thailand. This author has no less than 52 products on the mql5.com, a good portion of that is free.

With regard to investing, if you have already collected some crypto and you desire to obtain some more, you should be cautious about overleveraging. A trader who holds a cryptocurrency may not thus want to exceed 5% of portfolio value. Even if overall conditions worsen, with such an approach traders can still earn money from their investments. Moreover, the upside-downside ratio can be indeed helpful in gaining a new perspective on this matter, in that if everything collapses and a trader loses all money, the upside on such investment is incomparably more satisfactory. Therefore, if you use this strategy, you know that you can either lose only what you initially invested or truly amass a fortune.

With regard to investing, if you have already collected some crypto and you desire to obtain some more, you should be cautious about overleveraging. A trader who holds a cryptocurrency may not thus want to exceed 5% of portfolio value. Even if overall conditions worsen, with such an approach traders can still earn money from their investments. Moreover, the upside-downside ratio can be indeed helpful in gaining a new perspective on this matter, in that if everything collapses and a trader loses all money, the upside on such investment is incomparably more satisfactory. Therefore, if you use this strategy, you know that you can either lose only what you initially invested or truly amass a fortune.

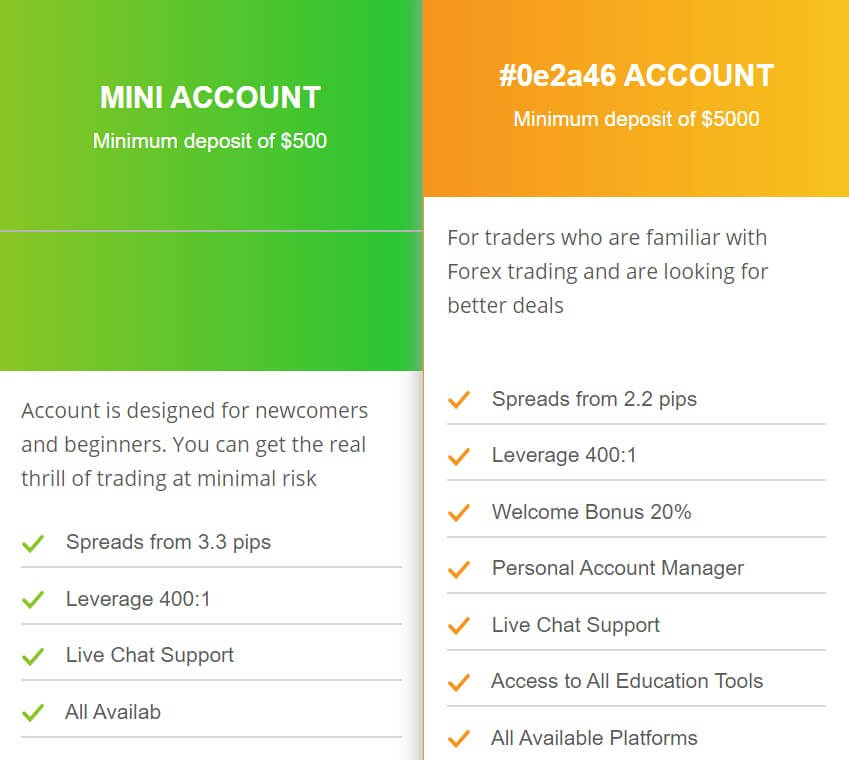

This broker offers leverage caps that range from a standard 1:100 level up to an impressive 1:1000 ratio. Along with the majority of other forex brokers, Maximus FX offers the higher caps on accounts that don’t typically hold a large balance. This restriction is often implemented due to the high-risk experience associated with trading with a higher than average leverage. The Mini account would be the only account that offers the most generous 1:1000 option, while the Standard and Islamic accounts cut the offer down to 1:500. This amount is especially flexible for Islamic account holders since the account requires a significant $50K deposit.

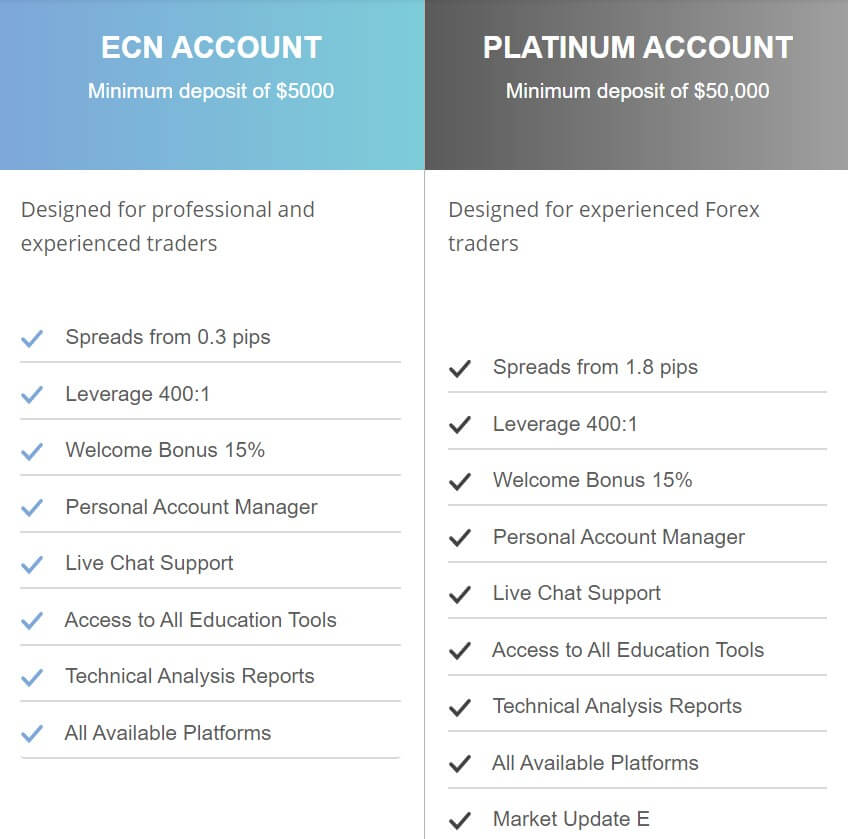

This broker offers leverage caps that range from a standard 1:100 level up to an impressive 1:1000 ratio. Along with the majority of other forex brokers, Maximus FX offers the higher caps on accounts that don’t typically hold a large balance. This restriction is often implemented due to the high-risk experience associated with trading with a higher than average leverage. The Mini account would be the only account that offers the most generous 1:1000 option, while the Standard and Islamic accounts cut the offer down to 1:500. This amount is especially flexible for Islamic account holders since the account requires a significant $50K deposit. Maximus FX primarily offers currency pairs for trading. Options include majors, minors, and some exotics, totaling 37 options. Precious metals Gold and Silver are also grouped in with the available FX pairs. Some of those exotic options include the South African Rand, Turkish Lira, Swedish Krone, Russian Ruble, Norwegian Krone, and more. It’s a little disappointing that the broker doesn’t offer a larger number of FX options, considering that this is their primary focus. Commodities, CFD’s, and indices are considered extra trading instruments, which are only available upon request for Standard, VIP, and Islamic account holders.

Maximus FX primarily offers currency pairs for trading. Options include majors, minors, and some exotics, totaling 37 options. Precious metals Gold and Silver are also grouped in with the available FX pairs. Some of those exotic options include the South African Rand, Turkish Lira, Swedish Krone, Russian Ruble, Norwegian Krone, and more. It’s a little disappointing that the broker doesn’t offer a larger number of FX options, considering that this is their primary focus. Commodities, CFD’s, and indices are considered extra trading instruments, which are only available upon request for Standard, VIP, and Islamic account holders. As we mentioned earlier, Maximus FX offers a more customizable experience by allowing traders to choose from different types of spreads on some of their account types. Remember that the chosen spread would affect the commission costs, so it is important to weigh those costs against one another. On the Mini account, spreads can be floating or ordinary. Floating spreads on this account start from as low as 0.2 pips and most of the options average less than

As we mentioned earlier, Maximus FX offers a more customizable experience by allowing traders to choose from different types of spreads on some of their account types. Remember that the chosen spread would affect the commission costs, so it is important to weigh those costs against one another. On the Mini account, spreads can be floating or ordinary. Floating spreads on this account start from as low as 0.2 pips and most of the options average less than

50% Welcome Bonus (Standard & Islamic accounts): After making an initial deposit of at least $200, traders would need to email

50% Welcome Bonus (Standard & Islamic accounts): After making an initial deposit of at least $200, traders would need to email  Maximus FX offers interactive educational resources in the form of individual training sessions, which covers financial markets, investment tactics, online trading, capital management, and trading psychology, in addition to webinars and seminars. Overall, the information covered in these one-on-one sessions is more advanced. Beginners will find a

Maximus FX offers interactive educational resources in the form of individual training sessions, which covers financial markets, investment tactics, online trading, capital management, and trading psychology, in addition to webinars and seminars. Overall, the information covered in these one-on-one sessions is more advanced. Beginners will find a

Although MM Financial doesn’t provide a comprehensive list of their available instruments, they do advertise currency pairs, indices, commodities, and stocks as being among their offers. The broker also offers currency pairs, which aren’t offered nearly as common among their competitors. In total, MM Financial claims to offer more than 800 liquid assets for trading, but traders shouldn’t be surprised if this statement doesn’t hold up entirely.

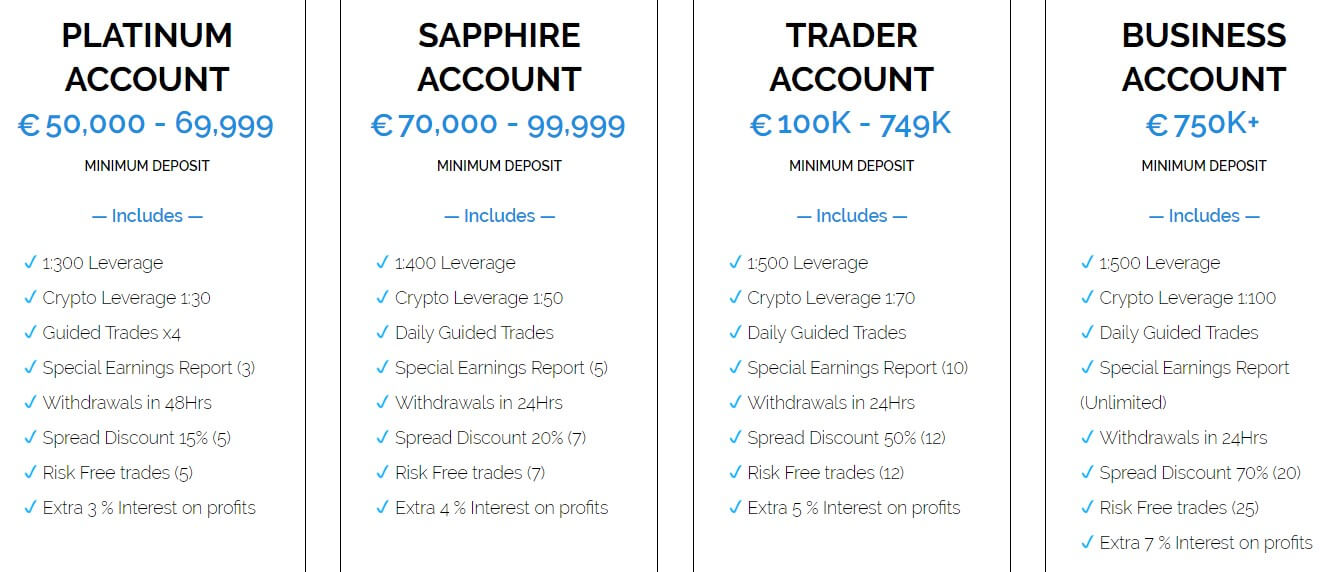

Although MM Financial doesn’t provide a comprehensive list of their available instruments, they do advertise currency pairs, indices, commodities, and stocks as being among their offers. The broker also offers currency pairs, which aren’t offered nearly as common among their competitors. In total, MM Financial claims to offer more than 800 liquid assets for trading, but traders shouldn’t be surprised if this statement doesn’t hold up entirely. MM Financial starts off with an expensive $1,000 entry-level deposit on their Test account, which is much higher than the $100 (or less) entry-level deposits offered by many other brokers. From there, the asking amounts keep climbing, up to $5,000 on the Micro account, $10,000 on the Standard account, $25,000 on the Silver account, $50,000 on the Platinum account, $70,000 on the Sapphire account, $100,000 on the Trader account, and $750,000 on the Business account. Traders should also note that each account holds a maximum balance that tops out at $1 below the funding amount for the next account. For example, the Test out tops out at $4,999, which is just $1 below the Micro account’s $5,000 deposit requirement. Costs with this broker aren’t exactly beginner-friendly and it may take some time to save up to open a simple Test account.

MM Financial starts off with an expensive $1,000 entry-level deposit on their Test account, which is much higher than the $100 (or less) entry-level deposits offered by many other brokers. From there, the asking amounts keep climbing, up to $5,000 on the Micro account, $10,000 on the Standard account, $25,000 on the Silver account, $50,000 on the Platinum account, $70,000 on the Sapphire account, $100,000 on the Trader account, and $750,000 on the Business account. Traders should also note that each account holds a maximum balance that tops out at $1 below the funding amount for the next account. For example, the Test out tops out at $4,999, which is just $1 below the Micro account’s $5,000 deposit requirement. Costs with this broker aren’t exactly beginner-friendly and it may take some time to save up to open a simple Test account. Traders won’t find a wide variety of resources available on the broker’s website, instead, MM Financial focuses on providing some articles about forex basics, analysis, trading plans, and market volatility. While those articles can be helpful, beginners will likely benefit from searching elsewhere on the web for more in-depth information and better learning tools, like video tutorials, e-books, and other sources. MM Financial seems to provide services for more experienced traders that can make larger deposits, which is likely the reason why they haven’t invested much of an effort in this category.

Traders won’t find a wide variety of resources available on the broker’s website, instead, MM Financial focuses on providing some articles about forex basics, analysis, trading plans, and market volatility. While those articles can be helpful, beginners will likely benefit from searching elsewhere on the web for more in-depth information and better learning tools, like video tutorials, e-books, and other sources. MM Financial seems to provide services for more experienced traders that can make larger deposits, which is likely the reason why they haven’t invested much of an effort in this category. MM Financial doesn’t exactly make it easy to reach out to support – the website doesn’t offer any instant option like LiveChat and it also fails to list a contacts page. In fact, we couldn’t even find a listed email address on the site, so traders will have to reach out to an agent through a form that is provided at the bottom of the website. 24/5 support is advertised, but we wouldn’t expect to see quick responses with all things considered.

MM Financial doesn’t exactly make it easy to reach out to support – the website doesn’t offer any instant option like LiveChat and it also fails to list a contacts page. In fact, we couldn’t even find a listed email address on the site, so traders will have to reach out to an agent through a form that is provided at the bottom of the website. 24/5 support is advertised, but we wouldn’t expect to see quick responses with all things considered.