Introduction

Divergence is used by traders to determine if there is going to be a reversal or a trend continuation. They sometimes work exceptionally well and, at times, goes entirely in the anticipated direction. Thus, to increase the consistency of divergence, we have listed out some rules for trading divergence.

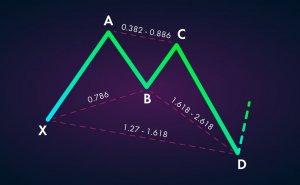

#1 Focus only on four price patterns

For legitimate divergence to exists, their price pattern must be either of the following:

- Higher high

- Lower low

- Double top

- Double bottom

If spot a divergence on the indicator that does not have either of the above price action, then the divergence will not work.

Several times, the price consolidates and shows divergence on the indicator. But there will not be any proper top or bottom to confirm that the divergence is real. Thus, such divergence must be ignored.

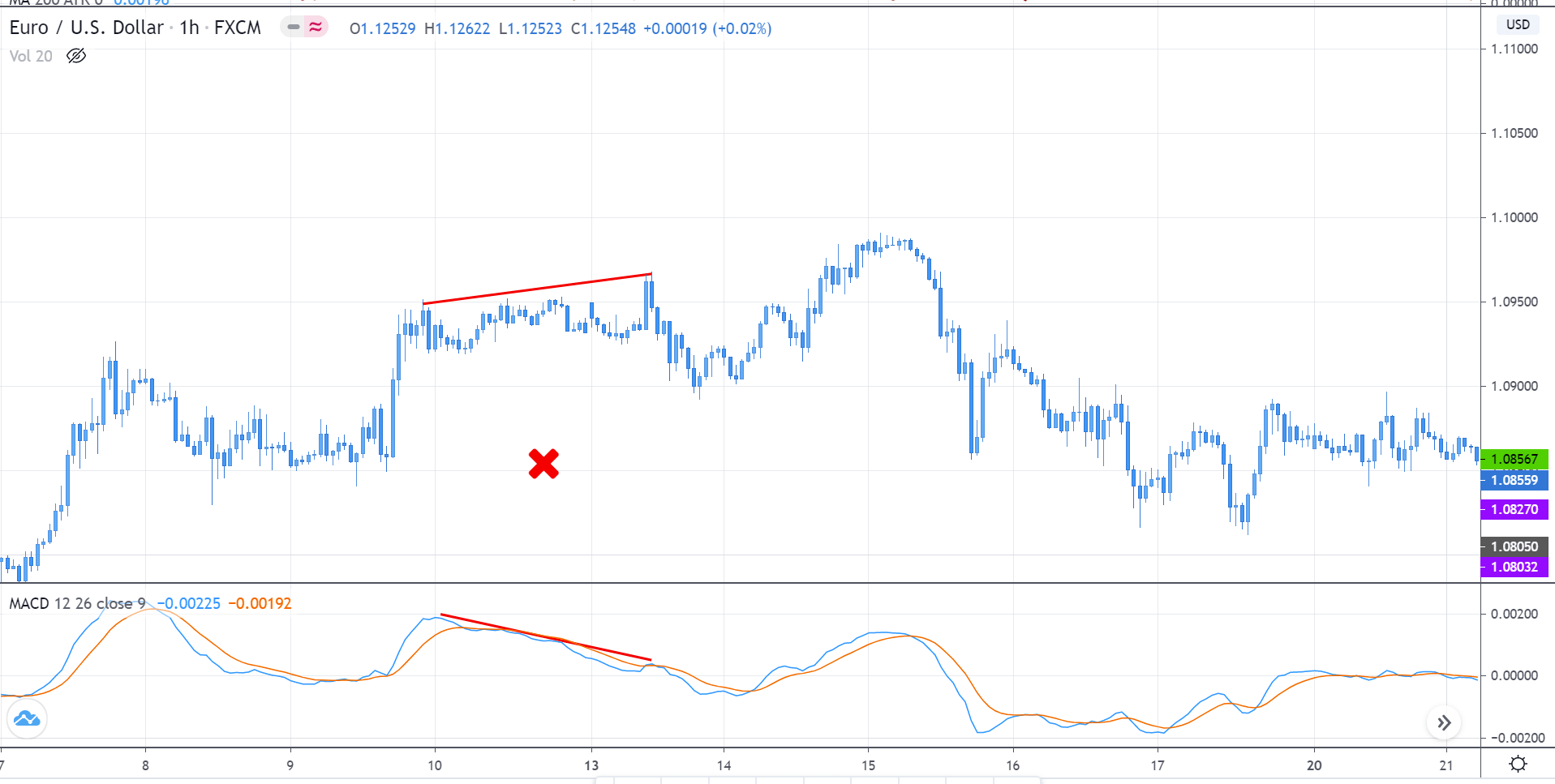

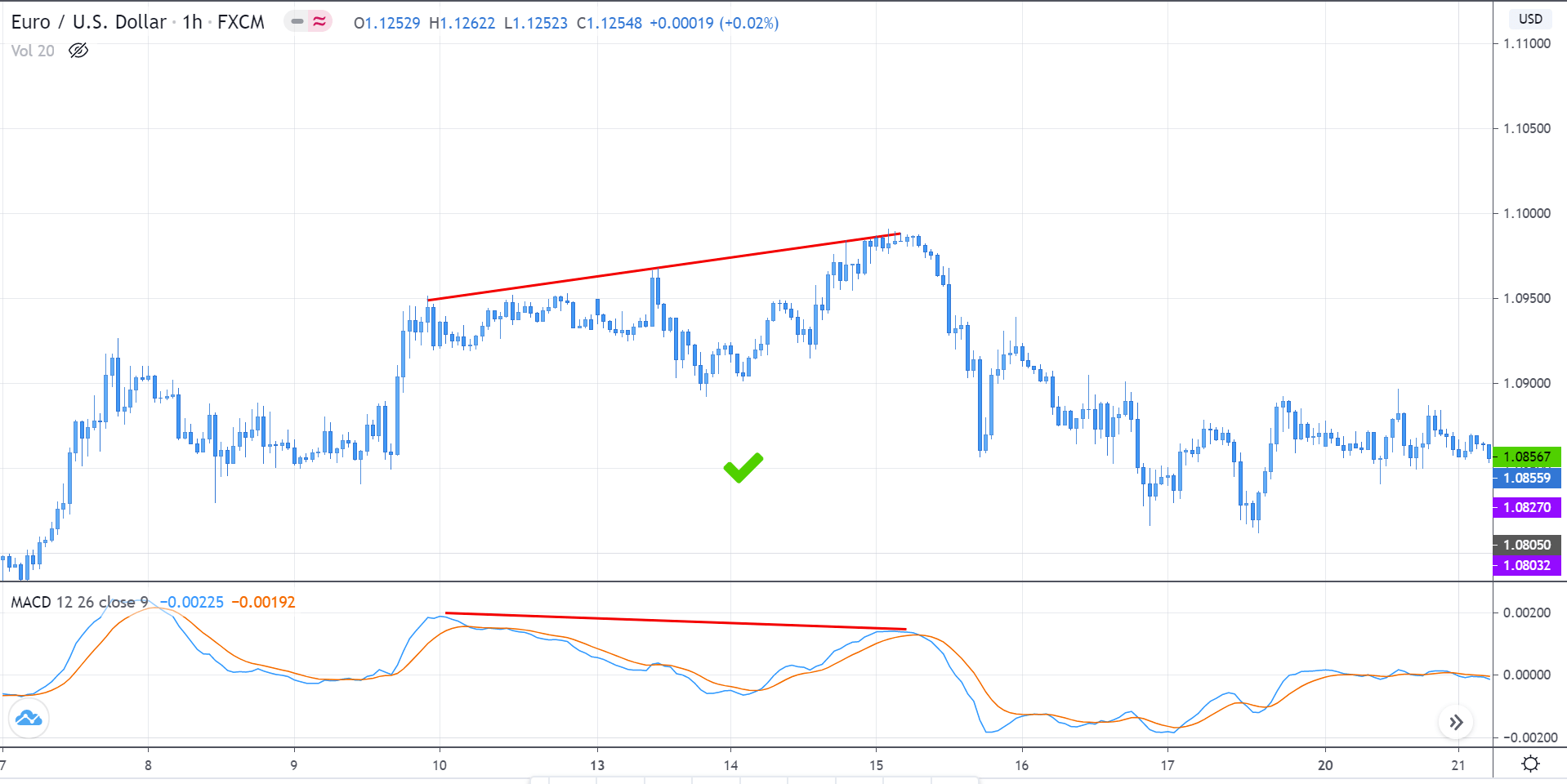

#2 Connect the lines only for significant highs and lows

Now that you know, we are concerned with one of the four patterns – higher high, lower low, equal high, and equal low. When it comes to drawing the trend lines, you must make sure the highs and lows are major enough to be considered. A little bump up or dips that may look like a higher high or lower low must be ignored.

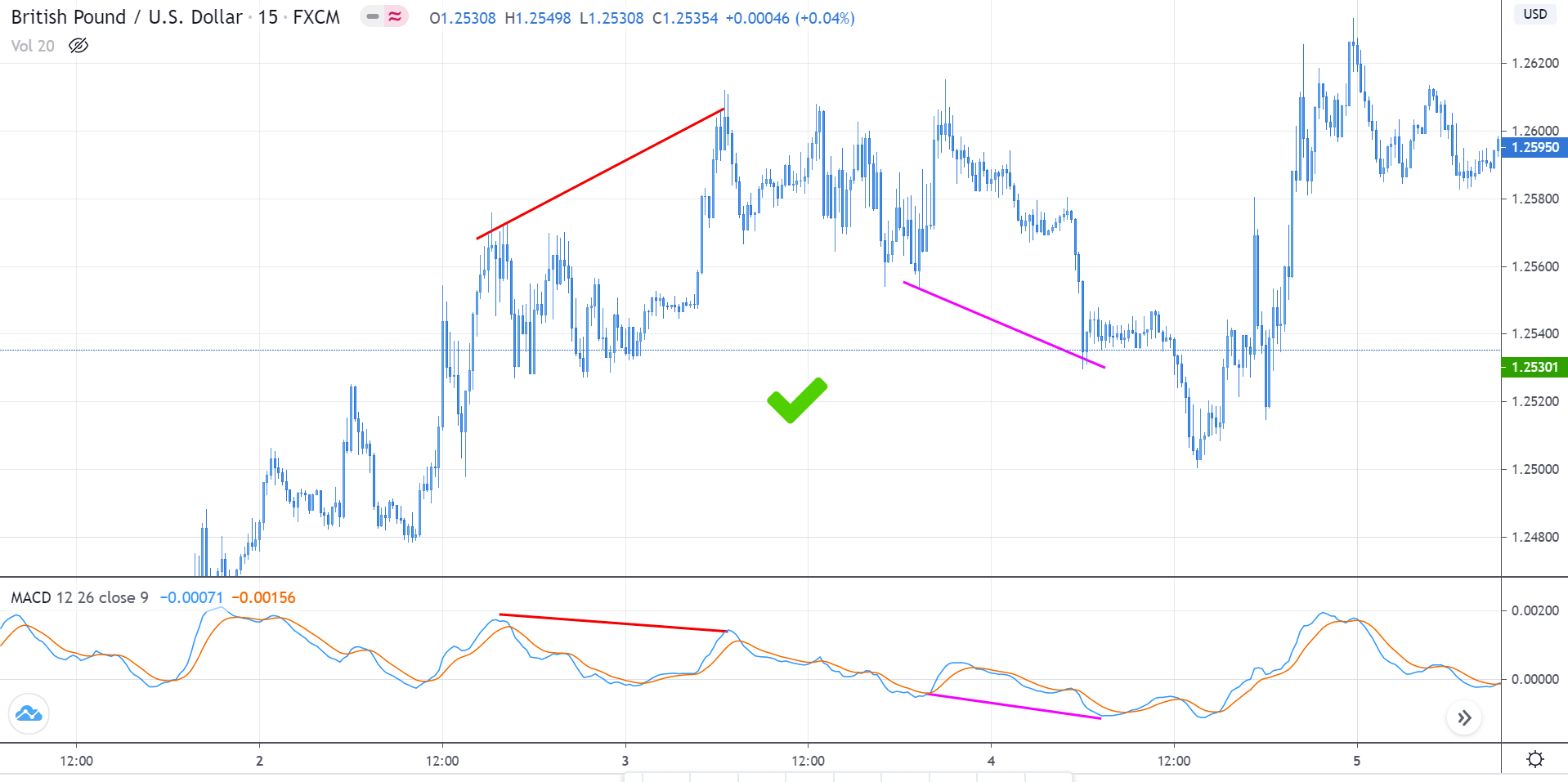

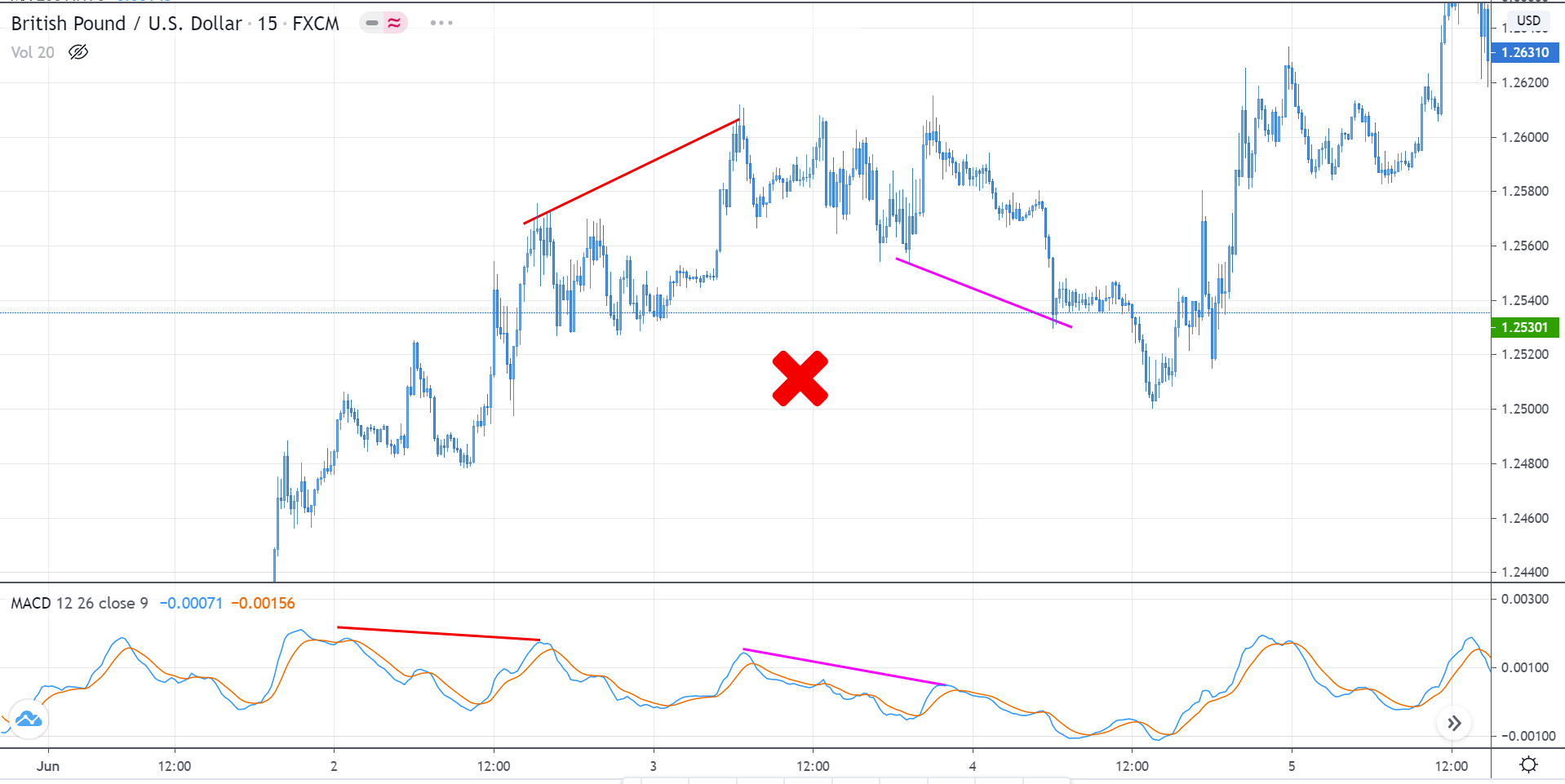

#3 Mark the corresponding highs and low

Always start by drawing the highs and lows from the price charts. Then you mark the highs and lows on the indicator corresponding with the highs and lows with the price.

Pro tip: Draw two vertical lines to perfectly mark the corresponding highs and lows.

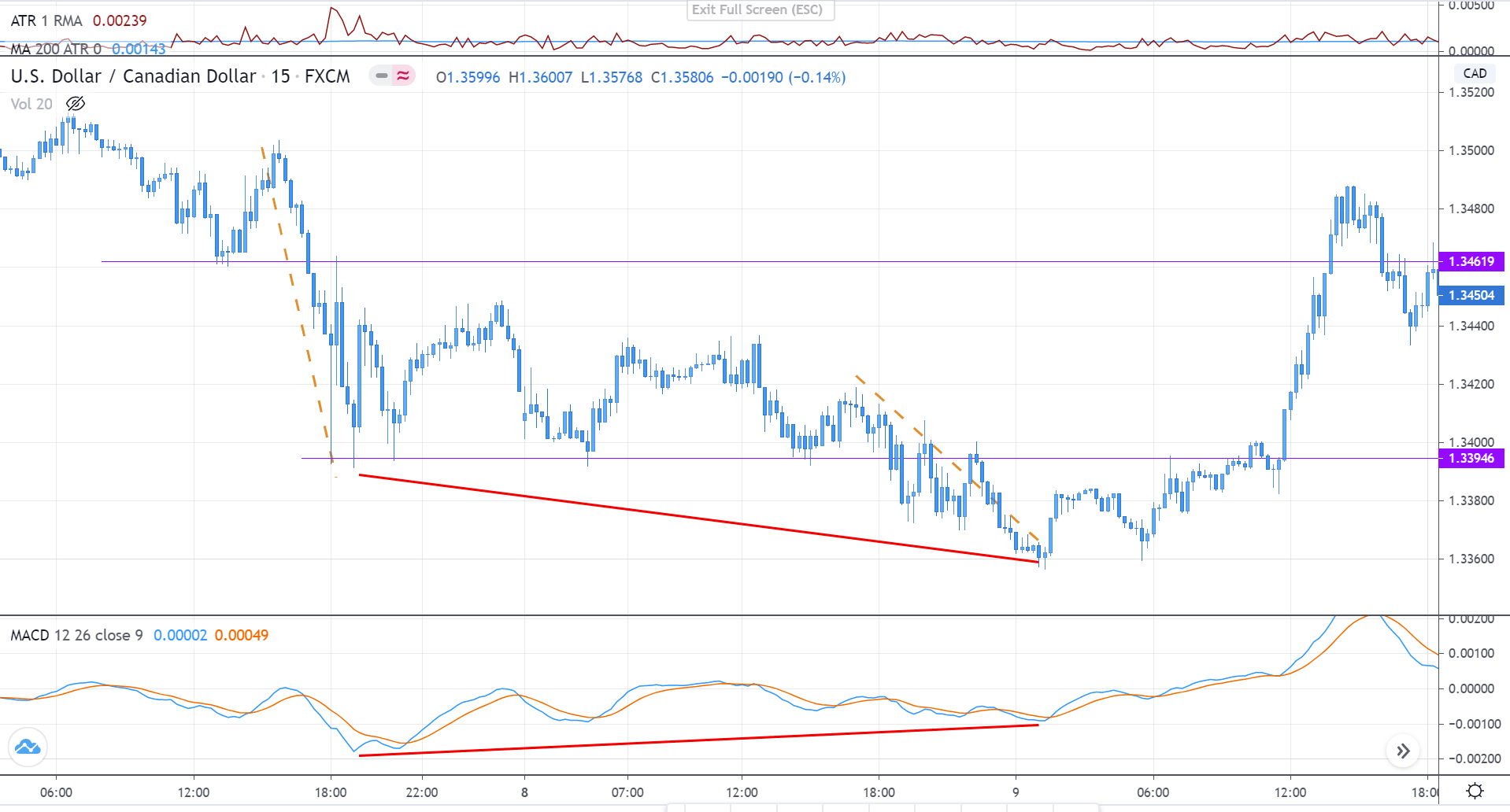

#4 Compare the length and strength of the pushes

This is one of the most important points to consider. In a trending market, the price makes higher highs or lower lows. But, when there is a divergence for a particular push, you must make sure that the momentum is weaker, and length is smaller than the previous trend sequence.

In the above chart, we can clearly ascertain that the lower low, which had divergence was much weaker and shorter than the previous push. As a result, the market reversed and had a big bull run.

#5 Do not try catching a falling knife

There are times when the market does not consolidate before reversing its direction. There could not be any entry for such trades. But there are traders who chase the market and end up buying at very high prices, which could be bad for business. Thus, you be patient and wait for the right opportunity, because buying at higher prices, could hinder the risk to reward ratio, leading to a high risk for small profits. [wp_quiz id=”78434″]