A good winning Forex trading plan should become the start for any path to becoming a consistently profitable trader. Unfortunately, some traders don’t write one until they’ve shredded some trading accounts. Even the task of writing a trading plan often falls into the category of, “I will do it when I have more time!”

So why don’t a lot of merchants spend some time making one if we’re talking about something so important? The answer is very simple: we don’t like the rules. And this doesn’t just apply to traders. We use the term “us” to refer to the entire human race.

When entering forex, we find an environment without many rules. Except for the ones our broker can put on, we’re free to do whatever we want. This is a somewhat frightening proposition for someone who’s been bound by rules all his life. We attribute to this fact the phenomenon that so many traders fail; they cannot handle the fact that they have no rules to follow. Or rather, they do not set their own rules.

In this article, we intend to check what a trading plan is all about, why it is so important and some points we think you should consider including in your own trading plan.

What Is A Forex Trading Plan?

A trading plan is like the original plan of everything you do as a trader, grouped as concisely as possible, but also descriptively. Your negotiation plan should consist of how and when you operate, as well as what you do before and after each operation.

Anyway, writing your trading plan isn’t the hard part. The hard part is to do it in as much detail as possible while keeping it as concise as possible, preferably just one page. After all, an 8-page trading plan that takes 15 minutes to read is not likely to be consulted often, which you should be doing.

Finally, your plan needs to be reviewed as your trading skills improve. Do not mistakenly think that your business plan is immovable and that just have to make it work.

Why Is A Trading Plan Important?

Simply put, a forex trading plan helps you stay disciplined. Commerce is a business and has to be treated as such. Like a business has a standardized operating procedure to keep things running properly, you must have a trading plan to keep yourself disciplined. As mentioned above, the forex market is a boundless environment and rules, so you need your trading plan to serve as a rule book to help you stay out of trouble.

Building Your Forex Trading Plan

Now is the time to work to put the pieces together. Below we have outlined what we believe are the most important topics to include in your trading plan. This is not a complete list, so you are free to add topics that you think should be included in your trading plan.

Every winning trading plan begins with a well-defined strategy or set of strategies. For us, these strategies could be the indecision candle, reversion pinbar, internal bar breaks, power candle, etc. It is important to define each strategy you will use and also to define the market conditions necessary to validate a setup. Does the market have to be biased or can it be of rank? Should the pinbar occur at a support and resistance level or will you also consider operating continuation pinbars?

Defining Time Frames

This theme is very simple, but it is also crucially important. You have to define the time frames in which you will operate. The omission of this simple rule has caused a lot of headaches for many traders. For example, we know a trader who when he first started in this world of forex, was constantly changed from the time frame. One week he used H1, then he got bored and moved on to M5 the next week.

Not only that, but he was in the habit of entering the market by looking at the H1 graph and then switching to H4, D1, M15, and even M5, just to see if things looked “right”. This person had no idea what he was looking for but was determined to make sure that every time frame looked favorable.

Choose only 1 or 2 time frames with which you feel more comfortable and stick to them. Look for setups in these time frames, operate in these time frames, and exit the operations in these time frames. This is the only way to break with “the dance of time frames,” which I think we’ve all experienced before.

Defining Your Watch List

As part of your trading plan, you will want to define the currency pairs you will operate. As with your overall trading plan, your watch list will change over time. Normally we recommend starting with 10 pairs of coins to observe at any time. This will give you several setups every week even in the highest time frames. As time goes on your business skills will tend to improve and your confidence increases, you can extend the list to include other pairs and even some commodities.

Mental Preparation

No, you should not meditate. Mental preparation is undoubtedly the most neglected topic in a trading plan. Maybe it’s because traders are too busy defining their strategy. Or perhaps simply because people don’t like to talk about their feelings. Whatever the case, this point is a must!

How do you feel today? Did you have a good night’s rest? Do you feel energetic, tired, or something in between? These are virtually all the questions that need to be asked as part of your business plan. We’ve all had those mornings. Whether we’ve been up late with friends, the stress of life that won’t let you sleep, or maybe you got up on your left foot. These things happen to the best too and will continue to happen. It’s your job to assess the situation and find out if you’re mentally prepared to face the markets. If not, maybe it’s best to sit back and do nothing until tomorrow.

The financial markets will always be there and believe us when we tell you that it will be much better to wait to operate until you are mentally prepared than to lose money for a mistake you would not otherwise have made. Just remember, being “flat” (not having open positions) is one position and the safest you can have.

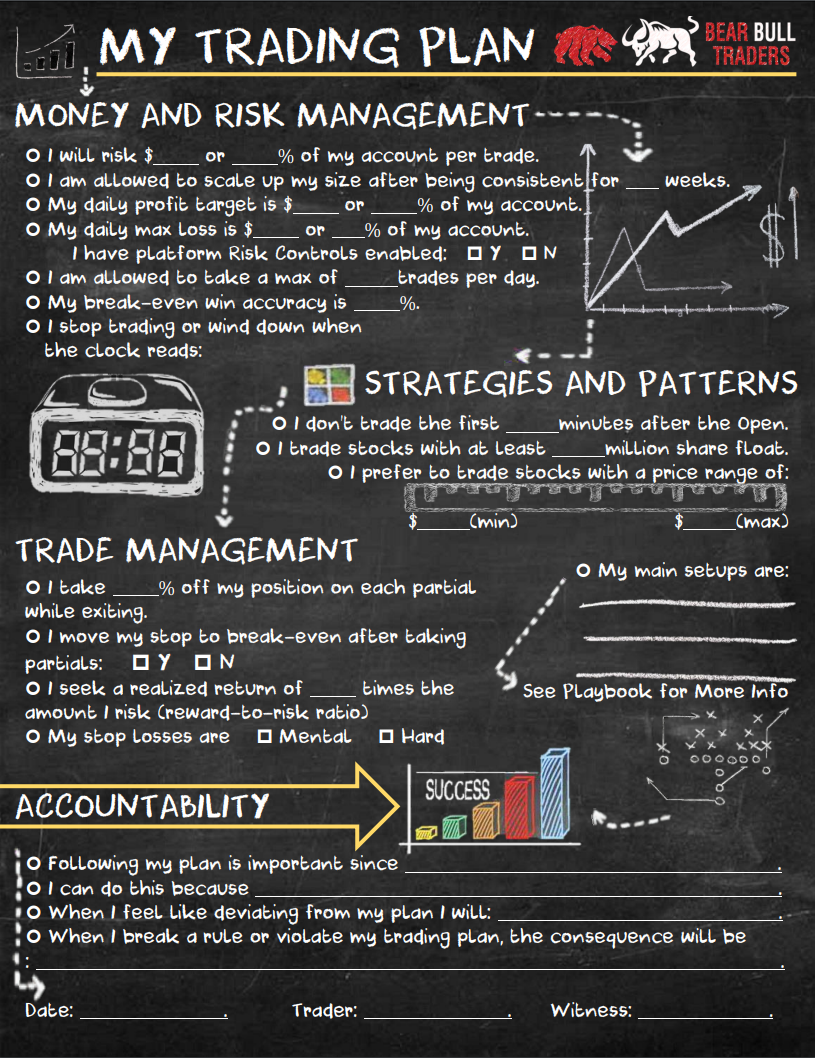

Lay Down Your Risk

As some will know, we do not recommend setting the risk in percentage terms. A much more precise approach is to define your risk level as a monetary value. But on the other hand, setting a percentage also gives some value, so we think it advisable to use both methods combined.

Here we can give an example of how you could define your risk within your trading plan. First, you must determine what your risk threshold is in terms of percentage. We recommend something between 1% and 5%. Let’s assume that you want to risk 2% per operation. The next step would be to define your risk threshold in terms of monetary value. Suppose you have a $10,000 account and are comfortable with risking 2%. Using the percentage rule only, your risk will be $200 on any transaction. But the question is, what kind of risky dollars do you start feeling a little anxious about?

Put another way, how much capital are you willing to lose an operation? The reason you have to ask yourself this is that it will not always fit perfectly with the percentage you have defined above. Let’s say your monetary threshold is $100. Any value above that and your emotions will start to bring out the worst in you. But in the $100 example is half of what your 2% rule tells you that you should risk…

For this reason, it is important to define risk in both terms: percentage and monetary value, and that you risk the least between them. Clearly, these numbers will change as your trading account grows, just be sure to redefine both whenever necessary.

Define Your Multiple of R

Your multiple of R is simply your profit-risk ratio expressed in a single number. For example, if you risk $50 on an operation and your potential gain is $100 (based on your goal), then your risk-benefit ratio is 1:2. In other words, the risk is half of the potential benefit. In terms of multiple of R, this would be a “2R”.

Another example would be to risk $70 to get a potential of $170. By dividing 170 between 70 we get a 2.4R. It is important to define a minimum ratio as part of your trading plan. We recommend 2R, but of course, we each apply the value that best suits you. The higher the value R is the better.

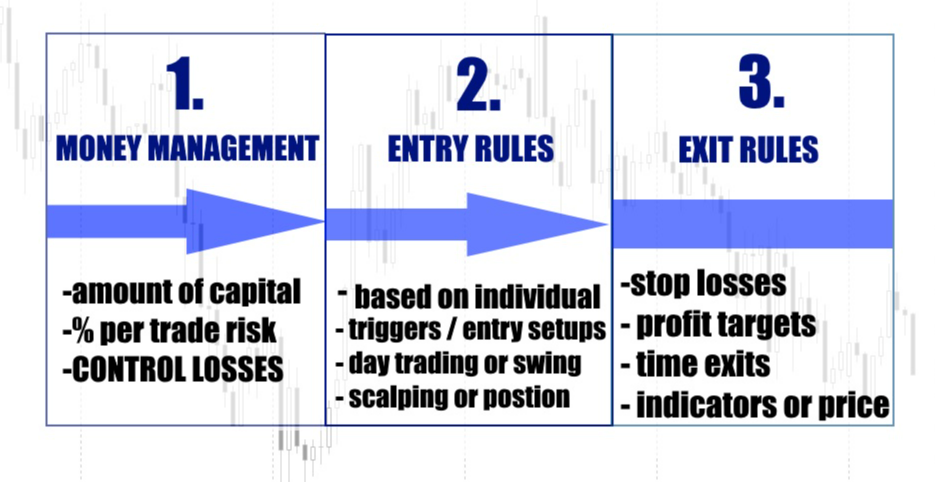

Defining Entry Rules

How are you going to enter into the trading strategies you previously defined in your plan? Let’s take an example, if any of your strategies are pinbar, what kind of input method will you use? Will you enter a “nose” break of the pinbar or perhaps prefer to enter in the middle of it?

If you are open to both methodologies, you should also define when to use each of them. What market conditions justify using the method of entering the middle of the pinbar? What market conditions must be present to justify entering a pinbar nose break?

Defining Output Rules

This is one of the most misunderstood rules when we talk about drawing up a trading plan. Why? Because too many people are so obsessed with developing a setup to operate that they completely forget to look for outlets before entering the market. Although most traders are excellent at finding a possible way out, everyone likes to see how much money they have a chance of making on each operation. But not defining an exit point will prevent you from defining your R-value based on your potential loss.

In this heading of your business plan, you will want to define where the stop loss will be located as well as how to define your objectives. Speaking of objectives, you’ll also want to define in detail how you plan to get out of a winning operation. Will you go out of position completely to the first target achieved, or will you close only half of the position and keep the other half in play? These are questions that need an answer.

Risk Management

Setting rules to manage your risk is an essential part of a good trading plan. Even though you have already established where you will place your initial stop, you will also want to define how you plan to modify it as the operation develops, if you wish to do so. For example, you could use the highs and lows of the previous days to move your stops to safe places and insure profits.

The issue of risk management is what makes a trader. As we said before, it’s not your percentage of winning operations that makes you consistently profitable, but the amount of money you make with a favorable operation vs. the amount you lose with an unfavorable operation averaged over a long series of operations. And the only way to put the scales in your favor is with a solid plan for your risk management as well as a disciplined approach to implementing your plan.

What you do after each operation is as important as the way you mentally prepare before the operation. One of the most important rules is how long you will take away from your trading place before entering the next transaction. This is very important! After losing an operation, you may be tempted to take revenge and take back what you’ve lost. This is usually called revenge trade and is one of the reasons why so many traders fail.

The urge to jump immediately to the market after a winning operation is also very strong. This impulse is caused by 2 thoughts:

You feel invincible. That feeling that everything is going as you expect, so why not take another operation and earn even more money?

Building trust is one thing, but not being able to recognize overconfidence in key situations is called arrogance. And this one has no place in the forex market.

You feel like you have extra money to spend. The profits made in the last operation give a feeling of “I found money”, then no problem if I return some to the market. We call this “casino mentality”. It’s the same feeling that casino players get after winning $500. Instead of leaving with that money won, they immediately bet the $500 just to lose everything and a little more. You must use this part of your operations plan to redefine how to mentally prepare for the next operation.

Summary

The hardest part of writing your own forex trading plan is not defining your rules. The most difficult part is to include enough details to make it effective and yet be concise enough for you to use in practice. Remember that the idea behind putting together a trading plan is so you can go over it daily. This means that it must occupy 1 page (or 2 at most) and must be somewhere that is visible to you. It is our wish that this article has given you some practical tips on how to write a forex trading plan.