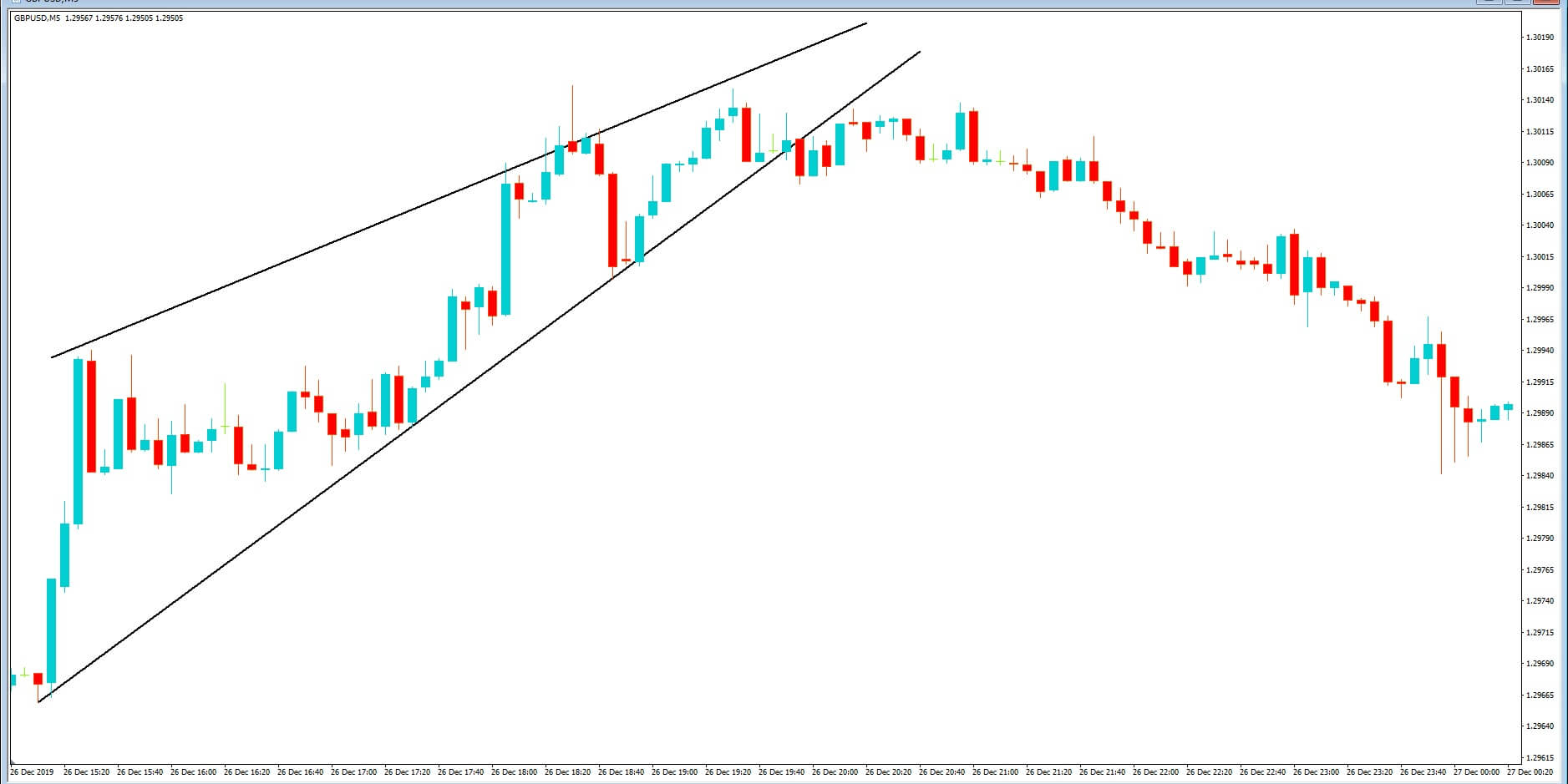

Hedging Strategy Via The Ascending Pennant Chart Pattern

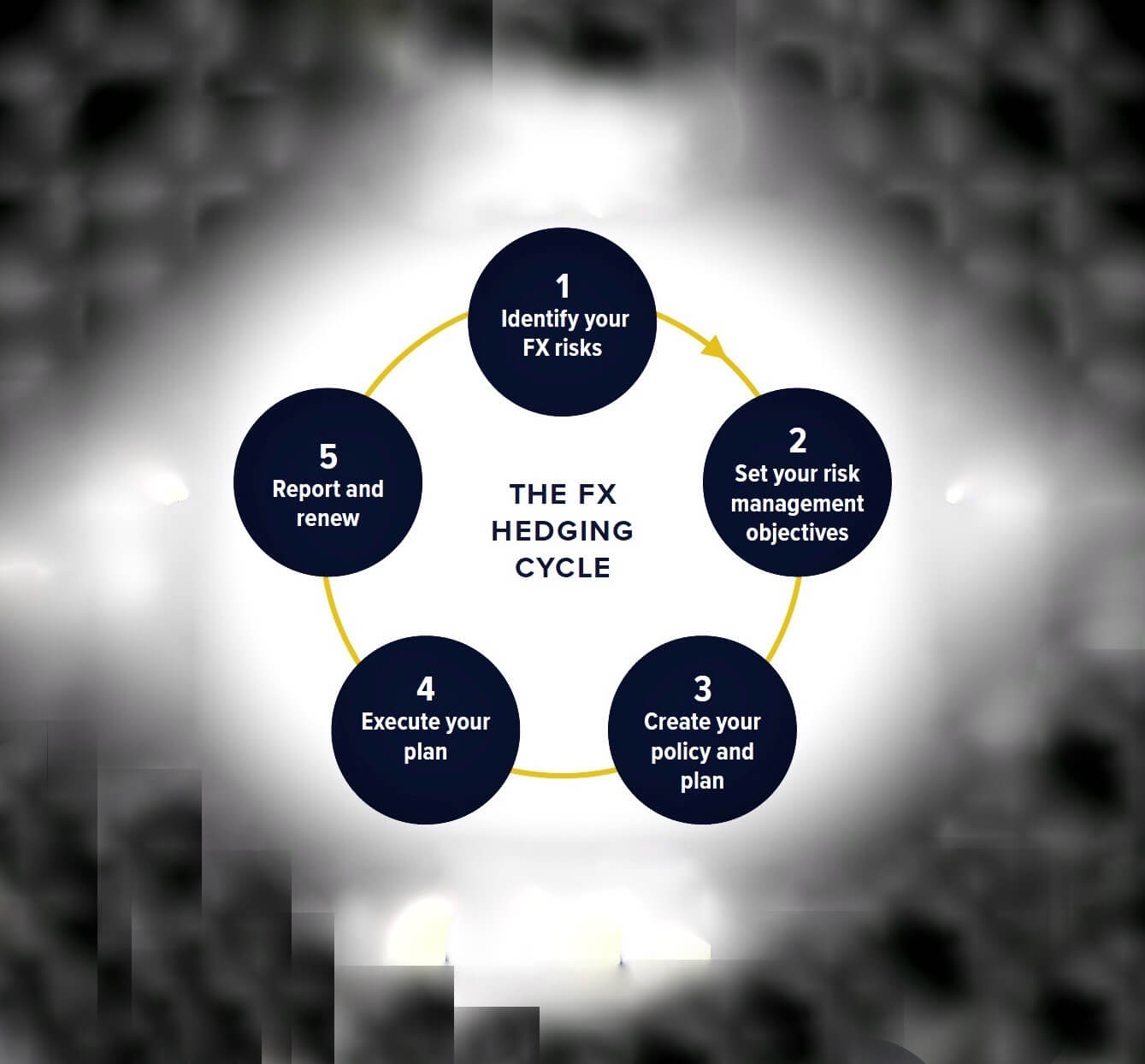

Today’s video is a follow on from our: Hedging – Making money no matter which way the market moves. So be sure and check that out if you missed it. The theory in this series is that we are looking to maximize successful trading opportunities from areas in price action that are likely to accelerate in either direction. And by covering both eventualities, we create a situation where we can capture the breakout in either direction, even if our initial trade goes against us.

There are various types of hedging, such as selling equities in favor of buying gold or buying one currency pair while simultaneously hedging the position by selling another pair, which might be seen as acting in confluence, in order to spread the risk.

But this is a different style of hedging, where we essentially set up two trades in the opposite direction, while incorporating tight stop losses and where trade one is based on a high probability of a correct move based on our technical analysis and where trade 2 acts as a backup trade, or insurance policy if the market reverses against our technical setup, which, unfortunately, can happen.

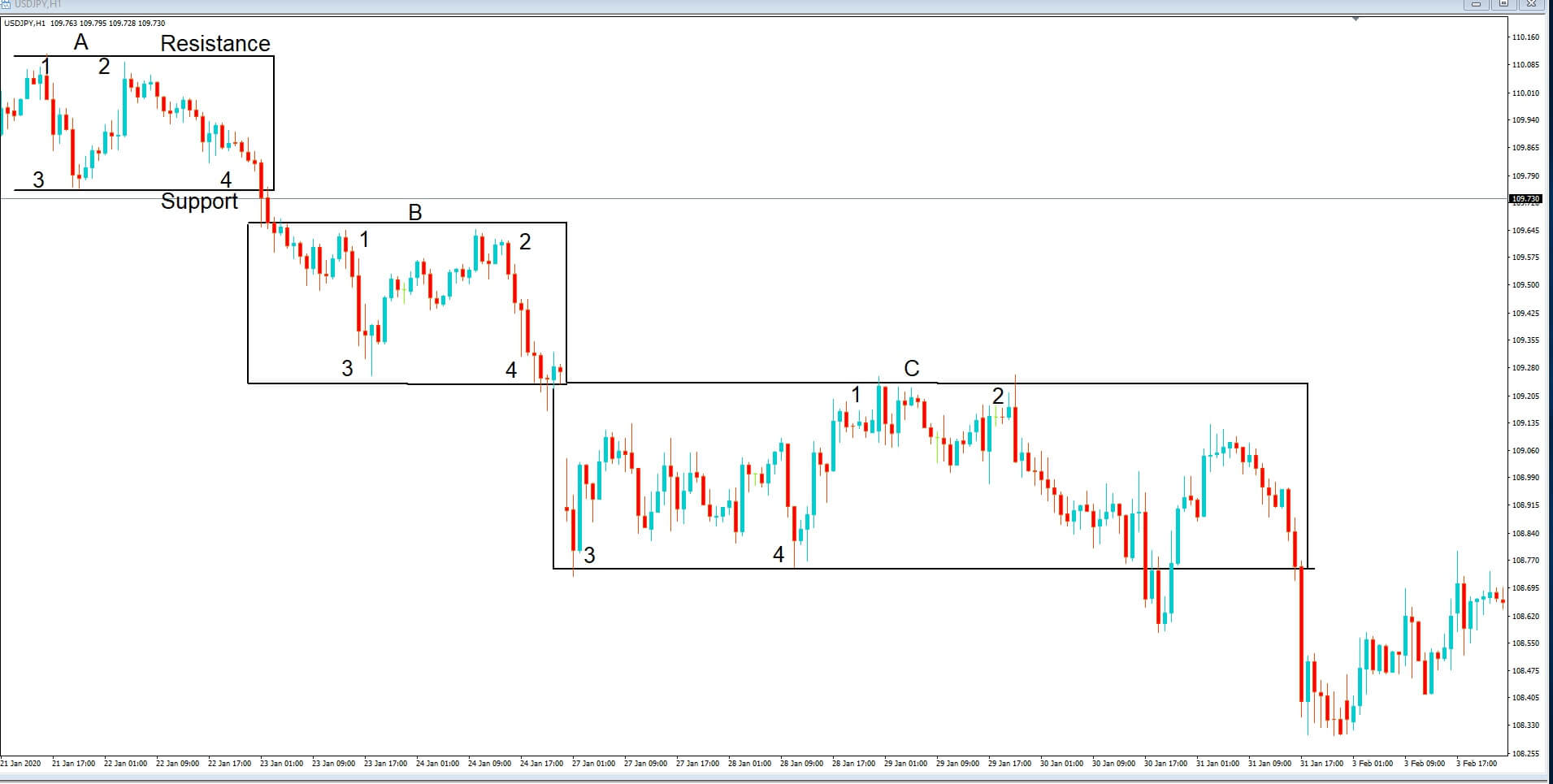

Example A

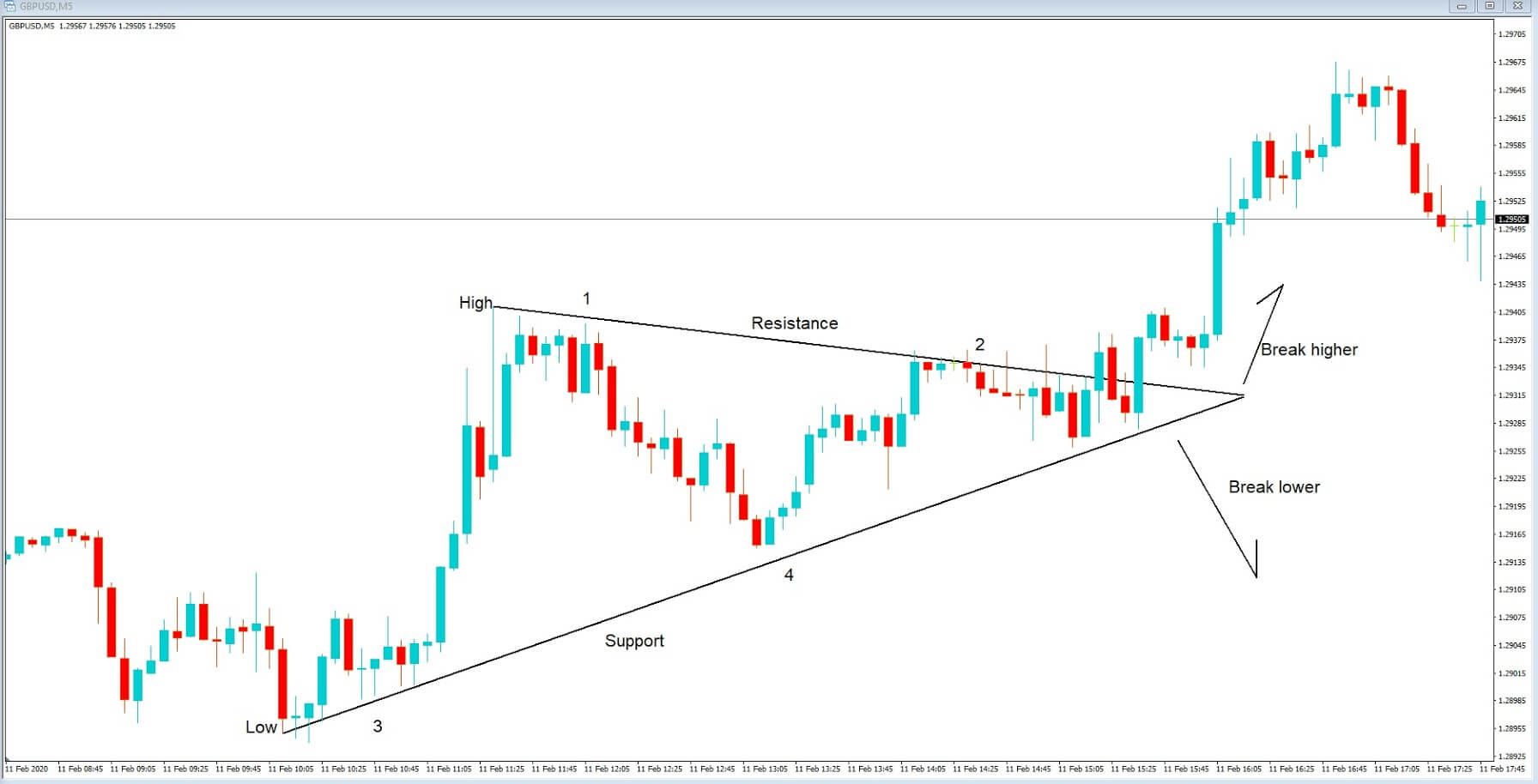

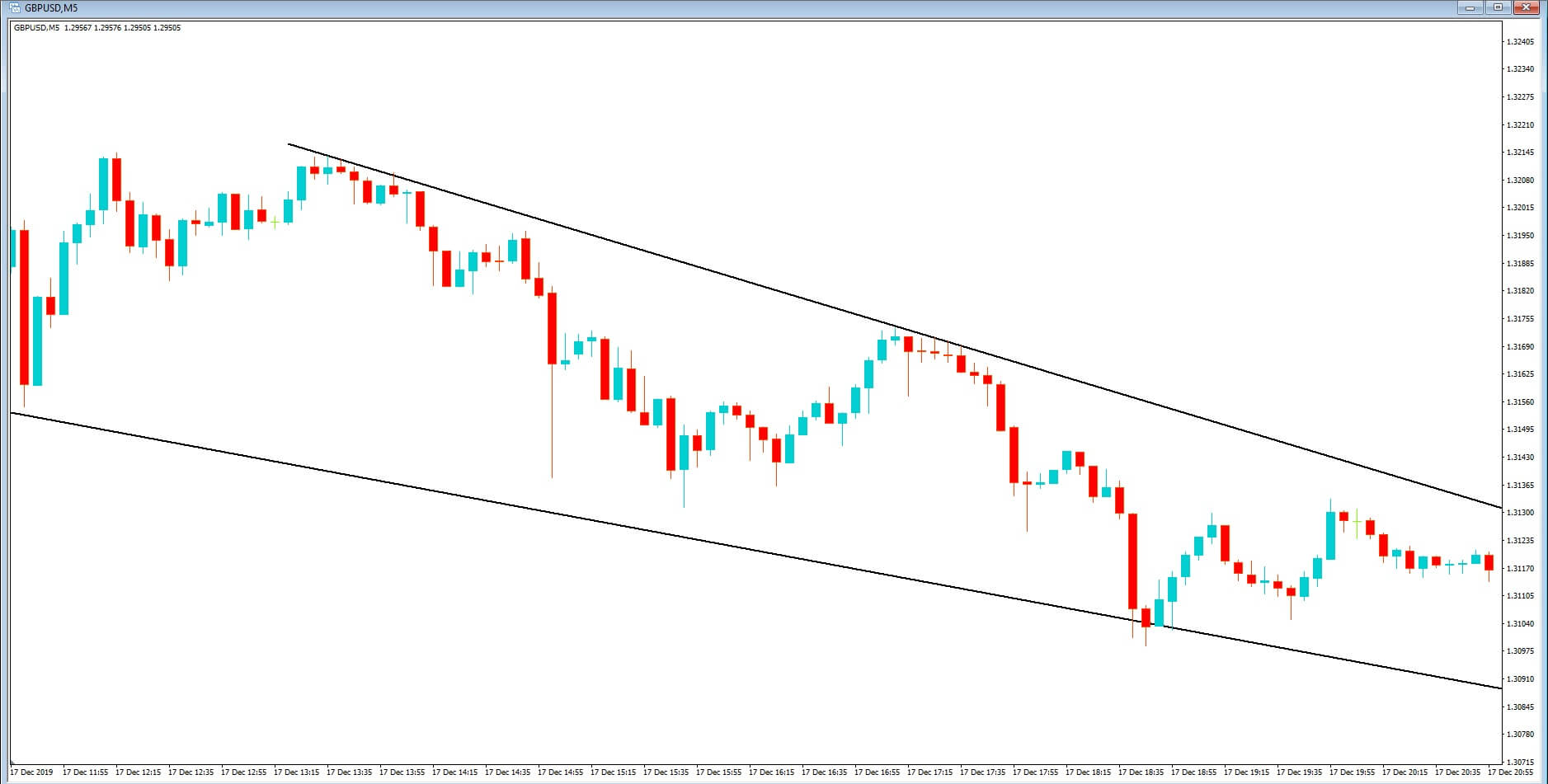

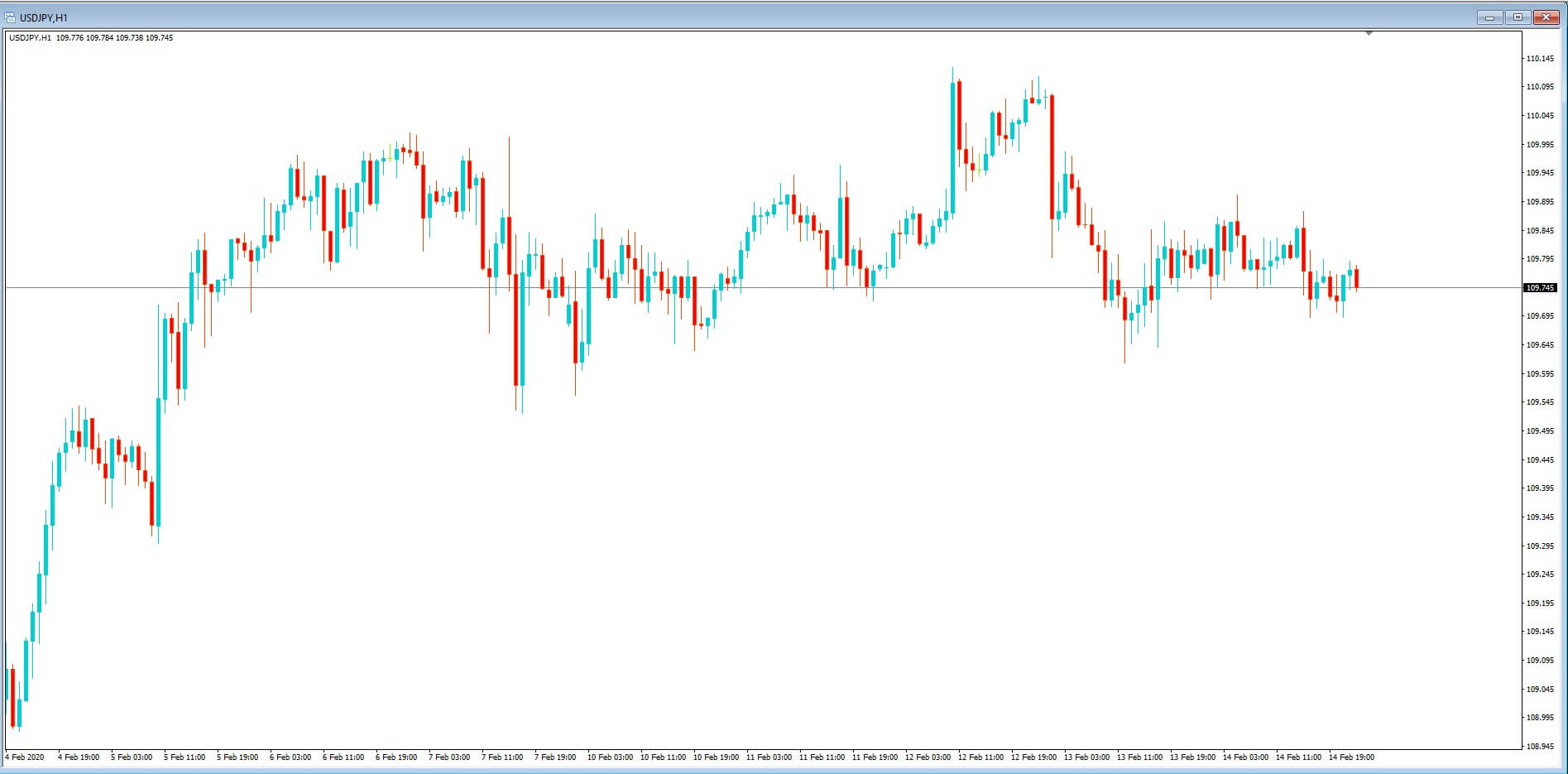

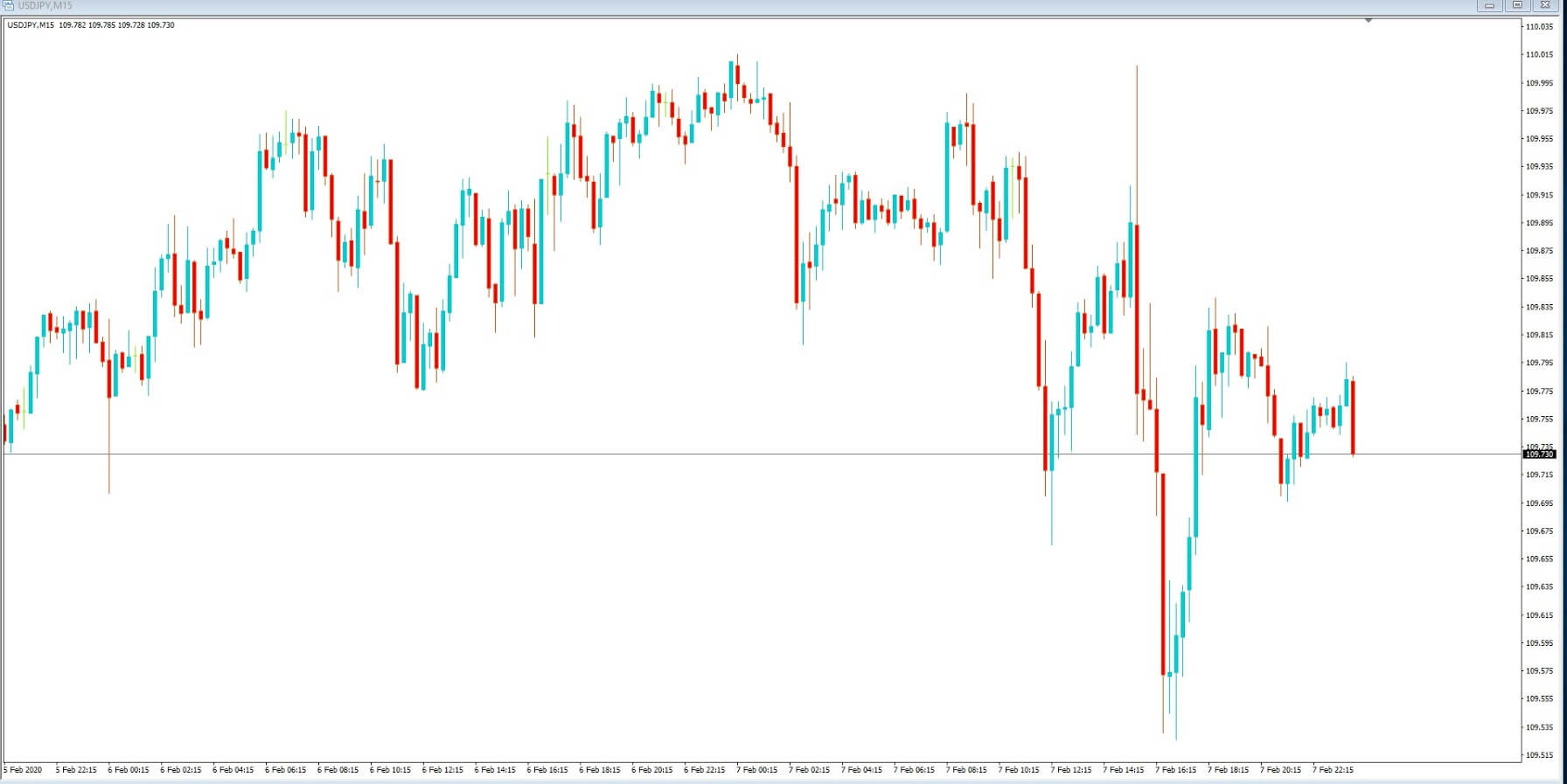

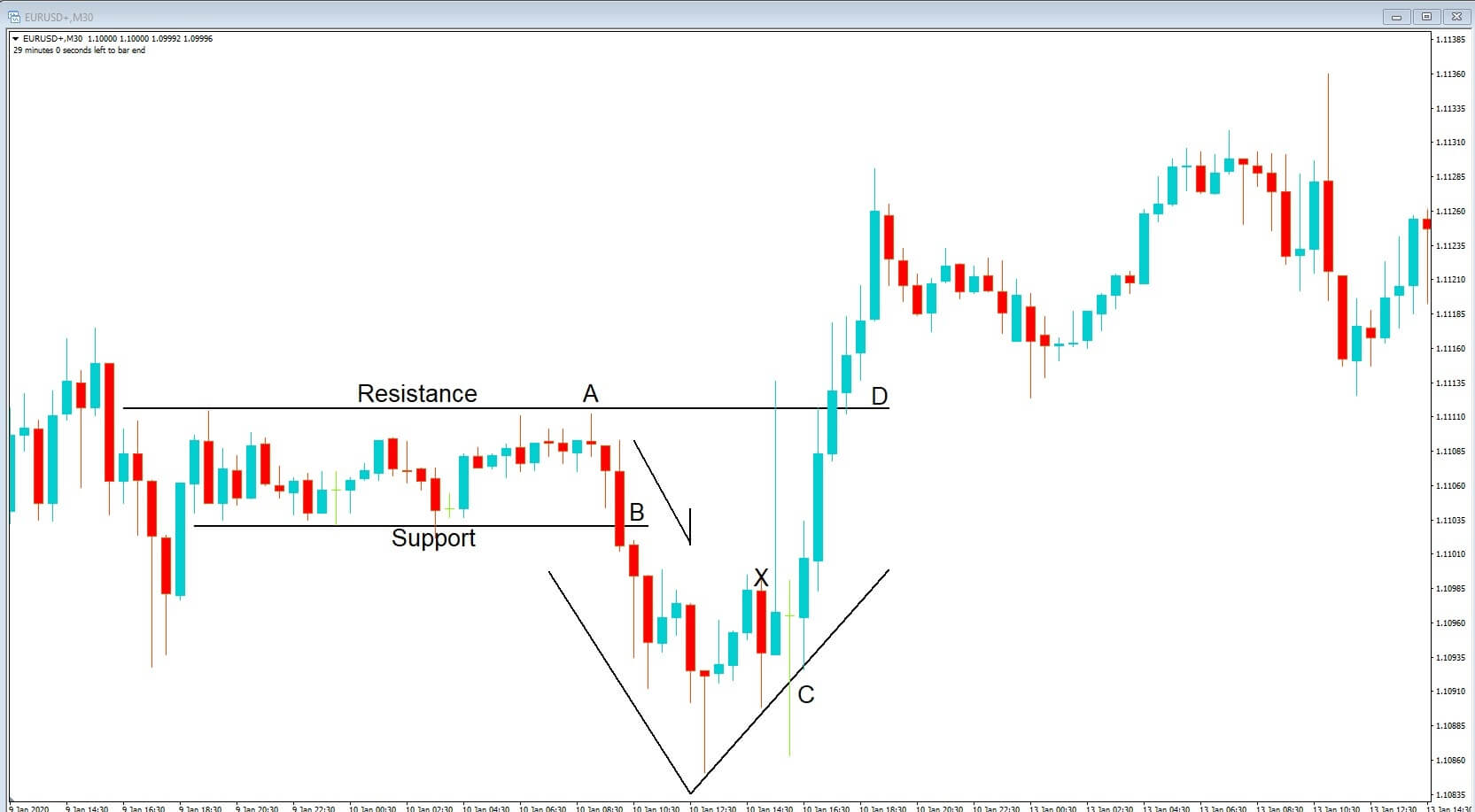

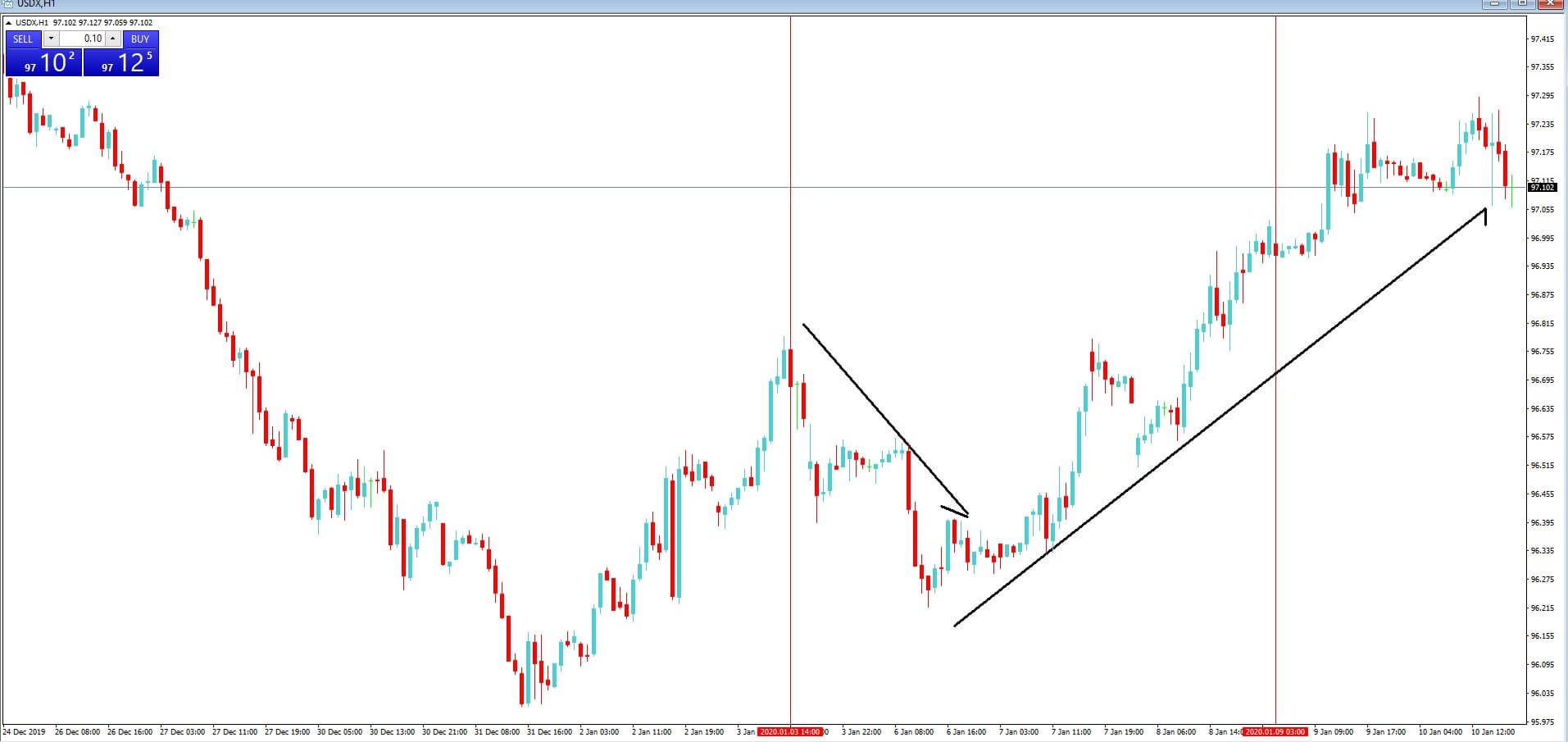

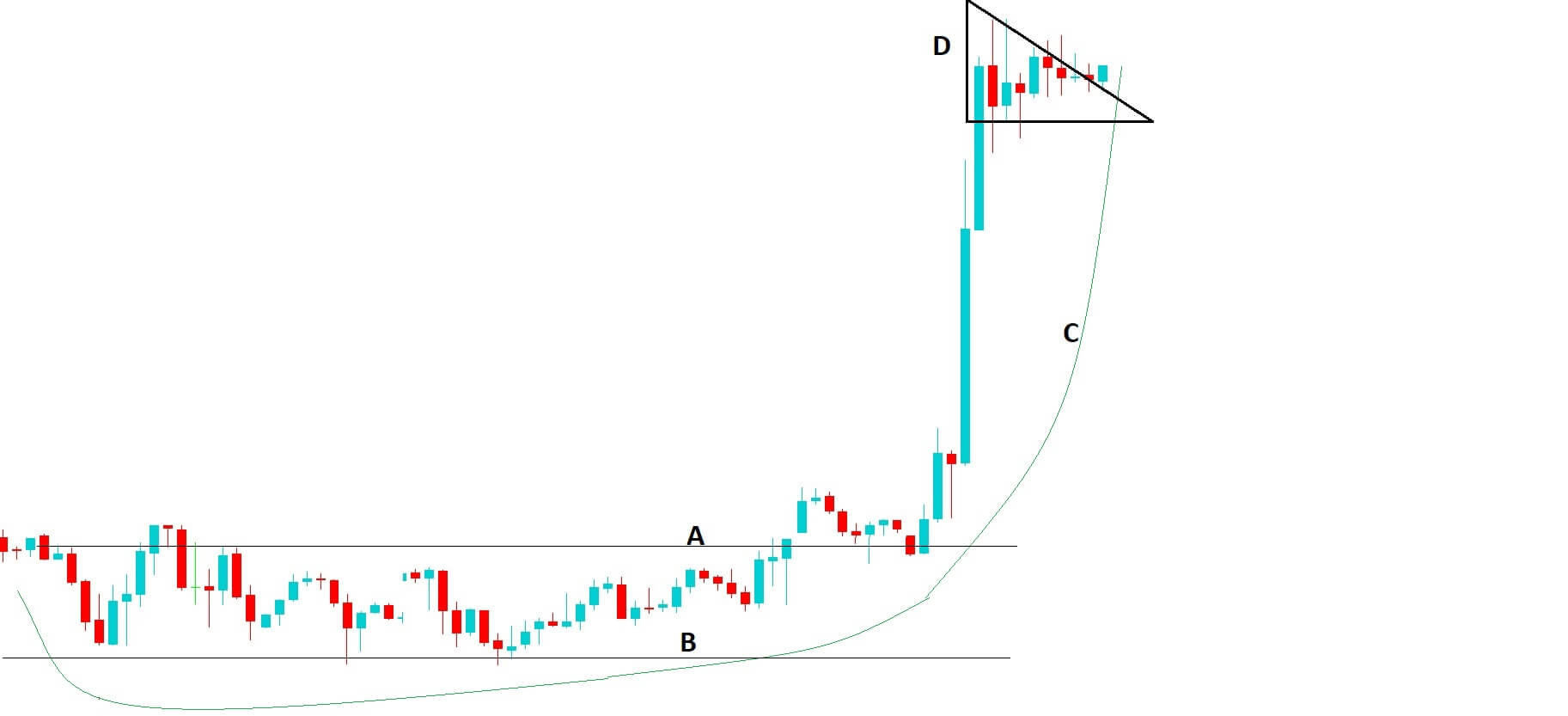

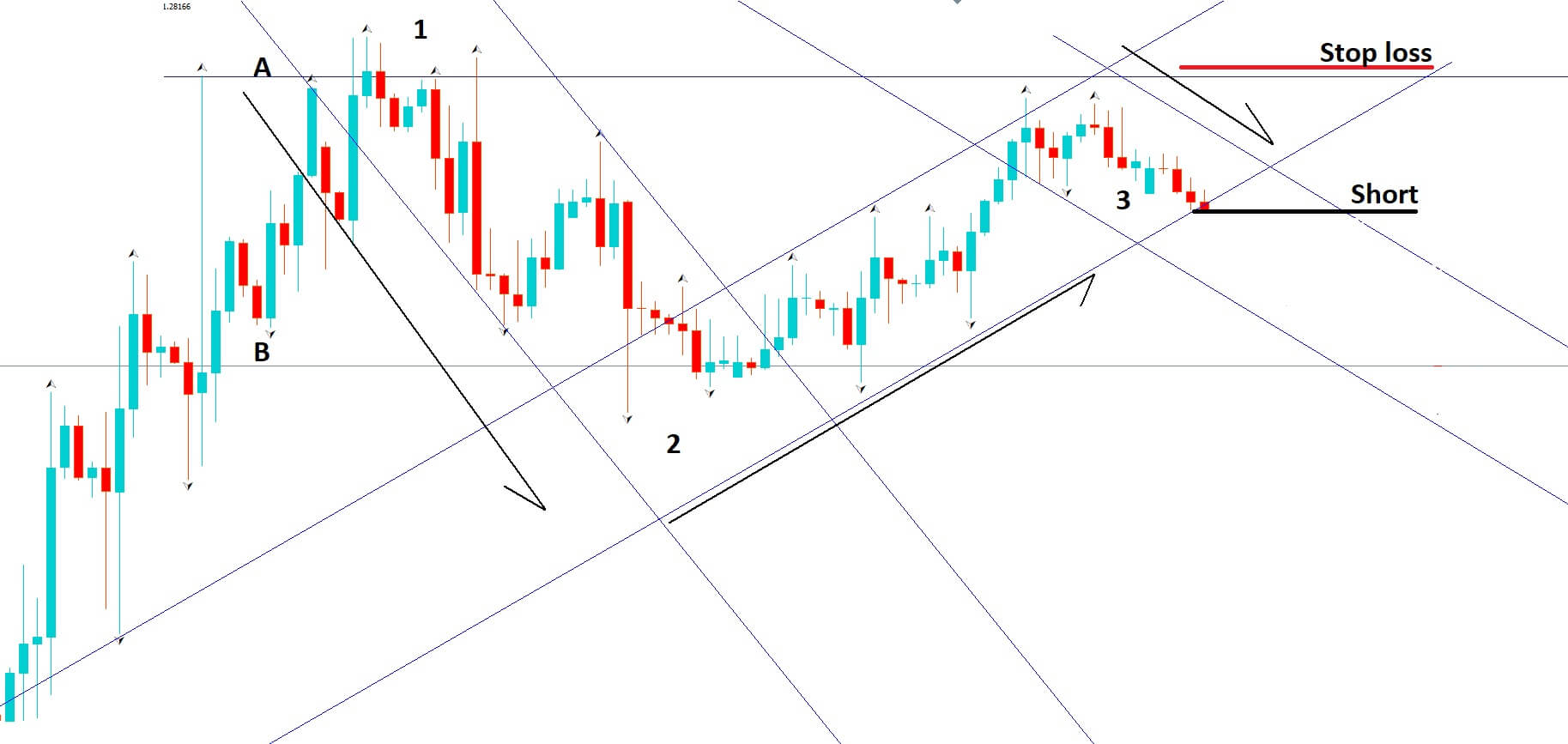

Let’s look at example A. This is the basic pattern you would expect to see on an ascending pennant pattern.

Example B

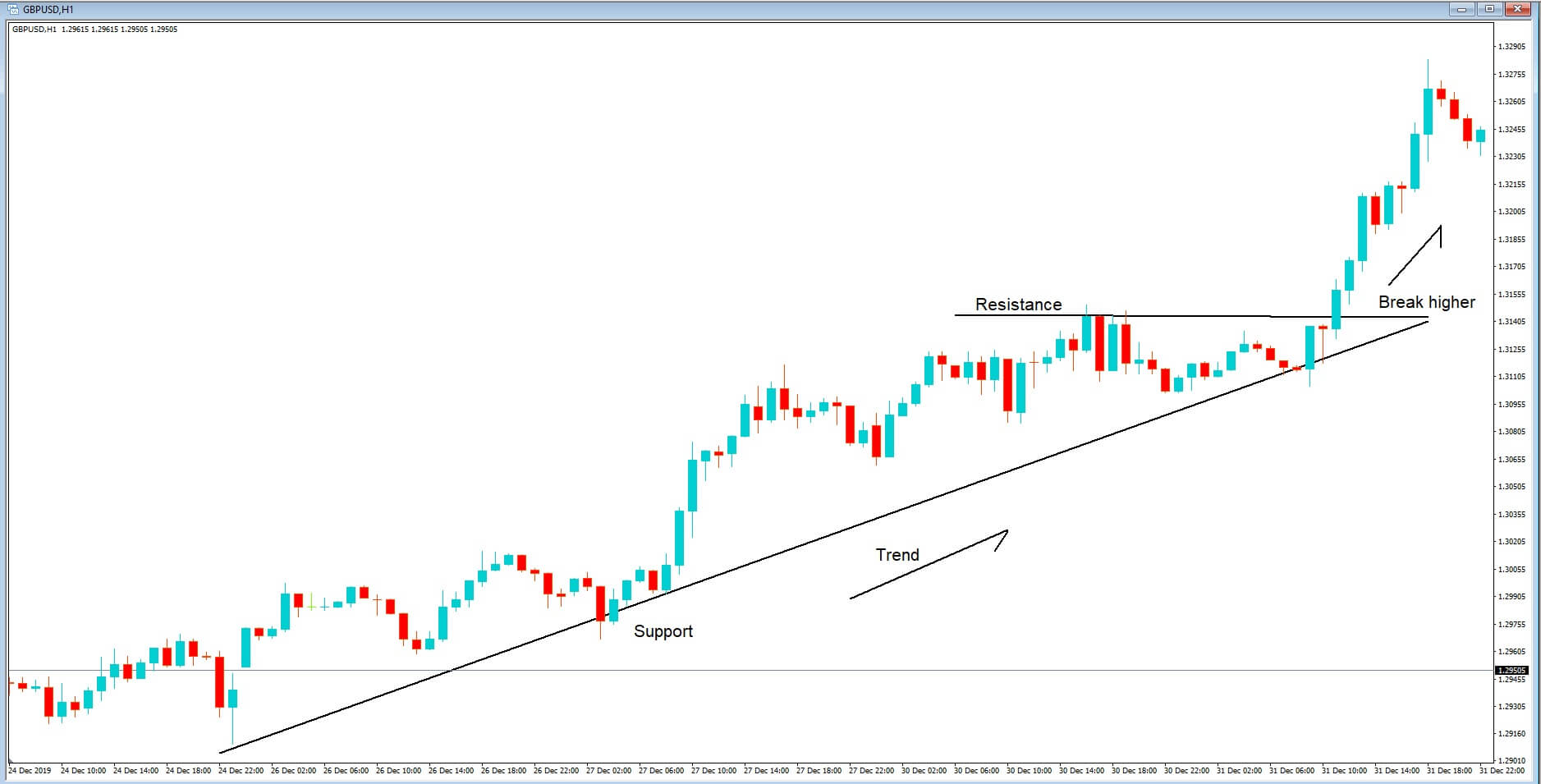

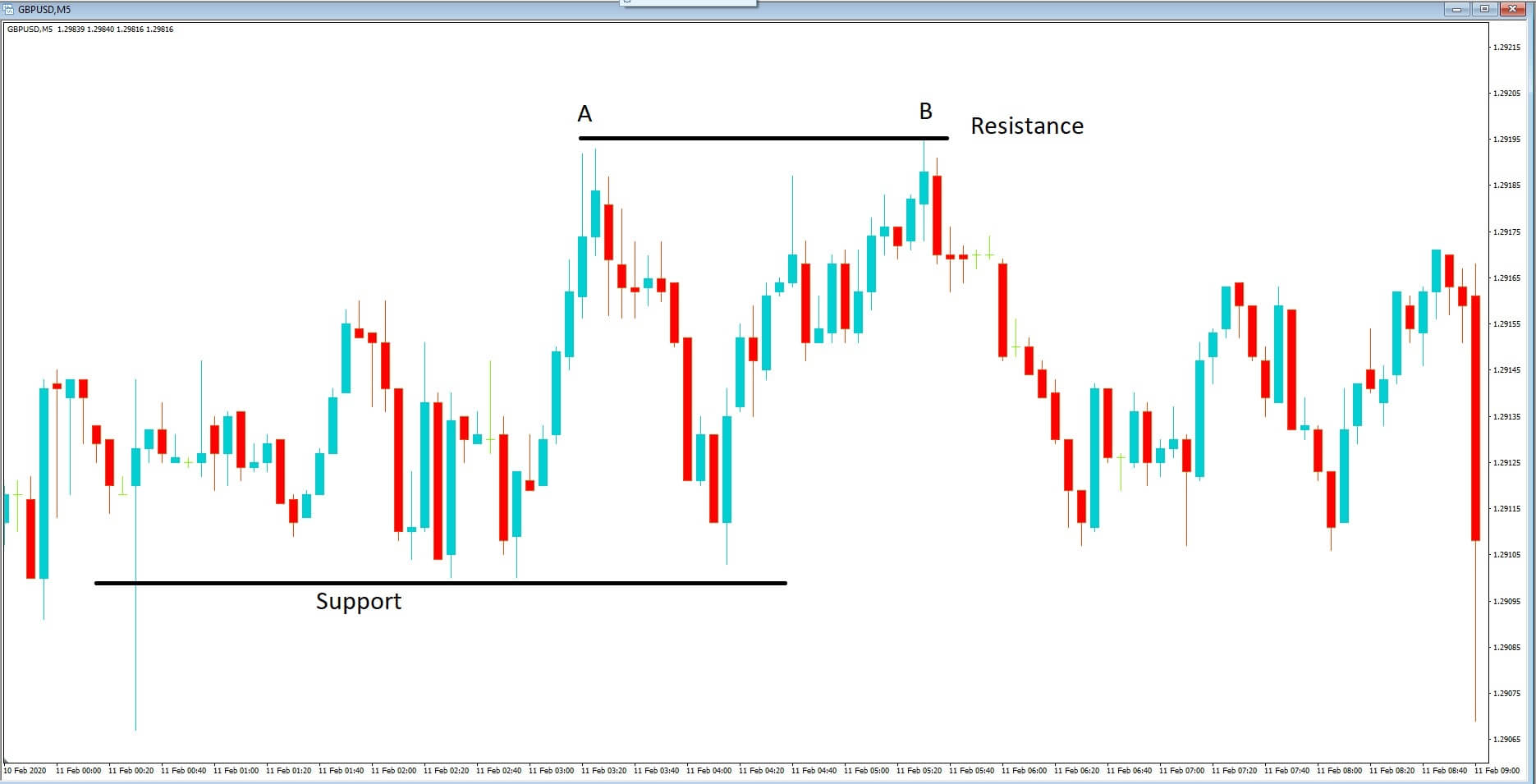

Now let’s take a look at this setup in a little more detail in example B. Initially we can see that there has been a period of consolidation, where price action is conforming to an area of support and resistance at positions A and B, and where price action remains above a key moving average, which is gradually moving higher, in line with price action, which eventually breaches the area of resistance at position A and a short while after finds support at that level, before continuing higher.

At the top of our charts, at position D, we have a wedge shape formation, which confirms our bullish Pennant chart pattern. Price action has consolidated within the wedge and is beginning to break out from it in an upward direction. From this setup, we would have very good technical grounds to believe that the buyers have got hold of this pair at the current time and that break from price consolidation within the D shaped wedge is likely to be higher, in continuation of the overall trend.

Had you not already been buying into the trend, this is the point at which you might want to seriously consider buying the potential continuation.

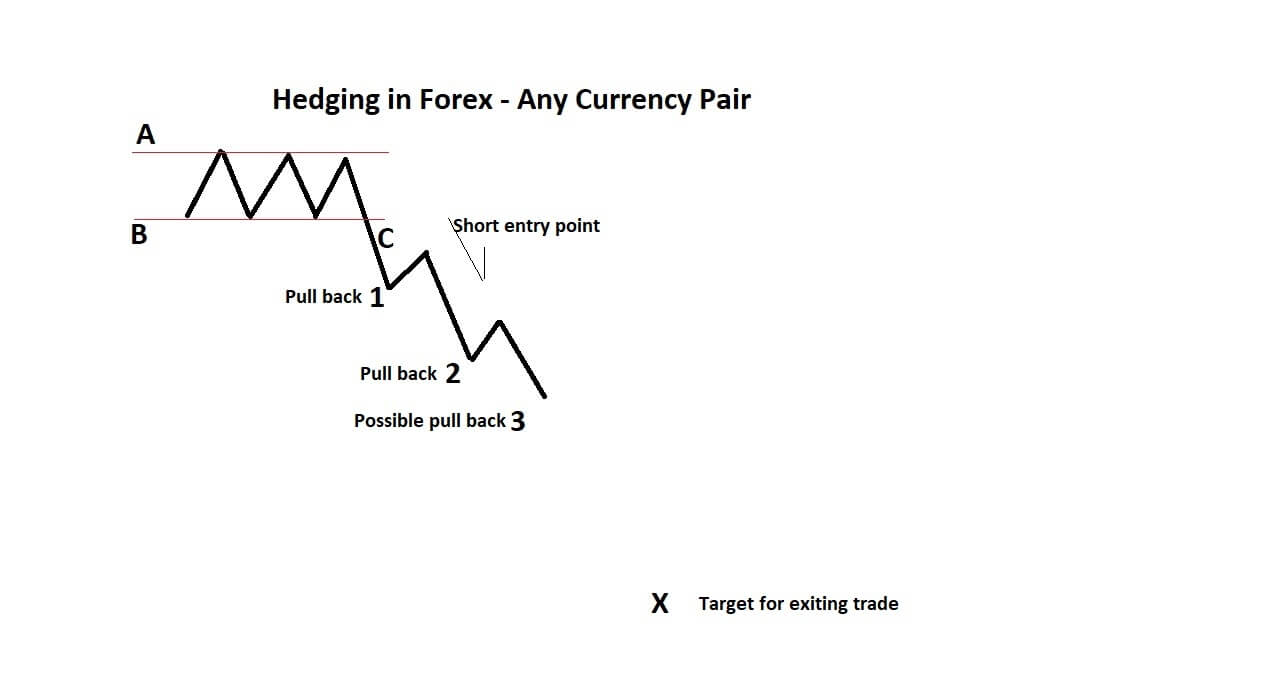

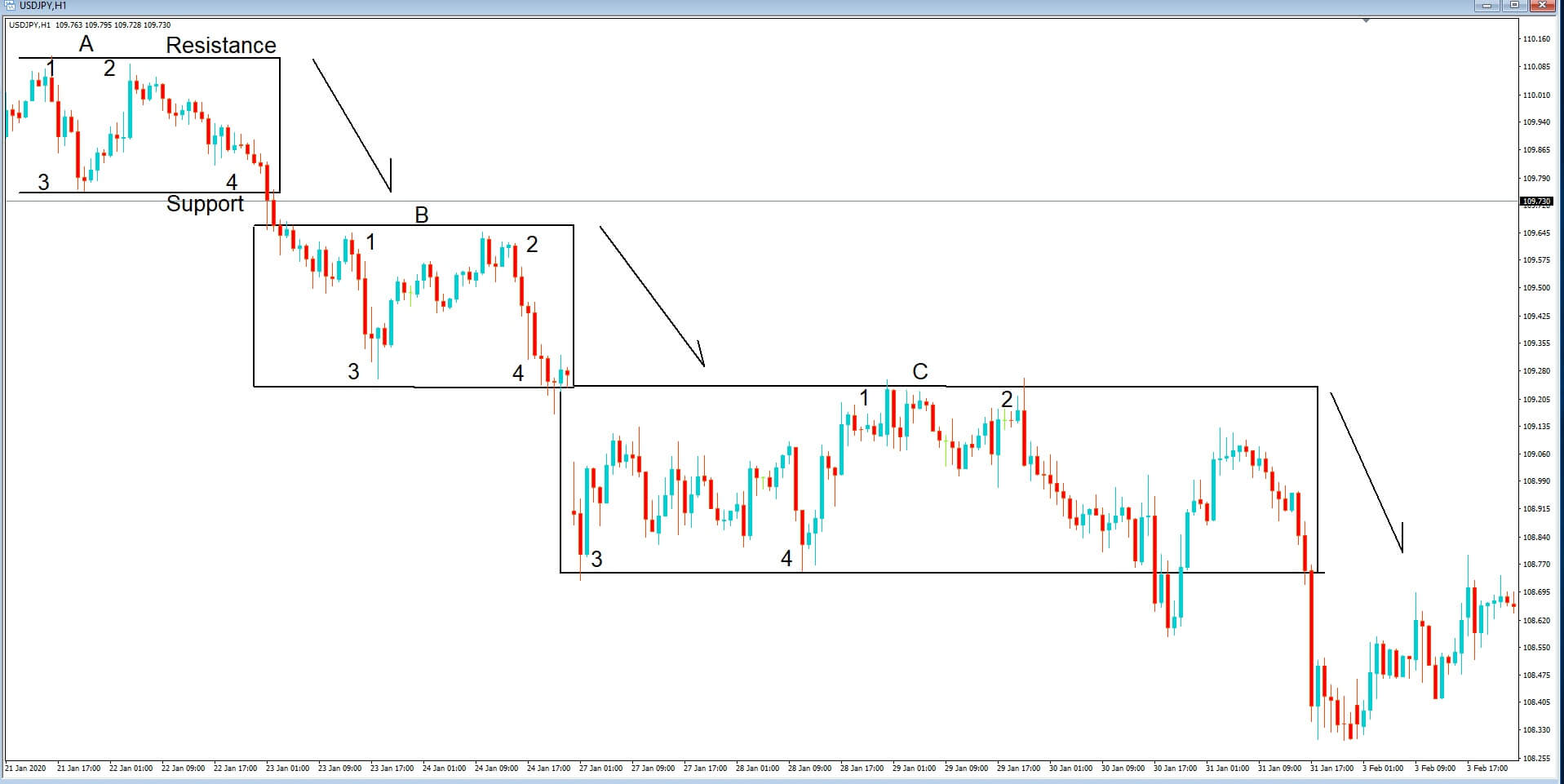

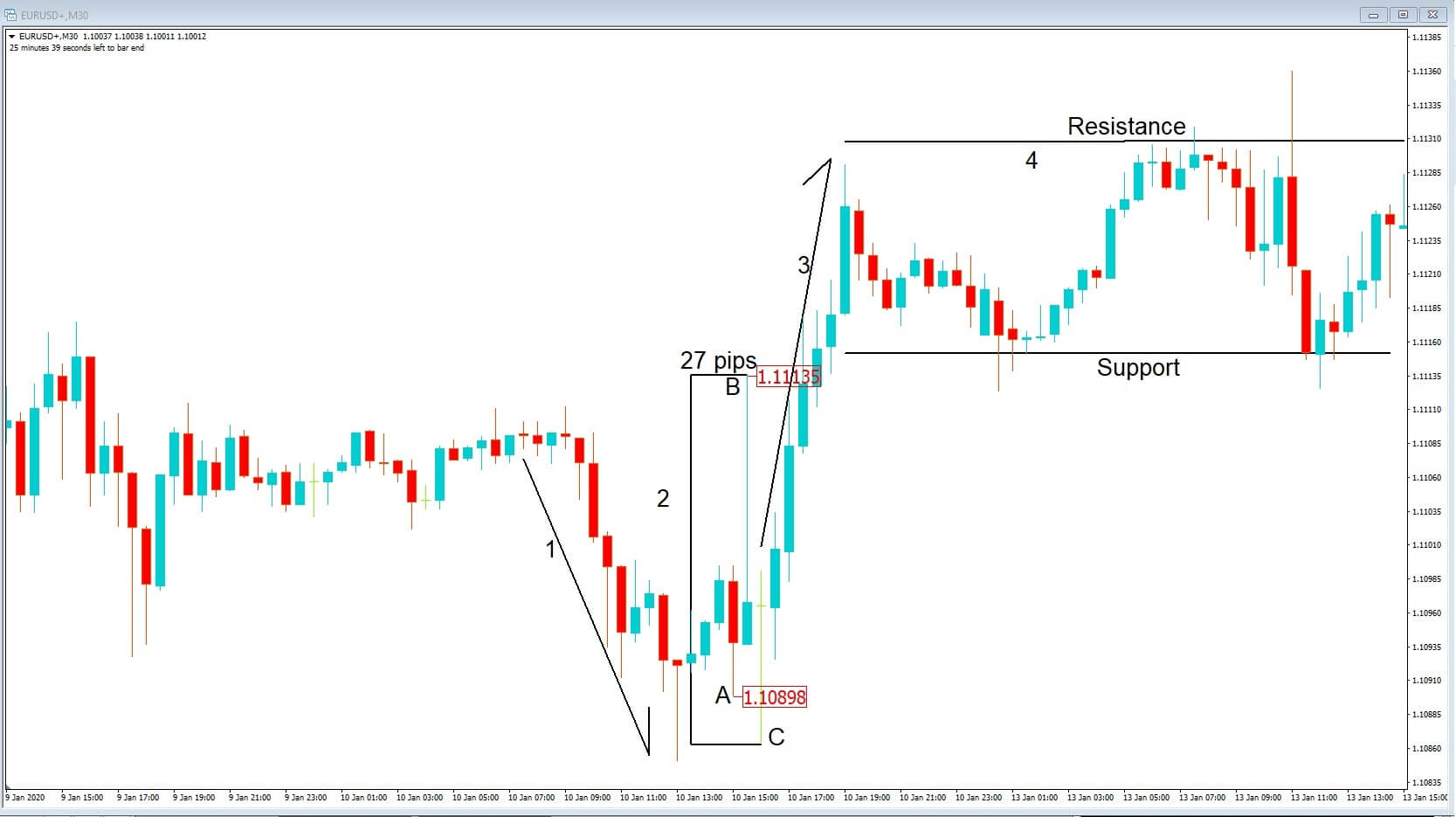

Example C

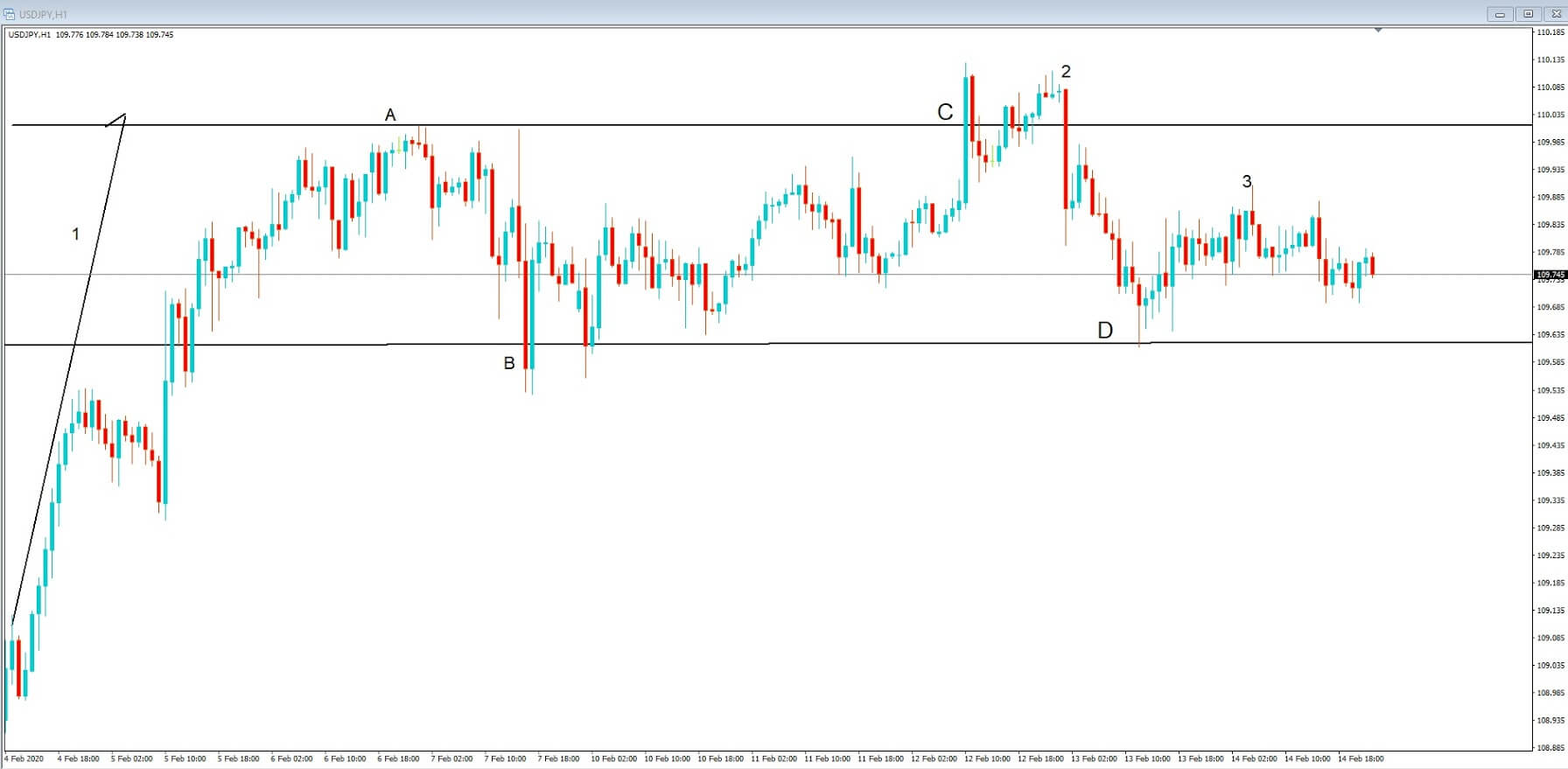

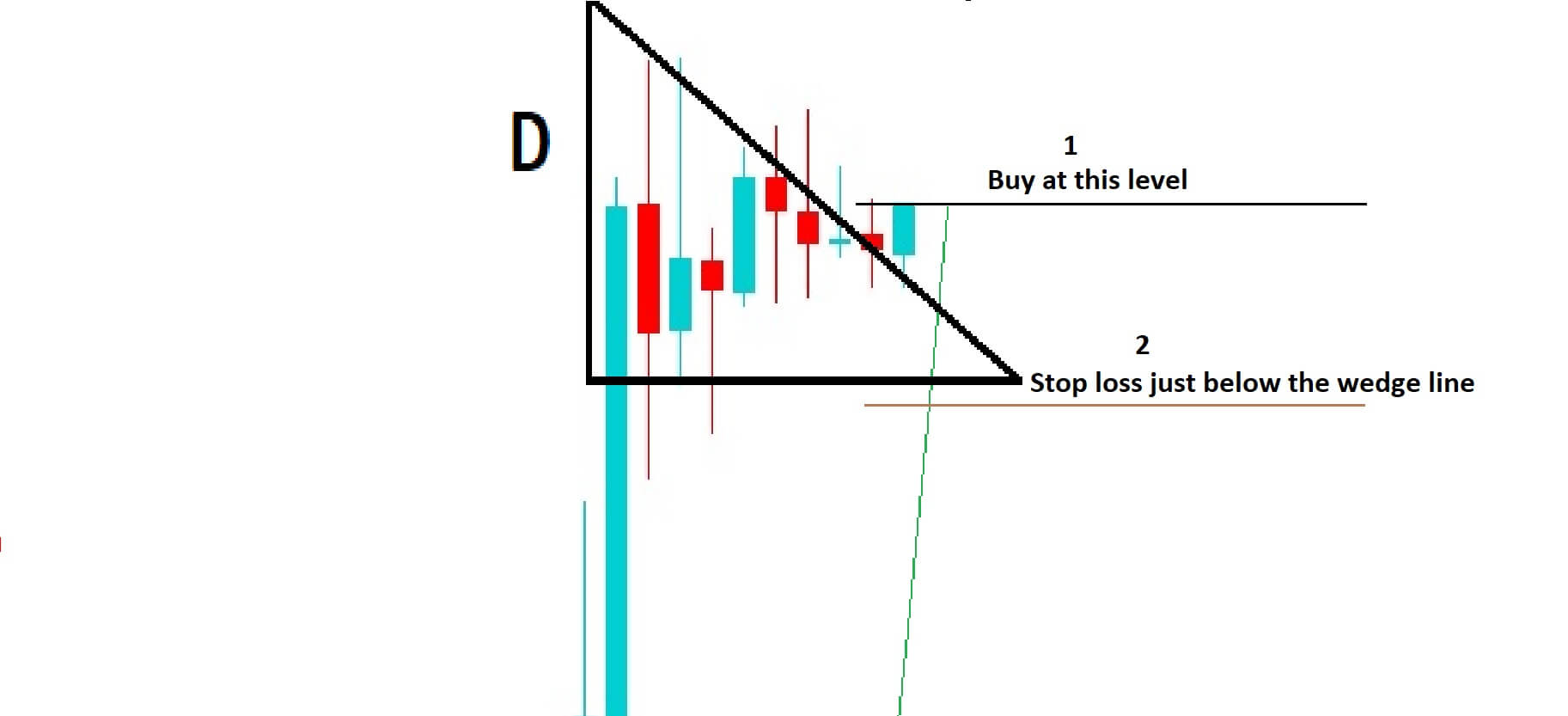

In Example C, we are going to implement our hedging strategy with an immediate buy order at position 1, and a stop loss at position 2.

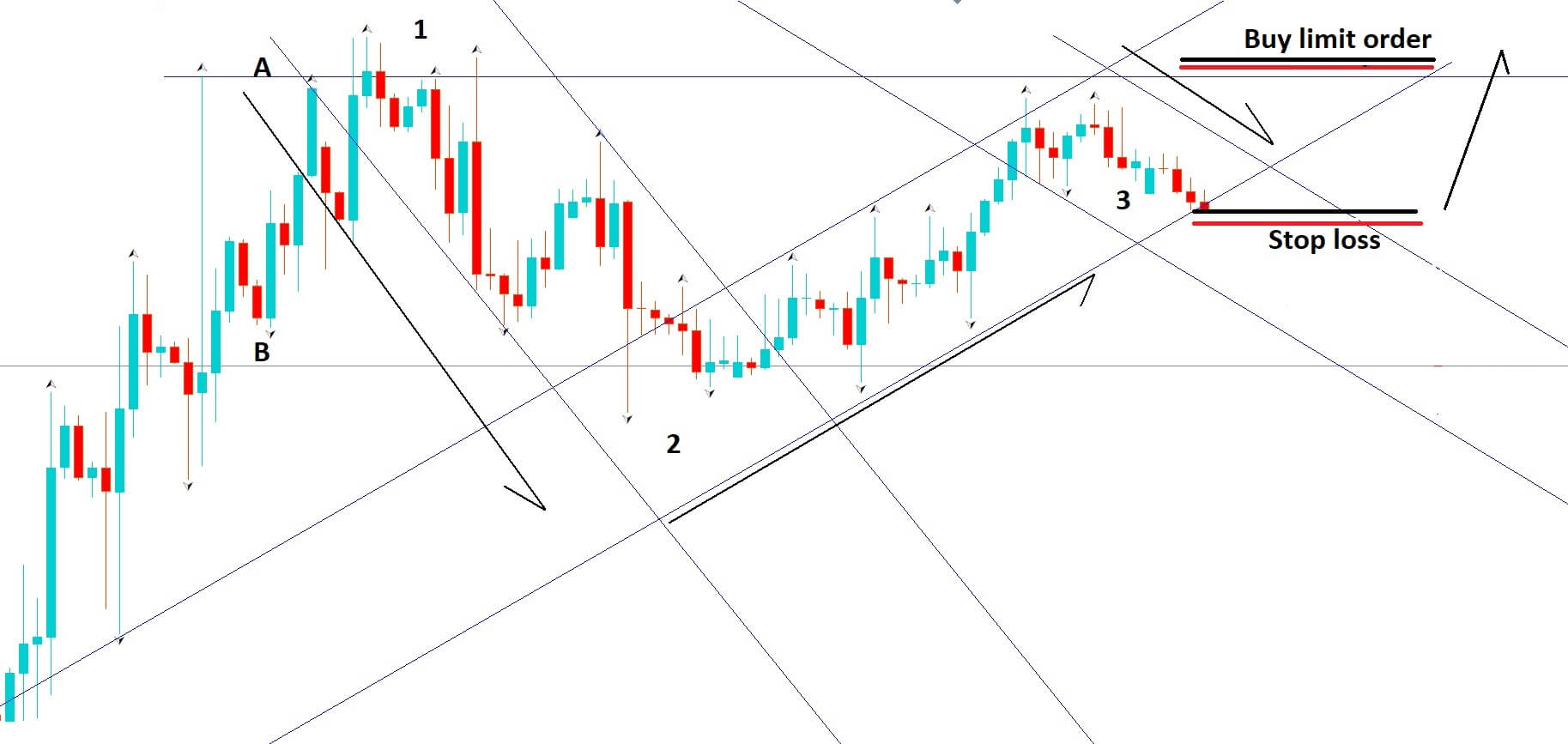

Example D

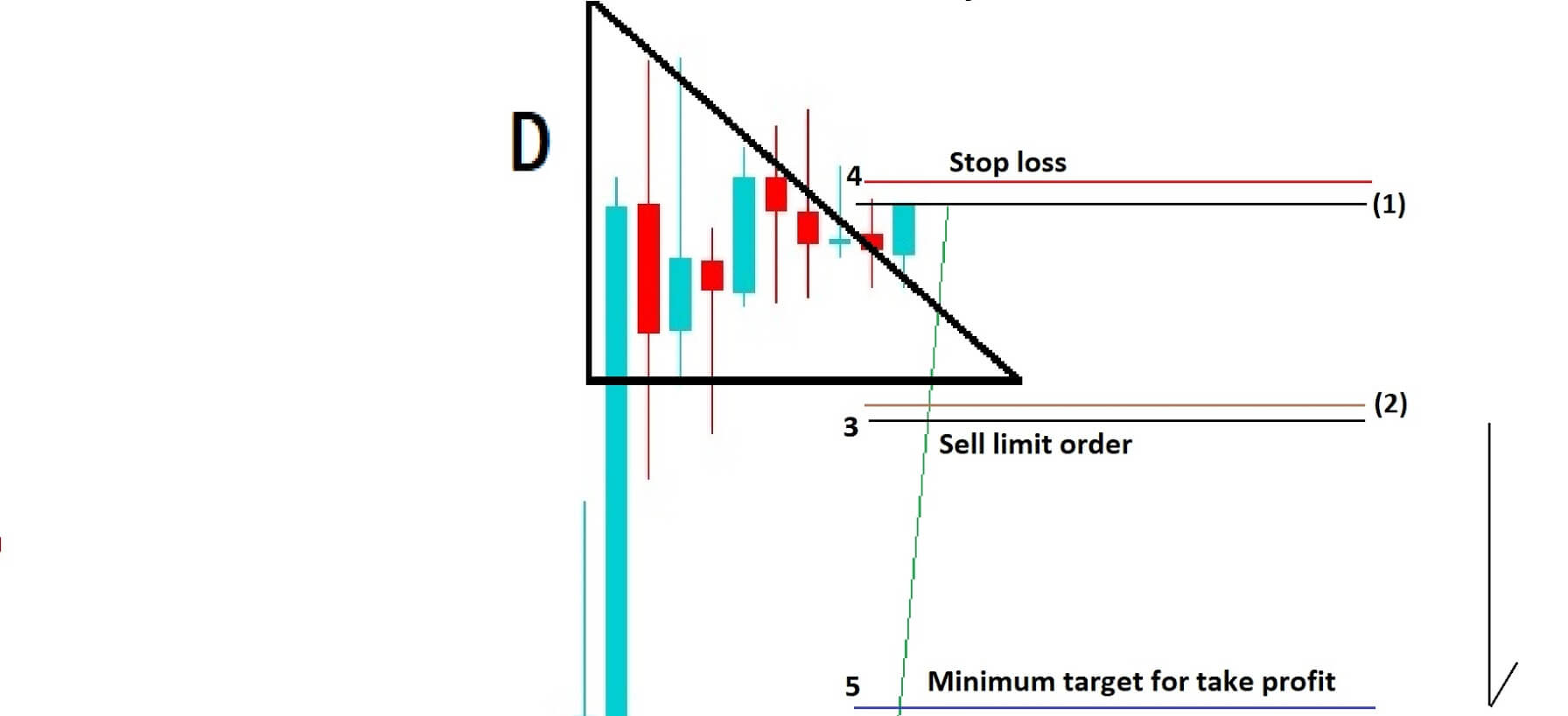

In example D, we are going to set up our backup trade in the event that our first trade reverses.

First of all, we are going to put a sell limit order just below the stop loss of our first trade at position 3, and we will place a stop loss for this second backup trade just above our entry of the first trade at position 4. We need to place a take profit at around the area or position 5, which would be equal to at least the amount that we lost in our first trade in order to rebalance our profit and loss. In this a hedging strategy, we have covered all the bases regarding strict observation of technical analysis, and we have carefully placed our orders in order to capture the breakout from this ascending

pennant set up. We have also carefully mitigated against the risk of a price reversal by incorporating a backup trade.

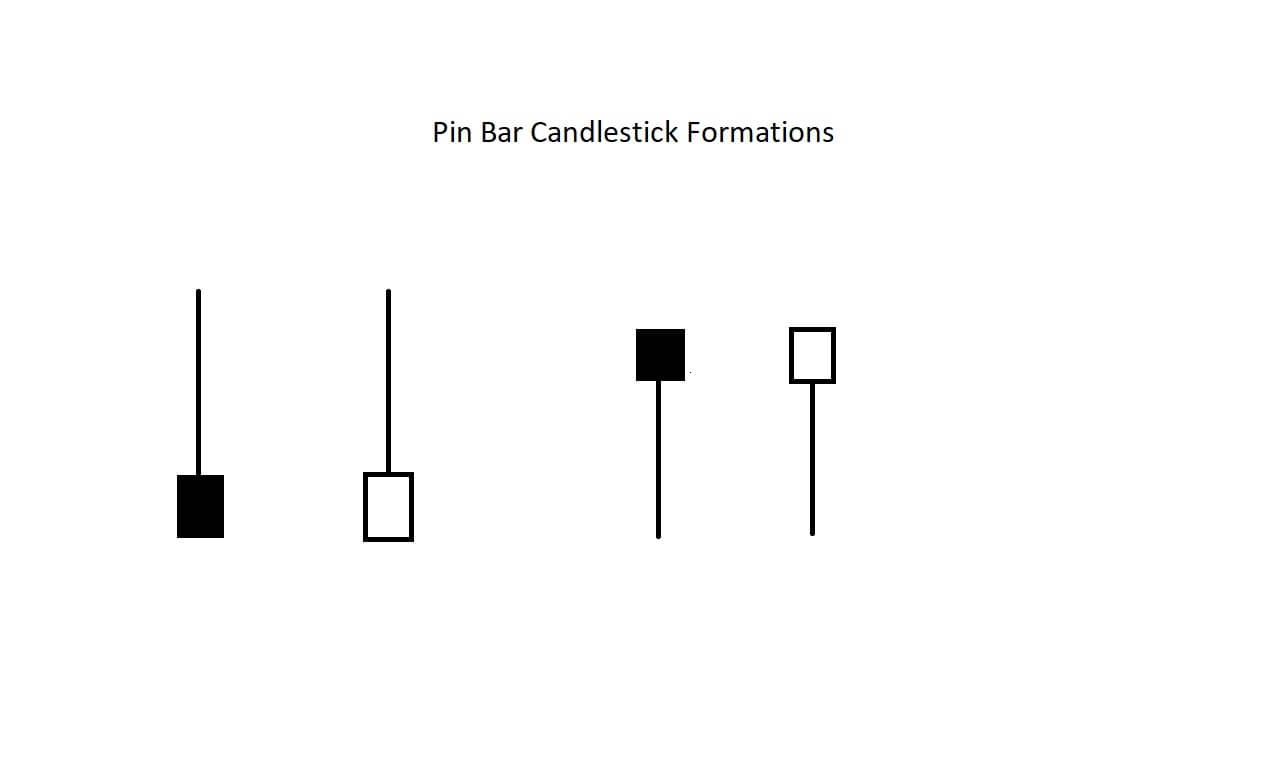

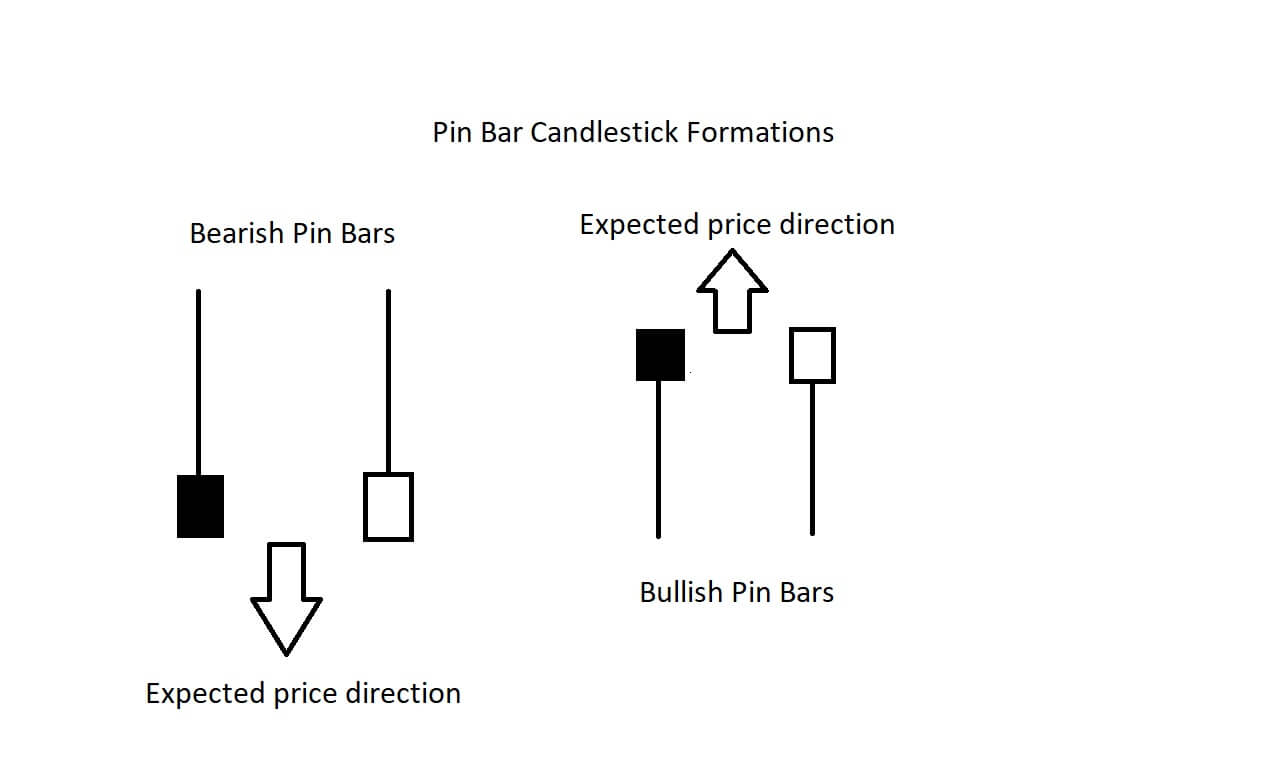

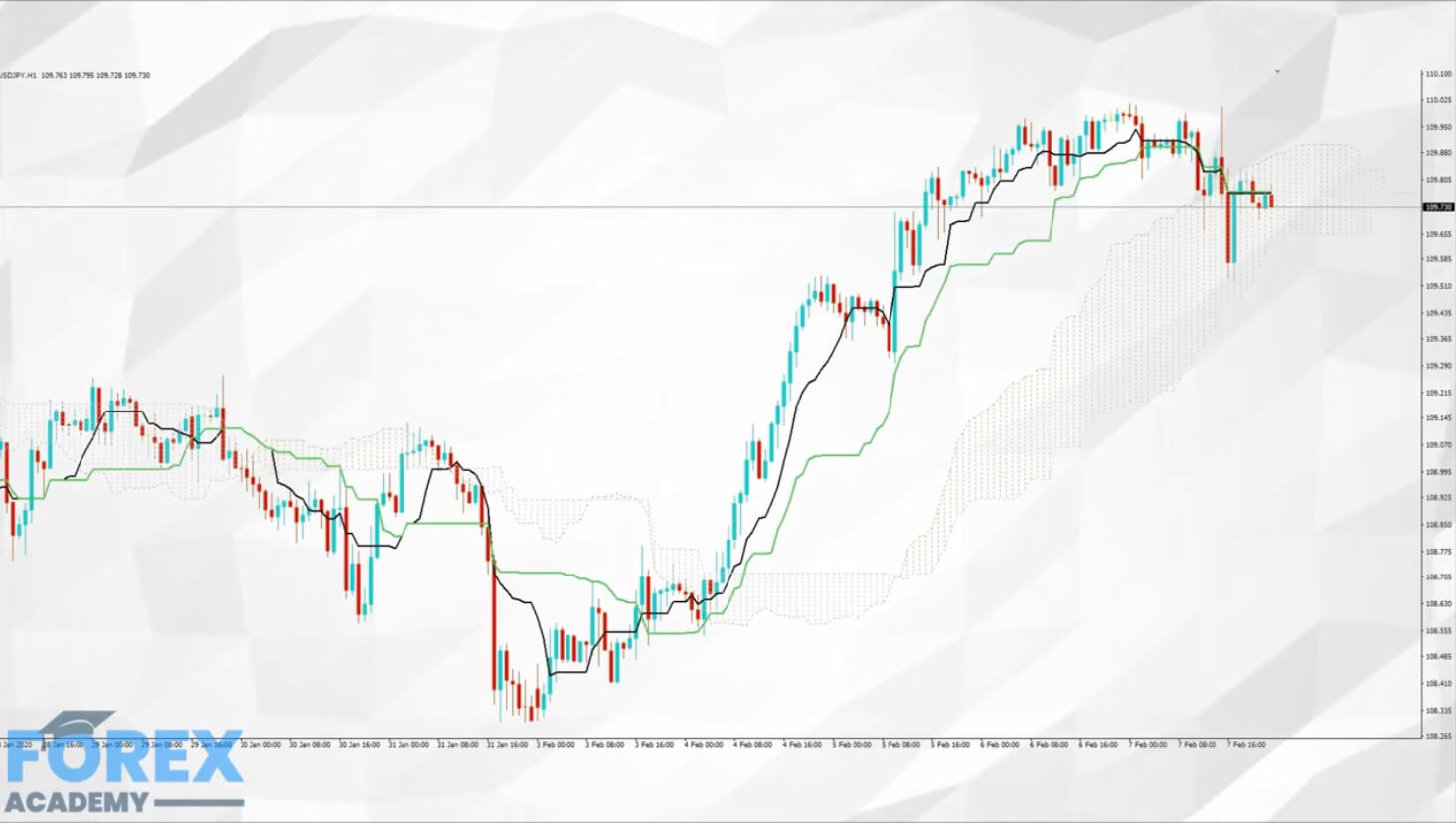

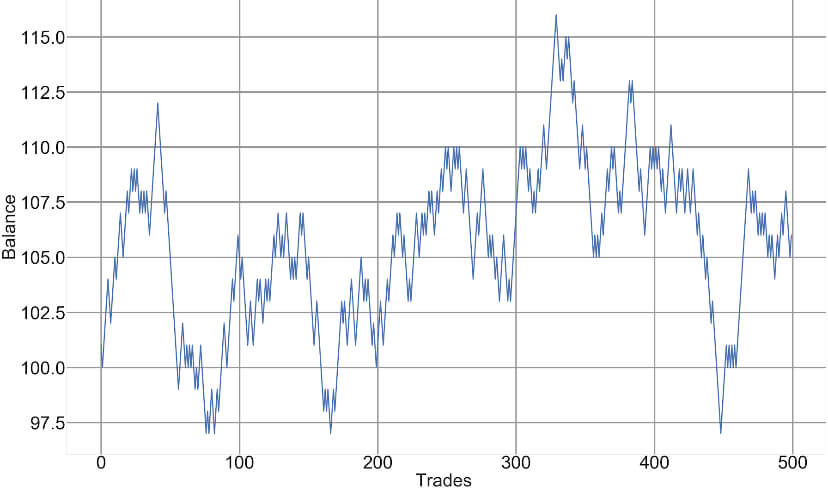

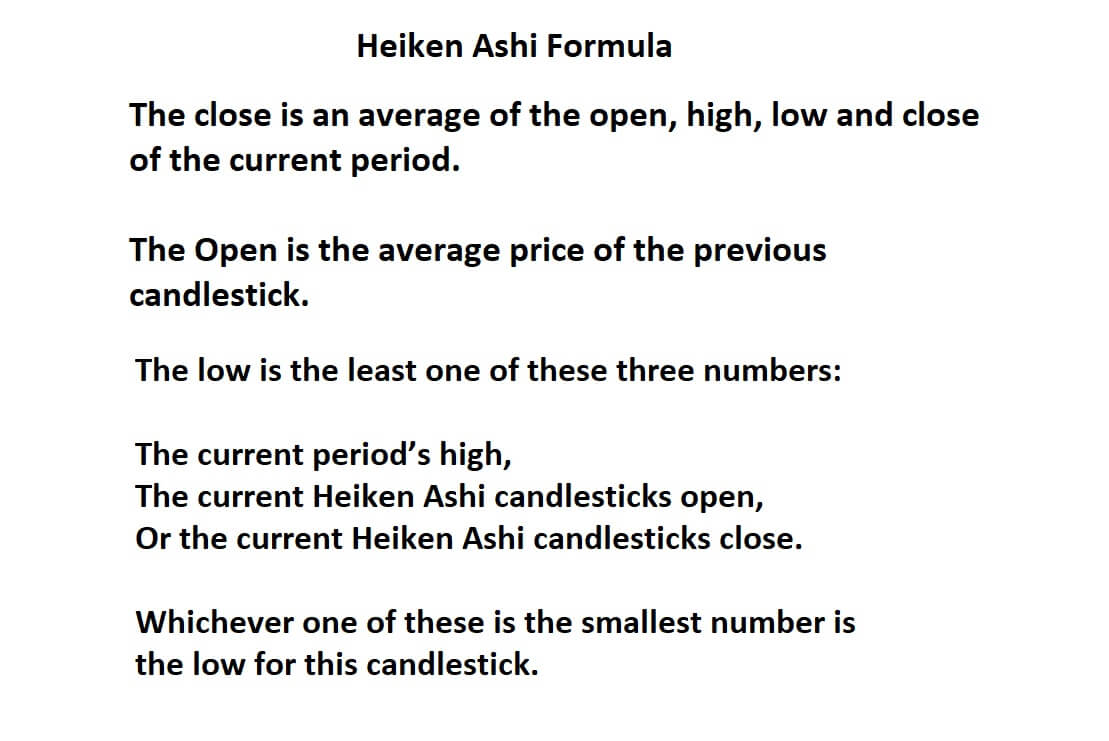

The close is an average of the open, high, low, and close of the current period. The Open is the average price of the previous candlestick.

The close is an average of the open, high, low, and close of the current period. The Open is the average price of the previous candlestick.