Hedging – Making money no matter which way the market moves

In this video, we are going to show you how to make money by using a hedging strategy that will take advantage of a breakout move in the market, no matter what direction. There are many different styles of hedging, and while some are implemented to protect profit and loss, The following strategy has been developed to maximize opportunities increase the chance of profitability know matter which way the market moves, and hence to create more money-making opportunities with your trading.

If used correctly you will be able to regularly make money using this strategy. Hedging sounds like a strategy that is too good to be true, however, we back up this strategy with a clear and precise methodology, while looking for breakout strategies that professional traders use every day in the Forex market.

Therefore the basis of this ageing strategy is that it should be implemented at such points that markets have consolidated, or has reached high or low peaks which are right for a reversal in price action. With the correct implication you will be able to make money even if you have a short position and the market goes against you, or if you have a long position and the market goes short.

This strategy consists of two parts, the initial trade and a backup trade.

First of all let’s look at a potential set up before we implement this strategy.

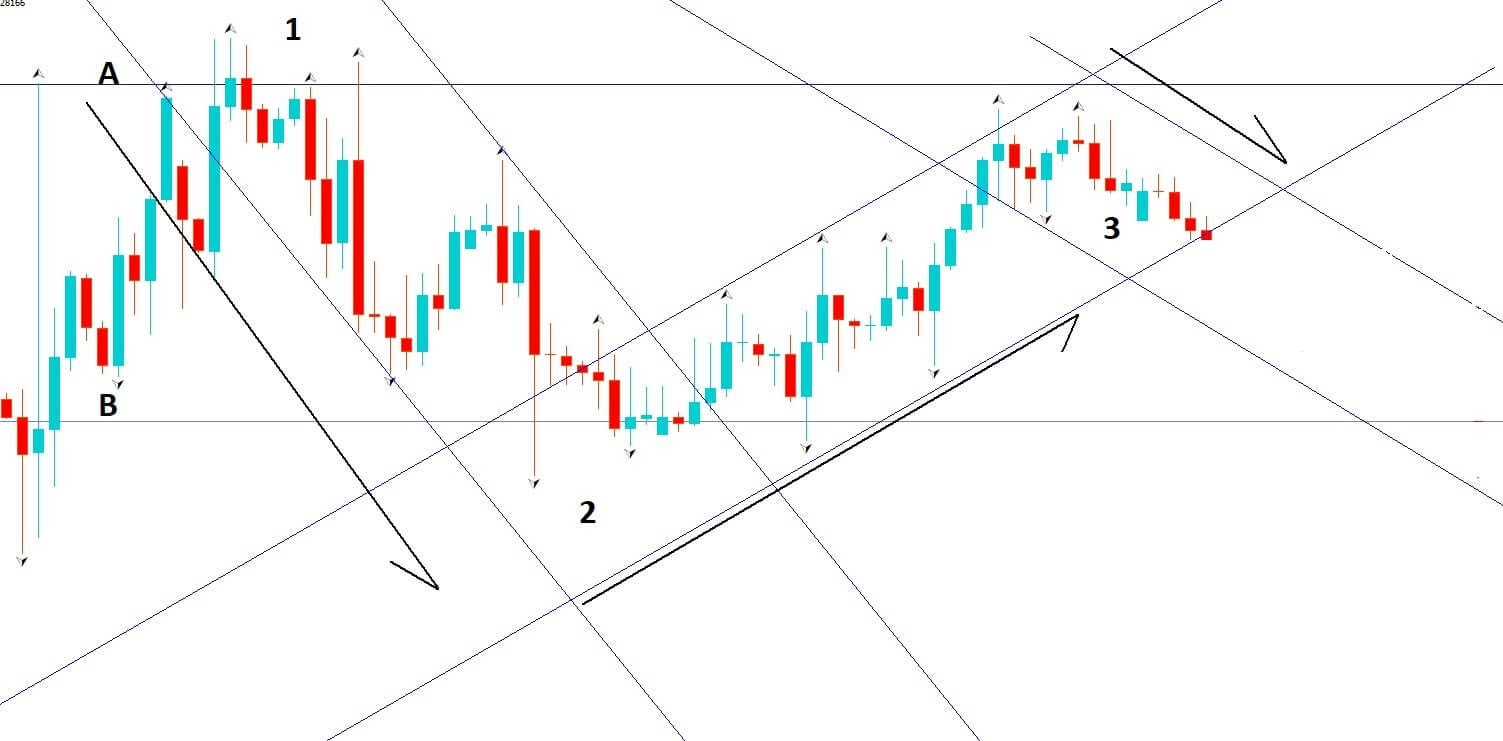

Example A

Example A is a pretty standard screenshot that you will see on any of the forex pairs. We have two key horizontal lines A&B and where they would typically be a big figure, or whole numbers, such as 1.2800, which you might see in cable currently, or 1.100, which you might see in EURUSD.

In our chart, we can see that price action has been moving between the two key levels in a series of channels. At position 1, price is rejected and moves lower to position 2 in a channel, and is rejected by the lower key level and moves higher in our second channel from position 2 to position 3.

Critically, price fails to reach the key level or line A. Secondly, we have a Fractal reversal signal suggesting price will move lower and we have what appears to be a third lower channel forming to the downside and where the line of support between move 2 to 3 has been breached by our last bearish candlestick on the chart.

We are going to implement our strategy at this point. The first and immediate thing that we need to do do is to enter a short position, as shown in example B.

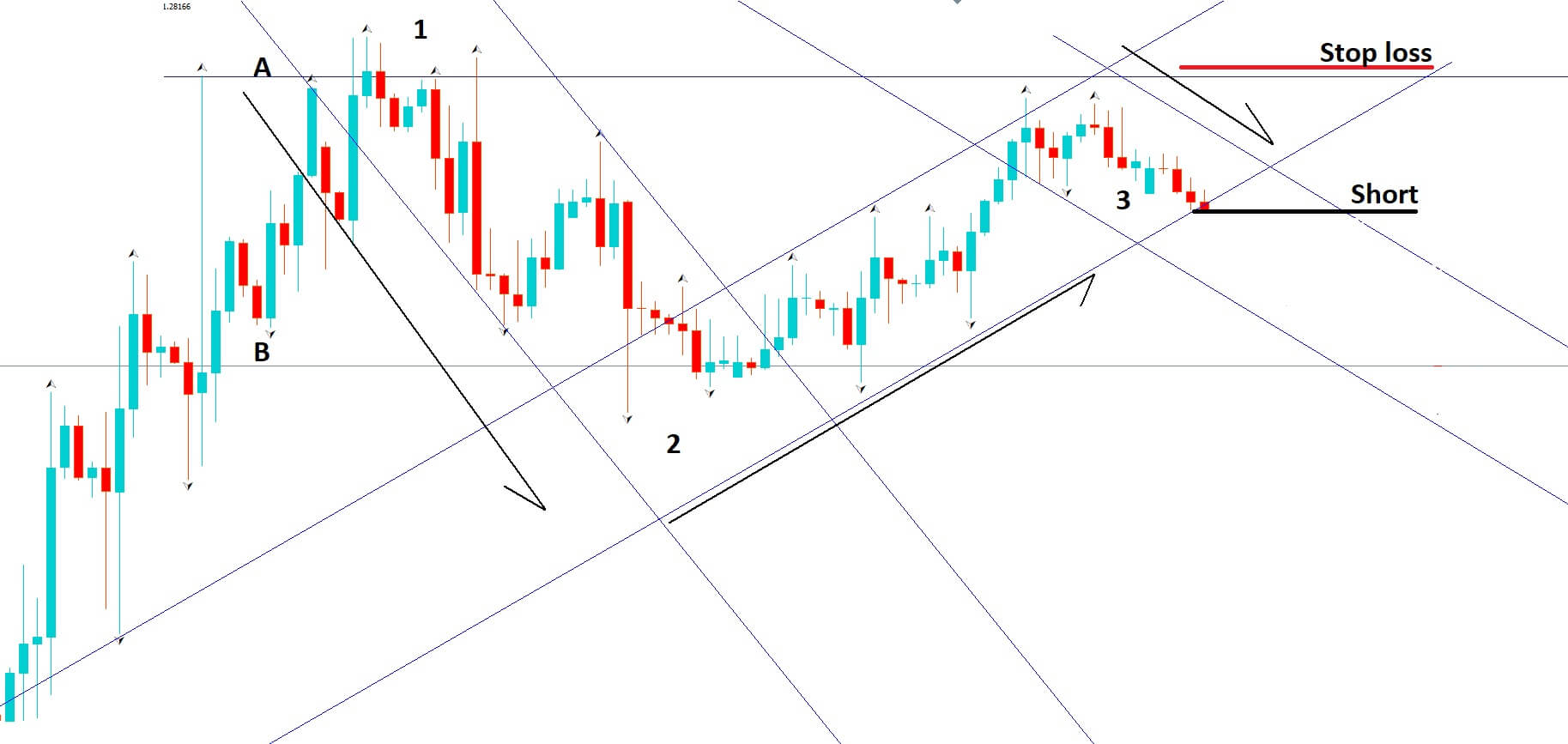

Example B

We will need to put our stop loss a couple of pics above our key level, as defined by line A, which has proven to be an area of resistance.

So at this stage, we believe that we have done everything humanly possible to analyze the comings and goings of this trade, and we believe we have taken all necessary steps to pick the correct trade and gone short. However, as we know, anything is possible in the forex market. And that is why we intend two support our trade with a secondary back up or insurance policy trade if you will, and we can show you how that is set up now in example C.

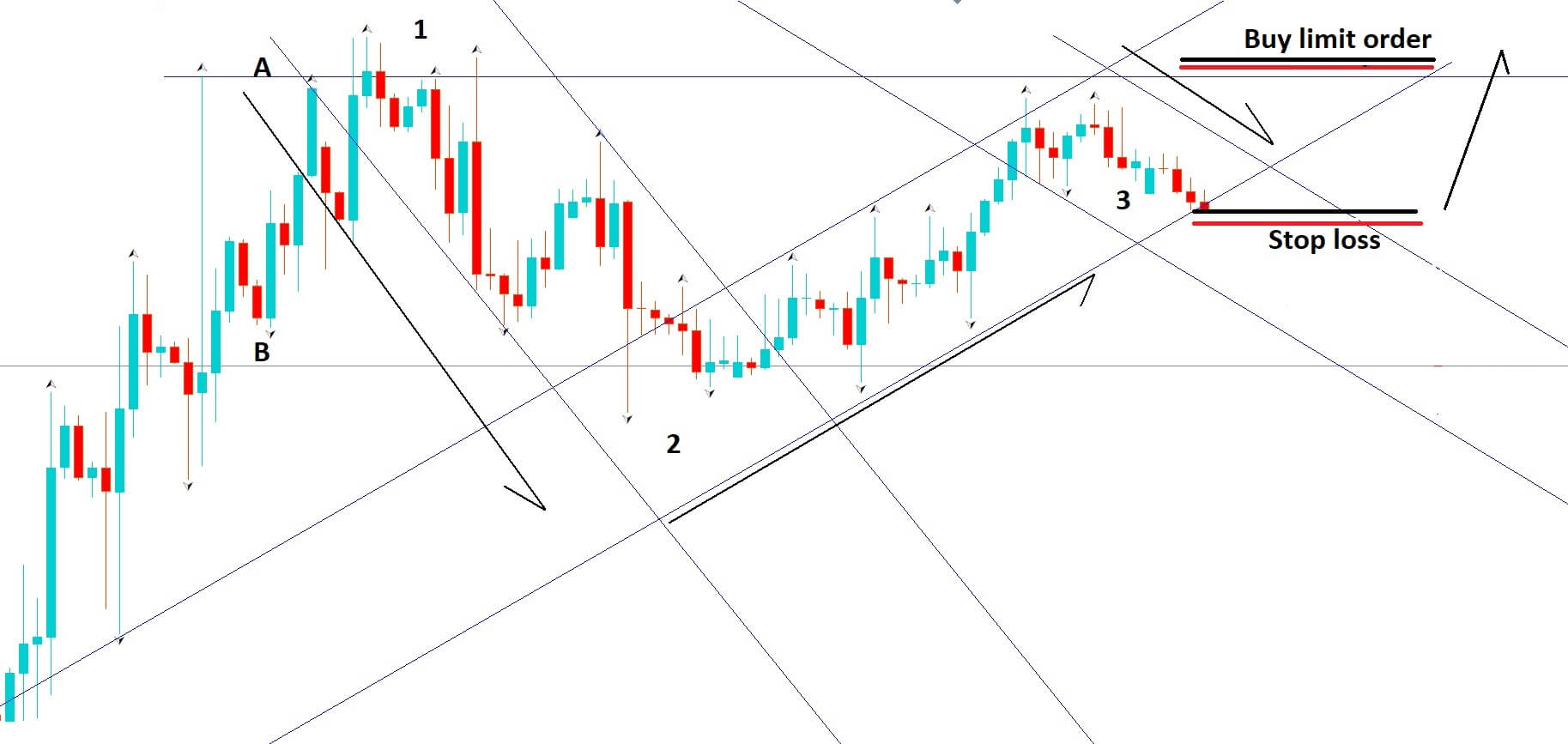

Example C

Should price action reverse and trigger our stop loss we will enter a buy limit order, at, or slightly above the same point as our stop loss on the sell trade, in order to try and capture the reversal in price action and possible continuation upwards in the original trend line between position 2 and 3.

We will also enter a stop loss a couple of pips below our entry-level of the original short trade. Because if the price does move higher, our line of support between positions 2 and 3 will have been confirmed as a line of support. We must also place a take profit level with an aim to at the very least break even from our first losing trade.

No strategy is without risk. The forex market, like every other market, can turn direction in an instant, and never more so than in the current climate, where markets are tiptoeing nervously around the Coronavirus epidemic. As such, we suggest you try and adapt the methodology to your own trading style, or practice the above strategies on a demo account until you have honed your skills before trying it on a real money account.