200-day moving average

Is a popular technical indicator which investors use to analyze price trends. It is simply a security’s average closing price over the last 200 days.

Absolute advantage

is an advantage in production of certain goods or services some country has over the others due to peculiarities of climate, education, labour resources and other factors. If a country has an absolute advantage in certain industries, it can produce corresponding goods and services at a lower cost per unit, than competitors.

Account

Personal account opened with the company by a client. This account is used to offset the obligations of the client and dealer, resulting from the deals concluded under the present agreement.

Account history

A full list of completed transactions and non-trading operations of a certain trading account.

Accounting currency

Currency unit in which deposit/withdrawal operations are performed.

Adjustment

The decision of a central bank to adjust domestic economic policy aimed at eliminating imbalances of payments or determining an official exchange rate.

Adviser

A trading account management algorithm in a form of a program engineered in MetaQuotes Language 4, that sends requests and orders to the server via the client terminal (platform).

Agent

A brokerage firm is said to be an agent when it acts on behalf of the client in buying or purchasing of shares. At no point of time in the entire transaction the agent will own the shares.

American Depository Receipts

Introduced to the financial markets in 1927, an American depositary receipt (ADR) is a stock that trades in the United States and is denominated in US dollars but represents a specified number of shares in a foreign corporation. ADRs are also freely traded on European markets. ADRs can also be listed on major exchanges. It is a tool for raising capital on the US and international markets. ADRs can have different names depending on the requirements of a particular market.

American Stock Exchange (AMEX)

The stock exchange that had grown into the second largest securities market in the United States from a small securities house. Most of the securities listed on the AMEX are of small and medium sized companies. Its major indices are AMEX Major Market Index and AMEX Market Value Index.

Annual inflation

Is the increasing of the overall prices for goods and services during the period of one calendar year.

APEC (Asia-Pacific Economic Cooperation)

Is a forum of 21 Asia-Pacific countries that seeks to promote free trade, investment liberalisation and facilitation across the region, as well as to foster economic growth and strengthen the Asia-Pacific community.

Arbitrage

The simultaneous purchase of an asset on one market and sale on another to profit from a temporary difference in the price.

Ask/Offer

The lowest price an owner is willing to sell the stocks.

Asset

Any item of economic value which is the subject of a trade on a financial market. An asset can be a currency pair with an aim to profit from a difference in its exchange rate.

At best

An order to a dealer or a broker to buy or sell a financial asset at the most desirable price available.

At the money

A situation at which an options strike price is identical to the price of the underlying securities. Options trading activity tends to be high when options are at the money.

Balance

The total financial result of all fully executed transactions and deposits/withdrawals to/from an account.

Balance of payments

Shows the balance of a country’s overseas payments and payments incoming from abroad over a certain period of time.

Bank Stress Test

Is a compulsory condition for high estimation of the risk management system under the Direction of the Central Bank of Russia dd. January 16, 2004 No 1379 U “On assessment of the financial stability of the bank with the purpose to confirm it as sufficient for participating in the deposit insurance system”.

Bar chart

A style of chart on which the top of the vertical line indicates the highest price of an asset for the certain period, while the bottom represents the lowest price. The closing price is displayed on the right side of the bar, and the opening price is shown on the left side.

Barrel

Is a unit of liquid volume which is used on international oil market. Price for basic oil brands is estimated in dollars per barrel.

Base currency

Currency unit in which an account, balances, commission fees and payments are nominated and calculated.

Base interest rate

The rate of interest used by commercial banks as a basis for their lending rates. Determined by a country’s central bank, the base interest rate has a direct impact on the national currency’s exchange rate. This makes monitoring its changes a useful indicator for Forex traders.

Basis points

They are 1/100th of a percent. This means 9% would be 900 basis point, and the difference between 9% and 0.5% interest would be 850 basis points.

Bear

Is the market participant who opens sell trades and believes that a currency exchange rate is about to fall.

Bear Market

A market in which stock prices are falling consistently.

Beta

It is a measurement of relationship between stock price of any particular stock and the movement of whole market.

Bid

Is the demand price; the price at which a market participant is willing to buy the base currency.

Bid price

The price at which an investor can sell an asset on financial markets. The bid price is a part of the formula which is used to calculate the expiry level of an asset.

Blue Chip Stock

Stocks of large, well-established and financially-sound companies which hold a record of consistently increasing rate of paying the dividends over decades to its stock holders. Blue chip stocks typically have a market capitalization in thousands of crores.

Board Lot

A standard trading unit as defined by the particular exchange board. Board lot size usually depends on the per share price. Common board lot size are 50, 100, 500, 1000 units.

Bollinger Bands

An indicator that allows users to compare volatility and relative price levels over a period of time. Made up of a Simple Moving Average (SMA), an Upper Band (SMA plus two standard deviations), and a Lower Band (SMA minus two standard deviations).

Bonds

It is promissory note issued by companies or government to its buyers. It speaks about the specified amount held for a specified time period by the buyer.

Brent

Is a standard oil brand which is sourced near the European shoreline in the North Sea. This brand is famous for low percentage of sulfur which makes it attractive for oil-processing companies. Brent is a pricing benchmark for almost 40% of all global oil brands. It is traded on international oil markets.

Broker/Brokerage Firm

A registered securities firm are called broker/brokerage firm. Broker’s acts as an advisor for purchase and sell of listed stocks, they do not own the securities at any point of the time. But they charge a commission for their service.

Bull

An investor who thinks the market will rise; purchases securities under assumption that they can be sold later at a higher price.

Bull Market

A market in which the stock price are increasing consistently.

Business Climate Indicator (BCI)

Is a business climate indicator of a particular country which is based on the responses of business representatives. Index data has a direct impact on the market.

Business Day

Monday to Friday, excluding public holidays.

Call Option

An option that is given to investor the right but not obligation to buy a particular stock at a specified price within a specified time period.

Capital account

Is the other component of the balance of payments directly related to the GNP. It represents the balance of public and private capital inflow and outflow as well as the amount of funds borrowed and lent.

Carry trade

Is a Forex trading strategy in which the profit is gained not from the price movement and closure of profitable position, but from holding position with a positive swap.

Cash

The currency of a nation in its physical form. Cash is money (notes or coins) that is in free circulation and that is used in the turnover of goods and services.

Central Bank of the Russian Federation

Is the primary bank of Russia, its main issuing monetary body. Together with the government, it develops and implements the monetary policy. The bank has broad powers. In particular, it is accredited to issue the national currency and regulate commercial banks. The central bank of the Russian Federation coordinates and regulates Russia’s entire credit system. It acts as economic regulator. The bank supervises lending institutions, grants and withdraws banking licences. The headquarters of the bank are in Moscow.

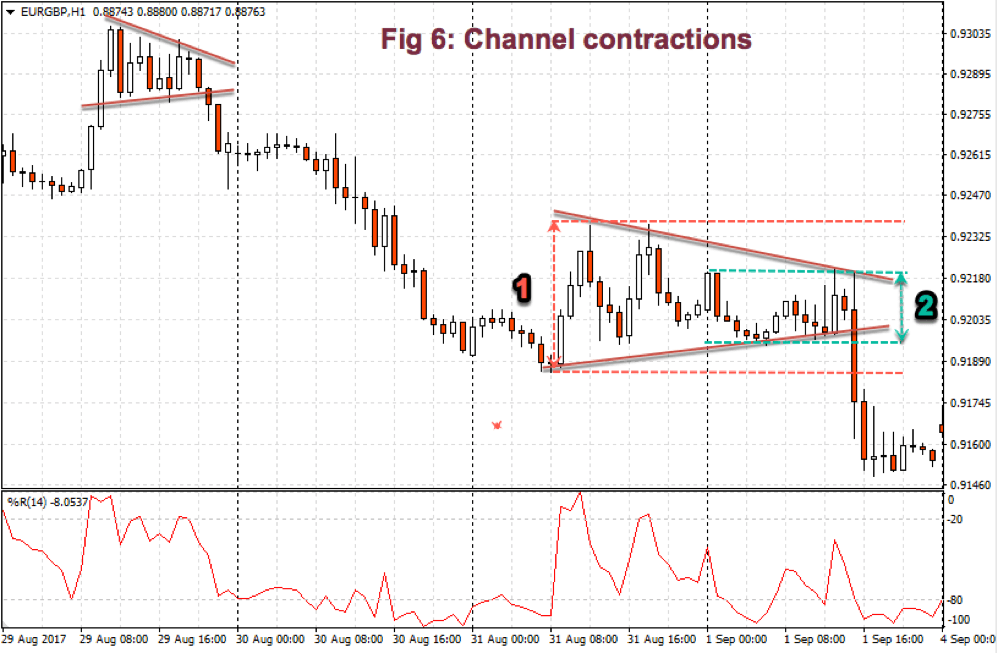

Channel Line

The channel line (or return line) is a useful variation of the trendline technique. Sometimes, prices trend between two parallel lines; the basic trendline and the channel line. When this is the case and when the analyst recognizes that a channel exists, this knowledge can be used to profitable advantage. Channel line can be projected by constructing a parallel line over the first peak.

Chart

Graphical representation of a particular currency’s price change over the given period of time. The chart types are: the line chart, the bar chart and the candlestick chart.

Chicago Board Options Exchange (CBOE)

Is the US options exchange located in Chicago. More than 2,200 companies 22 market indices and 140 market indices funds with the overall trade turnover of 1 billion contracts are listed in it.

Chicago Mercantile Exchange (CME)

The Chicago Mercantile Exchange (CME) is an American financial and commodity derivative exchange. Originally established as a non-profit organization, the CME is a platform for futures and options trading and is also a regulatory authority, collecting and releasing information about the market and ensuring orderly clearing and settlement of executed trades.

Clearing

The end of mutual settlements on a trade.

Client terminal

MetaTrader 4 or 5 software product that lets the client get information about financial market trades in real time mode (volume defined by the company), perform technical analysis of markets, operate, set/change/cancel orders and receive messages from the dealer and the company as well.

Close position

Is a fixation of profits or losses on an open position; removal of a pending order.

Close Price

The final price at which the stock is traded on a given particular trading day.

Closed transaction

Consists of two opposite trading operations of equal volume (the position opening and closing): buying followed by selling or selling followed by buying.

COMEX (Commodity Exchange)

Is a leading exchange market of valuable metals, department of New York commodity market. Futures contracts are concluded for any month, including the current month. Schedules for trading sessions of every futures contract are individual. Electronic trading session is hold daily from Sunday to Friday.

Commodities

Product used for commerce that are traded on a separate, authorized commodities platform. Commodities include agricultural products and natural resources.

Comparative advantage

Is an economic law referring to the ability of an individual or a country to demonstrate the best performance producing goods and services in the sphere they are the most competent, qualified or experienced.

Concealed Unemployment

Is not reflected in official statistics. It relies on data on how many people receive unemployment benefits in a country. Apart from this group of people, there are other categories of employable citizens: those who are almost out of work, but do not get any jobless benefits; those employed part-time; and those who have not claimed for any benefits for some reason.

Consolidation

Is a period during which a price action fluctuates in a certain range without establishing a trend either up or down. Consolidation is believed to be followed by a breakout in one direction or the other.

Consumer Confidence

Indicates how consumers feel about current economic conditions in their country. The index is calculated on the basis of a monthly survey. The survey respondents are asked to assess economic prospects of their country. The index does not tend to affect the markets much, because it provides a subjective vision of the economy, rather than a real picture. A rising index augurs well for the national currency.

Continuous Linked Settlement (CLS)

Is a global multi-currency payment system founded in 1997 by the largest brokerage Forex companies for cash remittances on currency deals.

Trading Contract specifications

General trading conditions (such as spread, lot size, minimal trading operation volume, trading operation volume increment, initial margin, lock margin etc.) for each instrument

Convergence

A situation in trading when the price of an underlying asset is moving to the price of a futures contract and vice versa.

Convertible Securities

A security (bonds, debentures, preferred stocks) by an issuer that can be converted into other securities of that issuer are known as convertible securities. The conversion usually occurs at the option of the holder, but it may occur at the option of the issuer.

Correction

A reverse price movement, or its sideways movement after the previous uptrend or downtrend weakened, which led to positions’ closing or profit taking by market participants as they considered the price too high or low for further trading.

Cost of Carry

The cost, usually quoted in terms of dollars or pips per day, of holding an open position.

Counter currency

The currency used as the second currency in a currency pair. It is also known as the quote currency. Units of the counter currency are expressed in terms of a single unit of a base currency.

CPI (Consumer Price Index)

Indicates changes in retail prices for goods and services the market basket comprises. The index is based on cost of food, clothes, education, housing and household utilities, leisure and entertainment, charges for health care services and transportation fares. The index is calculated monthly. It is a key measure of inflation in any country.

Credit rating

Measures the creditworthiness of an individual, firm, region, or a country. Ratings are calculated based on past and current financial performance of market participants as well as on the estimated amount they borrowed and obligations incurred. The estimates are supposed to provide potential lenders/investors with insight into probability of on time repayment.

Cross Currency

A pair of currencies traded in FOREX that does not include the U.S. dollar.

Cross rate

Is the currency exchange rate between two currencies, both of which are not the official currencies of the country in which the exchange rate quote is given in.

Currency basket

A selected group of currencies in which the weighted average is used as a measure of the value of a currency not included in the group. Depending on its purpose, the currency basket can include currencies in different relative amounts, a currency’s inclusion on a constant basis or changing depending on different Forex market factors.

Currency code

The three-letter alphabetic code, where the first two letters represent the country of a currency, while the third one stands for the name of the currency. The currency codes are specified by the International Organization for Standardization (ISO).

Currency intervention

Is a significant one-time and direct central bank’s intervention in the currency market and the currency rate implemented by means of buying and selling of large amount of foreign currency. Currency intervention is used to regulate the course of foreign currencies in the interest of the government.

Currency pair

Two currencies which make up a foreign exchange rate, for example, EUR/USD.

Currency risk

Potential adverse movements of currency rates.

Current account balance

Is one of the two components of the balance of payments referring to net revenue on exports minus payments for imports, net revenue on investments and net transfer payments.

DAX (Deutsche Akzien Index)

The benchmark index for the German equity market. It tracks the performance of 30 selected German blue chip stocks traded on the Frankfurt Stock Exchange. There is also the DAX 100 index, which includes reinvested dividends to show the overall return available to investors. The index was introduced in 1987. It is calculated using the Xetra technology.

Day trading

Trading on a financial market during one session within a day. This means that positions opened this day are kept overnight to the next day and the next trading session.

Dealing

Non-cash currency trading.

Dealing center

Company that provides access to the money market.

Debentures

A type of debt instrument that is not secured by physical assets or collateral. Debentures are backed only by the general creditworthiness and reputation of the issuer.A debenture is an unsecured form of investment.

Defensive Stock

A stock that provides a constant dividends and stable earnings even in the periods of economic downturn i.e. even in the extreme critical situations of the stock market these companies continue to pay the dividends at a constant rate.

Deflator

Is a statistical tool used to convert a national currency into inflation-adjusted national currency.

Delivery

A deal on Forex under which a currency is tendered to and received by the buyer.

Delta

The ratio that compares the change in the price of the underlying asset to the corresponding change in the price of a derivative. Sometimes referred to as the hedge ratio. It has a range from 0 to 1.

Demo account (Demonstration account)

Is a virtual trading account rendered by a broker to review and test the trading systems features on financial markets without the risk of losing real funds. As a rule, the demo account interface is similar to that of a live account.

Depreciation

A decrease in the value of a currency as a result of market forces.

Derivatives

Financial instruments with a price that is derived from one or more underlying assets (bonds, options, shares, futures contracts). Derivatives are often used for hedging and also for speculative purposes. Leverage is applied in buying these financial instruments, thus allowing traders to buy derivatives at a price much higher than they can afford.

Direct quote

A foreign exchange rate quoted as the domestic currency per unit of the foreign currency.

Discount rate

An interest rate charged to financial institutions for loans received from a country’s central bank.

Divergence

Is the difference between two correlative instruments. For instance, intermarket divergence happens when one of the markets reaches cyclical/session/history price extremes (highs or lows) when the correlated market does not do so. Divergence quite often signifies a price reversal; (it) is used by traders as a trading signal.

Diversification

Is the distribution of invested or loanable money assets among different investments with the purpose of smoothing out potential losses.

Dividend

A portion of the company’s earnings decided to pay to its shareholders in return to their investments. It is usually declared as a percentage of current share price or some specified value, usually decided by the board of directors of the company.

DJIA

Is Dow Jones Industrial Average index, the oldest stock index in the USA which is a simple arithmetic average of price growth of 30 top industrial U.S. companies’ shares.

Double Bottom(Top)

A charting pattern used in technical analysis. It describes the drop (rise) of a stock/index, a rebound (a drop), another drop (rise) to the same/similar level as the original drop (rise), and finally another rebound (drop.)

Double top

Is a classic pattern of technical analysis used to depict two consecutive price rises placed at the same level; it signifies a reversal.

Downtick

A stock market transaction at a price below the previous transaction.

Downtrend

Is the forex market term meaning gradual decline of a currency price at a certain period of time.

ECB (European Central Bank)

European Central Bank which carries out EU is monetary policy. Was established on June 1, 1998. The ECB headquarters are situated in Frankfurt am Main, Germany. The General Council of the European Central Bank includes representatives of all the EU countries. The ECB is independent from other EU authorities.

Economic Calendar

The date and time when each economic indicator will be released. Economic announcement may cause unanticipated price movement during these periods. Corresponding trading strategy: News Fade.

Economic integration

Is the development of stable relations among neighbouring countries into unification of economies. This process is usually accompanied by coordinated interstate economic policy.

Economy Watchers Survey

Assesses current economic conditions in a country.

Elliot Wave Theory

Asserts that crowd behavior moves in waves. Can be used to identify structure to price movements in financial markets. Elliot Waves come in two forms, impulse and corrective, and patterns made by them are analyzed to predict trends.

Equity

The secured part of the client account, including open positions, that is bound to the Balance and the Floating rate (profit/loss) by the following formula: Balance + Floating + Swap, i.e. the funds on the client account minus the current loss of the open positions, plus the current profit of the open positions.

ESM

Stands for European Stability Mechanism. It is a joint financial fund of the Eurozone countries replacing the two existing EU funding programmes.

ETF (Exchange Traded Fund)

Investment funds much like securities which serve as certificates for share portfolio. ETF may consist of securities of different companies and share funds. On legal basis, ETF is a type of share funds.

Euribor

Is a rate European banks use to borrow funds from peers for three months.

Exchange rate

The price of a nation’s currency in terms of another currency.

Expiry time

A predetermined deadline for a binary option which a trader can choose prior to opening a trade. At the time of a binary option expiration, the financial result of the trade is fixed and traders either receive the profit known in advance, or they suffer a loss in case of an incorrect forecast.

Export

Means delivering (or shipping) goods or capital abroad.

Face value

It is the cash denomination or the amount of money the holder of the individual security going to earn from the issuer of the security at the time of maturity. It is also known as par value.

Fan Principle

Sometimes after the violation of an up trendline, prices will decline a bit before rallying back to the bottom of the old up trendline (now a resistance line). Often, previously broken support lines become resistance and resistance lines become support. The term “fan principle” derives from the appearance of the lines that gradually flatten out, resembling a fan.

Federal Reserve Bank

Is a regional bank of Federal Reserve System of the USA. A network of 12 Reserve Banks carry out money management of the government.

Federal Reserve System

Is the U.S. banking system which fulfils functions of country’s Central Bank.

Fibonacci Retracements

Based on the fibonacci sequence and the golden ratio, one can find resistance and support points using these. To use them, start the retracements at the lowest point in a graph and drag it up to the highest point, or vice versa.

Financial instruments

Various types of financial market products, including securities, bonds, forex, futures, options, etc.

Financial Transaction Tax

Allows regulating financial markets, in particular, the market of derivatives.

Fitch Ratings

Is one of the largest rating agencies which provide analytical data of financial markets and estimates companies’ borrowing power.

Flag

Both flag and pennants represent brief pauses in a dynamic market move. They represent situations where a steep advance or decline has gotten ahead of itself, and where the market pauses briefly to “catch its breath” before running off again in the same direction. Both are treated together because they are very similar in appearance and only rarely produce a trend reversal. The flag resembles a parallelogram or rectangle marked by two parallel trendlines that tend to slope against the prevailing trend.

Flat

Is the situation on the currency market characterized by the absence of an uptrend or downtrend; also known as non-trend or sideways movement.

Flexible exchange rate

An exchange rate which fluctuates depending on the supply and demand of a currency in relation to other currencies on the forex market. It is also called floating exchange rate.

Floating profit/loss

Unrecorded gains/losses on the opened positions at current rates values.

Force major circumstances

Occurrences which could not be foreseen or prevented. These include: natural disasters; wars; acts of terrorism; government actions, actions of executive and legislative government authority, hacker attacks, and other unlawful acts toward servers.

Forecast

Assesment of future market conditions on Forex within a short-term, medium-term and long-term framework.

Forex (foreign exchange market)

Is a segment of the financial market for interbank currency exchange at non-fixed rates.

Forex indicator

Is a software-based analytical tool that can be used to receive and visualize additional information (or information transformed into more understandable format) about the price chart.

Forex trend

It occurs when the price moves in an identifiable direction over a specific period. There is an uptrend, downtrend and a sideways trend.

Forward contract

A contract that specifies the price and quantity of an asset to be delivered in the future. Although delivery is made in the future, the price is determined on the day of the transaction.

Free margin

Determines the state of an account. Calculated according to the formula: Equity – Margin = Free margin.

FSSS

Stands for Federal State Statistics Service of Russia. It is a federal executive institute responsible for official statistical data on social, economic, demographic, and ecological conditions in Russia. In addition, FSSS controls and supervises state statistics in the Russian Federation.

Fundamental analysis

A popular way of forecasting price behavior on the forex market. The fundamental analysis is based on the analysis of the world’s leading economies’ indicators and reports on economic sectors released by major countries. The fundamental analysis also includes important political and financial news that can have impact on prices. Based on the analyzed information, experts say in what direction an asset’s price will move.

Futures contract

An agreement to buy or sell a predetermined amount of a financial asset or a commodity at a specific price on a specific date in the future. Futures contracts are characterized by strict conditions on the type and quantity of assets, involving only minor discrepancies. These contracts also have certain terms of payment of invoices or transportation costs.

Gap

A quick market move in which prices skip several levels without any trades occurring. Gaps usually follow economic data or news announcements. Is a break between prices which may happen as a result of sharp fluctuations on the market or during the weekends (between the closing price of one week and opening price of the other)

GDP (Gross Domestic Product)

Is a macroeconomic indicator measuring the market value of output produces within a year in all the economic sectors of a country, for consumption, exporting and hoarding, regardless of the producer’s nationality.

Hard currency

The term denoting a currency that can be easily exchanged (i.e. widely accepted around the world) with a stable rate. Hard currencies generally come from developed nations with strong economies. Because of its liquidity, a hard currency is considered to be a good investment instrument.

Hedge

A strategy or an attempt in reducing the risk of adverse price movements of assets.

Hedge fund

The funds that are managed much more aggressively than their mutual fund counterparts. The strategies applied for increasing the yield include trading with leverage, swaps, and arbitrage.

Hedged margin

Collateral necessary to cover open position.

Hedging

Operation that protects an asset or liability against a fluctuation in the foreign exchange rate.

HICP

Stands for Harmonized Consumer Price Index. HICP is an indicator of inflation, a single cornerstone in the statistical system for the EU countries. The index is particularly important in the periods of interest rate increases, as its growth provokes further monetary tightening and consequently the national currency upswing.

High-Frequency Trading, HFT

Is a type of trading which applies technical tools and computer algorithms (high-speed servers) to trade securities with high speed. In contrast to usual trading, High-Frequency Trading uses powerful computers to execute a greater number of trading operations. Usually, a computer analyzes the markets and executes operations based on its own trading strategy. The number of operations generated via High-Frequency Trading daily is counted in tens of thousands.

Hot Money

Large inflows of funds into countries with high interest rates that drive up their exchange rate.

IMF (International Monetary Fund)

International organization established by the UN and grants loans to member countries to meet balance of payments needs.

Import

Is delivery of goods or capital into the country from abroad.

Import substitution

Is fostering domestic production of goods rather than importing foreign goods.

Income Stock

A security which has a solid record of dividend payments and offers the dividend higher than the common stocks.

Index

A statistical measurement of change in the economy or security market. Indices have their own calculation methodology and are usually measured as a percentage change in the base value over the time.

Indicative quote

A quote serving for information about the current price of an asset. It is not used for making market orders.

Industrial Production Index

Is an economic indicator published by the Federal Reserve Board of the United States. It is based on the most significant categories of industrial goods. Since this index reflects changes in output of mineral resources, energy efficiency, gas and water usage as well as manufacturing production, it can be regarded as a GDP constituent.

Inflation

Is the process of increase in prices for goods and services. Due to inflation, a certain amount of money sufficient for purchase of some good or service at present will not be sufficient anymore in a while.

Initial margin

An amount necessary to open a position that serves as a trader’s guarantee of fulfillment of obligations towards a broker. The margin largely depends on leverage. The higher the leverage, the lower the margin required to open a position.

Initial Public Offering (IPO)

A company’s first issue of shares to general public. IPOs are issued by smaller, younger companies seeking funds for expansion and growth, but large companies also practice this to become publicly traded companies.

Insider

A person who belongs to a group or organization and has special knowledge about it unknown to ordinary traders and related to financial markets.

Instant execution

The mechanism of providing a client with quotes without prior request. Clients see live streaming forex rates of a dealer, based on which they can send an order to execute a trading operation at any time.

International division of labour

Implies that each country produces certain goods because it has everything necessary to produce them as compared to other countries. By specializing in suitable production, the country satisfies its own needs yet relying on foreign trade. Thus, international division of labour is a principle of the world economy where every country has its own specializations, exports the goods produces while importing the goods other countries specialize in.

International reserves

Refer to a country’s external highly liquid assets, namely gold and currency, controlled by the monetary authorities. International reserves are meant for financing the current account deficit, currency interventions etc.

International trade

Is a system of relations implying exchange of goods and services across international borders.

Internet Trading

Internet Trading is a platform with Internet as a medium. Internet trading execution takes place through order routing system, which will rout traders order to exchange trading system. Thus traders sitting in any part of the world can be able to trade using their brokers Internet Trading System. The Securities and Exchange Board of India (SEBI) approved Internet Trading in January 2000.

Intraday trade

Trade oriented at gaining profit within one day.

Investments

Assets purchased with the idea that they will provide income in the future or will be sold at a higher price for profit. However, an investment not always results in a financial gain, unless it is made in profitable projects or shares. So it is crucial to determine potential risks. As a rule, investing in high-yield assets is more risky.

IPO (Initial Public Offering)

Is the initial public offering of joint-stock company shares for selling.

ISM Service Index

Surveys supply managers in the field of services with an aim to trace changes in this field. The index tends to be sensitive to psychological factors, rather than an actual situation. New readings of the index are published at the beginning of every month at 10:00 EST (NY).

Lagging Indicator

Measurable economic variable that changes after the economy has begun to follow a particular path or trend; can confirm a trend, but cannot predict it.

Leading index

Shows an average of leading economic indicators such as Factory Orders, Initial Jobless Claims, Money Supply, Average Workweek, Building Permits, quotes of common stocks, Durable Goods Orders and Consumer Confidence. The leading index is believed to predict the pace of economic growth over the next six months. The index is calculated at the beginning of every month and released at 10:00 EST (NY).

Leverage

An amount of money a broker is ready to give to a trader to trade on financial markets with larger trading volume. Using the leverage, traders increase their deposits tenfold and even more. Leverage is expressed in the ratio between the trader’s own funds and those funds borrowed from the broker: 1:10, 1:100, 1:500, etc. If traders use the leverage, their own money serves as collateral.

Libor

Stands for London Interbank Offer Rate. Libor is a commonly recognized indicator of the cost of funds to banks. This is the rate that determines the cost of loans the world’s largest banks provide each other with on the London Interbank Exchange. Libor is one of the most widely used benchmarks for short-term interest rates. At present, it fixes rates for EUR, USD, GBP, JPY, CHF, CAD, AUD, DKK, and NZD. Libor is calculated for various borrowing periods, ranging from overnight to one year.

Light Sweet

Is a standard oil brand which is extracted in Texas (the USA). Due to low content of sulfur and relatively high output of useful products, it is used mainly for gasoline processing. This kind of oil is in high demand in the USA and China. Light Sweet Crude Oil is a pricing benchmark for world types of oil. It is traded on NYMEX (New York Mercantile Exchange).

Limit

Allows investor to set the minimum or maximum price at which they would like to buy or sell.

Limit Order

An order to buy or sell a share at a specified price. The order will be executed only at the specified limit price or even better. A limit order sets a minimum price the seller is willing to accept and maximum price the buyer is willing to pay for it.

Liquidation

Closing of an existing position by opening the opposite trade.

Liquidity

Is the degree to which an asset (currency, security, etc.) can be sold at the current market price. This term refers to market volatility and dynamics: a liquid market is a type of a market with large trading volumes where every trade incapable of making a significant impact.

Listed Stocks

The shares of an issuer that are traded on the stock exchange. The issuer has to pay fees to be listed in the stock exchange and abide by the regulations of the stock exchange to maintain listing privilege.

Locked positions

Positions of the same asset and volume opened on one account in opposite directions (buy and sell).

Long

Buying of a security with the expectation that asset will rise in value.

Long position

Is the buying of a financial instrument.

Loss

Is the fixed loss on the position.

Lots

Is a trading unit on the market; A micro lot is 1000 units of currency, and a mini lot is 10,000 units. If an account is based in dollars, a micro lot would be 1000$. The standardized quantity of goods making up a transaction, exchange-traded securities, a certain amount of currency on Forex. Lot also represents the trade volume (position, order).

Lot Size

A quantity base currency in one lot, that is specified in the contract.

Low price

The lowest traded price for an underlying instrument for the specific period of time. On the stock market it is the lowest traded price for a security for one trading day.

M&A (Mergers and Acquisitions)

Is a buyout market. It is highly developed in the USA and in Euro area where in the history of every company information about its merging and absorption with other companies is stated.

MACD (Moving Average Convergence Divergence)

Momentum indicator that shows the relationship between two moving averages of prices. Calculated by subtracting 26 EMA from 12 EMA. Use with a 9 period EMA signal line. Generate trade signals when crossover or divergence between price and MACD appears.

Margin

The required equity which an investor must deposit to collateralize a position equal to 1% (when leverage = 1:100) of an open position deposit.

Margin level

The ratio of equity to margin expressed in percentage. The margin level shows existing risks enabling a trader to prevent them. Looking at the margin level, a trader realizes whether he has enough funds to further open traders and keep orders open. The margin level is calculated using the following formula: Margin Level = (Equity Necessary Margin) × 100%.

Margin trading

using borrowed money to buy securities, with the expectation of increasing profits. Margin trading can bring big returns, but is also risky

Market

A system with established rules of trade in financial assets or instruments, goods or services.

Market Capitalization

The total value in INR of all of a company’s outstanding shares. It is calculated by multiplying all the outstanding shares with the current market price of one share. It determines the company’s size in terms of its wealth.

Market opening

Trade opening after a weekend, holidays or after an interval between trading sessions

Market opening price gap

Either of the following situations:

– Market opening quote Bid is greater than market closing quote Ask.

– Market opening quote Ask is less than market closing quoteBid.

Market price

The last posted bid and ask prices for a given asset, currently valid on the market.

Market-Makers

Major banks and financial firms that pledge to provide liquidity by accepting the other side of a trade in a currency, security or futures contract.

MICEX (Moscow Interbank Currency Exchange)

Is a Russian stock exchange where papers of more than 700 issues with the total capitalization of 10 trillion rubles are trading.

Minimum deviation

An acceptable price range within one contract set by a stock exchange.

Money Flow Index

An indicator that analyzes the conviction in a trend through the price and volume of the security. MFI values range from 0 to 100. MFI below 20 suggests asset has been oversold, while MFI over 80 suggests asset has been overbought.

Mutual Fund

A pool of money managed by experts by investing in stocks, bonds and other securities with the objective of improving their savings. These experts will create a diversified portfolio from these funds.

NASDAQ (National Association of Securities Dealers Automated Quotation)

Is the US stock market where shares of more than 4,000 hi-tech companies with the total capitalization of $6 trillion are trading.

Necessary margin

The amount necessary to open the position of the needed volume. It is collateral a trader leaves on the account of a broker or a dealing center. The size of the necessary margin varies depending on the leverage used by the trader. The lower the leverage, the bigger the margin, and vice versa.

Net position

The difference between total open long and open short positions in a given asset held by an individual.

New York Stock Exchange (NYSE)

Is New York stock exchange where securities of more than 3,000 issues bodies are trading daily with the overall capitalization above $27 trillion.

Nikkei 225 Stock Average

Is Japanese stock market index which represents an average of the most widely quoted Japanese equities of 225 companies of the first section of Tokyo stock exchange.

Non-Farm Payroll (NFP)

Measure of the number of people employed in all activities except agriculture; released first Friday of each month.

Non-trading operation

Depositing or withdrawing funds from a trading account, or extending credit.

Normal market conditions

Condition of a market that meets the following requirements:

– absence of noticeable breaks in relation to the trading platform quotes.

– absence of rushing price dynamics; absence of significant price gaps.

North American Free Trade Agreement

Is the world’s largest free trade area which includes the USA, Mexico, and Canada. The area’s population makes up 406 million people while the total GDP is $10.3 trillion.

Obvious mistake

Opening/closing client positions or executing client order at a price that greatly differs from price quoted per instrument in present flow quoting at the moment of processing. Or some other dealer activity or inactivity that deals with mistaken determination of market prices at the present moment.

Odd Lot

A number of shares which are less than or greater than but not equal to the board lot size. For example, if the board lot size is 100 shares, an odd lot would be 95 or 102 shares. Usually odd lots are difficult for trading and it is not accepted easily in the market.

Offset

Offsetting is a liquidating of a buy or sell position by opening the equivalent position in the opposite direction. Thus, if a trader has short EUR/USD position, the offsetting position will be a long trade on the same instrument of the same volume.

Offshore

The term “offshore” is used to describe a territory or a nation that accumulates foreign capital by offering special tax incentives to companies based there.

One-sided Market

A market that has only potential sellers or only potential buyers but not both.

Open position

The result of the first part of a completed transaction; at the position opening, the client accepts the following liabilities:

– to execute the opposite operation of equal volume;

– to maintain equity not lower than 10% of the necessary margin

Operation Twist

When the fed will buys either short term or long term bonds and sells the opposite in an effort to shape the yield curve.

Option

A contract between two investors, under which one party buys or sells an underlying asset within a specified period of time at an agreed-upon price. Another party sells or buys the asset according to specified conditions. In other words, an option can be both a contract to buy and sell a trading instrument.

Option exercise level

The price level of an underlying asset at the moment when an option is exercised, i.e. at expiration time of a binary option. Accurateness of a financial forecast of a trader is determined by comparing an option’s exercise level and the buying price level.

Order Forex

An instruction that is sent to a broker to enter or exit a position at a specified price.

Order level

The price specified in the order.

Oscillators

Momentum indicators that show subtle reversals in non-trending prices, and also indicate short-term overbought or oversold conditions. MACD, RSI are examples.

Out-of-The-Money (OTM)

For call options, this means the stock price is below the strike price. For put options, this means the stock price is above the strike price. The price of out-of-the-money options consists entirely of “time value.”

Output

Is the volume of goods a company has produced or services it has provided. It is measured in real and value terms.

Overbought

Is the situation on the currency market in which the demand for an asset increases the asset’s value to a level that does not meet the fundamental factors. It is commonly believed that in the overbought zone traders should sell.

Overnight position

The position that a trader possesses at the end of a trading day. A trade that remains open until the next business day.

Oversold

Is the situation on the currency market in which the demand for an asset decreases the asset’s value to a level that does not meet the fundamental factors. It is commonly believed that in the oversold zone traders should buy.

Payout

A fixed amount a trader gets in case of the correct forecast of a binary option’s price movement. The payout is directly proportional to the size of investment in the binary option.

Pending order

The client instructs the dealer to buy or sell once the price reaches the order level.

Pennants

Represent brief pauses in a dynamic market move. They represent situations where a steep advance or decline has gotten ahead of itself, and where the market pauses briefly to “catch its breath” before running off again in the same direction. The pennant is identified by two converging trendlines and is more horizontal. It very closely resembles a small symmetrical triangle. An important requirement is that volume should dry up noticeably while each of the patterns is forming.

Pip

The smallest price increment in a currency. Often referred to as “ticks” in the futures markets. For example, in EURUSD, a move from .9015 to .9016 is one pip. In USDJPY, a move from 128.51 to 128.52 is one pip.

Pip cost

The cost per 1 pip move per unit traded of a currency pair. For example if the price of EUR/USD increased to 1.3498 (increased by a pip), and the pip cost was $0.10 per lot, and we were long 10 lots, we will gain 10 × ($0.10) × 1 = $1.

Pivot point

Is the key point of support/resistance level calculated by taking the average of an asset’s previous high, low, and closing price.

PMI (Purchasing Managers’ Index)

Is a leading indicator. Its reading is determined by polling manufacturing supply managers. The index provides insight into business trends and influence of the economy on price formation.

Portfolio

Holding of any individual or institution. A portfolio may include various type of securities of different companies operating in different sectors.

Positions Limit

Maximum number of futures and options contract that any individual investor can hold at any given point of time.

Pre-opening Session

The pre-open session is for duration of 15 minutes i.e. from 9:00 AM to 9:15 AM. In pre-open session order entry, modification and cancelation takes place.

Producer Price Index (PPI)

Measures changes in prices domestic producers receive for their output.

Price Earnings (P/E) Ratio

A valuation of companies last traded share price to its latest reported 12 months earnings per share. For example, if the last traded share price of any X company is USD 40 and earnings over a last 12 months per share is USD 2, then the P/E ratio of that X company is USD 20 (40/2)

Price prior to non-market quoting

Closing price of minute bar, prior to minute bar with non-market quoting. Price Gap – either of the following situations:

– Present quoting Bid is greater than prior quoting Ask;

– Present quoting Ask is less than prior quoting Bid.

Price transparency

Equal availability of quotes to all market participants.

Principal value

Is a trader’s initial capital, start-up capital.

Producer-Price Inflation

Is the increasing of the average prices for raw materials and consumer goods calculated for the base/reference period.

Profit

A financial gain that resulted from investing, or from a speculative operation that exceeds an amount of initial capital.

Put Option

An option that is given to investor the right to sell a particular stock at a stated price within a specified time period. Put option is purchased by those who believe that particular stock price is going to fall down than the stated price.

Pyramiding

Is a method of increasing a position size in which each new position is less (greater) than the previous one.

Quantitative Easing

A government monetary policy used to increase the money supply by buying government securities from the market. The U.S. Federal Reserve has been buying billions of dollars worth of bonds to keep interest rates low.

Quote Currency (Secondary/Counter Currency)

Second currency quoted in a currency pair in FOREX. In a direct quote, the quote currency is the foreign currency while in an indirect quote, the quote is the domestic currency.

Quote flow

A sequence of numerical data describing the price value of an instrument at a certain time period.

Quotes base

Information about the stream of quotes.

Range

The distance between levels of support and levels of resistance.

Rate

The price of the base currency in terms of the quote currency.

RBA

Stands for Reserve Bank of Australia. The bank is responsible for Australia’s monetary policy, works to maintain a strong financial system and issues the nation’s banknotes.

Real GDP

Shows production output and incomes in real terms.

Repo

A repurchase agreement where a seller agrees to buy assets back from a buyer at a predetermined price.

Resistance level

Highest channel’s borderline

Retracement

A reversal in the direction of a price movement or its pullback from a previous low or high.

Rising trend

Occurs, when every following value of the wave curve is higher than the previous rate value. The lows of the waves are connected with a straight line – the trend line.

Risk

A probable chances of investments actual returns will be reduced then as calculated. Risk is usually measured by calculating the standard deviation of the historical price returns. Standard deviation is directly proportional to the degree of risk associated.

Risk management

Means using a strict set of rules in trading in order to limit losses.

Rollover

The interest earned when going long or short a currency pair. For example, since Australia has a high interest rate and the US has a low one, going long on the AUD/USD can earn you a heft rollover. This is essentially the same idea as shorting US Treasuries and using the proceeds to invest in Australian Treasuries, earning the spread between the interest rate differential.

RSI (Relative Strength Indicator)

Using recent gains and losses to compute if a security is overbought or oversold. If above 0 line – bull, below 0 line – bear. Generate trading signals when divergence between price and RSI, or when RSI is above 70 or below 30 (might consider using 80-20 or FX).

RTS (Russian Trading System)

Conducts trades on the stock and derivative markets. Open 10:00 to 23:50 MSK (GMT+4). In December 2011, RTS merged with MICEX into MICEX-RTS. In 2012 the united stock exchange was renamed as OAO Moscow Stock Exchange (MSE).

S&P

Is one of the largest rating agencies which deal with analytical investigations of financial market. The company to one of the world’s most powerful rating agencies. S&P is also known as the creator and editor of the American stock index S&P500; and the Australian S&P200.

S&P 500

Is stock index of Standard & Poor’s rating agency which is comprised of 500 top publicly traded companies of the USA which securities can be found on the largest U.S. stock markets. It is a market-value-weighted index and one of the main indicators of the American economic climate.

Saucers

Although not seen as frequently, reversal patterns sometimes take the shape of saucers (or rounding bottoms). The saucer bottom shows a very slow and very gradual turn from down to sideways to up. It is difficult to tell exactly when the saucer has been completed or to measure how far prices will travel in the opposite direction. Saucer bottoms are usually spotted on weekly or monthly charts that span several years. The longer they last, the more significant they become (cf. spikes).

Scalping

Is the method of short-term trading that suggests a large number of positions opened during a trading day fixing small amounts of profit or loss.

Securities

A transferable certificate of ownership of investment in products such as stocks, bonds, future contracts and options which an individual holds.

Sentix Investor Confidence Sentix

Measures credibility of the Eurozone economy in the eyes of investors. The indicator is calculated on the basis of a survey held among investors and analysts. If the indicator rises, a foreign currency is converted into a national one when buying securities or non-financial assets, which pushes the national currency rate up. Readings of the indicator exceeding forecast bode well for the currency.

Server log file

File, created by the server, which records all requests and orders received from the client to a dealer, as well as the processing result, with 1 second accuracy

Short

Sale of a borrowed security with the expectation that the asset will fall in value

Slippage

Is the situation on the currency market in which a broker closes an opened position at a less profitable price than stated in the order. It happens amid price spikes when the level of position closure is broken too fast.

Soft Currency

A currency with a value that fluctuates due to its country’s political or economic uncertainty. They tend to be avoided by traders as a result of the instability.

Spikes

Spikes are quick downward reversal patterns. Spikes are the hardest market turns to deal with because the spike (or V pattern) happens very quickly with little or no transition period. They usually take place in a market that has gotten so overextended in one direction, that a sudden piece of adverse news causes the market to reverse direction very abruptly.

Spot Market

The spot market is the market for buying and selling currencies at current market prices.

Spot price

The current price in the marketplace at which a given asset can be bought or sold. The standard settlement time frame for spot transactions is two business days from the trade date.

Spread – Bid/Ask

The distance, usually in pips, between the Bid and Ask price. A tighter spread is better for the trader.

Square Forex

The term means that the buy positions and the sell positions on the same asset are equal. It is also used when there are no opened trades.

Stock Index

Represents a compilation of stocks to measure the value of a stock market sector.

Stock market

(Securities market) is a segment of the financial market where securities are traded.

Stock Split

An attempt to increase the number of outstanding shares of a company by splitting the existing shares. It is usually done to increase the availability of shares in the market. The usual split ratio is 2:1 or 3:1, i.e. one share is split into two or three.

Stop

An order to buy at the market only when a currency moves up to a specific price, or to sell at the market only when a currency moves down to a specific price. allows an investor to specify the particular price at which they would like to buy or sell

Stop loss

Is a pending order to close the losing position when it reaches a certain price.

Stop out

A forced closing of a position without the client’s consent and prior notification in the event of lack of funds to maintain the opened position.

Strike Price

The price at which the holder of an option can buy (in case of call option) or sell (in case of put option) the securities they hold when the option is executed.

Support & Resistance

A price level that the price historically had difficulty crossing below and above. The more times the support/resistance is checked, the more credible it is for future use. When the price level is penetrated, the roles of support and resistance reverse.

Swap

The amount of money deducted from or added to a client account for the overnight position.

Swaption

A futures or an option granting its owner the right to enter into an interest rate swap agreement by some specified date in the future.

Take Profit

A trading order that allows a trader to take profit when the price reaches a certain level. The order helps a trader to reduce risks. The take profit order for a chosen trading instrument will close the transaction automatically as soon as the price reaches the specified level. In an open trade, take profit can be set at any time.

Technical analysis

A popular way of forecasting a price behavior on the forex market. The technical analysis is based on the opinion that a price change in the past will be repeated in the future. Confirmation of previous patterns of market behavior are searched with the help of price chart analysis that detects certain graphical patterns that are interpreted as signs of a possible price move in one direction or another.

The Organization of the Petroleum Exporting Countries, the OPEC

Was established in 1960 by the world’s largest exporters in order to create common oil policy and ensure stable prices on global oil market.

Thin Market

A market in which there are comparatively low number of bids to buy and offers to sell. Since the number of transactions is low the prices are very volatile.

Tick

Minimum upward or downward movement in the price of a security.

Ticker

A unique identification number given to each open position or a pending order in a trading platform.

Time frame

Refers to the time period of the chard chosen to display the price move on the forex market. Time periods in trading platforms include: 1 minute (M1), 5 minutes (M5), 15 minutes (M15), 30 minutes (M30), 1 hour (H1), 4 hours (H4), 1 day (D1), and 1 month (MN).

Tom-Next

Short for tomorrow-next day. The process of moving the settlement value date on an open position forward from one business day after the trade date (tomorrow), to the next valid value date (next).

Trade balance

Is a difference between the monetary value of exports and imports over a certain period of time (for example, a year). It is calculated for both separate nations and groups of countries and includes both actual transactions and those carried out on credit.

Trade deficit

Is a negative trade balance. Merchandise trade balance of a country is a difference between the value of exports and that of imports over a certain period of time. Merchandise trade balance includes all the actual transactions and those carried out on credit.

Trade forecast

An outlook for future changes on the forex market. It is carried out through analysis of financial information and related research studies.

Trade operation volume

Number of lots multiplied by lot size.

Trader

Person, who trades currency on the Forex market in order to earn profit.

Trading account

A unique account of a trader with a unique number where all trading operations of a trader are displayed, including deposit and withdrawal of funds, all pending orders and complete history of an account.

Trading hours

Operating time of the world’s financial markets such as London, New York, Hong Kong and others. Trading hours of exchanges located in different parts of the world differ. In the context of the forex market, trading hours mean the time when transactions can be made – round the clock on weekdays.

Trading operation

An act of buying or selling any instrument performed by the client.

Trading platform

Software and technical facilities that provide the transmission of financial trading information in real time mode, execution of trading operations with account of mutual obligations between the client and the dealer, and control of conditions and restrictions. For the purposes of the present regulation, it consists of “Server” and “Client terminal”

Trading range

It occurs when currency rates on Forex move in a certain price corridor. The lower limit is formed on the support level, while the upper limit is located on the resistance level.

Trading session

The period of time wich is open for trading for both sellers and buyers, within this time frame all the orders of the day must be placed. Here all the orders placed in pre-opening sessions are matched and executed.

Trading strategy

A system of trading on the forex market based on a certain approach to market forecasting. The most widespread strategies include trading with the help of Bollinger bands, moving averages, breakthrough of resistance levels, etc.

Trailing stop

Is a pending stop loss order automatically moved at a specified distance from the current price.

Transaction

Trade operations where money resources move from base currency into quoting currency and vice versa.

Trend

Is the current general direction of a price movement for a substantial period of time. There is an uptrend (bullish trend), downtrend (bearish trend), and non-trend (flat or sideways movement).

Trendlines

Trendlines are created by linking one strongly identifiable support to another or one strongly identifiable resistance to another. This creates an uptrend or downtrend.

TSE (Tokyo Stock Exchange)

Consists of more than 2,500 Japanese and foreign largest companies that are members of this stock exchange. It takes the second place in the world by capitalization after New York exchange.

Turnover

Turnover is an aggregated cost of all executed trades in a specified time period.

Two-way quote

The type of a quote that gives both the bid and the ask price of an asset.

Unemployment Rate

Is calculated by dividing the number of the jobless citizens by the number of the employed or by the total number of people of a certain population category. In most cases, the unemployment rate is expressed as a percentage.

Unprofitable option

A term used in binary options trading. It is a contract, where the asset price at the moment of expiration unfavorably for a trader differs from the asset price at the moment of the option’s buying.

Unrealized gain/loss

It is a theoretical gain or a loss of opened positions calculated in accordance with current market prices as defined by a broker in its sole discretion. When the position is closed, unrealized gains or losses turn into realized gains or losses.

Uptick

New price that is higher than the previous one.

Usable margin

Is a part of deposit not involved in trading which can be used to open new positions (orders). It is denoted as “Free” in the trading platform.

Used margin

Is the blocked part of the deposit, which is used to cover potential losses on open orders. In the trading platform it is displayed in the Margin field.

Value date

A date on which FX trades settle, i.e. the date that the payments of each currency are made.

Variation margin

Additional amount of deposit you need to make to your trading account in order to maintain sufficient money for loss deduction after significant losses have taken place.

Volatility

Is instability, the measure of how much the market conditions, demand or prices change.

Yield

It is the measure of return on investments in terms of percentage. Stock yield is calculated by dividing the current price of the share by the annual dividend paid by the company for that share. For example, if the current price of the share is INR 100 and the dividend paid is INR 5 per share annually, then the stock yield is 5%.

Forex traders usually get MT4 for free when opening a trading account, and MT4 includes what it calls a “strategy tester” which is accessible by clicking a magnifying glass button or Ctrl-R.

Forex traders usually get MT4 for free when opening a trading account, and MT4 includes what it calls a “strategy tester” which is accessible by clicking a magnifying glass button or Ctrl-R.

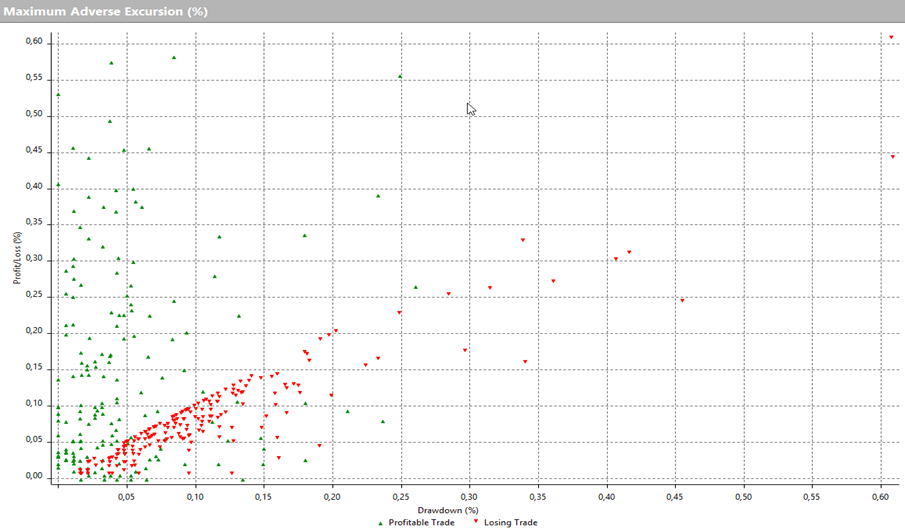

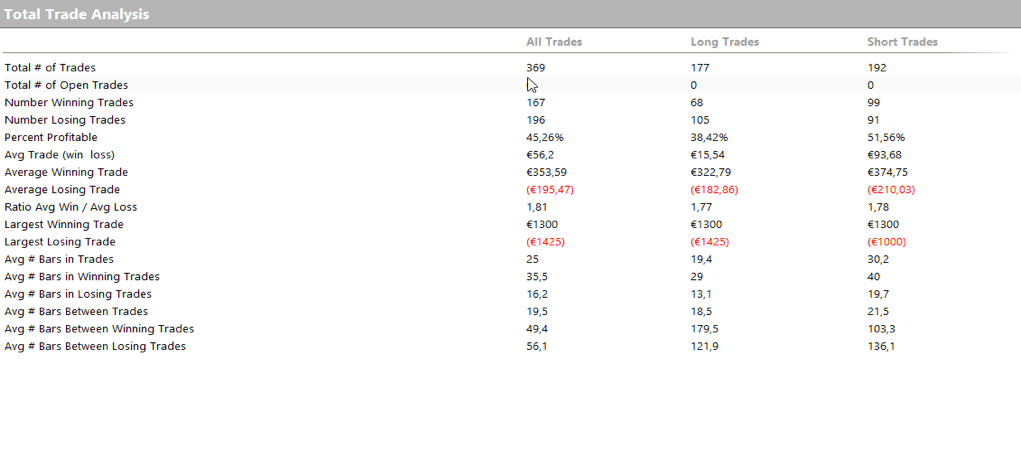

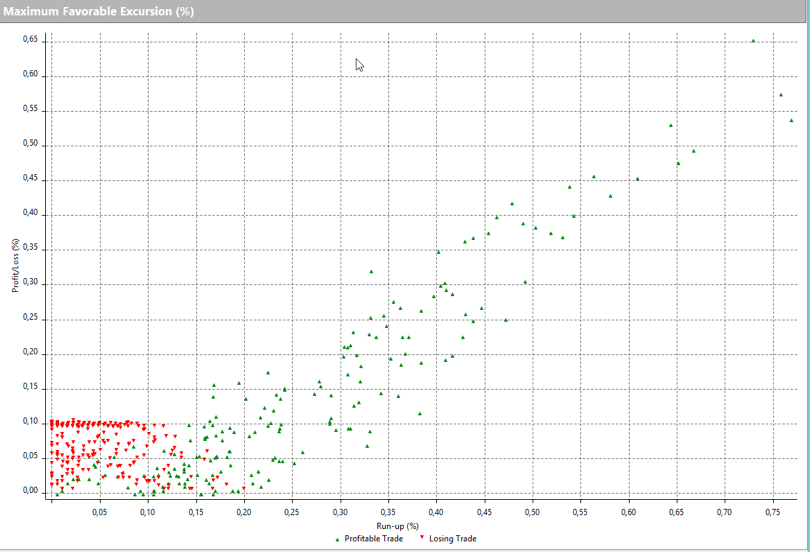

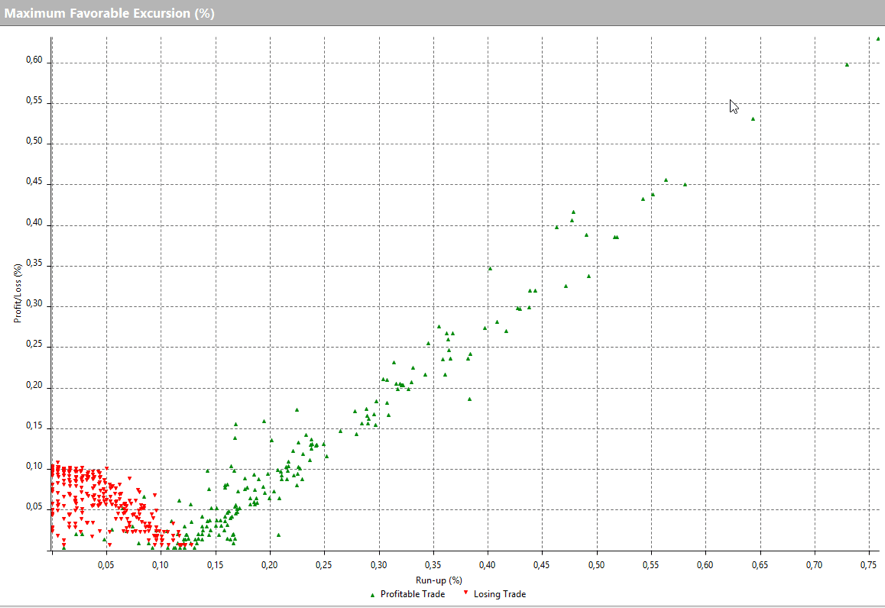

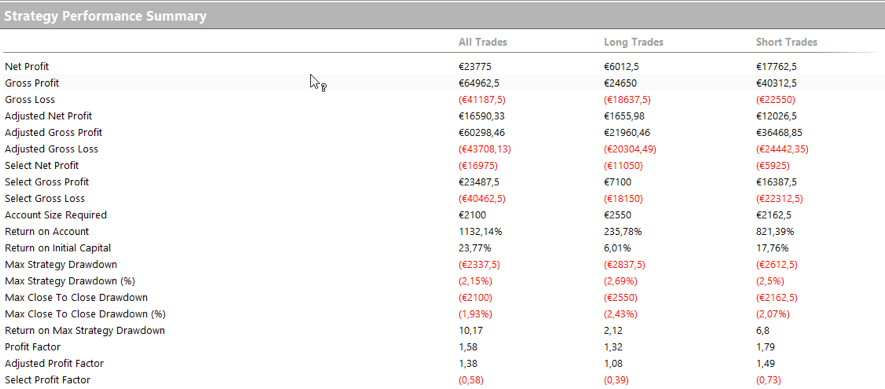

Based on the above results, we set the stop at 0.105% of retraction, and now it looks like this.

Based on the above results, we set the stop at 0.105% of retraction, and now it looks like this.

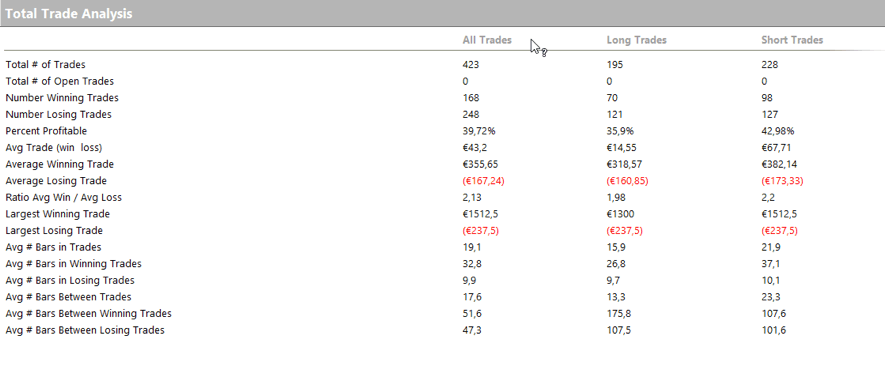

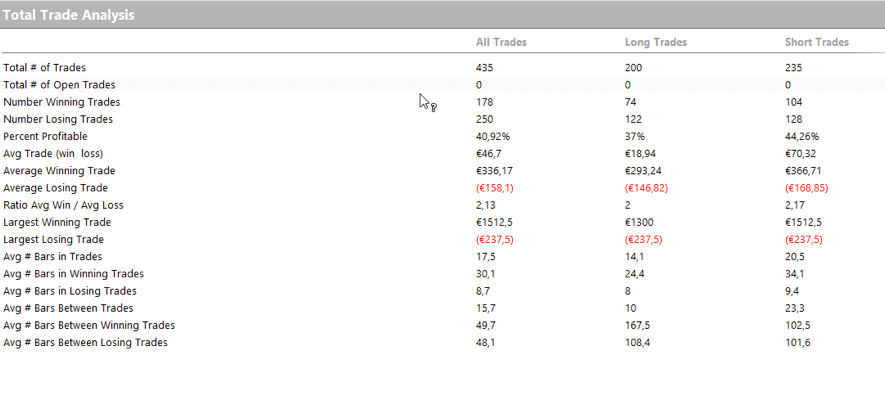

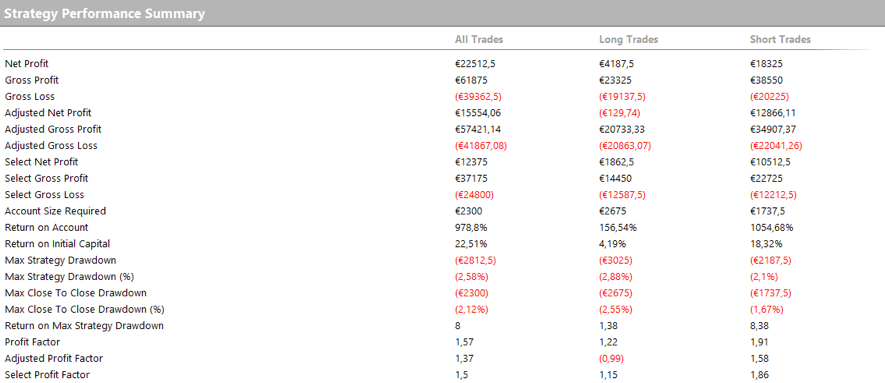

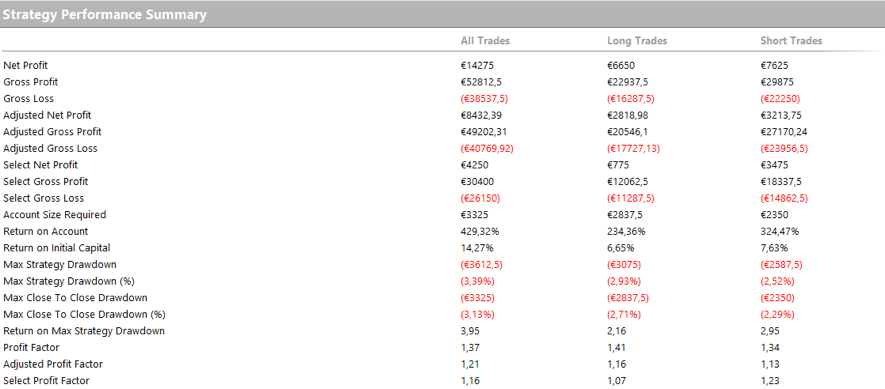

The statistics are as follows:

The statistics are as follows:

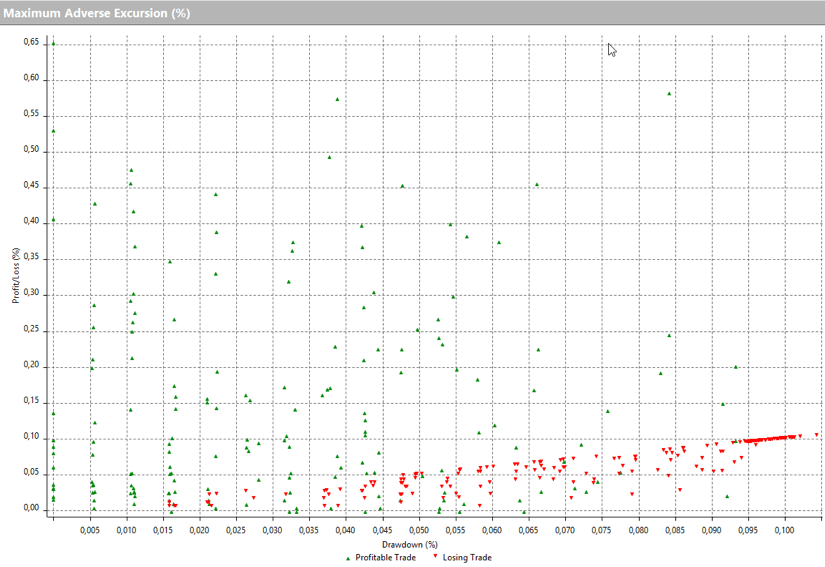

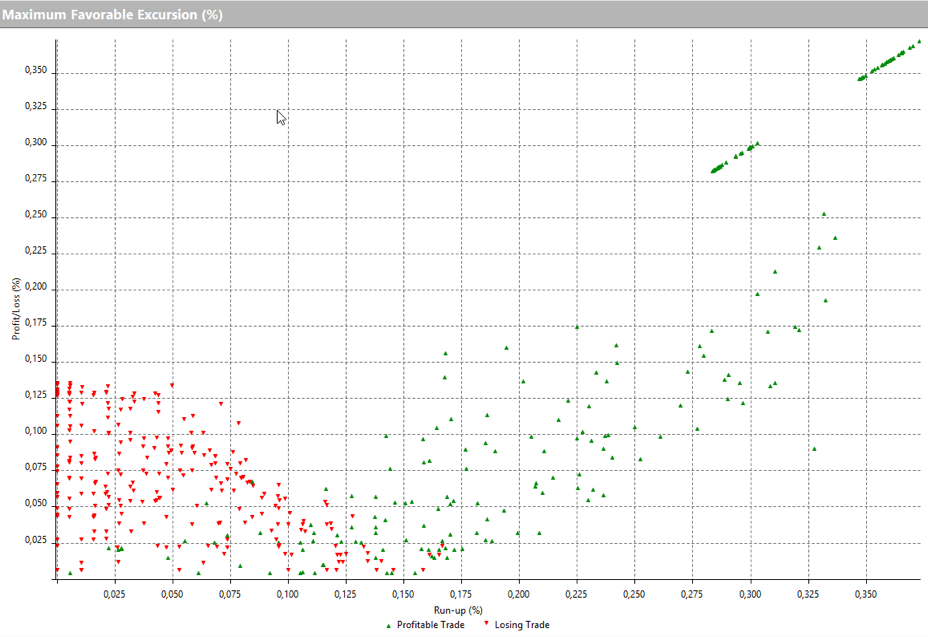

Now to advance the robustness of the system, let’s look at the Maximum Favorable Excursion (MFE) by looking at the following graph.

Now to advance the robustness of the system, let’s look at the Maximum Favorable Excursion (MFE) by looking at the following graph.

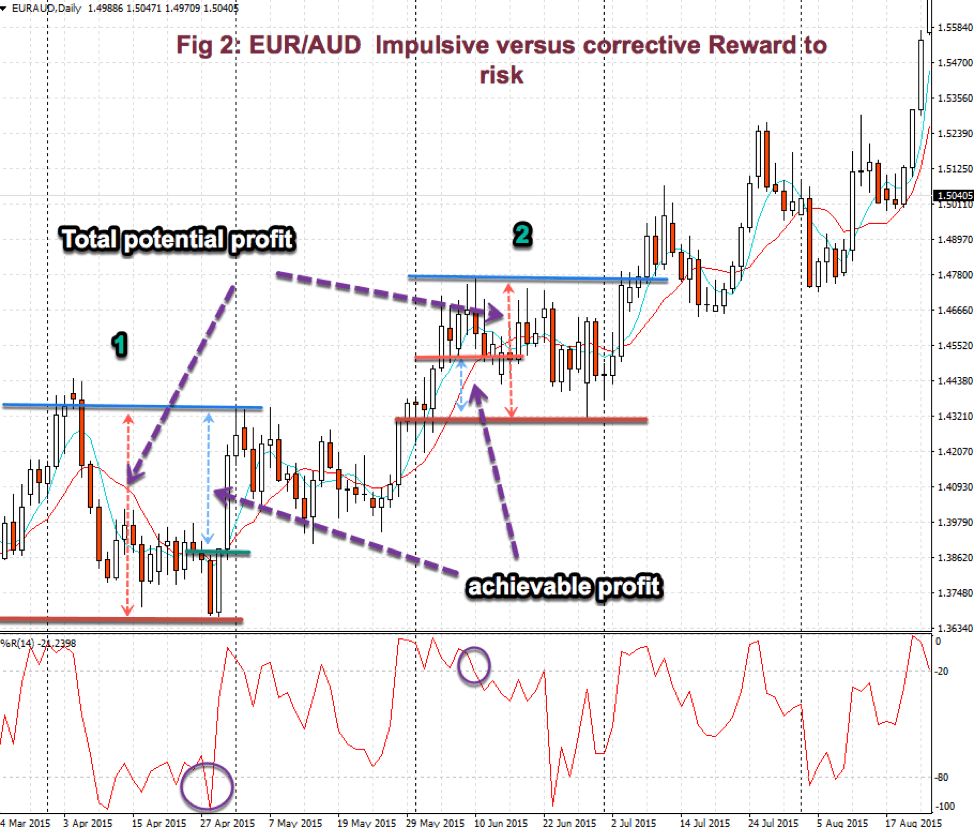

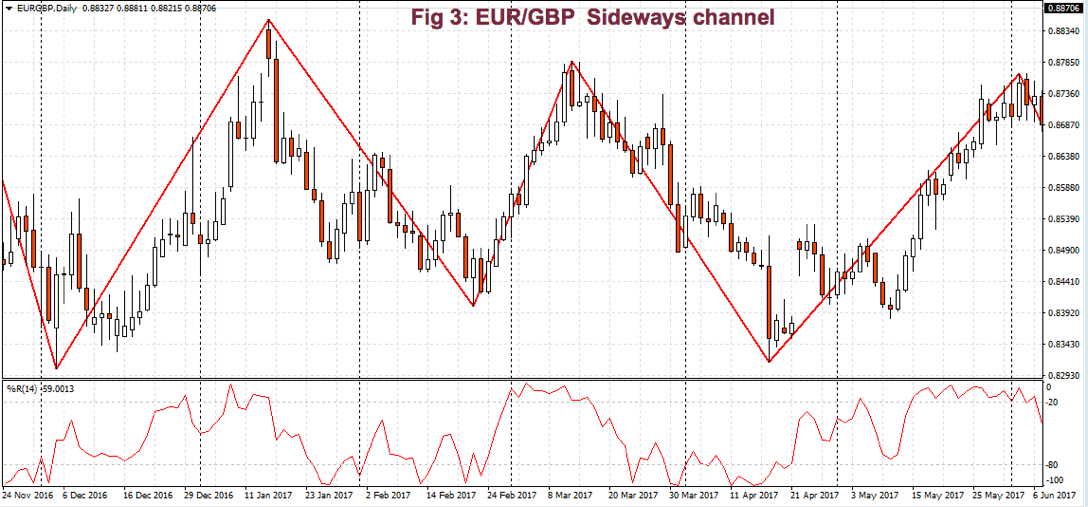

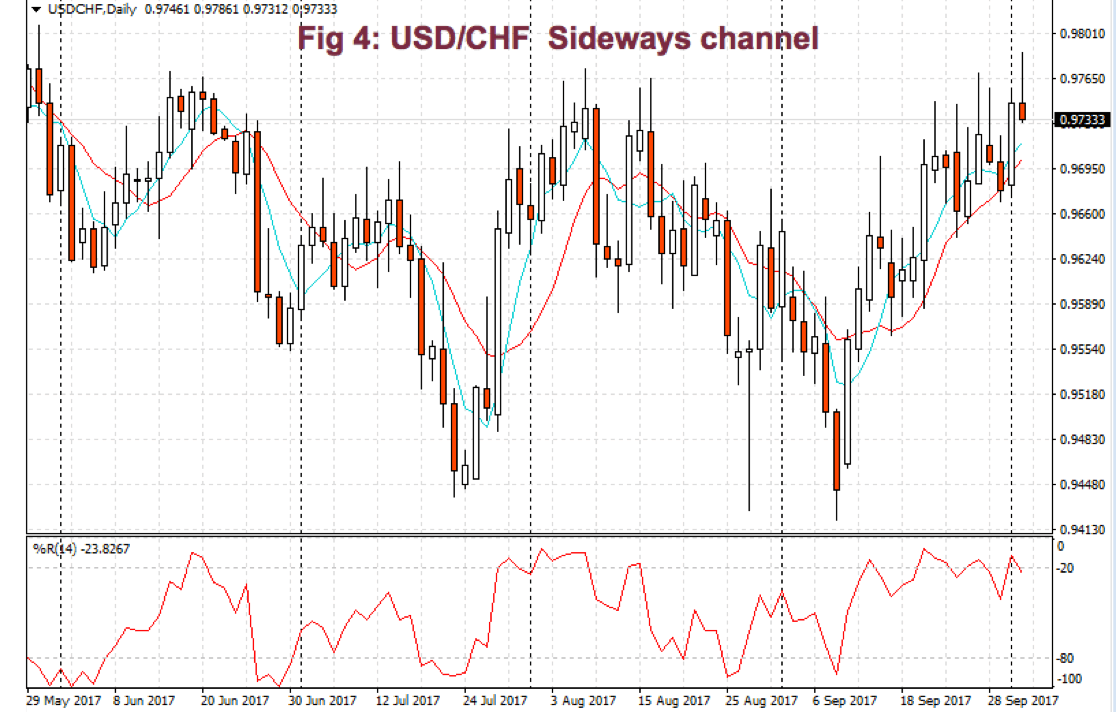

Usually, by just paying attention to where the most longer shadows are drawn, we get the information of who’s in command, although not always this translates into a trend change, it just adds volatility. If we follow, as if it were our polar star, the proper reward to risk ratio and use the oversold/overbought indications set by %R, or Stochastics. we may survive those siren chants…

Usually, by just paying attention to where the most longer shadows are drawn, we get the information of who’s in command, although not always this translates into a trend change, it just adds volatility. If we follow, as if it were our polar star, the proper reward to risk ratio and use the oversold/overbought indications set by %R, or Stochastics. we may survive those siren chants…

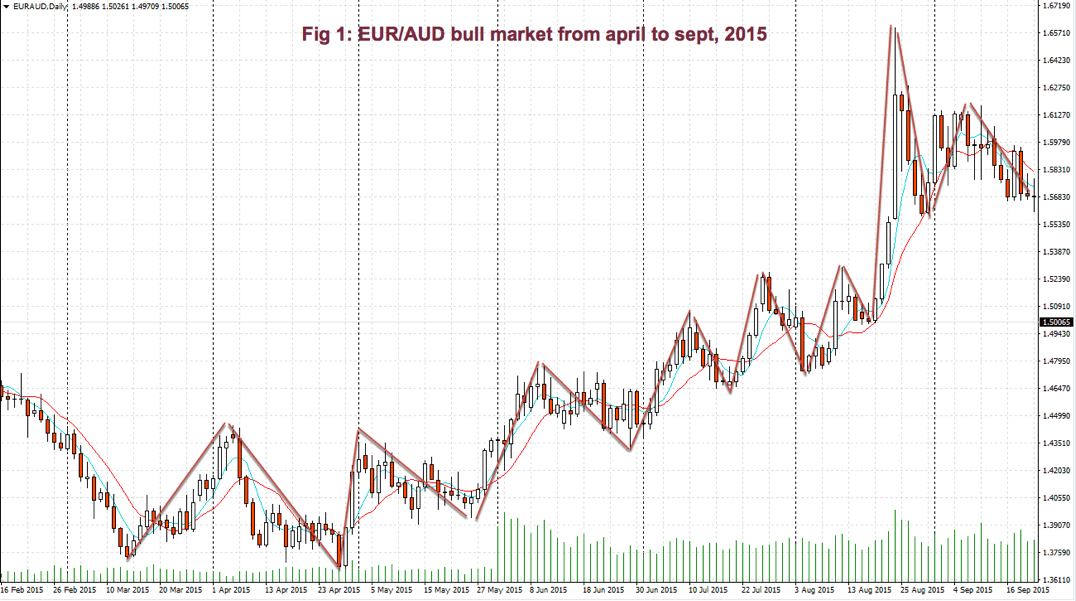

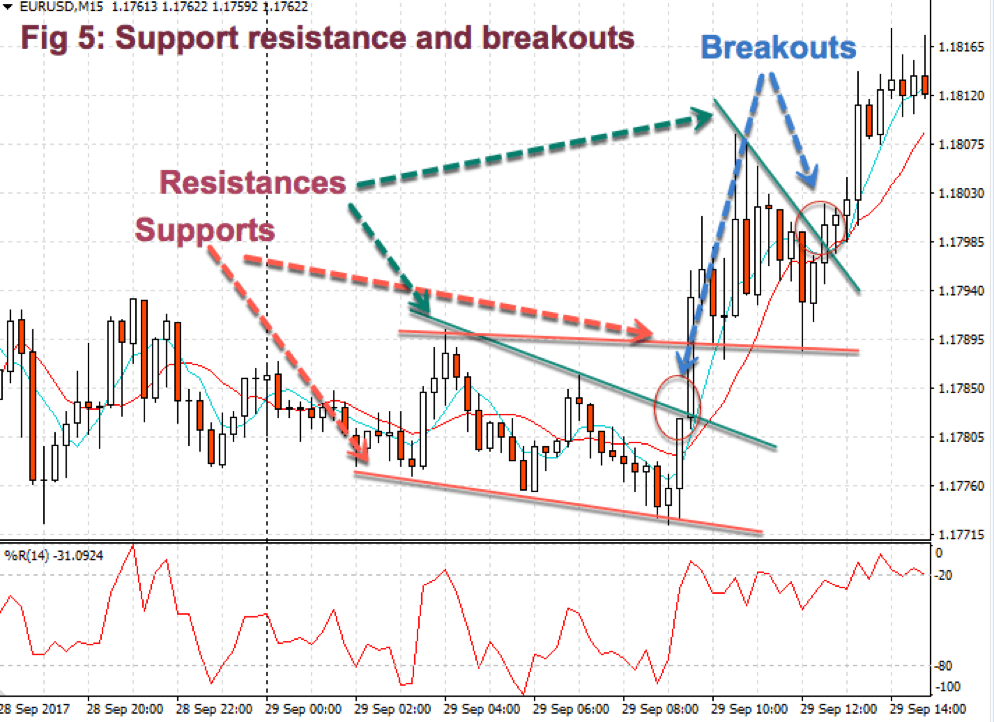

There had been a downtrend easily visible on the chart

There had been a downtrend easily visible on the chart

A bullish reversal bar is a bar with its low making a new low but closing higher. A bearish reversal is a bar where there’s a new high but with the closing lower. Those reversals aren’t significant unless in context with highly oversold or overbought situations.

A bullish reversal bar is a bar with its low making a new low but closing higher. A bearish reversal is a bar where there’s a new high but with the closing lower. Those reversals aren’t significant unless in context with highly oversold or overbought situations.