In a bear market, prices are trending downwards, with the most accepted definition being that the market declines more than 20% in value. The opposite of a bear market is a bull market, where prices have increased in value by more than 20%. Although most people prefer to trade in a bull market, it is often said that the best traders are made in bear markets when the pressure is on. Still, it can be intimidating to trade in a bear market and some traders avoid this situation altogether. Regardless of whether you have or haven’t traded in this type of market before, you should take a look at our tips for surviving in a bear market below.

Tip #1: Diversify Your Investments

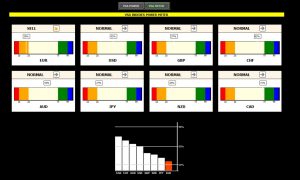

Rather than focusing on one or two instruments, the best strategy in a bear market is to diversify your portfolio by investing in other currency pairs.

It’s best to stick with majors & minors. Avoid exotics.

Consider hedging your trades by trading pairs that usually counter one another so that you can make a profit either way or reduce your loss.

Consider adding other instruments like stocks to your portfolio for more diversity.

Tip #2: Invest in the Right Currency Pairs

In order to trade successfully in a bear market, you’ll need to be able to spot which pairs are worth trading. This may seem difficult at first, as it will seem as though every pair is down.

Look for signs that the market is undervalued and will change soon.

Invest in a pair that is likely to recover soon and you will be able to sell your position at a good price because it was undervalued when you purchased it.

Tip #3: Buy Low and Sell High

This might seem obvious, but the best money-making strategy in a bear market is to buy once the market is close to the lowest price and to sell once the price rises. However, this can be risky because the market could continue to decrease in value.

Look for confirmation that the price is going to rise before buying low. The best indicator of this is a bullish candle.

Be sure to figure out how much you’re willing to risk first and use a stop loss along with your risk-management plan.

Consider using indicators to better trade the trends in the market

Tip #4: Larger Timeframes are Best

You’ll want to look at larger timeframes when trading in a bear market because they can last a long time and shorter timeframes just don’t get you a view of the bigger picture.