The brief USA and Iran conflict and how it played out in the market from the 3rd to the 9th of January 2020

It was the conflict that wasn’t. Thank God. So far, anyway. In normal times, the biggest market movers are interest rates. However, when it comes to war and conflicts, and especially where a leading country in the west is involved, nothing moves the markets more. Conflicts cause immense uncertainty in global economics. And that means one thing for investors: they will release cash by liquidating from investments such as stocks and put their money into safe-haven assets such as the Japanese yen or Swiss franc. Although these two currencies return less to the Investor due to their low-interest rates, they are seen as a safe and steady long term investments. Other safe-haven investments at such times are gold and even bitcoin in more recent times.

Indeed during this very short spat between the United States and Iran from the 3rd of January, when President Trump ordered the air-strike, which killed Iranian general Qasem Soleimani to the 7th January 2020. After Iran fired missiles at air bases in Iraq housing US soldiers, we saw a downside move in the major stock indices across the globe, and especially because President Donald Trump had threatened to target 52 sites of interest within Iran, should there be any reprisals. While the world waited with baited breath, extreme market jitters ran throughout the global markets. The US dollar also declined initially.

The oil market was affected during the initial phase because of the vast amount of oil passing through the Middle East region, en route to the rest of the globe, which would have been heavily affected by war in the region, thus sending the price of a barrel of oil to fresh highs. This move adversely affected the Canadian dollar, which moved lower against the USD and other major currencies.

Example A

Example A is of the Dow Jones 30 index, and we can see that the market initially collapsed when Iran fired the missiles to 2 US bases in Iraq, threatening an escalation of the war with the United States and Iran. However, because there was no collateral damage to American forces or their equipment, the Dow Jones quickly erased losses and indeed has subsequently rallied to record highs. This lift has been followed by global indices generally.

Example B

Example B shows a 1-hour chart of the EURUSD pair during the conflict, which, although declined during this period, heavy losses for the euro were pretty much contained in a very narrow sideways range and where the overall trend in the pair was lower prior to the event..

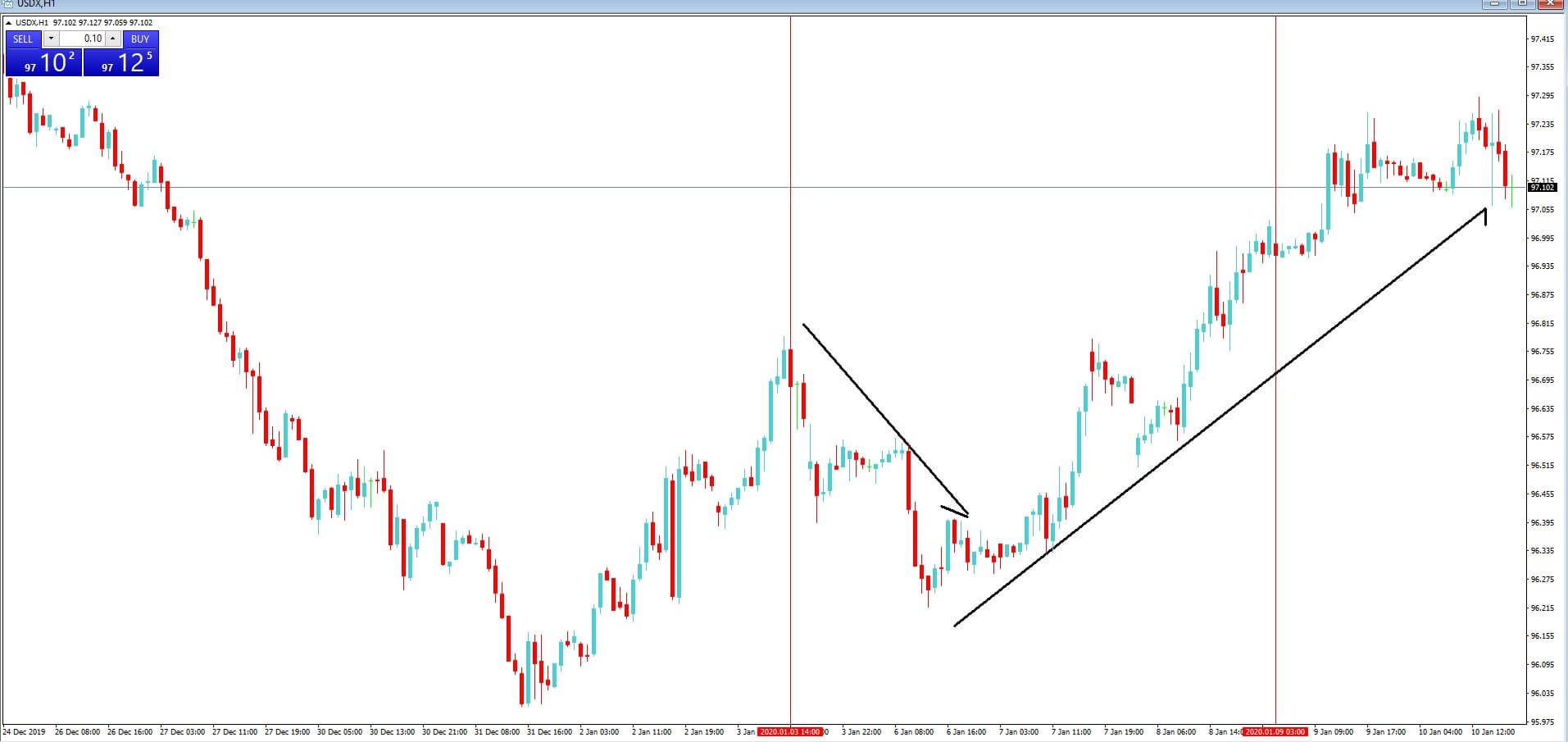

Example C

Example C is the US dollar index, where we can see that, after an initial slide when the Iranian general was killed, and the retaliation by Iran was not effective, and, also, the subsequent de-escalation of the tensions between Iran and the United States, investors have favored the US dollar which is broadly up against the other major currencies. The Yen also retraced its gains, and the USDJPY pair moved higher.

This event goes to show that geopolitics is as important as fundamental analysis when it comes to trading currencies. New traders are strongly advised to learn how all the markets are interwoven and how they react when major events such as wars take place.