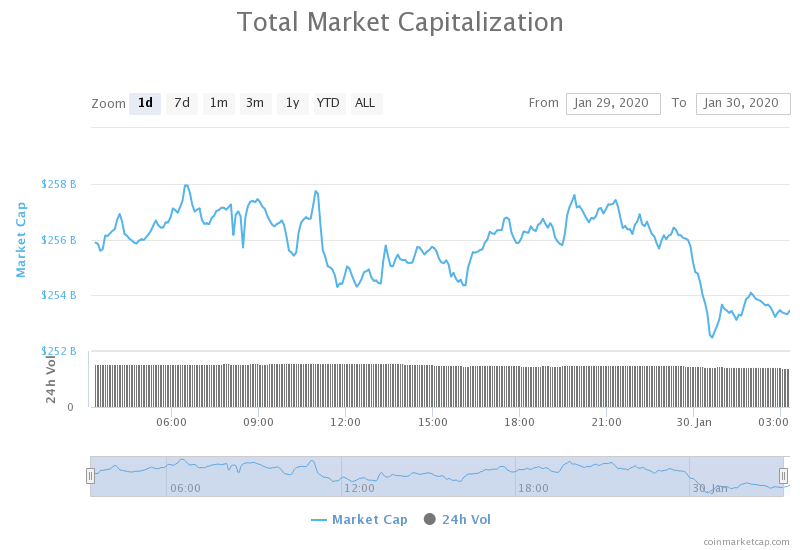

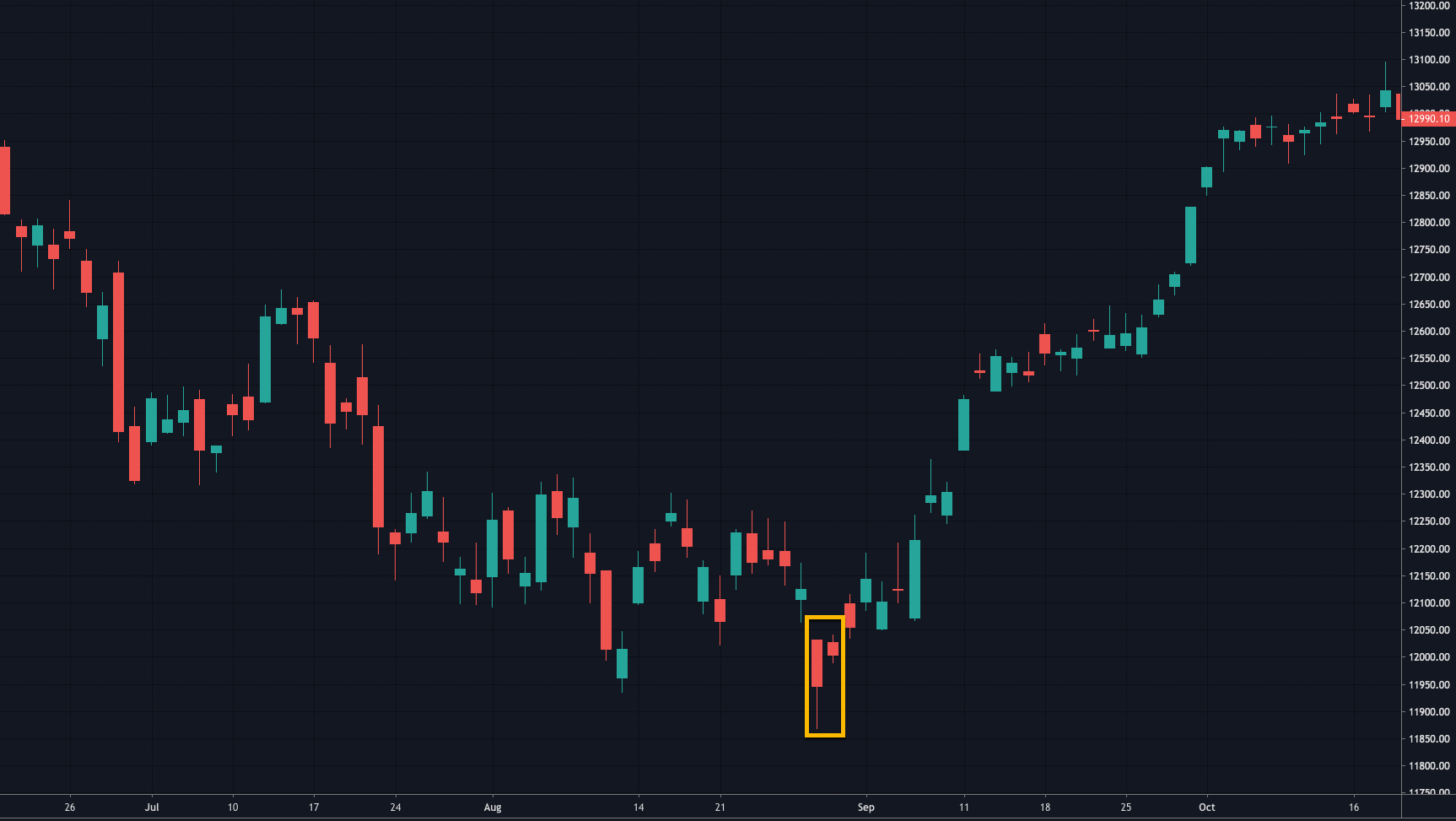

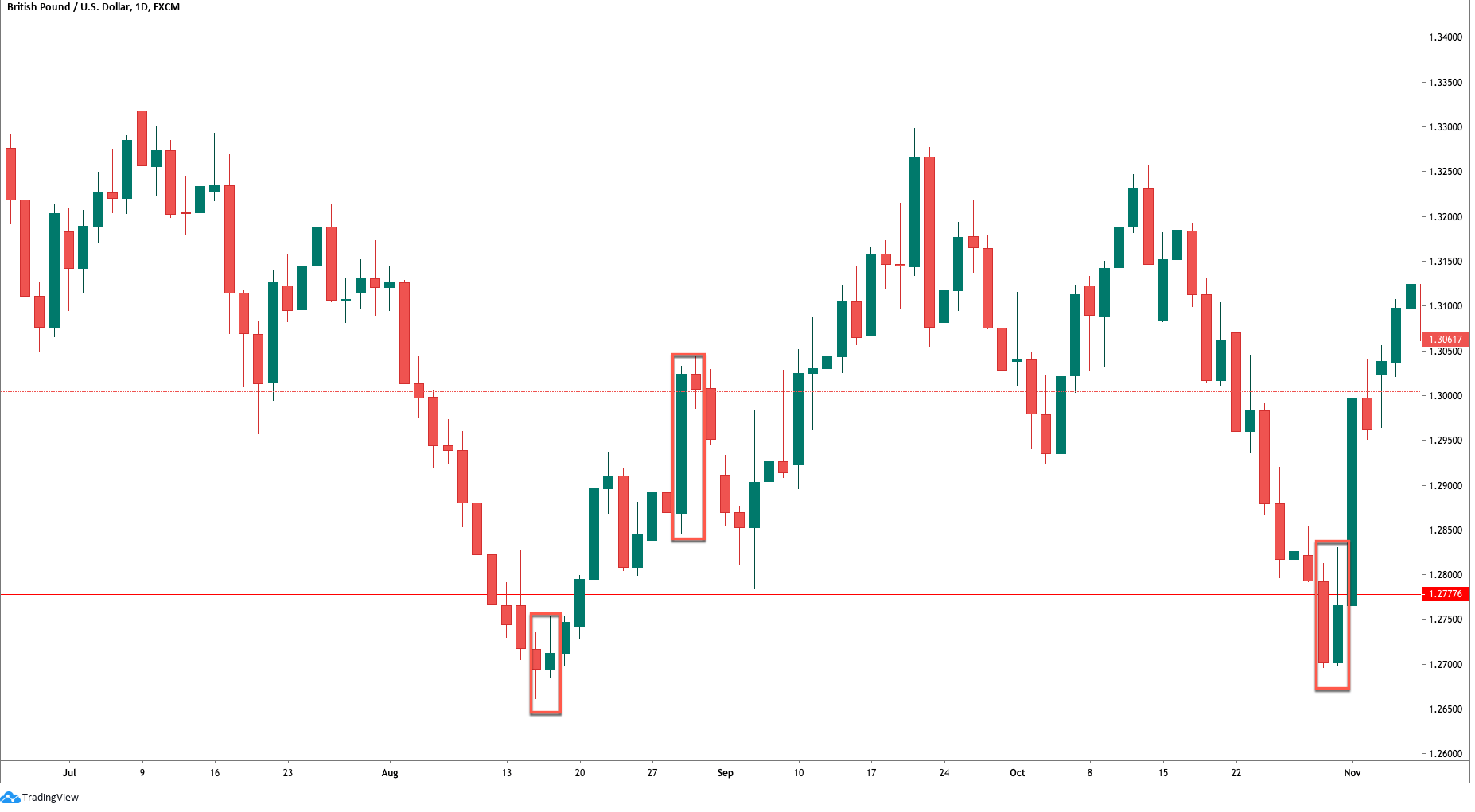

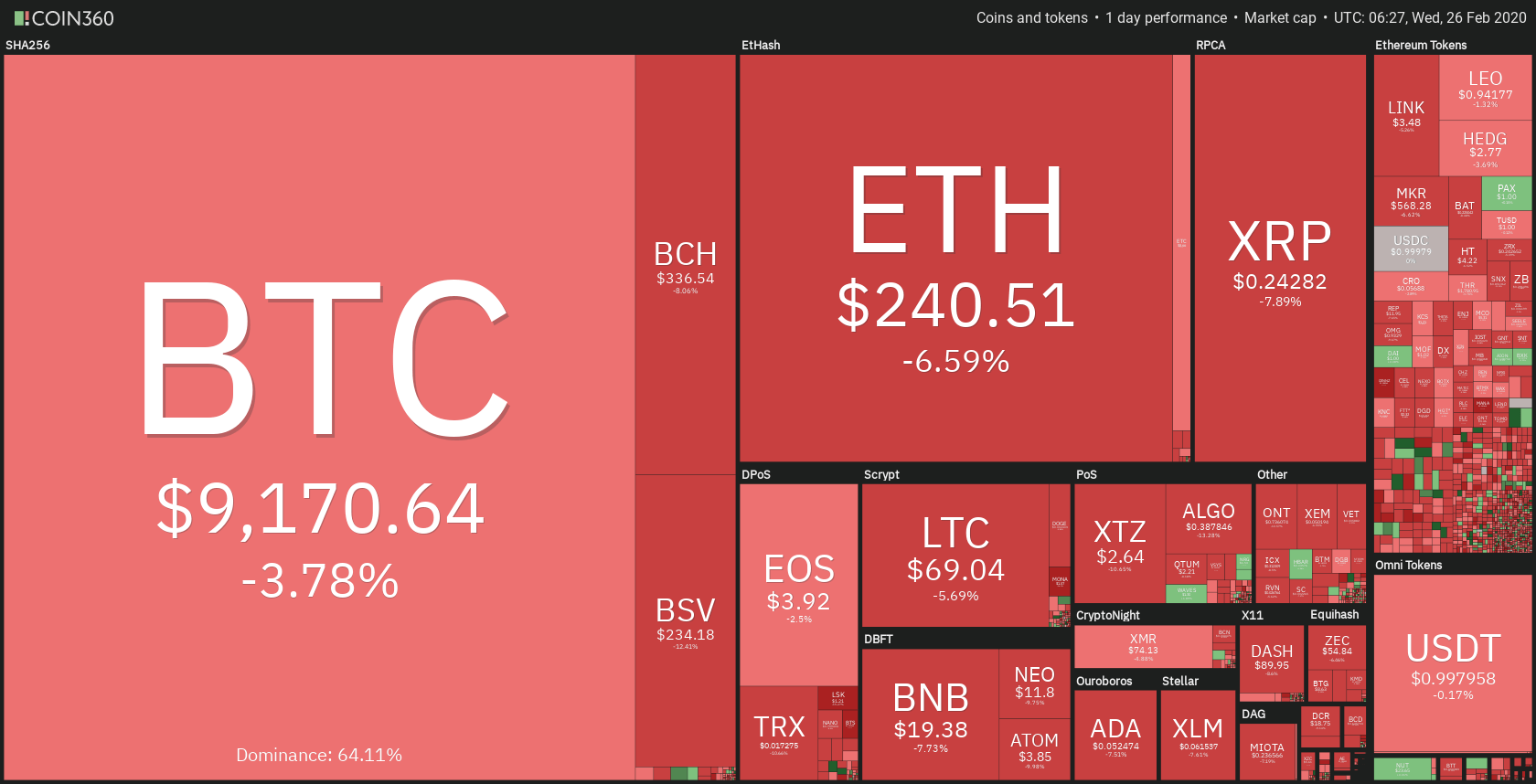

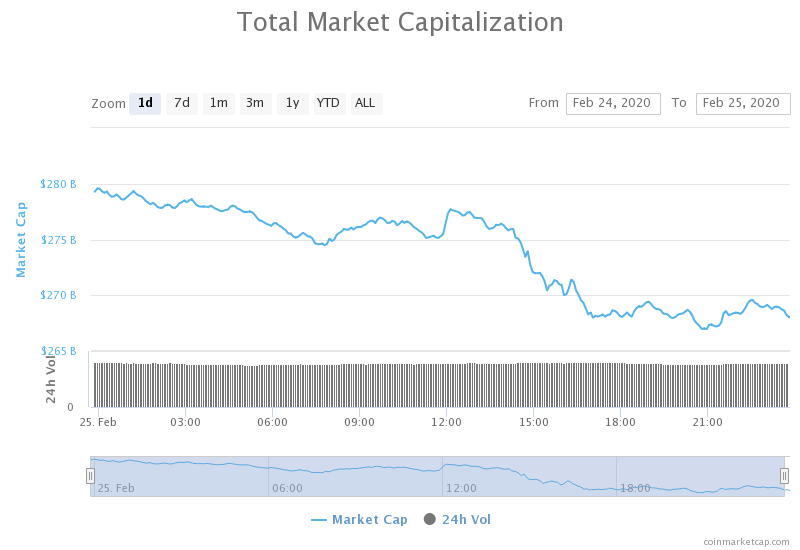

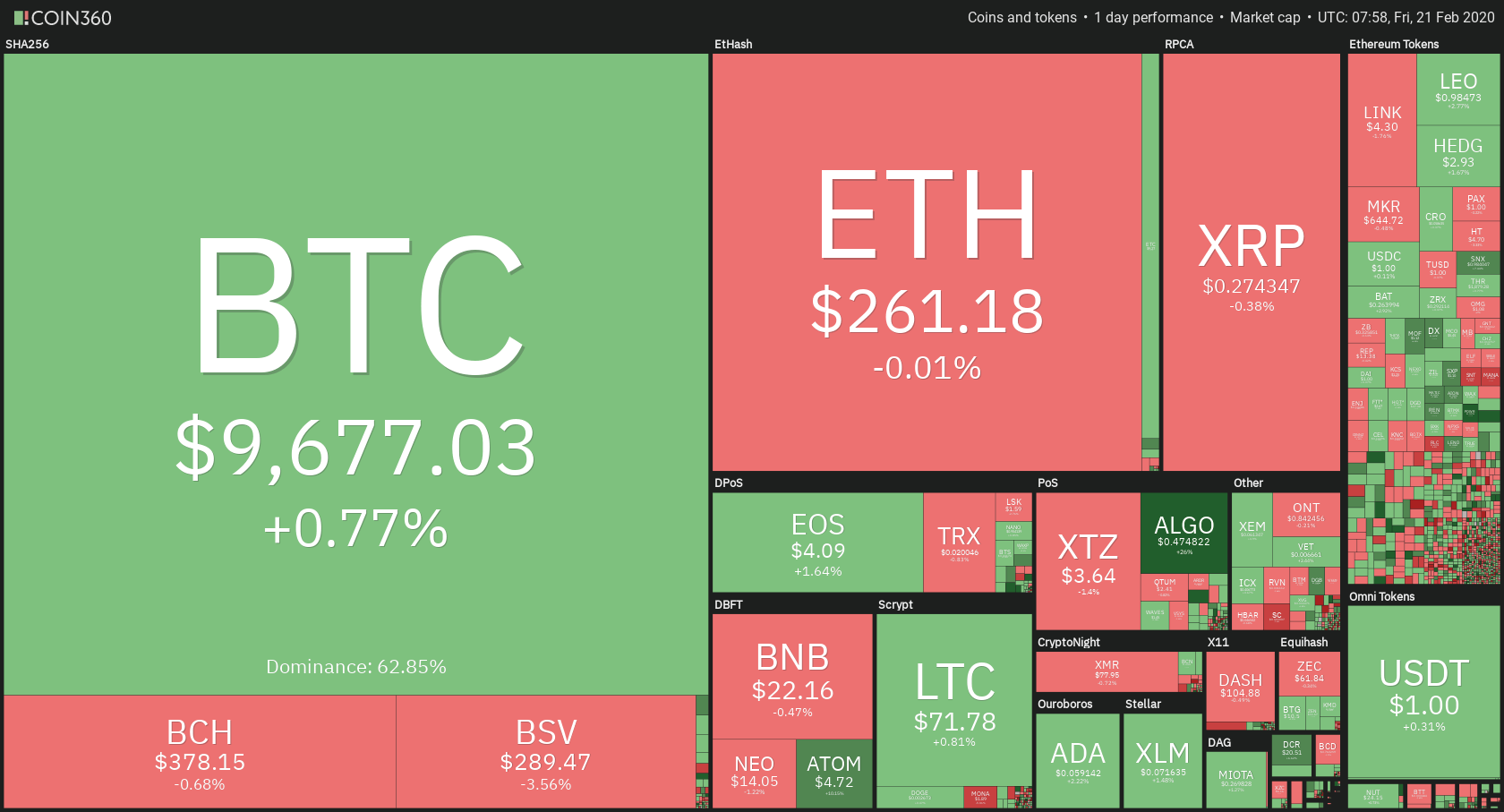

The idea behind cryptocurrencies was that they would be used side by side, or better, outmatch fiat currency in everything. cryptocurrencies would be quicker, more secure, more efficient, and so on. But as it grew popular, it soon became apparent that cryptocurrencies were extremely volatile. This volatility renders them untenable for use in daily transactions – necessitating the advent of stablecoins. Today, Tether is the poster child of stablecoins, or so to speak.

This guide walks you through everything you need to know about Tether, this thing called stablecoin and the seemingly endless controversy that Tether finds itself embroiled in.

What is Tether?

Tether is a cryptocurrency whose tokens are pegged to an equivalent amount of fiat currencies like the US dollar, the Chinese Yuan, the Euro, and so on. The Tether network’s native tokens are called Tether, and they trade by the name USDT.

Launched in July 2014 and opened for trading in February 2015, Tether was first called RealCoin, later rebranded as Tether by Tether LTD, the company behind the project.

Tether belongs to an emerging type of cryptocurrency called ‘stablecoins.’ Stablecoins operate under the premise that cryptocurrency valuations do not have to be as unpredictable as the traditional cryptocurrency. As such, stablecoins are backed by a reserve of fiat currencies or other cryptocurrencies that rely on external market economics (e.g., MakerDao) to create stable coins.

More on Stablecoins

In today’s crypto scene, the vast majority of cryptocurrencies are used purely as speculative trade instruments without much ‘’real-world” use. But this is not what cryptocurrency was invented for. The idea behind stablecoins is to provide stability for cryptocurrencies, which would make them suitable for use as mediums of exchange and stores of value.

Since cryptocurrencies are characterized by wild price swings, stablecoins attempt to provide price stability and offer fast processing power (for massive use ) and, at the same time, the privacy and security of cryptocurrencies. Also, investors can bet on stablecoins because they won’t experience the same volatility associated with cryptocurrencies.

In short, the original cryptocurrency vision was for it to compete with fiat currencies in purchasing power, be deflationary, and suitable for payments — Stablecoins attempt to model this ideal behavior.

How Does Tether Work?

Tether is based on different blockchain platforms. One version uses the Bitcoin blockchain-based Omni platform, with the other utilizing Ethereum’s blockchain.

The Bitcoin blockchain’s version inherits the stability and security of the world’s first blockchain.

Tether coins are collateralized by one US dollar, meaning a Tether coin is backed by and can be redeemed at any time for a US dollar.

Previously, Tether supported only the US dollar as a redeemable currency but has since added the Euro and the Chinese Yuan to its repertoire.

What’s the Point of Tether?

As we previously stated, cryptocurrencies are known for their incredibly wild volatilities. Yet that is partly why they are so popular – because traders and investors can purchase a cryptocurrency and sell it when prices shoot up – making significant profits.

Tether, being predicated on a stable, fixed price offers no thrill sufficient enough for crypto investors. The cacophony associated with the crypto market – the pumps, dumps, bubbles is absent when it comes to Tether. Owning the crypto is similar to having a bank account that gives you zero returns.

So what’s the point of Tether?

Let’s explore the reason why Tether is useful, after all:

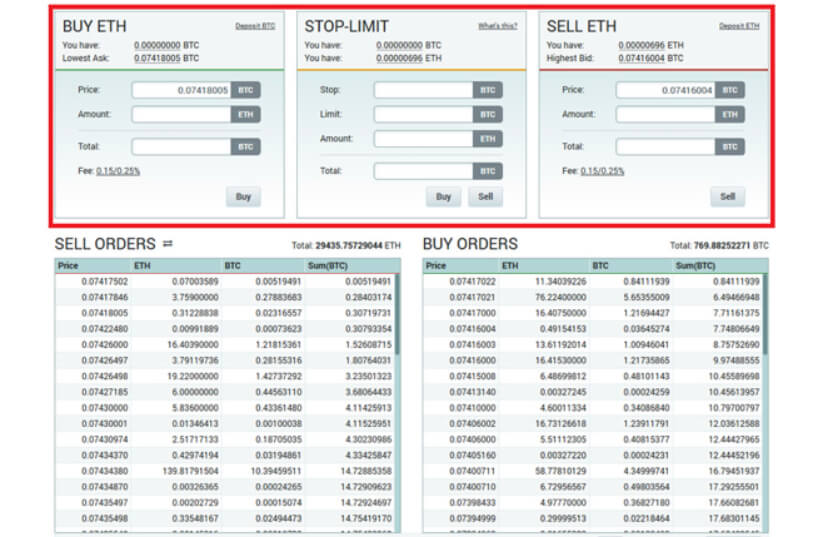

Transaction times. Money deposits and withdrawals on foreign exchanges are notoriously time-consuming processes that can even take up to a week to complete. Also, banks are closed after 5 pm, during the weekends and holidays. Thus, the traditional way is no guarantee for fast, quick, and reliable transactions. On the other hand, Tether transactions take just minutes. Traders can take advantage of this to quickly shift funds and grab arbitrage opportunities in the crypto market.

Transaction fees. The traditional money transfer system is characterized by expensive costs. On top of that, if you’re using another currency not supported by a particular exchange, you’ll be charged an extra conversion fee. By contrast, Tether charges very minimal to zero fees for transactions within its wallets.

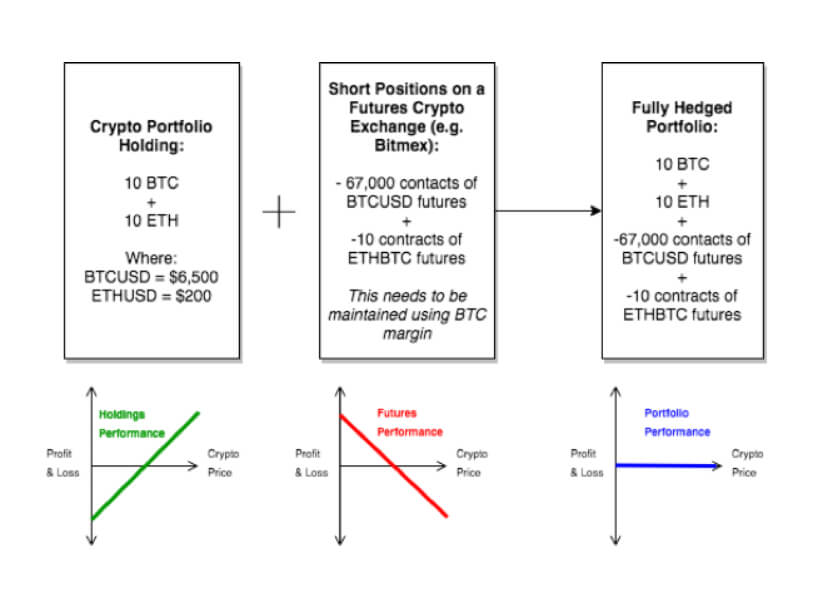

Price Stability. While cryptocurrencies’ volatility is a good thing for trading, the reality is not as rosy when you’re at risk of losing money. Countless people have invested in crypto waiting for it to spike – with no avail. Trading cryptos, while exhilarating and potentially lucrative, comes with a great deal of risk. That’s where a stablecoin like Tether comes in useful.

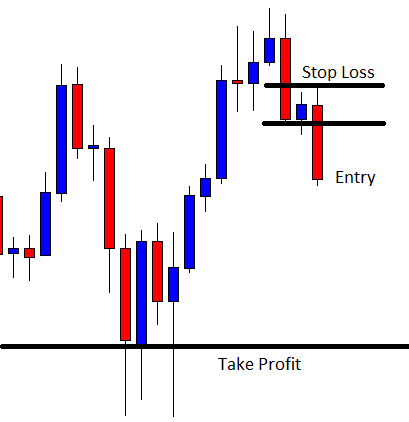

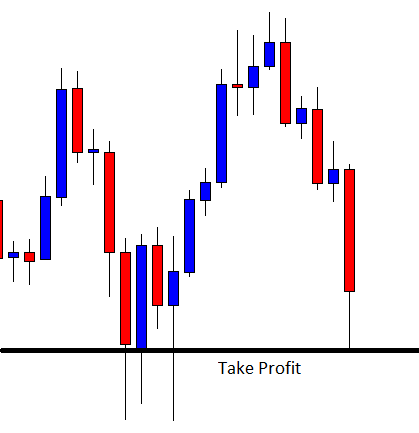

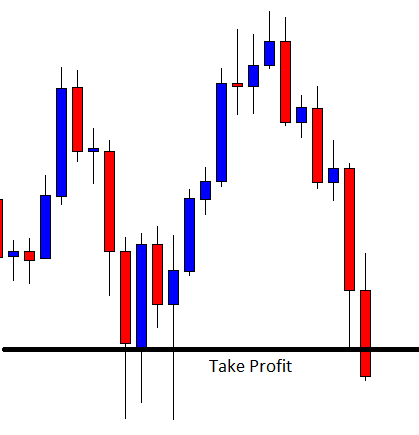

For example, imagine you’re trading Bitcoin for Litecoin. You convert BTC to buy LTC. Litecoin rises by 20%. You wish to make a profit and sell your LTC for BTC. While your trade is undergoing, Bitcoin suddenly falls by 30%. While you were right about LTC’s direction, you suffer a loss as a result of BTC taking a dip.

Tokenomics of Tether

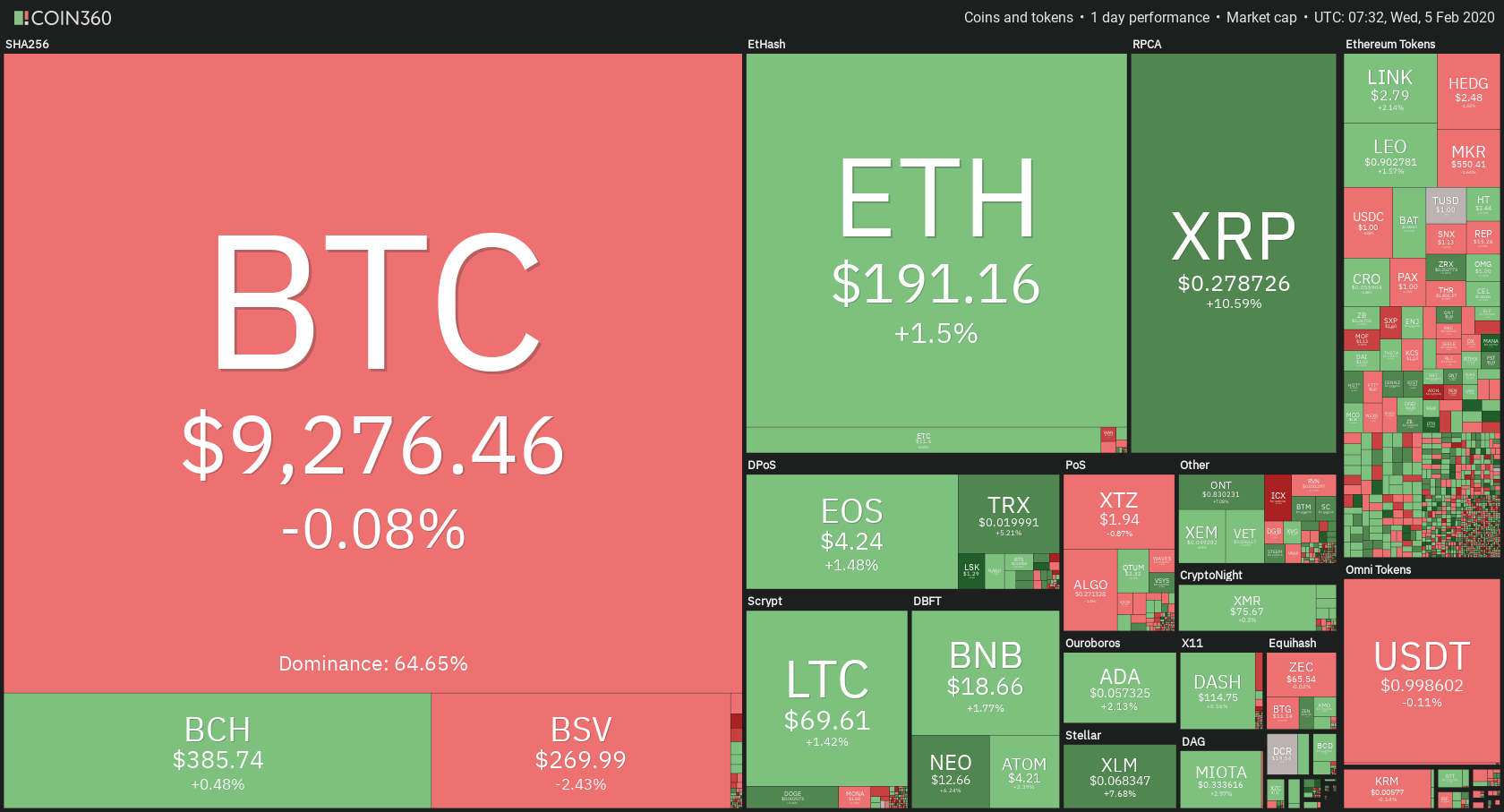

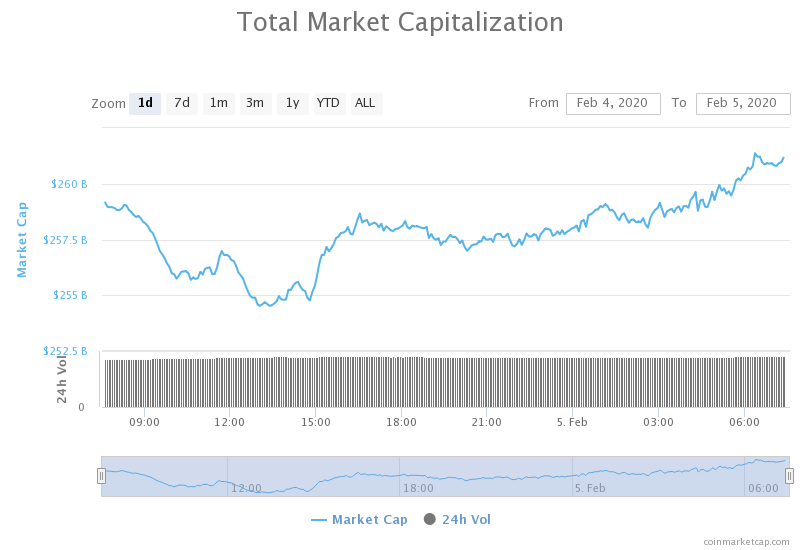

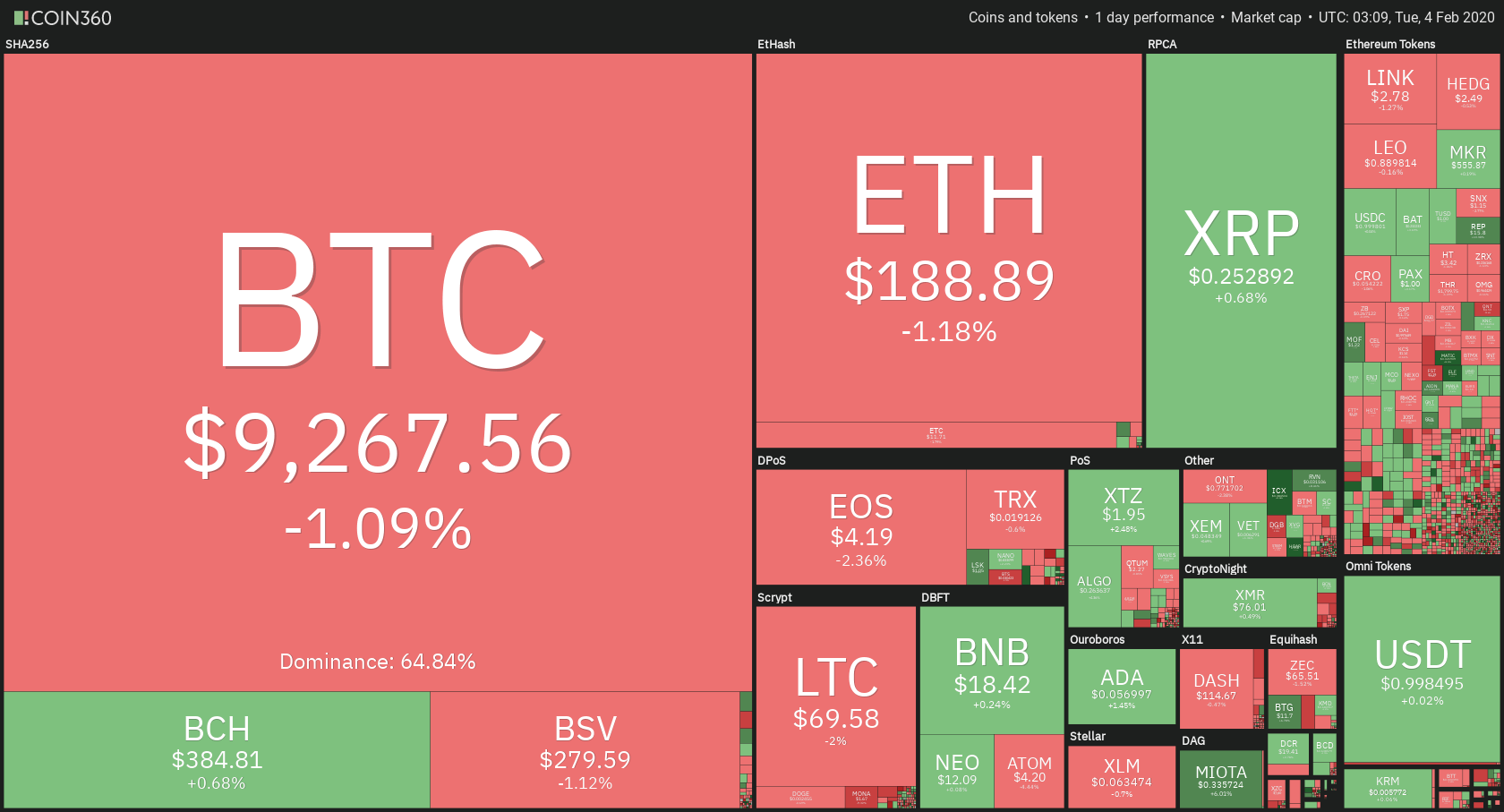

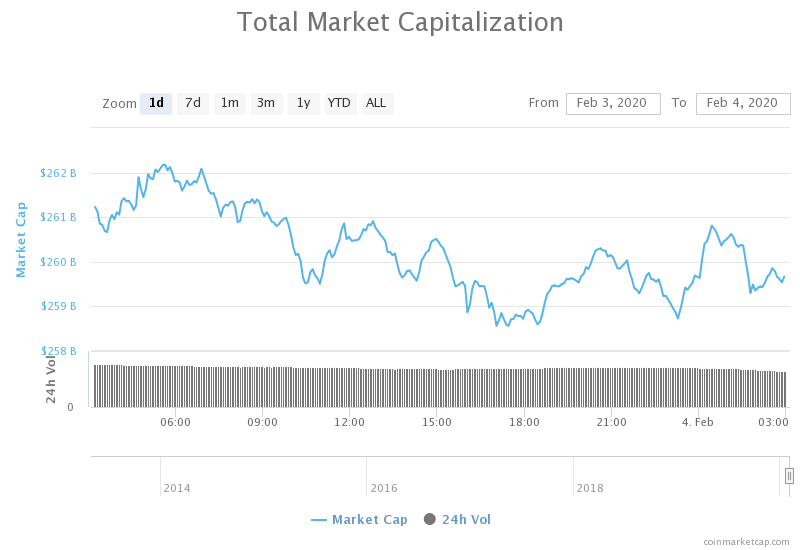

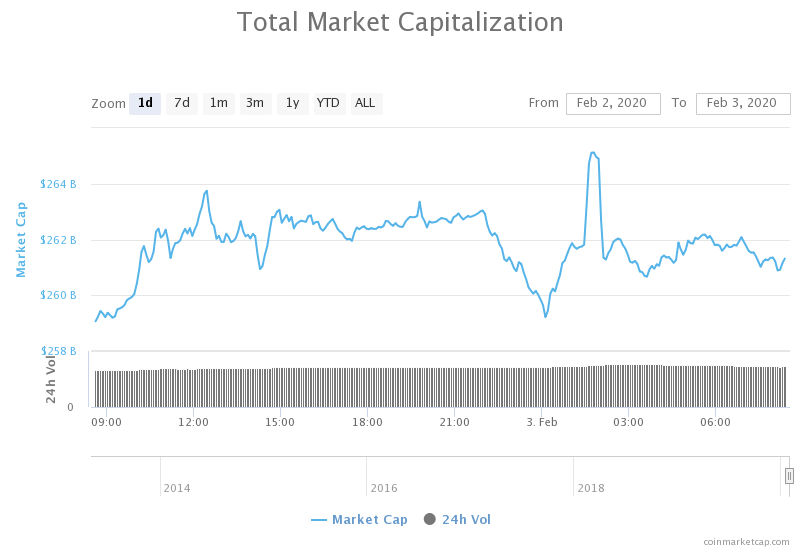

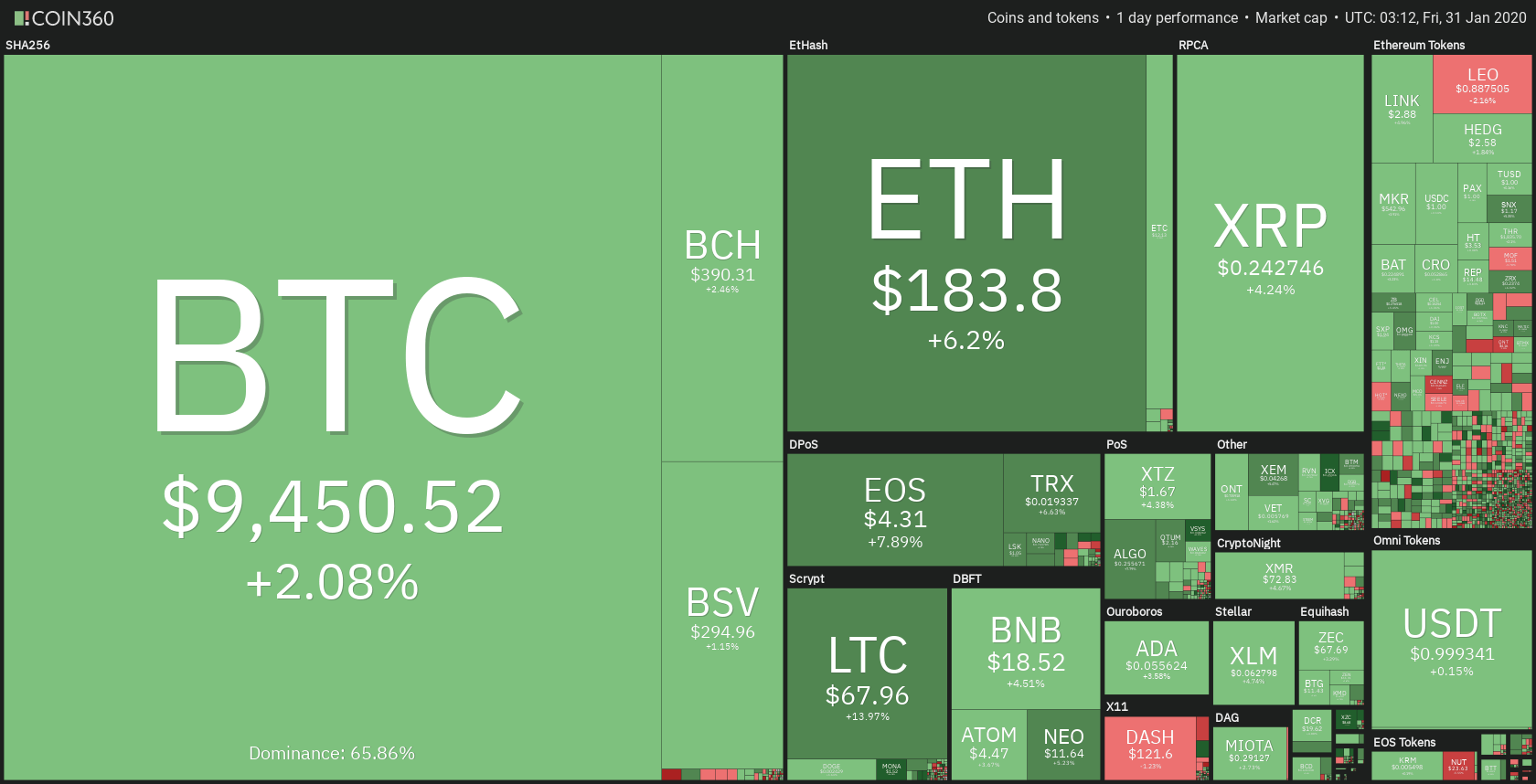

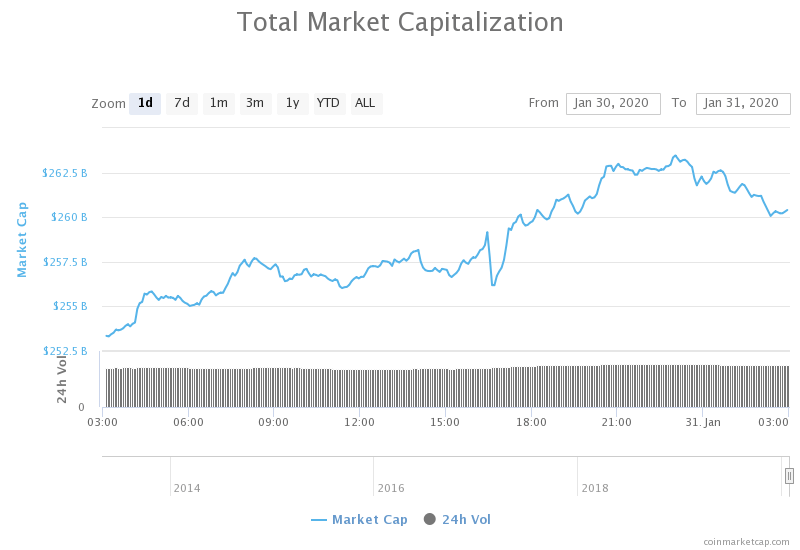

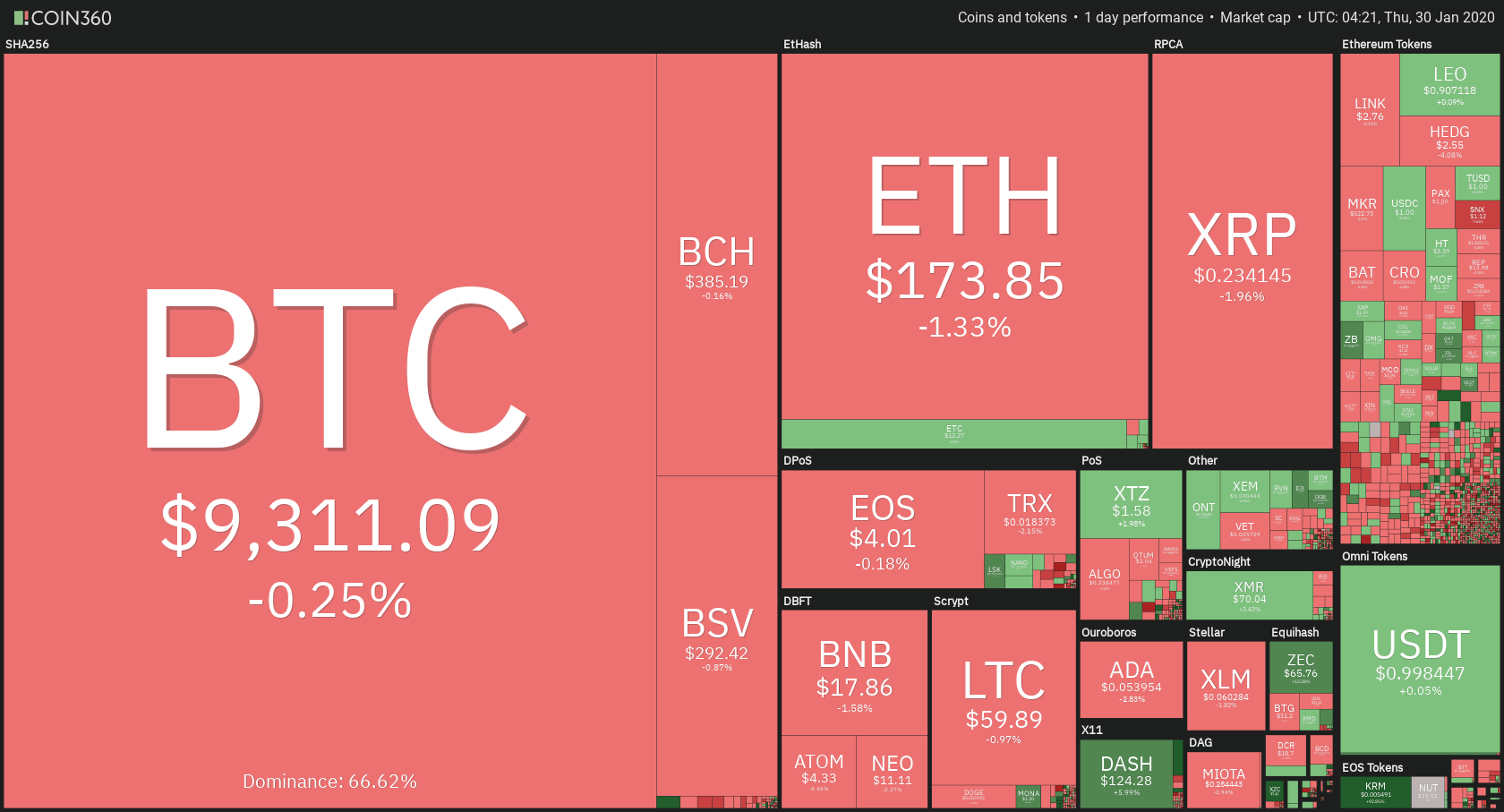

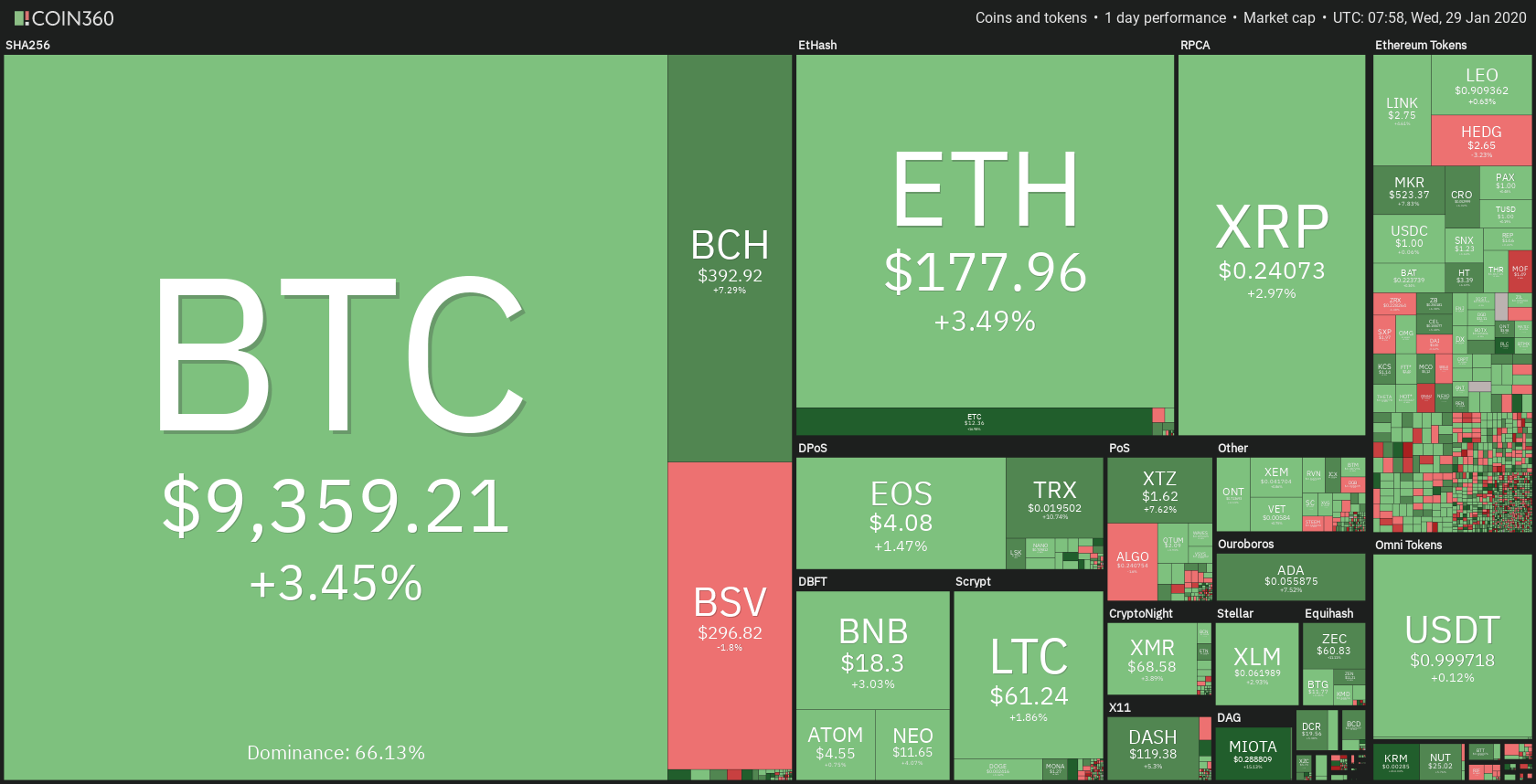

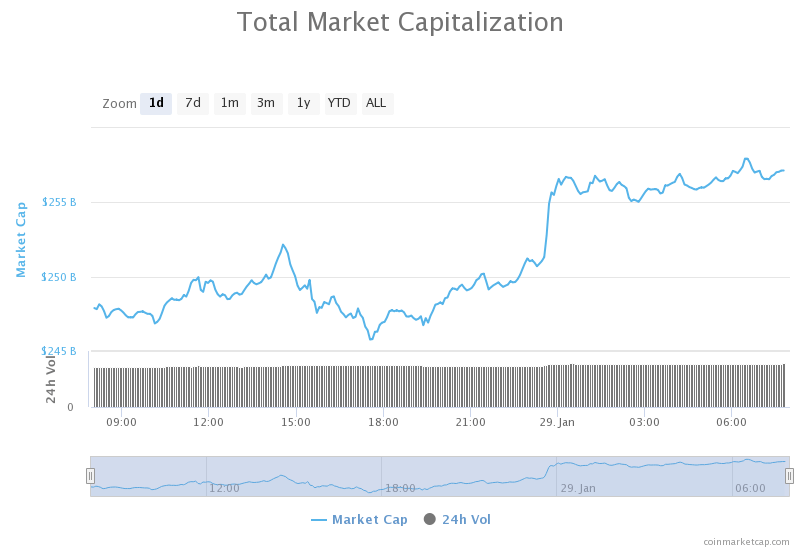

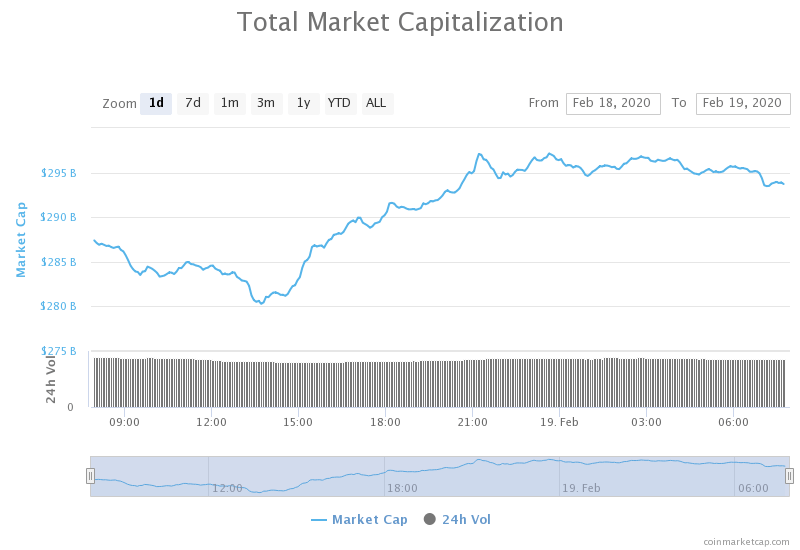

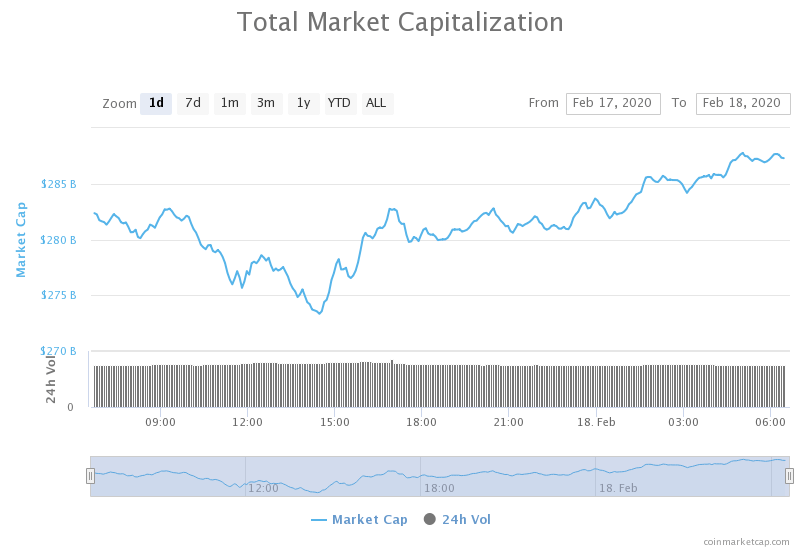

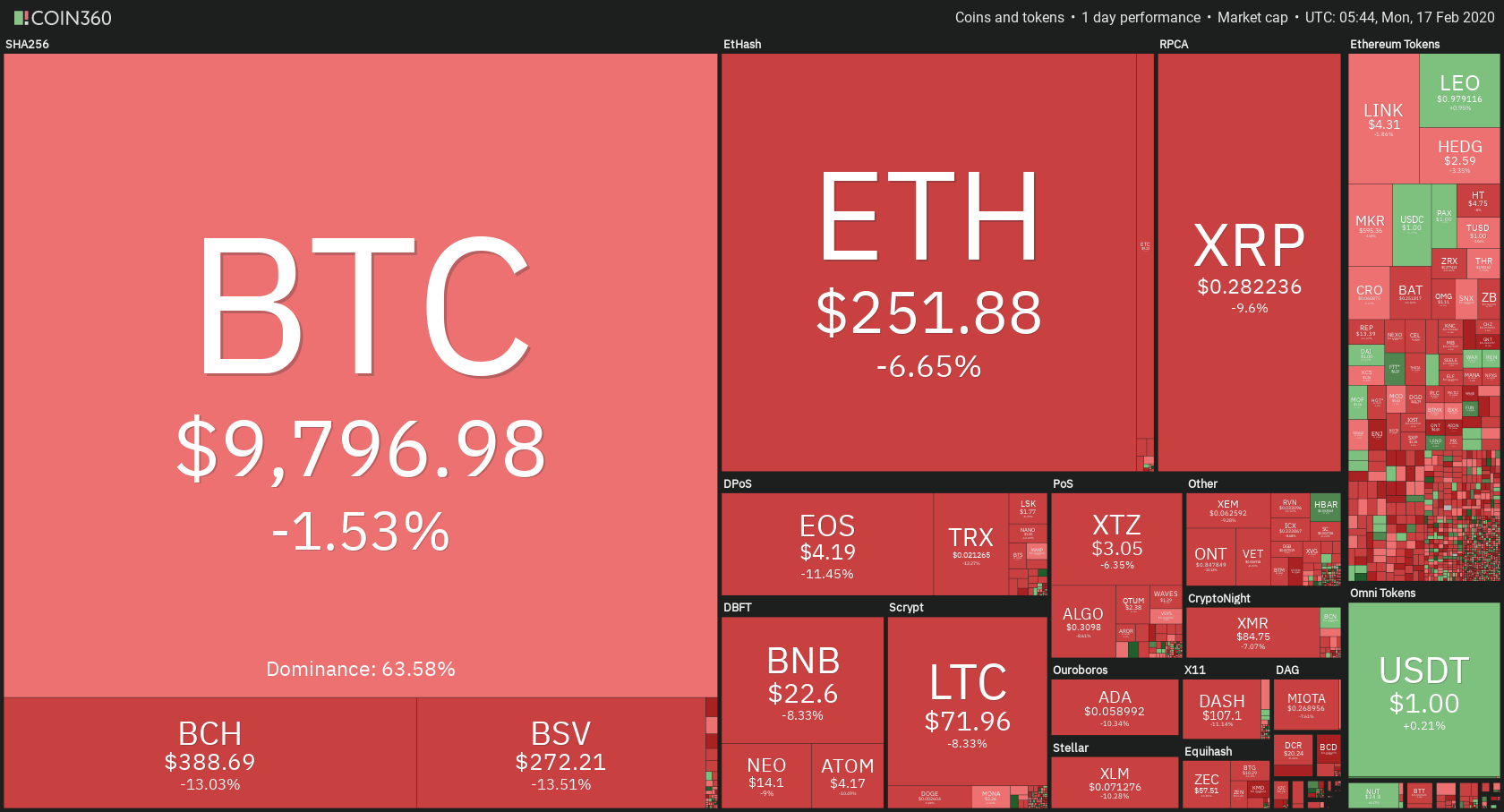

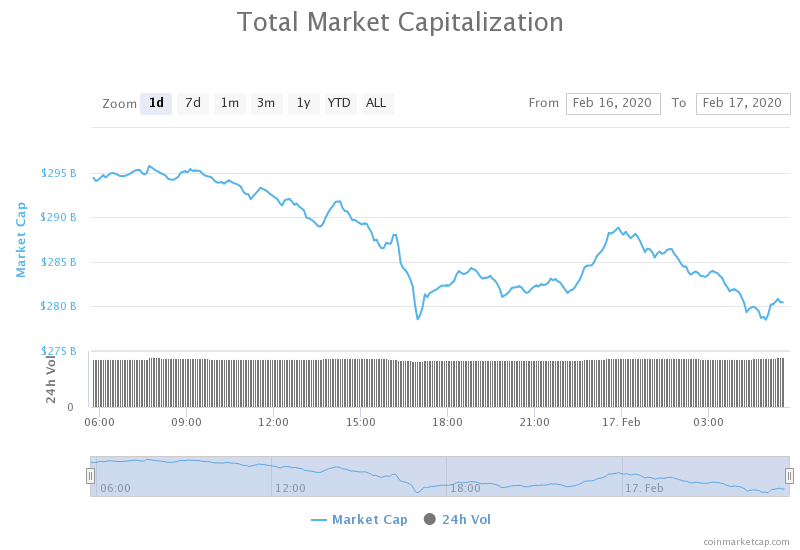

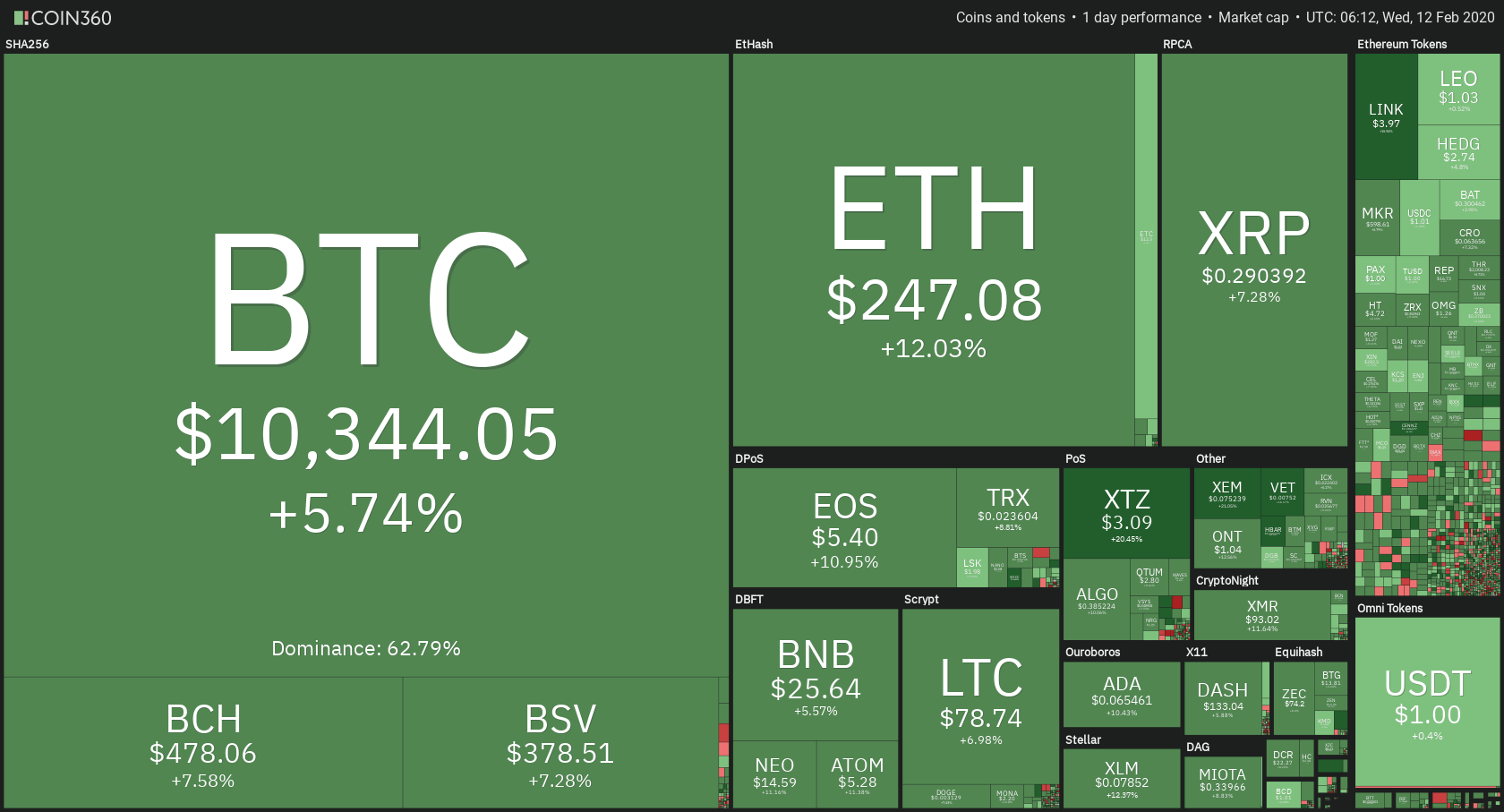

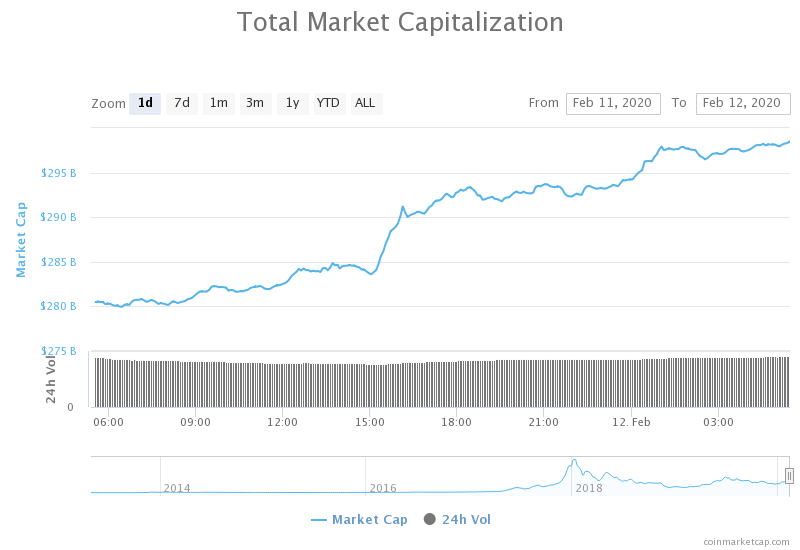

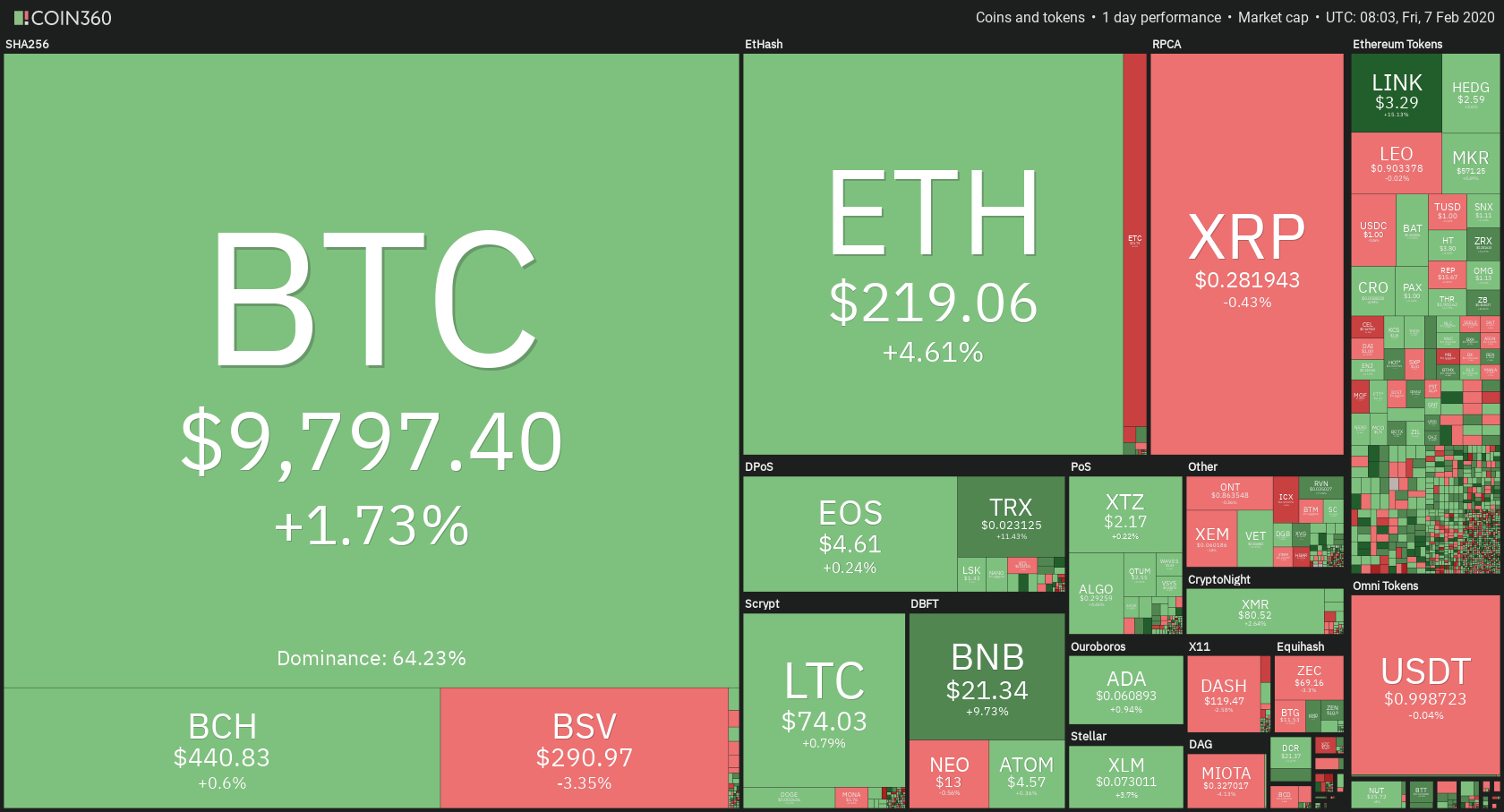

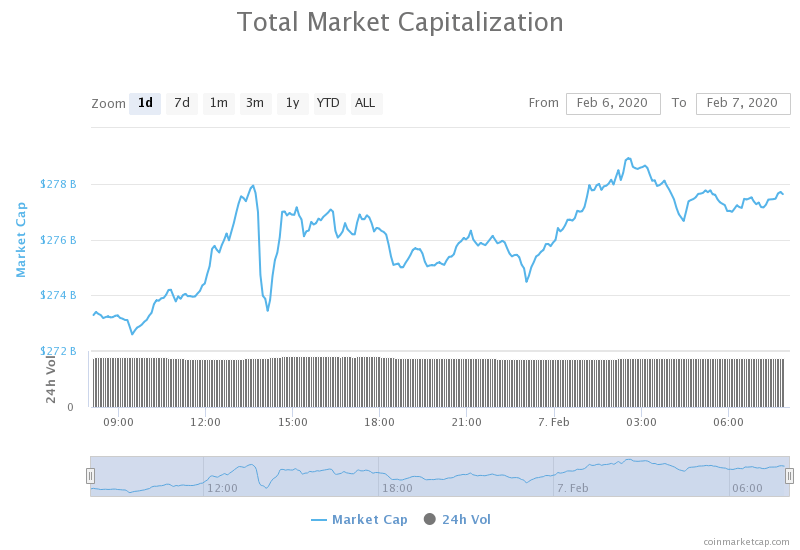

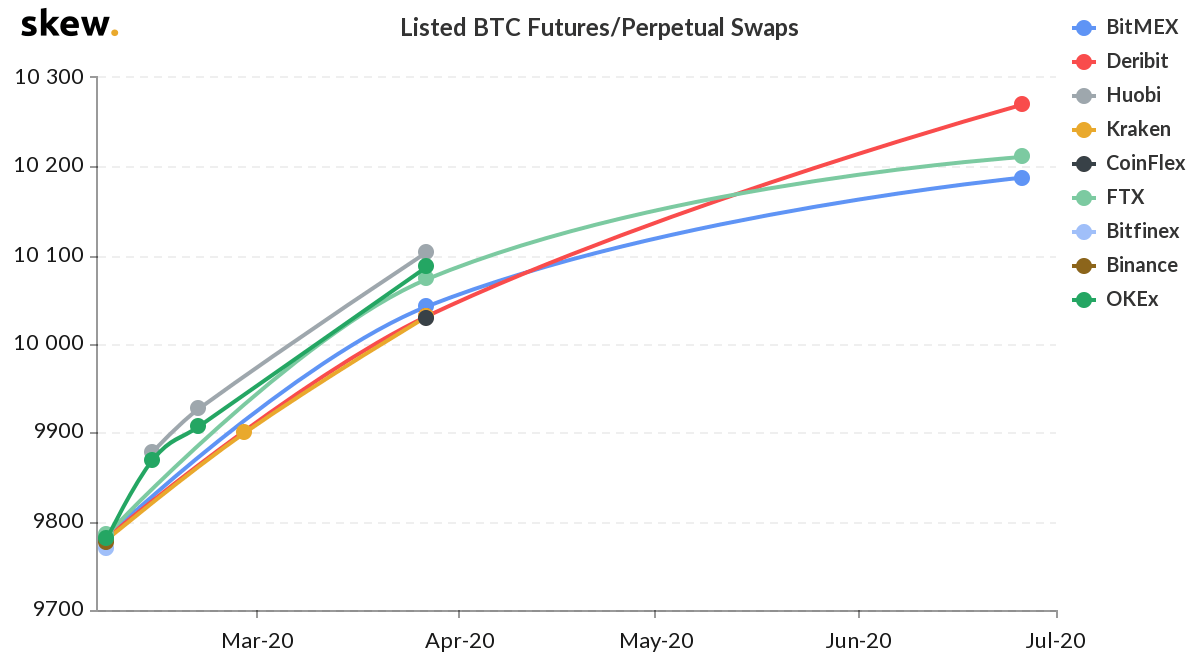

As of 3rd January 2020, Tether ranks at an impressive #6 position in terms of market capitalization, with the number standing at $4, 639, 755, 545. Its 24-hour volume is $39, 402, 491, 795, with a circulating supply of 4, 642, 367, 414. Tether’s total supply is 4, 776, 930, 644 USDT. Its all-time high was $1.21 in May 217, 2017.

Where to Buy and Store Tether

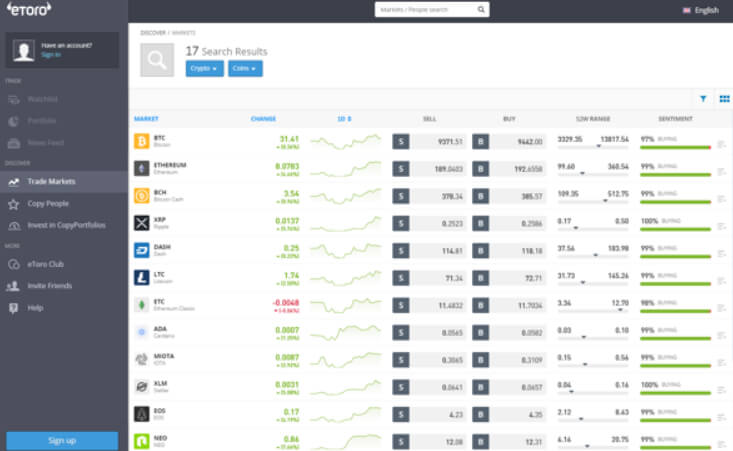

The most common way to acquire Tether is to exchange another cryptocurrency for it. There are hundreds of cryptocurrencies that are paired with the crypto.

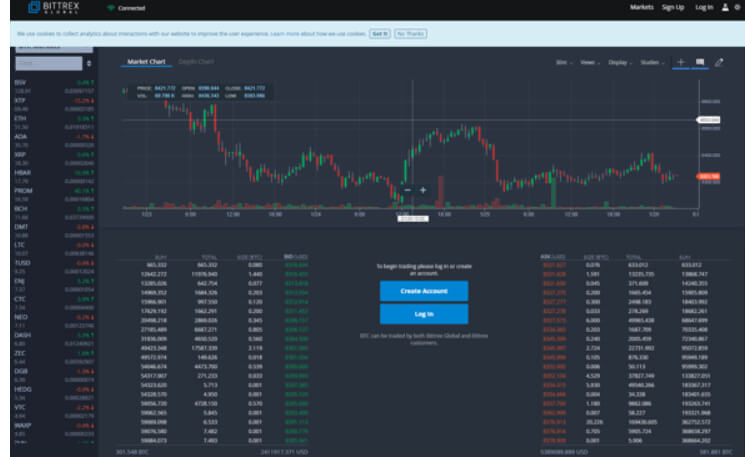

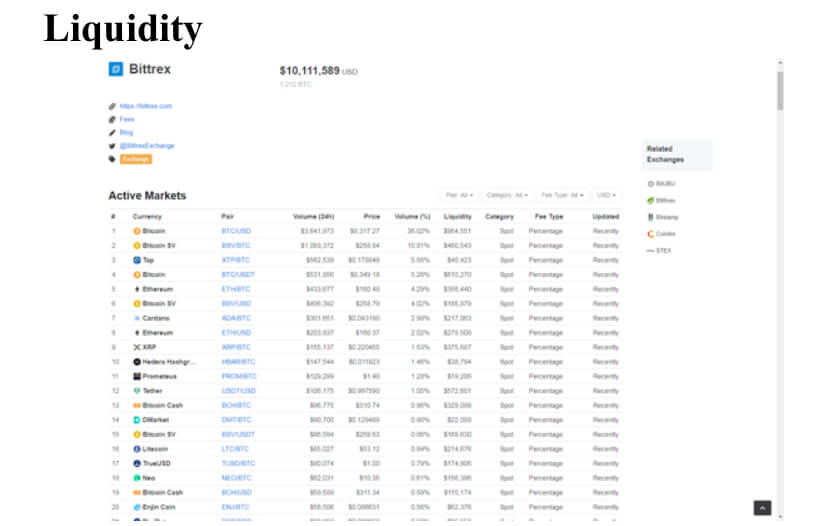

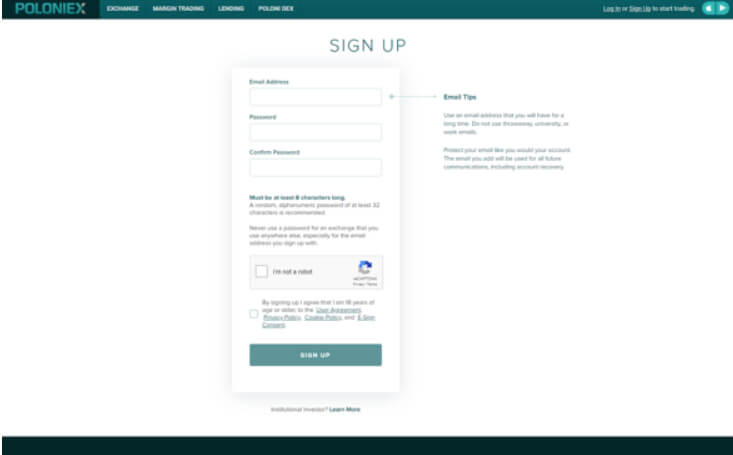

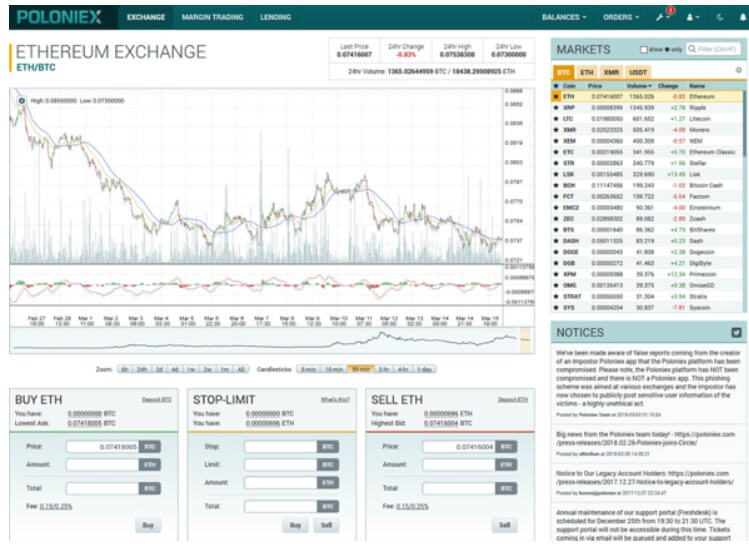

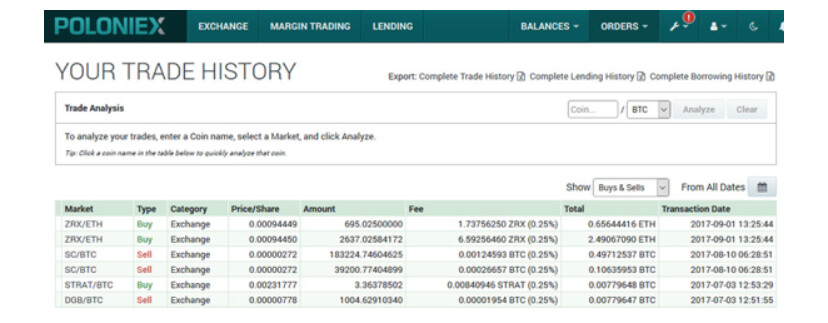

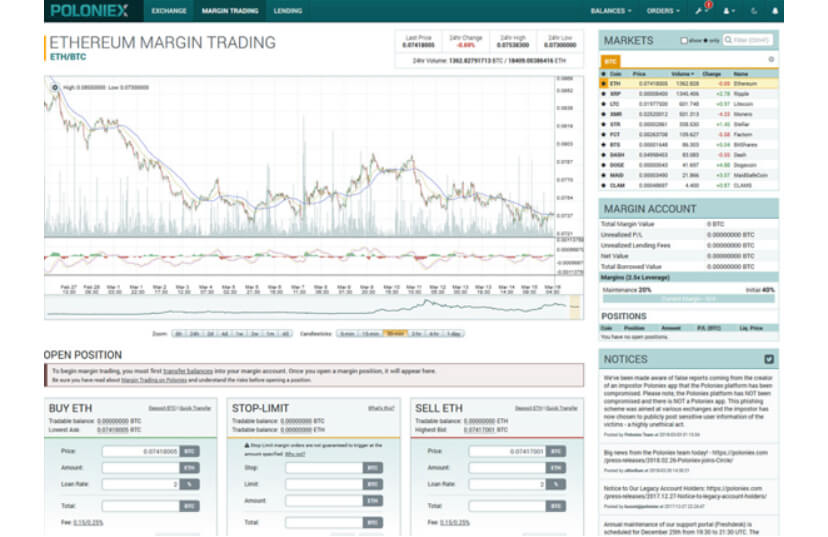

You’ll find Tether at some of the most popular exchanges, including Binance, Bitfinex, Kraken, Bittrex, Coinut, Poloniex, Exmo, and so on.

The ERC20 version of Tether can be stored in any Ethereum-compatible wallet, including MyEtherWallet, Trust Wallet, MetaMask, Atomic Wallet, Mist, and so on.

It is also highly recommended you store your coins in hardware wallets – which are immune from online vulnerabilities such as hacking, phishing, etc. Some reputable options include Ledger Nano, Trezor, Coinomi, Exodus, etc.

There’s also the option of storing your crypto on the dedicated Tether wallet web interface. However, you might rethink this option not only because it supports just Tether, but because its security history is less than satisfactory.

The Myriad Controversies of Tether

This guide would be remiss if we didn’t mention the litany of controversies that have beset Tether since its launch.

Let’s look at some of the controversies below:

In May 2016, the International Consortium of Investigative Journalists leaked documents that pointed to Tether Ltd and Bitfinex as having the same CFO, CEO, and CSO. In what is called the Paradise Papers, it was revealed that both companies are operated by the same group of people and were not separate entities as the cryptoverse had been led to believe.

- In April of 2017, Wells Fargo withdrew as the correspondent bank between US customers and Tether/Bitfinex. The two companies filed a lawsuit against the bank, only to withdraw it later.

- Tether inexplicably terminated its relationship with a third-party audit firm that was to conduct an independent audit on its reserves. The audit was meant to establish if indeed Tether tokens in circulation were collateralized by real reserves. Since then, no audit has ever been conducted to this day.

- In November 2017, a hacker made away with $31 million worth of USDT. The company quietly created a temporary hard fork to blacklist the address that had the funds – drawing criticism for that move.

- In December 2017, the Commodity Futures Trading Commission issued a subpoena to Tether and Bitfinex on the grounds of lack of audit and what seemed to be its manipulation of Bitcoin’s price.

- In June 2018, Bloomberg published a report titled “Crypto Coin Tether Defies Logic on Kraken’s Market, Raising Red Flags.” The report was published in response to what seemed as an unchanging price of Tether regardless of changes in the volume of buy and sell orders.

- In April 2019, the New York Attorney General’s office accused Tether and Bitfinex of engaging in a collaborative cover-up of the loss of $850 million of co-mingled client and investor funds. The sum was previously held by a Panamian entity called Crypto Capital Corp. Per the court filings, authorities seized the money in various countries. Bitfinex had allegedly received $700 million from Tether’s reserves to hide the loss.

What’s the Future for Tether?

To date, Tether is yet to release any evidence that all Tether coins in circulation are backed by real reserves, but it insists so. In June 2019, the law firm Freeh, Sporkin, and Sullivan composed “The Tether Transparency” report – which indicated that Tether had real reserves backing the token. However, crypto experts were not satisfied with the report, which they insisted was no audit, but mere data obtained from Tether’s bank accounts.

As well, many of the controversies surrounding Tether have been debunked as FUD (Fear, Uncertainty, and Doubt) that’s so rife in cryptoverse.

Tether appears to be going steady despite all the storms. This can be attributed to the crypto community’s support for it as the most popular stablecoin, and the crypto project’s fighting back, sometimes with proof, against all allegations.

Summing it all, any external threats that would bring Tether down result mostly to naught, as it remains a favorite within the community.

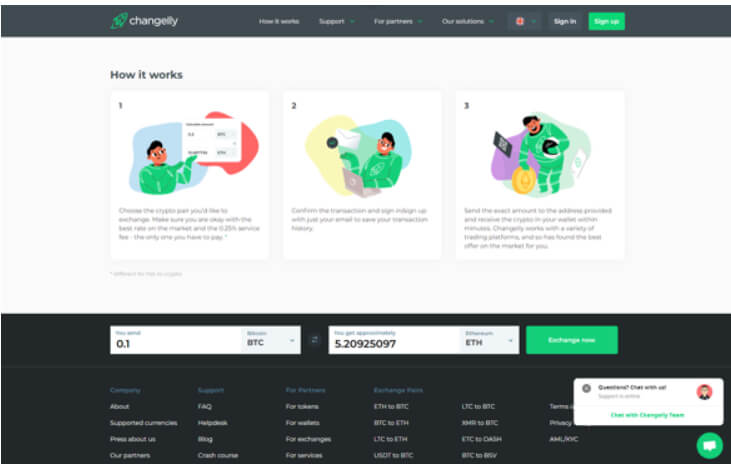

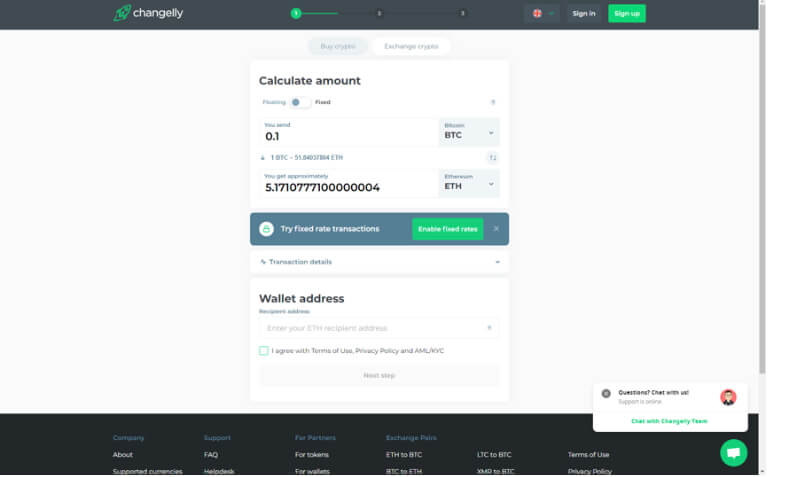

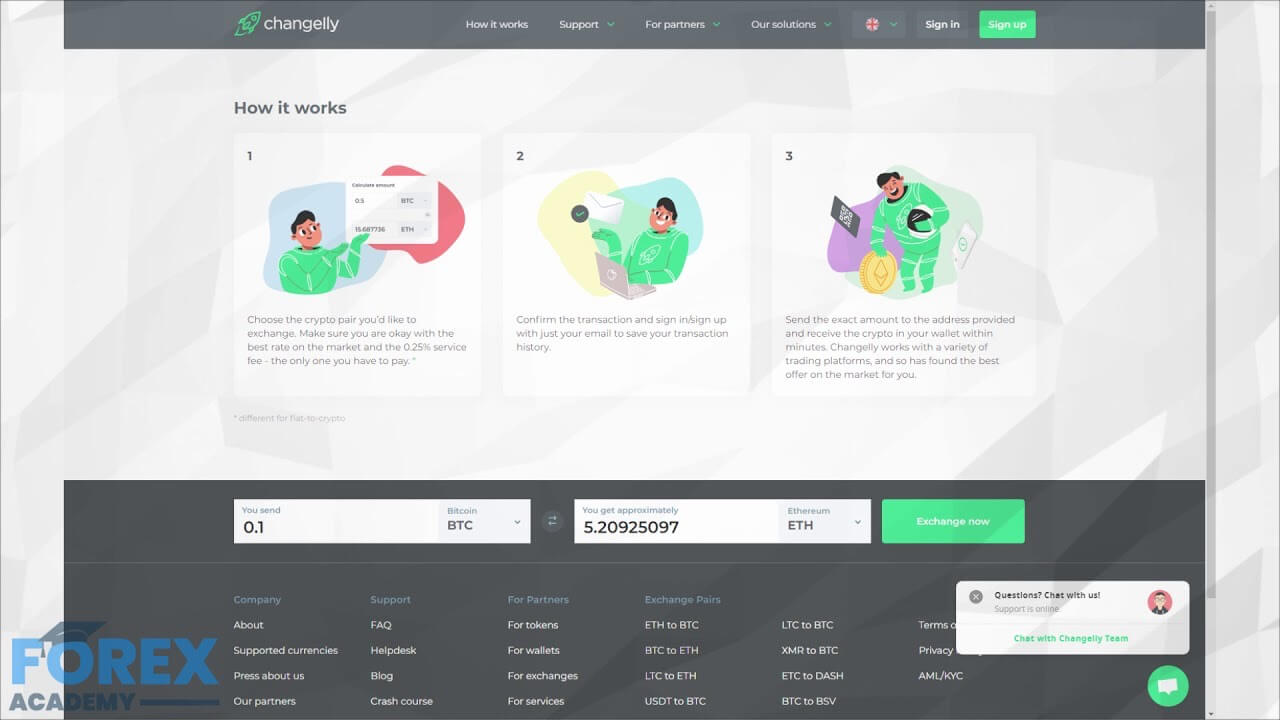

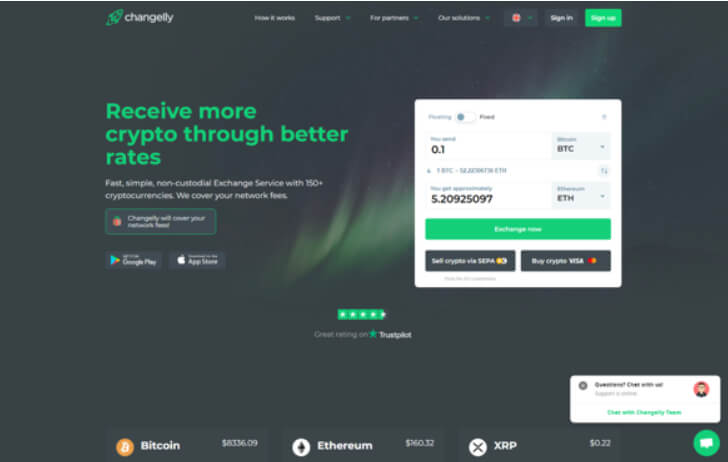

Changelly is not an exchange like the others. This platform is an instant crypto exchange that started operating in 2015. While it was previously headquartered in the Czech Republic, it is now based in Hong Kong. It also has offices around the world, including Malta, Great Britain, and Brazil.

Changelly is not an exchange like the others. This platform is an instant crypto exchange that started operating in 2015. While it was previously headquartered in the Czech Republic, it is now based in Hong Kong. It also has offices around the world, including Malta, Great Britain, and Brazil.