The crypto market rallied as Bitcoin moved above the $10,000 mark yet again. Bitcoin is currently trading for $10,058, which represents a 2.54% increase on the day. Meanwhile, Ethereum gained 2.97% on the day, while XRP gained 0.04%.

ABBC Coin took the position of today’s most prominent daily gainer, with gains of 29.24%. On the other side, MonaCoin lost 7.83% on the day, which made it the most prominent daily loser.

Bitcoin’s dominance increased slightly as altcoins rose while BTC stood still in the past 24 hours. It is now at 62.55%, which represents an increase of 0.44% when compared to the value it had yesterday.

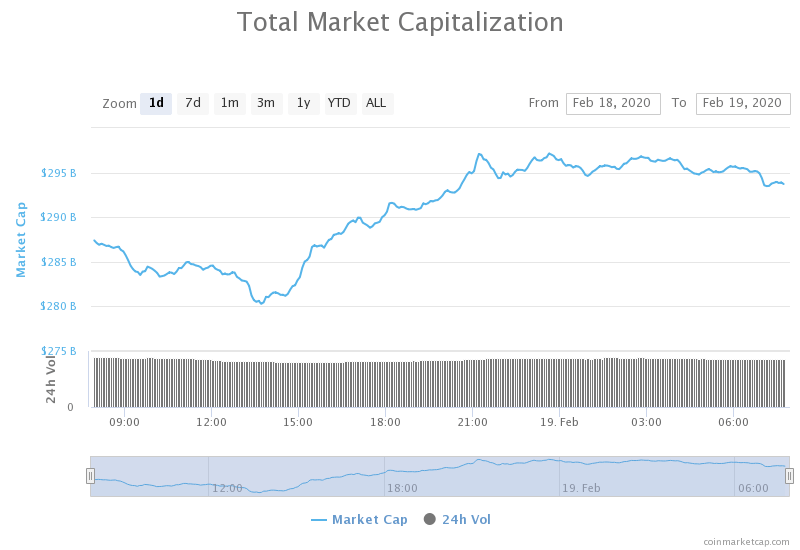

The cryptocurrency market capitalization increased slightly in the past 24 hours. It is currently valued at $293.84 billion, which represents an increase of $6.87 billion when compared to the value it had yesterday.

What happened in the past 24 hours

With the 2019 US tax season just around the block, the IRS wants to leave nothing off the table. The IRS has invited crypto companies and advocates to show up for a March 3 summit in Washington DC. One of the aims of the summit is to determine how to “balance taxpayer service with regulatory enforcement.”

Topics that will be discussed at the summit include regulatory guidance as well as compliance, preparing tax returns, crypto exchange issues, and technology updates.

Honorable mention

Ripple (XRP)

A recent Medium post from Whale Alert (blockchain monitor) showed Jed McCaleb, CTO of Stellar, sold more than 1 billion XRP between 2014 and 2019. Whale Alert, however, noted that compared with the trade volume XRP has on a daily basis, the amount McCaleb sold seems insignificant.

_______________________________________________________________________

Technical analysis

_______________________________________________________________________

Bitcoin

Bitcoin’s went above $10,000 yet again. The bull presence increased and the price spiked from the $9,580 support level all the way to $10,290, breezing through the $9,735, $9,870 and $10,015 resistance levels. As the bulls got tired and overextended, bears took over and the price fell a bit. Bitcoin is now consolidating at the $10,100 level.

Bitcoin’s volume quite average when compared to the past week, while its RSI is now near the middle of the value range.

Key levels to the upside Key levels to the downside

1: $10,360 1: $10,015

2: $10,505 2: $9,870

3: $10,855 3: $9,735

Ethereum

Ethereum also had a green day, with gains similar to Bitcoin’s. The second-largest cryptocurrency increased in price from $244 all the way up to $286. The move broke the $251.3, $259.5, and $279 resistances with ease. The move, however, ended, and Ethereum’s price fell slightly, dropping under the $279 support (now resistance) level.

Ethereum’s volume is quite average, while its RSI level is just above the middle of the value range.

Key levels to the upside Key levels to the downside

1: $279 1: $259.5

2: $302 2: $251.3

3: $240

Ripple

XRP performed worse than Bitcoin and Ethereum on the day. The third-largest cryptocurrency gained a bit of value, but actually stayed at the same level it was at 24 hours ago. It is currently consolidating and preparing for the next move, bound by the $0.31 resistance as well as $0.285 support level.

XRP’s volume is on the same levels it was at during the past week (if we disregard the few large candlesticks during the breakouts), while its RSI just under the middle of the value range.

Key levels to the upside Key levels to the downside

1: $0.31 1: $0.285

2: $0.324 2: $0.266

3: $0.332 3: $0.2454