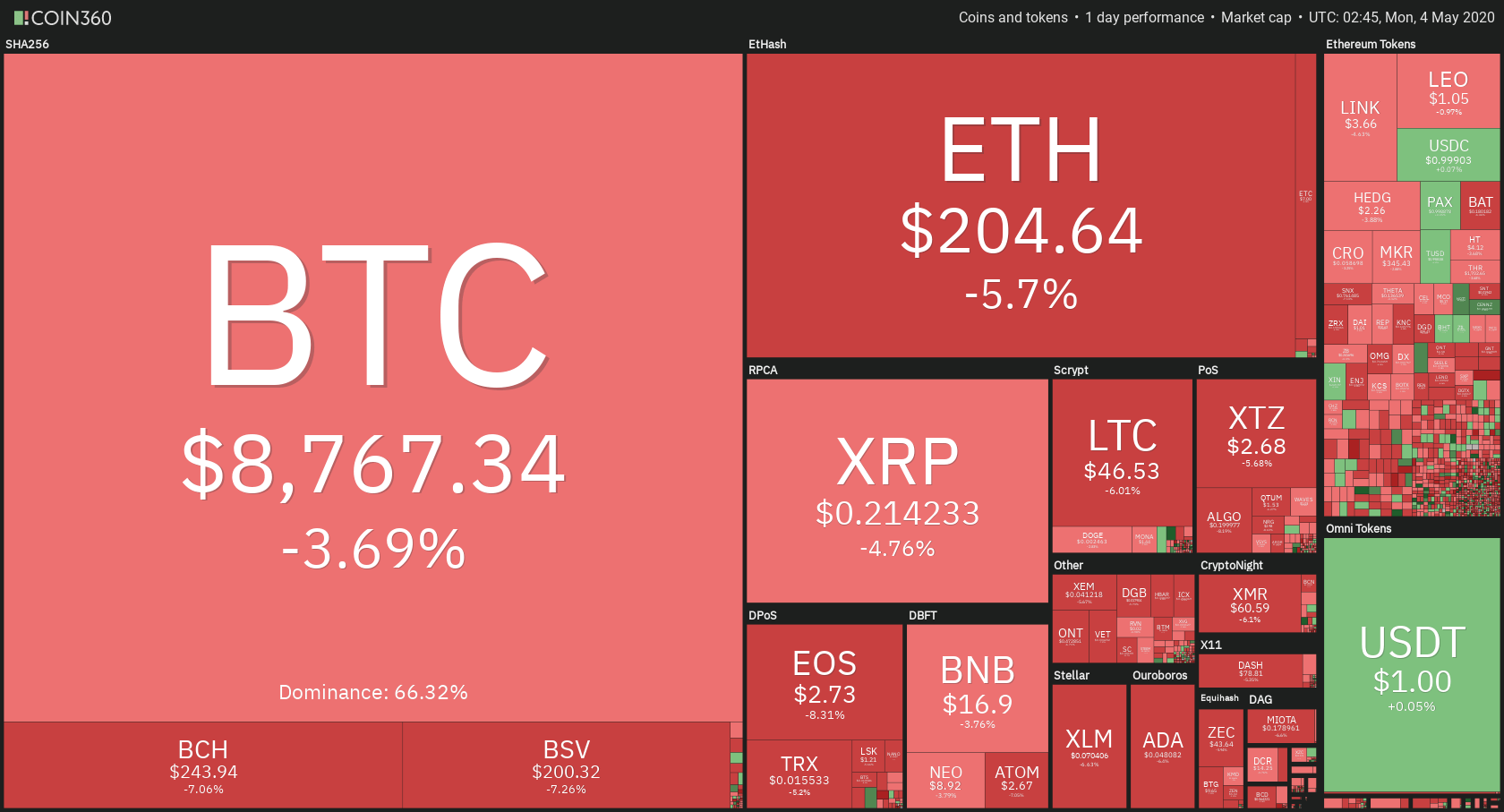

The cryptocurrency market has spent the weekend trying to find a level to consolidate at and testing narrow ranges. Bitcoin is currently trading for $8,767, which represents a decrease of 3/69% on the day. Meanwhile, Ethereum lost 5.7% on the day, while XRP lost 4.76%. However, when compared to the prices on Friday, the market hasn’t moved that much, if at all.

Hive took the position of today’s most prominent daily gainer, with gains of 22.27%. Unibright lost 17.28% on the day, making it the most prominent daily loser.

Bitcoin’s dominance increased over the weekend, with its value currently at 66.32%. This value represents a 0.66% difference to the upside.

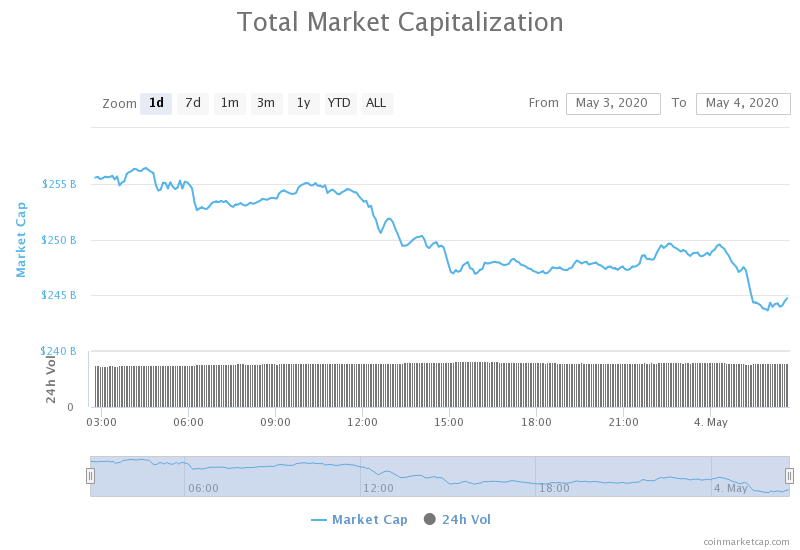

The cryptocurrency market capitalization decreased when compared to Friday’s value, with its current value being $243.97. This value represents a decrease of $3.58 billion when compared to the value it had on Friday.

Honorable mention

Bitcoin hash rate

Bitcoin’s third halving event is roughly two weeks away, and the BTC mining hash rate is pushing into record highs. Bitcoin hashing power plummeted by 40% just two weeks after setting its previous all-time high on March 8.

However, the hash rate increased by 90% in the following six weeks, reaching a new all-time high at 142 exahashes per second.

_______________________________________________________________________

Technical analysis

_______________________________________________________________________

Bitcoin

The largest cryptocurrency by market cap spent the weekend trying to find a good place to consolidate at. The narrow resistance ranges of $8,650, $8,820, $8,980 and $9,120 were tested over the weekend. Bitcoin’s price spent the majority of the weekend below $9,000, and most recently retested the $8,650 resistance. That resistance has proven its strength yet again and BTC bounced back up.

The next few days will lead up to Bitcoin either breaking down below $8,650, which would trigger a downturn, or above $9,120, which would trigger an uptrend.

Key levels to the upside Key levels to the downside

1: $8,820 1: $8,650

2: $8,980 2: $8,000

3: $9,120 3: $7,750

Ethereum

Ethereum has spent the weekend bouncing between the $200 and $217.6. The second-largest cryptocurrency by market cap is currently on the path down as the $217.6 resistance level held up twice already. With the volume normalizing and the RSI falling back in the lower half of the range, we can expect a few more days of consolidation from Ethereum, unless a run-up or down gets triggered by an external factor (Bitcoin’s movement or fundamentals).

Key levels to the upside Key levels to the downside

1: $217.6 1: $198

2: $225.5 2: $193.6

3: $240 3: $185

Ripple

XRP is also trading in a tight range, bound by $0.214 to the downside and $0.227 to the upside. However, the most recent retest of the support level has brought the price all the way down to $0.208 before recovering above $0.214. This level seems to be barely holding for now, and it is likely that it will not hold up if being tested for much longer. If $0.214 fails, we can expect XRP to fall to the $0.205 or $0.2 levels.

Key levels to the upside Key levels to the downside

1: $0.227 1: $$0.214

2: $0.235 2: $0.205

3: $0.285 3: $0.2