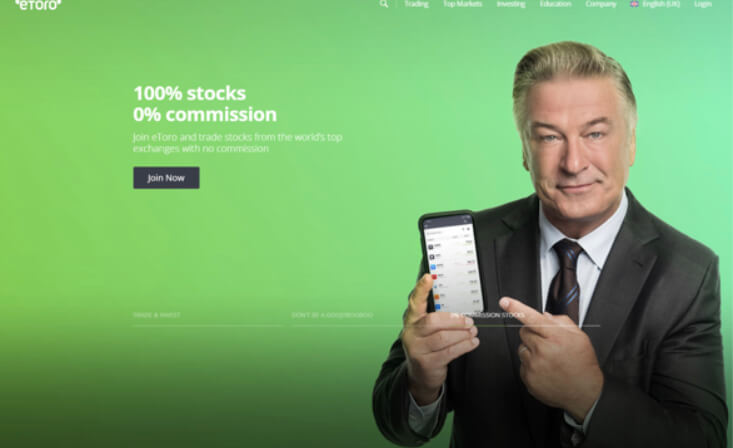

eToro was created by a group of entrepreneurs back in 2007 with the goal of making trading more accessible while reducing the reliance on financial institutions. The original vision started with a platform that focused on graphics in order to make trading easier to understand with more professional tools being added later on. In 2012, the mobile app was launched, stocks were introduced the following year, and social trading, cryptocurrency, and other features have joined the platform since. Today, eToro has come a long way and offers some useful features that help it stand out.

Features

- 2,000+ assets including forex, stocks, crypto, and more

- Easy to use intuitive interface

- Each client receives a free demo account preloaded with $100,000 worth of virtual currency

- Research Tab that includes insight from leading analysts

- One-click trading

- Stoploss and TakeProfit features

- ProCharts technical analysis tool

- Specific orders can be placed even during platform maintenance

- Access to social trading and copy trading

eToro Conditions

In order to use the eToro trading platform, you’ll need to sign up for an account through the broker. Here are some of their conditions:

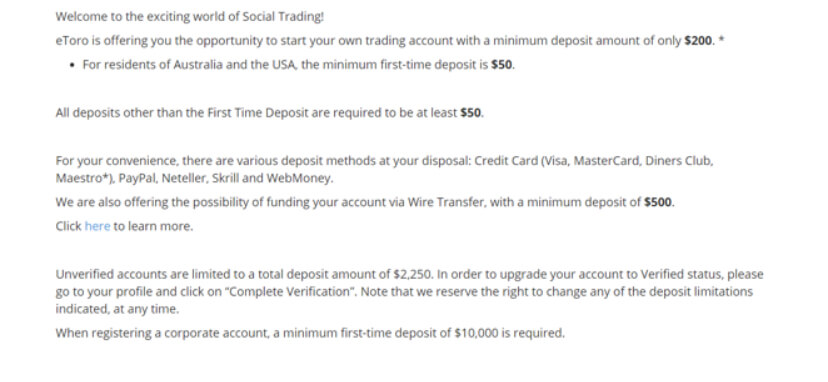

-$50 USD minimum deposit or $500 if depositing by wire

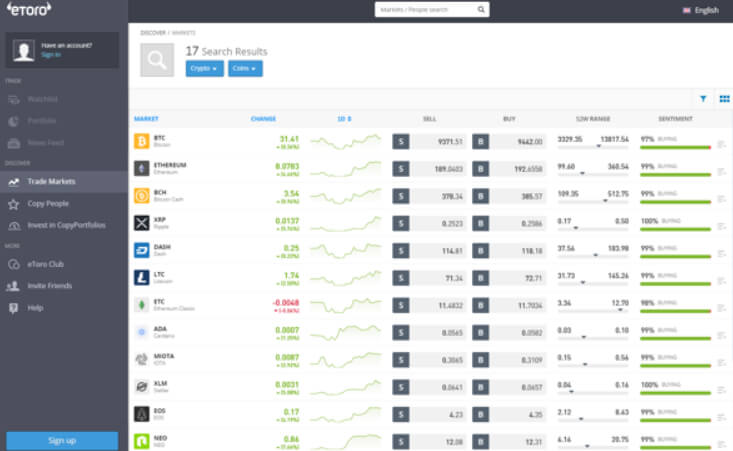

-14 available cryptocurrencies: Bitcoin, Ethereum, Ethereum Classic, Dash, Ripple, Litecoin, Bitcoin Cash, and many others

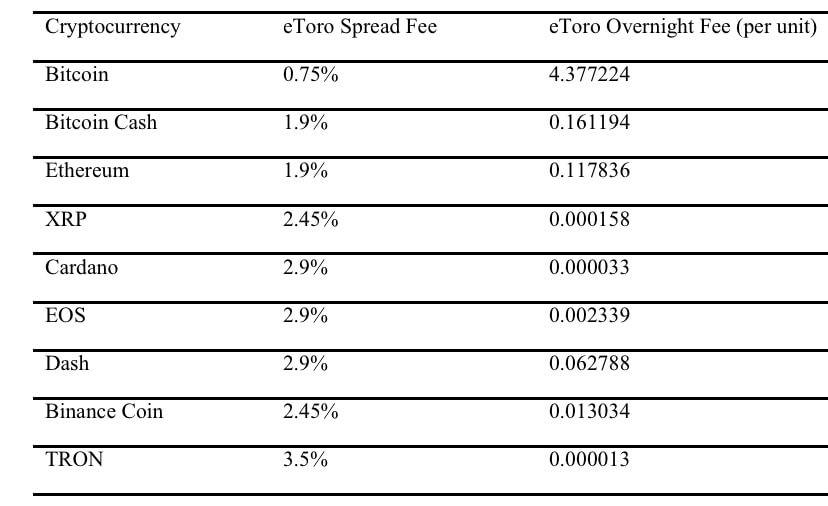

-Spreads start at 0.75% on Bitcoin

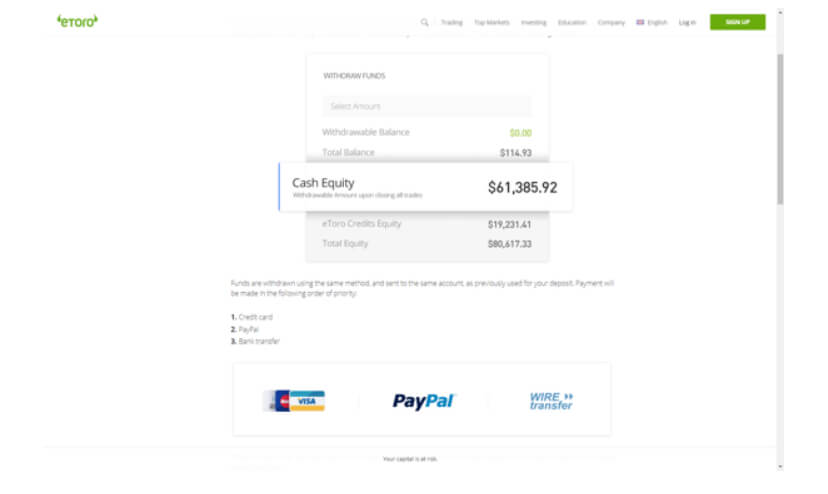

-Minimum withdrawal requirement of $30

-0.1% conversion fee

If you’re considering opening an account, be sure to do more research about the broker’s fees and to read through their terms & conditions.

Conclusion

eToro offers traders a wide variety of trading options to choose from, including expected options like forex pairs and less common choices including 14 different cryptocurrencies. Traders certainly have the chance to diversify their portfolio through this broker and one can open an account with only $50. As for the eToro trading platform, the primary focus seems to be on offering a user-friendly interface that is learnable for beginners, along with some social features.

In other areas, the eTrader platform might be simplistic, as it doesn’t seem to support customer indicators and other advanced features we’ve seen offered elsewhere. Some traders might not notice the missing extra features and would prefer having a more navigable platform, while others might not get everything they need from this broker/platform. This comes down to each trader’s own personal needs and wants.