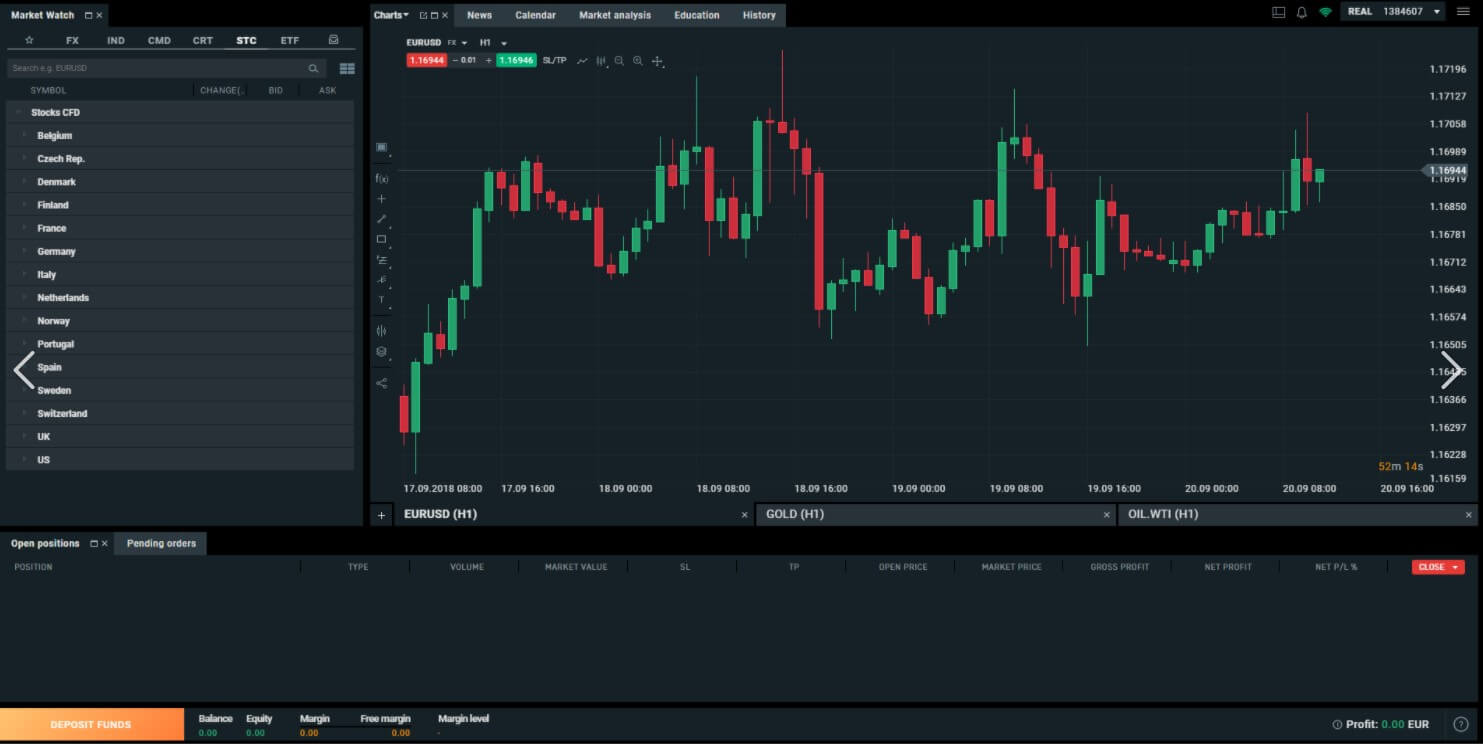

SmartTrader is an online trading platform that focuses on charting, trading, and social networking. The cloud-based platform supports trading in the forex, stocks, and cryptocurrency markets. SmartTrader also works with a growing list of brokers that currently includes more than 35 options, including some big competitors like Forex.com. Take a look at the SmartTrader platform’s features, compatibility, and price below.

Features:

- Access to 3 markets: stocks, crypto, and forex

- More than 8,000 symbols to choose from

- Supports up to 8 charts

- 100+ built-in technical indicators

- Ability to create your own custom indicators with up to 6 indicators per chart

- Place and close positions from charts

- Multiple timeframes

- Configurable chart styles

- Smart Analytics tool

- Customizable scripts and market watch

- Email, text, and browser-based alerts with real-world news updates

- Custom indicators

- Connect up to 6 demo or live trading accounts from virtually every major MT4 broker

- Network with thousands of traders

- Built-in economic calendar

- Accessible through phone, computer, or tablet devices

Compatibility

SmartTrader is compatible with several online brokerages. This includes Bitfinex, Forex.com, FPMarkets, FXChoice, FXCM, FXPro, GllopFX, GhandaFX, GKFX, GlobalPrime, GoMarkets, HalifaxPro, HFMarketsSV, CHFClearing, Oanda, and many more. The SmartTrader website explains that they are constantly adding new broker accounts to this growing list. You can trade on forex, crypto, and stock markets – but there are some limitations with the cheaper plans.

Pricing

SmartTrader offers five different plans on a monthly, yearly, or bi-yearly subscription basis:

The FREE plan costs $0.

The PLUS plan costs $14.95 per month/$12.95 per month with one-year subscription/$9.95 per month for 2 years.

The PRIME plan costs $29.95 per month/$24.95 per month with one-year subscription/$19.95 per month for 2 years.

The PRO plan costs $99.95 per month/$84.95 per month with one-year subscription/$64.95 per month for 2 years.

The 360PRO plan costs $199.95 per month/$179.95 per month with one-year subscription/$129.95 per month for 2 years.

With prices ranging from $0 to just below $200 per month, there are obviously some major differences between each plan. First, each plan supports a different number of charts per workspace. The FREE plan only allows for one chart, while the best plan allows up to 8 charts. The FREE and PLUS plans also limit users to one synced device, while the PRIME plan allows 2 devices, the Pro Plan allows 6 devices, and the 360PRO plan allows for the maximum of 8 synced devices.

Price styles, data feeds, the ability to use custom templates, number of indicators allowed per chart, smart trendlines, alert availability, ad-free experiences, and several other factors are different based on the plan one has chosen. You can compare plans on the SmartTrader website here: https://smarttrader.com/plans/compare. You can upgrade your plan at any time.

Conclusion

SmartTrader offers some clear benefits, including networking, charting, and trading tools and features that can help traders make quicker, more informed decisions. The platform is compatible with many forex brokers that are recognizable by name with more being added to the list often. The biggest downside to choosing this platform is the price, although you can start trading for free on the FREE plan. Traders simply need to know that the platform’s unique benefits are much more limited when you aren’t paying for a better plan, so you are likely to notice the restrictions on charting tools, alerts, and other features. Of course, SmartTrader is a solid platform if you can afford it, and there’s no reason why you can’t test it out on the FREE version with plans to upgrade to a paid version later on.