Cryptos in a bear market – what to do? – part 2/2

This article is picking up where the first one left off, which is explaining various things a trader can do while the cryptocurrency market is in a bearish trend.

Holding

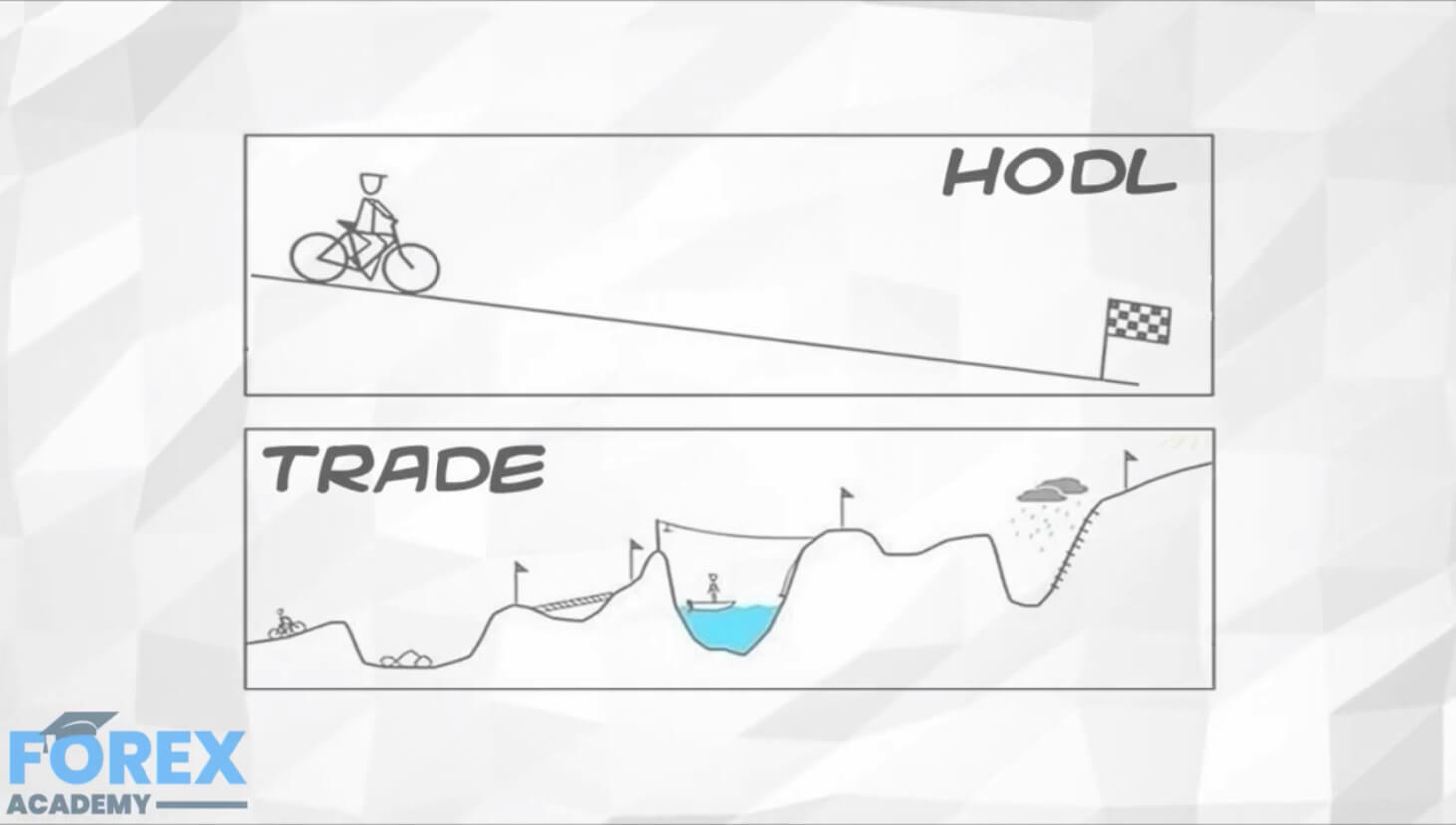

The second strategy would be holding, or “HODLing.” This is often a confusing term for a lot of newcomers, as most of them think that it is a misspelling. Interestingly enough, “HODL” became an acronym for “Hold On for Dear Life,” which means that investors will not sell their holdings even if the market goes into a deep downtrend.

The term represents a trading strategy, if it may be called a strategy, that is used by those who are willing to wait for greener pastures. Holding is a long-term strategy but also a philosophy of numerous investors. Since the crypto market is still young and new, it is widely believed that the current volatility, prices, and market crashes are just regular occurrences that happen on the path to stabilization and maturity. HODLers often think that the key to making a profit with cryptos is to stick to their holdings and endure the pressure. When the market stabilizes, and cryptos reach widespread adoption, it is expected that the HODLers will be rewarded for trusting in their cryptocurrencies.

HODLing is a huge part of the crypto culture nowadays. This strategy has gained a lot of support from investors all over the globe. As the overall opinion is that cryptocurrencies are here to stay, HODLing has a big potential in the long run. This strategy, just like short-selling, did not get created by crypto traders. The best example of failing to HODL, as well as the true testament of HODLing working, is Ronald Wayne’s sale of Apple shares in 1970. Back then, he made $800 from selling the shares. If he had waited a few decades, his $800 gain would have become $100 billion.

Everyone knows that predicting the future is impossible. However, popular investors such as Jay Smith think that holding is always the best option if you trust in the asset. He is convinced that cryptocurrencies will replace the old stock markets. He also said that they would power machines, the Internet of Things, governance, and voting systems, maybe even the internet itself. While he understands that it might take years, maybe even decades before this prediction comes true, he is convinced that cryptos are the future and that there is no better way to invest in crypto than by buying and holding.

Buy Low – Sell High

Naturally, investors always want to make a profit. For that reason, when the value of cryptocurrencies goes down, many investors decide to cut their losses. Only a rare few are willing to risk it and keep buying, even if their prices are going down. Most of the people tend to buy near the top and sell near the bottom of the move. This occurrence is not limited only to crypto; it is rather the human nature of risk-aversion.

While many investors panic-sell their holdings that they have bought near the top, some others are trying to average down the price of their holdings. As always, any and every investor must do proper in-depth research before buying any coin.

Diversification

Finally, the last so-called strategy for aspiring investors is always to diversify their holdings. Since predicting the future is impossible, any investment is a risk, especially cryptocurrencies. However, investing in a few projects that you are interested in increases the chances of making the right call.

Traders can diversify by investing in projects they like, but the main thing is to diversify by investing in assets with low correlation. By investing in such assets, the price drop of one asset will not affect the price of the others.