The unprecedented growth of the cryptocurrency market has created fortunes for a few “early adopters” who risked seed money on a new and relatively unknown technology before 2015. This has attracted interest from investors around the world, many with the intention of seeing three-figure returns in a matter of weeks.

In this article, we will never pretend to explain how to make you rich in a couple of months, and not why we don’t want it, but why it would be really it is not very prudent to invest in the world of cryptocurrencies with that premise. It is important to understand that investors who made fortunes were people who invested their capital in a temporary scenario where the perceived risk was really high, few people knew bitcoin, was associated with terrorism and arms trafficking, the future of these currencies was completely unknown…

A posteriori it is very easy to think that it should have been reversed, but those who made the decision at the time were not so clear and in many cases, the motivations were more socio-cultural than not economic. Not to mention the drops of up to 90% that they had to endure without selling to get the returns that now so amaze us.

As any investment has a very direct relationship between risk and return, now the risk is lower than in 2013 therefore the expected return is also. In any case, the current risk remains much higher than that of equity, for example, and for that reason can be a really interesting investment with a sound strategy and good risk management within the crypto market, so that we can opt for returns that we are not used to.

The idea is very simple, it finds the best value proposals, backed with the right resources, identifies good times of entry, and invests the right amount to not put at risk a large part of the portfolio.

Find the Best Value Proposals

We have to keep in mind that cryptocurrency projects use blockchain technology to cover a need in a different way. The first premise we will have to take into account is: does the project we plan to invest in really need the blockchain and the token to work? Could the same solution be offered without Blockchain? Does the need it seeks to cover really exist?

With these first questions, we can get an idea of if it really is an innovation and improvement or if on the other hand, it has wanted to put the Blockchain to the force in a system that did not need it.

From here it is necessary to assess a series of parameters that allow us to obtain an overview at the fundamental level of the project.

The main parameters would be:

Quality of whitepaper: This document is the DNA of the project, to distinguish the quality of the others it is necessary to read the whitepapers of projects that have already demonstrated their solidity and compare them with the new ones that we are inspecting. It is important to understand at a basic level the operation of the project and to be able to visualize its technical feasibility. It can be useful to rely on forums like bitcoin talk to better understand the project.

Team: It is a very important element, as in any startup the human team behind and their ability to overcome complex situations is what can make the difference between the failure or the success of the project. Interesting to see their “faces” on the web as this shows that they trust their work by putting their reputation on the line. It is also important that they have recognized “advisors” within the blockchain ecosystem to collaborate on the project.

Capitalization/#users 2: This metric is very interesting to keep in mind since most projects related to cryptocurrencies have the community effect, that is their value should increase proportionally to the square of the number of users. Values lower than the unit are ideal, although in many cases you see values that exceed one hundred or even one thousand, which would be an indicator to stay away from such criticism, showing a symptom of being overrated.

Limited units: It is essential that the founders do not have the capacity to create new units when they so wish.

Roadmap: All projects must have a well-structured and justified planning of the steps that will follow in the short, medium, and long term.

Github: This tool is a collaborative development platform. Most major projects have a thread on this platform and the developer community validates the quality of the code and makes new contributions to improve the project. We need to look at the size of this community.

We advise you to weigh these parameters according to their relative importance and obtain an overall score.

Finding a Good Time to Buy

Although I consider that a cryptocurrency must overcome the fundamental filter to be considered as a purchase option, it is not enough reason. The price has to confirm the purchase decision. Doesn’t make any sense, nor is it advisable, to invest in an apparent good project if your quote does not get out of a bearish trend, this fact could mean that the project is not as good as we think or that there may be some public or private information that we do not know.

We could understand price as a reflection or representation of the fundamental state of cryptocurrency in the medium and long term. So I don’t want to invest the capital in currencies that rise but do not have good foundations, nor in those that have them but fall. As you can see, I just want to invest in the ones that are fundamentally good and with their price rising.

To do this, after the fundamental analysis we must optimize the entry points, exit points, and the amount invested. Even if the best coins are filtered, without a good selection of entry and exit, or risk management, money is lost.

Let us briefly explain the basis of the strategy:

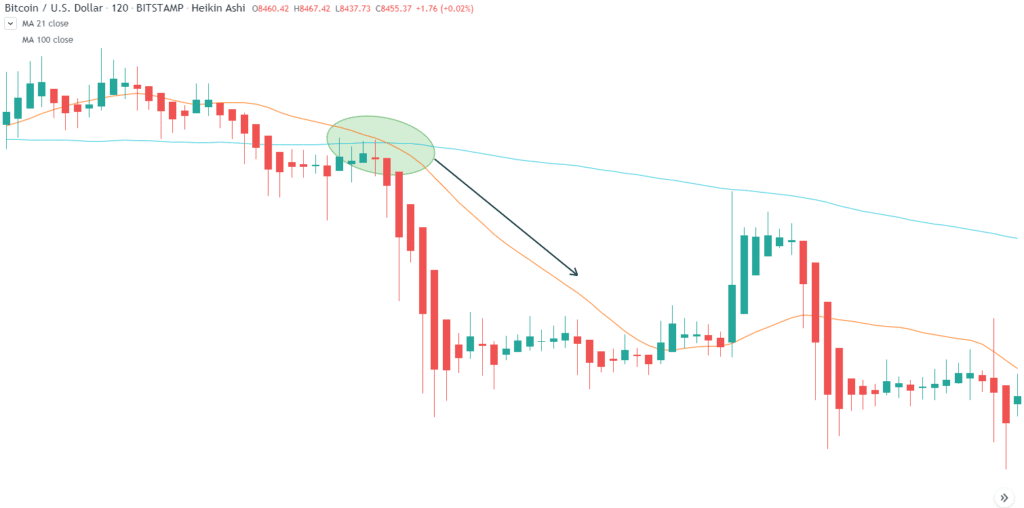

Looking at the chart with daily sails, from right (present) to left (past) we look for relative highs (MR) and relative lows (MR). An MR is the maximum point of a candle that is higher than the maximum of the previous three candles and at the same time exceeds the maximum of the next. An MR is formed when it meets the opposite condition, where the sail minimum is less than the minimum of the three previous and the next candles.

1) When we find an MR or MR we continue from right to left until we find in total two alternating maxima and minima, as shown in figure 1.

2) We will consider a possible purchase when MR and MR pairs follow an upward trend.

3) We place a Stop Purchase order just one satoshi above the MR, and the StopLoss (SL) just one satoshi below.

4) Each time the price creates a new MR and subsequently exceeds it, we will raise the SL just below the last MR.

5) We will keep the crypto in our wallet until the SL jumps. As you can see, we never limit profits by selling to the market or with Take Profits, but we let the price rise freely. On the other hand, losses are always cut at once. If we adjust the SL regularly when a change of trend appears, our tokens will be sold quickly and so we can invest the money in another cryptocurrency that has better prospects.

Risk Management

Everyone should know their risk aversion profile and should decide the proportion of the portfolio they want to risk per trade. As a general rule, I think it is optimal to risk 2% of the capital per operation, starting with 4 operations (8% total portfolio risk) and opening a new position once we have increased the SL from a previous operation above its purchase price.

In this way, exponential returns with limited risk may be eligible.

Diversification in a portfolio of cryptocurrencies is complicated as these are assets that belong to the same market. In any case, we should try to diversify at least taking into account the following two points:

– Market Cap: investing in large, medium, and small

– Typology: crypts that have currency functions (BTC, LTC, XMR…), blockchain infrastructure (ETH, NEO, NEM), and DAPPs (GNT, GNO, SC..)