Heikin Ashi Technique – Crypto trading (part 2/2)

We will take a look at a Heikin Ashi cryptocurrency high-low breakout trading strategy. We will need to go through several steps in order to fully execute the strategy.

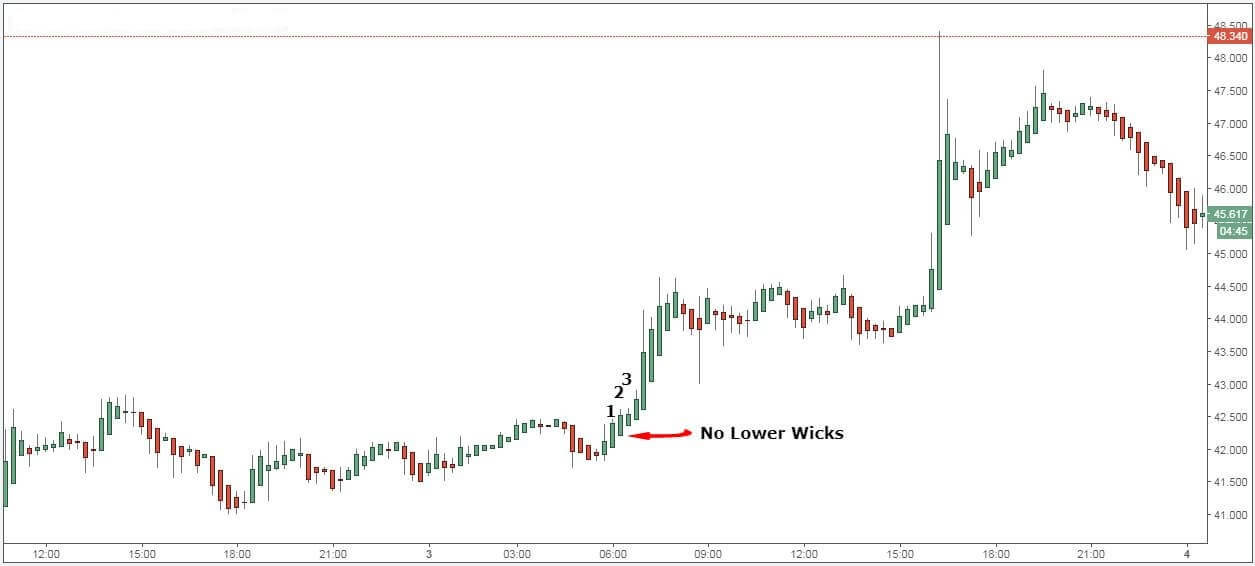

Identifying three consecutive bullish candles without any lower wicks.

After switching to the Heikin Ashi candlestick chart on your preferred trading platform, you will need to identify three consecutive bullish candles. It is mandatory that all three candlesticks have no lower wicks.

This is because bullish candlesticks with no wicks indicate a strong trend to the upside and a further increase in price. Once that is done, we need to check the location of the candles.

There have to be less than five consecutive bearish candles before the three consecutive bullish candles.

Trading Heikin Ashi candlesticks are very trend-oriented, so each of the little bits of info the chart gives, we have to take.

We need the location of the pattern, meaning that we can’t count more than five consecutive bearish candles prior to the three bullish candles spotted in the first step.

Now that we established the trend direction as well as the position of the pattern, we can look for buy opportunities.

Making an entry position at the 4th candle opening

To initiate a position, make an entry at the 4th candle opening, right after the three consecutive bullish candles have finished forming.

Get ready to pull the trigger near the finish of the 3rd candle, so you can be ready for the 4th candle opening.

Placing your Stop-Loss below the most recent swing low

As with every trade you will take, there is a chance of it going the opposite direction to what you predicted. That’s why setting stop-losses is extremely important. The strategy behind setting stop-loss with Heikin-Ashi is quite simple.

The protective stop-loss should be placed just below the most recent swing low, or ultimately below the three bullish candlestick pattern. However, placing it below the three bullish candlestick patter might be risky as you can be taken out of the trade prematurely.

Taking Profit

Depending on how strong the trend is, you would want your take profit to be two or three times more than you stop-loss. By doing so, you are trying to maximize your reward to risk ration.

Conclusion

Using the Heikin Ashi candles to determine the trend direction and set up trades can be extremely lucrative. It is important to make sure the position of the pattern is correct before entering trades, so that should not be compromised. This guide has hopefully taught you a trading strategy you can add to your toolset and possibly use.