Viable cryptocurrency trading strategies

“How can traders potentially profit from the cryptocurrency markets without risking too much money, and what are the profitable strategies for the current market?”

Whether the market is moving up or down, there is an opportunity for profit! Cryptocurrencies have been the most volatile tradable asset class in decades, which makes them the most sought after place for traders, as it offers the most opportunity. However, trading brings its risks along with the opportunities. So how can we overcome these risks and make sure the odds are in our favor when trading, even in the bear market we are in currently?

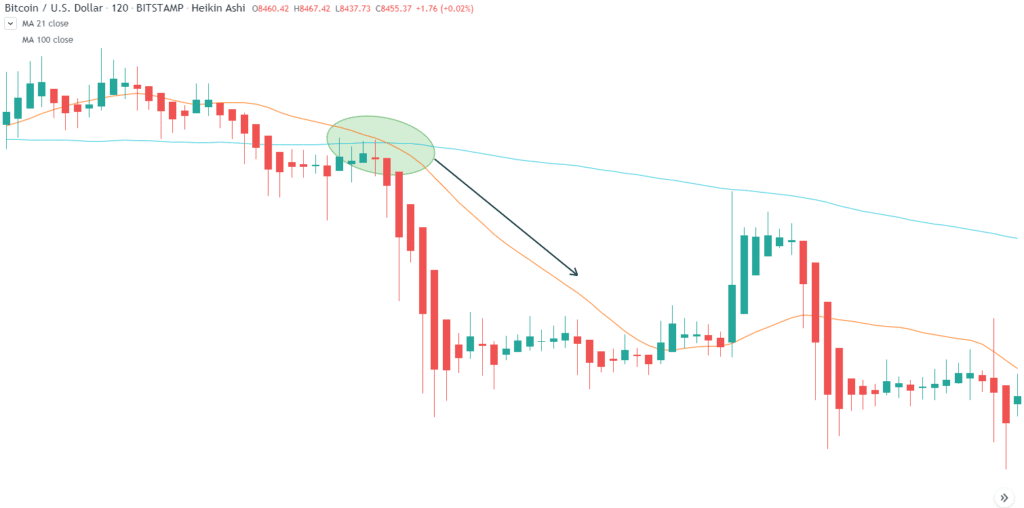

Strategy #1 Heikin Ashi and MA crossover

With the cryptocurrency market mostly being in a downtrend since 2017, we have to take a look at some good strategies for trending markets (whichever way they go). This strategy includes Heikin Ashi as well as slow and fast-moving average crossovers to create an entry point, a profit target as well as a stop-loss. It is suitable for automation as well as beginner traders, as it’s quite easy to pick up.

Heikin Ashi is a version of a chart similar to a candlestick chart. The main difference is that the Heikin Ashi “candles” are averaged out. When used along with moving average crossovers, it can be quite effective in catching upwards and downwards moving trends.

Setup

Heikin Ashi chart 13-21 Simple moving average (fast)

100 Simple moving average (slow)

This strategy marks an entry when the fast SMA crosses the slow SMA, and 2-3 Heikin Ashi candles in a row are in green. For short-selling, the entry should be when the slow SMA crosses the fast SMA, and 2-3 most recent Heikin Ashi candles are red.

The profit target is when (in case of a long position) a few HA candles in a row are red. In the case of a short position, the profit target is when a few HA candles in a row are green.

Stop-loss is a great prevention tool when it comes to preserving capital. When using this strategy, the stop loss should be the latest swing low for a long trade and the latest swing high for a short trade.

Caution: This strategy works extremely well in trending markets, but does poorly in ranging swings.

Strategy #2

Fib retracements, volume, and oscillators

The second strategy is quite the opposite of our first one: it works great in ranging markets, and poorly in uptrends/downtrends.

Using Fibonacci retracements, we can establish potential previous move reversal points. Combining the previous support and resistance levels makes it easy to predict support and resistance points that the price will react to. This is where volume and oscillators come into play. Oscillators such as RSI or Stochastic can tell us when to expect a reversal and are mostly used as confirmation indicators.

The entry points in this strategy should be breakouts to the upside or downside from the resistance/support levels followed by a spike in volume as well as a confirmation from the indicators. Stop-loss should be placed just on the other side of the support/resistance level that was used as an entry point.

Leveraging your position can be an amazing addition to this strategy, and is even considered necessary, as ranging moves are usually not big. This means that the movements are more predictable, and when supplemented with a medium to high leverage, can be an amazing profit-making strategy.

Utilizing leverage trading

Using leverage as a tool to increase the potential profits has been used by both institutions as well as retail traders for decades. It is a great tool to enhance potentially profitable trades. Many traders are arguing that it’s a fast way to lose all your money. However, if used properly, each of the trades taken will have a bigger upside than the downside. If that’s taken into consideration, leverage is an amazing way to increase profits, and start trading with as little money as possible!

If the market makes a 1% move, you will get only 1% profit without leverage. However, with the leverage of up to 1:100 that trading platforms are currently offering, that 1% move can turn into a 100% gain.

With that being said, people should be careful when using leverage as cryptocurrency markets are extremely volatile and unpredictable. The amount of leverage used should correspond to the level of risk a trader is willing to take.