Getting involved with precious metals trading is always a good idea. It is a great hedge against your forex risk-on positions. Long-term holding creates another safe haven benefit against investors’ greatest fears. Inherent precious metals value compensates for the inflation effect, political, terrorism, military or currency wars, pandemics, or economic downturn. Now, investors play the long game, the precious metal positions are held for a long time and they play a significant part of their portfolios.

Forex traders do not have long hold game ideas as their primary. Making profits with precious metals by holding for a long time requires patience measured in years, you never know when the crisis moment is going to come. Making profits right now requires active trading, the spot metals category is different than forex, traders need to be ready for another turn of testing and building. Going forward we will present one of the ways traders can utilize their knowledge and systems from forex, however, it is based on the system we have already described.

Most of the technical analysis we have created using the algorithm structure from our previous articles is going to be translated into the metals market, therefore you should be familiar with it. Of course, the exact formula is not the same, there are some adjustments and additional analysis, but most of the elements are following the same concept. Trends are the core of the system and it is the core in precious metals trading too. If you just go and carry over the system you have made for forex, you will still have some success, although, additional odds might be missed and your balance can feel the effect.

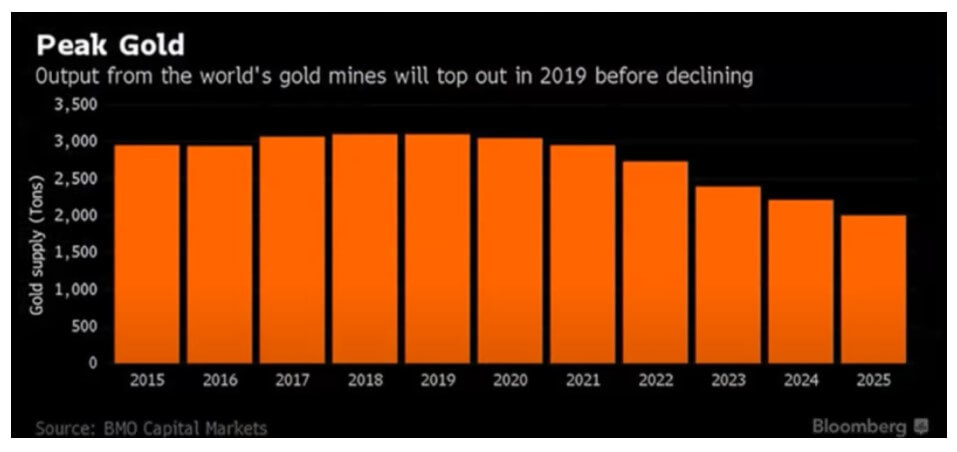

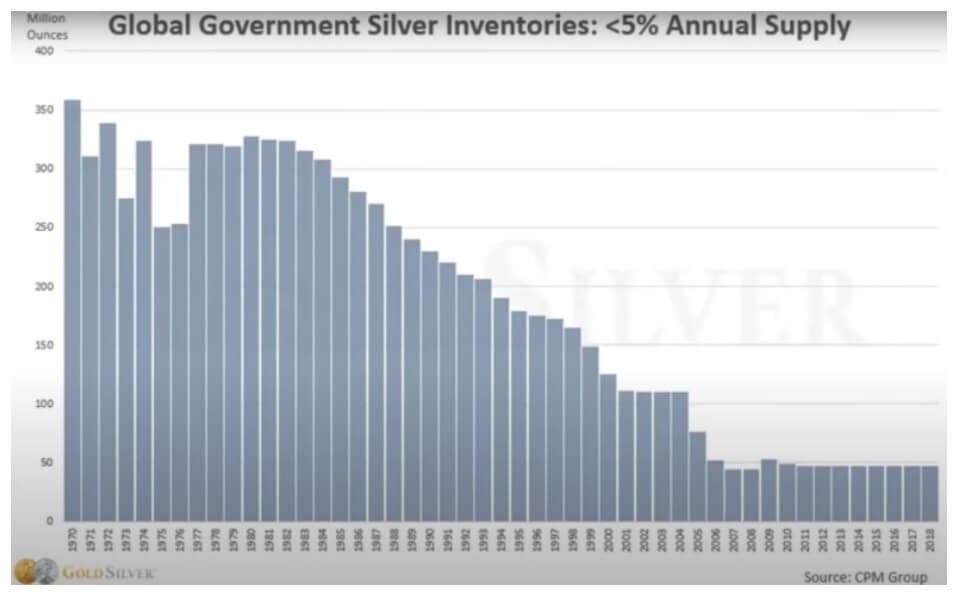

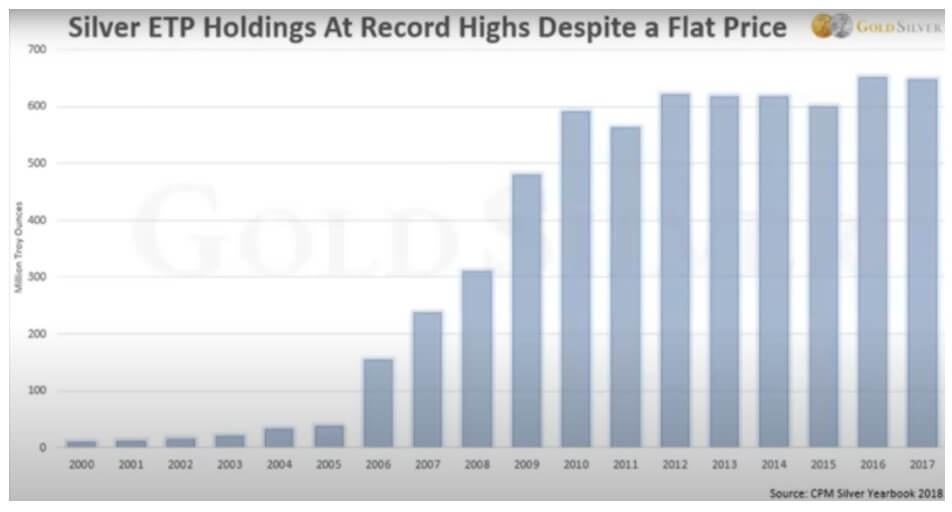

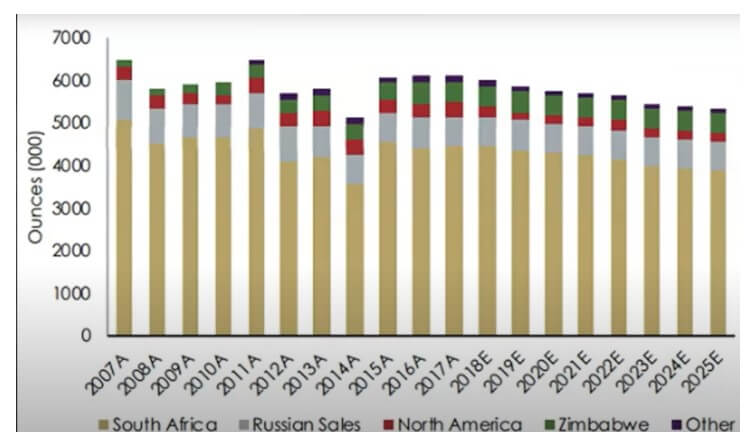

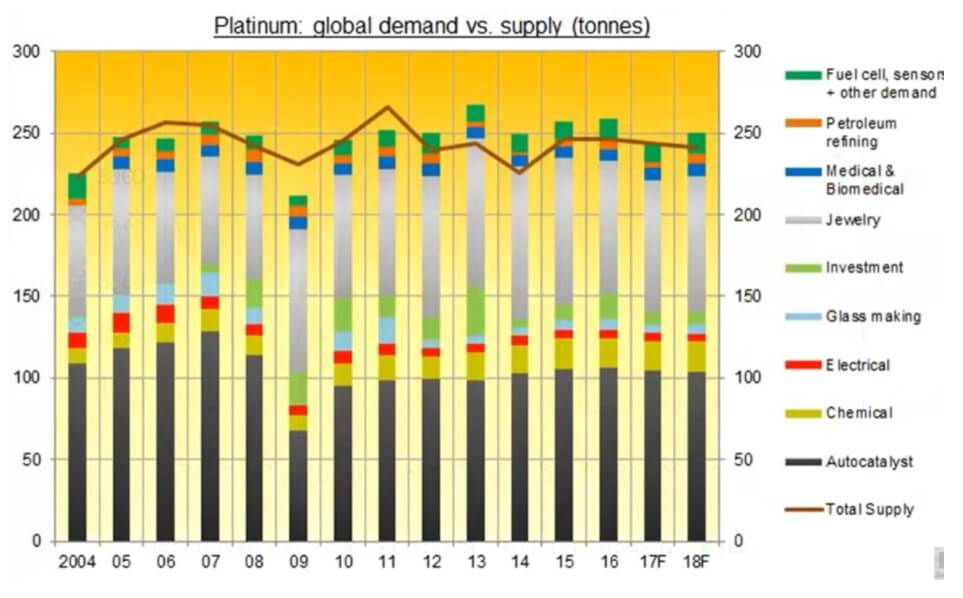

The biggest difference between the markets is the supply and demand forces. According to some prop traders’ opinion, the forex does not have real supply and demand, the central banks control the monetary politics and the mass levels. Nowadays it is common to read bank manipulation headlines and fines related, but they do not stop the activity and probably it is only the tip of the iceberg we see in the media. Manipulation is not the biggest issue actually, it is the fact supply and demand follow bank inputs, changing the balance in a very unpredictable manner. If you are trading forex successfully you might wonder why to bother with precious metals. Well, as our prop trader is suggesting, trading precious metals is easier, and there are often situations metals trading performance can outperform forex by far. In forex there are many currencies and combinations, in the spot metals market – you are trading 4 to 5 metals maximum. The differences are subtle still, we are going to focus on them and then go deeper into each of the metals specifics in the next series of articles.

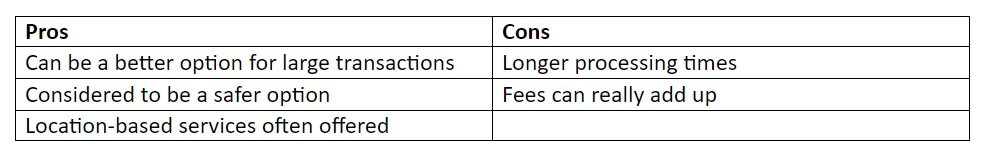

Most traders will focus on one market. It is a good idea to master one market, but often they do not go beyond. Whatsmore, sometimes they even stick to a few currency pairs, mostly majors. The self-limitation also translates into your diversification and your balance in the long term. Also, the system that works is never upgraded or used in other markets without a good reason. The system we write about is universal, you can trade both markets, with even more applications for other trading strategies. However, a limitation may come out from your broker asset range, not just from your trading mindset – which is harder to fix. Not all brokers offer four major metals – Gold, Silver, Platinum, and Palladium, the latter two are even rarer. In the United States, there are even more limitations. So you might need another broker leading you to open another account, and this is a good thing as our prop trader suggests. Diversification is created not just by trading in another asset category but with a different broker too. Remember though, trading with another broker should not be like trading with some other capital. It is still yours and you should treat your wealth as a whole, risk wise. Your position size and complete risk management will be like you are trading on one, major account.

As for the leverage, prop traders recommend setting it to 1:20, buying power is not important since we are using optimal, long term risk management which does not need leverage too much. In the US, the leverage is limited to 1:1 since the 2007/08 recession aftermath act to cope with the leverage abuse in the future. The measure could have been more optimal, not just completely ban any leverage on precious metals. During the Trump mandate, he announced to cancel the act but as it seems this will not come true. Of course, there are ways to go around this measure for US citizens through Exchange Traded Funds products and other less known ways you need to discover alone.

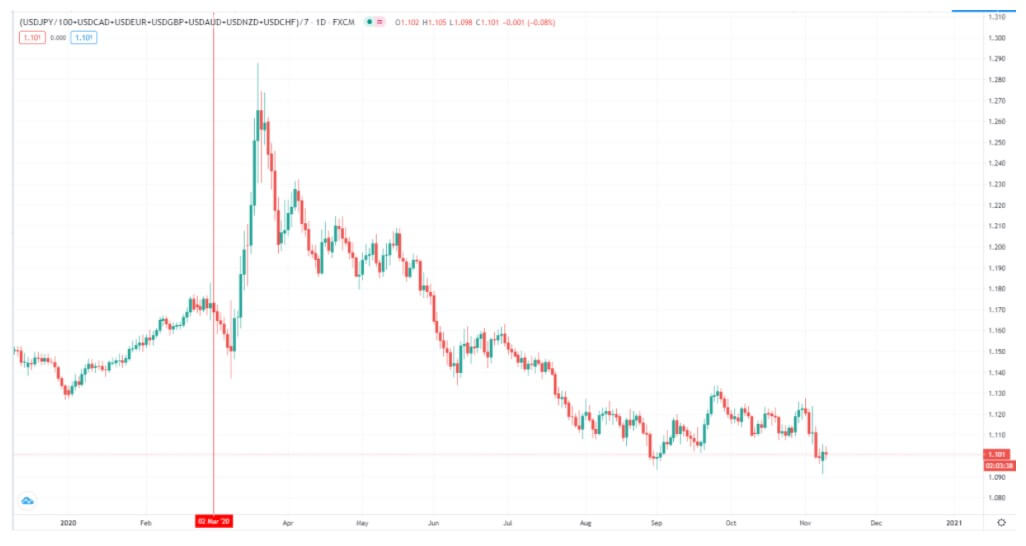

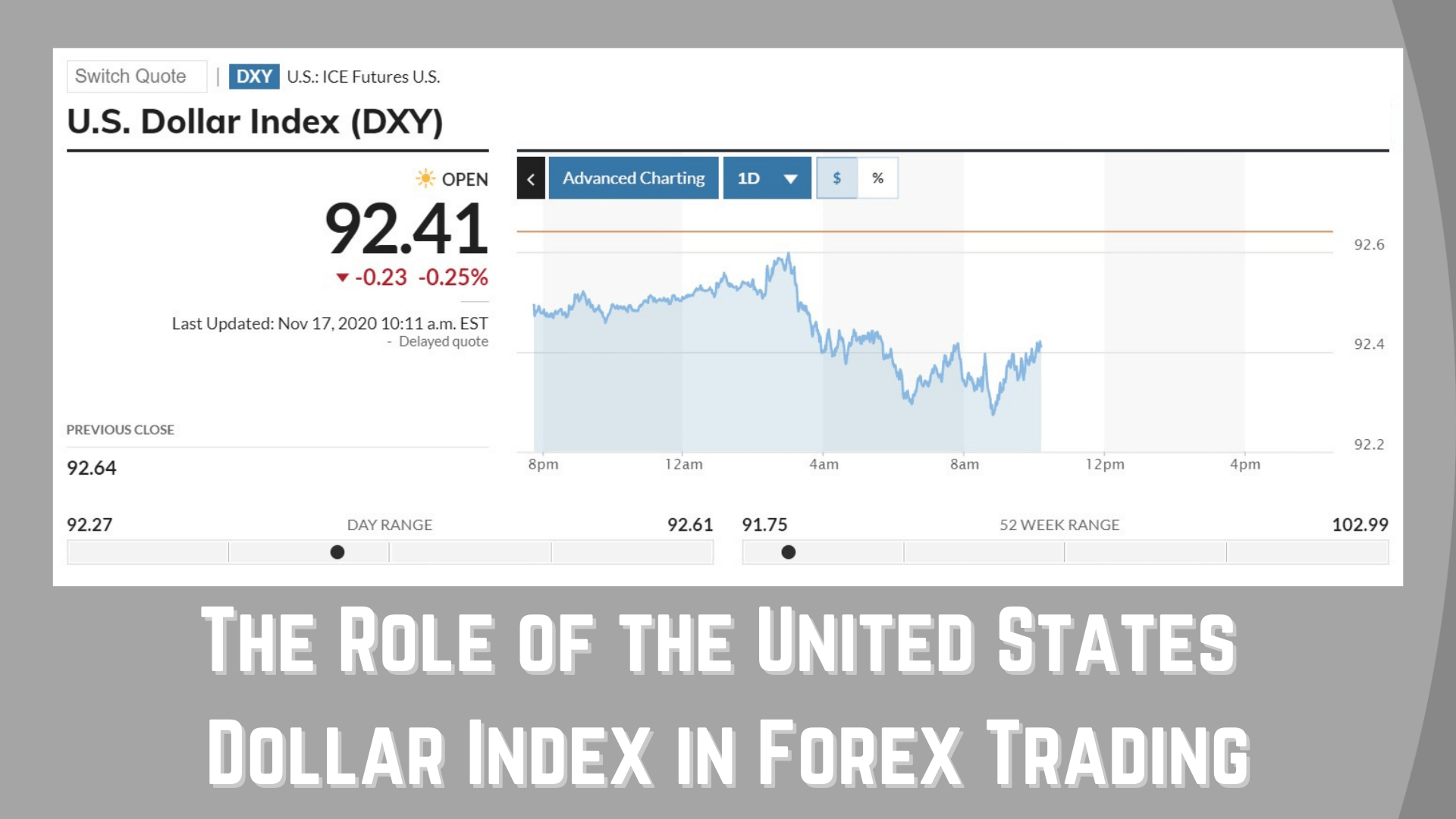

Trading metals can be against all the 8 majors if you have them offered by the broker. Markets.com allows them all and has one of the widest product offers in the industry. Rarely, you can also see spot Gold and other metals against the SGD and HKD. Interestingly, some prop traders advise trading spot metals against the USD only, for several reasons. If you are familiar with our articles describing the USD and how to approach trading with the pairs containing it, then you may wonder why trading metals against the USD is a better choice. Brokers that offer any other currencies are rare, XAU/EUR is probably the only other currency you will see metals paired with. Yet this is not a problem, the diversification is not at play here, when we compare the same metal against other currencies, the charts are not that different, especially on the daily timeframe we suggest.

In the picture above we have compared XAU against some major currencies. There are no significant differences in price action. If we zoom in and compare the candles on the daily timeframe, the candles are almost the same. Even when we witness Trump’s tweets, speeches, and announcements among other events that shake the market, we should not be concerned with the currency expressing the value of the metal. Therefore, for simplicity reasons just stick with the USD unless you have a strategy that works on very low timeframes.

As for the metals choosing, our prop traders recommend trading the major four metals mentioned. The symbols given for these assets are XAU for spot Gold, XAG for spot Silver, XPT for spot Platinum, and XPD for spot Palladium. Some brokers can even name them just “GOLD”, for example, and this usually means either CFD Gold futures or spot Gold against the USD. In the next few articles, each of the metals trading will be explained in detail. If you are wondering why Copper is left out, it is because it is a commodity metal with erratic movements. Copper is like a very exotic currency in forex, it can only be a good choice for traders into risky strategies. At the end of the day, you should not limit yourself if your back and forward testing show good results with this metal. Our long term testing results are not consistent enough to include Copper into our trading scope.

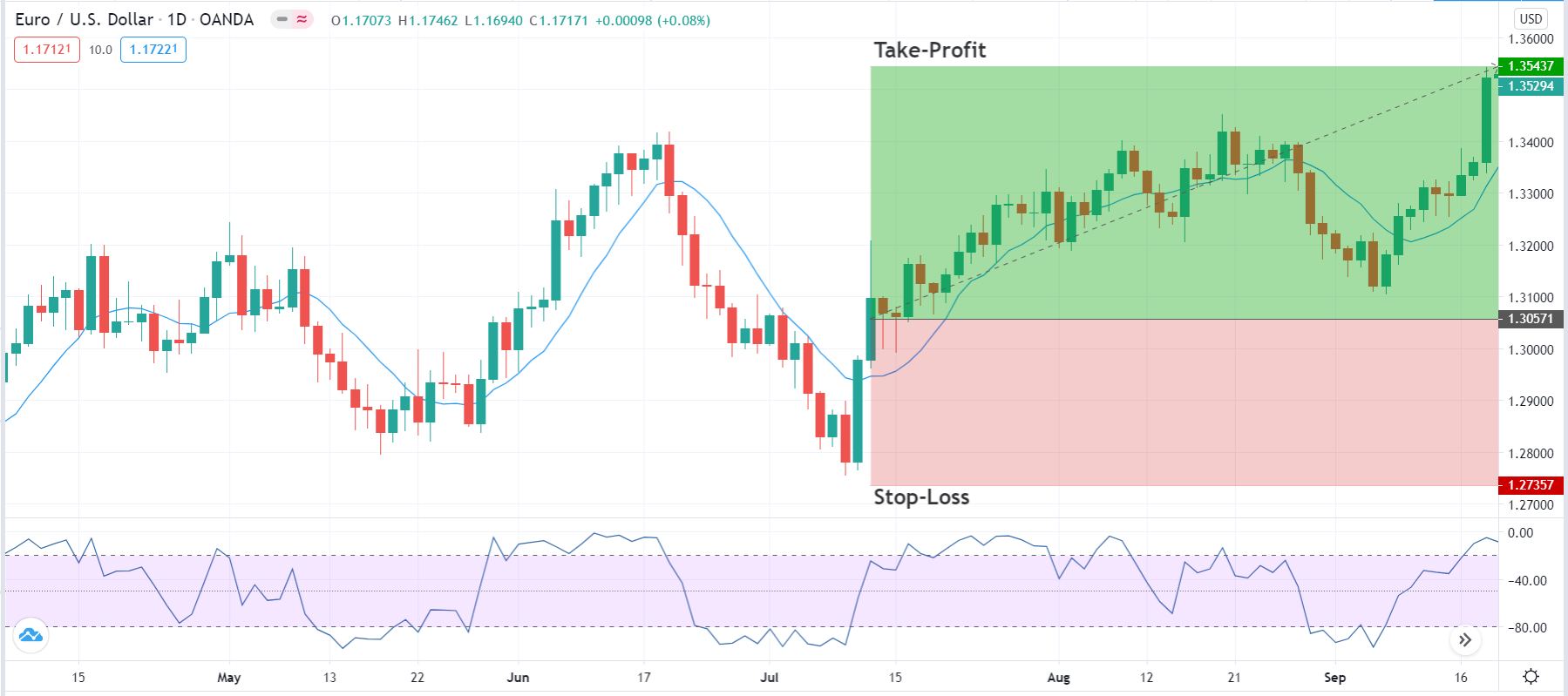

Money management and the mindset required for metals is the same as in forex. If you have a sturdy money (risk) management set up with forex trading, carrying it over to metals is easy, just do everything the same. Adjusting the usual Take Profit and Stop Loss levels is always open, there are no hard rules here, in some cases Gold might have a tighter Stop Loss, but the risk profile should be the same as well as the methodology you have with forex trading. Note this is true for the money management fundamentals explained in our previous articles, however, even if you have your own, you do not need to change much. Elementaries such as Journaling, Backetsing methodology, leverage set up, are also applicable to metals trading, the only major difference is in the algorithm and some additional analysis.

The transition is smooth for an established trader. These guys already know how the markets work, however, beginners might need a quick reminder about the supply and demand nature of different markets. Stocks have a limited number issued to the public, so equities respect the law of supply and demand, except for Indicies, they are a special story. Commodities also respect supply and demand. Cryptocurrencies are new and a kind of revolutionary twist on the scene without a strong market cap, yet they too respect the law of scarcity, which is also one of the core ideas of cryptocurrencies.

The forex market does not respect supply and demand, although traders that use support and resistance lines (many of them) would object. For more details, you can check our content on this topic too. Now, when we look at the asset we want to trade, the XAU/USD, for example, we see a mix of a currency and a precious metal. One has intrinsic value, the other one is paper or just a number but with the value stamp. One has the supply and demand naturally, fiat does not, therefore this asset cannot be traded as a currency pair nor as stocks. The difference is not great when we look at what we need to adjust but are significant when we talk about high percentage trading.

This asset we want to trade, precious metal against fiat combo makes us wonder, who is driving the bus? In other words, which side is responsible for most of the asset price action? It is usually metal. The USD might take over if the metal is stagnating, like any other currency against it will, but metals do not stay in place too long. However, major events regarding the USD will shake the metals market and it will drive the bus.

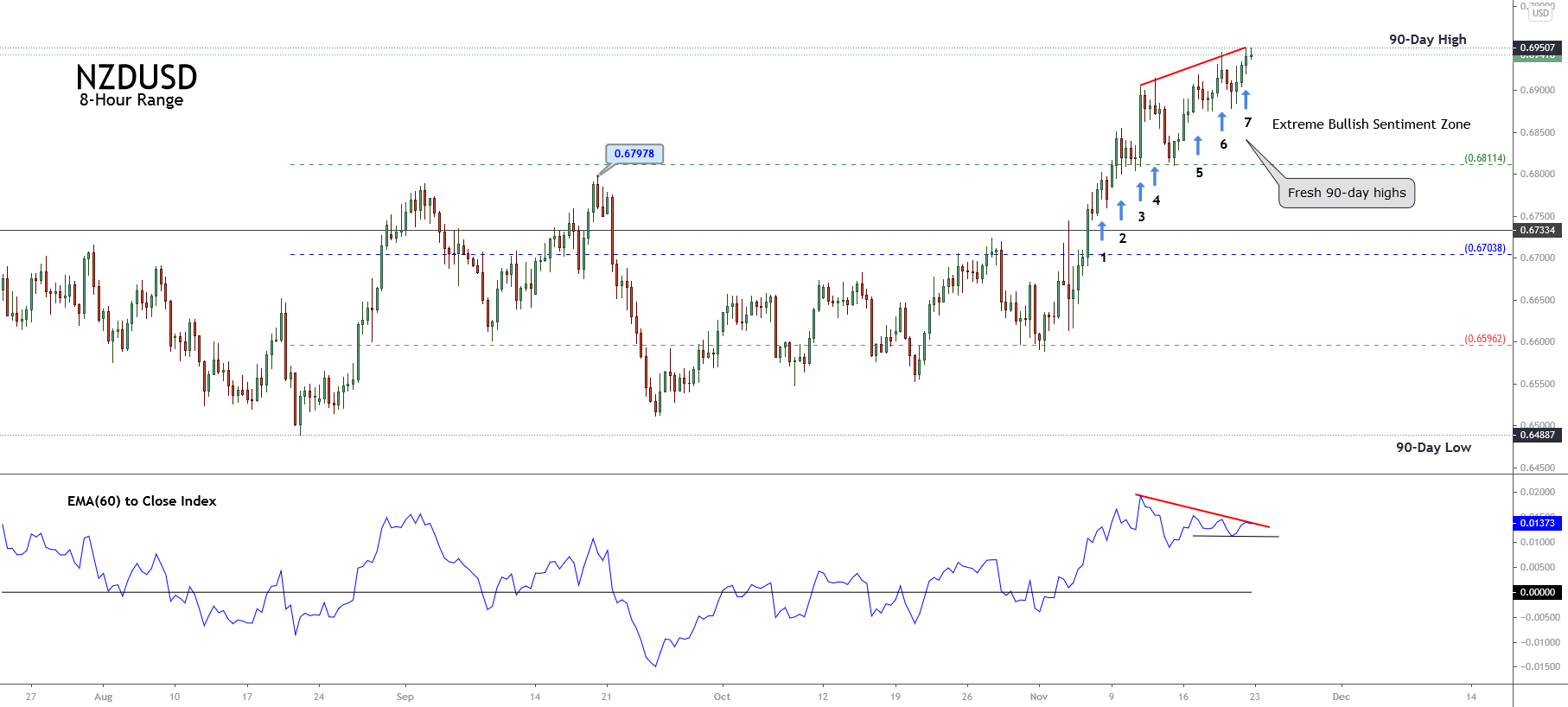

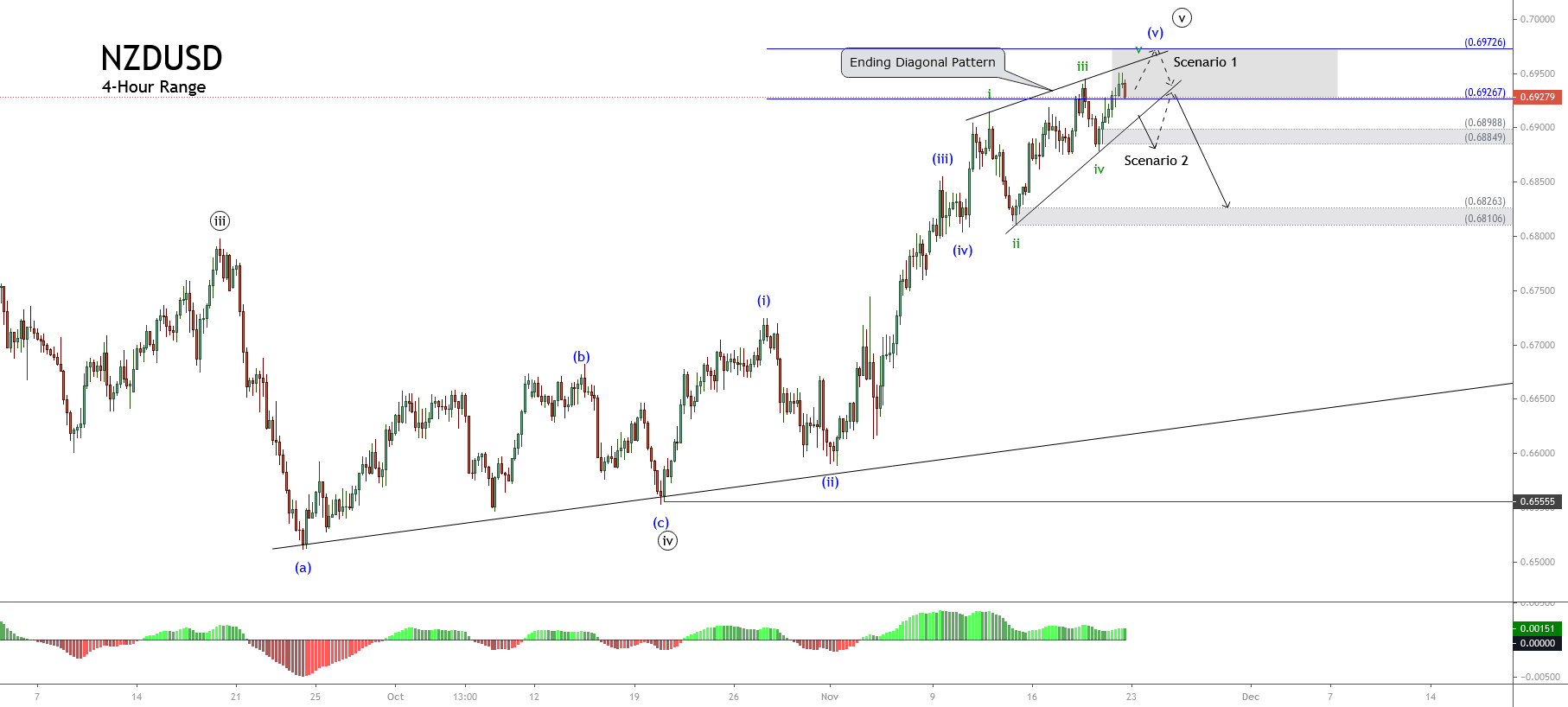

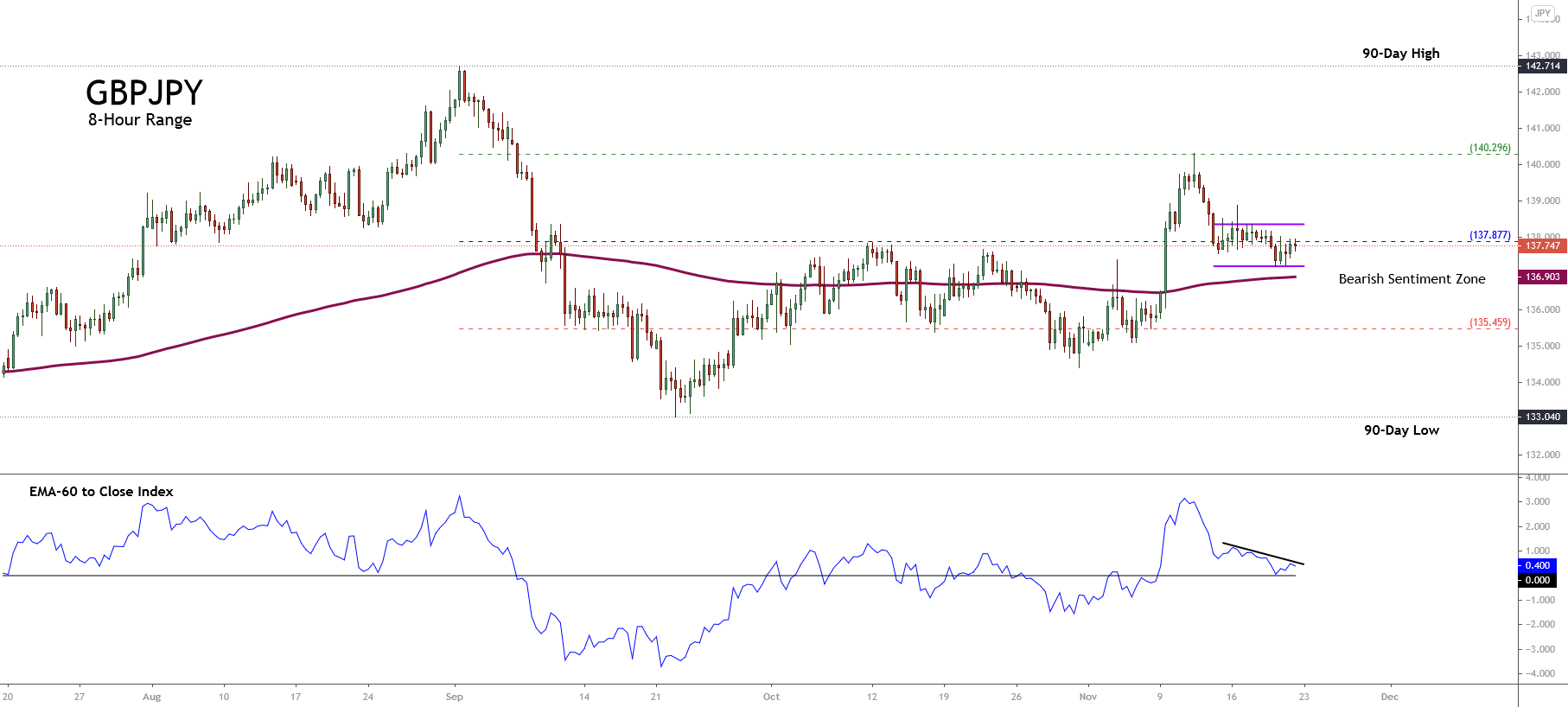

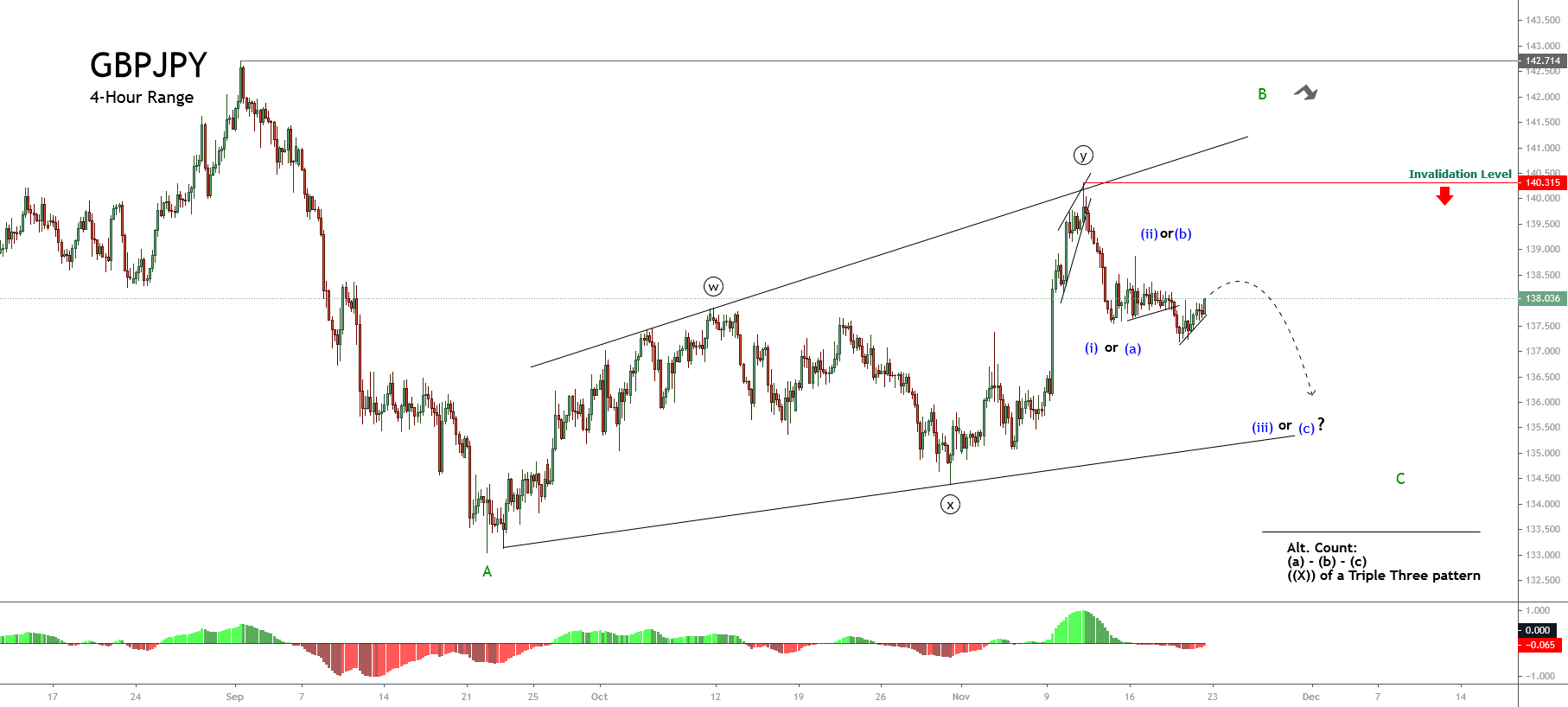

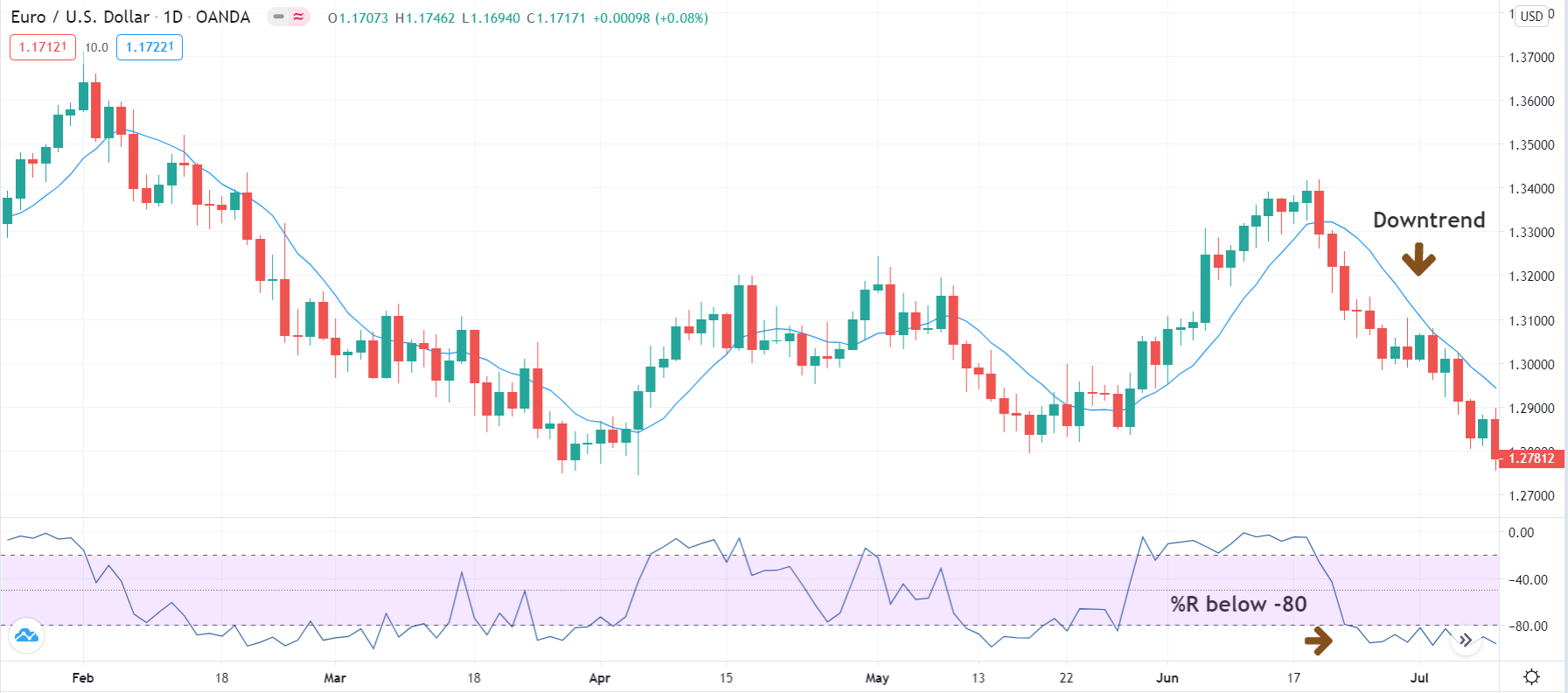

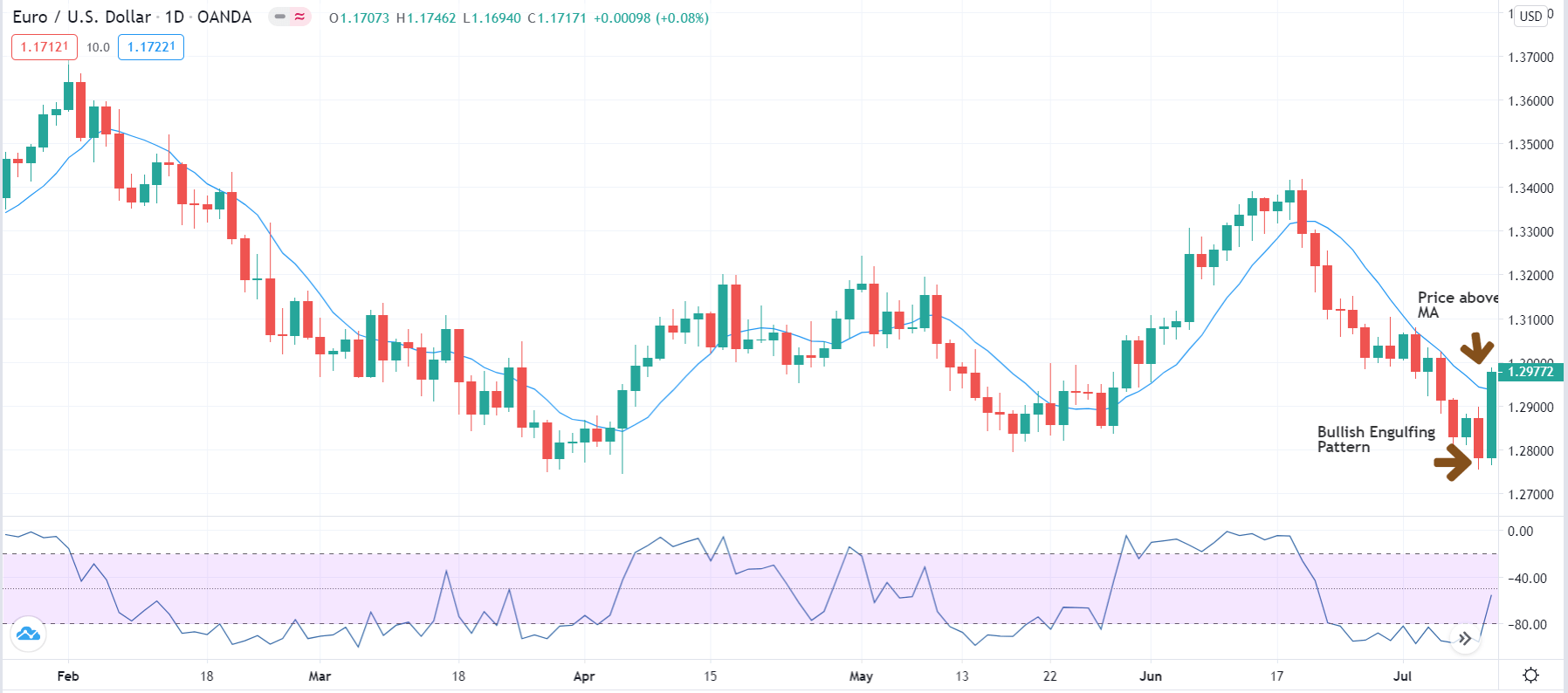

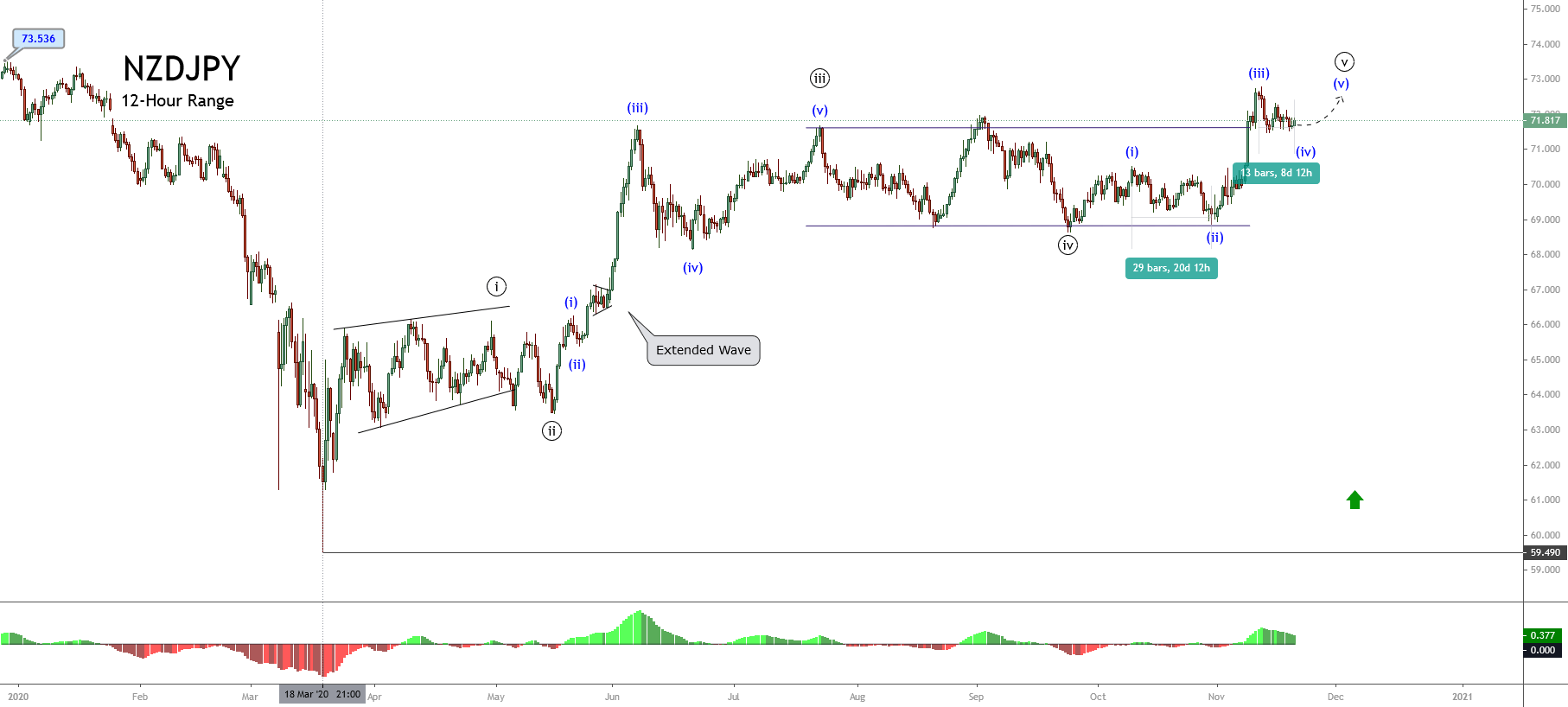

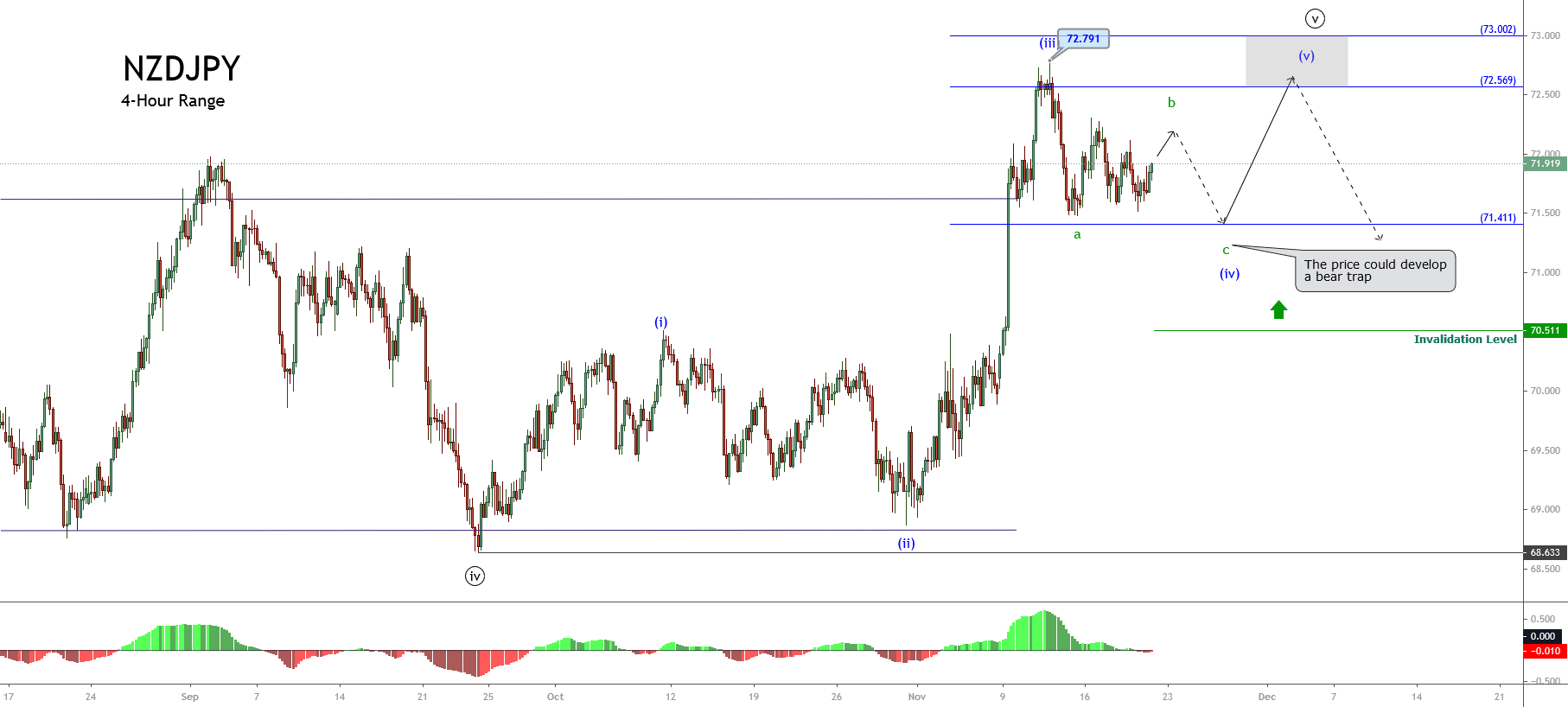

Trend following strategies is still the best way to trade according to research, including metals. Reversal strategies, however, are not that worse and you can incorporate one. Reversals may force you into higher drawdown and therefore, according to some professional traders, you should consider reducing the risk for them. Unlike forex trading, here traders can retain high percentage trading even with reversal strategies. But there is a difference between reversal strategies and some of them might not be what we classify as high percentage trading. If you like to call tops and bottoms using leading indicators, commonly presented with the overbought and oversold area oscillators, know you are not into a high percentage trading concept even if you have many other great tools incorporated.

Do not try to predict the future, trial has a price tag. Since reversals are in play, you may want to seek out reversal indicators if you do not have them right now in your algorithm. In that case, seek out newly made indicators, forget about the ones made in the previous decade or two. Chances are there are much better versions out there with more accurate and reliable signals. Of course, you can still tweak and adjust the good old RSI or Stochastic oscillator and still have results with the proper money management, just keep in mind there are new, better tools based on them.

Regarding technical analysis, following the algorithm structure made by us will have some adjustments since reversals are now a viable trading strategy. To refresh, the algorithm has 6 elements, two trend confirmation indicators, a baseline, an exit indicator, a volume or volatility indicator, and the ATR indicator for our position sizing and SL/TP placement. This algorithm is purely for trend following and to make it a reversal too we need to get rid of the baseline element. Consequently, the ATR measurement off the baseline does not factor in anymore.

Additionally, every direction is tradeable, up and down, they are not filtered by the baseline rule. So, now we even have more trading signals. However, there is more we need to change. Trading forex is different, metals move in their own way and therefore we might need to change our confirmation and exit indicators. This change is not obligatory, some indicators can work on the precious metals market and forex without any quirks. But if you find unsatisfactory performance, be sure to change these first. To give you some comparison, the results from trading 4 metals should be on par or better from trading 28 currency pairs.

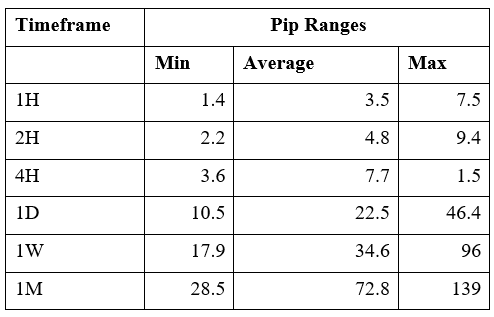

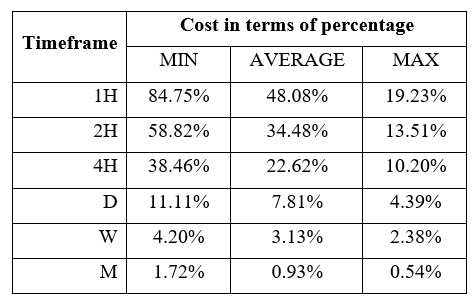

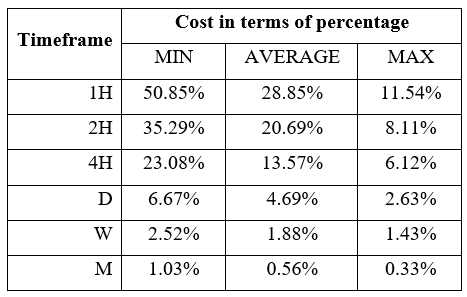

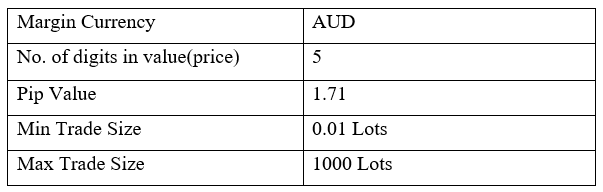

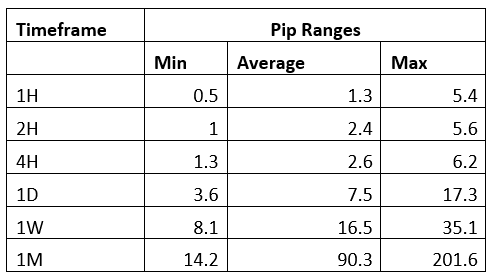

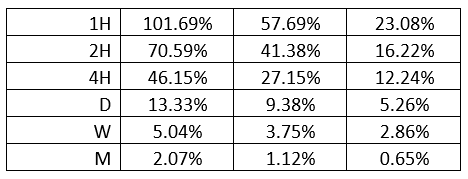

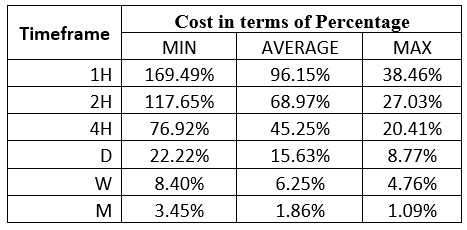

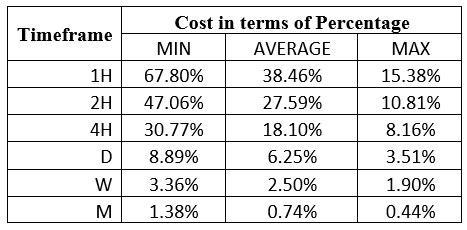

Price volatility in metals is not the same as with currencies of course. Precious metals like to move, their ATR values are much higher. Knowing our money management plan, we adapt everything to volatility or ATR. There is nothing bad with this, on contrary, you will enjoy dramatic trends that happen with metals often. Palladium has a specially high ATR so traders should know to adjust the size of their positions accordingly, on a demo account first. The calculus should not be difficult, there are even some useful MT4 plugins that calculate the sizes automatically once the ATR value is typed in. With higher ATR one can expect higher spreads too. If we measure the spread importance in the ATR, their ratio, the spreads again, like in forex, become insignificant for our daily timeframe trading. These kinds of traders should never be concerned about spreads unless they are with some exotic (bad) broker. For some reference, the spread part in the ratio is about 1% for Gold and about 7% for Platinum according to our measurements. If you trade on a few levels lower timeframes, the spread is a factor, do your calculus on how big the spread influences your trade.

Precious metals have such good momentums the volume indicator might lag too many times and cause you to miss more good trades that it filters the bad ones. Of course, this depends on the volume or volatility indicator used but they all lag more or less. As our prop trader says, he noted his trading had to change from this result and decided to update some trading rules. Namely, whenever a metal resumed the momentum in an already established trend, he would take a trade immediately on the confirmation indicator signals, even if his volume indicator does not agree. Still, for reversals, volume indicators play their role as usual. If you need an indicator to gauge the major trend direction, use some moving average or your baseline. Just know this is just one observation, the rule does not have to apply to you.

Sentiment indicators play a lesser role in precious metals. The ratios do not mean much and traders should not chase any signal interpretations from sentiments. Looking at the sentiments and the price action we can easily discern the difference from forex currency pairs. Change in the sentiments does not cause any particular price action with the metal. Of course, there are extremes, for example, XAG/USD at one point had 21 traders long for every 1 short, something like 97% traders long on this asset. There is little room for anyone else to go long. In these rare scenarios get ready for long trades, the ratio can only correct causing the already known contrarian trader idea to buy. The big bank manipulation is not that present with metals, but you can expect some degree of it, especially during very important events. So now you might wonder what events can cause metals to shift.

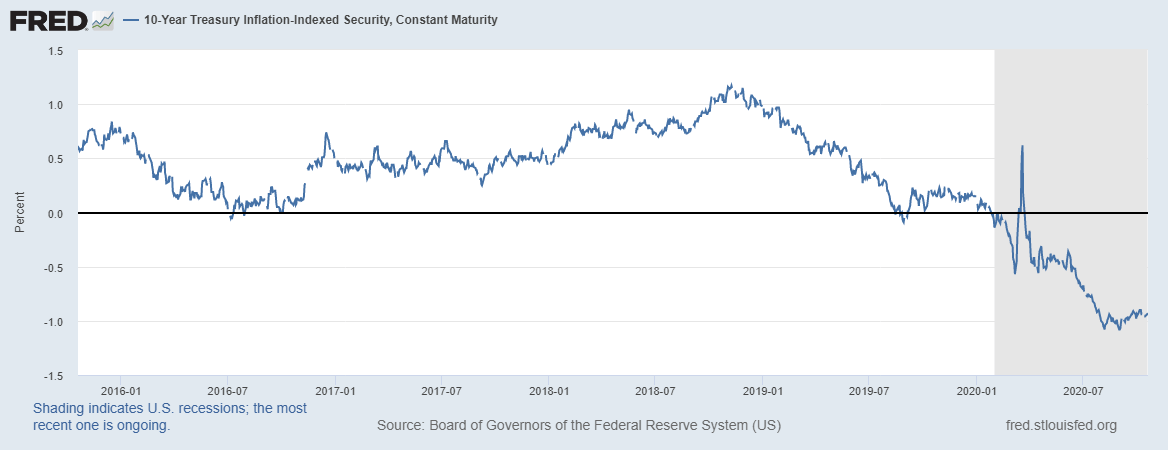

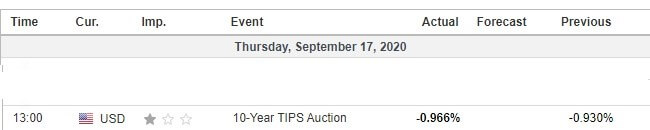

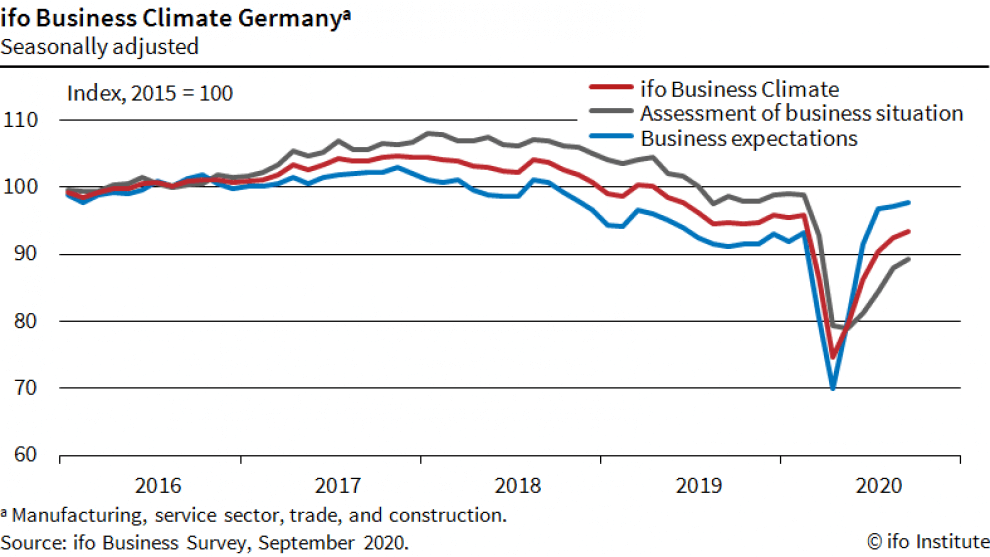

News rarely has any effect on the metals. Note though, according to statistics, interest rate decisions on the USD can affect metals too. Comparing the XAU/USD and the EUR/USD, interest rate change in the USD will likely cause traders to flock to the XAU since the EUR rates are extremely low too, especially at the time of writing this article. Gold simply offers protection and better-estimated income than interest rates with some safe-haven currency. Non-Farm Payroll event also does not have any significant effect on the charts. Additional caution has to be on the elections. Any market will go crazy during the US elections, prop traders usually like to avoid the risk associated with them and close all positions until all is normal again.

Be advised that precious metals trading hours are mostly different than with forex or crypto – which is always open. The hours also depend on the broker, usually, precious metals have one hour off longer than forex, and every working day they have 1-hour break around session closing. All this should be known to you when you start trading. The specification window in MT4/5 should have this information for every product offered or you can consult your broker support.

To conclude, do not limit to the forex market only, you have a universal system, use the opportunities everywhere. But know there are differences you need to recognize and adjust to, as with everything else. The differences are subtle but adjustments get better probability trades, even 1% better odds make a large % on the ending year balance. Find a broker with a good metals range and check the conditions. Lastly, trade your system and stay out of the way, test the plan, the upgrades to it, and apply, nothing more.