Trading and investing in Gold is one of the top searches on the internet and a hot skill that could be the best thing to develop nowadays. As one of the four precious metals usually offered for trading by brokers, gold is the most popular, most traded and historically the most valuable asset one can have in an economic downturn. Forex traders are in a very good position to grasp the advantages of precious metals trading, the small differences are easily adopted, the principles are the same.

Trend following is still the best approach, yet metals also offer opportunities for other trading combinations such as reversals. Before we move onto the actual gold differences, beginner traders should be familiar with the system structure and trading we apply in the metals assets category, using what we have mastered in the forex. The article in front of you will firstly digest gold fundamentals, trading requires some fundamental basics about this metal even though we are using mostly technical analysis systems. There is uniqueness for each of the 4 metals we are going to analyze.

XAU is the symbol mostly found on the brokers’ asset list for gold, the X stands for index or spot market and AU is the symbol from the periodic table of elements. In the asset contract, it is expressed in troy ounces which is slightly different from standard ounces. One standard contract holds 100 Oz and the chart price is for one Oz.

Gold is not used in production very much when compared to other metals, only 10% of the total gold extracted is used for various jewelry and electronics. So the demand for gold from the industry is not the main driver for its price, even though electronic devices are making a breakthrough in everyday lifestyle. The main drivers come from safety, hedging, and investment needs. Countries also use it for the same purpose except the amounts are measured in tons, Russia, and China currently being the biggest hoarders of this metal. Rich people also have this habit to collect gold in various forms but a part of them do not use it primarily for investment.

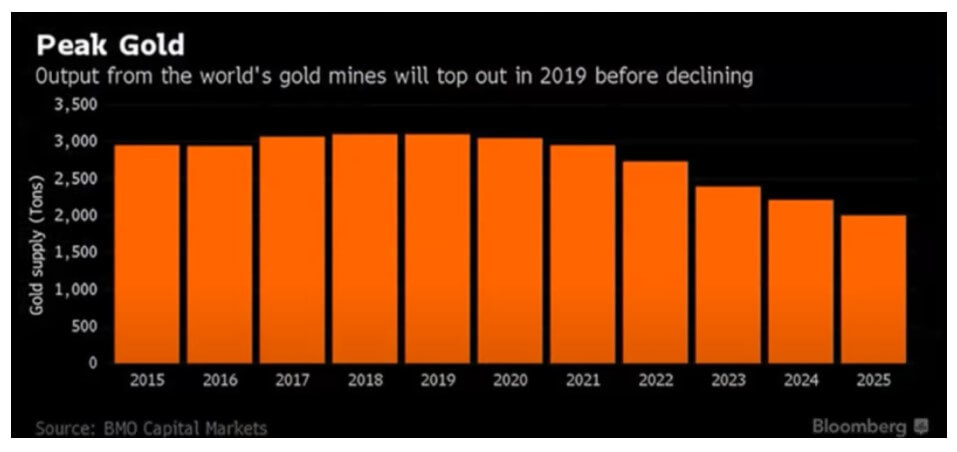

The image above is the supply of gold including a few years of prediction at this rate. Now, according to a certain group of prop traders, this is contrary to their expectations. They think millennials had new know-how and technology to boost production in the coming years, including better technology to find new deposits. The chart accounts for this phenomenon although the decline is still evident. This information has a huge bullish prospect for gold. The chart implies humanity can bring whatever technology they can to extract gold but unless it is dramatically effective in a short time it is not going to cut the price in a few years or compensate for the fact most of the gold is already extracted.

The chart is not implying anything related to world economic cycles, pandemics, or crises, making it easy for youngsters and traders to realize gold is the ultimate protection and savings solution. To some theories, China and Russia’s gold accumulation can bring the power balance to shift very quickly towards them. They do not have to strategize with trade wars, politics, military actions, all they have to do is gather the power out of gold holdings and wait out the west fiat influence to slowly fade out. Cryptocurrencies are also into play with this theory some might call crazy, but the effect is very close to being clear in a few years.

Investment wise, the gold price cannot go down to zero for sure, we can only witness some short term falls unless a miracle economy recovery or a golden mountain is discovered. When we look at the supply, long-term investment is logical but the demand is increasing too. Aside from the governments across the globe hoarding gold, the population is also very interested in physical gold holding. If you are well informed about the economic cycles, we are well past the peak and into the downturn, however, if you look at the equities indexes, there is no evident downturn. This could mean the crash is going to get more dramatic and gold will be one of the first assets masses will flock to.

XAU/USD and the USD Index can both move up as safe-haven assets but explains gold is in charge of the move, not the USD in the XAU/USD pair. When the metal has a reason to move it does not matter how strong is the currency denominating it. Investors, funds, and other major players will stock up gold reserves early in this trend, you will probably see signs like higher gold premiums, price action volatility, VIX, and $EVZ pick up, and others that a crisis is around the corner. Simply when things go bad, gold is the only asset people see as valuable, it has been like this for centuries. Essentially this is what investors do, when the world burns they hold the gold, and once recovery is in sight, cash in the gold and buy risk-off assets cheaply. Once another cycle downturn emerges, repeat. It is true these individuals make riches in such times.

Now into the technical specs of XAU. Gold moves in smooth trends. Smooth trends trigger technical algorithms signals early in the trend and trades see a followthrough. On a daily timeframe (we like to use) this is especially true. In forex, it is common to have step-trends, the kind that triggers the signal to trade on one candle and then a period of flat price action and then another step candle. Choppy trends like this are hard to follow, and they are happening even on slower systems just with a few candles more as steps. Compare the XAU pairs with forex, the charts show smooth transitions most systems can pick up easily. Whatsmore, gold also exhibits smoother price action than other precious metals. All precious metals have this characteristic but gold is a special case. Because of this, our trading systems can have tighter Stop Loss levels relative to the initial position.

The trend will in most cases continue on its way up or down, it does not need some correction room as with forex where we have to leave some space so it does not trigger our Stop Loss too soon in an emerging trend. If we take our algorithm money management plan of 1.5 ATR Stop Loss from the entry price level, we can cut it to 1.35 ATR. The 2% risk profile is still on, just in metals trading we distribute the risk capital onto 1.35 ATR pip range. Metals do not leave traces of bank manipulation effect, there are still some but the effect is very small and the frequency is lower. Therefore, whipsaws do not happen often because of this, it is more likely the metal is changing course.

Interestingly, gold with its smooth, somewhat predictable moves is easy to trade and we can also apply riskier strategies, like reversals…until Trump became president. Unfortunately gold is not immune to Trump’s tweets, speeches, and announcements. Gold is the fear metal, a panic buy button. One day a tweet may be about a trade war with China and one day after a positive outlook about a good deal with China. Banks can use the news as they see fit for short term USD manipulation, the price of gold will rocket as fears creep in, and when everybody goes “whew” it goes back down. These events will trigger your Stop Loss even if you see everything going smoothly. There is no defense against Trump’s tweets as we have explained in our previous article about them. Of course, you can avoid this inherent risk by waiting out his mandate but trends are still much better with gold than with forex, especially the USD currency pairs.

Prop traders adjust to this by bringing the Stop Loss level further away, like in forex to 1.5 ATR, but ultimately it is up to you if you want to avoid or adjust the risk profile. Since the new US presidential election is coming soon, hopefully, new traders will not have to deal with this. China’s trade war may not be a focal news point as pandemic cut down countries GDP measured in two-digit percentages, but the west tries to slow down the China extreme takeover in the global economic dominance. As a trader, you can expect more risks coming from this issue regardless of who will be the new US president.

To wrap all up, know the asset you are trading, the fundamental drivers. Gold respects the supply and demand as all precious metals but the upcoming trends, statistics, and results show holding gold is almost a certain win. Contrary to forex, knowledge about the swissy background will not help you much for technical trading as gold can. Risk related to gold is reduced by its price action nature although know things masses react to, like the Trump tweets, can mess your trades. Gold is gathering the fears and as such you will need to know fundamental drivers. Adjust your risk accordingly and enjoy smooth gold trends.